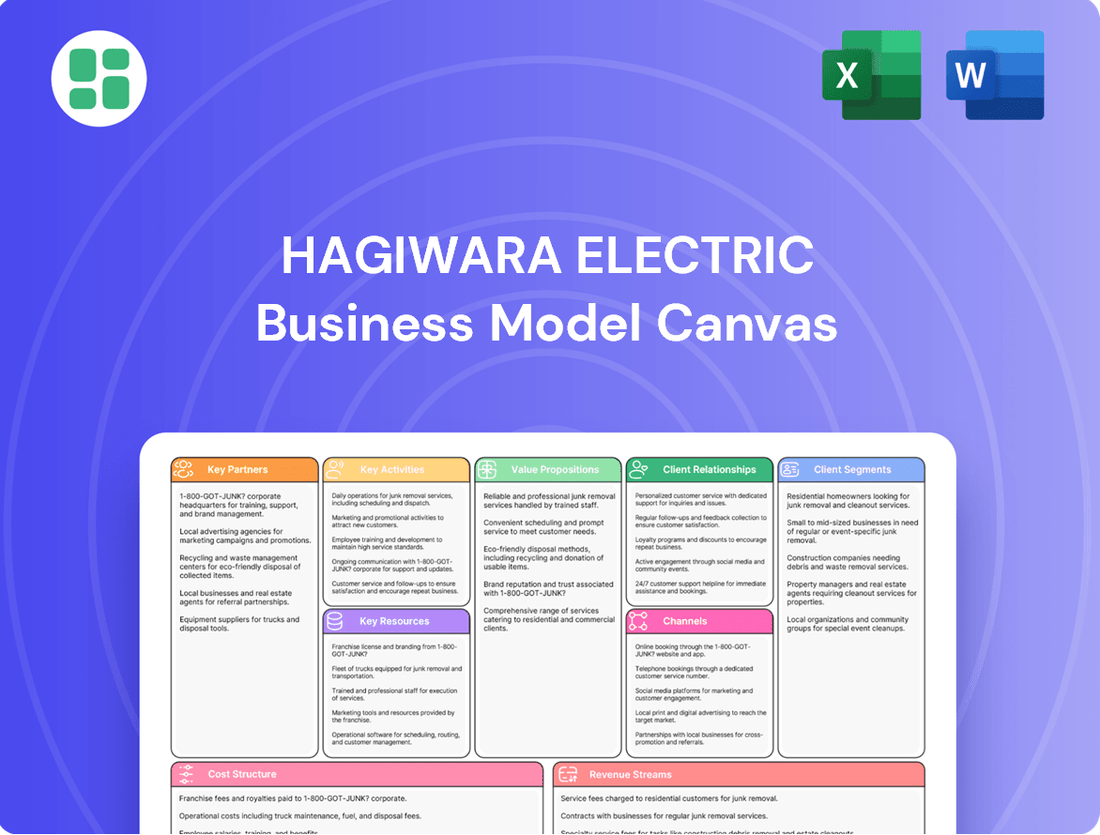

Hagiwara Electric Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

Discover the core strategies that fuel Hagiwara Electric's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights for any business strategist. Download the full canvas to unlock a deeper understanding of their competitive advantage and emulate their winning formula.

Partnerships

Hagiwara Electric Co., Ltd. strategically collaborates with premier manufacturers of embedded computers and industrial network equipment, alongside software providers. This ensures a robust and diverse product offering, vital for catering to the complex technological demands of their industrial customer base.

These alliances are fundamental to Hagiwara Electric's ability to provide cutting-edge solutions. For instance, in 2024, the demand for specialized industrial computing hardware saw a significant uptick, driven by advancements in automation and IoT. Hagiwara's partnerships allow them to stay at the forefront of these trends.

The company's electronic devices segment, particularly its automotive business, heavily depends on these key relationships for a consistent supply of essential semiconductors and electronic components. This ensures they can meet the rigorous production schedules and quality standards expected in the automotive industry.

Hagiwara Electric collaborates with system integrators and solution providers to deliver complete, end-to-end solutions, moving beyond just selling products. This strategic approach enables them to tackle complex projects like implementing IoT systems, building IT platforms, and setting up specialized industrial automation (FA) systems.

The recent business integration with Satori Electric is a key move to bolster Hagiwara Electric's global reach and their capacity to offer advanced supply chain solutions. This integration is expected to significantly enhance their ability to serve international markets and provide more robust, integrated services.

Hagiwara Electric's strategy heavily relies on collaborations with research and development institutions and technology development firms. These partnerships are crucial for maintaining a leading edge in industrial technology and embedded solutions, especially as the company ventures into new business models like data platforms.

For instance, in 2024, Hagiwara Electric actively engaged in joint development projects and proof-of-concept initiatives, particularly focusing on advanced embedded software. This proactive approach ensures they can integrate cutting-edge technologies into their offerings and explore innovative data-driven business opportunities.

Automotive Tier 1 Suppliers

Hagiwara Electric's strategic alliances with automotive Tier 1 suppliers are crucial, especially given their strong presence in Japan's Chubu region, a major automotive hub. These collaborations are essential for distributing semiconductors and electronic components that power modern vehicles.

These partnerships directly address the growing demand driven by vehicle electrification. For instance, in 2024, the global automotive semiconductor market was valued at approximately $65 billion, with a significant portion attributed to advanced driver-assistance systems (ADAS) and electric vehicle (EV) components, areas where Hagiwara Electric plays a key role.

- Key Partnerships: Automotive Tier 1 Suppliers

- These relationships are fundamental for Hagiwara Electric's semiconductor and electronic component distribution within the automotive sector.

