H&T Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

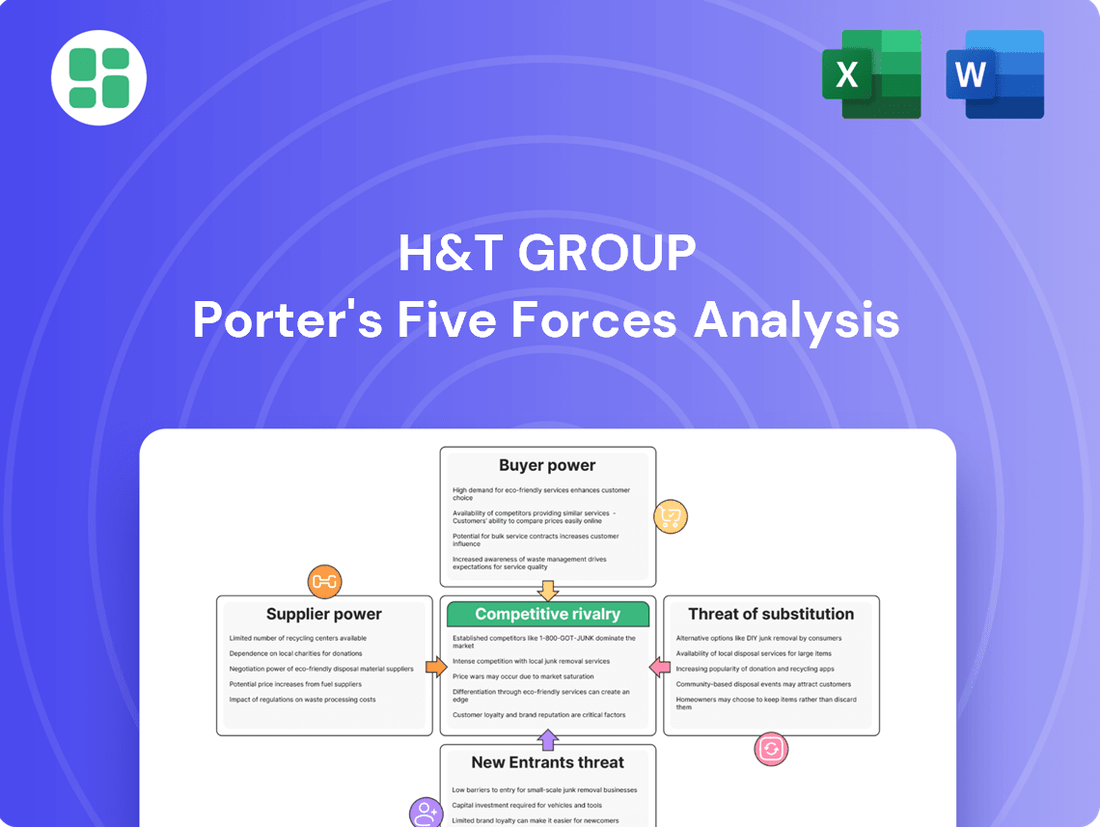

Understanding the competitive landscape is crucial, and H&T Group faces distinct pressures from buyer power, the threat of new entrants, and the intensity of rivalry. Analyzing these forces reveals the core dynamics shaping their market.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to H&T Group.

Suppliers Bargaining Power

H&T Group, a prominent pawnbroker, encounters substantial hurdles in securing traditional bank financing. Banks frequently categorize the pawnbroking industry as high-risk, with some reportedly excluding it from their lending portfolios. This restricted access to conventional capital amplifies the leverage of alternative funding sources or compels H&T to lean heavily on its robust financial standing to support its lending operations.

For H&T Group's gold buying and retail operations, individual customers are the primary suppliers of gold. These customers, often needing quick cash, possess some bargaining power due to the transparent pricing of gold and the existence of alternative purchasing avenues like online platforms or other jewelers. This dynamic means H&T must offer competitive prices to secure its supply of gold, influencing its cost of goods sold.

H&T Group's extensive network of high street stores makes labor costs a substantial operational expense. For instance, the UK's National Living Wage increased to £11.44 per hour in April 2024, directly impacting H&T's wage bill.

In a competitive labor market, particularly for skilled pawnbrokers and cashiers, employees can exert bargaining power. General wage inflation, which saw the average UK wage growth at 6.0% in the year to March 2024 according to the ONS, further strengthens this position, potentially increasing H&T's personnel costs.

