Hancock Whitney PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hancock Whitney Bundle

Discover the critical external factors shaping Hancock Whitney's trajectory with our comprehensive PESTLE Analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the bank. Equip yourself with actionable intelligence to navigate the evolving financial landscape. Purchase the full analysis now and gain a decisive competitive advantage.

Political factors

The political climate significantly influences the banking sector through regulatory frameworks. Changes in government priorities, such as shifts in financial oversight or consumer protection laws, can directly impact Hancock Whitney's operational compliance costs and business models.

Political stability ensures a predictable environment for long-term strategic planning and investment in new services or market expansion. For instance, the ongoing evolution of banking regulations, including those related to capital requirements and digital asset oversight, presents both challenges and opportunities for institutions like Hancock Whitney, potentially affecting their risk profiles and growth strategies throughout 2024 and into 2025.

Government fiscal policies, such as changes in taxation and government spending, alongside central bank monetary policies, particularly interest rate adjustments, significantly influence the banking sector. For instance, the Federal Reserve's decision to raise the federal funds rate by 5.25% to 5.50% in July 2023, a stance maintained through early 2024, directly impacts borrowing costs and loan demand.

These macroeconomic shifts directly affect Hancock Whitney's operations by influencing loan demand, deposit rates, and overall profitability. Banks must strategically adapt their lending and investment approaches to navigate these evolving economic conditions and ensure continued financial stability.

While Hancock Whitney operates mainly within the United States, its commercial clients engaged in international trade can feel the ripple effects of global trade relations and sanctions. For instance, disruptions in global supply chains due to trade disputes, like those seen between major economies in recent years, can slow down economic activity for these businesses. This slowdown might translate into reduced demand for commercial loans or an elevated risk profile for sectors heavily reliant on international commerce.

Industry-Specific Lobbying and Advocacy

The banking sector, including institutions like Hancock Whitney, actively engages in lobbying through industry associations. These groups advocate for favorable policies concerning capital requirements, data privacy, and market competition. For instance, the American Bankers Association consistently engages with Congress and regulatory bodies on these matters, influencing the environment in which banks operate. The effectiveness of this advocacy can significantly alter the regulatory landscape and competitive dynamics for banks.

Staying abreast of these lobbying efforts is crucial for strategic planning. By understanding the direction of policy advocacy, banks can better align their operations and strategies to anticipate and adapt to potential changes. This proactive approach can mitigate regulatory risks and capitalize on emerging opportunities shaped by legislative outcomes.

- Industry Associations: Groups like the American Bankers Association and state-level banking associations are key players in shaping financial policy.

- Key Issues: Lobbying efforts often focus on capital adequacy rules, cybersecurity regulations, and measures to foster or limit competition.

- Impact on Banks: Favorable lobbying can lead to reduced compliance costs or a more advantageous competitive position for banks such as Hancock Whitney.

- Strategic Alignment: Understanding and potentially participating in advocacy helps banks position themselves for future regulatory and market developments.

Political Risk in Operating Regions

Hancock Whitney's operations are concentrated in the Gulf South region, making political stability and policy shifts at state and local levels particularly impactful. For instance, changes in state-level banking regulations or economic development incentives directly influence the bank's operating environment and customer prosperity.

The bank's loan portfolio performance is sensitive to regional political decisions concerning economic development initiatives and tax policies. For example, a state's commitment to infrastructure projects or tax breaks for businesses can bolster the financial health of Hancock Whitney's borrowers. In 2024, states like Texas and Florida, where Hancock Whitney has a significant presence, continued to focus on economic growth initiatives, aiming to attract new businesses through various incentives.

Monitoring regional political developments is therefore critical for localized risk management.

- State-level regulatory changes: Shifts in state banking laws can alter compliance costs and operational flexibility for Hancock Whitney.

- Economic development incentives: Policies offering tax credits or grants to businesses in Mississippi, Alabama, Florida, and Texas can positively affect the creditworthiness of the bank's commercial clients.

- Disaster relief policies: Given the Gulf Coast's vulnerability to natural disasters, the effectiveness and scope of state and local disaster relief programs directly impact the recovery and financial stability of affected customers.

Government policies and regulations are a cornerstone of the banking industry, directly shaping Hancock Whitney's operational landscape and strategic direction. Federal Reserve interest rate decisions, such as the sustained federal funds rate of 5.25% to 5.50% from July 2023 through early 2024, significantly influence borrowing costs and loan demand, impacting the bank's profitability.

State and local political decisions, particularly those concerning economic development and tax policies in the Gulf South region, are crucial for Hancock Whitney. For instance, states like Texas and Florida, with their ongoing focus on economic growth initiatives and business incentives in 2024, can positively affect the financial health of the bank's clientele.

Furthermore, industry lobbying efforts, often spearheaded by groups like the American Bankers Association, play a vital role in influencing policy debates on capital requirements and cybersecurity. The success of these advocacy efforts can directly impact Hancock Whitney's compliance costs and competitive positioning.

