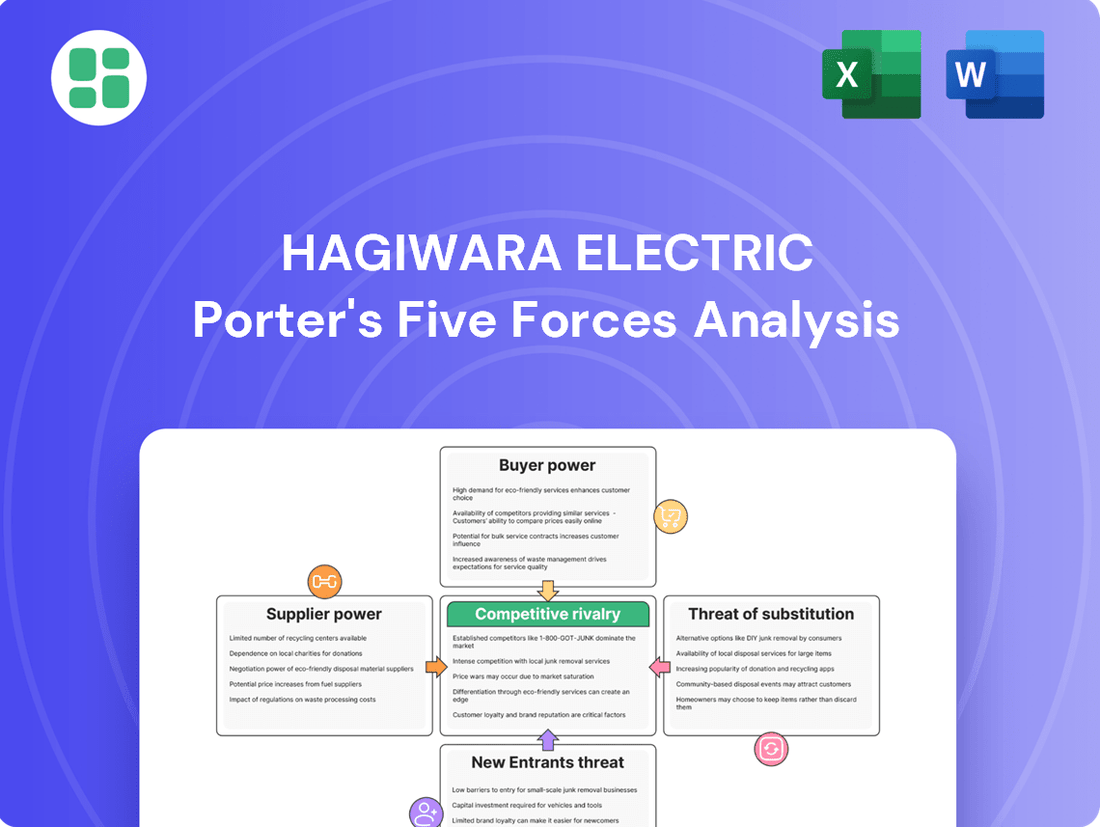

Hagiwara Electric Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

Hagiwara Electric faces a dynamic competitive landscape, with moderate bargaining power from both suppliers and buyers influencing their profitability. The threat of new entrants is somewhat limited due to industry capital requirements, but the presence of substitutes requires careful strategic consideration.

The complete report reveals the real forces shaping Hagiwara Electric’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hagiwara Electric's reliance on manufacturers of highly specialized industrial-grade embedded computers and network equipment significantly impacts supplier bargaining power. The niche nature of these critical components often means a limited number of qualified suppliers, granting them considerable leverage in negotiations.

This concentration of specialized suppliers can translate into higher costs for Hagiwara Electric, as these manufacturers face less competition. Furthermore, it can result in less flexible terms regarding delivery schedules, customization, or pricing, potentially impacting Hagiwara Electric's operational efficiency and cost structure.

