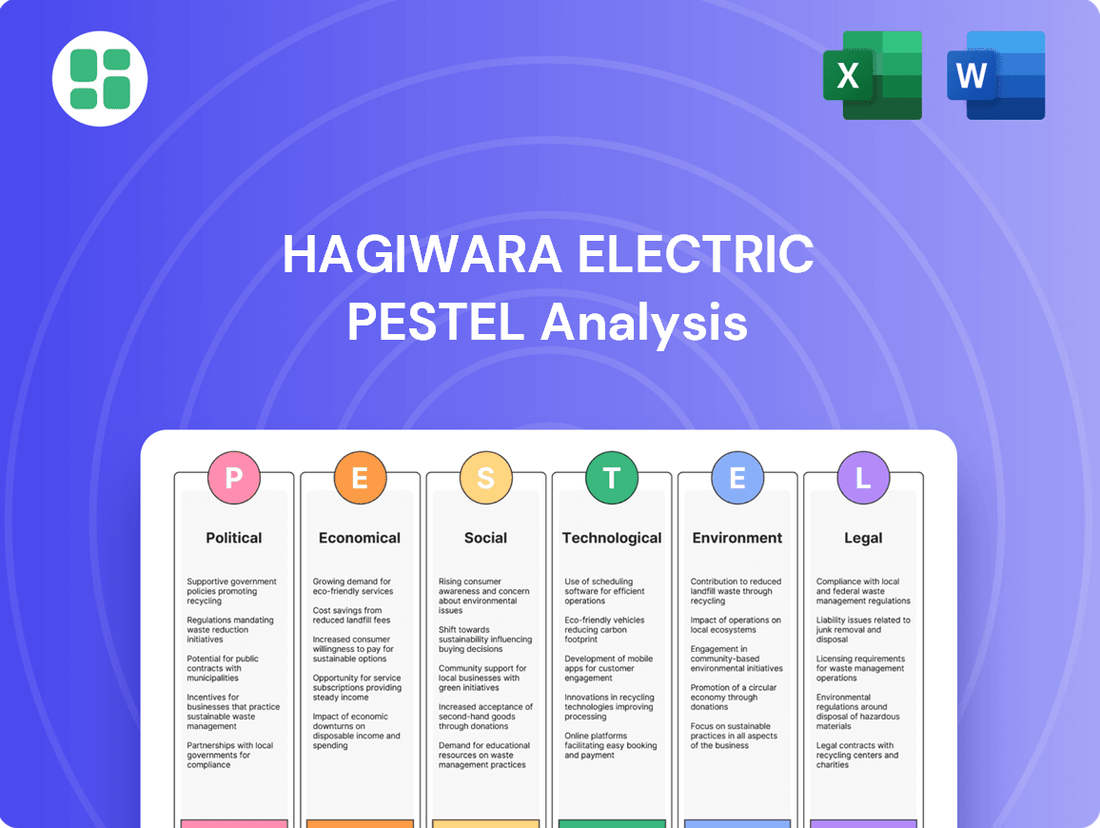

Hagiwara Electric PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

Uncover the critical political, economic, and technological forces shaping Hagiwara Electric's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external influences, empowering you to anticipate market shifts and identify strategic opportunities. Don't get left behind; download the full analysis now for actionable intelligence.

Political factors

Government industrial policies aimed at fostering automation and digital transformation are a significant tailwind for Hagiwara Electric. For instance, Japan's "Society 5.0" initiative, actively promoted in 2024 and continuing into 2025, encourages the integration of AI and IoT across industries, directly increasing the need for advanced electrical components and systems that Hagiwara provides.

Furthermore, fiscal incentives and subsidies play a crucial role. In 2024, many governments, including those in key Asian markets, are offering tax breaks and grants for companies investing in smart manufacturing upgrades. This makes Hagiwara's solutions more attractive and affordable for their target clientele, potentially driving higher sales volumes.

Changes in international trade agreements, such as potential renegotiations of existing pacts or the introduction of new ones, could significantly alter the landscape for Hagiwara Electric. For instance, if the US were to impose new tariffs on semiconductors imported from Asia, a key component for many electronic devices, this would directly increase Hagiwara's manufacturing costs. As of early 2024, global trade tensions remain a significant factor, with ongoing discussions around supply chain resilience and national security impacting component sourcing.

Geopolitical tensions, particularly those affecting major manufacturing hubs or shipping routes, pose a direct threat to Hagiwara Electric's operations. Disruptions in the South China Sea, for example, could impact the timely delivery of crucial electronic components, leading to production delays and increased logistics expenses. The ongoing global focus on diversifying supply chains away from single regions, driven by events in 2023 and continuing into 2024, underscores the vulnerability of companies like Hagiwara to such geopolitical shifts.

