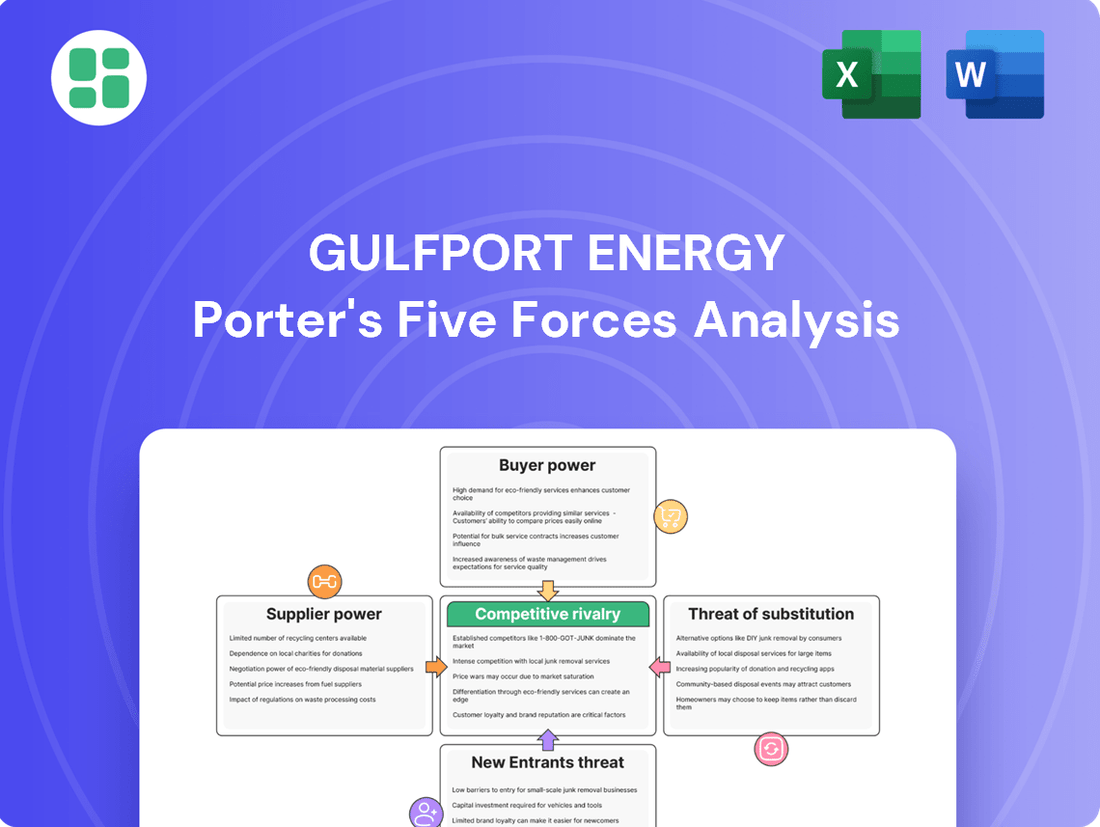

Gulfport Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulfport Energy Bundle

Gulfport Energy navigates a complex energy landscape, where the bargaining power of buyers and the intensity of rivalry significantly shape its profitability. Understanding these forces is crucial for any stakeholder looking to grasp the company's competitive position.

The complete report reveals the real forces shaping Gulfport Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and natural gas sector, including companies like Gulfport Energy, leans on highly specialized equipment and services. Think advanced drilling rigs, hydraulic fracturing, and complex completion technologies – these aren't everyday items.

Suppliers of these critical services often hold considerable sway. This power stems from the sheer technical know-how, the massive capital needed to operate, and the fact that sometimes, there are only a handful of qualified companies that can provide a specific niche service. For instance, in 2024, the cost of specialized drilling services saw upward pressure due to high demand and limited availability of advanced equipment.

Gulfport Energy, operating in areas like the Utica Shale and SCOOP, relies on these specialized providers for smooth and safe operations. The performance and cost of these services directly impact Gulfport's ability to extract oil and gas efficiently.