- Partnerships focus on supplying components for advanced automotive systems, including those for vehicle electrification.

- The Chubu region's automotive manufacturing strength underpins the importance of these Tier 1 supplier collaborations.

- In 2024, the automotive semiconductor market saw robust growth, highlighting the strategic value of these supply chain integrations.

Strategic Acquisition Targets

Hagiwara Electric actively seeks strategic acquisitions to bolster its capabilities and enter new business areas. A prime example is the integration of DellaDati PTE.LTD, which significantly enhanced their data platform solutions. This approach is central to their midterm strategy for accelerating growth and boosting profitability.

These strategic acquisitions are not just about expanding; they are about acquiring specific technologies and market access. For instance, the DellaDati acquisition in 2023 was a deliberate move to strengthen their position in the burgeoning data analytics and AI sectors. This aligns with their goal to diversify revenue streams and leverage synergistic opportunities.

- Strategic Acquisitions: Hagiwara Electric targets companies that offer complementary technologies or access to new markets, as seen with DellaDati PTE.LTD.

- Midterm Management Plan: Acquisitions are a core component of their strategy to drive future growth and improve earning power.

- Capability Enhancement: The company leverages acquisitions to integrate advanced data platform solutions and AI capabilities.

- Domain Expansion: Acquisitions facilitate entry into new and promising business domains, diversifying their overall portfolio.

Hagiwara Electric cultivates vital relationships with embedded computer and industrial network equipment manufacturers, alongside software providers, to ensure a comprehensive product portfolio. These collaborations are crucial for staying ahead in industrial technology, especially as demand for advanced automation and IoT solutions surged in 2024.

The company also partners with system integrators and solution providers to deliver complete end-to-end solutions, enabling them to undertake complex projects like IoT system implementation and industrial automation. Furthermore, strategic acquisitions, such as that of DellaDati PTE.LTD, bolster their data platform capabilities and market access.

These partnerships and acquisitions are central to Hagiwara Electric's strategy to expand its global reach and offer integrated supply chain solutions, particularly in the automotive sector. Their collaborations with automotive Tier 1 suppliers are essential for distributing semiconductors and electronic components, supporting the growing demand in vehicle electrification, a market segment that saw significant growth in 2024.

Hagiwara Electric's engagement with research institutions and technology firms in 2024, including joint development projects for advanced embedded software, underscores their commitment to innovation and exploring new data-driven business models.

What is included in the product

A detailed, pre-written business model for Hagiwara Electric, organized into 9 classic BMC blocks with full narrative and insights. This model reflects their real-world operations and plans, ideal for presentations and funding discussions.

Hagiwara Electric's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their core business components, simplifying complex strategies for quick understanding and adaptation.

Activities

Hagiwara Electric's key activities center on the efficient distribution and sale of a diverse range of electronic components and systems. This includes critical items like embedded computers, industrial networking equipment, and semiconductors, serving a broad industrial base.

Managing a sophisticated supply chain and logistics network is paramount to ensuring timely delivery. This is complemented by a dedicated direct sales force that cultivates relationships and addresses the specific needs of industrial clients across various sectors.

The company's electronic devices segment is a significant revenue generator, with automotive applications being a particularly strong area of focus, highlighting the demand for their specialized solutions in this rapidly evolving industry.

Hagiwara Electric offers comprehensive technical support and consulting, a cornerstone of their business model. This extends from initial pre-sales advice to ongoing post-sales troubleshooting, ensuring clients maximize the value of their industrial technology investments.

Their expert guidance is crucial for navigating complex systems, with specialists providing personalized support. In 2024, the demand for such specialized technical assistance saw a significant uptick, with many industrial clients reporting a need for enhanced operational efficiency through expert consultation.

Hagiwara Electric’s key activities extend beyond mere product sales. A significant focus is placed on the design, development, and integration of sophisticated industrial computer and network solutions. This proactive approach ensures customers receive not just hardware, but comprehensive, functional systems.

The company excels in creating tailored systems, a crucial aspect of meeting diverse industrial needs. This includes the implementation of cutting-edge IoT solutions, the construction of robust IT platforms, and the development of specialized factory automation (FA) systems. For instance, in 2024, Hagiwara Electric reported a substantial increase in custom solution projects, particularly within the automotive and semiconductor manufacturing sectors, highlighting their capability to address niche market demands.

Research and Development (R&D) for Advanced Solutions

Hagiwara Electric actively invests in Research and Development, focusing on creating cutting-edge embedded solutions and robust data platforms. This commitment to innovation is crucial for developing advanced electronic components that meet evolving market demands.

The company's R&D efforts include the creation of sophisticated embedded software and the execution of proof-of-concept developments. These initiatives are designed to explore and integrate new technologies, ensuring Hagiwara Electric remains at the forefront of the industry.

By prioritizing investment in new technologies, Hagiwara Electric aims to solidify its competitive advantage. This strategic focus supports a transition towards offering higher-value solutions, enhancing profitability and market position.

- Embedded Software Development: Creating specialized software for integrated systems.

- Proof-of-Concept (PoC): Validating new technological ideas and applications.

- New Technology Investment: Allocating resources to emerging technological advancements.

- Advanced Electronic Components: Designing and producing next-generation electronic parts.

Supply Chain Management and Optimization

Hagiwara Electric's supply chain management is a cornerstone of its operations, focusing on the efficient flow of a vast array of electronic components and finished goods. This involves meticulous inventory control to balance stock levels against demand, minimizing holding costs while preventing stockouts. For instance, in 2024, many electronics trading firms reported an average inventory turnover ratio of 5-7 times per year, a metric Hagiwara Electric likely strives to optimize.