Governments worldwide are intensifying their focus on protecting critical infrastructure, which directly impacts companies like Hagiwara Electric. New regulations and standards for industrial control systems and network security are becoming more stringent. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) continues to update its directives and guidance for critical sectors throughout 2024 and into 2025, emphasizing robust network defense measures.

Hagiwara Electric, as a provider of network solutions, must proactively adapt its offerings to ensure full compliance with these evolving national and international cybersecurity laws. This includes adhering to frameworks like the NIST Cybersecurity Framework, which is widely adopted and updated. Staying ahead of these regulatory shifts can present significant new business opportunities, particularly in offering specialized compliance solutions and secure network architectures to other businesses facing similar mandates.

Political Stability and Geopolitics

Political stability in Japan, a primary market for Hagiwara Electric, remains robust, fostering a predictable business environment. However, geopolitical tensions in East Asia, particularly concerning trade relations with China and regional security, present potential risks. For instance, escalating trade friction between major global economies in 2024 could impact component sourcing and export markets.

Geopolitical shifts directly influence global supply chains, a critical area for industrial technology firms like Hagiwara Electric. Disruptions stemming from conflicts or trade disputes can lead to increased costs and delays. In 2024, the ongoing semiconductor supply chain vulnerabilities, exacerbated by geopolitical factors, highlight the need for supply chain diversification.

- Political Stability: Japan's consistent political landscape supports Hagiwara Electric's domestic operations.

- Geopolitical Risks: East Asian geopolitical dynamics and global trade disputes pose potential threats to supply chains and market access.

- Supply Chain Impact: Trade tensions in 2024 could disrupt the flow of essential components, affecting production and pricing.

- Market Access: Geopolitical factors can influence Hagiwara Electric's ability to enter or maintain its presence in certain international markets.

Infrastructure Spending Initiatives

Government initiatives to upgrade national infrastructure, such as transportation and utilities, are a significant boon for Hagiwara Electric. These projects directly increase the need for the company's industrial computing and connectivity hardware. For instance, the US Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $1 trillion to infrastructure improvements, with substantial portions earmarked for transportation and broadband expansion through 2026.

These large-scale, multi-year projects offer Hagiwara Electric predictable revenue streams and ample opportunities for integrating its advanced systems. Such long-term commitments provide a stable foundation for business planning and investment. The ongoing focus on smart city development and the modernization of power grids, often supported by government funding, further amplifies demand for Hagiwara Electric's specialized solutions.

Key areas benefiting Hagiwara Electric include:

- Transportation Infrastructure: Upgrades to railways, highways, and airports require robust communication and control systems.

- Energy Grids: Modernization of power grids, including smart grid technologies, necessitates reliable computing and networking.

- Telecommunications: Expansion of broadband and 5G networks drives demand for connectivity hardware.

- Public Safety Systems: Investments in smart city initiatives and emergency response networks utilize industrial computing for data processing and management.

Government industrial policies, particularly those promoting automation and digital transformation like Japan's Society 5.0, directly benefit Hagiwara Electric by increasing demand for its advanced components. Fiscal incentives and tax breaks offered in 2024 by various Asian governments for smart manufacturing upgrades further enhance the attractiveness of Hagiwara's solutions, potentially boosting sales.

Geopolitical tensions and trade disputes in 2024, such as those impacting semiconductor supply chains, present risks by potentially increasing manufacturing costs and disrupting component flow. Conversely, government investments in infrastructure, like the US Infrastructure Investment and Jobs Act extending through 2026, create predictable revenue streams for Hagiwara Electric by driving demand for its industrial computing and connectivity hardware in areas like transportation and smart grids.

| Political Factor | Impact on Hagiwara Electric | Data/Example (2024/2025) |

|---|---|---|

| Government Industrial Policy | Increased demand for automation and digital solutions | Japan's Society 5.0 initiative actively promotes AI/IoT integration. |

| Fiscal Incentives | Enhanced affordability and sales potential of Hagiwara's products | Tax breaks for smart manufacturing upgrades in key Asian markets. |

| Geopolitical Tensions/Trade Disputes | Supply chain disruptions and increased component costs | Ongoing semiconductor supply chain vulnerabilities impacting global trade. |

| Infrastructure Investment | Predictable revenue streams and demand for hardware | US Infrastructure Investment and Jobs Act (through 2026) funding transportation and broadband. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Hagiwara Electric, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by detailing specific threats and opportunities relevant to Hagiwara Electric's market and industry.

Provides a concise version of Hagiwara Electric's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Economic factors

Global economic growth is projected to be moderate in 2024 and 2025. The International Monetary Fund (IMF) forecasts global GDP growth of 3.2% for 2024, slightly down from 3.3% in 2023, with a similar pace expected for 2025. This overall economic health directly impacts Hagiwara Electric's customer base, influencing their willingness to invest in new equipment and technology.

