Gulfport Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulfport Energy Bundle

Unlock the strategic blueprint of Gulfport Energy's operations with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their competitive advantage.

Dive deeper into how Gulfport Energy creates, delivers, and captures value across its entire business. This downloadable canvas provides actionable insights into their core activities and cost structure, perfect for strategic analysis.

See the full picture of Gulfport Energy's business model and gain a competitive edge. Our complete canvas details their value propositions and channels, empowering you with proven strategies for your own ventures.

Partnerships

Gulfport Energy relies heavily on midstream companies to manage the crucial steps of gathering, processing, and transporting its natural gas, crude oil, and natural gas liquids. These partnerships are essential for getting its production from the wellhead all the way to market.

The efficiency and reliability of these midstream partners directly impact Gulfport's ability to deliver its products. For instance, any disruptions or limitations with these third-party services can affect Gulfport's overall production and sales.

In 2024, the energy sector has seen continued investment in midstream infrastructure, aiming to alleviate bottlenecks and improve takeaway capacity. Gulfport's success is therefore intertwined with the operational performance and strategic investments of its midstream partners.

Gulfport Energy partners with specialized drilling and completion service providers to execute complex operations. These collaborations are crucial for accessing cutting-edge technology and industry expertise, directly impacting operational efficiency and cost-effectiveness.

These partnerships allow Gulfport to benefit from advancements in drilling techniques and completion methodologies. For instance, in 2024, the company reported significant improvements in average drilling footage per day and sustained continuous pumping hours on well pads, underscoring the value derived from these service provider relationships.

Gulfport Energy's business model hinges on securing access to vital energy resources through agreements with landowners and royalty owners. These partnerships are crucial for accessing key unconventional plays like the Utica Shale in Ohio and the SCOOP Woodford and Springer plays in Oklahoma. In 2024, Gulfport continued to foster these relationships, which are built on leasehold agreements and the payment of royalties, forming the bedrock of the company's asset base.

These crucial relationships extend beyond mere contractual obligations; Gulfport actively integrates into the local economic fabric by engaging with communities and distributing substantial royalties. This approach ensures that the company not only operates within these regions but also contributes to their economic well-being, fostering a mutually beneficial environment for resource development.

Financial Institutions

Gulfport Energy relies on financial institutions for crucial debt financing, including its revolving credit facilities. These partnerships are vital for maintaining operational liquidity and funding strategic growth. For instance, in early 2024, Gulfport's borrowing base under its revolving credit facility was reaffirmed, underscoring the strength of these lender relationships.

These financial collaborations enable Gulfport to execute its capital allocation plans. This includes returning value to shareholders through programs like share repurchases and managing its capital structure by redeeming preferred equity. The stability provided by these institutions is a cornerstone of Gulfport's financial strategy.

- Revolving Credit Facilities: Essential for day-to-day liquidity and operational needs.

- Debt Financing: Provides capital for strategic initiatives and growth opportunities.

- Strong Lender Relationships: Demonstrated by reaffirmed borrowing base in early 2024.

- Capital Allocation Support: Facilitates share repurchases and preferred equity redemptions.

Regulatory Bodies and Industry Associations

Gulfport Energy actively collaborates with regulatory bodies like the Environmental Protection Agency (EPA) and state-level agencies to ensure strict adherence to environmental, health, and safety (EHS) regulations. This commitment is vital for maintaining operational integrity and social license. For instance, in 2024, the company reported zero major environmental incidents, underscoring its focus on compliance.

Participation in industry associations, such as the American Petroleum Institute (API) and the Independent Petroleum Association of America (IPAA), allows Gulfport Energy to contribute to the development of industry best practices and advocate for policies supporting the natural gas and oil sector. These engagements help shape a favorable operating environment and promote responsible resource development.

- Regulatory Compliance: Gulfport Energy prioritizes meeting all federal, state, and local environmental regulations.

- Industry Best Practices: Active involvement in associations aids in adopting and promoting industry-wide standards.

- Advocacy: The company supports initiatives that foster a stable and responsible energy sector.

- Environmental Stewardship: Engagement reinforces Gulfport's dedication to sustainable and safe operations.

Gulfport Energy's key partnerships extend to financial institutions, which are critical for its liquidity and strategic growth. These include lenders providing revolving credit facilities, essential for day-to-day operations. The company also relies on debt financing to fund significant capital allocation plans, such as share repurchases and preferred equity redemptions.

In early 2024, Gulfport's revolving credit facility borrowing base was reaffirmed, highlighting the strength of its lender relationships. These financial partnerships are fundamental to Gulfport's ability to manage its capital structure and pursue growth opportunities effectively.

Gulfport Energy also partners with specialized service providers for drilling and completion, which is vital for operational efficiency. For example, in 2024, the company reported enhanced drilling footage per day and sustained continuous pumping hours, demonstrating the value of these collaborations.

Furthermore, Gulfport's business model is built on securing access to resources through agreements with landowners and royalty owners. These relationships, established via leasehold agreements and royalty payments, are the foundation of its asset base, particularly in key plays like the Utica Shale and Oklahoma's SCOOP Woodford and Springer. These partnerships also foster community engagement and economic contribution through royalty distributions.

| Partnership Type | Key Function | 2024 Impact/Data | Strategic Importance |

| Midstream Companies | Gathering, processing, and transportation | Continued investment in infrastructure to improve takeaway capacity | Ensures efficient delivery of production to market |

| Drilling & Completion Service Providers | Executing complex operations, providing technology and expertise | Reported improvements in drilling footage per day | Enhances operational efficiency and cost-effectiveness |

| Landowners & Royalty Owners | Access to key unconventional plays | Fostered relationships through leasehold agreements and royalties | Forms the bedrock of the company's asset base |

| Financial Institutions | Debt financing, revolving credit facilities | Reaffirmed borrowing base in early 2024 | Maintains operational liquidity and funds strategic growth |

| Regulatory Bodies & Industry Associations | Ensuring EHS compliance, developing best practices | Reported zero major environmental incidents in 2024 | Maintains operational integrity and social license |

What is included in the product

Gulfport Energy's Business Model Canvas focuses on efficient exploration and production of natural gas and oil in key U.S. basins, leveraging strategic asset acquisition and operational expertise to deliver value to shareholders.