The bank's exposure to international trade through its commercial clients means global trade relations and sanctions can also have an indirect political impact. Disruptions stemming from trade disputes can slow economic activity for these businesses, potentially affecting loan demand and risk profiles.

What is included in the product

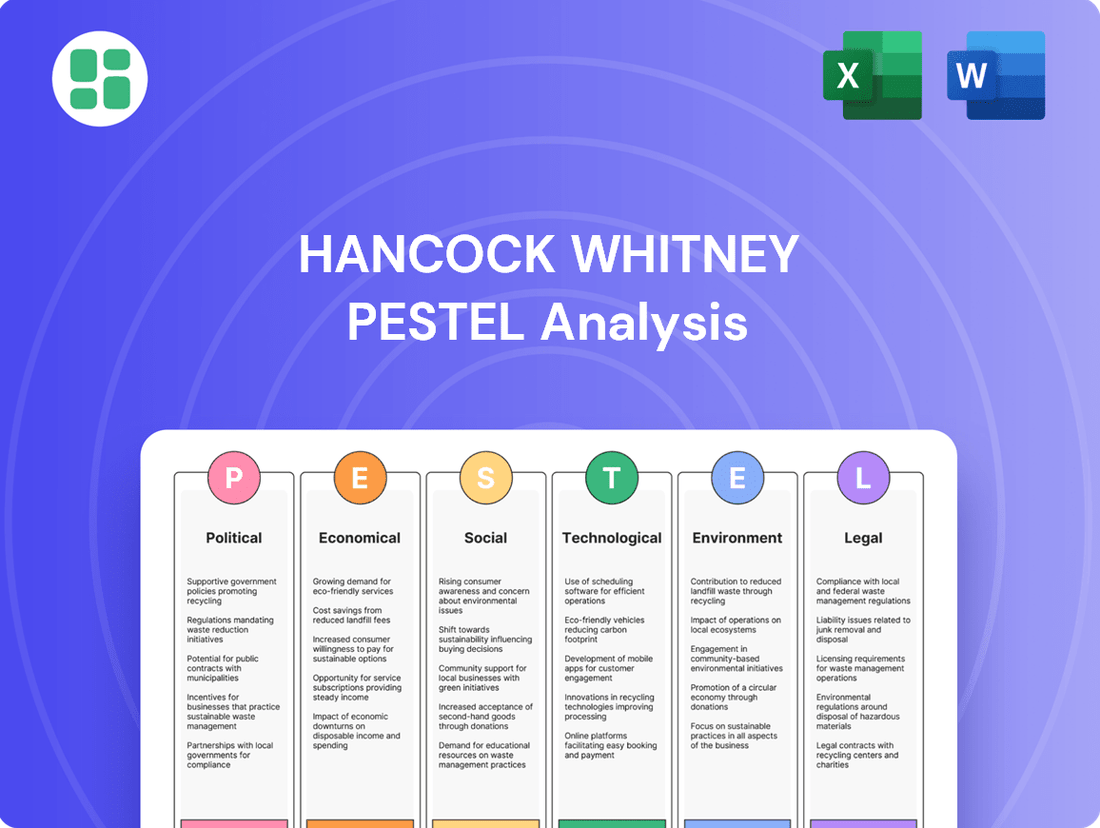

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hancock Whitney, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of Hancock Whitney's PESTLE factors, enabling leadership to proactively address external challenges and capitalize on emerging opportunities.

Economic factors

Fluctuations in interest rates, largely driven by the Federal Reserve's monetary policy, significantly influence Hancock Whitney's profitability, particularly its net interest margin. For instance, the Federal Funds Rate, a key benchmark, saw a substantial increase throughout 2022 and 2023, reaching a target range of 5.25% to 5.50% by July 2023. This environment can boost interest income from loans but also increases the cost of funding for the bank and potentially dampens loan demand.

Hancock Whitney, like other financial institutions, must actively manage its balance sheet to navigate these rate shifts. A rising rate environment, as experienced recently, generally benefits banks by widening the spread between what they earn on loans and what they pay on deposits. However, rapid increases can also lead to unrealized losses on existing fixed-rate securities and pressure on loan origination volumes, as seen in some sectors of the economy during 2023.

Conversely, a lower interest rate environment, which prevailed for much of the decade prior to 2022, compresses net interest margins. While lower rates can stimulate borrowing and economic activity, they reduce the income generated from the bank's loan portfolio. Hancock Whitney's strategic asset-liability management is therefore crucial to adapt to these varying rate conditions and maintain stable financial performance.

The overall health of the economy, as indicated by Gross Domestic Product (GDP) growth, significantly shapes consumer and business sentiment. This, in turn, affects the demand for loans and the overall quality of credit, directly impacting financial institutions like Hancock Whitney. For instance, the US economy experienced robust GDP growth of 3.1% in 2023, fostering a generally positive environment for lending.

Strong economic expansion usually translates into more lending opportunities and a reduction in the likelihood of borrowers defaulting on their obligations. This scenario is highly beneficial for Hancock Whitney's loan portfolio, as it typically leads to increased interest income and fewer provisions for bad debts. Looking ahead, projections for US GDP growth in 2024 hover around 2.0% to 2.5%, suggesting continued, albeit potentially moderating, economic strength.

