H&T Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

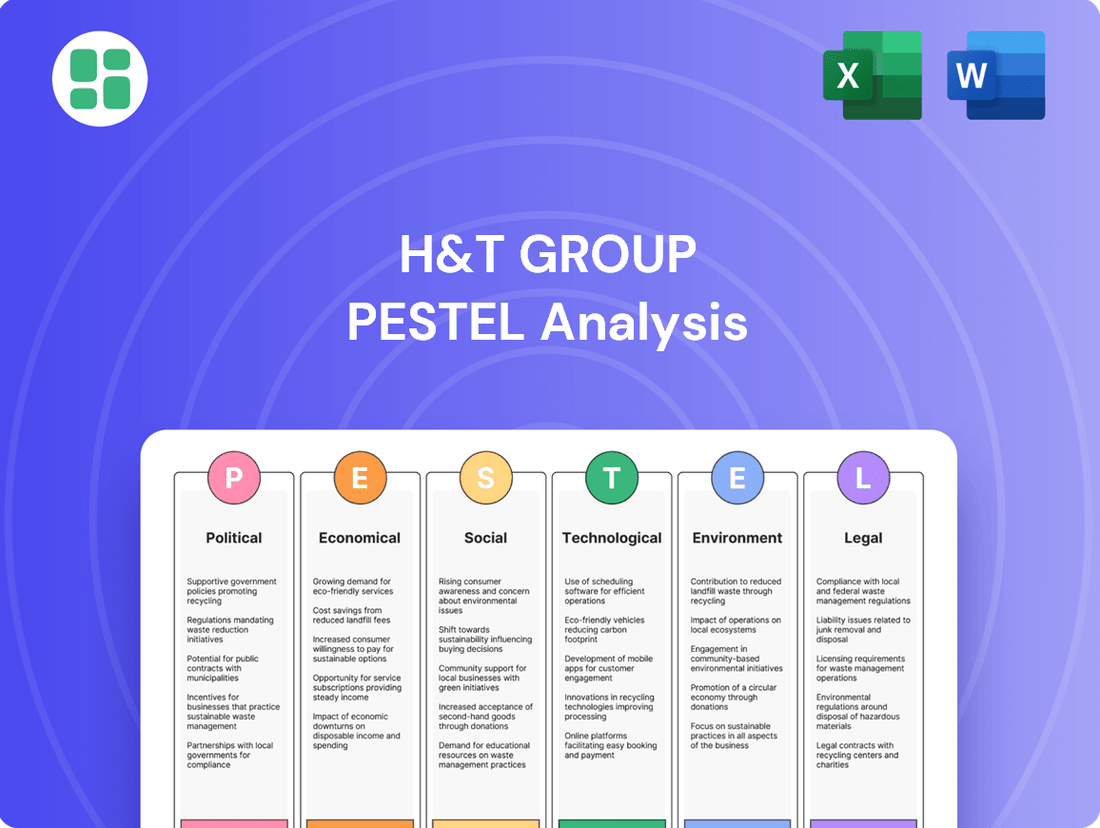

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping H&T Group's trajectory. Our meticulously researched PESTLE analysis provides a strategic roadmap, highlighting both opportunities and threats. Equip yourself with actionable intelligence to navigate the complex external landscape. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

The Financial Conduct Authority (FCA) remains a dominant force in the UK financial landscape, directly impacting H&T Group's operations, especially within consumer lending and pawnbroking. This oversight is crucial for maintaining market integrity and consumer protection.

A key area of focus for H&T Group is the FCA's Consumer Duty, which fully applied to closed products and services from July 2024. This regulation requires firms to demonstrably prioritize customer outcomes, ensuring products offer fair value, communications are transparent, and support mechanisms are robust for all consumers.

Navigating these evolving regulatory requirements, such as the Consumer Duty, necessitates H&T Group to adapt its operational strategies and product development. For instance, ensuring clear pricing structures and accessible customer support channels are paramount to meeting the FCA’s heightened expectations for consumer welfare.

The UK government's ongoing reforms to the Consumer Credit Act 1974 are set to modernize consumer credit regulations, potentially impacting H&T Group. These changes, along with the new regulation of Buy Now, Pay Later (BNPL) schemes, could reshape the competitive landscape and compliance burdens for the pawnbroking and credit sector.

With potential legislative changes anticipated by the close of 2025, H&T Group must remain agile and prepared to adapt its operations and compliance strategies to align with the evolving legal framework. This proactive approach is crucial for navigating the altered regulatory environment effectively.