Gulfport Energy's Business Model Canvas acts as a pain point reliever by providing a structured, visual roadmap to navigate the complexities of the oil and gas industry, allowing for focused problem-solving and strategic adjustments.

Activities

Gulfport Energy's core activities revolve around finding and developing oil and gas reserves. This involves a deep dive into geological data and securing the rights to drill in promising areas.

The company concentrates its efforts on specific, high-potential unconventional resource plays. These are primarily the Utica Shale in Ohio and the SCOOP Woodford and SCOOP Springer plays located in Oklahoma.

In 2024, Gulfport Energy continued to focus on optimizing production from these key assets. The company's strategy emphasizes efficient development and maximizing the value of its existing acreage.

Gulfport Energy's core activities center on the efficient drilling of new wells and the execution of robust completion programs. This is crucial for bringing new production online swiftly and cost-effectively.

The company has demonstrated impressive operational advancements, including achieving record drilling footage per day and all-time high completion efficiencies. For instance, in the first quarter of 2024, Gulfport reported significant improvements in their lateral lengths and overall drilling times across their Utica and SCOOP/STACK assets.

These operational efficiencies directly translate into reduced capital expenditures per well and a faster return on investment, enhancing Gulfport's overall capital efficiency and competitive positioning in the energy market.

Gulfport Energy's core operations revolve around the meticulous management and optimization of its existing well and asset portfolio. This ongoing effort involves constant monitoring of well performance, implementing advanced techniques to boost hydrocarbon recovery, and ensuring the reliable upkeep of all field infrastructure.

A significant aspect of this activity is Gulfport's strategic approach to its production mix. While the company remains fundamentally a natural gas producer, it has outlined plans to strategically increase its output of liquids, aiming for a more diversified revenue stream. This focus on optimizing production, particularly in the Utica and SCOOP plays, is crucial for maximizing returns from its asset base.

Capital Allocation and Shareholder Returns

Gulfport Energy strategically allocates capital with a sharp focus on initiatives that enhance shareholder value. This disciplined approach underpins their operational and financial strategy.

The company has established a robust framework to return substantially all of its adjusted free cash flow to shareholders. This commitment is primarily executed through the repurchase of common stock and the redemption of preferred equity, directly benefiting investors.

- Capital Allocation Focus: Investments are prioritized to drive shareholder value.

- Free Cash Flow Return: Aims to return substantially all adjusted free cash flow to shareholders.

- Shareholder Return Methods: Primarily utilizes common stock repurchases and preferred equity redemption.

- Commitment to Investors: Demonstrates a strong dedication to maximizing investor returns through these actions.

Regulatory Compliance and ESG Initiatives

Gulfport Energy actively engages in regulatory compliance and Environmental, Social, and Governance (ESG) initiatives as core operational activities. This includes meticulous adherence to all applicable environmental laws, stringent safety protocols, and robust governance frameworks. For instance, in 2024, Gulfport continued its commitment to transparent reporting, releasing its annual sustainability report detailing progress in reducing greenhouse gas emissions and enhancing operational safety.

These efforts are crucial for maintaining Gulfport's social license to operate and fostering trust with stakeholders. The company's sustainability reports, such as the one published in early 2024, showcase specific actions taken to minimize environmental impact, invest in local communities, and champion environmental stewardship across its operations. This proactive approach underscores a dedication to responsible energy development.

- Regulatory Adherence: Ensuring compliance with all federal, state, and local environmental and safety regulations is a paramount daily activity.

- ESG Reporting: Publishing comprehensive sustainability reports, like the 2024 edition, to communicate environmental performance, community engagement, and governance practices.

- Environmental Stewardship: Implementing initiatives aimed at reducing emissions, conserving water, and managing waste responsibly throughout the production lifecycle.

- Community Investment: Allocating resources and developing programs to support the economic and social well-being of the communities where Gulfport operates.

Gulfport Energy's key activities are focused on the efficient exploration, development, and production of oil and natural gas reserves, primarily in the Utica Shale in Ohio and the SCOOP plays in Oklahoma. The company emphasizes optimizing production from these core assets through advanced drilling and completion techniques, aiming to maximize value and capital efficiency. In 2024, Gulfport continued to showcase operational improvements, including enhanced lateral lengths and reduced drilling times, which directly contribute to lower per-well capital expenditures and faster investment returns.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Exploration & Development | Identifying and securing rights to oil and gas reserves in key unconventional plays. | Continued focus on Utica, SCOOP Woodford, and SCOOP Springer plays. |

| Production Optimization | Maximizing output and value from existing wells and acreage through advanced techniques. | Emphasis on efficient drilling and completion programs; strategic increase in liquids output. |

| Capital Allocation & Shareholder Returns | Disciplined investment to drive shareholder value, returning free cash flow. | Substantially all adjusted free cash flow returned via stock repurchases and preferred equity redemption. |

| ESG & Regulatory Compliance | Adhering to environmental laws, safety protocols, and robust governance frameworks. | Continued transparent ESG reporting, focusing on emission reduction and operational safety, as highlighted in their 2024 sustainability report. |