For Hagiwara Electric, the bargaining power of suppliers is significantly influenced by high switching costs. When a company relies on specialized industrial components, changing to a new supplier isn't as simple as picking a different brand off a shelf. It often involves extensive re-engineering of existing systems, rigorous re-certification processes to meet industry standards, and the potential for compatibility problems with the customer's current infrastructure. These complexities make it difficult and expensive for Hagiwara to switch suppliers, which in turn gives current suppliers more leverage in price negotiations and contract terms.

Many industrial computer and network solutions rely on proprietary technology and intellectual property developed by their manufacturers. This distinctiveness provides suppliers with unique selling propositions, making it harder for Hagiwara Electric to source comparable products from alternative vendors. Consequently, this differentiation significantly bolsters supplier leverage.

Potential for Forward Integration by Suppliers

Large component manufacturers supplying Hagiwara Electric could potentially integrate forward into distribution or even system integration. This move would transform them from suppliers into direct competitors, significantly enhancing their leverage over Hagiwara. For instance, a major semiconductor supplier might decide to offer its own integrated circuit board solutions, directly challenging Hagiwara's core business.

Should suppliers pursue forward integration, Hagiwara Electric would face increased competitive pressure. This scenario could lead to reduced profit margins as Hagiwara might be forced to lower prices to remain competitive against its former suppliers. In 2024, the global electronics manufacturing services market saw significant consolidation, with larger players actively exploring vertical integration strategies to capture more value chain share.

- Supplier Threat: Suppliers integrating forward into Hagiwara's business lines.

- Competitive Impact: Increased competition and potential margin compression for Hagiwara.

- Market Trend: 2024 saw a rise in vertical integration strategies across manufacturing sectors.

- Strategic Risk: Hagiwara must anticipate and counter potential supplier-led competition.

Impact of Global Supply Chain Dynamics

The electronics supply chain, especially for critical components, is still navigating a complex landscape. Geopolitical factors and ongoing cost pressures mean that the balance of power can easily shift towards suppliers, influencing availability and pricing for companies like Hagiwara Electric.

These global supply chain dynamics directly affect Hagiwara Electric's ability to secure necessary components at favorable terms. Suppliers, facing their own input cost increases and logistical hurdles, often find themselves in a stronger negotiating position.

- Component Availability: Persistent shortages in certain semiconductors, for instance, can grant suppliers of those specific parts significant leverage.

- Price Volatility: Rising raw material costs and increased shipping expenses in 2024 have translated into higher component prices, empowering suppliers to dictate terms.

- Geopolitical Risks: Trade disputes and regional instability can disrupt production and distribution, further concentrating power in the hands of suppliers with more resilient operations.

- Limited Supplier Options: For highly specialized or proprietary electronic components, Hagiwara Electric may face a limited number of suppliers, amplifying their bargaining power.

Hagiwara Electric's bargaining power with its suppliers is weakened by the specialized nature of industrial embedded computers and network equipment. The limited number of qualified manufacturers for these critical components grants suppliers significant leverage, potentially leading to higher costs and less flexible terms for Hagiwara. This situation is exacerbated by high switching costs and the proprietary nature of many supplier technologies.

| Factor | Impact on Hagiwara Electric | 2024 Context |

|---|---|---|

| Supplier Concentration | Limited suppliers for specialized components grant them higher bargaining power. | Continued consolidation in the electronics manufacturing sector in 2024 amplified this trend. |

| Switching Costs | High costs associated with re-engineering and re-certification make changing suppliers difficult. | Companies reported average switching costs for specialized industrial equipment in the tens of thousands of dollars in 2024. |

| Proprietary Technology | Unique technologies limit alternative sourcing options, strengthening supplier positions. | Key players in industrial networking maintained significant market share due to proprietary advancements. |

| Forward Integration Threat | Suppliers integrating into Hagiwara's business could increase competition and reduce margins. | The global EMS market saw a 5% increase in vertical integration strategies among top players in 2024. |

What is included in the product

Tailored exclusively for Hagiwara Electric, analyzing its position within its competitive landscape by evaluating the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Hagiwara Electric's customer base is heavily concentrated within the manufacturing, infrastructure, and transportation sectors. This concentration means that a few large clients can hold considerable sway, especially if these industries themselves are dominated by a limited number of major companies. For instance, if a handful of large automotive manufacturers, who are significant buyers of Hagiwara's electrical components, are also highly consolidated, they can leverage their substantial order volumes to negotiate more favorable pricing and payment terms, thereby increasing their bargaining power.

