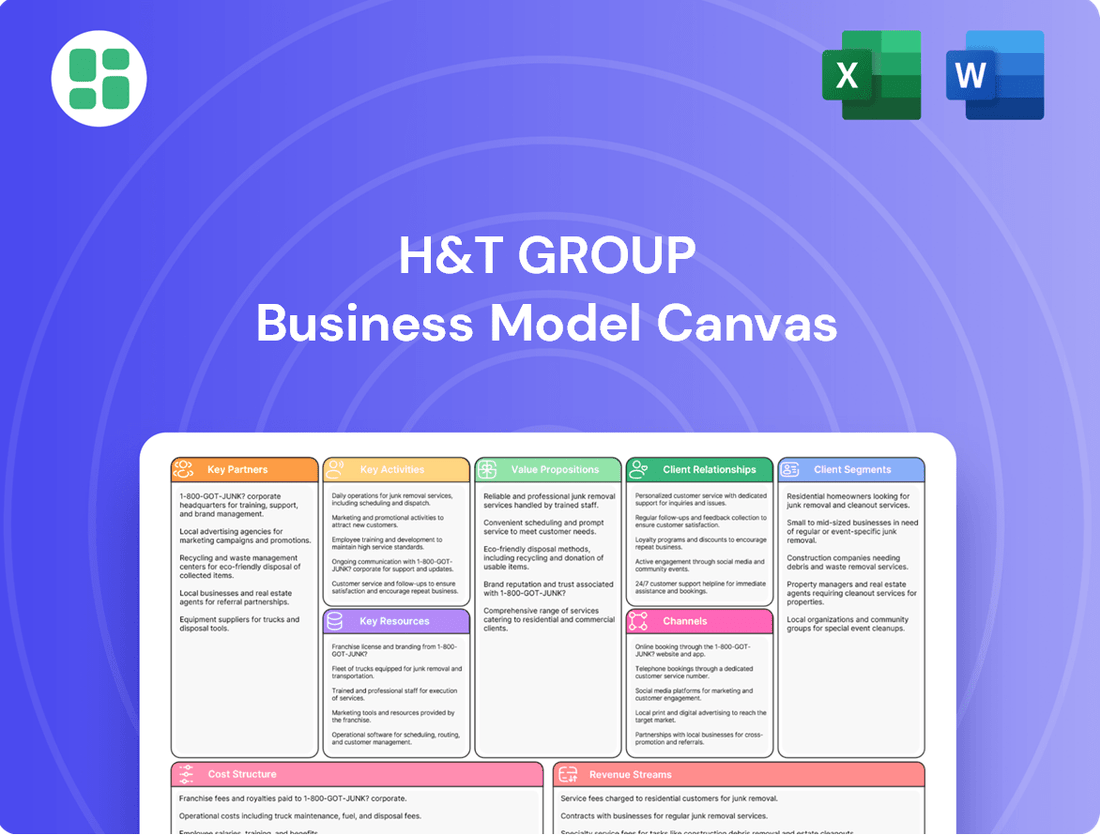

H&T Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

Unlock the strategic blueprint of H&T Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for aspiring entrepreneurs and seasoned business strategists alike. Discover the core elements that drive their market position and growth.

Partnerships

H&T Group maintains critical ties with financial institutions and lenders to fund its operations, especially its expanding pawnbroking pledge book. These relationships are vital for securing the capital needed to meet the consistent demand for small, short-term loans. For instance, as of their 2024 interim report, H&T Group highlighted its access to a diverse range of funding facilities, demonstrating the strength of these partnerships.

H&T Group's retail segment relies heavily on partnerships with suppliers of both new and pre-owned jewelry and watches. These relationships are vital for ensuring a broad and high-quality stock, which directly fuels their retail revenue streams. In 2024, H&T Group continued to emphasize expanding its selection of new jewelry, a key strategy aimed at accelerating sales growth within this segment.

H&T Group relies heavily on specialized security and logistics partners to safeguard its valuable assets, including gold, jewelry, and watches. These collaborations are critical for the secure transportation, storage, and handling of both customer collateral and the company's retail inventory.

For instance, in 2024, H&T Group's commitment to security is underscored by its stringent operational standards, which necessitate partnerships with providers equipped to handle high-value goods. This ensures the integrity of the supply chain and minimizes risks associated with theft or damage, thereby fostering customer confidence.

Regulatory Bodies and Compliance Experts

H&T Group, as a regulated financial services provider, cultivates essential relationships with key regulatory bodies. A prime example is their ongoing engagement with the Financial Conduct Authority (FCA) in the UK. These partnerships are fundamental for ensuring H&T Group operates within the established legal frameworks governing financial services.

To navigate the complex and ever-changing regulatory landscape, H&T Group actively collaborates with specialized compliance experts. These partnerships are vital for staying abreast of and adhering to critical regulations, including those concerning anti-money laundering (AML) and robust consumer protection measures. Such diligence is non-negotiable for maintaining legal operational status and safeguarding the company's reputation and its essential operating licenses.

- FCA Engagement: H&T Group maintains active communication and compliance with the Financial Conduct Authority, ensuring adherence to UK financial regulations.