Preview Before You Purchase

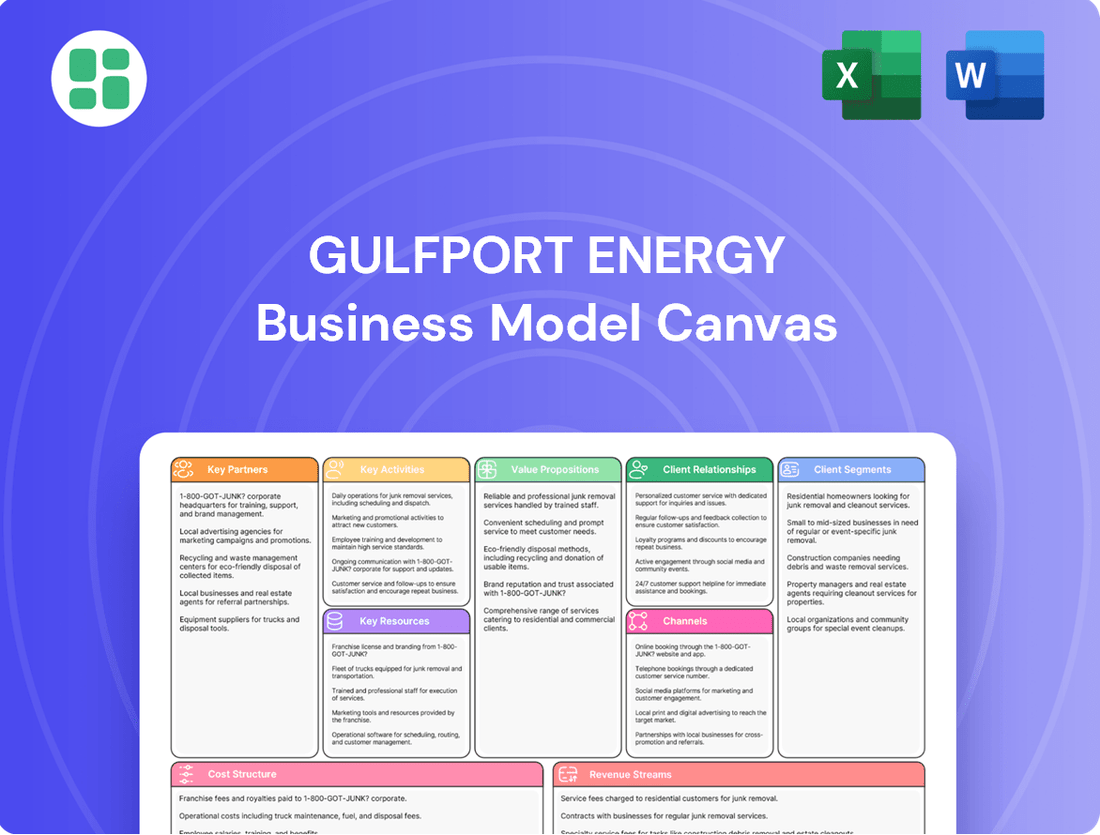

Business Model Canvas

The Business Model Canvas for Gulfport Energy that you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will download this identical, ready-to-use document, providing a complete overview of Gulfport Energy's strategic framework.

Resources

Gulfport Energy's most critical assets are its vast oil and natural gas reserves, both proven and unproven. These reserves are strategically located in key shale formations, primarily the Utica Shale in Ohio and the SCOOP Woodford and Springer plays in Oklahoma. This concentration forms the bedrock of the company's operational capacity and future production potential.

As of the end of 2024, Gulfport Energy held a substantial 4.0 trillion cubic feet equivalent (Tcfe) in total proved reserves. This significant reserve base underpins the company's ability to generate consistent production and cash flows, making it a cornerstone of its business model.

Gulfport Energy's strategic land and leaseholdings are a cornerstone of its business, providing access to vast reserves. As of late 2023, the company controlled approximately 228,500 net reservoir acres in the prolific Utica and Marcellus Shales, alongside about 73,000 net reservoir acres in the Anadarko Basin's SCOOP play.

These extensive, strategically positioned leaseholdings are crucial for Gulfport's long-term development plans, ensuring a robust inventory of drilling locations. This land base directly supports the company's operational runway, allowing for sustained activity and efficient resource extraction over many years.

Maintaining and expanding this land position is a recurring capital expenditure for Gulfport, underscoring its vital importance. The ongoing investment in leasehold and land management reflects the commitment to securing and preserving access to these valuable hydrocarbon resources for future production.

Gulfport Energy's business model heavily relies on advanced drilling and completion technologies, ensuring efficient and cost-effective resource extraction. This includes access to state-of-the-art drilling rigs and specialized completion equipment.

The company has seen tangible benefits, reporting a 15% reduction in average drilling time per well and a 10% improvement in completion efficiency in 2024 through these technological advancements.

This technological superiority allows Gulfport to maximize recovery rates from complex unconventional formations, directly impacting their operational performance and profitability.

Financial Capital and Liquidity

Gulfport Energy's financial capital and liquidity are foundational to its business model, enabling robust operations and strategic growth initiatives. This includes not only cash on hand but also the ability to tap into credit lines and capital markets when needed.

As of June 30, 2025, Gulfport demonstrated significant financial strength with approximately $884.9 million in total liquidity. This substantial figure is comprised of both its cash reserves and its available borrowing capacity, providing a strong buffer for various financial needs.

This financial flexibility is critical for several key aspects of Gulfport’s operations:

- Funding Capital Expenditures: The company can confidently invest in necessary equipment, infrastructure, and exploration activities to maintain and expand its production capabilities.

- Debt Management: Robust liquidity allows Gulfport to effectively manage its existing debt obligations, including timely interest payments and principal repayments, thereby maintaining a healthy balance sheet.

- Shareholder Returns: The financial resources available support Gulfport's ability to implement and sustain shareholder return programs, such as dividends or share buybacks, enhancing investor value.

Skilled Human Capital

Gulfport Energy's skilled human capital is a cornerstone of its operations, encompassing geologists, engineers, field operators, and corporate management. This expertise is vital for navigating the complexities of unconventional resource development. For instance, in 2023, Gulfport reported a total of 757 employees, a testament to the human resources driving their operations.