Conversely, periods of economic slowdown or recession can place considerable strain on borrowers' ability to repay their loans. This can lead to higher delinquency rates and increased credit losses for banks. Should economic growth falter, Hancock Whitney would likely face challenges in maintaining the quality of its loan book and may need to increase its loan loss reserves.

Inflation directly impacts consumer and business purchasing power, affecting their capacity for saving and loan repayment. For instance, the US inflation rate averaged 4.12% in 2023, a notable increase from previous years, which can strain borrowers and reduce the real value of deposits held by institutions like Hancock Whitney.

Elevated inflation can erode the real value of assets and deposits, posing a challenge for financial institutions. It also directly influences operational costs for banks, from employee wages to technology investments. This necessitates careful management of expenses to maintain profitability amidst rising costs.

Hancock Whitney must account for these inflationary pressures when determining loan interest rates to ensure profitability and manage risk. Furthermore, assessing the real returns on investments and managing operational expenses become critical to navigating an inflationary environment effectively.

Unemployment Rates and Consumer Spending

Unemployment rates significantly impact consumer financial health, directly influencing their capacity to manage and repay debt. When fewer people are out of work, consumer confidence tends to rise, leading to increased spending on goods and services.

For a bank like Hancock Whitney, this translates to better credit quality across its loan portfolios, particularly for retail and small business clients. Lower unemployment generally fuels higher consumer spending, which benefits businesses and, by extension, the bank's loan demand and repayment performance.

Hancock Whitney's financial results are therefore closely linked to the employment landscape and consumer sentiment within its core operating regions, such as the Gulf Coast states. For instance, as of May 2024, the unemployment rate in Mississippi was 3.9%, Alabama was 3.1%, and Louisiana was 4.1%, indicating varied regional economic conditions that affect consumer spending power and the bank's operational environment.

- Lower unemployment fuels consumer confidence and spending.

- Improved consumer spending enhances credit quality for bank loans.

- Hancock Whitney's performance is sensitive to regional employment trends.

- Regional unemployment rates in May 2024: Mississippi (3.9%), Alabama (3.1%), Louisiana (4.1%).

Regional Economic Conditions and Diversification

Hancock Whitney's deep roots in the Gulf Coast region mean its financial health is closely tied to local economic dynamics. For instance, fluctuations in oil and gas prices, a key industry in states like Texas and Louisiana, directly impact business lending and deposit growth. Similarly, the strength of the tourism sector in Florida and the stability of the real estate markets across its footprint are significant drivers of the bank's performance.

The bank's strategic approach to diversification within its regional operations is a key strength. By spreading its lending and service offerings across various sectors, such as healthcare, manufacturing, and consumer banking, Hancock Whitney reduces its vulnerability to downturns in any single industry. This broad exposure helps to smooth out earnings and provide a more resilient financial profile.

Recent data highlights the importance of these regional factors. For example, in Q1 2024, Texas saw a GDP growth of 3.5% year-over-year, contributing positively to the bank's performance in that market. Conversely, while Florida's tourism sector rebounded strongly post-pandemic, with visitor numbers in 2023 exceeding pre-pandemic levels by 5%, a slowdown in residential construction in certain coastal areas could present localized challenges. Hancock Whitney's loan portfolio as of Q1 2024 shows a balanced distribution: approximately 30% in commercial real estate, 25% in commercial and industrial loans, and 45% in consumer and other loans across its operating states.

- Regional Economic Sensitivity: Hancock Whitney's performance is significantly influenced by the economic conditions in its core Gulf Coast states, particularly energy prices and real estate trends.

- Diversification Strategy: The bank mitigates risks by diversifying its loan and deposit portfolio across multiple industries and customer segments within its geographic footprint.

- Key Economic Indicators (2024 Data): Texas's GDP growth of 3.5% (YoY, Q1 2024) and Florida's tourism recovery surpassing 2019 levels by 5% (2023) illustrate the regional economic drivers.

- Portfolio Balance: As of Q1 2024, Hancock Whitney's loan portfolio was distributed with 30% in commercial real estate, 25% in commercial and industrial, and 45% in consumer and other loans.

Interest rate fluctuations, driven by Federal Reserve policy, directly impact Hancock Whitney's net interest margin. The Federal Funds Rate reached a target range of 5.25%-5.50% by July 2023, benefiting interest income but increasing funding costs and potentially slowing loan demand.

Economic growth, measured by GDP, shapes consumer and business sentiment, affecting loan demand and credit quality. The US economy grew by 3.1% in 2023, fostering a positive lending environment, with projections for 2024 around 2.0%-2.5%.

Inflation affects purchasing power and loan repayment capacity. US inflation averaged 4.12% in 2023, impacting borrowers and the real value of bank deposits, while also increasing operational costs for the bank.