Key industrial sectors like manufacturing and infrastructure are crucial for Hagiwara Electric. While manufacturing growth has shown resilience in some regions, global industrial production growth is expected to remain subdued. For instance, the Purchasing Managers' Index (PMI) for manufacturing globally hovered around the 50 mark in late 2023 and early 2024, indicating a stabilization but not a strong expansion. This can lead to cautious capital expenditure from Hagiwara's clients.

A stronger economic environment typically spurs investment in automation and technological advancements, which are core to Hagiwara Electric's offerings. However, persistent inflation and higher interest rates in major economies throughout 2023 and into 2024 have dampened business confidence and investment appetite for many companies. This means Hagiwara Electric might face a more discerning customer base when pushing new capital-intensive solutions.

Rising inflation in 2024 and projected into 2025 directly impacts Hagiwara Electric by increasing the cost of essential raw materials and electronic components. For instance, the global semiconductor shortage, though easing, still contributes to higher component prices, and energy costs, a significant operational expense, have seen volatility. This upward pressure on input costs could force Hagiwara Electric to re-evaluate its pricing strategies.

These increased operational expenses and material costs can squeeze profit margins if price adjustments aren't fully passed on to consumers. For example, if Hagiwara Electric cannot raise prices to match a 3-4% inflation rate, their net profit could be reduced. Maintaining competitiveness while absorbing these rising costs presents a significant challenge for the company in the coming year.

Currency exchange rate fluctuations present a significant risk for Hagiwara Electric, an electronics trading company. For instance, if the Japanese Yen strengthens against the US Dollar, Hagiwara's costs for components sourced in USD will decrease, potentially boosting profit margins on those sales. Conversely, a weaker Yen could make imported parts more expensive, impacting the company's ability to maintain competitive pricing for its exported solutions.

Interest Rates and Investment Climate

Interest rates play a significant role in shaping the investment climate for Hagiwara Electric. Fluctuations in these rates directly impact borrowing costs, affecting the company's ability to finance its operations and expansion. For instance, if the Bank of Japan maintains its accommodative monetary policy, as it has indicated it might throughout 2024 and into 2025, this could keep borrowing costs relatively low, potentially benefiting Hagiwara Electric's capital expenditure plans.

Higher interest rates can act as a brake on demand for Hagiwara Electric's products and services. When borrowing becomes more expensive, businesses are less likely to invest in new industrial equipment, automation upgrades, or large-scale projects. This slowdown in capital investment can directly translate to reduced sales volumes and fewer project acquisitions for the company. For example, in late 2024, many global central banks were signaling a cautious approach to rate cuts, which could lead to a more challenging environment for companies reliant on business investment.

- Impact on Borrowing Costs: Changes in benchmark interest rates, such as the Bank of Japan's policy rate, directly affect Hagiwara Electric's cost of debt financing.

- Investment Deterrence: Elevated interest rates can discourage Hagiwara Electric's customer base from undertaking capital-intensive projects, potentially dampening demand for its automation and industrial solutions.

- Economic Outlook: Projections for 2024 and 2025 indicate a mixed global economic outlook, with some regions experiencing inflationary pressures that could lead to sustained higher interest rates, impacting Hagiwara Electric's sales pipeline.

Supply Chain Resilience Costs

The imperative to build resilient supply chains, a lesson learned from recent global disruptions, translates directly into higher operational expenses for companies like Hagiwara Electric. This includes the cost of establishing relationships with multiple suppliers across different regions, maintaining larger safety stocks of critical components, and investing in advanced tracking and logistics technologies to ensure smoother operations even during unforeseen events.

These increased costs associated with supply chain resilience can have a tangible effect on Hagiwara Electric's bottom line, potentially impacting their operational efficiency and necessitating adjustments to their pricing strategies to absorb these added expenditures. For instance, the global cost of shipping containers saw significant fluctuations in 2024, with spot rates for major East-West trade lanes remaining elevated compared to pre-pandemic levels, reflecting ongoing logistical pressures.

- Diversification Costs: Expanding supplier networks to mitigate single-point-of-failure risks often involves higher sourcing costs due to smaller order volumes or less favorable contract terms with new partners.

- Inventory Holding Costs: Maintaining larger inventories to buffer against supply shocks ties up working capital and incurs expenses related to warehousing, insurance, and potential obsolescence.

- Logistics Investment: Upgrading logistics infrastructure, including advanced tracking systems and diversified transportation options, requires substantial capital outlay.

- Impact on Margins: The cumulative effect of these resilience-building measures can squeeze profit margins if not effectively passed on to customers or offset by operational efficiencies.

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% GDP growth for 2024. This moderate pace impacts Hagiwara Electric's client investment in new technology. Inflationary pressures and higher interest rates in major economies throughout 2023 and into 2024 have dampened business confidence, making customers more cautious about capital expenditures.

