Gulfport Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulfport Energy Bundle

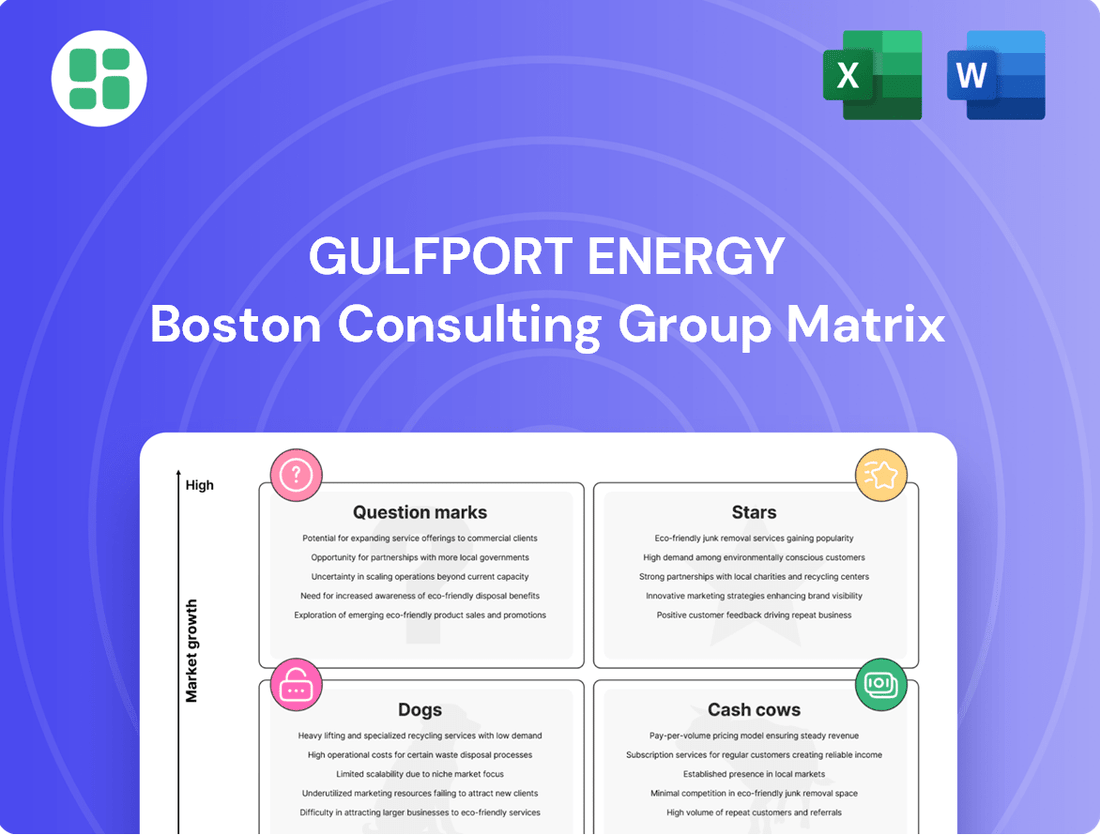

Curious about Gulfport Energy's strategic positioning? Our BCG Matrix preview hints at which segments are driving growth and which might need a closer look. Don't miss out on the full picture—unlock the complete BCG Matrix to understand their Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights for your own strategic planning.

Stars

Gulfport Energy is making a significant strategic move towards dry gas development in the Utica region. This focus is projected to drive a substantial 20% increase in their natural gas production by the end of 2025, when compared to the first quarter of that year.

This strategic pivot is well-timed, aligning with a positive outlook for the natural gas market in 2026. The company anticipates benefiting from rising commodity prices, making this a key growth area.

Operational enhancements in Ohio are fueling this expansion, evidenced by a notable 28% improvement in average daily drilling footage throughout 2024. This efficiency boost solidifies the Utica dry gas play as a high-growth, high-market-share segment for Gulfport Energy.