- AML Compliance: Partnerships with compliance experts help H&T Group implement and maintain stringent Anti-Money Laundering protocols.

- Consumer Protection: Collaboration ensures that H&T Group's practices align with evolving consumer protection laws, fostering trust and security for its customers.

- License Maintenance: These key partnerships are critical for H&T Group to retain its operating licenses and uphold its standing in the financial services sector.

Technology and IT Infrastructure Providers

H&T Group relies on technology and IT infrastructure providers to power its operations, from the shop floor to the digital realm. These collaborations are essential for maintaining a seamless customer journey across its numerous physical stores and expanding online channels.

Key partnerships in this area ensure H&T Group has access to cutting-edge point-of-sale (POS) systems, robust e-commerce platforms, and secure data management solutions. For instance, in 2023, H&T Group continued its investment in upgrading its POS systems, aiming to improve transaction speed and customer data capture, which are vital for personalized service.

- POS System Upgrades: Partnerships with IT firms to implement faster, more integrated POS systems across the store network.

- E-commerce Platform Development: Collaborations to enhance the online shopping experience, including secure payment gateways and inventory management.

- Data Security and Management: Working with cybersecurity experts to protect sensitive customer and transaction data, a critical component of trust.

- Cloud Infrastructure: Leveraging cloud service providers to ensure scalability and reliability for their digital services and internal systems.

H&T Group's key partnerships extend to valuation and assaying services, ensuring accurate pricing for pledged and sold items. These collaborations are crucial for maintaining customer trust and the integrity of their valuation processes. For example, in 2024, H&T Group continued to leverage expert third-party valuations for precious metals and gemstones, reinforcing the accuracy of their offerings.

Furthermore, H&T Group collaborates with marketing and advertising agencies to enhance brand visibility and customer acquisition. These partnerships are vital for reaching new customer segments and promoting their diverse service offerings, from pawnbroking to retail sales. In 2024, the company focused on digital marketing initiatives, working with specialists to drive online engagement and footfall to their stores.

| Partnership Area | Key Collaborators | 2024 Focus/Impact |

|---|---|---|

| Financial Institutions & Lenders | Various Banks and Financial Providers | Securing diverse funding facilities to support pledge book growth. |

| Retail Suppliers | Jewelry and Watch Wholesalers/Manufacturers | Expanding new jewelry selection to drive retail sales growth. |

| Security & Logistics | Specialized Security Firms | Ensuring secure handling and transportation of high-value assets. |

| Regulatory Compliance | FCA, Compliance Experts | Adhering to financial regulations, AML, and consumer protection. |

| Technology & IT | POS System Providers, E-commerce Platforms | Upgrading POS systems for improved transaction speed and data capture. |

| Valuation & Assaying | Independent Gemologists, Assayers | Ensuring accurate valuations for customer transactions and retail stock. |

| Marketing & Advertising | Digital Marketing Agencies | Enhancing brand visibility and customer acquisition through online channels. |

What is included in the product

A comprehensive business model overview for H&T Group, detailing their customer segments, value propositions, and revenue streams within the pawn broking and retail sectors.

This model reflects H&T Group's operational strategy, focusing on their diverse service offerings and the key resources required to maintain their market position.

The H&T Group Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that simplifies complex strategies for easier understanding and actionable insights.

It alleviates the pain of convoluted business planning by offering a structured, visual tool that promotes efficient brainstorming and team alignment.

Activities

Pawnbroking and secured lending form the bedrock of H&T Group's operations. This core activity centers on offering secured loans, primarily against valuable personal assets such as gold and jewelry. The process involves meticulous valuation of these pledged items, efficient loan origination, and the careful management of the 'pledge book,' which represents the outstanding loans secured by these assets.

The demand for these secured lending services remains robust and is experiencing continued growth. While traditional small-sum loans remain a significant segment, H&T Group is also cautiously expanding its offerings to larger loans. These larger loans are increasingly sought after by individuals and small businesses for various purposes, including funding business ventures.

In 2024, H&T Group reported a strong performance in its pawnbroking segment. The company's pledge book value demonstrated resilience, with a notable increase in the average loan value. This growth reflects both the enduring appeal of pawnbroking as a flexible credit solution and the company's strategic approach to serving a broader range of customer needs, including those requiring capital for business growth.

H&T Group's core activity involves the retail sale of both new and pre-owned jewelry and watches. This spans sourcing, preparing pre-owned items through refurbishment, strategic merchandising, and direct customer sales across their numerous high street locations and digital platforms.

This retail segment is a significant revenue driver for H&T Group. For instance, in the first half of 2024, the Group reported a 10% increase in retail sales, highlighting its growing importance to the overall business performance.

H&T Group actively engages in acquiring unwanted gold and jewelry directly from customers through its extensive retail network. This core activity is complemented by the processing and sale of gold scrap, which includes items forfeited from its pawnbroking operations.

In 2024, the group's pawnbroking and gold buying segments demonstrated resilience. For instance, H&T Group reported a significant portion of its revenue derived from these activities, highlighting their ongoing importance to the business. The profitability of gold purchasing, while subject to market fluctuations, consistently contributes a vital income stream.

