Hancock Whitney Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hancock Whitney Bundle

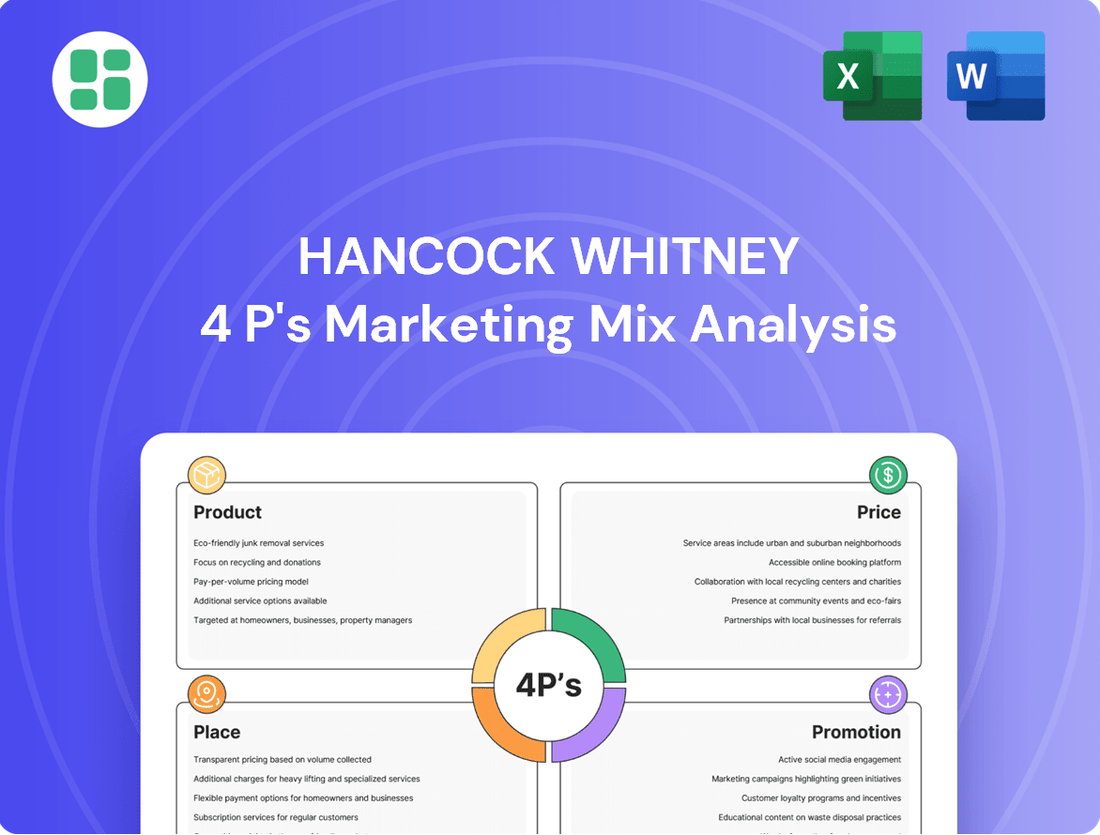

Dive into the strategic brilliance behind Hancock Whitney's market presence with our comprehensive 4Ps Marketing Mix Analysis. We dissect their product offerings, pricing strategies, distribution channels, and promotional activities to reveal the core elements of their success.

Unlock actionable insights and understand how Hancock Whitney effectively positions itself in the competitive financial landscape. This analysis is your key to grasping their marketing effectiveness and applying similar principles to your own business.

Ready to elevate your marketing strategy? Get the complete, editable 4Ps analysis of Hancock Whitney today and gain a powerful tool for learning, benchmarking, and business planning.

Product

Hancock Whitney's comprehensive banking solutions cover a wide spectrum, from everyday checking and savings accounts to more specialized money market and time deposits for individuals and businesses alike. This broad product suite addresses diverse financial needs, supporting both personal wealth building and corporate operational liquidity.

For instance, as of Q1 2024, Hancock Whitney reported total deposits of approximately $33.5 billion, showcasing the trust and volume of business they handle across their various deposit products. This extensive deposit base fuels their lending and investment activities, demonstrating the product's foundational role in their business model.

Hancock Whitney offers a robust suite of lending and credit solutions designed to meet diverse financial needs. Their portfolio spans secured and unsecured loans, revolving credit, and letters of credit, catering to both individual and business clients.