Rising inflation, expected to persist into 2025, increases Hagiwara Electric's costs for raw materials and electronic components, with semiconductor prices and energy costs remaining volatile. This upward pressure on input costs may necessitate pricing strategy adjustments to maintain profitability.

The need for supply chain resilience adds to operational expenses, including diversifying suppliers, holding larger inventories, and investing in logistics. These costs can strain profit margins if not effectively managed or passed on to customers, with global shipping costs remaining elevated in 2024.

| Economic Factor | 2024 Projection/Data | Impact on Hagiwara Electric |

|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Moderate demand for capital investments |

| Inflation | Persistent, impacting input costs | Increased operational expenses, potential margin squeeze |

| Interest Rates | Mixed, cautious rate cut signals | Deters customer investment, affects borrowing costs |

| Supply Chain Resilience Costs | Elevated shipping costs, diversification expenses | Higher operational overhead, potential price adjustments |

What You See Is What You Get

Hagiwara Electric PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hagiwara Electric PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Industrialized nations are grappling with aging workforces, with the average age of workers in many developed economies steadily increasing. This demographic shift, coupled with a persistent global shortage of skilled labor in critical fields like industrial automation, IT, and cybersecurity, creates a significant demand for advanced technological solutions. For instance, the International Federation of Robotics reported that the global robot density in manufacturing reached 151 units per 10,000 employees in 2023, a testament to the growing reliance on automation to offset labor challenges.

Hagiwara Electric's product portfolio, focusing on automation and efficiency, is strategically positioned to capitalize on these trends. By providing solutions that enhance productivity and reduce dependence on manual labor, the company directly addresses the core needs arising from these workforce demographic shifts and skill gaps. As of early 2025, the demand for automation in manufacturing is projected to grow by an average of 10-15% annually, according to various industry analyses, underscoring the market opportunity for Hagiwara Electric.

Societal and organizational readiness significantly shapes how quickly industries like manufacturing, infrastructure, and transportation embrace digital transformation. This readiness directly impacts the market size and growth potential for companies like Hagiwara Electric, whose solutions are central to this shift.

The increasing societal acceptance and adoption of technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and data-driven operational models are creating a robust and expanding market for Hagiwara Electric's offerings. For instance, a 2024 report indicated that global spending on AI in manufacturing alone was projected to reach over $10 billion, highlighting a clear demand for the digital solutions Hagiwara Electric provides.

Societal and regulatory pressure to enhance workplace safety and ergonomics is escalating, particularly within industrial sectors. This trend directly fuels demand for automation solutions that minimize human interaction with hazardous or physically demanding tasks. Hagiwara Electric's expertise in automation directly addresses this by offering systems that can significantly reduce the risk of workplace injuries.

For instance, the International Labour Organization (ILO) reported that in 2023, occupational accidents and diseases continue to pose a significant global burden, impacting millions of workers annually. Companies are increasingly investing in technologies that improve working conditions, making Hagiwara Electric's safety-focused automation a compelling proposition for businesses aiming to comply with stricter safety standards and protect their workforce.

Changing Consumer Expectations for Infrastructure

Public demand for upgraded infrastructure, characterized by greater efficiency, reliability, and smart capabilities, is a significant sociological driver. This societal shift is evident in the growing interest in smart city initiatives and intelligent transportation systems, which require advanced technological integration. For instance, a 2024 survey indicated that over 70% of urban residents in developed nations expect their city's infrastructure to incorporate smart technologies within the next five years.

This evolving consumer expectation directly translates into increased investment from both governmental bodies and private enterprises in cutting-edge solutions. Companies like Hagiwara Electric, which offer the foundational technological components for these advancements, are well-positioned to capitalize on this trend. The global smart infrastructure market, valued at approximately $1.5 trillion in 2023, is projected to reach over $3 trillion by 2028, highlighting the scale of this opportunity.

- Smart City Adoption: Growing public advocacy for connected urban environments fuels demand for integrated technological solutions.

- Transportation Modernization: Citizens increasingly expect intelligent traffic management and public transit systems, driving investment in related technologies.

- Sustainability Focus: Societal pressure for environmentally friendly infrastructure encourages the adoption of smart grid and energy-efficient solutions.

- Digital Infrastructure Needs: The pervasive use of digital devices creates an expectation for robust and ubiquitous connectivity, impacting infrastructure development.

Corporate Social Responsibility (CSR) Demands

Societal expectations for Corporate Social Responsibility (CSR) are intensifying, pushing companies like Hagiwara Electric to prioritize ethical sourcing and sustainable operations. This growing pressure directly impacts operational decisions and supply chain management, as businesses increasingly scrutinize their partners' practices. By 2024, over 70% of consumers reported that they consider sustainability a key factor when making purchasing decisions, a trend that is expected to continue its upward trajectory through 2025.

