Gulfport Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulfport Energy Bundle

Navigate the complex external forces shaping Gulfport Energy's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both challenges and opportunities for the company. Gain a critical edge in your market strategy by leveraging these expert-level insights. Download the full version now for actionable intelligence.

Political factors

Government policies at both federal and state levels are crucial for Gulfport Energy, influencing everything from getting permits to extract resources to building necessary infrastructure. The administration's overall approach to fossil fuels versus renewable energy really shapes how investors feel about the company and how much freedom Gulfport has to operate.

For instance, new Environmental Protection Agency (EPA) rules targeting methane emissions from oil and gas sites, which came into effect in May 2024, mean that companies like Gulfport operating in Ohio must adhere to tougher requirements by 2029. This directly affects their activities in the Utica Shale region.

Global geopolitical events, such as ongoing conflicts and trade disputes, significantly impact oil and natural gas prices, directly influencing Gulfport Energy's revenue streams. For instance, the ongoing instability in Eastern Europe and the Middle East in 2024 continued to create price volatility in energy markets, with crude oil prices fluctuating between $70 and $90 per barrel for much of the year.

Supply disruptions stemming from these geopolitical tensions can lead to sharp price increases. Conversely, shifts in international energy alliances or the emergence of new supply routes can alter market dynamics. The year 2024 saw continued efforts by various nations to secure diverse energy sources, impacting global supply-demand balances.

The stability of key energy-producing and consuming regions directly affects the global supply-demand equilibrium for natural gas. This, in turn, has an indirect but crucial impact on U.S. domestic prices and the attractiveness of U.S. liquefied natural gas (LNG) export opportunities, with U.S. LNG exports reaching record levels in late 2024.

U.S. trade policies significantly influence the domestic natural gas market, especially concerning liquefied natural gas (LNG) exports. These policies directly impact demand and pricing for U.S. natural gas producers like Gulfport Energy.

The expansion of U.S. LNG export capacity, with new terminals expected to commence operations in late 2024 and early 2025, is poised to boost demand for U.S. natural gas. For instance, the Golden Pass LNG terminal, with a nameplate capacity of approximately 16 million tonnes per annum, is slated for commercial operation in 2025, a key development for the sector.

This increased export demand can lead to higher domestic natural gas prices, creating a favorable market environment for Gulfport. In 2023, U.S. LNG exports reached a record 11.9 billion cubic feet per day, underscoring the growing global appetite for American natural gas.

Taxation and Fiscal Policies

Government taxation policies, including corporate taxes and specific industry levies, directly impact Gulfport Energy's financial performance. For instance, the U.S. federal corporate tax rate stands at 21%, a key figure influencing Gulfport's net income. Changes in severance taxes, often state-specific, can also affect operational costs and project profitability.

Fluctuations in these fiscal policies can significantly alter Gulfport Energy's profitability and its capacity to fund future exploration and development. Tax incentives aimed at encouraging domestic energy production, particularly for natural gas, can enhance the economic viability of Gulfport's projects. Conversely, potential disincentives for fossil fuels could introduce headwinds.

- U.S. Federal Corporate Tax Rate: 21% (as of current U.S. tax law).

- Impact of Severance Taxes: Varies by state, directly affecting production costs per barrel of oil equivalent.

- Incentives for Natural Gas: Government policies promoting natural gas as a cleaner energy source can benefit Gulfport's core business.

- Potential for Carbon Taxes: Future fiscal policies could introduce carbon taxes, impacting the cost of fossil fuel extraction and use.

State and Local Regulatory Environments

Gulfport Energy's operations are heavily influenced by state and local regulatory environments, particularly in key production areas like Ohio and Oklahoma. These sub-federal regulations can differ substantially from federal requirements, impacting everything from land use and water management to the crucial local permitting processes. Navigating this patchwork of rules is essential for project execution.

The company must remain agile in adapting to these varied state and local mandates. For instance, stringent state-specific environmental rules or significant local opposition can directly affect project timelines, increase operational costs, and even influence the feasibility of new developments. Gulfport's ability to manage these diverse regulatory landscapes is a critical factor in its success.

- Ohio's Utica Shale Regulations: Specific rules govern horizontal drilling, wastewater disposal, and air emissions, with potential for local zoning ordinances to impose further restrictions.

- Oklahoma's Corporation Commission Oversight: This body sets standards for well spacing, production reporting, and environmental protection, with ongoing reviews of rules impacting hydraulic fracturing.

- Local Permitting Hurdles: Community engagement and adherence to local zoning and land use plans are vital, as delays or denials at the municipal level can halt projects.