Key offerings include commercial and industrial loans, both real and non-real estate related, alongside specialized commercial real estate financing. They also provide construction and land development loans, residential mortgages, and a variety of consumer loans.

As of the first quarter of 2024, Hancock Whitney reported total loans of $25.2 billion, demonstrating their significant presence in the credit market and their capacity to fund a wide range of economic activities.

Hancock Whitney's Wealth Management and Investment Services division offers a comprehensive suite of financial solutions, extending well beyond typical banking. This includes specialized private banking, robust trust services, and expert investment management tailored to individual and institutional needs.

Clients gain access to a broad spectrum of investment advisory and brokerage products, alongside fixed annuity and life insurance options, ensuring a holistic approach to financial planning. For larger entities, Hancock Whitney also provides dedicated institutional investment services, demonstrating a commitment to diverse client segments.

In 2024, the wealth management sector saw continued growth, with many firms like Hancock Whitney focusing on personalized advice and digital integration. For instance, industry reports from late 2024 indicated that assets under management for wealth advisory services across similar institutions grew by an average of 8-10% year-over-year, highlighting the demand for these specialized financial tools.

Digital Banking Platforms

Hancock Whitney's digital banking platforms are central to their marketing mix, offering modern convenience through robust online and mobile services. These platforms enable customers to seamlessly manage accounts, pay bills, transfer funds, and deposit checks securely. This focus on digital accessibility reflects a significant investment in technology to meet evolving customer expectations, with digital transactions forming a growing percentage of overall customer interactions.

The digital tools provide personalized financial insights, enhancing customer engagement and financial management. For instance, as of Q1 2024, Hancock Whitney reported a substantial increase in mobile check deposits, indicating strong adoption of their digital features. This digital infrastructure is key to their strategy of providing accessible and efficient banking solutions.

- Enhanced Accessibility: Customers can manage finances 24/7 from any location.

- Comprehensive Functionality: Includes bill pay, fund transfers, and mobile check deposit.

- Personalized Insights: Offers tailored financial data to aid decision-making.

- Security Focus: Employs advanced security measures for all digital transactions.

Specialized Financial Services

Hancock Whitney extends its financial services beyond traditional banking, offering specialized solutions such as treasury management, dedicated healthcare banking, and select insurance products. These offerings cater to specific business needs, aiming to enhance financial efficiency and security for their clients.

The strategic acquisition of Sabal Trust Company in early 2025 significantly bolstered Hancock Whitney's wealth management capabilities. This move allows them to provide more comprehensive and sophisticated wealth planning and management services, further solidifying their position in this growing market segment.

Hancock Whitney's commitment to specialized financial services is evident in their targeted approach to client needs. For instance, their treasury management services are designed to optimize cash flow and mitigate financial risks for businesses. In 2024, the bank reported a substantial increase in treasury management revenue, reflecting strong client adoption of these specialized solutions.

- Treasury Management: Enhances operational efficiency and liquidity for businesses.

- Healthcare Banking: Tailored financial solutions for the healthcare industry.

- Insurance Products: Select offerings to complement financial planning.

- Wealth Management Expansion: Boosted by the Sabal Trust Company acquisition in early 2025.

Hancock Whitney's product strategy is anchored in a diversified portfolio designed to meet a broad spectrum of financial needs. From core deposit and lending services to sophisticated wealth management and specialized business solutions, the bank aims for comprehensive client engagement.

The bank's product suite is further enhanced by a strong digital offering, providing convenient and secure access to banking functions. This digital focus, coupled with strategic acquisitions like Sabal Trust in early 2025, underscores a commitment to modernizing services and expanding specialized capabilities.

As of Q1 2024, the bank's total loans stood at $25.2 billion, and total deposits reached $33.5 billion, demonstrating the scale and breadth of its core product adoption.

| Product Category | Key Offerings | Q1 2024 Data/2025 Context |

|---|---|---|

| Deposit Products | Checking, Savings, Money Market, Time Deposits | Total Deposits: $33.5 billion (Q1 2024) |

| Lending Products | Commercial Loans, Mortgages, Consumer Loans | Total Loans: $25.2 billion (Q1 2024) |

| Wealth Management | Private Banking, Trust Services, Investment Management | Acquisition of Sabal Trust Company (early 2025) |

| Digital Services | Online Banking, Mobile App, Mobile Check Deposit | Significant increase in mobile check deposits (Q1 2024) |

| Specialized Services | Treasury Management, Healthcare Banking, Insurance | Substantial increase in treasury management revenue (2024) |

What is included in the product

This analysis provides a comprehensive review of Hancock Whitney's marketing strategies, examining its Product, Price, Place, and Promotion efforts with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for decision-makers.