The company's success hinges on this workforce's proficiency in operational execution and strategic planning. Their collective knowledge directly influences Gulfport's ability to optimize production and adapt to market dynamics. This human capital is the engine behind their operational efficiencies and strategic pivots.

- Expertise in Unconventional Resources: The team's deep understanding of shale plays like the Utica and SCOOP/STACK formations is crucial for efficient extraction and development.

- Operational Excellence: Skilled field operators ensure safe and productive day-to-day activities, minimizing downtime and maximizing output.

- Strategic Acumen: Corporate management's ability to make informed decisions regarding exploration, hedging, and capital allocation is paramount.

Gulfport Energy's key resources are its substantial oil and natural gas reserves, strategically located in the Utica Shale and Oklahoma's SCOOP and Springer plays. These reserves, totaling 4.0 Tcfe proved reserves as of year-end 2024, form the foundation for its production and cash flow generation. The company also possesses extensive land and leaseholdings, covering approximately 228,500 net reservoir acres in the Utica/Marcellus and 73,000 net reservoir acres in the SCOOP, ensuring a long development runway.

Technological advancements in drilling and completion are critical, leading to a 15% reduction in drilling time and a 10% improvement in completion efficiency in 2024. Financial capital, evidenced by $884.9 million in total liquidity as of June 30, 2025, supports capital expenditures, debt management, and shareholder returns. Finally, Gulfport's 757 employees in 2023, comprising skilled geologists, engineers, and operators, are vital for operational execution and strategic decision-making in unconventional resource development.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Reserves | Proven and unproven oil and natural gas reserves | 4.0 Tcfe proved reserves (end of 2024) |

| Land & Leaseholdings | Strategic acreage in key shale formations | ~228,500 net acres (Utica/Marcellus), ~73,000 net acres (SCOOP) (late 2023) |

| Technology | Advanced drilling and completion techniques | 15% reduction in drilling time, 10% completion efficiency improvement (2024) |

| Financial Capital | Cash reserves and borrowing capacity | $884.9 million total liquidity (June 30, 2025) |

| Human Capital | Skilled workforce in geology, engineering, and operations | 757 employees (2023) |

Value Propositions

Gulfport Energy prioritizes shareholder value creation by efficiently developing its energy assets, aiming to deliver substantial returns. This focus is evident in their strategy to return nearly all adjusted free cash flow to shareholders.

In 2024, Gulfport Energy demonstrated this commitment through significant share repurchases and the redemption of preferred equity. These actions are designed to boost per-share metrics and ultimately increase total shareholder returns.

Gulfport Energy offers reliable supplies of natural gas, natural gas liquids, and crude oil. Their operations are designed to be highly efficient and environmentally conscious, reflecting a commitment to responsible energy production. This focus on sustainability is increasingly important as demand for cleaner energy sources grows.

The company places a strong emphasis on minimizing its environmental footprint and upholding rigorous safety standards across all its activities. For instance, in 2023, Gulfport reported a significant reduction in its greenhouse gas emissions intensity compared to previous years, demonstrating tangible progress in their environmental stewardship.

Gulfport Energy’s optimized production and resource development centers on maximizing output from its key Utica and SCOOP shale plays, ensuring a reliable hydrocarbon supply. This focus translates into consistent, strategic delivery for its customers.

The company prioritizes capital efficiencies, strategically shifting drilling activities to unlock the greatest long-term production and profitability. This adaptability allows Gulfport to respond to market dynamics.

In 2024, Gulfport continued to demonstrate this by adjusting its drilling plans, aiming to bolster future economic performance through prudent resource management and operational execution.

Operational Excellence and Cost Efficiency

Gulfport Energy drives value by relentlessly focusing on operational excellence and cost efficiencies within its drilling and completion processes. The company's dedication to improvement is evident in its enhanced drilling speeds and lower costs per lateral foot.

- Drilling Efficiency: In 2024, Gulfport reported significant advancements in drilling footage per day, demonstrating their commitment to faster and more productive operations.

- Cost Reductions: The company has achieved notable reductions in overall drilling and completion costs per lateral foot, directly boosting profitability.

- Financial Impact: These operational gains translate into stronger corporate margins and improved financial performance, enhancing shareholder value.

Strategic Portfolio Management

Gulfport Energy enhances its value by actively managing its asset portfolio. This includes making smart acquisitions of land and responding quickly to changes in the market. For instance, the company's strategic move to focus on dry gas development in the Utica shale, planned for late 2025, demonstrates its ability to adapt and seize opportunities in the energy sector.

This strategic portfolio management allows Gulfport to take advantage of shifts in commodity prices and fine-tune its development plans. By staying agile, the company can maximize the potential of its resources and ensure efficient operations, a key factor in achieving strong financial performance.

- Opportunistic Acreage Acquisitions: Gulfport actively seeks and acquires valuable land rights, enhancing its resource base.

- Dynamic Market Responsiveness: The company adjusts its strategy based on evolving commodity prices and market demand.

- Optimized Development Programs: Strategic management leads to more efficient and profitable resource extraction.

- Strategic Shift to Dry Gas Utica: A planned focus on dry gas in the Utica region by late 2025 highlights adaptability to market opportunities.

Gulfport Energy delivers substantial shareholder returns through efficient asset development and a commitment to returning nearly all adjusted free cash flow. This strategy was reinforced in 2024 with significant share repurchases and preferred equity redemptions, aimed at boosting per-share metrics and overall investor value.

The company provides reliable supplies of natural gas, NGLs, and crude oil, underpinned by efficient and environmentally conscious operations. Gulfport's dedication to sustainability is demonstrated by a notable reduction in greenhouse gas emissions intensity in 2023 compared to prior years.