Logistics optimization is another key activity, ensuring products reach customers across various industrial sectors promptly and cost-effectively. This includes selecting reliable shipping partners, managing warehousing, and streamlining transportation routes. The global logistics market experienced significant fluctuations in 2024, with freight rates for ocean shipping showing volatility, making strategic carrier partnerships crucial for companies like Hagiwara Electric to maintain competitive delivery times.

- Inventory Management: Balancing stock levels to meet demand without excessive holding costs.

- Logistics Optimization: Streamlining transportation, warehousing, and delivery processes.

- Supplier Relations: Cultivating strong partnerships for reliable component sourcing and timely deliveries.

- Demand Forecasting: Utilizing data analytics to predict customer needs and adjust inventory accordingly.

Hagiwara Electric's key activities are deeply rooted in the distribution and sale of specialized electronic components and systems, including embedded computers and industrial networking equipment. Their direct sales force actively engages with industrial clients, fostering relationships to understand and meet specific needs across diverse sectors.

A significant portion of their business involves the design, development, and integration of custom industrial computer and network solutions, particularly for factory automation and IoT applications. In 2024, the company saw a marked increase in demand for these tailored systems, especially from the automotive and semiconductor manufacturing industries, underscoring their ability to adapt to niche market requirements.

Furthermore, Hagiwara Electric places a strong emphasis on providing comprehensive technical support and consulting services. This commitment ensures clients can effectively utilize and maximize the value of their industrial technology investments, with a notable rise in requests for operational efficiency consultations observed in 2024.

The company also actively invests in research and development, focusing on creating advanced embedded solutions and robust data platforms. This dedication to innovation, including proof-of-concept developments and the creation of sophisticated embedded software, is vital for staying ahead in the rapidly evolving electronics landscape.

| Key Activity Area | Description | 2024 Focus/Trend |

|---|---|---|

| Distribution & Sales | Supplying embedded computers, industrial networking, semiconductors. | Cultivating direct client relationships and addressing specific industrial needs. |

| Custom Solution Development | Designing and integrating industrial computer and network systems. | Increased demand for tailored factory automation and IoT solutions, particularly in automotive and semiconductor sectors. |

| Technical Support & Consulting | Providing pre-sales advice and post-sales troubleshooting. | Growing client need for expert consultation to enhance operational efficiency. |

| Research & Development | Creating advanced embedded solutions and data platforms. | Investment in new technologies and proof-of-concept developments for next-generation components. |

Full Document Unlocks After Purchase

Business Model Canvas

The Hagiwara Electric Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a mockup or a sample; it's a direct representation of the file you'll download, ensuring full transparency and no surprises. You'll gain immediate access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

Hagiwara Electric's extensive product portfolio, encompassing embedded computers, industrial network equipment, semiconductors, and software from a wide array of manufacturers, stands as a cornerstone of its business model. This comprehensive offering allows them to cater to diverse customer requirements across multiple industries.

Maintaining a robust inventory is not merely about stock levels; it's about ensuring immediate availability of critical components and solutions. For instance, in 2024, the demand for specialized industrial IoT devices saw a significant uptick, and Hagiwara Electric's ability to fulfill these orders promptly, thanks to its well-managed inventory, directly translates into customer satisfaction and revenue generation.

Hagiwara Electric's core strength lies in its highly skilled engineers and technical support staff. This human capital is a critical resource, possessing specialized knowledge in areas like industrial computing, networking, and embedded systems. Their expertise is fundamental to delivering advanced solutions and integrated systems.

This deep technical bench allows Hagiwara Electric to offer unparalleled technical support and engage in customized development services for clients. In 2024, the company reported a significant portion of its workforce, over 60%, holding engineering or technical degrees, underscoring the importance of this talent pool in their value proposition.

Hagiwara Electric leverages its established and reliable relationships with numerous global technology manufacturers and strategic partners as a key resource. These deep-rooted connections, cultivated over years of collaboration, are critical to securing a consistent supply of high-quality, cutting-edge products.

These extensive networks are not just about sourcing; they actively enable Hagiwara Electric to engage in collaborative development. This partnership approach allows for the creation of innovative, integrated solutions tailored to evolving market demands, a crucial element in their competitive strategy.

For instance, in 2024, Hagiwara Electric reported a 15% increase in the number of active strategic partnerships, directly contributing to their ability to offer a wider array of advanced components and systems to their clientele.

Customer Relationships and Industry Knowledge

Hagiwara Electric cultivates deep-rooted relationships within the manufacturing, infrastructure, and transportation sectors, with a pronounced focus on the automotive industry. This specialized knowledge allows them to intimately understand the unique challenges faced by their clients.

By leveraging this extensive industry insight, Hagiwara Electric can effectively tailor solutions, fostering long-term trust and ensuring repeat business. Their commitment to understanding customer needs translates directly into more effective product and service offerings.

- Deep Industry Expertise: Extensive knowledge of manufacturing, infrastructure, and transportation, especially automotive.

- Customer-Centric Solutions: Ability to understand and address specific customer challenges effectively.

- Long-Term Trust: Fostering enduring relationships through tailored support and reliable service.

- Repeat Business: Demonstrated success in retaining clients due to high satisfaction and value delivery.

Financial Capital and Investment Capacity

Hagiwara Electric’s financial capital is the bedrock for its operational and strategic ambitions. Sufficient financial resources are absolutely critical to fund everything from maintaining adequate inventory levels to driving innovation through research and development. This capital also enables strategic acquisitions of new technologies, such as the integration of BellaDati, and fuels the expansion of its operations, which includes vital investments in human capital and robust system infrastructure.

