Hancock Whitney SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hancock Whitney Bundle

Hancock Whitney's robust market presence and strong customer loyalty are significant strengths, but they also face increasing competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any investor or strategist.

Unlock the complete picture behind Hancock Whitney's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Hancock Whitney boasts a diverse and comprehensive service portfolio, encompassing traditional banking, robust online platforms, specialized private banking, trust services, investment management, and even select insurance offerings. This broad spectrum allows them to serve a wide client base, from individuals to large corporations.

This extensive range of financial products and services is a significant strength, enabling Hancock Whitney to meet varied client needs effectively and cultivate multiple, diversified revenue streams. For instance, as of the first quarter of 2024, their total revenue reached $369.7 million, showcasing the breadth of their income generation capabilities.

Hancock Whitney boasts a strong capital position, evidenced by robust capital ratios. In Q1 2025, its CET1 ratio stood at an impressive 14.51%, complemented by a tangible common equity ratio of 10.01%.

Further demonstrating this financial strength, Q2 2025 figures show a CET1 ratio of 14.03% and a tangible common equity ratio of 9.84%.

This solid capital base, alongside a healthy allowance for credit losses—1.49% in Q1 2025 and 1.45% in Q2 2025—underpins Hancock Whitney's resilience, allowing it to weather economic downturns and market fluctuations effectively.

Hancock Whitney demonstrates strong operational efficiency, reflected in its improving efficiency ratio. This metric stood at 55.22% in the first quarter of 2025 and further improved to 54.91% in the second quarter of 2025. These figures suggest effective control over non-interest expenses.

This diligent cost management directly supports the company's profitability. By keeping expenses in check, Hancock Whitney can better maintain a healthy net interest margin, even when interest rates are unpredictable.

Strategic Digital Transformation and Customer Experience Focus

Hancock Whitney is making significant strides in its digital transformation, prioritizing an enhanced customer experience. The bank is investing heavily in technology to roll out advanced digital platforms. These platforms offer features like real-time account alerts, personalized financial insights, and simplified loan application processes, making banking more convenient and secure for its clients.

This strategic focus on digital innovation directly addresses evolving customer expectations and banking trends. By providing intuitive and feature-rich digital tools, Hancock Whitney aims to deepen customer engagement and loyalty. For instance, in the first quarter of 2024, the bank reported a continued increase in digital adoption, with a notable rise in mobile banking users and transaction volumes through its digital channels.

- Digital Investment: Hancock Whitney is actively channeling resources into technology upgrades to improve client interactions.

- Enhanced Features: The bank offers advanced digital tools, including real-time alerts, personalized financial advice, and streamlined loan applications.

- Customer Engagement: This digital push is designed to boost customer convenience, security, and overall engagement with the bank's services.

- Market Alignment: The strategy aligns with broader industry trends, ensuring Hancock Whitney remains competitive in a rapidly digitizing financial landscape.

Consistent Shareholder Returns and Positive Analyst Sentiment

Hancock Whitney's commitment to its shareholders is evident in its long-standing dividend history, with an uninterrupted quarterly payout since 1967. This reliability was further underscored by a recent increase to $0.45 per share in the second quarter of 2025.

This consistent shareholder return, coupled with generally positive analyst sentiment, forms a key strength. The consensus rating for Hancock Whitney (HWC) typically falls between 'Moderate Buy' and 'Strong Buy'.

- Consistent Dividend Payout: Uninterrupted quarterly dividend since 1967.

- Dividend Growth: Increased to $0.45 per share in Q2 2025.

- Analyst Confidence: Consensus ratings range from 'Moderate Buy' to 'Strong Buy'.

- Upside Potential: Average price targets suggest positive future performance.

Hancock Whitney's diversified service portfolio, including banking, investment management, and trust services, allows it to cater to a broad client base and generate multiple revenue streams. This breadth contributed to a total revenue of $369.7 million in Q1 2024.