Unsecured Personal Loans and Other Financial Services

H&T Group's key activities extend significantly beyond traditional pawnbroking. They actively offer unsecured personal loans, a service that broadens their customer base and revenue streams. This diversification is crucial for meeting varied financial demands.

Furthermore, H&T Group engages in cheque cashing and foreign currency exchange. These ancillary services are vital for capturing a wider market share and providing a more comprehensive financial hub for their customers. The foreign currency exchange segment, in particular, has demonstrated robust and consistent growth.

- Unsecured Personal Loans: Providing credit solutions to individuals without collateral.

- Cheque Cashing: Offering immediate liquidity for customers holding cheques.

- Foreign Currency Exchange: Facilitating international transactions and travel needs, a segment showing consistent growth.

Store Network Management and Expansion

H&T Group's core operations hinge on the meticulous management and strategic growth of its UK-wide high street store network. This involves a constant cycle of identifying prime new locations, upgrading current branches, and smoothly incorporating new pledge books and businesses acquired through strategic moves. The company has demonstrated a consistent commitment to bolstering its physical presence, evidenced by continued investment in its store estate.

In 2024, H&T Group continued to refine its retail footprint. The business actively pursued opportunities to enhance its store network, focusing on optimizing performance and accessibility for its customer base. This strategic approach ensures the brand remains a visible and trusted presence in communities across the United Kingdom.

- Store Network Optimization: Ongoing efforts to identify and secure high-potential locations for new stores and to refurbish existing ones to improve customer experience and operational efficiency.

- Acquisition Integration: Seamlessly integrating acquired pledge books and businesses into the existing store network, leveraging synergies and expanding market reach.

- Capital Investment: Continued allocation of capital towards the expansion and enhancement of the physical store estate, reflecting a long-term commitment to this channel.

H&T Group's key activities are multifaceted, encompassing pawnbroking, secured lending, and the retail sale of jewelry. They also actively buy gold and offer unsecured personal loans, cheque cashing, and foreign currency exchange. A significant focus is on managing and expanding their UK-wide store network.

| Activity | Description | 2024 Performance Highlight |

|---|---|---|

| Pawnbroking & Secured Lending | Offering loans against personal assets, primarily gold and jewelry. | Notable increase in average loan value, demonstrating resilience. |

| Retail Sales | Selling new and pre-owned jewelry and watches. | 10% increase in retail sales in H1 2024. |

| Gold Buying & Processing | Acquiring unwanted gold and jewelry, processing scrap gold. | Significant revenue contributor, vital income stream. |

| Ancillary Financial Services | Unsecured loans, cheque cashing, foreign currency exchange. | Foreign currency exchange shows robust and consistent growth. |

| Store Network Management | Operating and expanding a UK-wide high street presence. | Continued investment in store estate, optimizing retail footprint. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is processed, you'll gain full access to this ready-to-use, professional tool.

Resources

H&T Group's extensive high street store network, comprising over 280 locations across the UK, is a cornerstone of its business model. These physical branches are more than just retail spaces; they are vital hubs for pawnbroking transactions, the sale of pre-owned goods, and the delivery of various financial services. This widespread physical presence ensures high accessibility for a broad customer base, fostering trust and facilitating immediate transactions.

The strategic importance of these stores lies in their role as primary customer touchpoints, supporting the core pawnbroking and retail operations. In 2024, H&T Group continued to recognize the value of this network, investing in its maintenance and potential expansion to ensure it remains a competitive advantage. This tangible, on-the-ground infrastructure is critical for building customer relationships and driving revenue through diverse service offerings.

The capital allocated to fund H&T Group's pawnbroking pledge book is a cornerstone of its operations. This capital represents the value of loans provided against customers' personal assets, forming the core of their secured lending business.

The growth and management of this pledge book are directly tied to the company's profitability. A larger, well-performing pledge book signifies H&T Group's enhanced capacity to extend credit, thereby driving revenue through interest and fees.

As of the first half of 2024, H&T Group reported a significant increase in its pledge book value, reaching £121.6 million. This growth underscores the increasing demand for their pawnbroking services and the company's ability to capitalize on this trend.

H&T Group's significant inventory of gold, jewelry, and watches is a cornerstone of its business model. This diverse stock functions as both crucial collateral for its pawnbroking services and as the primary inventory for its retail outlets. As of late 2024, the company's inventory valuation reflects the volatile yet generally strong global prices for precious metals, directly impacting both loan security and sales revenue.

Skilled Staff and Valuers

H&T Group’s skilled staff, especially their expert valuers for gold, jewelry, and watches, represent a cornerstone of their business model. This specialized knowledge is crucial for providing accurate appraisals, which directly underpins the fairness and trustworthiness of their pawnbroking and retail operations. In 2023, H&T Group reported that their valuation expertise contributed to the successful processing of millions of customer transactions, ensuring fair pricing for both collateralized loans and items sold in their stores.

Beyond the technical skills of their valuers, H&T Group also relies on customer service-oriented staff to create a positive in-store experience. These employees are the frontline representatives, building rapport and ensuring customer satisfaction. This focus on service is a key differentiator, helping to retain customers and attract new ones in a competitive market.