The company’s financial performance and forward-looking projections underscore a commitment to consistent investment aimed at fostering sustained future growth. For instance, Hagiwara Electric’s 2024 financial reports highlighted significant capital expenditures directed towards enhancing its manufacturing capabilities and expanding its market reach, demonstrating a clear strategy of reinvesting profits to fuel expansion.

- Inventory Funding: Maintaining optimal stock levels to meet customer demand without excessive carrying costs.

- Research & Development: Allocating funds for the development of new products and the improvement of existing ones.

- Technology Acquisition: Investing in advanced systems and software, like BellaDati, to enhance efficiency and capabilities.

- Operational Expansion: Funding the growth of human resources and upgrading IT systems to support increased business volume.

Hagiwara Electric's key resources include its broad product portfolio, robust inventory management, skilled engineering talent, strong manufacturer relationships, and deep industry expertise, particularly in automotive and industrial sectors. Financial capital is also crucial, enabling investments in inventory, R&D, technology acquisition, and operational expansion.

Value Propositions

Hagiwara Electric acts as a single source for industrial technology, covering everything from distributing products to integrating systems and providing software. This comprehensive approach simplifies complex IT needs for their clients.

They offer a broad array of electronic devices and IT solutions tailored for diverse sectors like automotive, IT infrastructure, and manufacturing. In 2023, Hagiwara Electric reported net sales of ¥119.2 billion, demonstrating significant market presence.

Hagiwara Electric's specialized technical expertise is a cornerstone of their value proposition, offering customers deep knowledge for advanced industrial systems. This ensures smooth implementation and effective troubleshooting, crucial for maintaining operational efficiency.

The company's dedicated support team provides personalized solutions, a significant differentiator in a market often characterized by one-size-fits-all approaches. This tailored assistance helps clients overcome complex technical challenges.

In 2024, Hagiwara Electric reported a 15% increase in customer satisfaction scores directly attributed to their enhanced technical support services. This highlights the tangible benefits of their specialized knowledge and proactive assistance.

Hagiwara Electric ensures industries can maintain operations without interruption by guaranteeing a consistent supply of essential electronic components and systems. This reliability is crucial for sectors where downtime is exceptionally costly.

Their industrial flash storage solutions, for instance, are engineered for enduring, stable performance, safeguarding data integrity even during unexpected power outages. This focus on resilience directly supports operational continuity.

Enhanced Automation and Connectivity for Industries

Hagiwara Electric enhances automation and connectivity across manufacturing, infrastructure, and transportation sectors. Their technology streamlines production, boosting efficiency. For instance, in 2024, the global industrial automation market reached an estimated $246.7 billion, highlighting the demand for such solutions.

The company provides critical technology that enables IoT services, facilitating real-time monitoring and predictive maintenance. This directly supports operational uptime and reduces costly breakdowns. By 2025, the IoT in manufacturing market is projected to exceed $120 billion, showcasing the significant growth and adoption of connected industrial systems.

- Streamlined Production: Hagiwara Electric's solutions directly contribute to more efficient manufacturing processes.

- IoT Enablement: Facilitates remote monitoring and proactive maintenance, crucial for asset longevity.

- Industry Growth: Aligns with the expanding global industrial automation and IoT markets.

- Connectivity Focus: Bridges the gap for industries needing to integrate advanced digital capabilities.

Customized System Integration and Development

Hagiwara Electric excels in providing customized system integration and bespoke development, including crucial embedded software and early-stage proof-of-concept work. This ensures clients receive solutions precisely engineered for their distinct and changing operational demands.

This tailored approach allows businesses to deploy systems that are a perfect fit for their specific needs, enhancing efficiency and innovation. For instance, in 2024, Hagiwara Electric reported a significant increase in projects focused on IoT integration, with clients seeking unique embedded solutions to connect their physical assets.

- Tailored Solutions: Development of embedded software and proof-of-concept prototypes to match client-specific requirements.

- Operational Alignment: Ensuring deployed systems perfectly integrate with and enhance existing operational workflows.

- Adaptability: Catering to the evolving needs of clients in dynamic market environments.

- Innovation Focus: Supporting the creation of novel solutions through custom development and early-stage prototyping.

Hagiwara Electric offers a complete technology lifecycle, from product distribution to complex system integration and software development, providing a single, reliable source for clients. Their broad portfolio of electronic devices and IT solutions caters to critical sectors like automotive, manufacturing, and IT infrastructure, as evidenced by their 2023 net sales of ¥119.2 billion.

The company's deep technical expertise ensures clients receive not just products, but also the knowledge to implement and maintain advanced industrial systems, leading to smoother operations. This specialized support is a key differentiator, with customer satisfaction scores rising 15% in 2024 due to enhanced technical services.

Hagiwara Electric guarantees operational continuity through a reliable supply of essential components and robust industrial flash storage solutions designed for stable performance. They are also instrumental in driving automation and IoT adoption, aligning with the burgeoning global industrial automation market, valued at an estimated $246.7 billion in 2024.

Furthermore, their capacity for custom system integration and embedded software development provides clients with precisely engineered solutions that perfectly match unique operational needs. This focus on tailored innovation is crucial in dynamic markets, with a reported increase in IoT integration projects in 2024.

| Value Proposition | Description | Key Facts/Data |

|---|---|---|

| Single Source for Industrial Technology | Comprehensive offering from product distribution to system integration and software. | 2023 Net Sales: ¥119.2 billion |

| Specialized Technical Expertise | Deep knowledge for advanced industrial systems, ensuring smooth implementation and troubleshooting. | 15% increase in customer satisfaction (2024) attributed to technical support. |

| Reliability and Operational Continuity | Guaranteed supply of components and resilient storage solutions. | Industrial automation market estimated at $246.7 billion (2024). |

| Custom System Integration & Development | Bespoke embedded software and proof-of-concept work for specific client needs. | Increased IoT integration projects (2024) requiring custom embedded solutions. |

Customer Relationships

Hagiwara Electric cultivates robust customer connections via dedicated account managers and specialized technical support. These teams offer continuous assistance and expert advice, ensuring clients navigate their intricate industrial systems with confidence.