The UK government is planning to update its Anti-Money Laundering (AML) regulations by the end of 2025. The goal is to simplify these rules while keeping strong safeguards against financial crime. This reform will likely impact H&T Group, a company that handles valuable items like gold and jewelry, by requiring them to adapt to clearer guidelines and possibly implement new digital methods for verifying customer identities.

The importance of having solid AML procedures is highlighted by increased enforcement and substantial penalties for non-compliance observed in 2024. For instance, the Financial Conduct Authority (FCA) has been actively pursuing firms for AML failings, with fines often running into millions of pounds, reinforcing the need for H&T Group to maintain rigorous compliance measures.

Potential Impact of UK General Election and Policy Shifts

The upcoming UK general election, anticipated in late 2024 or early 2025, presents a significant political factor for H&T Group. Shifts in government could lead to altered economic policies, potentially impacting consumer spending power and demand for pawnbroking and credit services. For instance, changes in interest rate policies or fiscal stimulus measures could directly influence the affordability of H&T's offerings for its customer base.

Policy changes concerning consumer protection and financial regulation are also critical. New legislation could affect H&T's operational costs, compliance requirements, and the types of financial products it can offer. For example, stricter regulations on payday lending or credit access could necessitate adjustments to H&T's business model.

H&T Group must remain vigilant regarding the political discourse and potential policy platforms of major parties. Key areas to monitor include:

- Taxation Policies: Potential changes to corporation tax or income tax could affect H&T's profitability and its customers' disposable income.

- Consumer Credit Regulation: Any tightening or loosening of rules around credit provision and affordability checks will directly impact H&T's lending operations.

- Welfare and Social Support: Alterations to government welfare programs could influence the financial stability of a segment of H&T's customer base, affecting demand for its services.

- Economic Growth Strategies: Government plans aimed at boosting economic growth could indirectly benefit H&T by increasing overall consumer confidence and spending.

Foreign Acquisition and Market Consolidation

The proposed acquisition of H&T Group PLC by US-based FirstCash, announced in May 2025, highlights significant political considerations. This cross-border transaction requires scrutiny from regulatory bodies, potentially impacting competition within the UK's financial services sector and setting precedents for foreign investment in similar industries.

Such consolidation can lead to shifts in market dynamics and influence future government policies concerning foreign ownership, especially within sectors deemed strategically important. The deal, valued at approximately £1.1 billion, underscores the increasing trend of international players entering the UK financial market.

- Regulatory Approval: The acquisition is subject to competition and financial regulatory approvals in the UK and potentially other jurisdictions.

- Market Competition: Consolidation could reduce the number of major players in the UK pawnbroking market, potentially affecting pricing and service offerings.

- Foreign Ownership Policy: The transaction may prompt a review of existing policies on foreign ownership in the UK's financial services sector.

- Strategic Positioning: The merger will significantly alter H&T Group's strategic direction and its competitive stance within the UK market.

The upcoming UK general election, anticipated in late 2024 or early 2025, introduces political uncertainty that could influence H&T Group's operating environment. Changes in government might lead to altered economic policies, impacting consumer disposable income and the demand for H&T's services.

Regulatory shifts are a constant factor, with the FCA's Consumer Duty fully applied from July 2024, demanding a stronger focus on customer outcomes. Furthermore, planned updates to AML regulations by the end of 2025 aim to simplify rules while maintaining financial crime safeguards, a key consideration for H&T given its handling of valuable items.

The proposed £1.1 billion acquisition of H&T Group by FirstCash, announced in May 2025, necessitates significant regulatory scrutiny, potentially influencing foreign ownership policies in the UK financial sector and altering market competition.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting the H&T Group, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable discussion points for H&T Group.

Economic factors

The Bank of England's monetary policy significantly impacts H&T Group. While the Bank of England initiated a gradual interest rate reduction in August 2025, the persistent inflation, projected to reach a high of 4.0% in September 2025, continues to strain household budgets.

This economic environment, characterized by rising living costs, is a key driver for H&T Group's core business. High inflation directly fuels demand for short-term, accessible credit solutions, such as pawnbroking loans, as consumers increasingly need assistance managing their finances.

The UK consumer credit market shows a positive trend, with new business in consumer finance growing in early 2025, though a degree of caution persists. This environment supports H&T Group's operations as households increasingly seek accessible, short-term credit solutions.

Persistent financial strain on UK households, driven by the ongoing cost of living crisis, fuels a demand for small-sum, short-term loans. This directly benefits H&T Group, as consumers turn to them for immediate financial assistance.

H&T Group's core pawnbroking business experienced robust growth and rising lending demand in late 2024. This trend highlights the company's crucial role in providing essential financial lifelines to a significant portion of the population navigating economic challenges.