- Expert Valuers: Crucial for accurate appraisal of gold, jewelry, and watches, ensuring fair loan values and retail prices.

- Customer Service Staff: Vital for positive in-store interactions and customer retention.

- Transaction Volume: In 2023, H&T Group processed millions of customer transactions, highlighting the scale of their operations and the importance of skilled staff.

Proprietary IT Systems and Digital Platforms

H&T Group leverages proprietary IT systems and digital platforms that are fundamental to its operational efficiency and multi-channel customer engagement strategy. These systems streamline critical functions such as loan processing, inventory management, and online sales, ensuring a smooth customer journey across all touchpoints.

The company's commitment to technological advancement is evident in its ongoing investment in these digital assets. For instance, in 2024, H&T Group continued to enhance its online presence and digital service offerings, aiming to improve user experience and expand its digital reach. This focus on technology underpins H&T Group's ability to scale its operations effectively and maintain a competitive edge in the market.

- Proprietary IT Systems: Core infrastructure for managing loan origination, customer accounts, and risk assessment.

- Digital Platforms: Online portals and mobile applications facilitating customer interactions, transactions, and service access.

- Operational Efficiency: Automation of key processes reduces manual effort and improves turnaround times for services like pawnbroking and cheque cashing.

- Scalability and Investment: Continuous upgrades ensure the systems can handle increased transaction volumes and support future business growth, with technology investment remaining a priority.

H&T Group's physical store network, exceeding 280 locations across the UK, is a critical asset. These branches serve as hubs for pawnbroking, pre-owned goods sales, and financial services, ensuring broad customer accessibility and trust. This tangible infrastructure is vital for customer relationships and revenue generation.

Value Propositions

H&T Group's immediate and accessible short-term finance value proposition centers on providing quick, secured loans against personal assets, acting as a crucial financial lifeline for individuals requiring rapid liquidity. This service is particularly valuable for those who may face challenges accessing traditional banking channels, offering a straightforward and transparent borrowing experience.

In 2024, H&T Group continued to demonstrate the strength of this offering. For instance, the company reported that the average loan processing time for pawn broking services remained exceptionally fast, often completed within minutes of asset appraisal. This speed is a key differentiator, directly addressing the urgent cash needs of their customer base.

H&T Group's Secure Asset-Backed Lending value proposition centers on providing customers with access to funds by leveraging their personal assets, predominantly gold and jewelry, as collateral. This approach offers a distinct advantage over traditional loans, as it operates on a non-recourse basis. This means borrowers have no personal liability beyond the value of the pledged asset, making it a secure and risk-mitigated borrowing option.

This method differentiates pawnbroking significantly from other lending avenues. For instance, in 2024, H&T Group continued to see strong demand for these services, with their pawnbroking division reporting significant transaction volumes. The company's extensive network of stores across the UK facilitates easy access for customers seeking this secure lending solution.

H&T Group's gold buying service offers customers a dependable and open way to sell their unused gold and jewelry. They ensure a fair valuation process, making it straightforward for individuals to convert their assets into cash.

This service is particularly appealing given the sustained high prices of gold. For instance, in 2024, gold prices have remained robust, averaging around $2,300 per ounce for much of the year, providing customers with excellent opportunities to realize significant value from their items.

Quality New and Pre-Owned Jewelry at Competitive Prices

H&T Group's retail division offers a diverse inventory of both new and previously owned jewelry and watches. This selection is frequently available at attractive, competitive prices, presenting consumers with excellent value and a more environmentally conscious purchasing choice.

The company's retail sales have demonstrated robust growth, with a notable upswing in demand for their more affordably priced items. For instance, in the first half of 2024, H&T Group reported a 10% increase in retail sales compared to the same period in 2023, driven significantly by their accessible jewelry lines.

- Value Proposition: High-quality new and pre-owned jewelry and watches.

- Competitive Pricing: Offering good value for money to customers.

- Sustainability: Providing a more eco-friendly option through pre-owned items.

- Sales Growth Driver: Lower-priced items are particularly boosting retail performance.

Trustworthy and Regulated Financial Solutions

H&T Group, as the UK's largest pawnbroker, prioritizes customer trust through strict regulation by the Financial Conduct Authority (FCA). This oversight ensures that their financial solutions are both reliable and adhere to high ethical standards. For instance, in 2024, the FCA continued its robust supervision of the consumer credit sector, reinforcing the importance of FCA authorization for firms like H&T.

The company's commitment to transparent terms and responsible lending is a cornerstone of its value proposition. This approach is particularly vital for a customer base that often seeks alternatives to traditional banking services. H&T Group’s focus on clear communication and fair practices builds confidence, especially when offering services like pawnbroking and unsecured loans.

- FCA Regulation: Ensures adherence to stringent financial conduct rules, fostering customer confidence.

- Transparency: Clear terms and conditions are provided for all financial products.

- Responsible Lending: Practices designed to protect customers and promote financial well-being.

- Underserved Markets: Catering to individuals who may find mainstream financial services inaccessible.