The bank maintains a strong capital position, with a CET1 ratio of 14.03% and a tangible common equity ratio of 9.84% in Q2 2025, supported by a healthy allowance for credit losses (1.45% in Q2 2025), ensuring financial resilience.

Operational efficiency is a key strength, evidenced by an improving efficiency ratio that reached 54.91% in Q2 2025, indicating effective cost management and supporting profitability.

Hancock Whitney's commitment to digital transformation enhances customer experience through advanced platforms and features, driving engagement and aligning with market trends. Digital adoption, including mobile banking, saw notable increases in Q1 2024.

| Metric | Q1 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|

| Total Revenue | $369.7M | - | - |

| CET1 Ratio | - | 14.51% | 14.03% |

| Tangible Common Equity Ratio | - | 10.01% | 9.84% |

| Allowance for Credit Losses | - | 1.49% | 1.45% |

| Efficiency Ratio | - | 55.22% | 54.91% |

What is included in the product

Analyzes Hancock Whitney’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address Hancock Whitney's strategic challenges and opportunities.

Weaknesses

Hancock Whitney faced a sequential dip in its financial performance, with both loans and deposits experiencing a 1% decline in the first quarter of 2025, reaching $23.1 billion and $29.0 billion respectively. This trend continued into the second quarter of 2025, with another 1% decrease in both categories. These sequential decreases suggest potential headwinds in maintaining consistent quarter-over-quarter growth, possibly linked to subdued loan demand or typical seasonal outflows of public funds.

As a bank, Hancock Whitney's earnings are directly tied to interest rate movements. Changes in these rates can affect how much profit they make from lending and borrowing, known as their net interest margin (NIM). For instance, while NIM saw a healthy increase in 2024, the possibility of future rate reductions by the Federal Reserve presents a challenge. This means they need to be very careful in managing their assets and liabilities to avoid losing money if rates go down.

Hancock Whitney's operational footprint is largely confined to five Southern U.S. states: Mississippi, Alabama, Florida, Louisiana, and Texas, with supplementary offices in Nashville and Atlanta. This regional concentration, while fostering deep local market understanding, inherently exposes the bank's financial health to localized economic vulnerabilities and industry-specific challenges within these core areas. For instance, a downturn in the oil and gas sector, significant in Texas and Louisiana, could disproportionately impact Hancock Whitney's loan portfolio compared to a more geographically diversified institution.

Competition from Larger Institutions and Fintech

Hancock Whitney operates in a fiercely competitive banking environment. Larger national banks, boasting more extensive resources and broader market penetration, present a significant challenge. Furthermore, nimble fintech companies are increasingly disrupting the sector with specialized digital offerings, creating pressure on Hancock Whitney to innovate and maintain its competitive edge.

This heightened competition can directly impact Hancock Whitney's ability to attract and retain customers, potentially affecting its market share and profitability. For instance, as of Q1 2024, the overall U.S. banking sector saw continued growth in digital adoption, with mobile banking usage up 8% year-over-year, a trend that fintechs are particularly adept at leveraging.

- Intensified Rivalry: Facing off against national banking giants and agile fintech innovators.

- Pricing and Innovation Pressure: Competition can constrain pricing flexibility and demand constant product development.

- Market Share Erosion Risk: Failure to keep pace with competitors could lead to a decline in customer base.

Reliance on Traditional Banking Segments

Hancock Whitney's significant reliance on traditional banking segments, such as deposits and lending, presents a notable weakness. While the company has been investing in digital capabilities, a substantial part of its revenue and customer base is still tied to these conventional services.

This dependence becomes a challenge as consumer preferences increasingly lean towards purely digital banking experiences or alternative financial service providers. If Hancock Whitney cannot accelerate its adaptation of service delivery models to match this evolving landscape, it risks falling behind competitors who are more agile in embracing digital transformation.

- Traditional Segment Dependence: A large portion of Hancock Whitney's revenue is still derived from traditional deposit and lending activities.