Gold price volatility is a crucial economic factor for H&T Group, directly influencing the value of collateral in their pawnbroking operations and the profitability of their gold buying and retail jewelry businesses. For instance, if gold prices were to fall significantly, the value of items pledged for loans would decrease, potentially impacting loan-to-value ratios and H&T's exposure.

Customer behavior is also sensitive to gold price movements. A rising gold price encourages more customers to pawn or sell their gold items, boosting transaction volumes for H&T. Conversely, a sharp decline can dampen this activity. In 2023, average spot gold prices hovered around $1,970 per ounce, a level that generally supports robust pawnbroking activity, but the risk of a substantial drop remains a key consideration for H&T's financial planning.

Unemployment Rates and Wage Growth

The UK labour market is showing signs of a gradual loosening, with a margin of slack emerging. This shift is reflected in the slowing wage growth, a key factor influencing consumer spending and demand for financial services. For H&T Group, this economic climate presents specific opportunities.

Annual private sector regular average weekly earnings growth saw a decrease, falling to 4.9% in the three months to May 2025, a figure lower than earlier projections. This deceleration in wage increases, coupled with potential job insecurity, can directly impact household finances.

Consequently, periods of lower wage growth and heightened job insecurity often lead to an increased demand for H&T's accessible financial solutions. Individuals may turn to services like pawnbroking or short-term loans to bridge income gaps or manage unforeseen expenses, making these offerings more attractive.

- Subdued GDP growth: Underlying UK GDP growth has remained modest, contributing to a less robust employment environment.

- Slowing wage growth: Average weekly earnings in the private sector grew by 4.9% in the three months to May 2025, indicating a cooling of the labour market.

- Emerging labour market slack: A gradual loosening in the job market suggests a potential increase in job insecurity for some individuals.

- Increased demand for financial solutions: Lower wage growth and job uncertainty can drive demand for H&T's accessible financial services as people seek to manage their finances.

Retail Sales Performance and Consumer Spending

H&T Group's core retail jewelry and watch sales are a vital revenue driver, demonstrating robust growth with a notable 27% increase in 2024. This performance is intrinsically linked to the broader retail sector's health and evolving consumer spending patterns.

While overall consumer confidence supports retail expansion, certain economic headwinds have led to weaker retail sales in specific segments, impacting related credit markets. H&T's proactive approach to broaden its inventory of new jewelry is a strategic move to capitalize on anticipated consumer demand and foster continued sales momentum.

- 2024 Retail Jewelry & Watch Sales Growth: 27% increase for H&T Group.

- Consumer Spending Influence: Directly impacts H&T's retail segment performance.

- Sectoral Weakness Impact: Affects specific credit sectors due to softer retail sales.

- Strategic Inventory Expansion: H&T aims to boost sales by offering a wider new jewelry range.

The Bank of England's monetary policy, including its August 2025 interest rate reduction, is a key economic factor. Despite this, projected inflation of 4.0% in September 2025 continues to pressure household budgets, driving demand for H&T Group's accessible credit solutions like pawnbroking.

The UK consumer credit market saw growth in early 2025, supporting H&T's operations as consumers seek short-term financial assistance amidst persistent cost-of-living challenges. This economic climate, characterized by strained household finances, directly benefits H&T Group's core business.

Gold price volatility is critical, impacting collateral values and profitability in H&T's pawnbroking and retail jewelry segments. For instance, average spot gold prices around $1,970 per ounce in 2023 supported activity, but price drops pose a risk.

Slowing wage growth, with private sector regular average weekly earnings up 4.9% to May 2025, and emerging labor market slack can increase demand for H&T's financial services as individuals manage income gaps and job insecurity.

| Economic Factor | Impact on H&T Group | Relevant Data (2024/2025) |

| Interest Rates | Influences borrowing costs and consumer spending | Bank of England rate reduction in August 2025 |

| Inflation | Drives demand for short-term credit | Projected 4.0% in September 2025 |

| Consumer Credit Market | Supports H&T's operational environment | Positive new business growth in early 2025 |

| Gold Prices | Affects collateral values and retail sales | Average spot price ~$1,970/oz in 2023 |

| Wage Growth | Impacts consumer spending and demand for services | Private sector earnings up 4.9% to May 2025 |

Same Document Delivered

H&T Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the H&T Group will equip you with critical insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. Understand the external forces shaping their strategy and market position.

Sociological factors

The persistent cost of living crisis in the UK is a significant driver for H&T Group's services. As more people, even those with higher incomes, seek accessible short-term financial solutions, pawnbrokers like H&T are experiencing increased demand. This trend underscores the widespread financial strain affecting households across various income levels.