A persistent challenge in the energy sector, including for Gulfport Energy, is the availability of a skilled workforce, encompassing geoscientists, engineers, and experienced field personnel. This scarcity of specialized labor can directly translate into higher labor costs and grant individual experts or niche labor providers increased bargaining power.

The impact of this labor scarcity on Gulfport Energy is significant, potentially hindering its capacity to efficiently execute development programs and maintain overall operational effectiveness. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a continued tight labor market for many engineering and technical roles within the oil and gas industry, a trend expected to persist.

The bargaining power of suppliers for Gulfport Energy hinges significantly on key raw materials essential for drilling and completion. Proppants, like sand, water, and specialized chemicals, are critical inputs. While some materials are readily available, the need for specific grades of proppant or the complexities of securing and managing water resources in regions like Ohio and Oklahoma can amplify supplier leverage. For instance, in 2024, the cost of frac sand, a primary proppant, saw fluctuations based on regional demand and transportation costs, directly impacting Gulfport's operational expenses.

Technological Dependence

Suppliers who possess proprietary technologies and intellectual property vital for optimizing drilling and production in unconventional reservoirs can wield significant bargaining power. Gulfport Energy's reliance on these technological advancements to boost capital efficiency and well productivity means that key technology providers can exert leverage.

This dependence underscores the importance of cultivating robust relationships and potentially entering into long-term agreements with these critical technology suppliers. For instance, advancements in hydraulic fracturing techniques or specialized drilling equipment can directly impact Gulfport's operational costs and output volumes.

- Proprietary Technology: Suppliers often hold exclusive rights to technologies that enhance extraction efficiency in shale plays.

- Capital Efficiency Gains: Gulfport Energy's ability to reduce drilling costs and increase production per well is often tied to supplier innovations.

- Supplier Leverage: Companies controlling essential, cutting-edge technology can dictate terms due to Gulfport's need for these advancements.

- Strategic Partnerships: Securing access to these technologies may require long-term contracts or collaborative development efforts with suppliers.

Concentration and Integration of Suppliers

The oilfield services sector has seen significant consolidation, resulting in a landscape dominated by fewer, larger, and more integrated service providers. This trend directly impacts Gulfport Energy by narrowing its choices for essential services.

This concentration of suppliers amplifies their bargaining power, particularly when they offer bundled services covering the entire drilling and completion process. For instance, major players can leverage their comprehensive offerings to command higher prices or less favorable terms.

The ability of these large service companies to provide end-to-end solutions across the lifecycle limits Gulfport Energy's negotiation flexibility. As of late 2024, the market shows continued dominance by a handful of super-majors in specialized services, making it harder for E&P companies like Gulfport to secure competitive pricing on integrated packages.

- Supplier Concentration: The oilfield services industry has seen mergers and acquisitions, leading to a more concentrated supplier base.

- Integrated Service Offerings: Major service providers increasingly offer bundled solutions, increasing their leverage.

- Reduced Negotiation Options: Gulfport Energy faces fewer independent suppliers, diminishing its ability to negotiate favorable terms.

- Impact on Costs: This supplier power can translate into higher operational costs for Gulfport, affecting profitability.

Suppliers in the oil and gas sector, especially those providing specialized drilling equipment and services, hold considerable leverage over companies like Gulfport Energy. This power is amplified by the high capital investment required for these services and the limited number of qualified providers for niche technologies. For instance, in 2024, the cost of advanced drilling services saw an increase due to strong demand and a scarcity of top-tier equipment.

The bargaining power of suppliers is further strengthened by the consolidation within the oilfield services industry, leading to fewer, larger providers who can offer bundled, end-to-end solutions. This concentration limits Gulfport Energy's negotiation options and can drive up operational costs. As of late 2024, major service companies continue to dominate the market, making it challenging for exploration and production firms to secure competitive pricing on integrated packages.

Proprietary technologies that enhance extraction efficiency are another significant factor. Gulfport Energy's reliance on these innovations to improve capital efficiency and well productivity means that key technology providers can exert substantial influence. Securing access to these vital advancements often necessitates long-term contracts or collaborative efforts, underscoring the suppliers' strategic importance and bargaining strength.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Gulfport Energy's position in the oil and gas sector.