Customers are actively seeking out and favoring business partners that exhibit transparent and responsible conduct. This shift means Hagiwara Electric must not only meet but exceed expectations in areas like environmental impact and fair labor practices to maintain and grow its customer base. For instance, a 2024 survey indicated that 60% of B2B buyers are more likely to choose suppliers with demonstrable CSR initiatives.

- Increased consumer demand for sustainable products and services.

- Investor focus on Environmental, Social, and Governance (ESG) performance.

- Regulatory bodies potentially introducing stricter CSR reporting requirements.

- Reputational risk associated with non-compliance or unethical practices.

Societal trends significantly influence Hagiwara Electric's market. The growing demand for safer workplaces, driven by public awareness and regulatory pressure, directly boosts the need for automation solutions that minimize human exposure to hazardous conditions. For example, the International Labour Organization noted that occupational accidents remain a substantial global issue in 2023, pushing companies to invest in safety technologies.

Public expectation for modernized infrastructure, including smart cities and efficient transportation, creates a substantial market for Hagiwara Electric's technological components. A 2024 survey revealed that over 70% of urban dwellers anticipate smart technologies in their cities within five years, indicating strong societal backing for such advancements.

Furthermore, increasing consumer and investor emphasis on Corporate Social Responsibility (CSR) and ESG performance means Hagiwara Electric must demonstrate ethical and sustainable practices to maintain its competitive edge. By 2024, a significant majority of consumers considered sustainability in their purchasing decisions, a trend expected to persist through 2025.

| Sociological Factor | Impact on Hagiwara Electric | Supporting Data (2023-2025) |

|---|---|---|

| Workplace Safety Demand | Increased demand for automation to reduce worker risk. | ILO data highlights ongoing burden of occupational accidents globally (2023). |

| Infrastructure Modernization | Market growth for smart city and intelligent transport solutions. | 70%+ urban residents expect smart city tech within 5 years (2024 survey). |

| CSR & ESG Focus | Need for transparent, sustainable operations to attract customers and investors. | Over 70% of consumers prioritize sustainability in purchases (2024). |

Technological factors

The rapid evolution of Industrial Internet of Things (IIoT) is significantly impacting manufacturing. By 2024, the global IIoT market is projected to reach over $115 billion, a substantial increase from previous years, driven by demand for enhanced efficiency and predictive maintenance.

Hagiwara Electric's embedded computers and network solutions are crucial for leveraging these IIoT advancements. Integrating sophisticated AI algorithms into edge computing devices allows for real-time data analysis on the factory floor, optimizing operations and reducing downtime.

For instance, AI-powered predictive maintenance, a key IIoT application, can anticipate equipment failures, potentially saving industries billions. In 2023, companies adopting such solutions reported an average reduction in unplanned downtime by up to 30%, highlighting the competitive imperative for Hagiwara Electric to stay at the forefront of these technological integrations.

The industrial network landscape is constantly evolving, with new standards like 5G and Time-Sensitive Networking (TSN) emerging. These advancements, such as the ongoing standardization efforts for TSN in sectors like automotive and manufacturing, directly influence the design and functionality of network equipment. Hagiwara Electric must integrate these evolving protocols to ensure their products remain compatible and perform optimally in modern industrial environments.

The increasing complexity of cyber threats targeting industrial control systems demands continuous advancement in cybersecurity technologies. Hagiwara Electric needs to integrate cutting-edge security features into its network and system integration services to safeguard critical infrastructure.

For instance, the global cybersecurity market for industrial control systems was projected to reach $24.1 billion in 2024, with a compound annual growth rate of 7.8% expected through 2029, highlighting the critical need for robust solutions.

Miniaturization and Edge Computing

The ongoing trend toward miniaturization is making computing devices smaller, more powerful, and significantly more energy-efficient. This is crucial for industrial applications where space and power are often limited. For Hagiwara Electric, this means their embedded computer solutions need to capitalize on these advancements to deliver compact yet robust systems capable of handling on-site data processing effectively.

Edge computing, which brings data processing closer to the source of data generation, is also experiencing substantial growth. This shift allows for real-time analysis and quicker decision-making, which is a major advantage in industrial settings. Hagiwara Electric's embedded computer offerings are well-positioned to benefit from this trend by providing the necessary hardware for decentralized data intelligence.

- Miniaturization: Devices are shrinking, packing more processing power into smaller footprints. For example, System-on-Chip (SoC) technology continues to advance, enabling higher performance in smaller packages.

- Energy Efficiency: Reduced power consumption is a key driver, especially for battery-powered or remote industrial devices.

- Edge Computing Growth: The global edge computing market was valued at approximately $19.4 billion in 2023 and is projected to reach over $135 billion by 2030, indicating a compound annual growth rate (CAGR) of around 31.4%.