Place

Hancock Whitney boasts a substantial physical footprint, operating 180 banking locations across the Gulf South states of Mississippi, Alabama, Florida, Louisiana, and Texas as of December 31, 2024. This extensive branch network offers convenient access for customers seeking in-person banking services and reinforces their commitment to serving these communities. The sheer number of locations underscores their strategy of widespread accessibility within their core markets.

Hancock Whitney complements its physical branch presence with a robust ATM network, boasting 223 ATMs across its service areas as of late 2024. This widespread access provides customers with convenient options for cash withdrawals and essential banking tasks beyond branch hours. The accessibility of these machines is a key element in ensuring customer satisfaction and operational efficiency.

Hancock Whitney's robust online banking portal offers customers extensive functionality, enabling a wide range of banking activities from any internet-connected device. This digital platform is central to providing client convenience and streamlining account management.

In 2024, digital banking adoption continued its upward trend, with a significant portion of Hancock Whitney's customer base actively utilizing online services for transactions and account inquiries. This focus on digital accessibility is key to maintaining customer engagement and operational efficiency.

Feature-Rich Mobile Banking Application

Hancock Whitney's mobile banking application provides customers with continuous, around-the-clock access to their financial information and essential banking tasks. This feature-rich platform allows for easy balance inquiries, seamless fund transfers, and convenient check deposits directly from a smartphone, enhancing the banking experience for users on the move. The app prioritizes both security and ease of use, ensuring a reliable and accessible banking solution.

The digital platform is a key component of Hancock Whitney's strategy to meet evolving customer expectations for convenient financial management. As of early 2024, mobile banking adoption continues to surge across the industry, with a significant percentage of retail banking transactions occurring through digital channels. Hancock Whitney's investment in its mobile app reflects this trend, aiming to capture a larger share of digitally active customers.

- 24/7 Account Access: Check balances, view transaction history, and manage accounts anytime, anywhere.

- Mobile Check Deposit: Deposit checks quickly and easily by simply taking a photo.

- Fund Transfers: Move money between accounts or to external accounts with just a few taps.

- Transaction Alerts: Receive real-time notifications for account activity, enhancing security and awareness.

Strategic Loan and Deposit Production Offices

Hancock Whitney strategically deploys dedicated loan and deposit production offices in major metropolitan hubs like Nashville, Tennessee, and Atlanta, Georgia. These specialized units complement their full-service branches, allowing for a focused approach to capturing specific market segments and expanding their client base in key growth areas. This targeted presence is crucial for driving new business acquisition and deepening customer relationships in competitive urban environments.

These production offices are designed to be agile and responsive to market demands, focusing on originating loans and attracting deposits. For instance, in the first quarter of 2024, Hancock Whitney reported a significant increase in loan originations, partly attributable to the concentrated efforts of these specialized offices. Their operational model allows for more streamlined client interactions, particularly for those seeking dedicated lending or deposit-gathering services.

- Targeted Market Penetration: Offices in Nashville and Atlanta allow for focused efforts in high-growth metropolitan areas.

- Enhanced Loan Production: These units are instrumental in driving new loan originations, contributing to overall portfolio growth.

- Deposit Gathering Efficiency: They provide a dedicated channel for attracting new deposit accounts, strengthening the bank's funding base.

- Customer Acquisition: The specialized nature of these offices can lead to more efficient client onboarding and relationship building.

Hancock Whitney's physical presence is a cornerstone of its marketing strategy, ensuring accessibility for its target customer base. With 180 banking locations and 223 ATMs spread across the Gulf South states as of December 31, 2024, the bank emphasizes convenience and community engagement. This extensive network, further bolstered by digital platforms like its robust online banking portal and feature-rich mobile app, caters to both traditional and modern banking preferences.

Preview the Actual Deliverable

Hancock Whitney 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hancock Whitney 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Hancock Whitney demonstrates strong community engagement, a vital component of its promotional strategy. In 2024, the company continued its tradition of awarding grants to non-profit organizations, supporting critical local initiatives. This commitment solidifies their brand identity as a community-focused institution.

Their sponsorship of community development programs further amplifies this outreach. By investing in local projects, Hancock Whitney not only fosters goodwill but also creates tangible benefits for the areas they serve. This proactive approach enhances brand visibility and customer loyalty.