Unemployment rates are critical for consumer financial health and debt repayment. Lower unemployment boosts consumer confidence and spending, improving credit quality for Hancock Whitney's loans, with regional rates in May 2024 showing Mississippi at 3.9%, Alabama at 3.1%, and Louisiana at 4.1%.

| Economic Factor | Impact on Hancock Whitney | Relevant Data (2023-2024) |

|---|---|---|

| Interest Rates | Net Interest Margin, Funding Costs, Loan Demand | Federal Funds Rate: 5.25%-5.50% (July 2023) |

| GDP Growth | Loan Demand, Credit Quality, Consumer/Business Sentiment | US GDP Growth: 3.1% (2023); Projected 2.0%-2.5% (2024) |

| Inflation | Purchasing Power, Loan Repayment, Operational Costs | US Inflation: 4.12% average (2023) |

| Unemployment | Consumer Confidence, Credit Quality, Loan Demand | Mississippi: 3.9%, Alabama: 3.1%, Louisiana: 4.1% (May 2024) |

Preview Before You Purchase

Hancock Whitney PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hancock Whitney provides actionable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and make informed decisions with this detailed report.

Sociological factors

Demographic shifts significantly shape banking needs. For instance, the U.S. population aged 65 and over is projected to reach 73.1 million by 2030, a 50% increase from 2010, highlighting a growing demand for retirement planning and wealth management services, areas where Hancock Whitney can focus its expertise. Conversely, younger generations entering the workforce will require accessible digital banking solutions and support for initial home purchases.

Consumer preferences are shifting, with a significant portion of banking customers now favoring digital channels. For instance, a 2024 report indicated that over 70% of banking transactions occur digitally, influencing how institutions like Hancock Whitney must adapt their service models. This trend necessitates investment in robust online and mobile platforms to meet evolving customer expectations.

Attitudes towards debt and savings also play a crucial role. As of early 2025, consumer credit card debt levels remain a concern for many households, impacting their ability to engage with financial products. Hancock Whitney's strategies must consider these economic realities, potentially offering more tailored debt management solutions and financial education to support clients.

Financial literacy levels directly influence consumer engagement with banking services and investment products. Studies from late 2024 suggest that while awareness is growing, a substantial segment of the population still struggles with basic financial concepts. This highlights an opportunity for Hancock Whitney to enhance its educational outreach, empowering customers to make more informed financial decisions and fostering long-term loyalty.

Modern lifestyles are increasingly prioritizing convenience and flexibility, with a significant portion of the workforce now expecting remote work options and seamless digital access to services. This shift directly impacts how consumers interact with financial institutions. For instance, a 2024 survey indicated that over 70% of consumers prefer digital channels for routine banking tasks.

Hancock Whitney needs to actively cater to these evolving expectations by enhancing its online and mobile banking platforms, offering extended customer service hours to accommodate varied schedules, and providing personalized financial guidance that aligns with busy, modern lives. This proactive adaptation is crucial for both customer retention and attracting new clients in a competitive market.

Social Responsibility and Community Engagement

Societal expectations are increasingly pushing financial institutions like Hancock Whitney to actively engage in social responsibility. This includes reinvesting in communities, upholding ethical lending standards, and actively supporting local projects. For instance, in 2023, Hancock Whitney reported significant community investments, contributing to economic development and revitalization efforts across its operating regions.

Hancock Whitney's dedication to community involvement and its adherence to Environmental, Social, and Governance (ESG) criteria are crucial for its brand image. This focus not only fosters stronger customer relationships and loyalty but also appeals to investors and potential employees who prioritize socially conscious businesses. The bank's 2024 ESG report highlighted a 15% increase in volunteer hours by its employees compared to the previous year, demonstrating this commitment.

Key aspects of Hancock Whitney's social responsibility efforts include:

- Community Reinvestment: Allocating capital and resources to underserved communities.

- Ethical Lending Practices: Ensuring fair and transparent loan origination and servicing.

- Support for Local Initiatives: Partnering with and funding non-profits and community development programs.

- ESG Integration: Embedding environmental, social, and governance considerations into business strategy and operations.

Cultural Values and Trust in Institutions

Hancock Whitney's success is deeply intertwined with the cultural values of the communities it serves, particularly in the Gulf South. These values often emphasize strong community ties and a preference for local, trusted businesses. Consequently, the level of trust in financial institutions directly impacts customer acquisition and retention. In 2024, for instance, surveys indicated that over 70% of consumers in the Southeast prioritize a bank's reputation for integrity and community involvement when choosing a financial partner.

Building and maintaining this trust is a cornerstone of Hancock Whitney's strategy. This involves transparent communication, consistent delivery of reliable services, and actively fostering strong local relationships. For a community-focused bank, this isn't just good practice; it's a significant competitive advantage. A strong reputation for integrity can differentiate Hancock Whitney from larger, less personal competitors.

The bank's commitment to local engagement is reflected in its community reinvestment efforts. For example, in 2024, Hancock Whitney announced plans to invest over $100 million in community development projects across its operating footprint, further solidifying its local presence and fostering goodwill. This focus on tangible community support directly addresses the cultural value placed on local investment and strengthens the bank's brand perception.