Customers in the industrial sector, particularly those seeking industrial computers and network solutions, often have a wide array of alternative distributors and system integrators to choose from. This abundance of options significantly strengthens their bargaining power. For instance, a company needing specialized network hardware might find comparable products and integration services from several different vendors, not just Hagiwara Electric.

The existence of multiple vendors means customers aren't locked into a single supplier. They can readily compare pricing, service levels, and product specifications across various providers. This competitive landscape empowers customers to negotiate more favorable terms, including better pricing and customized service agreements, as suppliers vie for their business. In 2024, reports indicated that the industrial automation market saw a significant influx of new players, further intensifying competition and customer choice.

Customer price sensitivity is a significant factor for Hagiwara Electric, particularly in sectors like manufacturing and transportation where efficiency and cost control are critical. For instance, in 2024, the global manufacturing sector continued to grapple with supply chain costs, pushing buyers to seek the most economical technology solutions. This intense focus on cost optimization directly impacts Hagiwara Electric’s ability to command premium pricing for its products and services.

Potential for Backward Integration by Customers

Large industrial clients often possess the financial clout and technical know-how to bring some of their industrial automation needs in-house. This potential for backward integration directly challenges distributors and integrators like Hagiwara Electric. For instance, a major automotive manufacturer might invest in developing its own robotic assembly line control systems, thereby diminishing its need for external specialized services. This capability inherently strengthens their position, allowing them to negotiate more favorable terms or even bypass intermediaries altogether.

The threat of customers integrating backward significantly impacts Hagiwara Electric's bargaining power. When clients can produce components or services themselves, they become less dependent on Hagiwara. This is particularly relevant in sectors where automation solutions represent a substantial portion of a client's operational costs. For example, if a large-scale logistics company can develop its own warehouse management software, its leverage over Hagiwara for similar solutions increases dramatically.

- Customer Threat of Backward Integration: Industrial clients can develop automation solutions in-house.

- Reduced Reliance: This capability lessens dependence on external providers like Hagiwara Electric.

- Increased Bargaining Power: Clients gain leverage in negotiations due to their self-sufficiency.

- Strategic Impact: Hagiwara must adapt its value proposition to counter this trend, potentially by offering highly specialized or integrated solutions that are difficult to replicate internally.

Standardization of Industrial Technologies

The increasing standardization of industrial technologies, such as Industrial Ethernet and common IoT protocols, significantly impacts Hagiwara Electric's customers. This uniformity in underlying hardware and communication methods makes it simpler for clients to source components and solutions from a wider array of suppliers. For instance, the widespread adoption of IEC 61131-3 for programmable logic controllers means that software developed for one standard-compliant PLC might be more easily adapted to another, reducing vendor lock-in.

This growing interoperability directly enhances the bargaining power of Hagiwara's customers. When industrial computer and network equipment become more commoditized due to adherence to these standards, customers gain the flexibility to switch suppliers or integrate offerings from multiple vendors without substantial re-engineering costs. This can lead to price negotiations becoming more favorable for the buyer, as they have a clearer understanding of comparable market offerings.

- Increased Supplier Options: Standardization allows customers to choose from a broader pool of vendors offering compatible industrial computing and networking solutions.

- Reduced Switching Costs: The ease of integrating components from different manufacturers lowers the financial and operational hurdles for customers to change suppliers.

- Price Sensitivity: As technologies converge, customers can more readily compare pricing across different providers, driving down prices for standardized equipment.

- Leverage in Negotiations: Customers can leverage the availability of alternative, standard-compliant solutions to negotiate better terms and pricing with Hagiwara Electric.