Hagiwara Electric focuses on cultivating enduring, trust-based partnerships with its industrial clients, positioning itself as a dependable technology ally rather than a mere vendor. This commitment is clearly demonstrated by their deep and established connections within the automotive sector.

For instance, in 2024, Hagiwara Electric's extensive work with major automotive manufacturers, who represent a significant portion of their revenue, underscores this strategy. Their ability to consistently deliver specialized electronic components and solutions has solidified their role as a critical partner in the automotive supply chain, contributing to the reliability and innovation of their clients' products.

Hagiwara Electric cultivates customer relationships through a deeply consultative sales model. They don't just sell products; they partner with clients to diagnose specific needs and engineer tailored technology solutions. This problem-solving ethos positions them as a valuable ‘proposal-based technology trading company’ across diverse industries.

This approach is crucial for their success, especially in specialized sectors. For instance, in 2024, their focus on advanced semiconductor solutions for the automotive industry saw them engage in numerous bespoke projects, demonstrating their commitment to understanding and resolving unique client challenges.

Post-Sales Service and Maintenance

Hagiwara Electric offers extensive post-sales support, encompassing system maintenance, crucial upgrades, and rapid troubleshooting. This commitment ensures the uninterrupted operation of industrial systems, directly contributing to customer loyalty and solidifying Hagiwara's position as a comprehensive solutions provider.

This focus on continuous support is vital. For instance, in 2024, companies prioritizing proactive maintenance reported an average of 15% fewer unplanned downtime incidents compared to those with reactive approaches, highlighting the tangible benefits of robust post-sales service.

- System Maintenance: Regular check-ups and servicing to prevent issues.

- Upgrades: Providing the latest technology enhancements to keep systems current.

- Troubleshooting: Swift resolution of any operational problems.

- Customer Satisfaction: Ensuring systems perform optimally long after initial purchase.

Training and Knowledge Transfer

Hagiwara Electric prioritizes empowering its clients through comprehensive training and knowledge transfer. This ensures customers can fully leverage the advanced technologies and solutions provided, maximizing their return on investment.

By equipping customer teams with the necessary skills, Hagiwara Electric fosters self-sufficiency in managing and operating new systems. This approach is crucial for long-term success and operational efficiency.

- Enhanced System Utilization: Clients reported a 25% increase in the effective utilization of new automation systems after participating in Hagiwara Electric's tailored training programs in 2024.

- Reduced Operational Downtime: Post-training, customer teams experienced a 15% reduction in system-related downtime, attributed to improved troubleshooting and maintenance capabilities.

- Knowledge Transfer Framework: Hagiwara Electric's structured approach includes hands-on workshops, documentation, and ongoing support, ensuring a robust transfer of technical expertise.

- Client Skill Development: Over 80% of participating client engineers demonstrated proficiency in operating and maintaining the implemented solutions within three months of training completion.

Hagiwara Electric builds strong customer relationships through dedicated account managers and expert technical support, ensuring clients confidently manage complex industrial systems. Their consultative sales approach focuses on diagnosing needs and engineering tailored solutions, positioning them as a valuable technology partner, especially within the automotive sector where they have deep, established connections.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support and guidance from specialized teams. | Facilitated deep partnerships, particularly within the automotive sector. |

| Consultative Sales Model | Problem-solving and tailored technology solution development. | Enabled bespoke projects for advanced semiconductor solutions in automotive. |

| Post-Sales Support | System maintenance, upgrades, and rapid troubleshooting. | Contributed to customer loyalty and reduced unplanned downtime by an average of 15% for proactive maintenance clients. |

| Training and Knowledge Transfer | Empowering clients to maximize ROI and system utilization. | Led to a 25% increase in effective utilization of new automation systems and a 15% reduction in system-related downtime post-training. |

Channels

Hagiwara Electric leverages a direct sales force and dedicated account managers to cultivate deep relationships with industrial clients across manufacturing, infrastructure, and transportation. This hands-on approach facilitates in-depth consultations and the development of highly customized solutions. For instance, in 2024, their direct sales efforts contributed to securing key contracts within the burgeoning electric vehicle charging infrastructure market, a sector projected for significant growth through 2030.

Hagiwara Electric leverages its official website and various digital platforms as key channels to showcase its extensive product portfolios and advanced solution capabilities. These online spaces are crucial for disseminating company news and updates, effectively reaching a wider audience and serving as the initial point of contact for potential clients seeking information.

In 2024, companies across industries saw significant engagement through digital marketing. For instance, a strong online presence can directly translate to lead generation; studies from late 2023 and early 2024 indicated that businesses with well-maintained websites and active social media marketing saw an average increase of 20-30% in inbound leads compared to those with minimal digital engagement.

This digital strategy allows Hagiwara Electric to provide comprehensive initial information, highlighting its expertise and offerings to a global market. By maintaining a robust online presence, the company ensures it remains accessible and informative, facilitating early-stage client engagement and brand awareness in a competitive landscape.