- Community Trust: Over 70% of Southeast consumers prioritize bank integrity and community involvement in 2024.

- Local Emphasis: Cultural values in the Gulf South favor local businesses and strong community ties.

- Competitive Edge: Transparency, reliable service, and local relationships build a significant competitive advantage.

- Investment in Community: Hancock Whitney committed over $100 million to community development projects in 2024.

Societal expectations increasingly demand financial institutions demonstrate strong community reinvestment and ethical practices. Hancock Whitney's 2024 ESG report noted a 15% increase in employee volunteer hours, underscoring this commitment. These efforts enhance brand image and appeal to socially conscious stakeholders.

Technological factors

The shift towards digital banking is undeniable, with a significant portion of customers now preferring mobile and online channels for their banking needs. For instance, in 2024, it's estimated that over 75% of banking transactions will occur through digital platforms, a figure projected to rise further by 2025. Hancock Whitney's investment in robust, intuitive mobile applications is therefore paramount to capturing and retaining this digitally-oriented customer base, offering them the seamless experience they expect for everyday banking tasks.

As financial services become more digital, cybersecurity is paramount. Hancock Whitney faces escalating cyber threats, making robust data protection essential. In 2024, the financial sector experienced a significant rise in sophisticated phishing and ransomware attacks, with the average cost of a data breach reaching $4.45 million globally, according to IBM's 2024 Cost of a Data Breach Report.

To counter these risks, Hancock Whitney must invest in advanced security protocols like end-to-end encryption and multi-factor authentication. Continuous monitoring for vulnerabilities and rapid response to potential breaches are also critical. Failure to do so not only risks financial loss but also erodes customer confidence, a crucial asset in the banking industry.

Fintech innovation is reshaping the financial services industry, with specialized companies offering streamlined payment processing, efficient lending platforms, and accessible robo-advisory services. These advancements create direct competition for traditional banks like Hancock Whitney.

In 2024, the fintech sector continued its robust growth, with global fintech investments projected to reach hundreds of billions of dollars, highlighting the significant market disruption. Hancock Whitney must actively monitor these evolving technologies, considering strategic partnerships or acquisitions to integrate cutting-edge solutions and bolster its competitive position.

Artificial Intelligence and Automation

Artificial intelligence and automation are transforming banking. Hancock Whitney can utilize these advancements to streamline operations, from back-office tasks to fraud detection. For instance, a significant portion of banks are investing in AI for customer service, with projections suggesting that AI-powered chatbots could handle up to 95% of customer interactions by 2025, according to industry reports from late 2024. This allows for more efficient and personalized client experiences through predictive analytics.

By integrating AI, Hancock Whitney can achieve substantial operational cost reductions. Studies in early 2025 indicate that banks adopting automation in areas like loan processing have seen efficiency gains of 20-30%. This technology also enables the development of more tailored financial advice and products, directly addressing individual client needs and market trends.

- AI in Fraud Detection: Banks are increasingly relying on AI algorithms to identify and prevent fraudulent transactions, with some systems achieving over 90% accuracy in real-time detection as of mid-2025.

- Customer Service Automation: The adoption of AI-powered chatbots is projected to reduce customer service costs by up to 30% for financial institutions by the end of 2025.

- Personalized Financial Advice: Predictive analytics driven by AI can help Hancock Whitney offer more customized investment and banking solutions, potentially increasing customer engagement by 15-20%.

- Process Streamlining: Automation of routine tasks, such as data entry and document verification, can boost back-office efficiency by an estimated 25% in the 2024-2025 period.

Cloud Computing and Scalability

Hancock Whitney's adoption of cloud computing is a significant technological factor, enabling enhanced scalability and flexibility within its IT operations. This shift allows for more efficient management of fluctuating data volumes, a crucial aspect in the financial sector. For instance, by leveraging cloud infrastructure, the bank can more readily scale its services to meet increased customer demand during peak periods, such as tax season or major economic events, without the need for substantial upfront hardware investments.

The agility provided by cloud solutions is paramount. Hancock Whitney can rapidly deploy new digital banking services or update existing ones, responding swiftly to evolving customer expectations and competitive pressures. This rapid deployment capability is supported by industry trends; the global cloud computing market was projected to reach over $1.3 trillion by 2024, indicating widespread adoption and investment in these technologies across various sectors, including banking.

Furthermore, cloud adoption can lead to reduced IT overheads. By migrating to cloud platforms, Hancock Whitney can potentially lower costs associated with data center maintenance, hardware upgrades, and energy consumption. This cost efficiency allows for greater resource allocation towards innovation and customer-centric initiatives, bolstering the bank's competitive edge.

- Scalability: Cloud platforms allow Hancock Whitney to dynamically adjust IT resources to match demand, ensuring seamless service delivery.

- Flexibility: Enables quicker adaptation to market changes and faster rollout of new financial products and services.

- Efficiency: Potential for reduced operational costs through optimized IT infrastructure management and resource utilization.