Government policies significantly shape Gulfport Energy's operational landscape, from federal environmental regulations impacting emissions to state-specific rules governing resource extraction. The ongoing shift towards cleaner energy sources influences investment sentiment and the company's strategic flexibility. For example, new EPA methane emission rules effective May 2024 require adherence to stricter standards by 2029, directly affecting operations in regions like the Utica Shale.

Geopolitical events in 2024 continued to drive energy market volatility, with conflicts in Eastern Europe and the Middle East causing crude oil prices to fluctuate between $70-$90 per barrel, impacting Gulfport's revenue. U.S. trade policies, particularly those related to LNG exports, are crucial for domestic demand and pricing, with new export terminals like Golden Pass LNG expected to boost natural gas demand in 2025.

Taxation policies, including the U.S. federal corporate tax rate of 21% and state severance taxes, directly affect Gulfport's profitability and investment capacity. While incentives for natural gas production can be beneficial, potential future carbon taxes could increase operational costs.

State and local regulations, such as those in Ohio and Oklahoma, present a complex compliance environment for Gulfport, influencing land use, water management, and permitting processes. Navigating these varied rules is critical, as local opposition or stringent state environmental rules can cause project delays and cost increases.

| Policy Area | 2024/2025 Data/Trend | Impact on Gulfport Energy |

|---|---|---|

| Environmental Regulations (Methane Emissions) | New EPA rules effective May 2024; stricter compliance by 2029. | Increased operational costs and potential need for new equipment in Utica Shale. |

| Geopolitical Instability | Crude oil prices $70-$90/barrel (2024); ongoing conflicts. | Revenue volatility; potential for supply disruptions impacting prices. |

| LNG Export Capacity | Golden Pass LNG terminal to commence operations in 2025. U.S. LNG exports reached record 11.9 bcf/d in late 2024. | Increased domestic demand and potentially higher natural gas prices. |

| Taxation | U.S. Federal Corporate Tax: 21%. State severance taxes vary. | Directly impacts net income; state taxes affect production costs. |

| State/Local Regulations (Ohio) | Specific rules for drilling, wastewater, air emissions; potential local zoning. | Project execution challenges, increased compliance costs, potential delays. |

What is included in the product

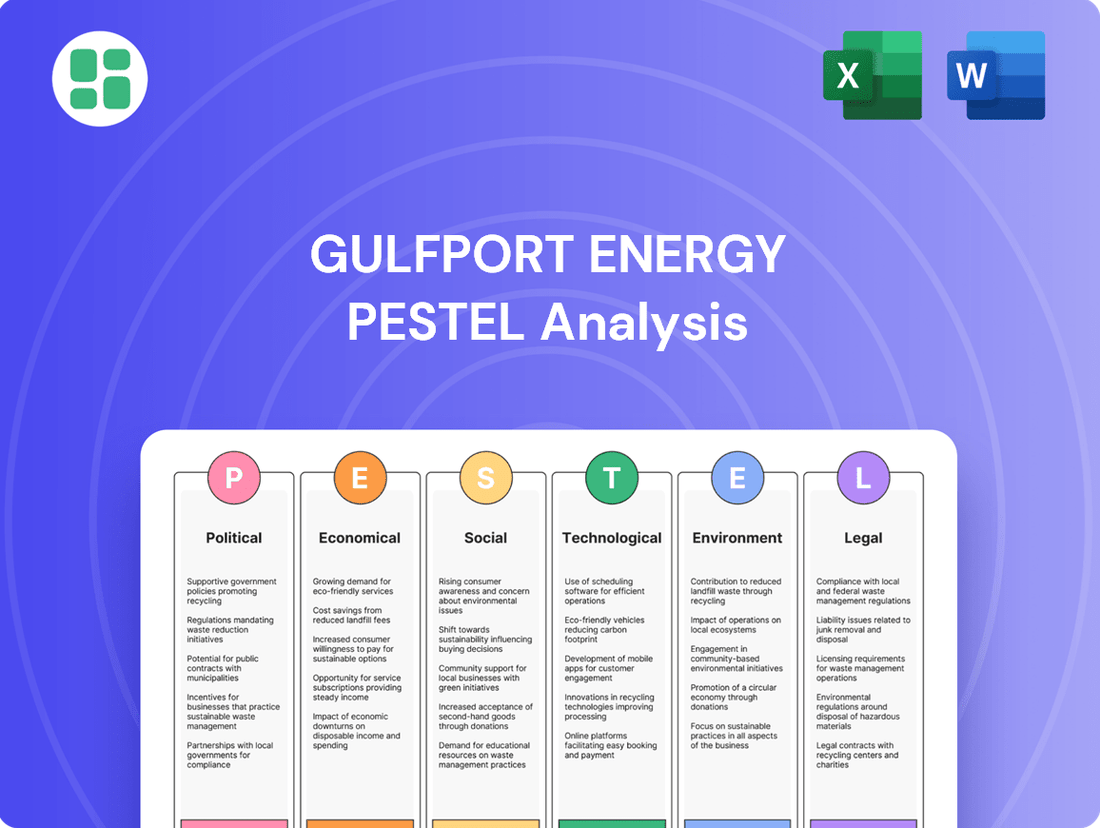

This PESTLE analysis of Gulfport Energy examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations, providing a comprehensive overview of its external macro-environment.