- Shifting Consumer Preferences: There's a growing trend towards digital-only banking and non-bank financial services.

- Adaptation Pace: The company must continuously and rapidly evolve its service delivery models to remain competitive.

Hancock Whitney's concentrated geographic footprint in five Southern states, while fostering local expertise, also makes it vulnerable to regional economic downturns. For instance, a slowdown in key industries like oil and gas in Texas and Louisiana could disproportionately affect its loan portfolio. This regional focus limits its ability to offset localized economic shocks with broader national diversification.

The bank faces significant competitive pressure from larger national institutions with greater resources and from agile fintech companies offering specialized digital solutions. This rivalry can impact customer acquisition and retention, potentially eroding market share. For example, in Q1 2024, U.S. banks saw an 8% year-over-year increase in mobile banking usage, an area where fintechs often excel.

Hancock Whitney's reliance on traditional banking services, such as deposits and lending, represents a weakness as consumer preferences shift towards digital-first experiences. The bank's pace of adaptation to these evolving digital demands is crucial to avoid falling behind competitors who are quicker to embrace digital transformation.

| Weakness Category | Description | Impact | Supporting Data/Example |

| Geographic Concentration | Operations limited to five Southern U.S. states. | Vulnerability to regional economic downturns. | Exposure to sectors like oil and gas in Texas and Louisiana. |

| Competitive Landscape | Rivalry from national banks and fintechs. | Risk of market share erosion and pricing pressure. | 8% YoY increase in U.S. mobile banking usage (Q1 2024) highlights fintech advantage. |

| Traditional Service Reliance | Dependence on deposits and lending. | Risk of lagging behind digital-native competitors. | Evolving consumer preference for digital-only banking experiences. |