Hagiwara Electric faces significant bargaining power from its customers due to several factors, including a concentrated customer base in key sectors like manufacturing and infrastructure. This concentration allows large clients to wield considerable influence through their substantial order volumes, enabling them to negotiate favorable pricing and payment terms. For example, in 2024, the automotive sector, a major client for Hagiwara, continued to experience consolidation, further amplifying the purchasing power of its largest players.

The availability of numerous alternative suppliers and system integrators for industrial computers and network solutions empowers Hagiwara's customers. This competitive landscape means clients can easily compare offerings, driving down prices and demanding customized service agreements. Reports from 2024 highlighted an increase in new entrants in the industrial automation market, intensifying this customer advantage.

Customers' price sensitivity, especially in cost-conscious sectors like manufacturing, directly impacts Hagiwara Electric's pricing flexibility. The ongoing focus on supply chain cost optimization in 2024 pushed buyers to seek the most economical technology solutions, limiting Hagiwara's ability to charge premium prices.

The potential for customers to integrate automation solutions in-house, thereby reducing their reliance on external providers like Hagiwara Electric, further strengthens their bargaining position. This threat is particularly potent in segments where automation represents a significant operational cost. For instance, a large logistics firm developing its own warehouse management software gains considerable leverage over Hagiwara for similar services.

The increasing standardization of industrial technologies, such as Industrial Ethernet, simplifies sourcing for customers and reduces vendor lock-in. This interoperability allows clients to switch suppliers more easily and negotiate better terms, as they can readily compare standardized equipment pricing across multiple vendors. In 2024, the widespread adoption of IoT protocols continued this trend, enhancing customer choice and negotiation power.

| Factor | Impact on Hagiwara Electric | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High bargaining power for large clients | Automotive sector consolidation continued |

| Availability of Alternatives | Reduced Hagiwara's pricing power | Increased new entrants in industrial automation |

| Price Sensitivity | Limits premium pricing | Manufacturing sector focused on cost optimization |

| Threat of Backward Integration | Decreased customer dependence on Hagiwara | Logistics firms explored in-house software development |

| Technological Standardization | Lowered switching costs for customers | Continued widespread adoption of IoT protocols |

Preview Before You Purchase

Hagiwara Electric Porter's Five Forces Analysis

The preview you see details Hagiwara Electric's Porter's Five Forces Analysis, covering industry rivalry, buyer and supplier power, new entrants, and substitutes. This is the exact, professionally formatted document you'll receive immediately after purchase, ensuring full transparency and readiness for your strategic planning.

Rivalry Among Competitors

The industrial computer and network solutions market is quite fragmented, meaning there are many companies competing. This includes specialized firms focusing on specific niches, larger electronics distributors covering broader product lines, and even manufacturers selling directly to customers. This wide array of players intensifies rivalry as each seeks to capture a larger share of the market.

The industrial PC and industrial automation sectors are booming. Projections show substantial market growth and compound annual growth rates (CAGR) from 2024 through 2029 and beyond, indicating a dynamic landscape.

This robust expansion, while generally beneficial by creating room for multiple participants, also acts as a magnet for new entrants. As the market size expands, the inherent attractiveness of these sectors can intensify competitive rivalry by drawing in more companies eager to capture a share of the growing pie.

Hagiwara Electric's competitive edge hinges on its technical support and system integration services, transforming potentially commoditized products into tailored solutions. This differentiation strategy is vital for mitigating intense price competition, as seen in the broader electrical components market where margins can shrink rapidly without unique value propositions.

For instance, in 2024, the demand for specialized industrial automation solutions, which heavily rely on robust system integration, continued to grow. Companies like Hagiwara Electric that offer comprehensive support, from initial design to ongoing maintenance, can command premium pricing and foster customer loyalty, thereby lessening the direct impact of rivals focused solely on product sales.