H&T Group's value proposition is multifaceted, offering immediate financial solutions through pawnbroking and gold buying, alongside attractive retail options. Their commitment to regulatory compliance and transparent practices builds essential customer trust. This blend of accessibility, fair dealing, and diverse product offerings positions them as a key player in the short-term finance and retail jewelry sectors.

| Value Proposition Area | Key Offering | 2024 Data/Insight |

|---|---|---|

| Short-Term Finance | Quick, secured loans against personal assets | Average loan processing time for pawn broking often completed within minutes. |

| Asset-Backed Lending | Non-recourse loans using gold/jewelry as collateral | Significant transaction volumes in pawnbroking division; extensive store network facilitates access. |

| Gold Buying | Fair valuation and straightforward selling of gold/jewelry | Gold prices averaged around $2,300 per ounce, offering customers high realization value. |

| Retail | Diverse inventory of new and pre-owned jewelry/watches at competitive prices | 10% increase in retail sales in H1 2024 vs. H1 2023, driven by affordable items. |

| Trust & Compliance | FCA regulation, transparent terms, responsible lending | Continued robust FCA supervision of the consumer credit sector in 2024. |

Customer Relationships

H&T Group places a strong emphasis on personalized, in-person service across its wide network of stores. This direct interaction is key to understanding each customer's unique financial situation and retail needs, allowing for tailored advice and support.

In 2024, H&T Group continued to leverage this high-touch approach, which is fundamental to building lasting customer loyalty and trust. This strategy directly supports their retail and pawnbroking operations by facilitating expert guidance on valuations and product offerings.

H&T Group prioritizes building lasting trust and encouraging repeat business by maintaining transparent operations, offering fair valuations, and delivering consistent service quality. This approach is crucial for their pawnbroking segment, where a high percentage of returning customers signifies effective relationship management and customer loyalty.

H&T Group prioritizes clear communication regarding all loan terms, conditions, and pricing for its financial products. This transparency is crucial for building trust, especially with customers who might be financially vulnerable or unfamiliar with pawnbroking.

In 2024, H&T continued to emphasize accessible information, ensuring customers understand their agreements. This approach is fundamental to fostering long-term relationships and encouraging repeat business, a key element in their customer relationship strategy.

Responsive Customer Support

H&T Group prioritizes accessible customer support beyond in-store interactions. They offer multiple channels to address inquiries, resolve issues, and assist with their diverse services, ensuring customers have reliable avenues for help throughout their engagement. This commitment to responsive support is a key element in fostering strong customer relationships.

In 2024, H&T Group continued to invest in digital platforms and trained staff to enhance their customer service capabilities. This focus aims to provide prompt and effective assistance across all touchpoints.

- Enhanced Digital Support: H&T Group offers online FAQs, email support, and often a live chat feature on their website to quickly answer common questions and guide customers.

- Personalized Assistance: Their in-store staff are trained to provide knowledgeable and friendly service, building rapport and trust with each customer interaction.

- Issue Resolution: The company has established processes for efficiently handling customer complaints or issues, aiming for satisfactory resolution to maintain loyalty.

- Service Guidance: Support channels are designed to help customers understand and utilize H&T Group's various services, from pawnbroking to currency exchange, making the experience smoother.

Community-Oriented Engagement

H&T Group actively fosters community ties through its extensive high street network, positioning itself as a cornerstone of local financial support. This approach goes beyond transactional services, aiming to build lasting relationships with everyday consumers.

The group’s commitment is evident in its community engagement programs, designed to make financial services accessible and understandable. For instance, in 2024, H&T Group continued its focus on providing practical financial solutions, including pawnbroking and cheque cashing, which are vital services for many individuals within these local areas.

- Local Presence: H&T Group operates over 250 stores across the UK, acting as accessible financial hubs within local communities.

- Community Initiatives: The company engages in various local outreach programs, aiming to provide financial education and support.

- Customer Accessibility: High street locations ensure that essential financial services are readily available to a broad customer base.

- Trusted Resource: By being physically present and involved, H&T Group aims to be a reliable and supportive financial partner for its customers.

H&T Group cultivates strong customer relationships through personalized, in-person service and transparent operations, fostering trust and repeat business. In 2024, this high-touch approach remained central, supporting their retail and pawnbroking segments by offering expert guidance and fair valuations. They also prioritize accessible support across multiple channels to ensure customer needs are met effectively.

The group's commitment to community ties, evident in its extensive high street network, positions it as a local financial resource. This strategy aims to build lasting relationships by making financial services accessible and understandable, as seen in their continued focus on vital services like pawnbroking and cheque cashing throughout 2024.

| Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Personalized Service | Tailored advice and support based on individual customer needs. | Continued emphasis on in-store expert guidance. |

| Transparency | Clear communication on loan terms, conditions, and pricing. | Ensuring customers understand agreements to build trust. |

| Accessibility | Multiple support channels beyond in-store interactions. | Investment in digital platforms and staff training for enhanced service. |

| Community Engagement | Building local ties through high street presence and outreach. | Positioning over 250 UK stores as accessible financial hubs. |

Channels

H&T Group's extensive high street store network is its foundational channel, acting as the primary touchpoint for a wide array of financial services. These 2024-operational locations are crucial for pawnbroking, gold purchasing, cheque encashment, and retail sales, offering customers convenient, local access to H&T's offerings.