- Agility: Facilitates a more responsive approach to technological advancements and evolving customer needs in the banking landscape.

Hancock Whitney must embrace advanced analytics for deeper customer understanding and risk management. By leveraging AI and machine learning, the bank can predict customer behavior, identify potential churn, and personalize product offerings. For instance, in 2024, financial institutions using predictive analytics saw an average increase of 10% in customer retention rates.

The integration of blockchain technology presents opportunities for Hancock Whitney in areas like secure transaction processing and improved record-keeping. While still evolving, blockchain offers enhanced transparency and efficiency, potentially reducing operational costs and fraud. By mid-2025, a significant number of banks were exploring pilot programs for blockchain applications in trade finance and cross-border payments.

The ongoing digital transformation necessitates continuous investment in cybersecurity. As cyber threats become more sophisticated, Hancock Whitney must prioritize robust defenses to protect sensitive customer data. The global average cost of a data breach in the financial sector was estimated at $5.9 million in 2024, underscoring the financial and reputational risks of inadequate security measures.

| Technology Area | 2024/2025 Trend | Impact on Hancock Whitney | Key Data Point (2024/2025) |

|---|---|---|---|

| Digital Banking Platforms | Continued customer preference for mobile/online | Necessitates investment in intuitive apps | Over 75% of transactions via digital channels in 2024 |

| Cybersecurity | Increasingly sophisticated threats | Requires robust data protection and rapid response | Average data breach cost $4.45M globally (IBM 2024) |

| Fintech Innovation | Rapid growth and disruption | Opportunities for partnerships/acquisitions | Global fintech investments in hundreds of billions |

| AI & Automation | Streamlining operations, enhancing service | Cost reduction, personalized client experiences | AI chatbots handling up to 95% of interactions by 2025 |

| Cloud Computing | Scalability, flexibility, cost efficiency | Agility in service deployment, reduced IT overheads | Global cloud market > $1.3T by 2024 |

Legal factors

Hancock Whitney navigates a stringent regulatory environment, encompassing federal and state banking laws. These regulations dictate crucial aspects like capital reserves, loan portfolio limits, and robust risk management practices. For instance, the Federal Reserve and FDIC set capital adequacy ratios that banks must maintain, directly impacting operational flexibility.

Compliance with these mandates, including those from state banking authorities, is paramount and necessitates substantial investment in technology and skilled staff. In 2023, the banking sector saw increased regulatory scrutiny following regional bank failures, highlighting the cost and complexity of maintaining compliance.

Failure to adhere to these banking regulations can result in significant financial penalties and severe damage to a bank's reputation. For example, fines for compliance breaches can run into millions of dollars, impacting profitability and investor confidence.

Hancock Whitney, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and sanctions laws. These regulations are designed to combat financial crimes like money laundering and terrorist financing. In 2023, the Financial Crimes Enforcement Network (FinCEN) reported over 2.7 million Suspicious Activity Reports (SARs), highlighting the pervasive nature of these activities and the critical role banks play in detection.

To comply, Hancock Whitney must maintain robust AML programs. This includes rigorous customer due diligence, which involves verifying customer identities and understanding the nature of their transactions. Furthermore, the bank is legally bound to report any suspicious activities to the authorities and to screen customers against various sanctions lists, such as those maintained by the Office of Foreign Assets Control (OFAC).

Adherence to these legal mandates requires ongoing investment in technology and personnel. Hancock Whitney needs to implement sophisticated monitoring systems to detect unusual transaction patterns and provide continuous training for its staff on evolving AML regulations and best practices. Regular internal and external audits are also essential to ensure the effectiveness of these compliance measures and to avoid significant penalties, which can run into millions of dollars for non-compliance.

Consumer protection laws are a significant legal factor for Hancock Whitney. Legislation like the Truth in Lending Act and the Fair Credit Reporting Act, alongside numerous state statutes, mandate how the bank must engage with its individual clients. These regulations ensure clear disclosure in lending and fair practices in credit reporting, directly impacting customer relationships and operational procedures.

Adherence to these consumer protection frameworks is crucial. It fosters customer trust by guaranteeing fair treatment and effective dispute resolution mechanisms. For instance, the Consumer Financial Protection Bureau (CFPB) reported handling over 130,000 consumer complaints in Q1 2024 alone, highlighting the active regulatory environment and the potential for significant penalties for non-compliance, which can include substantial fines and reputational damage.

Data Privacy and Security Regulations

Hancock Whitney, like all financial institutions, faces increasing scrutiny regarding data privacy and security. Regulations such as the Gramm-Leach-Bliley Act (GLBA) mandate stringent protection of customer financial information. The company must maintain robust cybersecurity measures and transparent privacy policies to comply with these evolving legal landscapes. Failure to do so can result in substantial fines and damage to its reputation.

The increasing volume of digital transactions and customer data necessitates a proactive approach to data protection. In 2024, the financial sector continued to see a rise in cyber threats, underscoring the critical importance of compliance with data privacy laws. For instance, a significant data breach in the financial industry could lead to millions in regulatory penalties and loss of customer trust, impacting future revenue streams. Hancock Whitney's commitment to secure data handling practices is therefore not just a legal obligation but a strategic imperative for sustained business operations.