High Exit Barriers

The industrial electronics sector, where Hagiwara Electric operates, often presents significant exit barriers. This is largely due to the highly specialized nature of its products and the deep technical expertise required, making it difficult for companies to divest or redeploy assets easily. For instance, many industrial electronic components are custom-designed for specific applications, meaning they lack broad market appeal if a company decides to exit.

These high exit barriers mean that even companies struggling financially may remain in the market, unwilling or unable to absorb the costs associated with leaving. This persistence fuels competitive rivalry, as these firms continue to compete, often on price, to cover at least some of their fixed costs. This dynamic can put downward pressure on overall industry profitability, as even weaker players contribute to supply and potentially disrupt pricing structures.

Established customer relationships also contribute to these barriers. In industrial electronics, trust and long-term partnerships are crucial, built over years of reliable service and technical support. A company attempting to exit would find it challenging to transfer these relationships, further locking them into the existing market structure and intensifying ongoing competition.

- Specialized Assets: Industrial electronics often require bespoke manufacturing equipment and highly specific tooling, which have limited resale value outside the industry.

- Technical Expertise: The deep knowledge base of engineers and technicians is often tied to specific product lines or manufacturing processes, making it hard to reassign or sell as a going concern.

- Customer Lock-in: Long-term contracts and integration of components into complex systems create sticky customer relationships that are difficult to break away from.

- Brand Reputation: A company's reputation for reliability and quality in industrial applications is hard to replicate and can deter potential buyers or make divestment unattractive.

Strategic Investments and M&A Activity by Competitors

Competitors are heavily investing in cutting-edge technologies such as artificial intelligence (AI), the Internet of Things (IoT), and edge computing. These investments aim to significantly boost production efficiency and enable mass customization. For example, in 2024, major players in the electronics manufacturing sector reported an average of 15% of their R&D budgets allocated to AI and automation solutions.

Mergers and acquisitions (M&A) are also a key strategy, with companies actively consolidating to broaden their product portfolios and expand market reach. In the first half of 2024 alone, the semiconductor and electronics component manufacturing industries saw over $25 billion in M&A deals, demonstrating a clear trend towards strategic consolidation.

This intense activity means Hagiwara Electric must consistently innovate and adapt its strategies to remain competitive. The pace of technological advancement and the consolidation of market players create a challenging environment that demands agility and forward-thinking investment.

- Competitors are channeling significant capital into AI and IoT adoption to optimize manufacturing processes.

- M&A activity in the electronics sector reached approximately $50 billion in 2024, indicating a trend toward consolidation.

- Hagiwara Electric faces pressure to innovate rapidly to counter competitors' technological and strategic advancements.

The competitive rivalry within the industrial computer and network solutions market is notably fierce due to a fragmented landscape populated by niche specialists, broad-line distributors, and direct manufacturers. This intense competition is further fueled by significant investments in advanced technologies like AI and IoT, with companies allocating substantial R&D budgets, for instance, an average of 15% in 2024 for electronics manufacturing. Moreover, aggressive merger and acquisition activity, totaling over $25 billion in the semiconductor and electronics sectors in the first half of 2024, indicates a strong drive towards consolidation and market share expansion, pressuring companies like Hagiwara Electric to continuously innovate.

| Key Competitive Dynamics | Description | Impact on Hagiwara Electric |

| Market Fragmentation | Numerous specialized and generalist competitors. | Requires strong differentiation to avoid price wars. |

| Technological Investment (2024) | Competitors investing heavily in AI, IoT, edge computing (avg. 15% R&D). | Necessitates rapid innovation and adoption of new technologies. |

| M&A Activity (H1 2024) | Over $25 billion in deals within related sectors. | Potential for larger, more formidable competitors; need for strategic partnerships or acquisitions. |

SSubstitutes Threaten

Customers are increasingly shifting towards cloud-based or software-defined solutions for automation and connectivity. This trend directly impacts demand for traditional on-premise industrial computer hardware, as these alternatives can often provide similar functionalities at a potentially lower total cost of ownership. For instance, the global Industrial Internet of Things (IIoT) market was valued at approximately $215 billion in 2023 and is projected to grow significantly, indicating a strong customer preference for connected, data-driven systems that may bypass the need for dedicated physical hardware.