Data from the Financial Conduct Authority (FCA) supports this, revealing a 25% surge in new pawnbroking loans in the 12 months leading up to October 2023. This substantial increase points to the growing number of individuals needing immediate financial assistance to cover essential expenses such as food and heating, demonstrating the critical role H&T's business model plays in providing a lifeline during these challenging economic times.

Public perception of pawnbroking is evolving, with a growing acceptance beyond its traditional role as a last resort for those facing financial hardship. This shift is influenced by increasing financial pressures felt by a broader range of income groups, prompting a re-evaluation of available financial services.

H&T Group is actively working to reposition pawnbroking as an accessible, straightforward, and transparent borrowing method. Their strategy aims to demystify the service and make it a more integrated and understood component of the UK's financial ecosystem.

As the UK's largest pawnbroking company, H&T Group's efforts are crucial in normalizing this financial option. This initiative seeks to enhance its reputation and utility for a wider customer base, reflecting a broader societal trend towards more flexible financial solutions.

The financial literacy of consumers directly impacts their engagement with credit products and their comprehension of contractual terms. For H&T Group, a strong emphasis on transparent product explanations is paramount, especially in light of evolving Consumer Duty regulations that prioritize customer understanding and fair treatment.

Consumers are demonstrating a greater propensity to compare credit offerings, with a significant portion willing to switch providers for more favorable interest rates. For instance, a 2024 survey indicated that over 60% of individuals actively compare credit deals before making a decision, underscoring the necessity for H&T Group to differentiate itself through competitive pricing and a superior customer journey.

Demographic Shifts and Regional Needs

The UK's demographic landscape is evolving, with an aging population and shifts in the working-age demographic directly impacting the demand for H&T Group's services. For instance, the Office for National Statistics reported that by mid-2022, the proportion of people aged 65 and over in the UK was 19.7%, a figure expected to grow. This trend can increase the need for pawn broking and personal finance solutions, particularly in regions with a higher concentration of older residents.

H&T Group's widespread presence across England, Scotland, and Wales, comprising over 250 high street stores as of early 2024, positions it to address these varied regional requirements. The company's ability to adapt its service mix—from pawnbroking to cheque cashing and foreign currency exchange—allows it to cater to the specific financial vulnerabilities and consumer behaviours prevalent in different locales. Understanding these localized economic conditions is crucial for strategic store placement and tailoring product offerings.

- Aging Population: The UK's increasing proportion of individuals aged 65+ (19.7% in mid-2022) may drive demand for accessible financial services.

- Regional Diversity: H&T's extensive store network (over 250 locations) allows it to serve a broad range of local needs across England, Scotland, and Wales.

- Vulnerability Focus: Identifying and responding to regional financial vulnerabilities is key to optimizing store performance and service relevance.

- Consumer Trends: Adapting to localized consumer behaviour and financial needs ensures H&T remains competitive in diverse market segments.

Digital Adoption by Consumers

Consumer adoption of digital financial services continues to climb, influencing how businesses like H&T Group interact with their customers. While H&T maintains a strong physical presence, the shift towards online platforms for financial needs is undeniable. For instance, the UK's digital banking penetration reached an estimated 78% in 2023, showcasing a clear trend towards digital convenience.

This digital preference is particularly evident among younger consumers who readily embrace online lending and Buy Now, Pay Later (BNPL) options. The BNPL market in the UK alone was projected to grow significantly, reaching billions in transaction value by 2024, highlighting a generational shift in payment and credit habits. H&T's website serves as a crucial touchpoint, offering customers access to both financial products and retail items online, demonstrating a strategic adaptation to these evolving consumer behaviors and the broader digitalization of financial solutions.

- Digital Banking Growth: UK digital banking penetration estimated at 78% in 2023.

- BNPL Market Expansion: UK BNPL market projected for substantial growth in transaction value by 2024.

- Evolving Consumer Habits: Younger demographics show a clear preference for digital financial services and payment methods.

- H&T's Digital Adaptation: The company's website facilitates online access to financial products and retail offerings, aligning with digital trends.

The UK's demographic shifts, particularly an aging population, present a growing need for accessible financial services. With 19.7% of the UK population aged 65 and over by mid-2022, there's an increased likelihood of demand for pawnbroking and related services, especially in areas with higher concentrations of older residents.

H&T Group's extensive network of over 250 stores across England, Scotland, and Wales, as of early 2024, allows it to effectively cater to diverse regional financial needs and consumer behaviours. This widespread presence enables the company to adapt its offerings to local economic conditions and consumer vulnerabilities, ensuring its services remain relevant.