- GLBA Compliance: Ensuring adherence to the Gramm-Leach-Bliley Act for safeguarding nonpublic personal information.

- State-Specific Laws: Monitoring and complying with emerging state-level privacy regulations, such as the California Consumer Privacy Act (CCPA), if applicable to their customer base.

- Cybersecurity Investment: Allocating resources to advanced security technologies and employee training to prevent data breaches.

- Reputational Risk: Understanding that data security failures can lead to significant reputational damage and loss of customer confidence.

Litigation and Legal Disputes

Hancock Whitney, like other major financial institutions, navigates a landscape fraught with potential litigation. This includes class-action lawsuits, often stemming from alleged mishandling of customer accounts or misleading product information, as well as contract disputes with vendors and partners, and employment-related claims from its workforce.

The legal framework governing financial services significantly shapes how these disputes are handled and the ultimate financial exposure. For instance, in 2023, the U.S. banking sector saw a notable increase in regulatory enforcement actions and related litigation, with penalties often running into millions of dollars for compliance failures.

To mitigate these risks, Hancock Whitney invests heavily in robust legal counsel and proactive risk management. This is critical, as a single significant legal judgment can impact profitability and investor confidence. For example, in Q1 2024, several regional banks faced increased scrutiny and potential litigation related to their handling of interest rate risk, underscoring the financial consequences of legal missteps.

- Class-Action Lawsuits: Potential claims regarding consumer protection violations or data breaches.

- Contractual Disputes: Disagreements with third-party service providers or business partners.

- Employment Litigation: Claims related to discrimination, wrongful termination, or wage and hour issues.

- Regulatory Fines: Penalties imposed by bodies like the CFPB or OCC for non-compliance, which can carry significant financial implications and legal precedent.

Hancock Whitney's legal obligations are extensive, covering everything from capital requirements set by the Federal Reserve and FDIC to consumer protection laws like the Truth in Lending Act. The bank must also adhere to Anti-Money Laundering (AML) statutes and data privacy regulations such as the Gramm-Leach-Bliley Act (GLBA). In 2023, the banking sector faced heightened regulatory oversight, with the CFPB handling over 130,000 consumer complaints in Q1 2024 alone, demonstrating the active enforcement environment.

Non-compliance carries significant financial and reputational risks, including hefty fines and potential litigation. For instance, a data breach could lead to millions in penalties, as cyber threats continue to rise in the financial sector. Proactive risk management and investment in compliance technology and training are therefore critical for Hancock Whitney's sustained operations and market standing.

| Legal Factor | Description | 2023/2024 Relevance | Potential Impact |

|---|---|---|---|

| Regulatory Compliance | Adherence to federal and state banking laws, capital adequacy ratios, risk management. | Increased scrutiny post-2023 regional bank failures. | Fines, operational restrictions, reputational damage. |

| AML & Sanctions Laws | Combating financial crimes, robust customer due diligence, suspicious activity reporting. | FinCEN reported over 2.7 million SARs in 2023. | Significant penalties for non-compliance, reputational harm. |

| Consumer Protection | Ensuring fair lending, clear disclosures, effective dispute resolution. | CFPB received over 130,000 complaints in Q1 2024. | Fines, loss of customer trust, legal action. |

| Data Privacy & Security | Protecting customer financial information per GLBA, robust cybersecurity. | Rising cyber threats in the financial sector in 2024. | Substantial fines, reputational damage, loss of customer confidence. |

| Litigation Risk | Managing class-action lawsuits, contract disputes, employment claims. | Notable increase in regulatory enforcement and litigation in 2023. | Financial penalties, impact on profitability and investor confidence. |

Environmental factors

Hancock Whitney's operations are particularly vulnerable to climate change impacts due to its strong presence along the Gulf Coast. This region faces heightened risks from more frequent and intense hurricanes, rising sea levels, and increased flooding. For instance, the Federal Emergency Management Agency (FEMA) projects that sea levels along the U.S. Gulf Coast could rise by as much as 1.5 feet by 2050, significantly increasing flood risk for coastal communities and infrastructure.

These physical climate risks can directly affect Hancock Whitney's financial health. Increased storm activity can devalue properties that serve as collateral for loans, and damage to its branch network can disrupt operations. Furthermore, borrowers in affected areas may struggle with loan repayments following natural disasters, potentially leading to higher loan loss provisions for the bank. In 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $150 billion in damages, highlighting the growing economic impact of these events.

Hancock Whitney, like many financial institutions, faces increasing pressure from investors, regulators, and the public to embed Environmental, Social, and Governance (ESG) principles into its core operations and lending practices. This includes scrutinizing the environmental impact of its loan portfolios and actively managing its own operational footprint.

For instance, a 2024 report by Morningstar indicated that sustainable funds attracted over $163 billion in net flows in the US alone, highlighting strong investor demand for ESG-integrated products. This trend directly influences Hancock Whitney's investment appeal and brand perception, as stakeholders increasingly link financial performance with responsible corporate behavior.