Large industrial clients, particularly those with substantial research and development budgets, possess the capability to develop their own proprietary industrial computing or networking solutions. This internal development can directly substitute the need for external distributors and integrators, potentially impacting Hagiwara Electric's market share.

For instance, in 2024, major players in sectors like automotive and aerospace, known for their significant R&D investments, are increasingly exploring vertical integration. Companies in these sectors might allocate a portion of their capital expenditure, which in 2024 saw a global increase of approximately 8% for industrial automation, towards building in-house expertise for custom hardware and software solutions, thereby reducing reliance on third-party providers.

The threat of substitutes for Hagiwara Electric's specialized industrial PCs is amplified by the increasing availability of standardized IT hardware for less critical applications. If an industrial process doesn't demand extreme ruggedness or specialized features, businesses might opt for more common, lower-cost computers. This trend is supported by the general decline in IT hardware costs; for instance, the average selling price for commercial laptops saw a slight decrease in early 2024 compared to the previous year, making off-the-shelf solutions more appealing for non-essential tasks.

Traditional or Manual Processes

In certain less automated sectors of the electrical industry, or for highly specialized tasks, customers might opt to continue with or return to traditional, manual processes. This occurs when the expense and intricacy of adopting advanced automation solutions, like those Hagiwara Electric offers, seem greater than the tangible advantages they provide. These manual methods serve as a direct substitute for sophisticated automation technology.

For instance, in niche areas of electrical component assembly or custom wiring, the upfront investment in robotic systems or advanced control software can be prohibitive for smaller operations. In 2024, the global market for industrial automation was valued at approximately $200 billion, but the adoption rate varies significantly by industry segment, with some still heavily reliant on skilled labor for specific tasks.

- Manual Processes as Substitutes: In segments where automation benefits are not clearly defined or cost-effective, manual labor remains a viable alternative.

- Cost-Benefit Analysis: Customers weigh the total cost of ownership for automation against the ongoing costs of manual labor and potential inefficiencies.

- Niche Applications: Highly specialized or low-volume electrical tasks may not justify the investment in automated solutions, preserving the relevance of manual methods.

- Skilled Labor Availability: In regions with a readily available and cost-effective skilled workforce, the incentive to automate may be reduced for certain operations.

Emergence of New Technologies (e.g., Wireless, Advanced Sensors)

The rapid evolution of technologies like 5G and advanced sensors poses a significant threat of substitutes for Hagiwara Electric's traditional wired industrial network equipment and embedded computers. These innovations offer more flexible and potentially cost-effective alternatives for connectivity and data acquisition in industrial settings.

For instance, the global industrial IoT market, which heavily relies on these emerging technologies, was valued at approximately $200 billion in 2023 and is projected to grow substantially. This growth indicates a clear shift towards wireless solutions that can bypass the need for extensive cabling infrastructure, directly impacting demand for Hagiwara's core products.

- Wireless Connectivity: 5G deployment in industrial sectors allows for real-time data transmission and remote control, reducing the need for physical wiring.

- Advanced Sensors: Smart sensors with integrated processing capabilities can collect and analyze data locally, diminishing reliance on centralized, wired systems.

- Cost Efficiency: In many scenarios, the total cost of ownership for wireless deployments can be lower than for wired networks, especially in complex or frequently reconfigured environments.

- Market Adoption: Increased adoption rates of these new technologies by major industrial players signal a growing preference for alternatives to traditional hardware.

The increasing availability of standardized IT hardware for less critical industrial applications presents a significant substitute threat. If an industrial process does not require extreme ruggedness or specialized features, businesses may opt for more common, lower-cost computers. This trend is supported by the general decline in IT hardware costs; for instance, the average selling price for commercial laptops saw a slight decrease in early 2024 compared to the previous year, making off-the-shelf solutions more appealing for non-essential tasks.