Gulfport Energy maximizes value by focusing on operational excellence and cost efficiencies in drilling and completion, evidenced by improved drilling speeds and reduced costs per lateral foot. This focus directly enhances corporate margins and financial performance.

Value is further amplified through active asset portfolio management, including opportunistic acreage acquisitions and dynamic market responsiveness. A strategic shift towards dry gas development in the Utica shale by late 2025 exemplifies this adaptability.

| Key Performance Indicator | 2023 (Actual) | 2024 (Guidance/Early Results) |

|---|---|---|

| Net Production (Boe/d) | 215,000 - 225,000 | 215,000 - 225,000 |

| Adjusted Free Cash Flow ($M) | $1,000+ | $1,000 - $1,200 |

| GHG Emissions Intensity (kg CO2e/Mboe) | ~15% reduction vs. 2022 | Continued focus on reduction |

| Drilling Footage/Day | ~1,200 ft | ~1,300+ ft |

Customer Relationships

Gulfport Energy prioritizes investor relations and transparency, actively engaging with stakeholders through quarterly earnings calls and detailed financial reports. In 2024, the company continued its commitment to providing clear updates on operational performance and financial health, ensuring investors have the information needed for informed decisions.

The company’s investor presentations in 2024 offered comprehensive insights into its capital allocation strategies and future guidance. This proactive approach to communication builds trust and supports a diverse base of financial stakeholders, from individual investors to institutional portfolio managers.

Gulfport Energy actively cultivates robust relationships with local communities and landowners in its operational regions by making tangible investments in their economic and social betterment. This commitment is demonstrated through consistent royalty and tax payments, alongside dedicated environmental stewardship efforts. For instance, in 2023, Gulfport's operations contributed significantly to local economies through these direct payments and indirect job creation.

Gulfport Energy secures its revenue streams through long-term contractual sales relationships with buyers of its natural gas, crude oil, and natural gas liquids. These agreements are primarily with midstream companies and marketers, ensuring a consistent demand for its production and fostering revenue stability.

These contracts are crucial for Gulfport's operational predictability. For instance, in 2024, the company continued to leverage these agreements to provide a baseline for its sales, insulating it to a degree from immediate market volatility.

Furthermore, Gulfport actively employs commodity derivative contracts. These financial instruments help manage the inherent price fluctuations in the energy markets, directly impacting the value and predictability of its sales relationships and overall financial performance.

Shareholder Engagement and Returns

Gulfport Energy prioritizes shareholder engagement through robust capital return strategies. This includes a strong focus on share repurchase programs and the redemption of preferred equity, directly aiming to enhance shareholder value and reflect a commitment to investor returns.

- Aggressive Share Repurchases: Gulfport has actively bought back its own shares, reducing the number of outstanding shares and thereby increasing the ownership stake and potential earnings per share for remaining shareholders.

- Preferred Equity Redemptions: The company has also focused on redeeming its preferred equity, which can simplify its capital structure and potentially reduce future dividend obligations, freeing up cash flow.

- Commitment to Investor Returns: These actions underscore Gulfport's strategy of directly returning capital to its investors, demonstrating a clear focus on maximizing shareholder returns through tangible financial actions.

Regulatory and Industry Dialogue

Gulfport Energy actively engages with regulatory bodies to ensure compliance and shape industry standards. This proactive approach is vital in the dynamic energy sector. For instance, in 2024, Gulfport continued its commitment to environmental stewardship, aligning with evolving regulations.

- Regulatory Engagement: Gulfport maintains ongoing dialogue with federal, state, and local agencies, including the EPA and state-level environmental departments.

- Industry Participation: The company actively participates in industry associations like the American Petroleum Institute (API) and the Independent Petroleum Association of America (IPAA) to contribute to policy discussions and best practices.

- Sustainability Reporting: Gulfport’s 2024 sustainability reports detail progress on emission reduction targets, demonstrating transparency and commitment to responsible operations.

- Policy Influence: Through these engagements, Gulfport aims to influence policies that promote safe, efficient, and environmentally sound energy production.

Gulfport Energy fosters strong relationships with its investors through transparent communication, including quarterly earnings calls and detailed financial reports, ensuring stakeholders are well-informed about operational performance and financial health. The company's 2024 investor presentations highlighted its capital allocation strategies and forward-looking guidance, building trust with a diverse investor base.

Channels

Gulfport Energy's company website and investor relations portal are key communication channels, offering a wealth of information for stakeholders. These platforms host everything from press releases and SEC filings to quarterly financial results and investor presentations. For instance, as of the first quarter of 2024, Gulfport reported total production of 1,439 Mmcfe/d, highlighting operational performance directly on their site.

These digital assets are crucial for providing transparency and accessibility to a diverse audience, including individual investors, financial professionals, and business strategists. The investor relations section, in particular, is designed to be a comprehensive resource, featuring sustainability reports and other vital documents. This commitment to readily available data supports informed decision-making across the financial spectrum.

Gulfport Energy leverages quarterly earnings conference calls and webcasts as a primary channel to engage with the investment community. These sessions offer direct insights from management regarding operational performance and financial results.

During these calls, Gulfport provides crucial updates on its guidance, allowing analysts and investors to refine their valuations. For instance, in their Q1 2024 earnings call, the company discussed its strong production volumes and reiterated its commitment to capital discipline.

These events are indispensable for financial professionals and individual investors alike, offering a transparent platform for Q&A. This direct interaction helps stakeholders understand Gulfport's strategic direction and make informed investment decisions based on the latest data, such as the reported free cash flow generation for the period.

As a publicly traded entity, Gulfport Energy relies on SEC filings like the 10-K and 10-Q for transparent, legally required disclosures of its financial health and operational activities. These filings offer a deep dive into the company's performance, potential risks, and strategic direction, serving as crucial resources for financial analysts and researchers seeking to understand its market position.