Technology and Infrastructure Providers

As H&T Group continues its strategic investments in upgrading its technology and store infrastructure, the bargaining power of suppliers in these sectors is generally moderate. The market for IT infrastructure and store refurbishment services typically features a healthy number of competing vendors, which naturally limits the leverage any single supplier can exert. For instance, in 2024, the global IT infrastructure market was valued at approximately $500 billion, indicating a competitive landscape with numerous options for H&T.

However, this power can shift. When H&T requires highly specialized IT solutions or unique security systems, the number of capable suppliers shrinks, thereby increasing their bargaining power. Similarly, if a supplier offers proprietary technology or has a strong track record in delivering complex store refurbishment projects on time and within budget, they can command more favorable terms.

- Supplier Competition: A broad base of IT infrastructure and store refurbishment vendors generally moderates supplier power.

- Specialization Impact: The need for unique or specialized IT and security systems can elevate supplier bargaining leverage.

- Vendor Track Record: Suppliers with proven expertise in complex projects or proprietary technology can increase their influence.

- Market Dynamics: The overall size and competitiveness of the technology and infrastructure supply markets play a key role in determining supplier power.

Regulatory and Compliance Services

The bargaining power of suppliers in regulatory and compliance services for H&T Group is significant due to the stringent oversight by the Financial Conduct Authority (FCA). Specialized legal, compliance, and audit firms possess unique expertise vital for H&T's adherence to these regulations.

These suppliers' ability to command higher prices or dictate terms is amplified because their services are not easily substitutable and are fundamental to H&T's operational legitimacy. For instance, the complexity of FCA regulations means that finding alternative providers with the same depth of understanding and accreditation can be challenging, thereby strengthening supplier leverage.

- High Switching Costs: H&T faces considerable costs and disruption if they were to switch compliance service providers, given the need to re-establish trust and understanding of H&T's specific operations with a new firm.

- Essential Nature of Services: The services provided by regulatory and compliance experts are non-discretionary for H&T, as failure to comply can lead to severe penalties, reputational damage, and even operational suspension.

- Concentration of Expertise: The market for highly specialized compliance and legal services within the UK financial sector may be concentrated, with a limited number of firms possessing the requisite qualifications and experience.

The bargaining power of suppliers for H&T Group is a mixed bag, largely dependent on the specific input. For gold, individual customers hold some sway due to transparent pricing and alternative buyers, forcing H&T to offer competitive rates. Labor costs are a growing concern, with the UK's National Living Wage increase in April 2024 to £11.44 per hour and general wage inflation of 6.0% in the year to March 2024 impacting personnel expenses.

Suppliers of IT infrastructure and store refurbishment generally have moderate power due to a competitive market, with the global IT infrastructure market valued around $500 billion in 2024. However, this can increase for specialized solutions. Regulatory and compliance service providers wield significant power due to the essential nature of their expertise and the high costs associated with switching, given the stringent oversight by bodies like the FCA.

| Supplier Category | Bargaining Power | Key Factors Influencing Power | 2024 Data/Context |

|---|---|---|---|

| Individual Gold Sellers | Moderate | Transparent gold pricing, alternative buyers (online platforms, jewelers) | Gold prices fluctuate, impacting consumer selling decisions. |

| Labor (Employees) | Moderate to High | National Living Wage increases, general wage inflation, demand for skilled staff | UK National Living Wage £11.44/hr (April 2024), ONS reported 6.0% average wage growth (year to March 2024). |

| IT Infrastructure & Store Refurbishment | Moderate | Competitive vendor landscape, number of providers | Global IT infrastructure market ~ $500 billion (2024 estimate). |

| Specialized IT/Security Systems | High | Limited number of capable suppliers, proprietary technology | N/A - highly specific to project needs. |

| Regulatory & Compliance Services | High | FCA oversight, specialized expertise, high switching costs, essential services | Continued evolution of financial regulations requires specialized legal/compliance firms. |

What is included in the product

This analysis illuminates the competitive intensity and market power affecting H&T Group, detailing the influence of buyers, suppliers, new entrants, substitutes, and existing rivals.

H&T Group's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick, informed decision-making.

Customers Bargaining Power

H&T Group's customers frequently require quick access to small amounts of money for short periods, often because they have immediate financial needs. This urgency, coupled with their limited options within traditional banking systems, naturally lessens their ability to negotiate terms. For instance, many individuals seeking pawn broking services or short-term credit may not qualify for standard bank loans, making H&T a vital, albeit sometimes more expensive, solution.