This PESTLE analysis for Gulfport Energy offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during strategic discussions.

By visually segmenting the PESTLE analysis by categories, Gulfport Energy can quickly interpret at a glance the external forces impacting their business, alleviating the pain of sifting through dense information.

Economic factors

Gulfport Energy's financial health is intrinsically tied to the often-unpredictable prices of natural gas, crude oil, and natural gas liquids (NGLs). These commodity markets directly influence the company's revenue streams and overall profitability.

Looking ahead, natural gas prices are projected to see an increase in 2025 and 2026 when compared to 2024 levels. However, even with this upward trend, price volatility remains a significant factor that can cause substantial swings in Gulfport's earnings.

To navigate this, Gulfport Energy is strategically increasing its liquids production in 2025. This move is designed to capitalize on potentially stronger liquids pricing and bolster the company's cash flow generation.

Capital availability is a significant factor for Gulfport Energy. In early 2024, the company maintained a strong liquidity position, with approximately $1.3 billion in available borrowing capacity under its revolving credit facility, providing ample financial flexibility for its operations and growth initiatives.

The cost of capital directly impacts Gulfport's project economics. As of the first quarter of 2024, the Federal Reserve's benchmark interest rate remained elevated, influencing the cost of debt financing. This environment necessitates careful management of leverage to ensure projects remain profitable and shareholder returns are protected.

Gulfport Energy's profitability hinges on its operational efficiency and rigorous cost management. The company has made strides in optimizing its drilling and completion processes, which directly impacts its bottom line.

In 2024, Gulfport reported notable enhancements in drilling footage per day and a reduction in completion hours. This focus on efficiency is projected to continue into 2025, with a target of lowering capital expenditures per foot of completed lateral.

These improvements in operational efficiency are crucial for Gulfport to maintain strong shareholder value, especially given the inherent volatility in natural gas and oil commodity prices.

Market Demand and Supply Dynamics

The interplay of natural gas supply and demand in the United States is a critical factor influencing market prices. Projections indicate that U.S. dry natural gas production is set to achieve new records by 2025. Concurrently, demand is anticipated to rise, driven significantly by liquefied natural gas (LNG) exports and the residential and commercial sectors, suggesting potential upward price momentum.

Gulfport Energy's operational and production strategies are designed to capitalize on these evolving market conditions. The company's focus on efficient production methods and its asset base in key natural gas-producing regions position it to benefit from sustained or increasing demand.

- U.S. Dry Natural Gas Production: Expected to reach record highs by 2025.

- Demand Drivers: Growth in LNG exports and residential/commercial consumption are key.

- Price Impact: Increased demand coupled with robust supply could lead to price appreciation.

- Gulfport's Strategy: Aligns production with market demand trends for optimal performance.

Inflationary Pressures and Supply Chain Costs

Inflationary pressures directly impact Gulfport Energy by increasing the costs associated with essential materials, equipment, and services crucial for oil and gas exploration and production. For instance, the Producer Price Index (PPI) for oil and gas extraction saw significant increases throughout 2023 and into early 2024, reflecting these rising input costs.

Supply chain disruptions and escalating costs for key commodities like steel (used in drilling pipes and infrastructure) and proppant (essential for hydraulic fracturing), along with labor, can significantly alter Gulfport's capital expenditure plans and overall operating expenses. The cost of steel, for example, experienced volatility, with benchmarks like the US Gulf Coast Hot-Rolled Coil price fluctuating, impacting project economics.

Gulfport's financial health hinges on its capacity to maintain capital efficiencies and manage these inflationary headwinds effectively. The company's ability to secure favorable pricing for its inputs and optimize its operational processes is paramount in mitigating the impact of rising supply chain costs on its profitability and future investment capacity.

- Rising Input Costs: Inflation directly inflates the price of materials like steel, proppant, and specialized equipment needed for drilling and well completion.

- Supply Chain Volatility: Disruptions in global supply chains continue to affect the availability and cost of critical components and services for the energy sector.