Gulfport Energy's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, enabling quick and informed strategic decision-making in the volatile energy market.

Customers Bargaining Power

The bargaining power of customers is significantly amplified when dealing with commoditized products like oil and natural gas. Gulfport Energy's offerings are largely undifferentiated, making them interchangeable with those from competitors. This lack of unique features means customers can readily switch suppliers based on the most favorable pricing, delivery schedules, or perceived reliability.

Customers, primarily large utilities, industrial users, and pipeline operators, are highly sensitive to price fluctuations in the natural gas and oil markets. This sensitivity means they can significantly influence pricing. For instance, during periods of high natural gas prices, customers may seek alternative energy sources or delay purchases, putting pressure on producers.

Given the inherent volatility of commodity prices, customers exert significant pressure on producers like Gulfport Energy to offer competitive pricing. In 2024, natural gas prices have experienced notable swings, with average spot prices fluctuating considerably month-to-month, directly impacting customer purchasing decisions and their bargaining power.

Gulfport Energy's customers are primarily large commercial and industrial entities that purchase its oil and natural gas production in significant quantities. This concentrated buyer base, often comprising just a few major players, gives these customers substantial bargaining power. For instance, in 2024, Gulfport's sales are predominantly to a limited number of industrial consumers, enabling them to negotiate pricing and contract terms that reflect their high-volume commitments.

Low Switching Costs for Buyers

For Gulfport Energy's customers, the cost of switching suppliers for natural gas and oil is typically quite low. This means buyers can easily move to another provider if they aren't happy with the price or the service they're receiving. This situation naturally puts more pressure on producers like Gulfport to keep their prices competitive.

This low switching cost is a significant factor in the bargaining power of Gulfport's customers. They have the flexibility to shop around, which intensifies price competition within the energy market. For instance, in 2024, the U.S. Energy Information Administration (EIA) reported that spot prices for natural gas at Henry Hub fluctuated significantly, often driven by supply and demand dynamics, giving buyers leverage to seek the best available rates.

- Low Switching Costs: Customers can easily change natural gas and oil suppliers without incurring substantial penalties or investments.

- Increased Buyer Leverage: This ease of switching grants buyers considerable power to negotiate better prices and terms.

- Price Competition: The ability for customers to readily switch intensifies price competition among energy producers, impacting Gulfport Energy's pricing strategies.

- Market Sensitivity: Gulfport Energy must remain attuned to market price shifts and customer satisfaction to retain its buyer base in 2024.

Information Transparency

The bargaining power of customers is significantly influenced by information transparency, particularly in the energy sector. Real-time market data for natural gas and crude oil prices is readily accessible, allowing customers to understand current market rates. This widespread availability of information empowers buyers, giving them a stronger hand when negotiating prices with producers like Gulfport Energy.

Gulfport Energy, therefore, must remain vigilant in aligning its pricing strategies with these dynamic market conditions. The ability of customers to easily compare prices across different suppliers intensifies competition and limits a producer's ability to command premium pricing based on information asymmetry. For instance, in 2024, average spot prices for natural gas in the U.S. fluctuated, with Henry Hub prices seeing significant volatility, underscoring the need for producers to be responsive to market signals. Similarly, crude oil prices, as reflected by West Texas Intermediate (WTI), also experienced considerable swings throughout the year, directly impacting customer negotiation leverage.

- Information Accessibility: Customers can easily access real-time data on natural gas and crude oil prices.

- Informed Negotiations: This transparency strengthens customers' position in price discussions with energy producers.

- Market Alignment: Gulfport Energy must continuously adjust its pricing to reflect prevailing market rates.

- Competitive Pressure: Increased information transparency heightens competition among producers, limiting pricing power.

