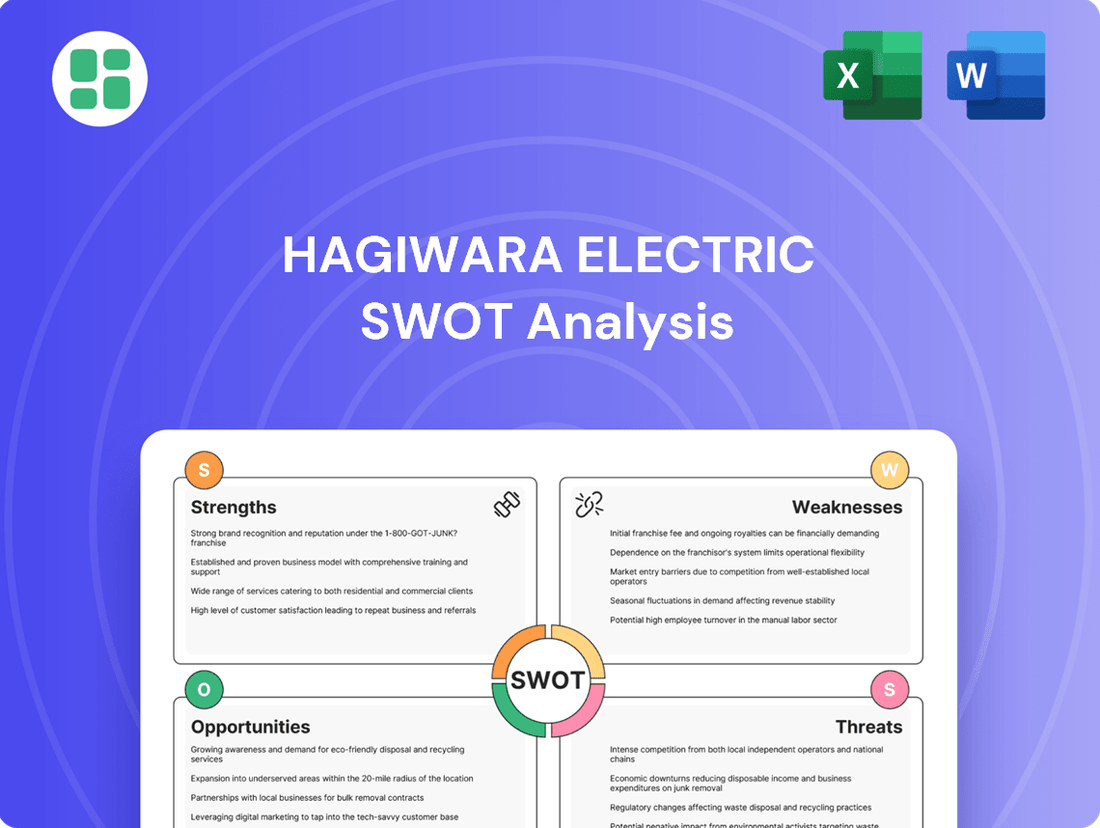

Hagiwara Electric SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

Hagiwara Electric's SWOT analysis reveals a company with strong technological capabilities and a solid market presence, yet facing potential challenges in adapting to rapid industry shifts. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Hagiwara Electric's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hagiwara Electric's core strength is its deep specialization in industrial computer and network solutions, serving critical sectors like manufacturing, infrastructure, and transportation. This niche focus allows them to cultivate profound expertise and deliver tailored solutions for complex industry demands, setting them apart from broader electronics distributors.

Hagiwara Electric boasts a broad product and service catalog, encompassing embedded computers, industrial network equipment, and crucial value-added services such as technical support and system integration. This extensive portfolio positions the company as a comprehensive, one-stop solution for its clientele.

By addressing a wide array of technological requirements, from hardware procurement to seamless implementation and continuous support, Hagiwara Electric cultivates deeper client relationships. This integrated approach enables them to capture a greater portion of customer expenditure, meeting diverse needs under one roof.

Hagiwara Electric benefits from a robust and loyal customer base, primarily concentrated in the manufacturing, infrastructure, and transportation sectors. These industries, by their nature, demand long-term relationships due to the critical and complex systems involved, ensuring a consistent and predictable revenue stream for Hagiwara Electric.

Strategic Positioning in Growing Markets

Hagiwara Electric's strategic focus on automation and connectivity places it at the forefront of major global technological shifts like Industry 4.0, the Internet of Things (IoT), and the development of smart infrastructure. These sectors are not just growing; they are fundamental to the modernization of economies worldwide. For instance, the global industrial automation market was valued at approximately $230 billion in 2023 and is projected to reach over $370 billion by 2030, demonstrating a robust compound annual growth rate (CAGR) of around 7.1%. This expansion is fueled by a widespread push for digitalization and efficiency across manufacturing, logistics, and utilities.