Gulfport Energy is projecting a significant increase in its net daily liquids production, aiming for a 30% jump by 2025 over 2024 levels, with a target of 18.0 to 20.5 MBbl per day.

This expansion is largely fueled by advanced flowback techniques in the SCOOP basin, a strategy designed to bolster profit margins and improve free cash flow. The company's second quarter 2025 performance already demonstrated this momentum, with a 26% sequential rise in liquids production, underscoring successful operational execution in this key growth area.

Gulfport Energy demonstrates exceptional leadership in operational efficiency, particularly evident in its Ohio drilling ventures. This focus has driven significant cost savings, with drilling and completion costs per lateral foot decreasing by approximately 35% from 2022 levels, projected to reach around $900 per foot for 2025.

This robust operational performance and strict cost management create a distinct competitive edge. It allows Gulfport to sustain a strong market position and profitability, even when oil and gas prices fluctuate unpredictably.

High-Quality Inventory Expansion

Gulfport Energy is strategically investing in expanding its high-quality inventory, particularly in the Utica Shale. The company has earmarked between $75 million and $100 million for discretionary acreage acquisitions in 2025. This focused investment aims to bolster its inventory of low-breakeven wells.

This expansion is projected to add more than two years to Gulfport's existing inventory runway. Such a move is critical for sustaining its long-term production capabilities and reinforcing its leadership in key unconventional resource plays. By prioritizing organic growth of its inventory, Gulfport is positioning itself for sustained high market share in these developing plays.

- Targeted Acquisitions: $75 million to $100 million allocated for 2025 discretionary acreage acquisitions.

- Strategic Focus: Expansion of high-quality, low-breakeven inventory in the Utica Shale.

- Inventory Runway Extension: Expected to add over two years to the company's inventory life.

- Market Position: Aims to solidify long-term production and leadership in key unconventional plays.

Strategic Capital Allocation for Growth

Gulfport Energy strategically directs capital towards enhancing its development program and portfolio, aiming for greater capital efficiency and robust corporate margins.

The company prioritizes investment in its core Utica and SCOOP assets. This focus, combined with its strong adjusted free cash flow generation, solidifies these regions as key areas for sustained capital allocation to preserve and expand their market leadership.

- Strategic Capital Allocation: Gulfport's strategy centers on optimizing its development program and asset portfolio to boost capital efficiencies and corporate margins.

- Core Asset Focus: The company is heavily investing in its foundational Utica and SCOOP assets.

- Cash Flow Generation: Gulfport's ability to generate substantial adjusted free cash flow supports its ongoing investment in these key operational areas.

- Market Position: Continued investment aims to maintain and grow the leading market positions of its Utica and SCOOP assets.

Gulfport Energy's strategic emphasis on dry gas in the Utica region, coupled with operational efficiencies, positions this segment as a Star in its BCG Matrix. The projected 20% increase in natural gas production by the end of 2025, compared to Q1 2025, and a 28% improvement in average daily drilling footage in 2024 highlight its high growth potential.

The company's aggressive expansion into dry gas development, expected to benefit from rising natural gas prices in 2026, further solidifies its Star status. This focus on a high-growth market, supported by strong operational execution and cost management, indicates a dominant market share in this segment.

| Segment | Growth Rate | Market Share | BCG Category |

|---|---|---|---|

| Utica Dry Gas | High (Projected 20% production increase by end of 2025) | High (Strong operational efficiencies and market focus) | Star |

| SCOOP Liquids | High (Projected 30% liquids production increase by 2025) | Moderate to High (Driven by advanced flowback techniques) | Question Mark / Star |

What is included in the product

This BCG Matrix overview for Gulfport Energy analyzes its business units based on market share and growth.

It provides strategic guidance on which segments to invest in, maintain, or divest.

A clear BCG Matrix visualizes Gulfport Energy's portfolio, alleviating the pain of complex strategic decision-making.