Preview Before You Purchase

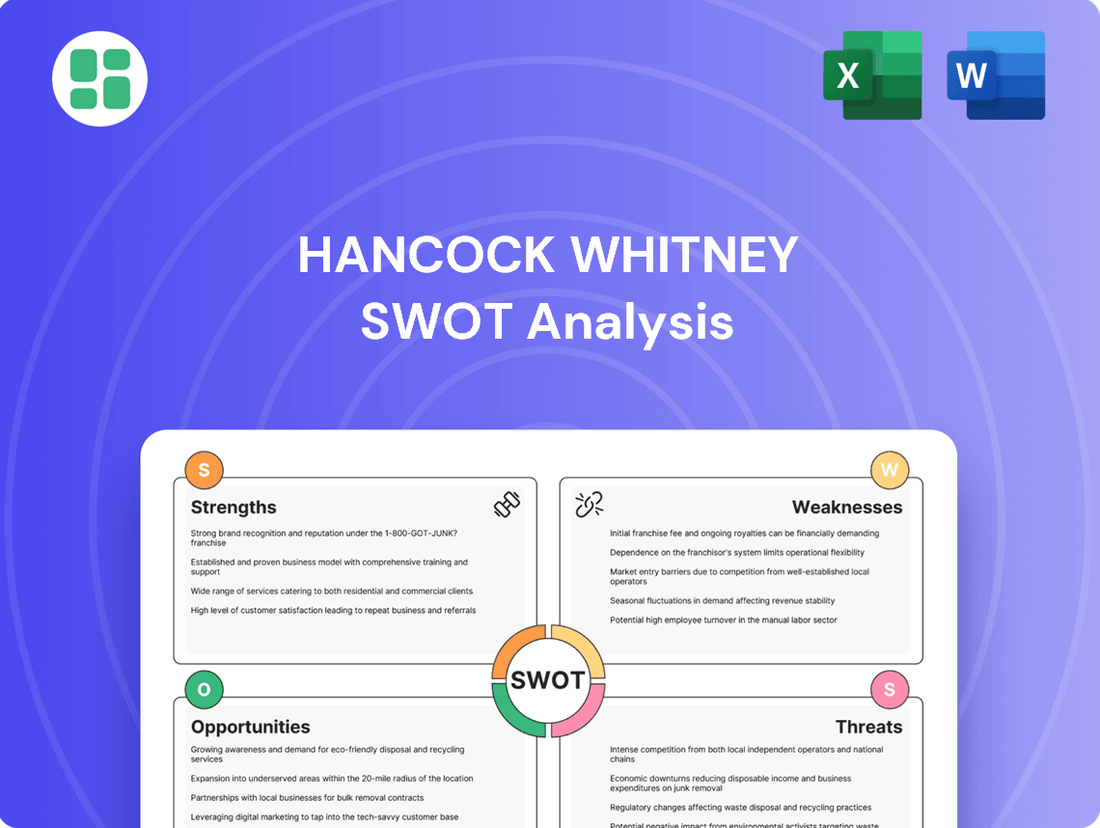

Hancock Whitney SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive look at Hancock Whitney's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Hancock Whitney SWOT analysis, ready for your strategic planning.

You’re viewing a live preview of the actual SWOT analysis file for Hancock Whitney. The complete version becomes available after checkout, offering a thorough breakdown of their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Hancock Whitney's strategic expansion into wealth management and trust services, notably the acquisition of Sabal Trust Company in January 2025, is a key growth avenue. This move, with integration finalized by May 2025, significantly bolsters their capacity to serve high-net-worth individuals.

The focus on private banking, trust, and investment management offers a substantial opportunity to increase non-interest income, diversifying revenue streams away from traditional lending. This diversification is crucial for a more resilient financial profile.

By attracting and retaining affluent clients through these enhanced services, Hancock Whitney can build deeper relationships and capture a larger share of their financial needs. This strategic push is expected to contribute positively to fee income growth in the coming fiscal years.

Hancock Whitney is strategically expanding its presence into high-growth markets, notably planning new financial centers in the Dallas metropolitan statistical area. This expansion includes adding more bankers to serve these new locations. This move is designed to capture new market share and extend the company's reach beyond its established operational territories.

Hancock Whitney's commitment to digital innovation, including AI, presents a significant opportunity. By enhancing its digital platforms with AI-driven customer support and personalized financial insights, the bank can elevate customer satisfaction and streamline operations. For instance, in 2024, many financial institutions reported increased customer engagement through AI chatbots, with some seeing a 20% reduction in query resolution times.

Further integration of emerging technologies like predictive analytics and virtual reality can also carve out competitive advantages. This attracts a younger, tech-oriented client base, a demographic increasingly important for long-term growth. The banking sector's adoption of AI is projected to grow substantially, with investments expected to reach billions globally by 2025, indicating a strong market trend towards these advancements.

Strategic Acquisitions and Partnerships

Hancock Whitney's successful acquisition of Sabal Trust Company in 2022, which added approximately $1.7 billion in assets under management, highlights its ability to grow through strategic acquisitions. This track record suggests that further inorganic expansion, particularly into areas like fintech or specialized financial services, could significantly broaden its service portfolio and market presence. For instance, acquiring a company with advanced digital banking solutions could rapidly enhance its customer experience and operational efficiency, a key differentiator in the current financial landscape.

Exploring partnerships with fintech innovators presents another avenue for growth. Such collaborations could allow Hancock Whitney to integrate cutting-edge technologies without the full commitment of an acquisition. This approach can accelerate the development and deployment of new digital products and services, helping the bank stay competitive. For example, a partnership focused on AI-driven wealth management tools could tap into a growing market segment and attract a younger demographic.

- Acquisition of Sabal Trust Company: Added ~$1.7 billion in assets under management in 2022, demonstrating inorganic growth capability.

- Fintech Partnerships: Potential to integrate advanced digital solutions for enhanced customer experience and operational efficiency.

- Specialized Financial Services: Opportunities to expand service offerings and market reach through targeted acquisitions.

- Accelerated Technological Adoption: Collaborations can speed up the deployment of new digital products and services.