- Industrial IoT (IIoT): Miniaturized and edge-capable embedded systems are fundamental to the expansion of IIoT, enabling smarter factories and more efficient operations.

Software and System Integration Complexity

The increasing complexity of industrial automation systems, a trend Hagiwara Electric navigates, necessitates advanced software solutions and robust system integration. For instance, the global Industrial Internet of Things (IIoT) market, which heavily relies on such integration, was projected to reach approximately $111.7 billion in 2024, with a compound annual growth rate (CAGR) of 12.9% expected through 2030.

Hagiwara Electric's strength lies in its capacity to offer not just hardware but also comprehensive software and integration services. This technological synergy is a significant differentiator, allowing them to provide end-to-end solutions for clients. Their ability to manage the intricate interplay between diverse hardware components and sophisticated software platforms is crucial for delivering efficient and reliable automation.

Key aspects of this technological advantage include:

- Expertise in diverse automation software platforms: Hagiwara Electric demonstrates proficiency across various industrial software ecosystems, enabling seamless integration.

- End-to-end solution provision: The company's ability to bundle hardware with tailored software and integration services offers a complete package to customers.

- Focus on interoperability: Ensuring that different systems and components can communicate effectively is a core technological competency.

- Adaptability to evolving standards: Staying abreast of new communication protocols and software architectures is vital for maintaining a competitive edge in this dynamic field.

The relentless pace of technological advancement, particularly in areas like Artificial Intelligence (AI) and the Internet of Things (IoT), presents both opportunities and challenges for Hagiwara Electric. The global AI market alone was projected to exceed $200 billion in 2024, underscoring the pervasive influence of intelligent systems across industries.

Hagiwara Electric's embedded systems are critical enablers for these technologies, facilitating real-time data processing at the edge. This capability is vital for applications ranging from autonomous systems to smart manufacturing, where immediate insights are paramount. For instance, the demand for AI-powered edge devices is surging, with the edge AI hardware market expected to grow significantly in the coming years.

The company's focus on miniaturization and energy efficiency in its embedded computers aligns perfectly with the trend towards more distributed and power-conscious computing solutions. This allows for the deployment of advanced processing capabilities in environments where space and power are constrained, a common scenario in industrial settings. By 2025, the market for low-power embedded processors is anticipated to see substantial growth, driven by mobile and IoT applications.

Furthermore, the evolution of network technologies, such as 5G and Time-Sensitive Networking (TSN), is reshaping industrial communication. Hagiwara Electric's ability to integrate these new protocols into their offerings ensures their solutions remain relevant and performant in next-generation industrial networks. The ongoing standardization of TSN in critical sectors highlights the need for robust and adaptable network hardware.

| Technology Trend | Market Projection (2024/2025) | Impact on Hagiwara Electric |

| Artificial Intelligence (AI) | Global AI Market > $200 billion (2024) | Enables advanced data processing in embedded systems; drives demand for AI-capable hardware. |

| Internet of Things (IoT) | Global IIoT Market ~ $111.7 billion (2024) | Fundamental to smart factories and operational efficiency; requires robust connectivity and processing. |

| Edge Computing | Edge AI Hardware Market Growth | Leverages embedded systems for real-time, on-site data analysis; crucial for faster decision-making. |

| 5G & TSN | Standardization in Automotive & Manufacturing | Requires integration of new communication protocols for enhanced industrial networking and real-time control. |

Legal factors

Hagiwara Electric operates under a stringent legal framework, particularly concerning data privacy and security. Regulations like the EU's General Data Protection Regulation (GDPR) and similar national laws worldwide mandate robust data protection measures for any collected industrial data, especially from Industrial Internet of Things (IIoT) devices. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Ensuring Hagiwara Electric's solutions meet these evolving legal requirements is not just a matter of avoiding penalties but is fundamental to maintaining operational legitimacy and building customer confidence. For example, the California Consumer Privacy Act (CCPA), which became effective in 2020 and was further amended by the California Privacy Rights Act (CPRA) in 2023, grants consumers significant rights over their personal information, impacting how companies collect, use, and store data, including data generated by industrial applications.

Hagiwara Electric must strictly comply with national and international product safety and quality standards for its industrial electronics. This is crucial, especially when supplying components for sectors like automotive and public infrastructure, where failures can have severe consequences.

Failure to meet these stringent regulations, such as ISO 9001 for quality management or specific safety certifications like UL or CE marking, can lead to significant liabilities, product recalls, and loss of market access. For instance, in 2023, the global industrial electronics market saw increased scrutiny on component reliability, with reported incidents in the automotive sector leading to billions in recall costs for some manufacturers.