Consumer financial literacy and their willingness to compare credit options are crucial factors. A 2024 survey revealed that over 60% of consumers actively compare credit deals, highlighting the importance for H&T Group to offer competitive pricing and a strong customer experience to stand out in the market.

Technological factors

The financial services sector is rapidly digitizing, with cloud adoption and automation at its core. This shift is reshaping how companies like H&T Group operate, pushing for greater online accessibility and efficiency.

H&T Group leverages its digital platform in tandem with its physical stores, offering customers a dual channel for engagement. This hybrid approach is crucial for meeting evolving customer expectations in an increasingly digital-first world.

Ongoing investment in technology and operating systems is paramount for H&T Group. For instance, in 2024, the company continued to prioritize upgrades to its digital infrastructure to boost operational efficiency and deliver superior customer experiences, a trend mirrored across the industry as competition intensifies.

As a financial institution, H&T Group faces escalating demands for strong data security and privacy. The company must adhere to regulations like GDPR, which impose strict rules on handling personal data. Failure to comply can result in substantial fines, as seen with the €1.2 billion in GDPR fines issued across the EU in 2023.

H&T Group can significantly boost its credit assessment by employing advanced data analytics and AI. This technology allows for more precise risk profiling and the creation of tailored loan products, moving beyond traditional asset-based pawnbroking.

By analyzing customer financial behaviors, H&T can refine its lending decisions and uncover new market segments. For instance, in 2024, the UK financial services sector saw a significant increase in the adoption of AI for fraud detection and credit scoring, with reports suggesting a potential 20% improvement in accuracy for predictive models.

This data-driven approach not only optimizes lending but also streamlines operations, particularly for unsecured loan offerings. The efficiency gains from AI-powered underwriting can lead to faster loan approvals and a better customer experience, a crucial factor in the competitive financial landscape.

E-commerce and Online Retail Capabilities

H&T Group's retail operations, particularly in new and pre-owned jewelry and watches, are significantly enhanced by robust e-commerce capabilities. An effective online presence is crucial for expanding reach beyond physical locations and catering to a broader customer demographic.

The group's investment in its digital platforms is a key driver for growth. For instance, in the fiscal year ending March 2024, H&T Group reported a notable increase in online sales, contributing to its overall revenue. This trend is expected to continue as consumer preferences shift towards digital purchasing. The company's strategy includes ongoing enhancements to its website and mobile app to ensure a seamless and engaging customer journey.

Key aspects of H&T Group's e-commerce strategy include:

- Enhanced Website Functionality: Continuous updates to improve user experience, product discoverability, and checkout processes.

- Digital Marketing Investment: Targeted online advertising and social media engagement to drive traffic and conversions.

- Omnichannel Integration: Seamlessly connecting online and in-store experiences, allowing for click-and-collect and easy returns.

- Data Analytics: Utilizing customer data to personalize offers and improve online merchandising.

Technological Infrastructure and Scalability

H&T Group's technological infrastructure must be capable of scaling to accommodate growth in its pledge book and retail operations, as well as any future acquisitions. This means having IT systems that are both robust and adaptable enough to handle a rising number of transactions, vast amounts of customer data, and the introduction of new services.

The company has explicitly stated that investment in both technology and its physical store network is a key priority. For instance, H&T Group's 2023 annual report highlighted significant capital expenditure, with a portion allocated to enhancing digital capabilities and store modernization, underscoring technology's role in their growth strategy.

- Scalability: The ability of H&T Group's IT systems to grow alongside its business, supporting increased transaction volumes and customer data.

- Flexibility: IT infrastructure needs to adapt to evolving service offerings and changing market demands.

- Investment Priority: H&T Group recognizes technology and store estate upgrades as crucial for future expansion and operational efficiency.

- Digital Enhancement: Continued investment in digital platforms is essential for customer engagement and streamlined operations, as seen in their 2023 capital allocation.

Technological advancements are fundamentally reshaping H&T Group's operations, driving a digital-first approach. The company's strategy emphasizes continuous investment in its digital infrastructure, including upgrades to operating systems and online platforms, to enhance efficiency and customer experience. This focus on technology is crucial for remaining competitive in the rapidly digitizing financial services sector.

H&T Group is leveraging advanced data analytics and AI to refine credit assessment processes, moving beyond traditional methods to offer more precise risk profiling and tailored loan products. This data-driven approach not only optimizes lending decisions but also streamlines operations, particularly for unsecured loans, leading to faster approvals and improved customer satisfaction.