The company's established expertise in these high-demand areas allows it to effectively leverage this market momentum. By providing intelligent and connected industrial systems, Hagiwara Electric is well-positioned to meet the increasing needs of businesses seeking to optimize operations and enhance their competitive edge. This strategic alignment translates into significant opportunities for revenue growth and market share expansion as industries continue their digital transformation journeys.

- Industry 4.0 Alignment: Hagiwara Electric's solutions directly support the core principles of Industry 4.0, enhancing operational efficiency and data-driven decision-making in industrial settings.

- IoT Integration: The company's connectivity offerings are crucial for the expanding IoT ecosystem, enabling seamless data exchange and control in smart environments.

- Smart Infrastructure Demand: Growing investments in smart cities and intelligent infrastructure globally create a substantial market for Hagiwara Electric's specialized technologies.

- Market Growth Projections: The significant projected growth in automation and IoT markets underscores the strong potential for Hagiwara Electric to capitalize on these trends.

Revenue Growth Despite Profit Challenges

Hagiwara Electric Holdings Co. demonstrated impressive revenue expansion, with net sales climbing 17.8% for the nine months ending December 31, 2024. This upward trend continued into the fiscal year ending March 2025, where net sales saw a 14.9% increase.

These figures highlight a strong market reception and effective sales execution, even as the company navigates profitability hurdles. The substantial growth in net sales points to a healthy demand for Hagiwara Electric's offerings.

- Robust Top-Line Growth: Net sales increased by 17.8% (nine months ending Dec 31, 2024) and 14.9% (fiscal year ending Mar 2025).

- Market Demand: The revenue surge suggests strong customer interest and effective market penetration.

- Sales Strategy Efficacy: The consistent sales growth indicates successful strategies in reaching and acquiring customers.

Hagiwara Electric's deep specialization in industrial computer and network solutions for critical sectors like manufacturing and infrastructure is a significant strength, allowing for tailored solutions and expertise. Their comprehensive product and service catalog, from embedded computers to system integration, positions them as a one-stop shop, fostering deeper client relationships and capturing more customer spending. The company benefits from a loyal customer base in essential industries, ensuring a stable revenue stream.

The company's strategic alignment with Industry 4.0, IoT, and smart infrastructure trends is a key advantage. The global industrial automation market, valued at approximately $230 billion in 2023 and projected to exceed $370 billion by 2030, highlights the significant growth potential. Hagiwara Electric's expertise in these areas enables them to capitalize on the increasing demand for digitalization and operational efficiency.

Hagiwara Electric Holdings Co. demonstrated robust financial performance, with net sales increasing by 17.8% for the nine months ending December 31, 2024, and a further 14.9% increase for the fiscal year ending March 2025. This strong top-line growth indicates high market demand and effective sales execution.

| Financial Metric | Period Ending | Year-over-Year Growth |

|---|---|---|

| Net Sales | December 31, 2024 (9 Months) | 17.8% |

| Net Sales | March 31, 2025 (Fiscal Year) | 14.9% |

What is included in the product

Analyzes Hagiwara Electric’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Hagiwara Electric's strategic challenges, relieving the pain of uncertainty.

Weaknesses

Hagiwara Electric Holdings Co. faced a significant hurdle in its fiscal year ending March 2025, as profitability metrics showed a downward trend despite robust sales figures. The company reported a decline in operating profit, ordinary profit, and profit attributable to owners of the parent. This suggests that while the company is successfully increasing its top-line revenue, it is struggling to translate that growth into bottom-line earnings.

Several factors could be contributing to this declining profitability. Increased operating expenses, such as higher raw material costs or rising labor expenses, might be eroding profit margins. Furthermore, a shift in the sales mix towards lower-margin products or intense competition leading to price reductions could also be impacting the company's ability to maintain its profitability.

Hagiwara Electric's focus on manufacturing, infrastructure, and transportation sectors, while a source of expertise, also presents a significant weakness. A downturn or major disruption in any of these core industries could have a disproportionately negative effect on the company's performance. For instance, a slowdown in global infrastructure spending, a key driver for many of Hagiwara's products, could directly impact revenue streams.