Leveraging Strong Capital for Organic Growth and Shareholder Returns

Hancock Whitney's robust capital position, evidenced by strong capital ratios, provides a significant opportunity for fueling organic growth. This financial strength allows the bank to expand its lending activities and invest in talent, such as hiring additional revenue-generating employees, to capture market share. For instance, as of the first quarter of 2024, Hancock Whitney reported a Common Equity Tier 1 (CET1) ratio of 12.3%, well above regulatory requirements, demonstrating its substantial capacity.

Beyond organic expansion, the company is well-positioned to continue rewarding shareholders through strategic capital allocation. This includes ongoing share repurchase programs and consistent dividend increases, which not only return value directly to investors but also signal financial health and confidence, potentially attracting new capital. In 2023, Hancock Whitney returned approximately $250 million to shareholders through dividends and buybacks, a testament to its commitment to shareholder returns.

- Capital Strength: Maintaining top-tier capital ratios, like the Q1 2024 CET1 ratio of 12.3%, enables robust organic growth funding.

- Organic Growth Initiatives: Capacity to increase loan origination and invest in new revenue-producing personnel.

- Shareholder Returns: Continued execution of share repurchase programs and dividend increases enhances shareholder value.

- Investor Attraction: A de-risked balance sheet and consistent capital returns make the company more attractive to investors.

Hancock Whitney's strategic push into wealth management, bolstered by the Sabal Trust acquisition, offers a significant opportunity to diversify revenue and cater to affluent clients. This focus on private banking and investment services aims to boost non-interest income, creating a more resilient financial profile.

The bank's expansion into high-growth markets, such as the Dallas area, coupled with investments in AI and digital platforms, positions it to attract new customers and enhance operational efficiency. These technological advancements are key to staying competitive and engaging a younger demographic.

Hancock Whitney's strong capital ratios, including a CET1 ratio of 12.3% in Q1 2024, provide ample capacity for organic growth initiatives and strategic capital allocation, such as share repurchases and dividend increases, thereby enhancing shareholder value.

| Opportunity Area | Key Action/Factor | Impact | Supporting Data |

|---|---|---|---|

| Wealth Management Expansion | Sabal Trust Acquisition | Increased AUM, diversified revenue | Acquired ~$1.7B AUM in 2022; targeting high-net-worth individuals |

| Digital Innovation | AI integration, enhanced platforms | Improved customer experience, operational efficiency | AI adoption projected to grow significantly by 2025; 20% reduction in query times reported by peers |

| Market Expansion | Dallas metro area growth | Capture new market share | Planning new financial centers and increased banker presence |

| Capital Strength & Shareholder Returns | Strong capital ratios, buybacks/dividends | Fund organic growth, enhance shareholder value | Q1 2024 CET1 ratio of 12.3%; Returned ~$250M in 2023 |

Threats

A significant economic downturn or recession poses a substantial threat, potentially leading to increased loan defaults and a higher need for provisions for credit losses. This could directly impact Hancock Whitney's profitability by reducing demand for its banking products and services.

While Hancock Whitney has demonstrated a robust allowance for credit losses, a prolonged period of economic weakness could still strain its asset quality. For instance, if unemployment rates were to rise significantly, as seen in past recessions, it could increase the likelihood of borrowers being unable to repay their loans.

Financial institutions like Hancock Whitney face increasing regulatory oversight. For instance, in 2024, the Federal Reserve continued to emphasize robust capital and liquidity management, directly impacting banks' operational strategies and increasing compliance burdens. These evolving rules, especially concerning consumer protection and anti-money laundering, necessitate significant investment in technology and personnel, thereby raising operational costs.

Moreover, potential shifts in tax legislation or new federal policies introduced in 2024 and anticipated for 2025 could materially alter Hancock Whitney's financial performance. For example, changes to corporate tax rates or new capital gains regulations can directly affect profitability and the overall attractiveness of the financial services sector.