Cash Cows

Gulfport Energy's Utica and Marcellus natural gas production in Eastern Ohio are its undisputed cash cows. These regions are the backbone of the company's operations, contributing around 80% of its total output in 2024, primarily in the form of natural gas.

Despite potential fluctuations in the broader natural gas market, Gulfport's well-established presence in these mature basins ensures a steady and significant generation of cash flow. This consistent performance underscores their role as reliable profit drivers for the company.

Gulfport Energy's SCOOP Natural Gas and Liquids Production (Mature) segment, primarily in Oklahoma's Woodford and Springer plays, functions as a classic cash cow. These operations are the bedrock of its revenue, consistently generating reliable income.

While not as expansive as its Utica operations, the SCOOP assets are mature, meaning they leverage established infrastructure for cost-effective production. This efficiency translates into strong, consistent cash flow for Gulfport.

In 2024, Gulfport reported that its SCOOP assets continued to provide a significant and stable contribution to its overall production volumes, underpinning its financial stability. The focus here is on maximizing returns from existing, low-cost wells rather than aggressive expansion.

Gulfport Energy's core assets are performing exceptionally well, consistently producing substantial free cash flow. The company anticipates generating between $2.8 billion and $3.6 billion in adjusted free cash flow from 2025 through 2029, depending on commodity prices. This strong cash generation is a hallmark of mature, profitable operations.

Historically, Gulfport has returned a significant portion of this cash flow to shareholders, with 96-99% directed towards share repurchases. These established production streams are the engine driving shareholder returns and supporting broader corporate objectives.

Low Leverage and Strong Liquidity

Gulfport Energy demonstrates a robust financial footing, characterized by a prudent leverage ratio of roughly 0.85x. This conservative approach to debt management is further supported by significant liquidity, which stood at approximately $885 million as of the second quarter of 2025. This financial health is a direct result of its cash-generating assets, allowing for effective debt servicing and strategic capital deployment without undue reliance on external funding for day-to-day activities.

This financial stability is a hallmark of successful cash cow operations.

- Conservative Leverage: Gulfport Energy maintains a low debt-to-equity ratio, around 0.85x, indicating a strong capacity to meet its financial obligations.

- Substantial Liquidity: With approximately $885 million in liquidity as of Q2 2025, the company possesses ample resources to manage operations and pursue opportunities.

- Financial Flexibility: The combination of low leverage and high liquidity provides Gulfport with considerable freedom in allocating capital and weathering market fluctuations.

Optimized Per-Unit Operating Costs

Gulfport Energy's optimized per-unit operating costs are a key driver of its cash cow status. In the second quarter of 2025, the company reported per-unit operating costs of $1.22 per Mcfe. This figure reflects a sustained effort in cost discipline, showing improvements from previous periods.

These highly efficient operating costs, particularly within its core production regions, translate directly into robust profit margins for its mature assets. This efficiency solidifies these assets’ position as reliable cash generators for the company.

- Disciplined Operating Costs: Per-unit operating costs at $1.22 per Mcfe in Q2 2025.

- High Profit Margins: Low costs ensure strong profitability from mature assets.

- Cash Flow Maximization: Operational efficiency directly boosts cash flow from existing production.

Gulfport Energy's Utica and Marcellus natural gas production in Eastern Ohio, along with its SCOOP Natural Gas and Liquids Production in Oklahoma, are firmly established as its cash cows. These regions consistently generate substantial free cash flow, a testament to their mature and efficient operations. The company anticipates generating between $2.8 billion and $3.6 billion in adjusted free cash flow from 2025 through 2029, with a significant portion attributed to these core assets.

These cash cows are characterized by disciplined operating costs, with per-unit costs at $1.22 per Mcfe in Q2 2025, ensuring strong profit margins. This operational efficiency directly translates into robust cash generation, allowing Gulfport to maintain a conservative leverage ratio of approximately 0.85x and substantial liquidity of $885 million as of Q2 2025.