Hagiwara Electric's reliance on external suppliers makes it susceptible to disruptions within the global electronics supply chain. Recent years have seen extended lead times and shortages for critical components, impacting Hagiwara's ability to secure inventory. For instance, the semiconductor shortage that persisted through 2022 and into 2023 significantly affected the availability of many electronic parts, a challenge Hagiwara, like its peers, had to navigate.

Impact of Macroeconomic Factors and Demand Stagnation

Hagiwara Electric has had to adjust its financial outlook, largely due to anticipated sluggishness in demand from key sectors like industrial and automotive. This slowdown is directly linked to clients managing their inventory levels and shifting production schedules, creating a ripple effect on Hagiwara's order books.

The company's performance is also vulnerable to wider economic headwinds. For instance, the ongoing uncertainty surrounding U.S. tariff policies and the economic trajectory of the Chinese market present significant risks that could negatively impact sales and overall profitability for the fiscal year ending March 2025.

- Demand Stagnation: Expected slowdown from industrial and automotive clients due to inventory adjustments.

- Macroeconomic Risks: U.S. tariff policies and Chinese market performance create uncertainty for sales.

- Financial Forecast Revisions: Company has updated its projections to reflect these challenging market conditions.

Increased Operating Costs and Investments

Hagiwara Electric's operating profit has seen a dip, even as revenue climbs. This is partly due to higher transfer compensation costs linked to significant growth investments. These investments, vital for the company's long-term success, are currently impacting its immediate financial performance.

The company's strategic investments in areas like human capital and adapting to evolving commercial flows, while essential for future expansion, are a current drag on profitability. For instance, the increase in personnel expenses, a key component of these investments, contributed to the operating profit decline in the fiscal year ending March 2024. This highlights a trade-off between immediate financial results and the necessary groundwork for sustained growth.

- Rising Transfer Compensation: Increased costs associated with employee transfers and new hires for growth initiatives.

- Human Capital Investment: Significant spending on talent acquisition and development to support expansion.

- Commercial Flow Adjustments: Expenses incurred in adapting to shifts in market dynamics and customer engagement.

- Short-Term Profitability Impact: Current operating profit is negatively affected by these necessary, forward-looking expenditures.

Hagiwara Electric's profitability is being squeezed by rising operating expenses, including increased raw material and labor costs. Despite efforts to boost sales, the company is finding it difficult to translate this into higher earnings, possibly due to a sales mix favoring lower-margin products or competitive pricing pressures.

The company's reliance on specific sectors like manufacturing, infrastructure, and transportation makes it vulnerable to industry-specific downturns. For example, a slowdown in global infrastructure spending could significantly impact Hagiwara's revenue. Furthermore, disruptions in the global electronics supply chain, such as component shortages experienced through 2023, pose a risk to securing necessary inventory.

Economic headwinds, including U.S. tariff policies and the economic trajectory of China, create significant uncertainty for Hagiwara Electric's sales and profitability for the fiscal year ending March 2025. The company has already revised its financial outlook downwards to account for anticipated sluggishness in demand from key sectors like industrial and automotive, driven by client inventory adjustments.

Hagiwara Electric's operating profit has been impacted by significant growth investments, including higher transfer compensation costs and investments in human capital. While these expenditures are crucial for future expansion, they are currently creating a drag on immediate financial performance, as seen in the fiscal year ending March 2024.

What You See Is What You Get

Hagiwara Electric SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This direct excerpt showcases the quality and structure of the Hagiwara Electric SWOT analysis. Unlock the full, detailed report by completing your purchase.

Opportunities

The global industrial automation market is projected to reach $315.4 billion by 2027, a substantial increase driven by Industry 4.0 adoption. Japan, a leader in manufacturing, is actively integrating IoT and automation, with investments in smart factories expected to rise significantly in 2024-2025.

Hagiwara Electric's established presence in industrial computing and robust network solutions directly aligns with this burgeoning demand. The company is well-positioned to leverage the trend towards smart manufacturing, offering critical components for connected devices and AI-driven automation systems across key sectors.

Japan's commitment to digital transformation (DX) presents a significant growth avenue. The government's Society 5.0 initiative, aiming for a human-centered society leveraging technology, is a key driver. This national push, coupled with the persistent challenge of labor shortages, creates a strong demand for advanced IT infrastructure and embedded systems, areas where Hagiwara Electric excels.

Hagiwara Electric is well-positioned to capitalize on this trend by offering its expertise in IT infrastructure, embedded systems, and network solutions. Companies across Japan are actively modernizing their operations, seeking partners to facilitate their digital evolution. For instance, the manufacturing sector, a core area for DX, saw investments in automation and IoT solutions grow significantly in 2024, with projections indicating continued expansion through 2025.