- Impact on Capital Expenditures: Increased costs for materials and labor can force revisions to capital expenditure budgets, potentially delaying or scaling back exploration and production projects.

- Operational Expense Increases: Higher energy prices, transportation costs, and wages contribute to increased day-to-day operating expenses for Gulfport.

The economic outlook for Gulfport Energy is shaped by fluctuating commodity prices and the broader macroeconomic environment. While natural gas prices are expected to rise in 2025 and 2026 compared to 2024, ongoing volatility remains a key concern, directly impacting revenue and profitability.

Gulfport's strategic pivot towards increasing liquids production in 2025 aims to leverage potentially stronger liquids pricing and enhance cash flow generation, demonstrating a proactive approach to market dynamics.

The company's financial flexibility is supported by a strong liquidity position, with approximately $1.3 billion in available borrowing capacity as of early 2024, allowing for operational and growth initiatives despite elevated interest rates influencing the cost of capital.

Operational efficiency improvements, such as increased drilling footage per day and reduced completion hours in 2024, are projected to continue into 2025, with a focus on lowering capital expenditures per foot, crucial for maintaining shareholder value amidst price volatility.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on Gulfport Energy |

|---|---|---|---|

| Natural Gas Prices | Volatile, with expected increase in 2025/2026 vs. 2024 | Projected to increase | Directly impacts revenue and profitability; strategic liquids production aims to mitigate gas price swings. |

| Liquids Production | Increasing in 2025 | Continued focus on increasing | Aims to capitalize on potentially stronger liquids pricing and bolster cash flow. |

| Interest Rates (Federal Reserve Benchmark) | Elevated in Q1 2024 | Likely to remain a consideration | Influences the cost of debt financing, necessitating careful leverage management. |

| U.S. Dry Natural Gas Production | On track for record highs by 2025 | Record highs expected | Supports potential price appreciation due to increased demand from LNG exports and domestic consumption. |

Preview the Actual Deliverable

Gulfport Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Gulfport Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights for strategic planning.

Sociological factors

Public perception surrounding hydraulic fracturing and fossil fuel extraction directly impacts community relations and regulatory backing for companies like Gulfport Energy. Negative public sentiment can trigger heightened scrutiny, more stringent local regulations, and potential project opposition, as seen in various shale plays across the US.

Maintaining a social license to operate is paramount for Gulfport Energy. This involves demonstrating a commitment to responsible development practices and actively engaging with communities, particularly in regions like the Utica and SCOOP/STACK plays where public discourse on energy development remains robust.

Gulfport Energy's operations in Ohio and Oklahoma directly influence these communities through employment, infrastructure strain, and overall quality of life. Maintaining strong local ties is crucial for operational continuity, fostered by open dialogue and economic contributions via royalties and taxes.

The company emphasizes its commitment to the economic and social betterment of its operating regions, a stance vital for long-term sustainability and social license to operate. For instance, in 2023, Gulfport Energy reported significant capital expenditures in its Utica and SCOOP/STACK plays, directly translating into local job creation and economic activity.

The oil and gas sector, including companies like Gulfport Energy, grapples with a persistent challenge in securing and keeping a skilled workforce, particularly in critical fields such as drilling and well completions. This shortage is exacerbated by demographic shifts, with an aging workforce retiring and fewer young professionals entering the industry. For instance, a 2024 report indicated that the average age of an oil and gas worker is nearing 50, highlighting a potential wave of retirements in the coming years.

Competition from other sectors offering potentially more stable or perceived as less hazardous work environments further strains labor availability. Furthermore, the industry's evolving technological landscape demands new skill sets, creating a skills gap that requires significant investment in training and development. This dynamic can translate into increased labor costs as companies compete for limited talent, directly impacting operational efficiency and project timelines.

Health and Safety Standards

Societal expectations and regulatory demands for worker health and safety are critical in the energy industry, influencing how companies like Gulfport Energy operate. Adherence to rigorous safety protocols is not just a legal obligation but a fundamental aspect of responsible business practice, aimed at preventing incidents and safeguarding personnel.

Gulfport Energy, like its peers, must navigate a landscape where robust safety performance directly impacts its public image and operational stability. A strong safety record, evidenced by low incident rates, enhances corporate reputation and mitigates risks that could lead to costly shutdowns or legal liabilities. For instance, the U.S. Bureau of Labor Statistics reported a total recordable case rate of 2.4 per 100 full-time workers in the oil and gas extraction industry in 2023, a figure companies strive to significantly outperform.

- Regulatory Compliance: Gulfport must comply with OSHA standards, which mandate specific safety procedures for oil and gas operations.