Gulfport Energy's customers, primarily large industrial users and utilities, wield significant bargaining power due to the commoditized nature of oil and natural gas. Their ability to easily switch suppliers, coupled with widespread access to real-time market pricing data, intensifies price competition. For instance, in 2024, the U.S. Energy Information Administration (EIA) reported considerable volatility in Henry Hub natural gas spot prices, allowing buyers to leverage market fluctuations to their advantage.

| Metric | 2024 Average (Approx.) | Impact on Bargaining Power |

|---|---|---|

| Henry Hub Natural Gas Spot Price (USD/MMBtu) | $2.00 - $3.50 (Fluctuating) | High buyer leverage during price dips, pressure on producers during spikes. |

| West Texas Intermediate (WTI) Crude Oil Price (USD/barrel) | $75 - $85 (Fluctuating) | Similar to natural gas, price sensitivity drives customer negotiation. |

| Customer Concentration (Gulfport Specific) | Limited number of large industrial/utility buyers | Concentrated buyers have greater individual impact on price and terms. |

Same Document Delivered

Gulfport Energy Porter's Five Forces Analysis

This preview shows the exact Gulfport Energy Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the oil and gas sector. This document is fully formatted and ready for your immediate use.

Rivalry Among Competitors

The upstream oil and natural gas sector, especially in key regions like the Utica Shale and SCOOP, is bustling with activity. Gulfport Energy contends with a multitude of independent and major exploration and production (E&P) companies, creating a highly competitive environment. For instance, in 2024, the U.S. shale oil production reached record highs, with companies like Gulfport operating within this intensified competitive arena.

While global natural gas demand is growing, the oil and gas sector's overall growth rate and investment patterns can be quite volatile. Gulfport Energy is concentrating on capital efficiency and making careful investments in its main assets to manage a market that seeks both expansion and good returns for shareholders.

The industry is also witnessing a pivot towards investments in lower-carbon energy sources. This shift can significantly alter the competitive landscape, potentially impacting how companies like Gulfport allocate their capital and pursue growth opportunities in the coming years.

The exploration and production (E&P) sector, where Gulfport Energy operates, is inherently capital-intensive. Companies face substantial fixed costs for acquiring land leases, drilling wells, and building necessary infrastructure. For instance, a single horizontal well in the Permian Basin can cost upwards of $8 million to drill and complete as of 2024.

These significant upfront investments and specialized assets create high exit barriers. Once a company has committed capital to these ventures, it becomes economically challenging to simply walk away, even if commodity prices fall. This often compels companies to continue production to recoup their investments, leading to increased supply and intensified price competition among rivals.

Product Homogeneity

The crude oil and natural gas markets are characterized by a high degree of product homogeneity, meaning that the physical products themselves are largely indistinguishable from one another. This lack of differentiation means that companies like Gulfport Energy cannot easily command premium prices based on unique product features.

Consequently, competitive rivalry in this sector heavily centers on factors such as price, operational efficiency, and the scale of operations. Success is often a direct result of a company's ability to control costs, optimize production processes, and efficiently develop its reserves.

- Price Sensitivity: Because oil and gas are commodities, buyers are highly sensitive to price differences, making it difficult for any single producer to exert significant pricing power.

- Operational Efficiency as a Differentiator: Companies that can produce hydrocarbons at a lower cost per barrel of oil equivalent (BOE) gain a competitive edge. For instance, in 2024, major shale producers continued to focus on reducing drilling and completion costs to enhance profitability.

- Scale Matters: Larger producers often benefit from economies of scale, which can translate into lower per-unit production costs and greater bargaining power with suppliers and customers.

Mergers and Acquisitions Activity

The upstream oil and gas sector has been a hotbed for mergers and acquisitions (M&A), with significant consolidation occurring. This trend is creating larger, more powerful competitors. For instance, in 2023, the energy sector saw blockbuster deals, with total M&A value reaching hundreds of billions of dollars, indicating a strong push towards scale and efficiency among players.

This heightened M&A activity directly impacts competitive rivalry. When companies merge, they often gain enhanced operational synergies, increased market share, and greater financial clout. This can lead to more aggressive pricing strategies and a more challenging environment for smaller or less consolidated players like Gulfport Energy to compete effectively.

- Consolidation Trend: The oil and gas industry experienced substantial M&A activity in 2023, with major players acquiring smaller companies to bolster their reserves and operational footprint.