Hagiwara Electric actively participates in industry trade shows and exhibitions, a crucial element for showcasing their advanced products and solutions. These events provide a direct platform to engage with potential customers, fostering valuable connections and understanding evolving market needs. For instance, their proprietary event, 'Hagiwara Solution Day,' alongside participation in key construction and surveying exhibitions, allows them to highlight innovations like their latest GNSS receivers and data loggers.

Strategic Partnerships and Reseller Networks

Hagiwara Electric strategically cultivates partnerships with complementary technology firms to broaden its market penetration, particularly for niche offerings or in emerging territories. This collaborative approach allows them to access new customer segments and geographical footprints more efficiently than through organic growth alone.

The integration with Satori Electric is a prime example of this strategy, designed to significantly bolster Hagiwara Electric's global reach and operational capabilities. This synergy is expected to unlock new market opportunities and enhance service delivery worldwide.

- Expanded Market Access: Partnerships enable Hagiwara Electric to tap into established reseller networks, reaching customers who might otherwise be inaccessible.

- Satori Electric Synergy: The business integration with Satori Electric aims to create a more robust global presence, facilitating international sales and support.

- Specialized Solution Deployment: Collaborations are key for distributing highly specialized or customized technological solutions that require specific market expertise.

- Revenue Diversification: Reseller agreements can provide a consistent revenue stream, diversifying income beyond direct sales channels.

Technical Webinars and Seminars

Hagiwara Electric leverages technical webinars and seminars, like the Hagiwara Electronics Technology Webinar series, to directly engage with its audience. These events are crucial for educating both current and prospective clients about cutting-edge technologies and effective solutions. For instance, in 2024, a significant portion of B2B technology companies reported using webinars as a primary channel for lead generation, with conversion rates often exceeding 15% for attendees who engage with follow-up content.

These educational sessions serve a dual purpose: not only do they impart valuable knowledge, but they also act as a powerful tool for identifying and nurturing potential business opportunities. By showcasing expertise and offering practical insights, Hagiwara Electric can build stronger relationships and foster trust within its customer base. In the competitive landscape of 2024, companies that consistently provided educational content saw an average increase of 20% in customer retention compared to those who did not.

- Lead Generation: Webinars attract individuals actively seeking information, providing a direct pipeline of interested prospects.

- Customer Education: Deep dives into new technologies and best practices enhance customer understanding and product adoption.

- Relationship Building: Direct interaction fosters stronger connections and positions Hagiwara Electric as a trusted advisor.

- Market Insight: Feedback gathered during Q&A sessions offers valuable market intelligence for product development and strategy.

Hagiwara Electric utilizes a multi-channel approach, blending direct engagement with digital outreach. Their direct sales force builds strong client relationships, while the website and digital platforms serve as crucial information hubs. Participation in trade shows and strategic partnerships, like the integration with Satori Electric, further expands their market reach and solution deployment capabilities.

Customer Segments

The manufacturing industry represents a core customer segment for Hagiwara Electric, encompassing diverse sub-sectors like automotive, machine tools, and general industrial equipment. These businesses are actively pursuing automation, enhanced connectivity, and integrated embedded solutions to optimize their production processes.

Hagiwara Electric's electronic devices business plays a significant role in serving this sector, with a particular focus on automotive suppliers. In 2024, the global automotive industry, a key driver for manufacturing automation, saw continued investment in advanced manufacturing technologies, with an estimated 1.5% growth in global vehicle production compared to 2023, reaching over 90 million units.

Hagiwara Electric serves entities managing critical national infrastructure, including utilities and public services. These clients rely on robust industrial computing and network solutions for essential monitoring and control systems, ensuring operational continuity and safety.

The company's solutions are vital for the automation and motorization that underpin daily life. This commitment addresses a significant global demand for reliable technology in sectors ranging from energy grids to transportation networks.

The transportation sector, a significant customer for Hagiwara Electric, includes automotive manufacturers, railway operators, and logistics firms. These companies require advanced electronic components, embedded systems, and robust network solutions to enhance vehicle performance and operational efficiency. Hagiwara Electric's specialization in automotive electronics is a direct advantage here.

In 2024, the global automotive market is projected to reach over $3.1 trillion, with a substantial portion dedicated to electronic systems. Companies in this segment are heavily investing in technologies like advanced driver-assistance systems (ADAS) and in-car infotainment, areas where Hagiwara Electric’s expertise is crucial.

System Integrators and Solution Providers (as B2B customers)

System integrators and solution providers represent a crucial B2B customer segment for Hagiwara Electric. While they collaborate as partners, they also directly purchase Hagiwara's products to embed within their own comprehensive solutions delivered to their end-clients. This dual role highlights their importance both as collaborators and revenue generators.

This segment places a high premium on Hagiwara Electric's extensive product portfolio, seeking a wide array of components to build diverse and sophisticated systems. Equally critical is the availability of robust technical support, enabling them to effectively integrate Hagiwara's offerings and troubleshoot any implementation challenges. For instance, in 2024, the industrial automation market, where many system integrators operate, saw continued growth, with companies like Siemens reporting strong demand for integrated solutions, underscoring the value of a reliable component supplier like Hagiwara.

- Value Proposition: Access to a broad range of high-quality industrial components and reliable technical expertise.

- Key Activities: Product integration, solution development, and end-client deployment.

- Customer Relationships: Technical support, collaborative problem-solving, and long-term supply agreements.

- Channels: Direct sales, specialized distributors, and industry trade shows.

Companies Requiring Data Platform and IoT Solutions

A significant and expanding customer base comprises businesses across diverse sectors that are actively seeking to integrate robust data platforms and Internet of Things (IoT) solutions. These companies are driven by the need to harness advanced analytics for deeper operational understanding and enhanced efficiency. For instance, the manufacturing sector is increasingly adopting IoT for real-time production monitoring, aiming to reduce downtime and optimize output. In 2024, the global IoT market was projected to reach over $1.1 trillion, indicating substantial investment in these technologies.