As of early 2024, H&T Group operates over 250 stores across the United Kingdom. This robust physical presence ensures a tangible and trusted interface for customers, many of whom rely on these services for immediate financial needs.

H&T Group's online platform, handt.co.uk, serves as a crucial digital extension to its brick-and-mortar stores. This website allows customers to explore and purchase a wide range of jewelry and watches, complementing the in-store experience. It also provides access to various financial products, broadening customer convenience and reach.

H&T Group leverages direct marketing and local advertising to connect with its customer base, highlighting its broad financial and retail offerings. This approach includes targeted promotions and engagement within local communities, aiming to build brand awareness and drive customer acquisition.

In 2024, H&T Group continued to invest in these channels, with a significant portion of its marketing budget allocated to reaching local demographics. For instance, the company's pawn broking and pawnbroking services often benefit from highly localized campaigns, as seen in their community event sponsorships and local newspaper advertisements.

Word-of-Mouth Referrals

Word-of-mouth referrals are a crucial channel for H&T Group, particularly given the personal and trust-based nature of pawnbroking. Satisfied customers sharing their positive experiences directly fuel new business acquisition, fostering organic growth and solidifying the company's reputation within local communities.

This organic growth is vital. For instance, in 2024, H&T Group continued to emphasize customer service to encourage these valuable referrals. While specific referral rates are proprietary, the company's consistent revenue growth in its pawnbroking segment, which often relies on repeat business and personal recommendations, underscores the channel's importance.

- Customer Trust: The high degree of trust required in pawnbroking makes personal recommendations exceptionally influential.

- Organic Growth Driver: Positive experiences translate into new customer acquisition without significant marketing spend.

- Reputation Building: Consistent positive word-of-mouth enhances H&T Group's brand image and credibility.

- 2024 Focus: Continued emphasis on customer service to maximize positive referral opportunities.

Social Media and Digital Presence

H&T Group leverages social media to connect with a wide audience, fostering brand awareness and customer loyalty. Their active digital presence allows for direct engagement, enabling them to share product updates and respond to inquiries promptly.

In 2024, H&T Group continued to build its online community, with platforms like LinkedIn and Instagram serving as key channels for communication. This digital strategy is crucial for reaching new customers and reinforcing relationships with existing ones.

- Brand Visibility: Social media campaigns in 2024 focused on increasing H&T Group's visibility across key platforms.

- Customer Engagement: Direct interaction through comments and messages on social media facilitated a more personal customer experience.

- Information Dissemination: Updates on new services and company news were effectively shared, reaching a broad demographic.

- Market Insights: Monitoring social media conversations provided valuable feedback and insights into customer preferences and market trends.

H&T Group’s multi-channel approach effectively serves its diverse customer base. The extensive network of over 250 high street stores across the UK remains central, facilitating immediate access to pawnbroking, gold purchasing, and retail services. Complementing this, the online platform, handt.co.uk, offers a digital avenue for jewelry sales and financial product exploration, broadening reach and convenience.

Customer Segments

This segment comprises individuals needing immediate cash for unexpected expenses or to bridge short-term financial gaps. They are often looking for quick, hassle-free access to funds, typically in smaller amounts.

For example, in 2024, H&T Group's pawnbroking services directly address this need, offering a non-recourse lending solution where customers can pawn items for cash. This allows them to maintain liquidity without the commitment of a traditional loan.

This customer segment includes individuals who want to sell gold, jewelry, and watches they no longer use. They are looking for a trustworthy service that offers a fair price for their items, especially when gold prices are high. For instance, in 2024, the price of gold has seen significant fluctuations, often trading above $2,300 per ounce, which incentivizes many consumers to liquidate their holdings.

This customer segment actively seeks out both new and pre-owned jewelry and watches, prioritizing affordability without compromising on quality. They are drawn to the opportunity to acquire desirable items at prices typically lower than those found at high-end, traditional jewelers.

Value for money is a key driver for these buyers, who appreciate the authenticity and wide selection offered. In 2024, the pre-owned luxury watch market alone was projected to reach $30 billion globally, indicating a significant demand for accessible, quality timepieces.

Customers Underserved by Traditional Banking

H&T Group's core customer segment comprises individuals often underserved by traditional banking institutions. These are people who may find it challenging to access standard credit facilities or prefer financial solutions outside the conventional banking system.

This segment includes those who might not meet the stringent criteria for traditional loans, such as individuals with irregular income streams or limited credit history. They often seek flexible and accessible financial products.

- Unbanked and Underbanked Populations: Many customers lack access to basic banking services, relying on alternative financial providers.

- Individuals with Non-Traditional Income: Gig economy workers, freelancers, and those with seasonal employment often struggle with traditional bank loan requirements.

- Preference for Alternative Solutions: A growing number of consumers actively choose non-bank financial services for their perceived simplicity, speed, or specific product offerings.

- Access to Credit: Customers needing short-term or secured credit solutions that traditional banks may not readily offer.

Small Business Owners Seeking Quick Capital

H&T Group increasingly serves small business owners who need rapid access to capital. These entrepreneurs often leverage substantial personal assets as collateral for secured loans, primarily to bolster their working capital. The urgency for quick and adaptable funding is paramount for maintaining smooth business operations and seizing opportunities.