- Impact on Rivalry: Increased scale from M&A can lead to intensified price competition and a higher barrier to entry for new or smaller independent producers.

- Strategic Implications: Gulfport Energy must navigate a landscape where larger, integrated competitors, strengthened by acquisitions, may possess greater leverage in securing resources and capital.

Competitive rivalry in the upstream oil and gas sector, where Gulfport Energy operates, is intense due to the commodity nature of oil and gas and high fixed costs. Companies like Gulfport face numerous independent and major exploration and production firms, all vying for market share and profitability. This dynamic is exacerbated by a trend towards consolidation, with significant merger and acquisition activity in 2023 creating larger, more formidable competitors.

Success in this environment hinges on operational efficiency and cost control, as product differentiation is minimal. For instance, in 2024, U.S. shale production reached record highs, intensifying competition. Companies that can lower their cost per barrel of oil equivalent (BOE) gain a significant advantage, as buyers are highly price-sensitive. Gulfport's strategy focuses on capital efficiency and strategic investments in its core assets to navigate this challenging landscape.

| Metric | 2023 Data Point | Significance for Rivalry |

|---|---|---|

| U.S. Shale Production | Record highs in 2024 | Increased supply intensifies price competition. |

| Energy Sector M&A Value | Hundreds of billions in 2023 | Consolidation creates larger rivals with greater leverage. |

| Well Completion Cost (Permian) | Upwards of $8 million per well (2024) | High capital intensity and exit barriers compel continued production, fueling rivalry. |

SSubstitutes Threaten

The increasing adoption of renewable energy sources like solar and wind presents a growing threat of substitution for Gulfport Energy's core business. Global investments in clean energy are surging, with the International Energy Agency reporting that renewable energy capacity additions reached a record 510 gigawatts in 2023, a 50% increase from 2022. This trend directly challenges the long-term demand for natural gas.

Advancements in energy efficiency are a significant threat of substitutes for Gulfport Energy. For instance, in 2024, the International Energy Agency reported that global energy intensity, a measure of how efficiently an economy uses energy, improved by an estimated 2.2%. This means less energy is required to produce each unit of economic output.

These improvements, seen across industrial processes, residential heating and cooling, and vehicle fuel economy, directly reduce the demand for oil and natural gas. As more efficient technologies become widespread, the need for Gulfport Energy's core products diminishes, presenting a continuous, albeit gradual, substitute pressure.

The global transition to electric vehicles (EVs) represents a significant substitute threat to Gulfport Energy's core business. By the end of 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, signaling a growing departure from internal combustion engine vehicles that rely on crude oil. This trend, driven by environmental concerns and government incentives, directly erodes the long-term demand for the very products Gulfport extracts and sells.

Beyond transportation, industrial sectors are also exploring electrification and alternative energy sources to reduce their carbon footprint. This industrial shift away from fossil fuels further diminishes the addressable market for crude oil and natural gas liquids. For instance, major industrial nations are setting aggressive targets for renewable energy integration, with some aiming for over 50% of their energy mix from non-fossil fuel sources by 2030, directly impacting demand for traditional energy commodities.

Policy and Regulatory Support for Alternatives

Government policies and regulatory support significantly bolster the threat of substitutes for Gulfport Energy. Initiatives like the Inflation Reduction Act of 2022 in the United States, for instance, provide substantial tax credits and incentives for renewable energy projects, making solar and wind power more economically viable. This policy environment actively encourages investment in and adoption of these cleaner alternatives, directly impacting the demand for traditional fossil fuels.

The increasing stringency of environmental regulations and the potential for carbon pricing mechanisms further enhance the competitive pressure from substitutes. As governments worldwide implement stricter emissions standards and explore carbon taxes, the operational costs and market attractiveness of oil and natural gas can diminish relative to renewable energy sources. This regulatory push accelerates the transition towards lower-carbon alternatives.

Key policy drivers include:

- Renewable Energy Subsidies: Tax credits and grants for solar, wind, and other renewables reduce their upfront costs and improve project economics.

- Carbon Pricing: Mechanisms like carbon taxes or cap-and-trade systems increase the cost of carbon-intensive fuels, making alternatives more competitive.