Hancock Whitney actively utilizes digital marketing to enhance its online presence, employing its official website as a primary hub for customer engagement and information dissemination. This digital platform serves to communicate its diverse financial product offerings, highlight its commitment to community initiatives, and provide essential investor relations updates to a wide-ranging online audience.

In 2023, Hancock Whitney reported a significant increase in digital engagement, with website traffic up by 15% year-over-year. Their mobile banking app, a key component of their digital strategy, saw a 20% rise in active users by the end of Q4 2024, reflecting a growing reliance on digital channels for banking needs.

Hancock Whitney actively engages in public relations, routinely issuing press releases to inform stakeholders about key developments. These announcements cover financial performance, strategic initiatives like acquisitions, community support through grants, and important leadership changes.

This proactive communication strategy aims to secure media coverage, thereby boosting public recognition and cultivating a favorable perception of the company. For instance, in the first quarter of 2024, Hancock Whitney announced a net income of $126.7 million, highlighting its ongoing financial stability.

Personalized Client Relationships

Hancock Whitney prioritizes cultivating deep, enduring connections with its clientele, delivering tailored services designed to address specific financial requirements. This dedication to personalized care builds significant trust and encourages client loyalty.

This relationship-centric strategy functions as a potent promotional tool, driving organic growth through positive word-of-mouth referrals and bolstering client retention rates. In 2024, banks that excelled in customer service saw an average of 15% higher customer lifetime value.

- Personalized Service: Tailoring financial solutions to individual client needs.

- Relationship Building: Fostering trust and long-term partnerships.

- Word-of-Mouth Promotion: Leveraging satisfied clients for organic marketing.

- Client Retention: Reducing churn through superior customer engagement.

Financial Education and Insights

Hancock Whitney actively fosters client financial literacy and provides valuable market perspectives, underscoring its dedication to customer prosperity. This initiative aims to establish the bank as a reliable source of financial guidance, drawing in individuals and businesses keen on enhancing their financial acumen.

The bank offers a range of educational tools, including informative articles, user-friendly calculators, and insightful webinars. These resources are designed to empower clients with knowledge, thereby strengthening their financial decision-making capabilities and building trust.

For instance, in 2024, Hancock Whitney’s investment insights section saw a 15% increase in engagement, with its webinar series on navigating market volatility attracting over 5,000 participants. This demonstrates a clear demand for such educational content.

- Educational Resources: Hancock Whitney provides articles, calculators, and webinars.

- Market Insights: Offers analysis to help clients understand financial markets.

- Client Empowerment: Aims to boost financial literacy and informed decision-making.

- Trusted Advisor Positioning: Builds credibility by sharing expertise and commitment to success.

Hancock Whitney's promotional efforts are multifaceted, blending community involvement with robust digital outreach. Their commitment to local communities through grants and sponsorships builds significant brand goodwill. This is further amplified by their digital presence, including a user-friendly website and a popular mobile banking app, which saw a 20% rise in active users by the end of 2024.

Public relations and personalized customer service are also key promotional pillars. Issuing press releases about financial performance, such as the $126.7 million net income in Q1 2024, reinforces stability. Furthermore, their focus on tailored services and relationship building cultivates loyalty and drives organic growth through positive word-of-mouth, with banks excelling in service seeing 15% higher customer lifetime value in 2024.

Educational initiatives, like their investment insights section which saw a 15% engagement increase in 2024, position Hancock Whitney as a trusted advisor. By providing valuable financial literacy tools and market perspectives, they attract and retain clients seeking guidance, strengthening their brand as a supportive financial partner.

| Promotional Tactic | Description | 2024/2025 Data Point |

| Community Engagement | Grants and sponsorships for local initiatives | Continued grant awards to non-profits |

| Digital Marketing | Website and mobile app engagement | 15% increase in website traffic, 20% rise in mobile app active users |

| Public Relations | Press releases on financial and strategic updates | Announced $126.7 million net income in Q1 2024 |

| Customer Relationship Management | Personalized service and trust-building | 15% higher customer lifetime value for service-focused banks |

| Financial Literacy | Educational resources and market insights | 15% increase in engagement with investment insights section |

Price

Hancock Whitney actively positions itself with competitive interest rates across its product range, from mortgages and personal loans to savings accounts and Certificates of Deposit (CDs). This strategy aims to attract and retain both borrowers and depositors by offering favorable terms in the market.