In H&T Group's collateral-based lending model, customers' bargaining power is inherently constrained. Pawnbroking loans, secured by assets like gold and jewelry, bypass traditional credit checks, offering swift access to funds. This convenience, however, means customers have limited leverage on interest rates or loan terms once they agree to the collateral's valuation.

In H&T Group's retail segment, which focuses on new and pre-owned jewelry and watches, customers face a multitude of alternatives. These include numerous high street jewelers, a vast array of online retailers, and thriving second-hand marketplaces. This abundance of choice significantly heightens customer price sensitivity.

The increased price sensitivity directly translates into greater bargaining power for customers within H&T's retail operations. For instance, in the UK, the online retail market for jewelry saw substantial growth, with reports indicating a year-on-year increase of over 10% in 2024. This online competition forces traditional retailers like H&T to be more competitive on pricing, thereby empowering consumers.

Growing Demand Amid Macroeconomic Conditions

The current economic climate, marked by a persistent cost of living crisis and stricter lending from traditional financial institutions, has significantly boosted the appeal of pawnbroking. This surge in demand has translated into record new customer acquisition for H&T Group, a key indicator of shifting consumer behavior.

This elevated demand directly translates to a reduced bargaining power for individual customers. With a larger pool of individuals seeking their services, H&T Group is in a stronger position to dictate terms and pricing, as evidenced by their ability to maintain pricing structures even with increased customer volume.

- Increased Demand: H&T Group reported a substantial rise in new customers in 2023, driven by economic pressures.

- Reduced Customer Leverage: High demand allows H&T to maintain its service terms and pricing, limiting individual customer negotiation power.

- Market Resilience: The pawnbroking sector demonstrates resilience, attracting customers who might otherwise use traditional credit.

Information Asymmetry and Trust

While H&T Group strives for transparency, customers might possess less information about the actual market worth of their pledged items compared to H&T's specialized valuation knowledge. This information asymmetry can influence their bargaining power.

However, H&T's commitment to excellent customer service and its regulation by the Financial Conduct Authority (FCA) are key factors in building customer trust. This trust is vital for fostering repeat business and mitigating the impact of any perceived information gaps in the pawnbroking sector.

- Information Gap: Customers may not fully understand the resale value of their pledged items, giving H&T an advantage in valuation.

- Trust as a Mitigator: H&T's FCA regulation and customer-centric approach build confidence, reducing customer leverage stemming from information asymmetry.

- Repeat Business: Strong customer relationships, built on trust, are crucial for sustained revenue in the pawnbroking industry.

In H&T Group's pawnbroking operations, customers' bargaining power is limited due to their immediate need for funds and the collateral-based nature of the loans. This means they have less leverage on interest rates or loan terms once the collateral is valued. In contrast, H&T's retail segment faces strong customer bargaining power due to the competitive landscape of jewelry and watch sales, especially with the significant growth in online retail, which saw over a 10% year-on-year increase in the UK in 2024.

| Factor | Impact on H&T Group | Customer Bargaining Power |

| Urgency of Need (Pawnbroking) | Customers require quick cash, limiting negotiation. | Low |

| Collateral-Based Lending | Valuation of assets dictates loan terms. | Low |

| Retail Competition (Online & High Street) | Numerous alternatives increase price sensitivity. | High |

| Economic Climate (Cost of Living) | Increased demand for pawnbroking services. | Low (for pawnbroking) |

| Information Asymmetry (Valuation) | H&T's expertise versus customer knowledge. | Low (for customers) |

Same Document Delivered

H&T Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the H&T Group, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and no surprises. This includes an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and the intensity of rivalry within the industry, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

H&T Group stands as the UK's largest pawnbroker, commanding a substantial market share. This dominant position grants it a significant competitive edge over a more fragmented landscape of smaller competitors.

This leading status translates into tangible benefits, including economies of scale in operations and robust brand recognition, which can attract and retain customers more effectively than its rivals.

The pawnbroking industry has seen a noticeable trend toward consolidation, with a shrinking number of physical locations and some businesses exiting the market altogether. This has resulted in a more concentrated competitive landscape. For instance, in the UK, the number of pawnbrokers has been on a downward trend, contributing to fewer direct rivals for established players like H&T Group.

This consolidation directly impacts competitive rivalry by reducing the sheer number of direct competitors vying for the same customer base within the specialized pawnbroking niche. As the market tightens, the intensity of direct competition tends to lessen, potentially allowing surviving firms to operate with greater pricing power and market stability.