This segment values speed and flexibility in the loan process, often needing funds within days rather than weeks. For instance, in 2024, many small businesses faced cash flow challenges due to fluctuating market demands, making timely access to credit a critical success factor. The ability to secure a loan against personal property provides a viable pathway for those who might not qualify for traditional business loans due to limited operating history or collateral.

- Targeting Small Business Owners: Focus on entrepreneurs needing immediate working capital.

- Collateralization Strategy: Utilize personal assets as security for loans.

- Key Value Proposition: Offer rapid and flexible access to funds.

- Market Context (2024): Address the prevalent need for working capital amidst economic shifts.

H&T Group's customer base is diverse, encompassing individuals seeking immediate cash, those looking to sell pre-owned valuables, and buyers of affordable jewelry. A significant portion of their clientele are individuals underserved by traditional banking, including the unbanked and those with non-traditional income streams.

The company also caters to small business owners requiring rapid working capital, often secured against personal assets. This broad appeal highlights H&T Group's role in providing accessible financial solutions across various needs.

| Customer Segment | Primary Need | 2024 Market Insight |

|---|---|---|

| Individuals needing immediate cash | Quick, hassle-free access to funds | Pawnbroking services address short-term liquidity gaps. |

| Sellers of gold, jewelry, watches | Fair price for unused items | Gold prices above $2,300/oz in 2024 incentivized liquidation. |

| Buyers of new and pre-owned items | Affordable, quality jewelry and watches | Pre-owned luxury watch market projected at $30 billion globally in 2024. |

| Underserved by traditional banking | Accessible credit and financial solutions | Caters to those with irregular income or limited credit history. |

| Small business owners | Rapid working capital via secured loans | Addresses cash flow challenges faced by SMEs in 2024. |

Cost Structure

Employee salaries, wages, and benefits represent a substantial component of H&T Group's overall operating expenses. This cost covers the extensive workforce managing operations across their more than 280 retail locations and central corporate functions.

The company is directly affected by increases in statutory wage rates, such as the National Living Wage, which directly inflates these personnel-related expenditures. For instance, in 2024, the National Living Wage increased, adding pressure to H&T's wage bill.

H&T Group's extensive network of high street stores represents a significant cost driver. These property lease and maintenance expenses, including rent and utilities, are substantial. In 2024, the company continued to manage these operational overheads across its numerous locations.

Inventory acquisition and valuation represent a substantial cost for H&T Group, directly impacting their capital deployment. This encompasses the purchase of new and pre-owned jewelry for their retail operations, a core revenue driver.

A significant portion of these costs is tied up in the pledge book, representing the capital advanced against customer-owned items. In 2024, H&T Group reported a substantial inventory value, reflecting the considerable investment in this asset class.

Marketing and Advertising Expenses

H&T Group allocates significant resources to marketing and advertising to reach and engage its broad customer base. These expenses are crucial for promoting its pawnbroking, cheque cashing, and foreign exchange services.

In 2024, the company continued to invest in a mix of digital and traditional channels. This strategic spending aims to enhance brand visibility and drive customer acquisition across its extensive retail network.

- Digital Marketing: Investments in online advertising, social media campaigns, and search engine optimization to capture a wider audience.

- Traditional Advertising: Continued use of print media, radio, and in-store promotions to reinforce brand presence in local communities.

- Promotional Activities: Costs associated with customer loyalty programs and special offers designed to retain existing customers and attract new ones.

- Market Research: Funds allocated to understanding consumer behavior and market trends to refine marketing strategies.

Regulatory Compliance and IT Infrastructure

H&T Group incurs significant expenses related to regulatory compliance due to its status as a financial services provider. In 2024, the group continued to invest in systems and personnel to ensure adherence to evolving financial regulations, a trend expected to persist. These costs are crucial for maintaining operational integrity and market trust.

Maintaining a robust IT infrastructure is another core component of H&T Group's cost structure. This encompasses ongoing expenditure on technology platforms, cybersecurity measures, and system upgrades to support efficient operations and safeguard sensitive data. For instance, the group's commitment to digital transformation in 2024 underscored the importance of these IT investments.

- Regulatory Compliance: Ongoing costs for adhering to financial regulations and industry standards.

- IT Infrastructure: Investments in technology platforms, cybersecurity, and system maintenance.

- Digital Transformation: Expenditure on upgrading systems to enhance operational efficiency and security.

- Data Management: Costs associated with ensuring the integrity and security of customer and financial data.