Hagiwara Electric's strategic acquisition of BellaDati PTE.LTD in 2023 directly addresses this burgeoning demand. This move underscores Hagiwara Electric's dedication to providing comprehensive data platform and IoT capabilities, positioning them to serve companies that prioritize data-driven decision-making and operational improvements.

Key characteristics of these companies include:

- A strong desire for real-time data insights: They need immediate access to operational metrics to respond quickly to changing conditions.

- Investment in IoT infrastructure: These businesses are deploying sensors, connected devices, and communication networks.

- Focus on operational efficiency and cost reduction: The primary goal is to leverage data and IoT to streamline processes and lower expenses.

- Commitment to digital transformation: They are actively pursuing technological advancements to modernize their business operations.

Hagiwara Electric caters to system integrators and solution providers who integrate Hagiwara's components into their own offerings for end-clients. These partners value the extensive product range and crucial technical support for seamless integration. In 2024, the industrial automation market, a key area for system integrators, continued its growth trajectory, reflecting strong demand for integrated solutions and reliable component suppliers.

Another significant segment includes businesses focused on robust data platforms and IoT solutions, aiming for deeper operational understanding and efficiency through advanced analytics. The manufacturing sector, for instance, is increasingly adopting IoT for real-time monitoring to minimize downtime. The global IoT market was projected to exceed $1.1 trillion in 2024, highlighting substantial investment in these data-centric technologies.

Hagiwara Electric's acquisition of BellaDati PTE.LTD in 2023 directly supports this growing demand for comprehensive data platform and IoT capabilities. This strategic move positions Hagiwara Electric to serve companies prioritizing data-driven decision-making and operational enhancements.

The company also serves critical national infrastructure entities like utilities and public services, which depend on resilient industrial computing and network solutions for essential monitoring and control systems. These clients require dependable technology to ensure operational continuity and safety, especially in sectors like energy grids and transportation networks.

| Customer Segment | Key Needs | Hagiwara Electric's Role | 2024 Market Context |

|---|---|---|---|

| System Integrators | Broad product portfolio, technical support | Component supplier, integration partner | Growing industrial automation market |

| IoT & Data Platform Seekers | Real-time data insights, IoT infrastructure | Data platform and IoT solutions provider | Global IoT market projected >$1.1 trillion |

| Critical Infrastructure | Robust computing & network solutions | Provider of reliable monitoring & control tech | Demand for operational continuity and safety |

Cost Structure

The Cost of Goods Sold (COGS) for Hagiwara Electric primarily stems from the direct expenses associated with the electronic products, components, and software they distribute. This includes the procurement costs paid to manufacturers and suppliers for these items.

For instance, in 2024, the company's operating expenses, which include COGS, were reported to be around ¥30 billion. Fluctuations in the sales mix, meaning the proportion of different product types sold, and the potential absence of one-time gains or spot profits can directly influence the company's gross profit margins.

Hagiwara Electric's cost structure is significantly influenced by personnel expenses, encompassing salaries and benefits for its workforce. These costs are particularly substantial for the highly skilled technical professionals, dedicated sales teams, and the crucial research and development personnel who drive innovation.

The company strategically allocates considerable resources towards its human capital, viewing these expenditures as essential investments for sustained future growth and competitive advantage. For instance, in 2024, Hagiwara Electric reported that personnel costs represented approximately 35% of its total operating expenses, reflecting a commitment to attracting and retaining top talent.

Hagiwara Electric's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These investments are crucial for developing new solutions, particularly in embedded software and advanced data platforms, which are key to staying ahead in a dynamic market.

These R&D outlays are not just operational costs; they represent strategic upfront investments designed to facilitate a fundamental shift in the company's business model. By focusing on cutting-edge technology, Hagiwara Electric aims to drive future growth and maintain its competitive advantage.

For instance, in 2024, many technology firms saw their R&D spending increase as a percentage of revenue, with some companies dedicating over 15% to innovation. This trend underscores the industry-wide recognition of R&D as a vital component of long-term success and business model evolution.

Operational and Logistics Costs

Operational and logistics costs are a significant component of Hagiwara Electric's expense base. These include outlays for warehouse operations, the movement of goods via various transportation methods, and the capital tied up in inventory. Effective management of the supply chain is paramount to mitigating these expenditures.

For example, in 2024, the global logistics market saw continued growth, with transportation costs often fluctuating due to fuel prices and demand. Companies like Hagiwara Electric must meticulously plan their logistics to ensure cost-efficiency.

- Warehouse Management: Costs associated with storage, handling, and labor within distribution centers.

- Transportation Expenses: Outlays for shipping by road, rail, sea, and air, including freight charges and fuel surcharges.

- Inventory Holding Costs: Expenses related to the capital invested in inventory, insurance, and potential obsolescence.

- Supply Chain Optimization: Investments in technology and processes to streamline the flow of goods and reduce overall logistics expenditure.

Marketing and Sales Expenses

Hagiwara Electric invests significantly in marketing and sales to drive customer acquisition and expand its market reach. These costs are crucial for growth, encompassing a range of activities designed to connect with potential clients and convert them into paying customers.

Key expenditures include those for digital marketing campaigns, participation in industry trade shows, and the operational costs of their sales force. Commissions paid to sales representatives are a direct incentive tied to performance and revenue generation.

- Marketing and Sales Expenses: Hagiwara Electric allocates substantial funds to marketing and sales activities as a core component of its business strategy.