- Risk Mitigation: Investing in safety training and equipment helps prevent accidents, reducing potential financial losses from injuries and property damage.

- Reputation Management: A commitment to safety fosters trust among employees, communities, and investors, enhancing the company's social license to operate.

- Operational Efficiency: Safe working environments often correlate with higher employee morale and productivity, contributing to smoother operations.

Environmental Justice Considerations

Growing awareness of environmental justice issues means that the impact of industrial operations on vulnerable communities is under increasing scrutiny. Gulfport Energy must consider the equitable distribution of environmental benefits and burdens in its operational areas. For instance, in 2024, communities near oil and gas extraction sites, particularly those with higher proportions of minority populations, often experience disproportionately higher rates of respiratory illnesses, a trend that continues to be a focal point for regulatory bodies and advocacy groups. This necessitates a proactive approach to community engagement and impact mitigation.

Addressing concerns from local populations regarding air quality, water resources, and land use is increasingly important for maintaining social license to operate. Gulfport Energy’s commitment to transparency and community dialogue is crucial. Reports from 2024 indicate that public perception of energy companies is heavily influenced by their environmental stewardship, with community-led initiatives often driving stricter local regulations. This can translate into project delays or increased operational costs if not managed effectively.

- Community Health Monitoring: Implementing robust programs to monitor air and water quality in proximity to operations, with findings publicly accessible.

- Equitable Benefit Sharing: Exploring mechanisms for local communities to share in the economic benefits derived from resource extraction.

- Stakeholder Engagement: Establishing regular and transparent communication channels with local residents and community leaders to address grievances and incorporate feedback.

- Mitigation Strategies: Investing in technologies and practices that minimize environmental impacts, such as advanced methane leak detection and water recycling.

Public sentiment regarding hydraulic fracturing and fossil fuel extraction significantly shapes community relations and regulatory environments for companies like Gulfport Energy. Negative public opinion can lead to increased scrutiny and stricter local regulations, a pattern observed across various US shale plays.

Gulfport Energy's focus on maintaining a social license to operate involves active community engagement and demonstrating responsible development, especially in areas like the Utica and SCOOP/STACK plays where public discourse on energy is ongoing.

The company's operations in Ohio and Oklahoma directly impact local communities through job creation and infrastructure demands, making strong local relationships vital for operational continuity and supported by economic contributions via royalties and taxes.

Gulfport Energy highlights its commitment to the economic and social well-being of its operating regions, a crucial element for long-term sustainability. In 2023, the company's substantial capital expenditures in the Utica and SCOOP/STACK plays directly fueled local job growth and economic activity.

Technological factors

Gulfport Energy's operational strength is significantly bolstered by advanced drilling and completion technologies. Innovations like horizontal drilling and multi-pad drilling allow for more efficient extraction of resources, directly impacting cost reduction and optimizing recovery rates. For instance, in 2024, the company has reported a notable decrease in average drilling and completion times per well, a testament to the effectiveness of these technological integrations.

Hydraulic fracturing techniques are continuously refined to maximize production from unconventional reserves, a core focus for Gulfport. These advancements are not just about efficiency; they are crucial for unlocking the full potential of their acreage. The company's commitment to adopting cutting-edge completion technologies is reflected in their improved production per well in their key operating regions throughout 2024.

Data analytics and AI are revolutionizing oil and gas, with predictive maintenance and optimized reservoir management becoming standard. These tools enhance real-time monitoring and risk assessment, boosting efficiency and safety. For instance, in 2024, the global oil and gas AI market was valued at approximately $3.5 billion and is projected to grow significantly.

Gulfport Energy can leverage AI to analyze vast amounts of seismic data, leading to more informed drilling plans and improved resource extraction. This technological adoption is crucial for reducing operational costs, a key focus for energy companies navigating market fluctuations in 2024 and 2025.

New regulations and growing environmental pressures are driving the adoption of advanced technologies for methane emission detection and reduction. This includes implementing sophisticated sensors and comprehensive monitoring systems across operations. For instance, by the end of 2024, many energy companies are expected to have deployed advanced leak detection and repair (LDAR) programs, utilizing technologies like infrared cameras and continuous monitoring devices, to comply with evolving EPA standards.

Upgrades to equipment, such as replacing older pneumatic controllers with low-bleed or zero-bleed alternatives, are becoming essential to minimize leaks from wells, compressors, and other critical infrastructure. These investments are not only crucial for regulatory compliance but also for significantly improving a company's environmental performance and reducing operational losses, with some studies estimating that advanced leak detection can reduce methane emissions by up to 75%.