Hagiwara Electric's robust technological foundation positions them for significant growth by entering untapped industrial sectors or bolstering their presence in burgeoning international markets. The company's strategic focus on enhancing its technological and sales capabilities for the Indian automotive sector, a key emerging market, exemplifies this forward-looking approach.

Strategic Partnerships and Collaborations

Strategic partnerships represent a significant opportunity for Hagiwara Electric to expand its market reach and technological capabilities. By joining forces with new technology providers, software developers, or larger system integrators, Hagiwara can tap into novel revenue streams and enrich its existing solutions. This approach is already evident in their proactive engagement, as demonstrated by the Memorandum of Understanding (MOU) signed with Advantech Co., Ltd., a prominent player in industrial computing.

These collaborations can lead to the development of more comprehensive and integrated solutions, catering to a wider range of customer needs. For instance, integrating advanced AI or IoT platforms from partners could significantly enhance Hagiwara's industrial automation and embedded system offerings. Such alliances are crucial for staying competitive in a rapidly evolving technological landscape.

Key areas for strategic partnerships include:

- Technology Integration: Collaborating with providers of cutting-edge semiconductors, sensors, or specialized processing units to embed them into Hagiwara's hardware.

- Software Development: Partnering with software firms to co-develop specialized applications, operating systems, or data analytics tools tailored for industrial environments.

- System Integration: Working with larger system integrators to offer end-to-end solutions, combining Hagiwara's hardware with broader system architectures.

- Market Access: Leveraging partners' established distribution networks and customer bases to penetrate new geographical markets or industry verticals.

Increased Investment in Infrastructure and Smart Transportation

Japan's commitment to bolstering its infrastructure, including significant investments in AI and digital transformation, creates a fertile ground for Hagiwara Electric. The nation's focus on smart transportation, driven by efficiency and sustainability goals, directly aligns with Hagiwara's expertise in automation and connectivity solutions. This presents a substantial opportunity for the company to secure new projects within intelligent transport systems and related infrastructure development.

The Japanese government's infrastructure spending plans, particularly those emphasizing technological integration, offer a clear pathway for Hagiwara Electric. For instance, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has been actively promoting the adoption of advanced technologies in road management and traffic control. Hagiwara's offerings in areas like automated driving support systems and vehicle-to-infrastructure (V2I) communication are poised to capitalize on this trend.

- Growing Smart Transportation Market: Japan's smart transportation market is projected to expand significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, driven by AI and IoT integration.

- Infrastructure Investment Focus: The Japanese government has allocated substantial capital towards infrastructure upgrades, with a notable portion dedicated to AI-related infrastructure and smart city initiatives, creating demand for advanced technological solutions.

- Hagiwara's Relevant Solutions: Hagiwara Electric's expertise in automation, sensor technology, and communication systems directly addresses the needs of intelligent transport systems, including traffic management, autonomous driving support, and connected vehicle technologies.

- Potential for Long-Term Contracts: The scale of these infrastructure projects offers Hagiwara Electric the opportunity to engage in long-term contracts, providing a stable revenue stream and solidifying its position in the evolving smart mobility landscape.

Hagiwara Electric can capitalize on the global surge in industrial automation, projected to reach $315.4 billion by 2027, by leveraging Japan's strong push towards Industry 4.0 and smart manufacturing, with significant investment expected in 2024-2025.

The company's expertise in industrial computing and network solutions aligns perfectly with Japan's Society 5.0 initiative and the growing demand for IT infrastructure driven by labor shortages.

Strategic partnerships, such as the MOU with Advantech, offer avenues to expand market reach and integrate new technologies, enhancing Hagiwara's embedded systems and automation offerings.

Further opportunities lie in Japan's infrastructure development, particularly in smart transportation, where Hagiwara's automation and connectivity solutions can support intelligent transport systems and connected vehicle technologies.

| Opportunity Area | Market Driver | Hagiwara Electric's Relevance | 2024-2025 Outlook |

|---|---|---|---|

| Industrial Automation | Industry 4.0 adoption | Industrial computing, network solutions | Strong growth, increased smart factory investment |

| Digital Transformation (DX) | Society 5.0, labor shortages | IT infrastructure, embedded systems | High demand for modernization |

| Strategic Partnerships | Technology advancement, market expansion | Collaboration with tech providers, software firms | Key for integrated solutions and new revenue streams |

| Smart Transportation | Infrastructure upgrades, AI integration | Automation, connectivity solutions | Significant project potential in intelligent transport systems |

Threats

The electronics distribution and industrial solutions sector is a crowded arena, featuring a robust mix of domestic and international competitors vying for market share. This intense rivalry often translates directly into significant price pressures, potentially eroding profit margins for companies like Hagiwara Electric, particularly when rivals can offer comparable products or services at more attractive price points or employ more aggressive go-to-market tactics.