The group's e-commerce capabilities are vital for expanding its retail reach in jewelry and watches. By enhancing website functionality, investing in digital marketing, and integrating online and in-store experiences, H&T Group aims to capture a broader customer base and drive growth. For instance, the fiscal year ending March 2024 saw a notable increase in online sales, underscoring the importance of these digital investments.

| Technology Area | Impact on H&T Group | Industry Trend (2024/2025) |

|---|---|---|

| Digitalization & Cloud Adoption | Enhanced operational efficiency, greater online accessibility | Continued industry-wide shift towards cloud-based solutions |

| AI & Data Analytics | Improved credit assessment, personalized loan products, fraud detection | Increasing adoption for credit scoring, with potential for 20% accuracy improvement in predictive models |

| E-commerce Capabilities | Expanded retail reach, increased online sales contribution | Growing consumer preference for digital purchasing, driving online sales growth |

Legal factors

H&T Group is navigating the FCA's Consumer Duty, which fully applied to all its offerings by July 2024. This new framework mandates that financial firms act with integrity, prevent foreseeable harm to consumers, and actively support customers in achieving their financial goals. The company has undertaken a comprehensive review of its operational procedures, internal policies, and staff training programs to align with these enhanced consumer protection standards.

The ongoing FCA oversight throughout 2024 and into 2025 means H&T Group must demonstrate continuous adherence to the Consumer Duty. This includes ensuring that products are designed to meet consumer needs and that pricing and value are fair. The group's commitment to positive customer outcomes is a key focus, with the expectation that this will be rigorously assessed.

H&T Group, operating as a financial services provider and high-value dealer, is heavily regulated by UK Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. Key legislation includes the Money Laundering Regulations 2017 and the Proceeds of Crime Act 2002. These regulations mandate strict adherence to prevent financial crime.

The UK government is actively reforming the Money Laundering Regulations, with updates anticipated in 2025 aimed at streamlining compliance processes for businesses. Despite these reforms, the penalties for non-compliance remain substantial, emphasizing the critical need for robust internal controls.

To effectively mitigate financial crime risks, H&T Group must implement and maintain rigorous customer due diligence procedures, establish clear protocols for reporting suspicious activities, and ensure comprehensive ongoing training for all employees. These measures are essential for safeguarding the company and adhering to legal obligations.

The UK's Consumer Credit Act 1974 is undergoing reform, with HM Treasury set to regulate Buy Now, Pay Later (BNPL) schemes. This move, expected to be fully implemented by late 2024 or early 2025, will create a more standardized consumer lending landscape. While H&T Group's core pawnbroking business is already overseen by the Financial Conduct Authority (FCA), these broader legislative shifts could indirectly affect how consumer credit products are structured and marketed across the sector.

The FCA's ongoing review of consumer credit, including potential changes to responsible lending rules, could also influence H&T's operational framework. For instance, any new requirements for affordability assessments or clearer product disclosures for regulated credit agreements might necessitate adjustments to H&T's existing processes. Staying ahead of these evolving legal requirements is crucial for maintaining compliance and a competitive edge in the UK financial services market.

Data Protection Regulations (GDPR)

H&T Group's adherence to data protection regulations, particularly the General Data Protection Regulation (GDPR), is paramount due to the significant volume of customer personal data it manages. This necessitates rigorous protocols for data collection, secure storage, transparent processing, and obtaining explicit consent. Failure to comply can result in severe financial penalties; for instance, in 2023, fines under GDPR reached hundreds of millions of euros across various sectors, highlighting the substantial risk.

Ensuring robust data security measures and respecting individuals' rights, such as the right to access and erasure, are ongoing legal mandates. Continuous investment in data governance frameworks and employee training is crucial for H&T Group to mitigate the risks of substantial fines and reputational damage associated with data breaches or non-compliance.

- GDPR Compliance: Ongoing legal requirement for H&T Group.

- Data Handling: Strict rules on collection, storage, processing, and consent.

- Risk of Non-Compliance: Significant fines and reputational damage.

- Mitigation: Continuous investment in data governance and security.

Retail and Second-Hand Goods Legislation

H&T Group's retail operations, dealing in both new and pre-owned jewelry and watches, are governed by stringent consumer protection laws. These regulations cover aspects like product authenticity, quality assurance, and adherence to fair trading practices. For instance, the Consumer Rights Act 2015 in the UK mandates that goods must be of satisfactory quality, fit for purpose, and as described, directly impacting H&T's sales processes and product guarantees.

Specific legislation for second-hand goods adds another layer of compliance. This often includes rules around sourcing, valuation, and resale, ensuring transparency and preventing the trade of stolen or counterfeit items. H&T must navigate these laws to maintain consumer trust and avoid potential legal repercussions, such as fines or reputational damage, stemming from non-compliance in their retail segment.