Digitalization and Automation

Gulfport Energy is increasingly leveraging broader digitalization efforts, including the Industrial Internet of Things (IIoT) and automation. These technologies are significantly enhancing operational efficiency and safety across its oil and gas value chain. For instance, the adoption of automated drilling rigs and advanced remote monitoring systems aims to minimize human error and bolster safety in inherently hazardous operational environments.

The integration of real-time data analytics through these digital solutions empowers better-informed decision-making. This trend is not merely about modernization; it's a critical imperative for Gulfport to maintain its competitive edge and ensure robust operational resilience in a dynamic market. By mid-2024, many oil and gas companies reported substantial investments in digital transformation, with IIoT adoption alone projected to grow significantly in the coming years, driven by the pursuit of cost reductions and enhanced productivity.

- IIoT Adoption: Expected to drive significant cost savings through predictive maintenance and optimized resource allocation.

- Automation Impact: Reduced downtime and improved safety metrics are key benefits observed across the industry.

- Remote Operations: Facilitates efficient oversight and management of dispersed assets, crucial for cost control.

- Data-Driven Decisions: Real-time insights from automated systems lead to faster and more accurate operational adjustments.

Carbon Capture, Utilization, and Storage (CCUS)

While Gulfport Energy's primary focus remains on oil and gas exploration and production (E&P), the accelerating energy transition and mounting Environmental, Social, and Governance (ESG) pressures are making Carbon Capture, Utilization, and Storage (CCUS) technologies increasingly relevant. These advancements, though not directly tied to Gulfport's current operational model, could present future strategic opportunities or shape regulatory landscapes impacting the broader energy sector.

The global CCUS market is projected for significant growth, with estimates suggesting it could reach hundreds of billions of dollars by 2030. For instance, the International Energy Agency (IEA) highlighted in its 2024 reports that CCUS projects are crucial for meeting climate targets, with a substantial increase in planned capacity. Gulfport's potential involvement or adaptation to policies influenced by CCUS development could be a key factor in its long-term sustainability and competitiveness.

- Growing CCUS Investment: Global investment in CCUS projects saw a notable uptick in 2023, with a pipeline of over 300 projects globally, representing a significant increase from previous years.

- Policy Influence: Government incentives and carbon pricing mechanisms, often driven by CCUS policy frameworks, are increasingly influencing operational decisions and investment in the E&P sector.

- Decarbonization Goals: Exploring or adopting CCUS solutions aligns with stated corporate decarbonization targets and investor expectations for environmental stewardship, potentially enhancing Gulfport's ESG profile.

Technological advancements in horizontal drilling and hydraulic fracturing continue to enhance Gulfport Energy's production efficiency and cost-effectiveness. By mid-2024, the company reported further optimization in well completion times, directly impacting its operational output and profitability. The increasing adoption of AI and data analytics across the oil and gas sector, valued at approximately $3.5 billion in 2024, is enabling predictive maintenance and improved reservoir management.

Digitalization, including Industrial Internet of Things (IIoT) and automation, is a key technological driver for Gulfport, boosting operational efficiency and safety. These technologies are crucial for real-time decision-making and maintaining a competitive edge. For instance, the global market for IIoT in oil and gas is experiencing rapid growth, with companies investing heavily to reduce downtime and enhance productivity.

Furthermore, evolving environmental regulations are pushing for technological solutions in methane emission detection and reduction. Gulfport's investment in advanced leak detection and repair (LDAR) programs, utilizing technologies like infrared cameras, is essential for compliance and environmental performance. The company is also exploring the potential of Carbon Capture, Utilization, and Storage (CCUS) technologies, a sector projected for significant growth, as part of its long-term sustainability strategy.

Legal factors

Gulfport Energy navigates a stringent environmental regulatory landscape, encompassing federal and state mandates for air emissions, water quality, and waste disposal. New EPA methane regulations, like the OOOOb/c rules finalized in May 2024, impose substantial compliance burdens on facilities in key operational regions such as Ohio.

Failure to adhere to these environmental standards can trigger significant financial penalties and protracted legal disputes, impacting operational continuity and profitability. For instance, the EPA's methane regulations aim to curb emissions from oil and natural gas facilities, a critical area for companies like Gulfport Energy.

Laws dictating land access, mineral rights, and the crucial drilling permits form the bedrock of Gulfport Energy's operational framework. Navigating this complex legal landscape is paramount for the company's success.

Securing and retaining the required permits is an intricate and often lengthy undertaking. This process can be significantly impacted by community resistance and evolving regulatory interpretations, as seen in various energy projects across the US in 2024 and early 2025.