H&T Group's competitive rivalry is intensified by its diversified service portfolio, which spans gold buying, jewellery retail, unsecured loans, and foreign exchange. This broad offering allows H&T to compete effectively across various financial and retail sectors, reducing its dependence on any single revenue stream. For instance, in 2024, the company reported a significant contribution from its jewellery retail segment, alongside steady performance in its pawnbroking and unsecured lending operations, demonstrating its resilience against downturns in specific markets.

Broader Financial Services Competition

H&T Group faces competition not only from other pawnbrokers but also from a wider array of financial service providers. Companies like Vanquis Banking Group, which offers credit cards and personal loans, and Funding Circle, a peer-to-peer lending platform for businesses, represent significant competition. These entities cater to similar customer needs for short-term and accessible credit, often with competitive rates and diverse product offerings.

The broader consumer credit market is a dynamic space. For instance, the UK consumer credit market saw significant growth, with total lending reaching an estimated £276.4 billion in March 2024, according to the Bank of England. This expansion indicates a robust demand for credit products, which H&T must navigate alongside numerous other players.

H&T's competitive landscape includes:

- Direct Pawnbrokers: Established players like Ramsdens and Cash Converters offering similar core services.

- Short-Term Credit Providers: Companies offering payday loans, installment loans, and other forms of quick credit.

- Specialist Lenders: Firms focusing on specific lending niches, such as Vanquis Banking Group for unsecured personal loans and credit cards, or Funding Circle for business lending.

- Digital Lenders and Fintech Platforms: Increasingly, online platforms are offering faster, more convenient access to credit, directly challenging traditional models.

Impact of FirstCash Acquisition

The proposed acquisition of H&T Group by US-based FirstCash Holdings, Inc. is poised to reshape the competitive landscape, creating the largest publicly traded pawn platform worldwide. This significant development is expected to amplify H&T's competitive edge, granting it enhanced access to capital and greater operational leverage against its existing competitors.

This consolidation is particularly impactful for competitive rivalry by:

- Increasing Market Concentration: The merger will reduce the number of major players, potentially leading to a more concentrated market where fewer, larger entities dominate.

- Heightened Price Competition: With greater scale and access to capital, the combined entity can exert more pressure on pricing, potentially forcing smaller rivals to lower their margins or exit the market.

- Enhanced Service Offerings: FirstCash's resources could enable H&T to invest more heavily in technology and customer service, setting a higher bar for competitors. For instance, in 2023, FirstCash reported revenues of $1.9 billion, indicating substantial operational capacity.

H&T Group operates in a competitive environment, facing rivals from direct pawnbrokers like Ramsdens and Cash Converters, as well as broader financial service providers. The UK consumer credit market, valued at approximately £276.4 billion as of March 2024, is dynamic, with H&T needing to contend with entities like Vanquis Banking Group and digital lenders.

The proposed acquisition of H&T Group by FirstCash Holdings, Inc. is set to significantly alter this landscape, creating a dominant global pawn platform. This merger is expected to increase market concentration and potentially intensify price competition, as the combined entity leverages greater scale and capital access, evidenced by FirstCash's $1.9 billion revenue in 2023.

| Competitor Type | Examples | Impact on H&T |

|---|---|---|

| Direct Pawnbrokers | Ramsdens, Cash Converters | Direct competition for core pawnbroking services. |

| Short-Term Credit Providers | Payday loan companies | Competition for customers seeking quick, short-term credit. |

| Specialist Lenders | Vanquis Banking Group, Funding Circle | Competition for unsecured loans and business lending. |

| Digital Lenders/Fintech | Online credit platforms | Increasingly offering convenient, fast credit alternatives. |

SSubstitutes Threaten

While many H&T Group customers are underserved by traditional banks, personal loans and overdrafts from mainstream financial institutions can act as substitutes. However, the threat is somewhat mitigated as banks have tightened lending criteria, particularly for those with less-than-perfect credit histories, which is H&T's core demographic.

The increasing prevalence of online short-term lenders and payday loan providers presents a significant threat of substitution for H&T Group. These platforms offer quick access to credit, often without the need for physical collateral, appealing to customers seeking immediate financial solutions. For instance, in 2024, the online lending market continued to grow, with many platforms boasting rapid approval times and accessible application processes, directly competing with H&T's traditional pawnbroking and short-term loan services.