Hancock Whitney, like all financial institutions, faces significant cybersecurity risks. In 2023, the financial services sector experienced a substantial rise in cyberattacks, with the average cost of a data breach reaching $5.90 million, according to IBM's Cost of a Data Breach Report. A breach at Hancock Whitney could result in severe financial penalties, operational disruptions, and a loss of customer confidence, demanding ongoing, robust investment in advanced security protocols and employee training.

Interest Rate Volatility and Net Interest Margin Compression

While Hancock Whitney has demonstrated resilience with net interest margin (NIM) expansion, future interest rate volatility poses a significant threat. A sustained period of low interest rates or intensified competition for deposits could compress the bank's NIM, impacting profitability if funding costs outpace asset yields.

For instance, in the first quarter of 2024, while NIM saw improvement, the competitive deposit landscape remains a key concern. The bank's ability to manage its cost of funds effectively against a backdrop of potential rate hikes or prolonged low rates is crucial for sustained earnings.

- Interest Rate Sensitivity: Hancock Whitney's profitability is directly linked to interest rate movements, making it vulnerable to unexpected shifts.

- Competitive Deposit Environment: Increased competition for customer deposits can drive up funding costs, squeezing NIM.

- Asset Yield Management: Maintaining or increasing asset yields in a volatile rate environment is critical to offset rising funding expenses.

- Economic Slowdown Impact: A broader economic slowdown could further pressure loan demand and credit quality, indirectly affecting NIM.

Competition for Deposits and Funding Costs

The banking industry is experiencing heightened competition for customer deposits, which naturally pushes up the cost of funding for banks. While Hancock Whitney has a solid and varied deposit base, aggressive interest rate hikes by rivals or a general shift in public trust towards larger banks could trigger deposit outflows. This would put greater strain on Hancock Whitney's funding expenses.

For instance, as of Q1 2024, the average deposit growth rate across regional banks has slowed, with some experiencing slight declines, indicating increased competition. Hancock Whitney's net interest margin, a key indicator of funding cost management, remains a critical metric to monitor in this environment. A significant increase in funding costs could directly impact profitability.

- Intensified Competition: Banks are actively competing for deposits, leading to higher interest rates offered to customers.

- Deposit Outflow Risk: Shifts in customer confidence or more attractive offers from competitors could cause Hancock Whitney to lose deposits.

- Increased Funding Costs: A shrinking or more expensive deposit base directly translates to higher operational expenses for the bank.

Hancock Whitney faces significant threats from a challenging economic landscape and evolving regulatory requirements. A potential economic downturn could lead to increased loan defaults, straining asset quality, while heightened regulatory oversight necessitates substantial investment in compliance and technology, increasing operational costs.

Furthermore, intense competition for deposits, as evidenced by slowing deposit growth rates in the regional banking sector in Q1 2024, could drive up funding costs and compress net interest margins. Cybersecurity risks also remain a major concern, with the financial services sector experiencing a notable rise in cyberattacks, demanding continuous investment in security measures.

| Threat Category | Specific Risk | Potential Impact | Data Point/Example |

|---|---|---|---|

| Economic Downturn | Increased Loan Defaults | Reduced profitability, higher credit loss provisions | Past recessions show rising unemployment correlates with loan repayment issues. |

| Regulatory Environment | Increased Compliance Burden | Higher operational costs, need for tech/personnel investment | Federal Reserve emphasis on capital/liquidity management in 2024. |

| Competition for Deposits | Rising Funding Costs | Compressed Net Interest Margin (NIM), reduced profitability | Slowing deposit growth in regional banks (Q1 2024) indicates competitive pressure. |

| Cybersecurity | Data Breaches | Financial penalties, operational disruption, loss of customer trust | Average cost of data breach in financial services was $5.90 million (IBM, 2023). |

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, drawing from Hancock Whitney's official financial statements, comprehensive market research reports, and insights from industry experts to ensure a robust and accurate assessment.