The company prioritizes returning this generated cash to shareholders, with 96-99% historically directed towards share repurchases, underscoring the reliable profitability of these mature production areas.

| Asset Segment | Primary Region | 2024 Production Contribution (Approx.) | Key Characteristic |

|---|---|---|---|

| Utica & Marcellus | Eastern Ohio | ~80% of Total Output | Mature, High-Volume Natural Gas Production |

| SCOOP Natural Gas and Liquids | Oklahoma (Woodford & Springer) | Significant & Stable Contribution | Mature, Cost-Effective Production |

| Financial Metric | |||

| Adjusted Free Cash Flow (2025-2029 Est.) | $2.8B - $3.6B | Driven by Cash Cow Assets | |

| Leverage Ratio (Approx.) | 0.85x | Conservative Debt Management | |

| Liquidity (Q2 2025) | $885 Million | Strong Financial Flexibility |

Preview = Final Product

Gulfport Energy BCG Matrix

The Gulfport Energy BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises—just a professionally designed, analysis-ready report ready for your strategic planning and decision-making.

Dogs

Gulfport Energy's strategic positioning within the SCOOP region, particularly concerning dry gas development, shows a noticeable de-emphasis. In the first quarter of 2025, the company reported spudding zero new wells and completing only two in the SCOOP, a stark contrast to previous periods and contributing to a year-over-year decrease in gas production from this specific area. This deliberate slowdown suggests that SCOOP dry gas plays are currently receiving less capital allocation, likely reflecting a strategic decision to prioritize areas offering more attractive returns or growth potential.

This reduced activity in the SCOOP dry gas segment indicates a lower priority rather than an outright divestiture. It signals that while the assets remain part of Gulfport's portfolio, they are not the primary focus for new investment. This strategic shift is common when companies re-evaluate their asset base to align with current market conditions and profitability metrics, favoring areas with stronger economic performance or strategic importance.

Non-core or marginal acreage for Gulfport Energy, while not explicitly defined in their BCG matrix, would encompass any legacy holdings that don't fit their current strategic emphasis on efficient development in their core Utica and SCOOP plays. These areas might exhibit lower production rates or higher operational expenses per barrel, potentially becoming liabilities if they drain resources without significant future upside.

Gulfport Energy, like many exploration and production companies, likely operates older wells that naturally see production decrease over time. These wells often demand more resources for upkeep to maintain their output levels.

If these declining wells are situated in regions with scarce new drilling prospects or present greater operational hurdles, they might yield very little in terms of net cash flow. Such assets can consume valuable capital and attention without making a substantial impact on the company's growth or profitability. For instance, in 2024, the average production decline rate for mature shale wells in the US can range from 15-25% annually, necessitating continuous investment in artificial lift and workovers.

Assets Impacted by Midstream Constraints

Gulfport Energy's second quarter 2025 production experienced a reduction of about 40 million cubic feet equivalent per day (MMcfe/d) due to unexpected disruptions in third-party midstream services. These midstream constraints can directly impact the profitability of Gulfport's assets.

Assets that are heavily reliant on specific midstream infrastructure that experiences frequent or prolonged outages can become less attractive. This is because the cost and reliability of getting their production to market are compromised.

- Production Impact: Approximately 40 MMcfe/d reduction in Q2 2025 due to midstream issues.

- Asset Competitiveness: Persistent third-party midstream outages can diminish the profitability and market competitiveness of otherwise strong assets.

- Potential for 'Dogs': Assets facing ongoing transportation infrastructure problems may be categorized as 'dogs' until these issues are resolved or alternative market access is secured.

Lower Priority Capital Expenditures

In Gulfport Energy's strategic framework, areas or projects receiving minimal capital allocation, especially those not directly supporting growth in liquids or high-return dry gas in the Utica region, can be viewed as 'dogs' from an investment perspective. These are essentially the segments that are not prioritized for future funding.

Gulfport's capital expenditure guidance for 2025 clearly illustrates this prioritization. The company plans to allocate approximately 83% of its capital to Utica/Marcellus development. Another 10% is earmarked for SCOOP, and the remaining 7% is designated for land-related activities. This breakdown highlights where the company sees the most significant opportunities for growth and return.