Industry Conferences and Publications

Gulfport Energy leverages industry conferences and publications as key channels to communicate its value proposition and engage with the broader energy market. These platforms are crucial for showcasing operational achievements and strategic insights to a wide audience.

By actively participating in events like the North American Prospect Expo (NAPE) and being featured in publications such as the Oil & Gas Journal, Gulfport enhances its industry visibility. For instance, in 2024, Gulfport presented its operational advancements and resource potential at key industry gatherings, reinforcing its position as a significant player in the Appalachian Basin. This strategic engagement helps attract potential business partners and investors.

- Industry Conferences: Gulfport's presence at major energy summits allows for direct engagement with peers, investors, and potential partners, facilitating networking and business development opportunities.

- Energy Publications: Feature articles and company profiles in respected energy sector journals provide a platform to share operational successes, financial performance, and strategic outlook, thereby building credibility and market awareness.

- Market Engagement: These channels are vital for communicating Gulfport's commitment to efficient production and its role in meeting energy demands, contributing to brand recognition and investor confidence.

Financial News Outlets and Analyst Reports

Financial news outlets and independent analyst reports serve as vital conduits for Gulfport Energy, disseminating crucial information to a broad spectrum of stakeholders. These platforms translate complex company data into digestible insights, often including investment recommendations that influence market perception and investor decisions.

For instance, during 2024, Gulfport's operational updates and financial performance were frequently covered by major financial news providers, shaping how both individual investors and institutional analysts viewed the company's trajectory. These reports are instrumental in building credibility and facilitating informed investment choices.

- Market Reach: Financial news outlets like Bloomberg and Reuters provide extensive reach, ensuring Gulfport's narrative reaches a global audience of investors, analysts, and business strategists.

- Analyst Insights: Independent analyst reports from firms such as Evercore ISI or Goldman Sachs offer in-depth evaluations, often projecting future performance and providing valuation metrics, which are critical for decision-making. For example, in early 2024, several analysts reiterated Buy ratings on Gulfport, citing strong free cash flow generation.

- Perception Shaping: Consistent and positive coverage in these channels can significantly bolster Gulfport's market perception, influencing its stock price and its ability to attract capital for future growth initiatives.

- Data Accessibility: These outlets simplify complex financial data, making it more accessible for a wider range of investors, from novices to seasoned professionals, thereby democratizing access to key company information.

Gulfport Energy utilizes its corporate website and investor relations portal as primary digital channels for information dissemination. These platforms provide direct access to press releases, SEC filings, and financial reports, ensuring transparency for stakeholders. As of Q1 2024, Gulfport reported 1,439 Mmcfe/d of total production, a key metric readily available online.

Conference calls and webcasts are crucial for direct engagement, offering management insights into operational performance and financial results. These events allow for real-time Q&A, aiding financial professionals and investors in refining valuations. Gulfport reiterated its commitment to capital discipline during its Q1 2024 earnings call.

Industry conferences and publications serve to enhance Gulfport's market visibility and communicate its value proposition. Participation in events like NAPE and features in publications such as the Oil & Gas Journal highlight operational advancements. In 2024, Gulfport showcased its Appalachian Basin potential at key industry gatherings.

Financial news outlets and analyst reports are vital for shaping market perception and providing accessible insights. Coverage in 2024 by major financial providers influenced how investors viewed Gulfport's trajectory. For example, early 2024 saw multiple analysts reiterating Buy ratings, citing strong free cash flow.

| Channel | Purpose | Key Data/Activity (2024) |

| Website/Investor Relations | Information Hub, Transparency | Q1 2024 Production: 1,439 Mmcfe/d; SEC Filings (10-K, 10-Q) |

| Conference Calls/Webcasts | Direct Engagement, Management Insights | Q1 2024 Earnings Call: Reiteration of capital discipline, production updates |

| Industry Conferences/Publications | Market Visibility, Value Proposition | NAPE participation, Oil & Gas Journal features; Appalachian Basin potential showcase |

| Financial News/Analyst Reports | Market Perception, Accessibility | Multiple Buy ratings reiterated; Strong free cash flow cited |

Customer Segments

Gulfport Energy's natural gas and liquids purchasers are primarily utilities, industrial consumers, and commodity trading firms. These entities depend on Gulfport for a steady and dependable supply of natural gas, natural gas liquids (NGLs), and crude oil/condensate to fuel their operations and meet their own customer demands.

The company's production portfolio and its ability to deliver these resources are specifically designed to align with the consumption patterns and requirements of these diverse customer segments. For instance, in 2024, Gulfport's focus on the Utica Shale continued to provide a significant volume of natural gas, a key commodity for many utility and industrial customers.

Gulfport Energy serves a broad investor base, encompassing both large institutional players like mutual funds and pension plans, and individual retail investors. These customers are primarily driven by the prospect of financial gains, whether through the stock's price increasing or through dividends. For instance, as of early 2024, Gulfport's market capitalization reflects the collective investment of these diverse groups.

This segment places a high premium on clear and consistent financial reporting, along with evidence of solid operational execution within the energy sector. They also closely scrutinize the company's plans for deploying its capital, looking for strategies that promise to enhance shareholder value. Gulfport's stated commitment to returning capital to shareholders, a key element of its strategy, directly appeals to these financial motivations.

Landowners and mineral rights owners are a core customer segment for Gulfport Energy. These individuals and entities grant Gulfport access to the subsurface mineral estate in exchange for lease payments and royalties. In 2024, Gulfport's operational success directly hinges on their willingness to lease mineral rights, impacting the company's ability to secure new acreage and maintain existing production.

Ensuring fair and timely royalty payments is paramount for fostering trust and continued cooperation. For instance, in the Appalachian Basin, where Gulfport is a significant operator, efficient and transparent payment processes are key to maintaining positive landowner relations, which is crucial for long-term operational stability and growth.