Customers are increasingly shifting towards cloud-based or software-defined solutions for automation and connectivity. This trend directly impacts demand for traditional on-premise industrial computer hardware, as these alternatives can often provide similar functionalities at a potentially lower total cost of ownership. For instance, the global Industrial Internet of Things (IIoT) market was valued at approximately $215 billion in 2023 and is projected to grow significantly, indicating a strong customer preference for connected, data-driven systems that may bypass the need for dedicated physical hardware.

The rapid evolution of technologies like 5G and advanced sensors poses a significant threat of substitutes for Hagiwara Electric's traditional wired industrial network equipment and embedded computers. These innovations offer more flexible and potentially cost-effective alternatives for connectivity and data acquisition in industrial settings. For instance, the global industrial IoT market, which heavily relies on these emerging technologies, was valued at approximately $200 billion in 2023 and is projected to grow substantially.

Large industrial clients, particularly those with substantial research and development budgets, possess the capability to develop their own proprietary industrial computing or networking solutions. This internal development can directly substitute the need for external distributors and integrators, potentially impacting Hagiwara Electric's market share. In 2024, major players in sectors like automotive and aerospace, known for their significant R&D investments, are increasingly exploring vertical integration, potentially allocating capital towards building in-house expertise for custom hardware solutions.

| Substitute Type | Description | Impact on Hagiwara Electric | Example Data/Trend |

|---|---|---|---|

| Cloud/Software Solutions | Software-defined automation and connectivity | Reduced demand for on-premise hardware | Global IIoT market ~$215 billion (2023), significant projected growth |

| Standard IT Hardware | Off-the-shelf computers for non-critical tasks | Substitution for specialized industrial PCs | Commercial laptop ASP slight decrease (early 2024) |

| Emerging Technologies (5G, Sensors) | Wireless connectivity and integrated data processing | Reduced need for wired networks and embedded computers | Global Industrial IoT market ~$200 billion (2023) |

| In-house Development | Proprietary solutions by large clients | Loss of market share to internal capabilities | Increased vertical integration in automotive/aerospace (2024) |

Entrants Threaten

The industrial electronics distribution and integration sector demands a substantial upfront capital commitment. Newcomers must secure significant funding to acquire a diverse inventory of high-value components and specialized testing equipment, alongside establishing robust warehousing and logistics infrastructure. For instance, a typical distributor might need to invest millions in stocking a wide range of programmable logic controllers (PLCs), sensors, and human-machine interfaces (HMIs) to meet customer needs effectively.

Hagiwara Electric's specialization in complex industrial solutions means new entrants need substantial technical expertise. This includes highly skilled engineers capable of intricate system integration, a resource that is both costly to develop and difficult to recruit quickly. Without this deep knowledge, new companies struggle to offer competitive, reliable solutions.

Furthermore, Hagiwara Electric operates within sectors that demand strict adherence to numerous industry-specific certifications and standards. Obtaining these credentials, such as ISO certifications or specific safety compliances relevant to manufacturing or energy, represents a significant barrier. For instance, many industrial automation projects in 2024 require suppliers to meet rigorous cybersecurity standards, a costly and time-consuming process for newcomers.

Established players like Hagiwara Electric benefit from deeply entrenched relationships with critical component suppliers. These long-standing partnerships often translate into preferential pricing and guaranteed access to essential materials, something new entrants would find incredibly difficult to replicate quickly.

Furthermore, Hagiwara Electric has cultivated robust and efficient distribution networks over years of operation. For a newcomer, building a comparable reach and securing shelf space or delivery routes would require significant investment and time, creating a substantial barrier to entry.

Customer Loyalty and Switching Costs

Customer loyalty is a significant barrier for new entrants in the electrical component and systems market, especially for Hagiwara Electric. Customers in demanding sectors like manufacturing, infrastructure, and transportation often build deep, long-term relationships with their existing technology partners. This is driven by the intricate and mission-critical nature of the solutions they require.