Protecting Hagiwara Electric's intellectual property (IP) through robust patent, trademark, and copyright strategies is paramount for maintaining its competitive edge. In 2024, global IP filings continued to rise, underscoring the increasing importance of safeguarding innovations. Respecting the IP rights of others, particularly in software licensing and component sourcing, is equally critical to avoid costly litigation and ensure smooth operational partnerships.

Import/Export Compliance and Sanctions

As an electronics trading company, Hagiwara Electric must diligently adhere to intricate import and export regulations. This includes navigating the complexities of international trade sanctions and controls on dual-use items, which are goods that can have both civilian and military applications. Failure to comply can result in significant financial penalties, severe disruptions to its global supply chains, and lasting damage to its corporate reputation.

The global trade landscape is constantly evolving, with new sanctions and export control regimes being implemented. For instance, in 2024, several countries have tightened restrictions on the export of advanced semiconductors and related technologies, impacting companies like Hagiwara Electric that deal in high-tech components. Staying abreast of these changes is crucial for maintaining operational continuity and avoiding legal entanglements.

- Navigating Sanctions: Hagiwara Electric must screen all transactions against lists of sanctioned entities and countries to prevent violations.

- Dual-Use Controls: The company needs robust internal processes to identify and manage the export of items subject to dual-use regulations.

- Compliance Costs: Investing in compliance software and training is essential, with industry estimates suggesting that compliance can represent 5-15% of a company's total trade costs.

- Reputational Risk: A single compliance breach can lead to extensive negative publicity and loss of trust from partners and customers.

Industry-Specific Regulations (e.g., Transportation, Energy)

Hagiwara Electric operates within sectors like manufacturing and transportation, which are heavily regulated. These regulations dictate everything from product design to how technology is implemented, focusing on operational safety and environmental impact. For instance, in the transportation sector, the Federal Motor Carrier Safety Administration (FMCSA) in the US mandates specific safety standards for commercial vehicles, which could influence the integration of Hagiwara's electrical components. Similarly, environmental regulations, such as those from the EPA, affect manufacturing processes and the materials used, requiring adherence to emissions and waste disposal guidelines.

Hagiwara Electric must navigate complex data privacy laws like GDPR and CCPA, with GDPR fines potentially reaching 4% of global annual turnover. Compliance with product safety standards, such as ISO 9001 and CE marking, is crucial to avoid recalls and liabilities, as seen in the automotive sector's recall costs in 2023. Protecting intellectual property through robust filings, which saw a global increase in 2024, is vital for competitive advantage, while careful adherence to import/export controls on dual-use items is necessary to avoid penalties and supply chain disruptions.

| Legal Factor | Impact on Hagiwara Electric | Key Regulations/Examples | Potential Consequences of Non-Compliance | 2024/2025 Data/Trends |

| Data Privacy & Security | Mandates robust data protection for IIoT data | GDPR, CCPA/CPRA | Fines up to 4% of global turnover (GDPR); loss of customer trust | Increased regulatory focus on IIoT data security |

| Product Safety & Quality | Ensures reliability for critical sectors like automotive | ISO 9001, UL, CE Marking | Liabilities, product recalls, market access denial | Automotive recalls cost billions in 2023 due to component issues |

| Intellectual Property (IP) | Safeguards innovation and competitive edge | Patent, Trademark, Copyright laws | Costly litigation, loss of market exclusivity | Global IP filings rose in 2024, highlighting IP's growing importance |

| Trade Compliance | Governs import/export of components, especially dual-use items | Export Administration Regulations (EAR), OFAC sanctions | Financial penalties, supply chain disruption, reputational damage | Tightened controls on advanced semiconductor exports in 2024 |

Environmental factors

Environmental regulations concerning electronic waste (e-waste) are tightening globally, impacting companies like Hagiwara Electric. These rules mandate responsible handling of products at their end-of-life, pushing for take-back programs and designing for easier recycling. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive, which saw revisions in 2023, sets ambitious collection and recycling targets, with member states needing to collect 85% of e-waste by 2025.

Hagiwara Electric must therefore adapt its product lifecycle management to meet these evolving standards. This includes investing in or partnering with recycling facilities and potentially redesigning components to be more easily disassembled and reused. Failure to comply can lead to significant fines and reputational damage, as seen with companies facing penalties for improper e-waste disposal in various jurisdictions.

Global momentum towards energy conservation is driving more rigorous energy efficiency standards for industrial computers and network equipment. This trend is particularly evident in regions like the European Union, where regulations such as the Ecodesign Directive are continually updated to reduce energy consumption across various product categories.

Hagiwara Electric needs to ensure its product portfolio consistently meets or surpasses these evolving benchmarks. For instance, adherence to standards like ENERGY STAR for relevant product lines can significantly enhance marketability and appeal to a growing segment of environmentally conscious clients, potentially improving sales by attracting businesses focused on reducing their operational carbon footprint.