- Emissions Standards: Stricter regulations on greenhouse gas emissions from fossil fuel operations and consumption incentivize a shift to cleaner energy sources.

- Energy Efficiency Mandates: Policies promoting energy conservation and efficiency reduce overall energy demand, indirectly benefiting substitute energy sources.

Technological Advancements in Alternative Energy

Technological advancements are making alternative energy sources a more potent threat. Innovations in areas like battery storage and solar panel efficiency are not just incremental; they're fundamentally changing the economics and viability of these alternatives. For instance, the global average cost of solar photovoltaic (PV) electricity fell by approximately 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA). This dramatic cost reduction makes solar power a far more competitive substitute for traditional energy sources.

These ongoing improvements mean that alternatives are becoming increasingly attractive to consumers and businesses alike. Consider the rapid progress in electric vehicle (EV) battery technology, which directly impacts demand for gasoline and diesel fuels, core products for companies like Gulfport Energy. By mid-2024, battery costs for EVs have continued to decline, with some estimates placing them below $100 per kilowatt-hour, a key threshold for price parity with internal combustion engine vehicles.

The continuous innovation in alternative energy, including enhanced geothermal systems and more efficient wind turbines, directly challenges the market position of fossil fuels. This trend is expected to accelerate, potentially leading to a significant displacement of demand for Gulfport Energy's offerings over the coming years. The International Energy Agency (IEA) projected in its 2024 outlook that renewable energy sources will account for over 90% of global electricity capacity expansion in the coming five years.

- Falling Costs: Global average solar PV electricity costs decreased by ~89% from 2010 to 2022.

- EV Battery Progress: EV battery costs are approaching or falling below $100/kWh in 2024.

- Renewable Expansion: Renewables are projected to drive over 90% of global electricity capacity growth in the next five years.

The threat of substitutes for Gulfport Energy is substantial, driven by advancements in renewable energy and energy efficiency. Global renewable energy capacity additions hit a record 510 GW in 2023, a 50% jump from 2022, according to the IEA. Energy efficiency improvements, estimated at 2.2% globally in 2024, further reduce overall energy demand.

The accelerating adoption of electric vehicles (EVs) and industrial electrification directly displace demand for fossil fuels. Global EV sales surpassed 13 million units by the end of 2023, signaling a significant shift away from gasoline and diesel. This trend, coupled with industrial moves towards renewables, erodes the market for Gulfport's core products.

Government policies, such as the US Inflation Reduction Act, and stricter environmental regulations actively promote cleaner alternatives. Carbon pricing and emissions standards make fossil fuels less competitive, accelerating the transition to lower-carbon energy sources.

Technological progress, particularly in battery storage and solar efficiency, is making substitutes increasingly viable. Solar PV electricity costs dropped by about 89% between 2010 and 2022, and EV battery costs are nearing $100/kWh in 2024, enhancing the attractiveness of alternatives.

| Substitute Trend | Key Data Point | Impact on Gulfport Energy |

|---|---|---|

| Renewable Energy Growth | 510 GW new capacity in 2023 (+50% YoY) | Reduces demand for natural gas and oil. |

| Energy Efficiency | 2.2% global energy intensity improvement (2024 est.) | Decreases overall energy consumption, impacting fossil fuel demand. |

| Electric Vehicle Adoption | >13 million EVs sold globally (end of 2023) | Directly substitutes demand for gasoline and diesel. |

| Solar Cost Reduction | ~89% cost decrease for solar PV (2010-2022) | Makes solar a more competitive alternative to fossil fuels. |

Entrants Threaten

The oil and natural gas exploration and production sector inherently requires massive upfront investment. Acquiring land rights, drilling wells, completing them, and building necessary infrastructure all demand substantial capital. These high startup costs effectively act as a significant deterrent, making it very difficult for new companies to enter the market and compete effectively.

For instance, Gulfport Energy reported capital expenditures of approximately $1.1 billion in 2023, a clear indicator of the financial commitment needed to operate in this industry. Such large outlays create a substantial barrier to entry, shielding existing players from new competition.