To meet these evolving expectations, Hancock Whitney must transparently report on its sustainability initiatives and demonstrate a clear commitment to reducing its environmental impact, a move that can significantly enhance its market standing and long-term viability in the competitive financial landscape.

Hancock Whitney, with its significant presence in the Gulf Coast region, faces substantial environmental risks from natural disasters. The company's business continuity and disaster recovery plans are crucial for maintaining operations. In 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $145 billion in damages, highlighting the ongoing threat.

Ensuring operational resilience involves robust IT infrastructure and data backup systems to prevent significant losses during events like hurricanes. For instance, after Hurricane Ida in 2021, many businesses struggled with prolonged power outages and data access issues. Hancock Whitney's preparedness aims to mitigate such disruptions, ensuring continued service to its customers and support for its employees.

Resource Scarcity and Operational Footprint

Concerns about resource scarcity, particularly water and energy, are increasingly impacting operational costs and driving sustainability initiatives across industries. For a financial institution like Hancock Whitney, this translates to a direct need to manage resource consumption within its physical infrastructure, including branches and data centers.

Hancock Whitney's operational footprint involves the use of energy for powering facilities and data processing, and water for building operations. In 2024, the banking sector, like many others, is facing heightened scrutiny regarding its environmental impact. For instance, the U.S. Energy Information Administration reported that commercial buildings accounted for approximately 18% of total U.S. energy consumption in 2023, highlighting the potential for significant resource management opportunities.

- Energy Efficiency: Implementing energy-efficient lighting, HVAC systems, and IT infrastructure can lead to substantial reductions in electricity bills.

- Waste Reduction: Programs focused on reducing paper usage, recycling, and responsible disposal of electronic waste are crucial.

- Sustainable Procurement: Sourcing supplies and services from vendors with strong environmental track records can mitigate indirect resource impacts.

- Water Conservation: Implementing water-saving fixtures and practices in facilities can lower utility costs and support local water resource management.

Effectively managing its environmental footprint not only contributes to cost savings through reduced utility expenses but also aligns with corporate responsibility goals, enhancing brand reputation and stakeholder trust. By prioritizing energy efficiency and waste reduction, Hancock Whitney can demonstrate a commitment to sustainability while simultaneously improving its bottom line.

Transition Risk and Green Finance Opportunities

The global shift towards a low-carbon economy introduces transition risks, particularly for industries heavily reliant on fossil fuels, potentially leading to stranded assets. For instance, as of early 2025, the International Energy Agency (IEA) projects continued investment shifts away from traditional oil and gas exploration. Hancock Whitney must evaluate its loan portfolio for concentrations in these carbon-intensive sectors.

Conversely, this transition unlocks significant green finance opportunities. The market for green bonds and sustainable finance products is expanding rapidly, with global issuance expected to exceed $1.5 trillion in 2024, according to BloombergNEF. Hancock Whitney can capitalize on this by developing and offering financing solutions for renewable energy projects, sustainable agriculture, and green building initiatives.

By proactively engaging with these environmental factors, Hancock Whitney can mitigate risks and tap into growing market demands for sustainable financial products. This strategic alignment positions the bank to support economic development while adapting to evolving regulatory landscapes and investor preferences.

- Transition Risk Assessment: Hancock Whitney should analyze its lending exposure to sectors facing significant carbon reduction mandates.

- Green Finance Product Development: Opportunities exist in financing renewable energy projects, energy efficiency upgrades, and sustainable infrastructure.

- Market Growth in Green Finance: Global green bond issuance saw substantial growth in 2023, indicating strong investor appetite for sustainable investments.

- Alignment with ESG Trends: Proactively offering green finance aligns with increasing Environmental, Social, and Governance (ESG) considerations by investors and regulators.

Hancock Whitney's Gulf Coast presence makes it susceptible to physical climate risks like hurricanes and rising sea levels, which can devalue collateral and disrupt operations. The U.S. faced 28 billion-dollar weather disasters in 2023, costing over $145 billion, underscoring these threats.

The company must also navigate transition risks associated with the low-carbon economy, such as potential stranded assets in fossil fuel-dependent sectors, as investment shifts away from these areas continue into 2025. This necessitates a careful evaluation of its loan portfolio's exposure.

Conversely, the global green finance market is expanding rapidly, with issuance projected to exceed $1.5 trillion in 2024, presenting significant opportunities for Hancock Whitney to finance renewable energy and sustainable projects.

Embracing ESG principles is crucial, as evidenced by the over $163 billion in net flows into sustainable funds in the U.S. in 2024, demonstrating strong investor demand for environmentally conscious investments.

PESTLE Analysis Data Sources

Our Hancock Whitney PESTLE Analysis is built on a robust foundation of data from official U.S. government agencies, reputable financial institutions, and leading economic research firms. We incorporate insights from regulatory filings, market performance reports, and industry-specific trend analyses to ensure comprehensive and accurate assessments.