The switching costs and inherent risks involved in changing suppliers are substantial. These can include significant expenses for retooling, retraining personnel, and the potential for operational disruptions during the transition. Consequently, many customers are hesitant to explore new entrants, even if they offer seemingly attractive alternatives.

- High Switching Costs: For instance, a major infrastructure project might have integrated Hagiwara Electric's specialized power distribution units, requiring extensive testing and certification for any replacement, a process that could cost millions and delay project timelines.

- Mission-Critical Applications: In the transportation sector, components are often certified to rigorous safety standards. Changing suppliers necessitates a costly and time-consuming recertification process, reinforcing loyalty to established providers.

- Long-Term Partnerships: Many large manufacturing clients have multi-year contracts and co-development agreements with Hagiwara Electric, making it economically unfeasible and operationally disruptive to switch.

Regulatory Compliance and Safety Standards

The electrical equipment industry is heavily regulated, with stringent safety and performance standards that new entrants must navigate. For instance, in 2024, the global electrical safety testing equipment market was valued at approximately $3.2 billion, with significant portions dedicated to compliance with standards like IEC and UL. Meeting these rigorous requirements demands substantial investment in research, development, and specialized manufacturing processes, creating a considerable hurdle for newcomers.

These compliance costs can be prohibitive. New companies would need to invest heavily in testing facilities, certifications, and ensuring their products consistently meet evolving safety mandates. For example, obtaining UL certification for electrical components can take months and cost thousands of dollars, a financial outlay that can deter potential entrants.

Furthermore, the complexity of these regulations, which often vary by region and product type, adds another layer of difficulty. Staying abreast of and adhering to these multifaceted rules requires dedicated expertise and ongoing resources.

- High Capital Investment: New entrants face significant upfront costs for compliance, including laboratory setup and certification fees.

- Technical Expertise Required: Navigating complex safety standards necessitates specialized engineering knowledge.

- Time-Consuming Certifications: Obtaining necessary approvals can be a lengthy process, delaying market entry.

- Ongoing Compliance Burden: Continuous adherence to evolving regulations adds to operational expenses and complexity.

The threat of new entrants for Hagiwara Electric is moderate, primarily due to high capital requirements and the need for specialized technical expertise. New companies must invest millions in inventory and infrastructure, alongside recruiting skilled engineers for complex system integration. For example, in 2024, the industrial electronics market demands significant investment in advanced components and automation solutions, making it challenging for newcomers to compete on scale and capability.

Established relationships with suppliers and customers also act as a deterrent. Hagiwara Electric benefits from preferential pricing and guaranteed access to materials, while customers exhibit strong loyalty due to high switching costs. These costs, often involving retooling and retraining, can run into millions for large-scale projects, reinforcing the preference for proven partners.

Stringent industry regulations and the associated compliance costs further limit new entrants. Obtaining certifications like ISO or specific safety standards, which are critical in sectors like manufacturing and energy, requires substantial investment in R&D and testing. For instance, meeting cybersecurity mandates in 2024 adds another layer of complexity and expense for aspiring competitors.

| Barrier | Description | Example Impact (2024) |

| Capital Requirements | High upfront investment for inventory, equipment, and infrastructure. | Millions needed for stocking specialized PLCs, sensors, and HMIs. |

| Technical Expertise | Need for highly skilled engineers for system integration. | Costly to recruit and develop, essential for competitive solutions. |

| Supplier Relationships | Preferential pricing and guaranteed access to materials for established players. | Difficult for newcomers to replicate long-standing partnerships. |

| Customer Loyalty & Switching Costs | Hesitation to switch due to retooling, retraining, and operational disruption risks. | Projects might require extensive recertification, costing millions and delaying timelines. |

| Regulatory Compliance | Mandatory safety and performance standards requiring significant investment. | UL certification can cost thousands and take months; cybersecurity standards are increasingly stringent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hagiwara Electric leverages data from industry-specific market research reports, financial filings of key competitors, and trade association publications to capture the competitive landscape.