Financial Analysts and Advisors

Financial analysts and advisors rely on Gulfport Energy for granular financial data and operational performance metrics to conduct thorough valuations and provide informed investment advice. They need access to detailed reports, production figures, and cost structures to assess the company's financial health and future prospects. For instance, understanding Gulfport's reserve replacement ratios and finding costs is crucial for their analysis.

Gulfport's investor relations team actively engages with this segment through quarterly earnings calls, investor presentations, and readily available SEC filings. These resources are vital for analysts to perform discounted cash flow (DCF) analyses and other valuation models. In 2024, Gulfport reported significant production volumes, which directly impacts the inputs for these financial models.

- Data Dependency: Analysts require detailed financial statements, production reports, and commodity price sensitivity analyses.

- Valuation Tools: They utilize DCF models, comparable company analysis, and precedent transactions, all of which depend on Gulfport's reported data.

- Strategic Insights: Advisors look for information on Gulfport's capital allocation strategies, hedging programs, and outlook on the natural gas market.

- 2024 Performance Indicators: Key figures like average daily production volumes and realized commodity prices are critical for their assessments.

Regulatory and Governmental Bodies

Regulatory and governmental bodies represent a crucial customer segment for Gulfport Energy. These entities, spanning federal, state, and local levels, are responsible for overseeing the company's operations to ensure compliance with environmental, safety, and operational standards. For instance, in 2024, Gulfport continued its focus on environmental stewardship, aligning with evolving EPA regulations regarding methane emissions.

Maintaining strong relationships and strict adherence to these regulatory frameworks are essential for Gulfport's ability to secure and maintain operating licenses in its primary producing basins, such as the Utica and SCOOP/STACK plays. In 2023, the company reported significant progress in its ESG initiatives, a key area of focus for regulators.

- Federal Oversight: Agencies like the Environmental Protection Agency (EPA) and the Bureau of Land Management (BLM) set broad operational and environmental standards.

- State-Level Regulation: State agencies, such as the Ohio Department of Natural Resources (ODNR) and the Oklahoma Corporation Commission, manage permitting, drilling, and production activities.

- Local Ordinances: Municipal and county governments may impose additional rules concerning land use, noise, and traffic related to drilling operations.

- Compliance Focus: Gulfport's 2024 operational strategy includes continued investment in technologies and practices that meet or exceed current and anticipated regulatory requirements.

Gulfport Energy's customer segments are diverse, ranging from industrial and utility companies purchasing natural gas and liquids to landowners providing access to mineral rights. Investors, both institutional and retail, are also key customers, driven by financial returns. Furthermore, financial analysts and regulatory bodies are crucial stakeholders who rely on Gulfport's data for valuations and oversight.

In 2024, Gulfport's operational focus on the Utica Shale directly supported utility and industrial consumers. The company's commitment to returning capital to shareholders through dividends and stock appreciation appeals to its investor base. Maintaining positive landowner relations through timely royalty payments remains critical for operational stability.

Financial analysts in 2024 closely examined Gulfport's production volumes and cost structures for their valuation models, particularly DCF analyses. Regulatory bodies, like the EPA and state agencies, oversee Gulfport's operations, emphasizing compliance with environmental and safety standards, with the company investing in technologies to meet these requirements.

Cost Structure

Gulfport Energy's cost structure is heavily influenced by its Drilling and Completion (D&C) capital expenditures. These significant investments cover the essential expenses for constructing new wells, including the necessary equipment, skilled labor, and materials for both the drilling phase and the crucial hydraulic fracturing process.

The company is strategically focused on optimizing these D&C costs. A key objective is to reduce the capital expenditure per foot of completed lateral. Gulfport Energy projected a notable efficiency gain, anticipating a reduction in D&C capital per foot by approximately 20% in 2025 when compared to the figures from 2024.

Lease Operating Expenses (LOE) are the day-to-day costs of keeping Gulfport Energy's wells and facilities running smoothly. This includes things like paying the people who work in the field, the electricity and water needed, and the regular upkeep to prevent bigger problems. For instance, in the second quarter of 2025, Gulfport reported that their per unit operating costs were $1.22 per thousand cubic feet equivalent (Mcfe), which is a positive sign of efficiency compared to earlier in the year.

General and Administrative (G&A) expenses at Gulfport Energy encompass corporate overhead, executive and administrative salaries, and office-related costs not directly tied to field operations. For instance, in 2024, managing these costs efficiently is crucial for profitability. An optimized G&A structure directly impacts the company's ability to generate positive cash flow.

Transportation and Marketing Costs

Gulfport Energy's cost structure includes significant expenses for transporting natural gas, oil, and natural gas liquids (NGLs) from their production sites to market. These costs encompass pipeline tariffs, gathering fees, and fees for marketing services that facilitate the sale of these commodities. For instance, in 2024, the company's focus on optimizing its midstream infrastructure and securing competitive transportation rates directly impacts its netback pricing and overall profitability.

These transportation and marketing expenses are not static; they fluctuate based on several factors. Key drivers include the availability of pipeline capacity, the distance to key market hubs, and prevailing commodity prices, which can influence the demand for transportation services. Gulfport's strategy involves actively managing these variables to secure the most advantageous terms.

- Transportation and Marketing Expenses: These are critical operational costs for Gulfport Energy, directly affecting the final price received for produced hydrocarbons.

- Factors Influencing Costs: Market access, pipeline availability, and commodity price volatility are key determinants of these expenses.

- Strategic Importance: Negotiating favorable transportation agreements is essential for maximizing netback pricing and maintaining competitive advantage in the energy market.

Interest Expense and Debt Servicing

As a significant user of debt financing, Gulfport Energy incurs substantial interest expenses on its outstanding borrowings. This includes costs associated with its senior notes and revolving credit facilities, representing a consistent outflow impacting profitability. For instance, during the first quarter of 2024, Gulfport reported $47 million in interest expense.