Regulators, customers, and investors are increasingly demanding that companies shrink their supply chain environmental footprint. For Hagiwara Electric, this means a close look at how its sourcing, logistics, and operations contribute to carbon emissions and other environmental impacts. For instance, the global logistics sector alone accounted for over 10% of global greenhouse gas emissions in 2023, a figure that puts pressure on companies like Hagiwara to optimize their transportation networks.

This pressure translates into a need for Hagiwara Electric to actively assess and mitigate these impacts. Companies are investing in greener transportation options and more sustainable sourcing practices. By 2025, it's projected that over 60% of global companies will have publicly disclosed their Scope 3 emissions, which include supply chain impacts, highlighting the growing transparency expected in this area.

Climate Change Impact and Adaptation

Climate change presents significant physical risks that could disrupt Hagiwara Electric's operations. Extreme weather events, such as floods and heatwaves, can impact manufacturing facilities and logistics, potentially delaying product delivery or increasing operational costs. For instance, the World Meteorological Organization reported that weather, climate and water-related disasters caused USD 100 billion in economic losses globally in 2023 alone, a figure that is expected to rise.

Hagiwara Electric may also face challenges related to its customers' operations, especially those in the infrastructure sector. Disruptions caused by climate-related events could affect demand for Hagiwara's products or necessitate the development of more resilient solutions. The company's ability to provide adaptive technologies will be crucial for maintaining market share and supporting its client base through these environmental shifts.

- Supply Chain Vulnerability: Increased frequency of extreme weather events in key manufacturing or transit regions could lead to supply chain disruptions, impacting Hagiwara Electric's production schedules and delivery times.

- Customer Operational Impacts: Infrastructure projects utilizing Hagiwara's components could be affected by climate change, potentially altering project timelines or requiring retrofitting for resilience.

- Adaptation Solutions Demand: Growing pressure on industries to adapt to climate change will create opportunities for Hagiwara Electric to offer innovative products and services that enhance resilience and sustainability.

Corporate Sustainability Reporting Requirements

Hagiwara Electric is likely to encounter increasing demands for transparency regarding its environmental performance. This growing expectation for corporate sustainability reporting means the company may face pressure to disclose its environmental impacts, resource usage, and ongoing sustainability efforts. These reporting requirements can significantly shape Hagiwara Electric's operational choices and long-term strategic planning.

For instance, by the end of 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) is expected to require a substantial number of companies, including many operating within global supply chains, to report on a wide range of sustainability matters. This directive aims to standardize sustainability disclosures, making it easier for investors and stakeholders to compare companies' environmental, social, and governance (ESG) performance. By 2025, it's anticipated that over 50,000 companies will be subject to CSRD reporting, a significant increase from previous regulations.

- Increased Scrutiny: Stakeholders, including investors and consumers, are increasingly demanding detailed information on a company's environmental footprint.

- Regulatory Compliance: Evolving regulations, such as the CSRD, mandate specific reporting standards for sustainability, impacting operational disclosures.

- Resource Management: Reporting requirements often necessitate tracking and disclosing data on energy consumption, water usage, and waste generation, influencing resource management strategies.

- Supply Chain Impact: Hagiwara Electric's sustainability reporting may also extend to its supply chain, requiring greater visibility and accountability from its partners.

The increasing focus on environmental sustainability is a critical factor for Hagiwara Electric. Stricter regulations on electronic waste, like the EU's WEEE directive targeting 85% collection by 2025, necessitate responsible product lifecycle management. Furthermore, evolving energy efficiency standards, driven by initiatives like the Ecodesign Directive, require continuous product innovation to meet or exceed benchmarks such as ENERGY STAR.

Hagiwara Electric must also address its supply chain's environmental footprint, as the logistics sector's significant contribution to global emissions (over 10% in 2023) pressures companies for greener practices. The company will face growing demands for transparency in its environmental performance, with regulations like the CSRD by the end of 2024 requiring detailed sustainability disclosures from thousands of companies globally.

| Environmental Factor | Impact on Hagiwara Electric | Key Data/Trend (2024-2025) |

|---|---|---|

| E-waste Regulations | Need for compliant end-of-life product management and recycling. | EU WEEE directive: 85% e-waste collection target by 2025. |

| Energy Efficiency Standards | Requirement to design energy-saving industrial computers and network equipment. | Growing adoption of ENERGY STAR certifications for marketability. |

| Supply Chain Emissions | Pressure to reduce carbon footprint in sourcing and logistics. | Global logistics emissions >10% of global GHG in 2023. |

| Sustainability Reporting | Mandatory disclosure of environmental impacts and efforts. | EU CSRD to cover over 50,000 companies by 2025. |

PESTLE Analysis Data Sources

Our Hagiwara Electric PESTLE Analysis is built on a robust foundation of data from official government publications, reputable industry associations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, and social trends to provide a comprehensive overview.