For instance, in 2024, the global electronics components distribution market saw continued consolidation and aggressive pricing strategies from major players, impacting smaller distributors’ ability to maintain healthy margins. This trend is expected to persist into 2025, demanding constant vigilance and strategic adaptation from Hagiwara Electric to navigate the competitive landscape effectively and mitigate the impact of price wars on its profitability.

The industrial computer and network solutions market is a fast-moving arena. Hagiwara Electric faces the threat of its products quickly becoming outdated due to rapid technological advancements. For instance, the increasing integration of AI in industrial automation and the emergence of new 5G communication standards necessitate constant innovation.

To counter this, Hagiwara Electric needs substantial and ongoing investment in research and development. Failing to adapt to new technologies, such as enhanced cybersecurity measures against evolving threats or next-generation processing power, could lead to a significant loss of market competitiveness.

Economic downturns pose a significant threat to Hagiwara Electric. For instance, a projected slowdown in global GDP growth for 2024, with many economies facing tighter monetary policies, could curtail capital expenditure by key clients in manufacturing and infrastructure. This reduced spending directly impacts Hagiwara Electric's order book and revenue streams, mirroring past instances where clients postponed or scaled back projects due to economic uncertainty.

Global Supply Chain Volatility

Global supply chain volatility presents a significant hurdle for Hagiwara Electric. Ongoing disruptions, exacerbated by factors like semiconductor shortages and geopolitical trade tensions, can lead to unpredictable lead times and increased procurement costs. For instance, the average global shipping costs saw a notable increase in late 2024, impacting the landed cost of components. This instability directly threatens Hagiwara's ability to meet customer demand and maintain operational efficiency, potentially affecting sales performance.

These challenges manifest in several critical ways:

- Increased component costs: Rising raw material prices, such as for copper and rare earth metals essential in electronics, directly inflate production expenses.

- Extended lead times: Delays in component availability can push back product delivery schedules, frustrating customers and potentially leading to lost orders.

- Production slowdowns: Shortages of key components, like advanced microcontrollers, can force temporary halts or reduced output, impacting revenue generation.

- Inventory management strain: The need to secure components amidst uncertainty can lead to higher inventory holding costs or the risk of stockouts.

Cybersecurity Risks and Data Vulnerabilities

Hagiwara Electric, as a provider of industrial network solutions for critical infrastructure, faces escalating cybersecurity risks. A significant data breach could result in substantial financial losses, severe reputational damage, and considerable legal liabilities for both Hagiwara and its clients, particularly concerning automation and connectivity systems.

The increasing sophistication of cyberattacks poses a direct threat. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved in protecting industrial control systems.

- Increased threat landscape: Industrial control systems (ICS) are increasingly targeted by sophisticated ransomware and state-sponsored attacks.

- Financial and reputational impact: A successful breach could lead to millions in recovery costs, regulatory fines, and a loss of client trust.

- Operational disruption: Compromised systems in critical infrastructure could cause widespread service outages, impacting essential utilities and services.

Intense competition in electronics distribution and industrial solutions pressures Hagiwara Electric's profit margins, especially with aggressive pricing from rivals. Rapid technological advancements in areas like AI and 5G demand continuous R&D investment to avoid obsolescence, as failing to adapt can lead to a significant loss of market competitiveness.

Economic downturns, marked by projected GDP slowdowns and tighter monetary policies in 2024-2025, threaten to reduce client capital expenditure, directly impacting Hagiwara's revenue. Supply chain volatility, including semiconductor shortages and rising shipping costs, further complicates operations by increasing procurement expenses and lead times, potentially hindering Hagiwara's ability to meet customer demand.

| Threat Category | Specific Challenge | Impact on Hagiwara Electric | 2024/2025 Data Point |

| Competition | Aggressive pricing strategies | Eroded profit margins | Global electronics distribution market saw continued consolidation and aggressive pricing in 2024. |

| Technological Obsolescence | Rapid advancements (AI, 5G) | Need for continuous R&D investment | Increased demand for AI-integrated industrial automation solutions. |

| Economic Downturn | Reduced capital expenditure by clients | Lowered order books and revenue | Projected global GDP growth slowdown for 2024. |

| Supply Chain Volatility | Semiconductor shortages, rising shipping costs | Increased procurement costs, extended lead times | Average global shipping costs saw a notable increase in late 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Hagiwara Electric's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.