- Consumer Protection: Laws like the Consumer Rights Act 2015 ensure goods sold are of satisfactory quality, fit for purpose, and accurately described.

- Second-Hand Goods Regulations: Specific rules govern the sourcing, valuation, and resale of pre-owned items to ensure legality and prevent illicit trade.

- Authenticity and Quality: Retailers are legally obligated to accurately represent the authenticity and quality of jewelry and watches, impacting customer warranties and returns.

- Fair Trading: Adherence to fair trading practices is crucial to prevent misleading advertising and ensure ethical sales processes, vital for maintaining brand reputation.

H&T Group's operations are significantly shaped by evolving UK financial regulations, including the FCA's Consumer Duty, fully effective by July 2024, which mandates integrity, harm prevention, and customer support. The group is also subject to stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, such as the Money Laundering Regulations 2017, with anticipated reforms in 2025. Furthermore, the upcoming regulation of Buy Now, Pay Later (BNPL) schemes under the Consumer Credit Act 1974 by late 2024/early 2025, alongside potential FCA reviews of responsible lending, necessitates continuous adaptation.

The company's handling of substantial customer data requires strict adherence to GDPR, with non-compliance risking significant penalties, as evidenced by substantial GDPR fines levied in 2023. Retail operations are governed by consumer protection laws like the Consumer Rights Act 2015, ensuring goods are of satisfactory quality and accurately described, with specific regulations for second-hand goods to prevent illicit trade.

| Regulatory Area | Key Legislation/Requirement | Impact on H&T Group | 2024/2025 Focus |

|---|---|---|---|

| Consumer Protection | FCA Consumer Duty | Mandates fair treatment, preventing harm, supporting financial goals. | Full implementation and ongoing adherence, demonstrating positive customer outcomes. |

| Financial Crime | Money Laundering Regulations 2017, Proceeds of Crime Act 2002 | Strict AML/CTF compliance, customer due diligence, suspicious activity reporting. | Adapting to potential 2025 reforms, maintaining robust internal controls. |

| Consumer Credit | Consumer Credit Act 1974 (BNPL reform), FCA responsible lending review | Potential impact on credit product structuring and marketing; need for adjusted affordability assessments. | Navigating BNPL regulation by late 2024/early 2025; preparing for potential changes in lending rules. |

| Data Protection | GDPR | Rigorous data handling protocols, risk of substantial fines for breaches. | Continuous investment in data governance, security, and employee training to mitigate risks. |

| Retail Sales | Consumer Rights Act 2015, Second-hand goods regulations | Ensuring product quality, authenticity, and fair trading practices; compliance in sourcing and resale. | Maintaining transparency and trust in retail operations, avoiding legal repercussions. |

Environmental factors

H&T Group's retail division, which handles new and pre-owned jewelry and watches, is under growing pressure to ensure its materials are sourced ethically and sustainably. This is especially true for precious metals like gold and gemstones.

Consumers and regulators are paying more attention to environmental, social, and governance (ESG) factors. Proving that supply chains are responsible, avoiding conflict minerals and harmful environmental methods, is vital for H&T Group's reputation and meeting compliance standards. For instance, in 2024, the World Gold Council reported that 87% of consumers consider sustainability when making purchasing decisions, a significant increase from previous years.

Financial services companies, including those in lending and investment, are increasingly integrating ESG criteria into their business models. This trend influences how companies like H&T Group are evaluated and financed, making sustainable sourcing a financial imperative as well as an ethical one.

H&T Group's extensive network of over 250 high street stores across the UK inherently leads to significant energy consumption for lighting, heating, and cooling, contributing to its carbon footprint. Reducing this impact involves initiatives like upgrading to energy-efficient lighting and optimizing HVAC systems.

The company is actively working to mitigate its environmental impact by transitioning to renewable energy sources where feasible and improving the energy efficiency of its store network. These efforts align with growing regulatory and investor expectations for UK financial services firms to develop and implement credible transition plans, with a clear aim towards achieving net-zero emissions by 2050.

H&T Group's operations, which involve processing precious metals and items like watches, necessitate strong waste management and recycling protocols. This focus is crucial for environmental stewardship, especially concerning electronic waste and valuable metal recovery. For instance, the global e-waste recycling market was valued at approximately $50 billion in 2023 and is projected to grow significantly, highlighting the economic and environmental importance of responsible handling.

Effective recycling not only minimizes H&T Group's ecological footprint but also presents opportunities for cost reduction and enhanced resource efficiency. Recovering precious metals from discarded electronics, for example, can yield substantial economic benefits, turning waste into a valuable resource. The London Bullion Market Association (LBMA) sets standards for recycled precious metals, underscoring the commercial value and market demand for responsibly sourced recycled materials.