Customers needing quick cash have numerous options beyond pawning, such as selling valuable items like gold, jewelry, and watches directly to other buyers, online platforms, or auction houses. This direct selling route offers an alternative method for individuals to access liquidity, directly competing with H&T Group's gold buying and retail operations. For instance, the UK second-hand gold market is substantial, with many individuals opting for outright sales to maximize immediate returns, potentially diverting business from traditional pawnbrokers.

Informal Lending and Family Support

For smaller financial needs, informal borrowing from friends and family remains a common and often preferred substitute for formal financial services. This avenue typically involves no interest or formal credit arrangements, making it an attractive option for many. While unquantifiable, its persistence as an alternative cannot be ignored.

This informal sector is particularly relevant for individuals seeking quick, small-sum loans, bypassing the need for credit checks or lengthy application processes. In 2024, reports suggest that a significant portion of the population, especially in emerging economies, still relies on personal networks for financial assistance, highlighting the enduring nature of this substitute.

- Informal lending from friends and family offers interest-free or low-cost credit.

- It bypasses formal credit checks and lengthy application processes.

- This remains a persistent, though difficult to quantify, alternative for smaller financial needs.

- In 2024, personal networks continue to be a crucial source of financial support for many individuals globally.

Credit Cards and Other Unsecured Credit

Credit cards and other unsecured credit lines present a notable threat of substitution for H&T Group, particularly for consumers needing to bridge short-term financial gaps. While their application in small business financing has diminished, these instruments continue to be a popular choice for individuals, offering flexible, revolving credit. For instance, in 2023, the total outstanding credit card debt in the UK reached approximately £200 billion, highlighting the significant availability and consumer reliance on this form of credit.

The accessibility and convenience of credit cards mean they can directly compete with H&T Group's short-term lending products, such as pawnbroking loans and short-term credit. Consumers may opt for the familiar process of using a credit card, especially for smaller amounts, rather than engaging with a pawnbroker. This is particularly true as many credit cards offer 0% introductory periods, making them an attractive alternative for immediate cash needs.

- Consumer Reliance: Credit cards remain a primary tool for managing personal finances and accessing immediate funds for a broad consumer base.

- Competitive Interest Rates: Promotional 0% APR offers on credit cards can make them more appealing than traditional short-term loans for certain periods.

- Market Size: The substantial volume of outstanding credit card debt in the UK underscores the significant market share these products hold as substitutes.

- Digital Integration: The ease of use and integration of credit cards into digital payment ecosystems further enhance their appeal as a readily available alternative.

The threat of substitutes for H&T Group is multifaceted, encompassing traditional financial institutions, online lenders, direct selling of valuables, informal borrowing, and credit cards. While H&T caters to a specific demographic often underserved by mainstream banks, the availability of alternatives means customers have choices for accessing liquidity. The competitive landscape is dynamic, with digital platforms and readily available credit lines constantly evolving.

| Substitute Type | Key Characteristics | Impact on H&T Group | 2024 Data/Trend Relevance |

|---|---|---|---|

| Traditional Banks (Personal Loans, Overdrafts) | Formal credit, often stricter criteria | Mitigated by tightened lending for H&T's core demographic | Banks continue to focus on prime borrowers. |

| Online Short-Term Lenders | Fast approval, digital access | Significant direct competition for immediate needs | Online lending market growth continues. |

| Direct Selling of Valuables | Outright sale, maximizing immediate returns | Competes with gold buying and retail operations | UK second-hand gold market remains substantial. |

| Informal Lending (Friends/Family) | Interest-free, no credit checks | Persistent, unquantifiable alternative for small needs | Personal networks remain crucial for financial support globally. |

| Credit Cards | Revolving credit, convenience | Direct competitor for short-term financial gaps | UK credit card debt ~£200 billion (2023); 0% APR offers are common. |

Entrants Threaten

The pawnbroking industry, including players like H&T Group, demands considerable upfront investment. Establishing a robust pledge book, which represents the capital available for loans, and stocking retail inventory necessitates significant financial resources. For instance, in 2024, H&T Group reported total assets of £475.7 million, illustrating the scale of capital typically deployed in this sector.

These high capital requirements act as a substantial barrier, discouraging potential new competitors from entering the market. The sheer volume of money needed to establish a competitive presence, covering everything from physical store locations to the liquidity required for lending, creates a formidable entry hurdle.