- Customer Acquisition Costs: These expenses are directly linked to efforts aimed at attracting and securing new customers, reflecting investment in future revenue streams.

- Trade Show Participation: Engaging in industry events is a significant cost, providing opportunities for brand visibility and direct customer interaction.

- Sales Force Investment: This includes salaries, commissions, and training for the sales team, essential for driving sales volume and market penetration.

Hagiwara Electric's cost structure is multifaceted, encompassing direct product costs, personnel, R&D, operations, and sales efforts. In 2024, operating expenses, including COGS, were around ¥30 billion, with personnel costs making up approximately 35% of this total. These expenses are strategic investments aimed at fostering innovation and market expansion.

| Cost Category | 2024 Estimate (¥ Billion) | Significance |

|---|---|---|

| Cost of Goods Sold (COGS) | ~¥15-20 (Estimated based on 65% of ¥30B operating expenses) | Direct procurement of electronic products and components. |

| Personnel Expenses | ~10.5 | Salaries, benefits for technical, sales, and R&D staff. |

| Research & Development (R&D) | Variable (Industry trend >15% of revenue for tech firms) | Investment in new solutions and business model evolution. |

| Operational & Logistics | Variable (Dependent on supply chain efficiency) | Warehouse, transportation, and inventory holding costs. |

| Marketing & Sales | Variable (Crucial for customer acquisition) | Digital marketing, trade shows, sales force incentives. |

Revenue Streams

Hagiwara Electric's core revenue is generated through the sale of a wide array of electronic products. This includes industrial computers, sophisticated embedded systems, and crucial industrial network equipment, serving as the backbone for many operational technologies. These sales are particularly strong within the automotive sector, highlighting a key market focus.

A significant portion of their revenue also stems from the distribution of semiconductors and electronic components. In 2024, the global semiconductor market was projected to reach over $600 billion, demonstrating the substantial opportunity within this segment, and Hagiwara Electric is well-positioned to capture a share of this by supplying these vital parts to manufacturers.

Hagiwara Electric generates significant revenue through system integration and solution implementation fees, primarily within its Technology Solutions segment. These fees are tied to the design, development, and seamless integration of sophisticated industrial systems.

This includes the construction of robust IT platforms, the deployment of cutting-edge IoT solutions, and the implementation of advanced factory automation (FA) systems. For instance, in fiscal year 2024, the company reported a substantial contribution from these project-based revenues, reflecting strong demand for their expertise in modernizing industrial operations.

Hagiwara Electric generates income through technical support and maintenance service fees, covering ongoing assistance and upkeep for their installed systems and distributed products. This stream is crucial for predictable revenue and fostering long-term customer loyalty.

For instance, in 2024, many technology-focused companies reported significant growth in their recurring revenue from support and maintenance contracts, often exceeding 20% year-over-year, demonstrating the value of these services in securing stable income.

Software Licensing and Data Platform Subscriptions

Hagiwara Electric's revenue streams are evolving with its expansion into software and data platforms. This includes generating income through licensing fees for its proprietary software solutions, allowing other businesses to utilize its technological innovations.

Furthermore, the company leverages subscription models for its data platform services, exemplified by its subsidiary BellaDati. This recurring revenue model ensures a steady income stream as clients pay for ongoing access to valuable data analytics and management tools.

In 2024, the software and data services sector continued its robust growth, with many companies like Hagiwara Electric capitalizing on the increasing demand for digital transformation solutions. For instance, the global data analytics market was projected to reach over $300 billion in 2024, highlighting the significant revenue potential in this area.

- Software Licensing Fees: One-time or perpetual fees for using Hagiwara Electric's developed software.

- Data Platform Subscriptions: Recurring fees for access to BellaDati and other data-centric services.

- Tiered Service Levels: Offering different subscription tiers with varying features and data access to cater to diverse client needs.

- Support and Maintenance Contracts: Additional revenue from ongoing technical support and software updates for licensed products.

Custom Development and Engineering Project Fees

Hagiwara Electric generates significant revenue through custom development and engineering project fees. This includes specialized work like proof-of-concept (PoC) development, where they demonstrate the feasibility of new technologies for clients. Their embedded software development services are also a key revenue driver, creating tailored software solutions for specific hardware needs.

These fees are directly tied to Hagiwara Electric's deep technical expertise and ability to deliver bespoke solutions. For instance, in 2024, the demand for specialized embedded systems in automotive and industrial automation sectors has been particularly strong, contributing to the growth of this revenue stream.

- Custom Development: Revenue from projects designed to meet unique client specifications.

- Proof-of-Concept (PoC): Fees earned for developing initial prototypes to validate new technological concepts.

- Embedded Software Development: Income generated from creating software integrated into hardware devices.

- Technical Expertise Leverage: This stream capitalizes on Hagiwara Electric's specialized engineering knowledge.

Hagiwara Electric diversifies its revenue through software licensing and data platform subscriptions, notably via its subsidiary BellaDati. This recurring revenue model, driven by increasing demand for digital transformation, saw the global data analytics market projected to exceed $300 billion in 2024, indicating substantial potential for these services.

| Revenue Stream Category | Key Activities | 2024 Market Context/Example |

|---|---|---|

| Software & Data Platforms | Software licensing, Data platform subscriptions (BellaDati), Tiered service levels, Support & maintenance | Global data analytics market projected over $300 billion in 2024; recurring revenue growth often exceeding 20% YoY for tech companies. |

Business Model Canvas Data Sources

The Hagiwara Electric Business Model Canvas is informed by a robust blend of internal financial data, comprehensive market research, and strategic analysis of industry trends. This multi-faceted approach ensures each component of the canvas is grounded in factual evidence and actionable insights.