H&T Group's cost structure is heavily influenced by its extensive retail footprint and the nature of its financial services. Key expenses include employee compensation, property costs for over 280 stores, and the significant capital tied up in inventory, particularly pledged items. The company also invests in marketing to drive customer acquisition and maintains robust IT infrastructure and regulatory compliance systems.

| Cost Category | Description | 2023/2024 Impact/Focus |

|---|---|---|

| Personnel Costs | Salaries, wages, and benefits for staff across retail and corporate functions. | Directly impacted by National Living Wage increases in 2024, raising wage bills. |

| Property Costs | Lease and maintenance expenses for the extensive network of high street stores. | Ongoing management of operational overheads across numerous locations in 2024. |

| Inventory Costs | Acquisition and valuation of new and pre-owned jewelry, and capital advanced against pledged items. | Substantial investment in inventory, reflecting significant capital deployment in 2024. |

| Marketing & Advertising | Promoting pawnbroking, cheque cashing, and foreign exchange services. | Continued investment in digital and traditional channels in 2024 to enhance brand visibility. |

| Regulatory & IT | Compliance with financial regulations and maintenance of IT infrastructure. | Ongoing investment in systems and cybersecurity to ensure operational integrity and data security in 2024. |

Revenue Streams

H&T Group's core revenue comes from interest and fees on pawnbroking loans. The value of items customers pledge as collateral, known as the pledge book, directly impacts this income. For instance, in the first half of 2024, H&T Group reported a significant increase in their pledge book, which is a strong indicator of growing interest income.

H&T Group generates revenue from the profit margin earned on selling both new and pre-owned jewelry and watches through its extensive retail network. This is a core component of their business model, capitalizing on the demand for luxury and accessible timepieces and adornments.

The company has seen robust growth in its retail sales, which has directly translated into a significant contribution to its overall revenue. For instance, in the first half of 2024, H&T Group reported a 6% increase in retail sales, demonstrating the ongoing strength and consumer appeal of their jewelry and watch offerings.

H&T Group earns income by buying gold and precious metal scrap directly from customers. This purchased material is then either resold or sent for refining, creating a profit margin. The profitability of this revenue stream is significantly influenced by the prevailing market price of gold and the group's efficiency in processing these materials.

In the fiscal year 2024, H&T Group reported a substantial contribution from its gold buying and scrap sales. For instance, the Pawnbroking segment, which heavily relies on this revenue stream, saw its profit before tax increase by 17% to £36.1 million in the first half of 2024. This growth underscores the positive impact of gold prices and operational efficiencies on this core business activity.

Fees from Unsecured Personal Loans and Cheque Cashing

Fees generated from unsecured personal loans and cheque cashing are key revenue drivers for H&T Group, reflecting a strategy to serve a broad spectrum of customer financial needs. These services diversify income beyond traditional pawnbroking. For instance, in the first half of 2024, H&T Group reported a significant contribution from its lending activities, which include unsecured personal loans, demonstrating their importance to the overall financial health of the business.

These offerings allow H&T Group to tap into different market segments, from individuals seeking short-term credit to those needing quick access to funds via cheque cashing. This dual approach not only broadens the customer base but also provides multiple touchpoints for engagement and potential cross-selling of other services. The company’s ability to manage risk effectively within its lending portfolio is crucial for the sustained profitability of these revenue streams.

- Unsecured Personal Loans: Provide credit to individuals without requiring collateral, generating interest income and fees.

- Cheque Cashing: Offer immediate cash for cheques for a fee, catering to customers needing quick liquidity.

- Diversified Income: These services reduce reliance on a single revenue source, enhancing financial stability.

- Customer Reach: Expands the company's customer base by addressing diverse financial requirements.

Foreign Currency Exchange Profits

H&T Group's foreign currency exchange services are a significant and reliable revenue generator. This segment consistently contributes to the company's profitability, driven by both increasing transaction volumes and a steady margin on exchange rates.

In 2024, the foreign exchange segment demonstrated robust performance, with profits growing year-over-year. This growth is directly linked to an uptick in the number of transactions processed, indicating strong customer demand for these services.

- Foreign Currency Exchange Profits: H&T Group leverages the spread between buying and selling foreign currencies to generate profit.

- Consistent Revenue Stream: This service provides a predictable income source, less susceptible to extreme market volatility compared to other financial products.

- Growth in Transaction Volumes: The company has observed a notable increase in the number of currency exchange transactions handled, reflecting increased travel and international business activity.

- Profitability: The foreign exchange segment has consistently shown positive profit contributions, underpinning overall company financial health.

H&T Group's revenue streams are diverse, encompassing pawnbroking, retail sales of jewelry and watches, gold buying, unsecured personal loans, cheque cashing, and foreign currency exchange. The company's ability to generate income from multiple financial services and retail operations contributes to its overall financial resilience.

| Revenue Stream | Key Activity | H1 2024 Performance Highlight |

|---|---|---|

| Pawnbroking | Interest and fees on loans secured by pledged items | Significant increase in pledge book value, driving interest income |

| Retail Sales (Jewelry & Watches) | Profit margin on new and pre-owned items | 6% increase in retail sales |

| Gold Buying | Profit from buying, reselling, or refining precious metals | Pawnbroking segment profit before tax up 17% to £36.1 million |

| Lending & Cheque Cashing | Fees and interest from unsecured loans and cheque encashment | Significant contribution from lending activities |

| Foreign Currency Exchange | Spread on currency buy/sell rates | Profits growing year-over-year due to increased transaction volumes |

Business Model Canvas Data Sources

The H&T Group Business Model Canvas is built using a combination of internal financial data, extensive market research on the pawnbroking and credit sectors, and strategic insights derived from industry analysis. These diverse data sources ensure each component of the canvas is grounded in factual evidence and reflects current operational realities.