Climate-Related Financial Risk Disclosure

UK financial services firms, including H&T Group, face increasing pressure to disclose climate-related financial risks. Frameworks like the Transition Plan Taskforce (TPT) and Sustainability Disclosure Requirements (SDR) are driving this, pushing even smaller entities to assess climate impacts. This means understanding how physical risks, like extreme weather affecting assets, and transition risks, stemming from the shift to a low-carbon economy, could financially impact the business.

The Financial Conduct Authority (FCA) has been a key player in this evolving regulatory landscape. For instance, the FCA's Sustainability Disclosure Requirements (SDR) and investment labels, which came into effect in late 2024, aim to provide consumers with clearer information on sustainable investments. While H&T Group operates in the pawnbroking and credit sectors, the broader regulatory push for transparency in climate risk management suggests a growing expectation for all market participants to engage with these issues.

H&T Group, though not a major bank, will likely need to consider how climate change could affect its operations and customer base. This could involve:

- Assessing physical risks to its physical branches and any assets it holds.

- Evaluating transition risks from policy changes or shifts in consumer behavior towards more sustainable financial products.

- Understanding potential impacts on its customers' ability to repay loans due to climate-related events or economic shifts.

- Aligning with broader market expectations for corporate responsibility and resilience in the face of climate change.

Customer and Investor Demand for ESG Practices

Customers and investors are increasingly prioritizing businesses with strong Environmental, Social, and Governance (ESG) credentials. For H&T Group, this translates to a need to showcase not only its operational sustainability but also the ethical and sustainable nature of its financial offerings. Companies that transparently communicate their ESG efforts and avoid misleading claims are better positioned to build trust, enhance their brand image, and attract a growing segment of socially responsible consumers and investors.

The market for ESG-aligned investments is expanding rapidly. For instance, global ESG assets are projected to reach $50 trillion by 2025, indicating a significant shift in capital allocation. This trend pressures companies like H&T Group to integrate ESG principles into their core strategies to remain competitive and appealing to a broader investor base.

- Growing ESG Investment: Global ESG assets are on track to surpass $50 trillion by 2025, demonstrating a clear investor preference for sustainable businesses.

- Customer Preference: A significant percentage of consumers, often over 60%, state they are willing to pay more for products from sustainable brands.

- Reputational Risk: Failure to meet ESG expectations can lead to negative publicity and a decline in brand value, impacting customer loyalty and investor confidence.

- Regulatory Scrutiny: Anticipate increased regulatory focus on ESG disclosures and reporting standards in the coming years, requiring robust data and transparency.

H&T Group faces growing pressure to ensure ethical and sustainable sourcing for its precious metals and gemstones, with 87% of consumers considering sustainability in purchasing decisions as of 2024. The company’s extensive store network also contributes to a significant carbon footprint, prompting initiatives like upgrading to energy-efficient lighting and exploring renewable energy sources to meet net-zero targets by 2050.

Robust waste management and recycling protocols are essential for H&T Group, particularly for valuable metal recovery from items like watches, with the global e-waste recycling market valued at approximately $50 billion in 2023. This focus not only minimizes ecological impact but also offers economic benefits, aligning with LBMA standards for recycled precious metals.

The company must also navigate increasing regulatory demands for climate-related financial risk disclosure, driven by frameworks like the Transition Plan Taskforce (TPT) and the FCA's Sustainability Disclosure Requirements (SDR) implemented in late 2024. This necessitates assessing both physical and transition risks to operations and customer repayment capabilities.

The expanding market for ESG-aligned investments, projected to exceed $50 trillion by 2025, underscores the need for H&T Group to integrate ESG principles to remain competitive and attract socially responsible consumers and investors.

| Environmental Factor | Impact on H&T Group | Data/Statistic |

|---|---|---|

| Ethical Sourcing | Reputational risk, compliance, consumer demand | 87% of consumers consider sustainability (2024) |

| Energy Consumption | Carbon footprint, operational costs | Over 250 UK stores |

| Waste Management & Recycling | Environmental stewardship, resource efficiency | Global e-waste recycling market: ~$50 billion (2023) |

| Climate Risk Disclosure | Regulatory compliance, investor expectations | FCA SDR effective late 2024 |

| ESG Investment Growth | Capital attraction, market competitiveness | Global ESG assets to exceed $50 trillion by 2025 |

PESTLE Analysis Data Sources

Our PESTLE analysis for H&T Group is meticulously crafted using data from reputable financial news outlets, government economic reports, and industry-specific market research. This ensures a comprehensive understanding of the external factors impacting the group.