- Strategic Focus: The substantial allocation to Utica/Marcellus development (83% in 2025 guidance) signals this as the core growth engine for Gulfport Energy.

- Secondary Investment: SCOOP receives a notable, though smaller, portion of capital (10% in 2025 guidance), indicating it's a secondary area of focus.

- Lower Priority Areas: The 7% allocated to land suggests that other operational areas, not directly tied to the primary development or SCOOP, receive considerably less capital, fitting the description of 'dogs' in terms of future investment potential.

- Implicit Underinvestment: By concentrating capital on specific assets, Gulfport implicitly de-prioritizes other ventures, which may see minimal or no new capital expenditure, thus classifying them as lower priority.

Gulfport Energy's 'dogs' in the BCG matrix likely represent assets with low growth prospects and potentially low market share or profitability. These are areas receiving minimal capital investment, such as legacy wells with declining production or acreage facing operational challenges. For instance, the company's limited activity in the SCOOP dry gas region in early 2025, with zero new wells spudded, suggests this segment is not a growth driver.

The 2025 capital allocation further clarifies this, with only 10% directed to SCOOP and 7% to land activities, while 83% is focused on Utica/Marcellus. This stark difference in investment highlights the de-prioritization of other operational areas. Assets experiencing midstream disruptions, like the 40 MMcfe/d reduction in Q2 2025, could also fall into this category if these issues persist, impacting their overall viability.

| BCG Category | Gulfport Energy Asset Example | Rationale |

| Dogs | SCOOP Dry Gas Assets (limited activity) | Low growth, minimal capital allocation (0 wells spudded Q1 2025). |

| Dogs | Legacy Wells with Declining Production | High maintenance costs, low net cash flow, potential for production decline rates of 15-25% annually in 2024. |

| Dogs | Assets reliant on problematic midstream infrastructure | Production disruptions (e.g., 40 MMcfe/d reduction in Q2 2025) impact profitability and market access. |

Question Marks

Gulfport Energy is earmarking $75 to $100 million for discretionary acreage acquisitions, with a focus on the Utica Shale. This strategic move aims to bolster their inventory and extend their operational runway.

These acquisitions are positioned as future growth engines, currently characterized by minimal production and market share. However, they hold substantial potential for high growth if development proves successful.

Converting these newly acquired, low-production assets into profitable, high-market-share contributors will necessitate significant investment and successful exploration efforts from Gulfport.

Gulfport Energy's SCOOP operations are showing a notable increase in liquids production, with a 26% jump reported in Q2 2025. This growth is attributed to optimized flowback techniques in their liquids-rich SCOOP basin areas.

However, this new liquids-rich delineation could be considered a question mark for Gulfport. It may represent newer, less proven drilling targets within the SCOOP that necessitate ongoing investment to fully establish their potential and capture significant market share in the competitive liquids market.

Gulfport Energy's 2025 strategy signals a shift in the Marcellus, moving from exploring new areas to actively developing existing ones. This transition is crucial for solidifying their position in this significant shale play.

A key element of this shift is the deferral of a four-well Marcellus pad to 2026, indicating a careful approach to capital allocation and a focus on optimizing development timelines. This strategic adjustment suggests that while the Marcellus holds immense potential, Gulfport is prioritizing execution and efficiency.

The Marcellus, being a major shale play, presents both opportunities and challenges. Gulfport's investment here could be viewed as a question mark, as continued capital commitment and successful drilling and completion operations are necessary to achieve a strong market presence and predictable earnings.

Exploration in Underexplored Zones

Gulfport Energy's exploration in underexplored zones would represent potential "Question Marks" in a BCG Matrix analysis. These are ventures with low current market share but high growth potential, often involving significant risk and investment. For example, any ongoing seismic studies or pilot drilling in less conventional formations within their existing Appalachian Basin acreage, or even initial acreage acquisition in a new, promising geological basin, would fit this description. The success of these endeavors is uncertain, but if commercially viable, they could significantly expand Gulfport's market position.