The pawnbroking sector is overseen by the Financial Conduct Authority (FCA), requiring new entrants to navigate a complex web of compliance, licensing, and consumer protection regulations. This stringent regulatory environment acts as a substantial barrier, making it difficult and costly for new businesses to enter the market.

A significant hurdle for new pawnbrokers entering the market is the reported difficulty in securing bank financing and even basic banking services. Many UK banks are hesitant to engage with the pawnbroking sector, sometimes even blacklisting it, making it exceptionally hard for startups to establish essential operational accounts and obtain crucial funding.

Need for Established Trust and Reputation

The pawnbroking and related financial services sector, including companies like H&T Group, thrives on deeply ingrained customer trust and a solid reputation. Newcomers face a significant hurdle in replicating the years of reliability and positive customer experiences that established firms have cultivated. For instance, H&T Group, a prominent player, has been operating for over 125 years, building a significant level of brand recognition and customer loyalty. This long-standing presence directly translates into a barrier for new entrants attempting to establish credibility in a market where trust is paramount for transactions involving valuable personal assets.

New businesses would find it exceptionally difficult to quickly build the kind of trust that allows for immediate competitive engagement with existing, well-regarded brands. This is particularly true in financial services where customers entrust their assets and financial well-being. In 2023, H&T Group reported a revenue of £500.4 million, demonstrating their substantial market presence, which is partly attributable to their established reputation.

- Established Trust: Years of consistent service and ethical dealings create a strong foundation of trust that new entrants cannot easily replicate.

- Brand Loyalty: Existing customers often exhibit loyalty to brands they trust, making it challenging for new players to attract and retain business.

- Reputational Capital: A strong reputation acts as a significant intangible asset, providing a competitive edge that is built over time and difficult to acquire quickly.

- Market Inertia: Customers may be hesitant to switch from familiar and trusted providers to new, unproven entities, especially for essential financial services.

Extensive Store Network and Infrastructure

The extensive store network and established infrastructure of H&T Group present a formidable barrier to new entrants. With over 280 high street stores strategically located across the UK, H&T commands a significant physical footprint and customer accessibility that is incredibly challenging and capital-intensive for newcomers to match.

Replicating this scale of operation demands substantial upfront investment in real estate, store fit-outs, and logistical support, creating a high hurdle for potential competitors seeking to enter the market.

For instance, establishing a single new store can cost upwards of £100,000 to £250,000, depending on location and size. Therefore, a new entrant would need to commit tens of millions of pounds just to achieve a comparable physical presence.

- High Capital Investment: Building a network of over 280 stores requires significant capital outlay, deterring new entrants.

- Established Brand Recognition: H&T's widespread presence contributes to brand familiarity and trust, which new competitors lack.

- Operational Complexity: Managing a large, dispersed store network involves complex supply chains and staffing, a steep learning curve for new players.

- Time to Market: Developing a comparable infrastructure would take years, allowing H&T to further solidify its market position.

The threat of new entrants for H&T Group is relatively low, primarily due to significant capital requirements and regulatory hurdles. Establishing a robust pledge book and retail inventory demands substantial financial backing, as evidenced by H&T Group's total assets of £475.7 million in 2024. Furthermore, the stringent regulatory landscape overseen by the FCA necessitates complex compliance and licensing, acting as a considerable barrier.

Securing essential banking services and financing is also a major challenge for new pawnbroking businesses, with many UK banks hesitant to engage with the sector. This difficulty in obtaining basic operational accounts and funding makes market entry exceptionally hard.

Building established trust and brand reputation, cultivated over many years by companies like H&T Group (over 125 years of operation), is another critical barrier. Customers are often loyal to trusted providers, making it difficult for new entrants to gain credibility and market share in a sector where trust is paramount.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Significant investment needed for pledge books and retail inventory. | High barrier; discourages entry due to financial scale. |

| Regulatory Compliance | Stringent FCA regulations, licensing, and consumer protection. | Substantial barrier; costly and complex to navigate. |

| Banking & Financing Access | Hesitancy from banks to provide services to the pawnbroking sector. | Exceptional difficulty in securing operational accounts and funding. |

| Brand Reputation & Trust | Years of established trust and customer loyalty are hard to replicate. | Significant hurdle in building credibility and attracting customers. |

Porter's Five Forces Analysis Data Sources

Our H&T Group Porter's Five Forces analysis is built upon a foundation of robust data, drawing from company annual reports, industry-specific market research, and publicly available financial statements. This ensures a comprehensive understanding of competitive pressures within the sectors H&T Group operates.