Furthermore, disagreements concerning royalty interests and the broader spectrum of land usage frequently escalate into legal disputes, potentially creating significant operational and financial hurdles for Gulfport.

The oil and gas sector, including companies like Gulfport Energy, operates under stringent health and safety regulations, such as those mandated by OSHA. These rules are critical for ensuring worker well-being and preventing costly fines, with non-compliance carrying significant legal and financial repercussions. For instance, in 2023, OSHA reported over 5,000 workplace fatalities, underscoring the importance of adherence.

Corporate Governance and Shareholder Rights

Laws governing corporate governance, such as those dictating board composition and executive pay, directly influence Gulfport Energy's strategic and financial choices. Compliance with Securities and Exchange Commission (SEC) rules and stock exchange requirements for transparency is paramount for maintaining investor confidence and operational integrity.

Gulfport Energy's commitment to shareholder value, demonstrated through initiatives like share repurchases, reflects its alignment with robust corporate governance principles. For instance, as of the first quarter of 2024, Gulfport reported a significant increase in its free cash flow generation, allowing for continued capital allocation to shareholder returns, a key indicator of good governance in practice.

- Board Structure: Ensuring independent directors and diverse expertise on the board is a key governance tenet.

- Executive Compensation: Linking executive pay to performance metrics, including safety and environmental targets, is increasingly expected.

- Shareholder Rights: Protecting shareholder voting rights and providing clear channels for communication are fundamental.

- Transparency and Disclosure: Adherence to SEC reporting standards ensures all stakeholders have access to timely and accurate financial information.

Litigation and Legal Disputes

Gulfport Energy's operations are subject to potential litigation and legal disputes, posing significant risks. These can stem from environmental compliance issues, such as alleged violations of the Clean Air Act, or from disagreements regarding contractual terms with suppliers and partners. Regulatory bodies may also initiate enforcement actions, adding another layer of legal complexity.

The financial implications of these legal challenges can be substantial, including hefty fines, settlement costs, and potential judgments. For instance, environmental litigation can lead to remediation expenses and penalties. Beyond direct financial costs, adverse legal outcomes can severely damage Gulfport's reputation and disrupt its operational activities, impacting production and project timelines.

To mitigate these risks, Gulfport Energy must maintain a proactive and comprehensive legal risk management strategy. This includes rigorous contract review, diligent environmental monitoring, and prompt engagement with regulatory agencies. A strong legal defense posture and a commitment to compliance are critical for safeguarding the company's financial health and operational continuity.

- Environmental Lawsuits: Gulfport could face claims related to air emissions, water usage, or waste disposal, potentially incurring significant remediation costs and fines.

- Contractual Disputes: Disagreements with vendors, royalty owners, or joint venture partners can lead to costly arbitration or litigation.

- Regulatory Enforcement: Actions by agencies like the EPA or state environmental departments can result in penalties and operational restrictions.

- Reputational Damage: Publicly visible legal battles can erode stakeholder trust and negatively impact market perception.

Gulfport Energy operates under a complex web of environmental regulations, with new EPA methane rules like OOOOb/c, finalized in May 2024, significantly impacting compliance in regions like Ohio. Failure to meet these standards can result in substantial fines and legal challenges, affecting operational continuity.

Land access, mineral rights, and drilling permits are fundamental legal requirements, and securing these can be a lengthy process influenced by community sentiment and evolving regulations, as observed in various energy projects through early 2025. Disputes over royalties and land use can also lead to costly legal entanglements.

The company is also bound by stringent health and safety regulations, such as OSHA mandates, to protect workers and avoid penalties; OSHA reported over 5,000 workplace fatalities in 2023, highlighting the critical nature of compliance.

Corporate governance laws, including SEC and stock exchange requirements for transparency, are crucial for maintaining investor confidence and operational integrity. Gulfport's strong free cash flow generation in Q1 2024, enabling shareholder returns, reflects good governance practices.

Environmental factors

The oil and natural gas sector, including companies like Gulfport Energy, is inherently linked to greenhouse gas emissions, primarily methane and carbon dioxide. This reality places significant pressure on the industry as global and national attention to climate change intensifies.

This heightened focus translates directly into more stringent regulations and a growing demand for companies to actively reduce their carbon footprints. Gulfport Energy has acknowledged this by publishing sustainability reports detailing its commitment to emission reduction strategies.

Demonstrating progress, Gulfport reported a reduction in its Scope 1 methane intensity, a key metric for assessing emissions from direct operations. For example, in their 2023 sustainability report, they highlighted a methane intensity of 0.36% for their operated wells, down from previous periods.