These high-risk, high-reward plays are crucial for long-term growth. Gulfport's 2024 capital expenditure plans, for instance, might allocate a portion to such exploratory activities. While specific figures for underexplored zone exploration aren't always broken out, a significant portion of an energy company's R&D and exploration budget typically targets these frontier areas. The market share in these zones is effectively zero until a discovery is proven and production commences, making them inherently uncertain but potentially transformative.

- High Risk, High Reward: Ventures into new geological formations or less conventional resource plays carry substantial upfront costs and a higher probability of failure, yet promise significant returns if successful.

- Uncertain Market Share: Until commercial viability is established through successful drilling and production, the market share in these zones remains undefined.

- Strategic Importance: These explorations are vital for identifying future growth engines and diversifying the company's asset base beyond its current core production areas.

- 2024 Focus: Companies like Gulfport often dedicate a percentage of their annual capital budget to these speculative, yet potentially high-impact, exploration activities to secure future reserves.

Technological Enhancements for Future Productivity

Gulfport Energy's "question mark" initiatives would focus on technologies promising significant future productivity boosts but carrying higher risk. These include investments in advanced well designs, perhaps incorporating novel horizontal drilling techniques or multi-lateral completions, and exploring enhanced oil recovery (EOR) methods that are still in development. For instance, Gulfport might allocate capital towards pilot projects for novel chemical EOR applications or advanced seismic imaging for better reservoir characterization, aiming to unlock previously uneconomical reserves.

These ventures, while not yet proven profit centers, represent strategic bets on future operational efficiency and reserve growth. The company's commitment to exploring these cutting-edge technologies, even with their inherent uncertainties, signals a forward-looking approach to maintaining a competitive edge. For example, a company like Gulfport might have invested in early-stage research for CO2-EOR in 2024, a technology with long-term potential but significant upfront research and infrastructure costs.

- Advanced Well Designs: Exploring novel lateral lengths and multi-stage fracturing techniques to maximize reservoir contact.

- Enhanced Oil Recovery (EOR): Piloting emerging EOR methods like advanced chemical injection or microbial EOR.

- Digital Twin Technology: Developing sophisticated digital replicas of wells and reservoirs for predictive maintenance and optimization.

- Carbon Capture Utilization and Storage (CCUS): Investigating the integration of CCUS technologies for potential future regulatory compliance and operational synergies.

Gulfport Energy's strategic acquisitions in the Utica Shale, totaling $75 to $100 million, represent potential question marks. These assets currently have minimal production and market share but offer significant high-growth prospects if development is successful.

Similarly, the increased liquids production in their SCOOP operations, up 26% in Q2 2025, could be viewed as a question mark. These less proven, liquids-rich targets require ongoing investment to fully establish their potential and capture market share.

The company's shift in the Marcellus, focusing on developing existing areas rather than exploring new ones, also presents a question mark. Continued capital commitment and successful operations are crucial for solidifying their position and achieving predictable earnings in this significant play.

Gulfport's exploration in underexplored zones, such as new geological basins or less conventional formations, are classic question marks. These ventures have low current market share but high growth potential, carrying significant risk and investment, with success uncertain but potentially transformative.

| Initiative | Current Market Share | Growth Potential | Risk Level | Investment Focus |

| Utica Shale Acquisitions | Low | High | Medium | Discretionary Capital |

| SCOOP Liquids Growth | Developing | High | Medium | Optimized Operations |

| Marcellus Development | Established | Moderate | Low | Capital Allocation |

| Underexplored Zones | Negligible | Very High | High | Exploration Budget |

BCG Matrix Data Sources

Our Gulfport Energy BCG Matrix leverages comprehensive data from SEC filings, industry analyst reports, and internal operational metrics. This ensures a robust analysis of market share and growth potential.