The bank's net interest margin (NIM) serves as a crucial indicator of its profitability, reflecting the spread between the interest earned on its assets, like loans, and the interest paid on its liabilities, such as deposits. For instance, in the first quarter of 2024, Hancock Whitney reported a net interest margin of 3.14%, demonstrating its ability to manage this spread effectively amidst evolving economic conditions.

Hancock Whitney emphasizes transparent fee structures for its banking services. This includes clear disclosure of service charges on deposit accounts and fees associated with bank cards and ATM usage. In 2023, noninterest income, which includes various fees, contributed significantly to the bank's overall revenue, highlighting the importance of these charges to their financial performance.

Hancock Whitney's flexible financing options are a key component of its marketing mix, designed to appeal to a broad range of customers. This includes offering competitive terms on mortgages and business loans, making their products more accessible and attractive.

For instance, their ability to allow clients to fix rates on portions of credit lines provides valuable predictability in an often-volatile interest rate environment. This strategy aims to capture market share by catering to diverse financial needs and risk appetites.

Relationship-Based Pricing

Hancock Whitney likely employs relationship-based pricing, a strategy that rewards customer loyalty and deeper engagement. This means clients who utilize multiple Hancock Whitney products or maintain higher deposit and loan balances might qualify for preferential interest rates or reduced fees. This approach incentivizes customers to consolidate their financial needs with the bank, fostering a stronger, more valuable long-term relationship.

This pricing strategy aims to increase customer lifetime value by encouraging cross-selling and up-selling. For instance, a client with a checking account, savings account, and a mortgage might receive a slightly better mortgage rate than a customer with only a single product. This creates a tangible benefit for the customer to deepen their relationship with Hancock Whitney.

Consider these potential benefits for clients engaging in relationship-based pricing:

- Preferential Interest Rates: Clients with multiple products or higher balances may see improved rates on savings accounts, CDs, or loans.

- Reduced Fees: Certain account maintenance fees or transaction charges could be waived or lowered for valued, multi-product customers.

- Enhanced Product Bundling: Special package deals or bundled services could be offered, providing greater overall value.

- Personalized Service: Deeper relationships can sometimes translate into more dedicated and personalized attention from banking professionals.

Market and Economic Condition Adjustments

Hancock Whitney's pricing strategies are dynamic, reacting to shifts in market demand and competitor actions. The prevailing interest rate environment significantly shapes their decisions, particularly for loan and deposit products. For instance, as of Q1 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, influencing the cost of funds and lending rates across the industry.

Management actively monitors economic indicators and competitive pricing to ensure their offerings remain attractive and aligned with financial objectives. This includes analyzing net interest margins and fee structures in relation to peer institutions. In 2023, the U.S. economy experienced moderate growth, with inflation showing signs of easing, providing a backdrop for careful pricing adjustments.

Key adjustments to pricing policies are often driven by:

- Market Demand Fluctuations: Adapting loan and deposit rates based on customer borrowing and saving needs.

- Competitive Landscape: Benchmarking against other regional and national banks to maintain competitive interest rates and fees.

- Economic Climate: Adjusting pricing in response to inflation, unemployment rates, and Federal Reserve monetary policy.

- Regulatory Environment: Ensuring compliance and factoring in any new regulations that might impact pricing structures.

Hancock Whitney's pricing strategy focuses on competitive rates for loans and deposits, aiming to attract a wide customer base. Their net interest margin, reported at 3.14% in Q1 2024, reflects their effectiveness in managing interest income versus expenses.

The bank also emphasizes transparent fees, with noninterest income contributing significantly to revenue in 2023, indicating the importance of service charges. Relationship-based pricing further incentivizes customer loyalty by offering preferential rates and reduced fees for clients with multiple products.

Pricing decisions are dynamic, influenced by market demand, competitor actions, and the economic climate, such as the Federal Reserve's benchmark rate of 5.25%-5.50% in Q1 2024.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Net Interest Margin (NIM) | 3.14% | Indicates profitability on interest-earning assets and liabilities. |

| Benchmark Interest Rate (Fed Funds) | 5.25%-5.50% | Influences the bank's cost of funds and lending rates. |

| Noninterest Income Contribution | Significant (2023) | Highlights the role of fees in overall revenue. |

4P's Marketing Mix Analysis Data Sources

Our Hancock Whitney 4P's Marketing Mix Analysis is grounded in comprehensive data, including official financial reports, investor relations materials, and direct company communications. We also leverage industry-specific research and competitive intelligence to ensure accuracy.