The company actively manages its debt structure to optimize these costs. A key action in 2024 was the redemption of its 2026 senior notes, a move designed to reduce future interest payments and financial risk. Simultaneously, Gulfport continues to manage its 2029 senior notes, indicating ongoing strategic financial planning.

- Interest Expense (Q1 2024): $47 million

- Debt Management Actions: Redemption of 2026 senior notes, ongoing management of 2029 senior notes.

- Impact on Cash Flow: Reduced interest payments enhance free cash flow available for reinvestment or shareholder returns.

Gulfport Energy's cost structure is a multifaceted element of its business model, directly impacting profitability and operational efficiency. Key components include significant capital expenditures for drilling and completion, ongoing lease operating expenses, general and administrative overhead, transportation and marketing costs, and substantial interest expenses on its debt. The company actively seeks to optimize these costs through strategic initiatives and efficient management.

| Cost Category | 2024 Focus/Data | 2025 Outlook/Data |

|---|---|---|

| Drilling & Completion (D&C) | Focus on efficiency gains. | Projected 20% reduction in D&C capital per foot vs. 2024. |

| Lease Operating Expenses (LOE) | Efficient management crucial for profitability. | Q2 2025: $1.22 per Mcfe (indicative of efficiency). |

| General & Administrative (G&A) | Optimizing overhead for positive cash flow. | Continued focus on lean operations. |

| Transportation & Marketing | Securing competitive rates, optimizing midstream. | Fluctuations based on capacity, distance, and commodity prices. |

| Interest Expense | Q1 2024: $47 million. Redemption of 2026 senior notes. | Ongoing management of 2029 senior notes to reduce future payments. |

Revenue Streams

Gulfport Energy's main way of making money is by selling the natural gas it produces. The company focuses heavily on natural gas, which makes up a large part of what they extract.

Revenues from these sales depend on how much natural gas they produce and the prices they get, which change based on what's happening in the market. For instance, in the first quarter of 2024, Gulfport reported that natural gas accounted for approximately 86% of their total production, highlighting its dominance as a revenue driver.

Gulfport Energy generates revenue through the sale of natural gas liquids (NGLs), which are extracted alongside natural gas, especially from their liquids-rich Utica and SCOOP shale plays. This stream is becoming increasingly important as the company focuses on expanding its liquids output.

The company is projecting a significant uptick in NGL sales, with an anticipated rise of over 30% in net daily liquids production for 2025 when compared to 2024 figures. This strategic shift highlights the growing contribution of NGLs to Gulfport's overall revenue.

Gulfport Energy's revenue is bolstered by the sale of crude oil and condensate, even though these represent a smaller portion of their overall production. In 2024, the company has been actively pursuing development strategies that prioritize liquids-rich acreage, aiming to leverage the typically higher market prices for crude oil and condensate. This strategic shift enhances their ability to capture greater value from their hydrocarbon output.

Commodity Derivative Gains

Gulfport Energy employs commodity derivative contracts to hedge against unpredictable swings in oil and natural gas prices. These contracts allow the company to lock in prices for a portion of its future output, thereby reducing financial risk.

Gains realized from these derivative positions can be a substantial revenue stream, particularly when market prices fall below the hedged levels. For instance, in the first quarter of 2024, Gulfport reported gains on commodity derivatives, contributing positively to its overall financial performance.

- Hedging Strategy: Gulfport uses derivatives to secure prices for future production, offering a buffer against market volatility.

- Revenue Stabilization: Derivative gains can offset potential losses from lower commodity prices, providing more predictable revenue.

- Q1 2024 Performance: The company experienced positive contributions from its commodity derivative activities during the initial months of 2024.

Other Operating Income

Other Operating Income for Gulfport Energy encompasses a range of smaller revenue sources that supplement its primary hydrocarbon sales. These can include reimbursements from joint venture partners for specific operational costs or fees charged for services rendered. For instance, in 2024, Gulfport Energy reported miscellaneous income that, while not a primary driver, added to its overall financial resilience.

These ancillary revenue streams, though often less significant than revenue from oil and gas production, play a role in enhancing Gulfport's financial performance. They demonstrate the company's ability to leverage its operational infrastructure and expertise to generate additional value. This flexibility allows Gulfport to capture opportunities for income generation beyond its core business.

Examples of such income can include:

- Reimbursements: Recoveries from third parties for shared operational expenses.

- Service Fees: Charges for providing specific services to other entities.

- Miscellaneous Income: Various other smaller, non-recurring income items.

Gulfport Energy's primary revenue stems from the sale of natural gas, which constituted approximately 86% of its production in Q1 2024. The company is also increasingly focused on natural gas liquids (NGLs), projecting over a 30% rise in net daily liquids production for 2025 compared to 2024. While a smaller component, crude oil and condensate sales are also pursued, especially from liquids-rich acreage. Additionally, Gulfport utilizes commodity derivative contracts to hedge prices, with gains from these positions contributing to revenue, as seen in Q1 2024.

| Revenue Stream | Primary Focus | 2024/2025 Outlook |

| Natural Gas Sales | Core production and sales | Dominant revenue driver; Q1 2024: ~86% of production |

| Natural Gas Liquids (NGLs) Sales | Increasingly important, liquids-rich plays | Projected >30% net daily liquids production increase for 2025 vs. 2024 |

| Crude Oil & Condensate Sales | Smaller portion, strategic focus on liquids acreage | Leveraging higher market prices for liquids-rich output |

| Commodity Derivative Gains | Hedging against price volatility | Positive contributions observed in Q1 2024 |

| Other Operating Income | Ancillary sources | Includes reimbursements, service fees, and miscellaneous income |

Business Model Canvas Data Sources

The Gulfport Energy Business Model Canvas is informed by a blend of public financial disclosures, comprehensive market research reports, and internal operational data. These sources ensure a robust and data-driven representation of the company's strategic framework.