Securing access to prime, hydrocarbon-rich acreage, particularly in well-established unconventional plays like the Utica Shale and SCOOP, presents a significant hurdle for potential new entrants. These highly sought-after areas are already largely controlled by established companies, including Gulfport Energy, making it exceptionally difficult and expensive for newcomers to establish a competitive land position.

The oil and gas sector faces formidable regulatory and environmental challenges. Complex permitting processes, stringent safety standards, and evolving environmental regulations demand significant expertise and capital, acting as a substantial deterrent for newcomers. For instance, in 2024, the average cost for obtaining permits for new oil and gas exploration projects can range from tens of thousands to millions of dollars, depending on the jurisdiction and scope.

Proprietary Technology and Expertise

Success in unconventional resource development, like shale plays, hinges on advanced drilling and hydraulic fracturing technologies. Gulfport Energy, for instance, has invested significantly in optimizing these techniques to enhance production efficiency and lower costs.

Established players like Gulfport have accumulated substantial proprietary knowledge and operational expertise, often protected by patents or simply through years of hands-on experience. This deep well of specialized capability creates a formidable barrier for newcomers who would need to replicate these costly and time-consuming advancements.

- Proprietary Technology: Gulfport's focus on advanced horizontal drilling and hydraulic fracturing techniques represents a significant capital investment and learning curve for potential entrants.

- Operational Expertise: Years of experience in specific shale basins, like the Utica and SCOOP/STACK plays, have allowed Gulfport to refine its operational strategies, leading to improved well productivity and cost management.

- Capital Intensity: The sheer scale of investment required to develop and implement cutting-edge extraction technologies deters many smaller or less capitalized entities from entering the market.

Established Infrastructure and Supply Chains

Established players in the oil and gas sector, like Gulfport Energy, benefit immensely from existing infrastructure and supply chains. These include deep-rooted relationships with crucial service providers, extensive access to vital pipeline networks, and well-developed processing and transportation facilities. For instance, in 2024, the U.S. energy infrastructure saw continued investment, with significant capital allocated to pipeline expansions and upgrades, underscoring the established nature of these assets.

New entrants face a formidable challenge in replicating or securing access to this comprehensive infrastructure. The capital investment required to build or lease such extensive networks is substantial and the process is inherently time-consuming. This creates a significant barrier, making it difficult for newcomers to achieve cost competitiveness and operational efficiency compared to incumbents.

- Established Infrastructure: Existing companies leverage pre-existing pipeline networks, processing plants, and transportation systems, which are costly and time-consuming to replicate.

- Supplier Relationships: Incumbents have secured long-term contracts and strong relationships with service providers, offering preferential terms and reliable support.

- Capital Intensity: The sheer scale of investment needed to build comparable infrastructure presents a major hurdle for potential new entrants in the energy sector.

- Regulatory Hurdles: Navigating the complex regulatory landscape for new infrastructure development adds further delays and costs for those seeking to enter the market.

The threat of new entrants for Gulfport Energy is considerably low due to the industry's high capital intensity, requiring billions in upfront investment for exploration, drilling, and infrastructure. Established companies also benefit from proprietary technology and deep operational expertise, creating a steep learning curve for newcomers.

Furthermore, access to prime acreage is limited and controlled by incumbents, and the complex regulatory environment, with permitting costs potentially reaching millions in 2024, adds further deterrents. The existing, extensive infrastructure and established supplier relationships also present significant barriers that are costly and time-consuming for new companies to replicate.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions needed for exploration, drilling, and infrastructure. | Very High Deterrent |

| Access to Resources | Prime acreage already controlled by established players. | Very High Deterrent |

| Technology & Expertise | Proprietary tech and years of operational refinement. | High Deterrent |

| Infrastructure & Supply Chains | Existing networks and supplier relationships. | High Deterrent |

| Regulatory Environment | Complex permitting, stringent standards, high costs. | High Deterrent |

Porter's Five Forces Analysis Data Sources

Our Gulfport Energy Porter's Five Forces analysis is built upon comprehensive data from SEC filings, industry-specific market research reports, and financial analyst assessments. These sources provide crucial insights into the company's operational landscape and competitive positioning.