Hydraulic fracturing, a core operation for Gulfport Energy, demands considerable water volumes. Effectively managing flowback and produced water presents a significant environmental challenge, directly influencing operational sustainability and cost structures.

Stringent regulations govern water sourcing, disposal, and recycling practices, shaping how companies like Gulfport conduct their business. These rules can impact everything from permitting to the ultimate cost of operations.

Gulfport Energy has made strides in water stewardship, notably reporting the reuse or recycling of a substantial portion of its produced water. For instance, in 2023, the company achieved an impressive 90% water recycling rate for its operations, underscoring a commitment to efficient water management and reducing its environmental footprint.

Gulfport Energy's exploration and production activities, such as building well pads and pipelines, inevitably lead to land disturbance and can fragment natural habitats. This is a significant environmental factor to consider.

Careful land management is crucial, especially in the specific shale plays where Gulfport operates. Minimizing their ecological footprint through smart well placement and effective site reclamation are key environmental strategies for the company.

Waste Management and Pollution Prevention

Gulfport Energy, like many energy producers, faces the environmental challenge of managing diverse waste streams generated from its operations. These include drilling fluids, produced water, and various forms of solid waste. Effective strategies are essential to handle these materials responsibly.

Compliance with stringent waste disposal regulations is paramount. Gulfport Energy must adhere to local, state, and federal rules to prevent environmental contamination and avoid significant regulatory penalties. Implementing robust pollution prevention measures is a core component of this compliance effort.

In 2023, the energy sector, in general, saw increased scrutiny on environmental practices. For instance, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Water Act, which impacts the discharge and management of produced water. While specific 2024/2025 Gulfport Energy data on waste streams is not yet fully disclosed for the entirety of those years, the company's 2023 sustainability reports indicated ongoing investments in waste minimization and treatment technologies. For example, they reported efforts to reduce landfill waste by a notable percentage compared to previous years through recycling and reuse programs.

Key considerations for Gulfport Energy's waste management and pollution prevention include:

- Minimizing drilling fluid waste through advanced recycling and treatment technologies.

- Ensuring compliant disposal or beneficial reuse of produced water, a significant byproduct of oil and gas extraction.

- Implementing comprehensive solid waste management programs focused on reduction, reuse, and recycling across all operational sites.

- Proactively monitoring and mitigating potential sources of air and water pollution stemming from waste handling and storage.

Biodiversity and Ecosystem Protection

Gulfport Energy's operations, particularly in regions like the Appalachian Basin, necessitate careful consideration of biodiversity and ecosystem protection. The company must actively work to minimize its footprint on local flora and fauna, especially in areas known for sensitive habitats. This commitment is crucial for maintaining environmental stewardship and ensuring the long-term sustainability of its energy production activities.

Responsible development involves rigorous adherence to environmental impact assessments (EIAs) and the implementation of effective mitigation strategies. For instance, in 2024, Gulfport Energy continued to focus on best practices for minimizing surface disturbance and managing water resources, which are vital for protecting aquatic ecosystems and terrestrial wildlife habitats. The company's efforts are guided by regulatory requirements and its own internal environmental policies.

- Habitat Protection: Implementing measures to safeguard critical habitats for endangered or threatened species within operational areas.

- Mitigation Strategies: Developing and executing plans to offset or reduce the environmental impact of drilling and infrastructure development.

- Regulatory Compliance: Ensuring all activities comply with federal and state regulations concerning biodiversity and ecosystem preservation, such as those overseen by the U.S. Fish and Wildlife Service.

Environmental factors significantly shape Gulfport Energy's operations, primarily through climate change concerns and water management. The company's commitment to reducing its carbon footprint is evident in its sustainability reports, which detail efforts to lower methane intensity. For example, Gulfport reported a methane intensity of 0.36% for its operated wells in 2023, a key metric demonstrating progress in emission control.

Water usage in hydraulic fracturing is another critical environmental consideration. Gulfport Energy actively pursues water recycling, achieving a 90% reuse rate for produced water in 2023, underscoring its dedication to efficient resource management and minimizing environmental impact.

Land disturbance and waste management are also key environmental challenges. Gulfport focuses on minimizing its ecological footprint through smart well placement and effective site reclamation, while also adhering to stringent waste disposal regulations and investing in waste minimization technologies.

Biodiversity protection is paramount, especially in operational areas like the Appalachian Basin. Gulfport Energy implements strategies to safeguard critical habitats and comply with regulations like the U.S. Fish and Wildlife Service's guidelines, ensuring responsible development practices.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Gulfport Energy is built on a robust foundation of data from government agencies like the EIA and EPA, alongside industry-specific reports from organizations such as the American Petroleum Institute. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.