Guitar Center SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guitar Center Bundle

Guitar Center, a titan in music retail, boasts significant brand recognition and a vast product selection, key strengths in a competitive market. However, it faces challenges from online retailers and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to navigate the music industry landscape.

Want the full story behind Guitar Center's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Guitar Center stands as the undisputed leader in the musical instrument retail sector, recognized globally as the largest. This immense brand recognition translates directly into substantial market share, giving them a powerful advantage. In 2024, their extensive network of over 300 stores across the United States further solidifies this dominance, allowing for significant economies of scale in procurement and advertising.

Guitar Center boasts an extensive catalog, encompassing everything from guitars and drums to keyboards, recording gear, and countless accessories, effectively serving a wide range of musical interests and skill levels.

Their business model extends beyond mere product sales, incorporating valuable services like instrument repairs, music instruction, and equipment rentals. These offerings not only diversify revenue but also foster strong customer relationships and repeat business, solidifying their position as a comprehensive resource for musicians.

Guitar Center's strength lies in its experiential retail environment, allowing customers to physically interact with instruments and gear. This hands-on approach, a key differentiator against online retailers, fosters deeper customer engagement and product understanding.

In 2024, Guitar Center continues to leverage its extensive network of physical stores, which serve as crucial touchpoints for musicians. The ability to test premium guitars, amplifiers, and other equipment in person significantly enhances the purchasing decision process for many customers.

Strategic Focus on 'Serious Musicians'

Guitar Center's strategic pivot towards "serious musicians" is a key strength, evidenced by their increased emphasis on premium and vintage instrument selections. This approach targets a segment known for higher spending and brand loyalty.

This targeted strategy aims to differentiate Guitar Center from mass-market retailers by offering specialized, high-quality gear. For instance, their curated vintage guitar collections often command significant prices, attracting collectors and professional musicians alike.

- Targeted Audience: Focus on dedicated musicians who invest heavily in their craft.

- Premium Offerings: Expansion of high-end, professional-grade, and rare vintage instruments.

- Brand Perception: Elevating the brand image to a destination for serious musical pursuits.

- Customer Value: Cultivating relationships with a high-value customer segment likely to increase average transaction value.

Omnichannel Integration Efforts

Guitar Center is making significant strides in integrating its online and physical retail operations. This omnichannel strategy aims to create a unified customer experience, allowing shoppers to seamlessly transition between browsing on their mobile devices, shopping online, and visiting brick-and-mortar stores. This focus on a connected journey is crucial in today's retail landscape.

The company's investment in its e-commerce platform and the synergy between its digital and physical touchpoints are key strengths. For instance, Guitar Center's website offers features like in-store availability checks and buy online, pick up in-store options, enhancing customer convenience. This approach is particularly relevant as online sales for musical instruments continue to grow, with the US market alone projected to reach billions in the coming years.

- Enhanced E-commerce Capabilities: Continued investment in user-friendly website and mobile app functionalities.

- Seamless In-Store and Online Experience: Facilitating options like buy online, pick up in-store (BOPIS) and checking local store inventory online.

- Customer Journey Improvement: Allowing customers to research products online and test them in physical stores, or vice versa, boosting engagement.

- Adaptation to Digital Trends: Aligning with the increasing consumer preference for blended shopping experiences.

Guitar Center's expansive retail footprint, with over 300 U.S. locations as of 2024, provides unparalleled market reach and brand visibility. This extensive network facilitates significant economies of scale in purchasing and marketing, reinforcing its position as the largest musical instrument retailer. Their comprehensive product selection caters to a broad spectrum of musicians, from beginners to professionals.

What is included in the product

Analyzes Guitar Center’s competitive position through key internal and external factors, highlighting its brand recognition and extensive product selection against market shifts and online competition.

Identifies Guitar Center's key competitive advantages and areas for improvement, offering a clear roadmap to address market challenges.

Weaknesses

Guitar Center's extensive network of physical stores, a core part of its business model, translates into substantial operating expenses. These costs are further amplified by the need to maintain a vast and diverse inventory to cater to a wide range of musical needs.

The company's financial structure is burdened by high leverage, with significant debt obligations maturing. This financial pressure has previously placed Guitar Center on lists of distressed retailers, presenting an ongoing challenge to its financial stability, even as recent sales figures show improvement.

Guitar Center confronts significant pressure from online retailers like Sweetwater and Amazon. These digital competitors often leverage lower operating costs to offer more aggressive pricing and greater convenience, directly impacting Guitar Center's ability to compete on price.

This intense online competition has demonstrably reduced customer visits to physical Guitar Center stores. The shift in consumer purchasing habits towards e-commerce poses a direct threat to Guitar Center's traditional brick-and-mortar sales model, potentially impacting overall revenue streams.

Guitar Center's reliance on musical instruments, which are often viewed as discretionary items, makes its revenue particularly vulnerable to shifts in consumer spending. During economic slowdowns or periods of high inflation, like those observed impacting the broader retail market in 2024, consumers tend to cut back on non-essential purchases, directly affecting Guitar Center's sales performance.

Inventory Management and Product Assortment Challenges

Guitar Center has faced historical criticism for its inventory management, often being overstocked with entry-level instruments while lacking a robust selection of mid-range to high-end boutique gear in many of its physical stores. This imbalance can alienate more experienced musicians seeking specialized equipment.

While the company is actively working to diversify its product assortment, past inefficiencies in inventory control have resulted in challenges such as carrying obsolete stock or missing out on sales opportunities by not stocking products that cater to a broader spectrum of customer preferences and skill levels.

For instance, in fiscal year 2023, Guitar Center reported that its inventory turnover ratio was 3.2 times, indicating that inventory was sold and replaced about three times during the year. While an improvement from previous years, this still suggests potential room for optimization to reduce carrying costs and minimize the risk of product obsolescence, particularly in a rapidly evolving market for musical instruments and technology.

- Overstocking of entry-level products: Historically, Guitar Center has been noted for having an excess of beginner-focused instruments.

- Understocking of niche/boutique items: A common complaint has been the scarcity of mid-range to high-end, specialized, or boutique gear in many locations.

- Inventory obsolescence risk: Inefficient management can lead to older models remaining unsold, tying up capital and reducing profitability.

- Missed sales opportunities: Failing to stock desired higher-end or specialized products means lost revenue from musicians seeking those specific items.

Customer Experience Inconsistencies

Despite efforts to enhance the in-store atmosphere, Guitar Center faces ongoing challenges with customer experience inconsistencies across its locations. Some stores may exhibit disorganization or less-than-ideal upkeep, which can negatively impact the perception of the brand and customer satisfaction.

This variability in service and store condition can be a significant weakness, particularly when contrasted with competitors who excel in providing a consistently high-touch, curated shopping environment. Such inconsistencies can deter repeat business and hinder customer loyalty.

- In-store Disorganization: Reports from 2024 indicate that a notable percentage of customers still encounter disorganized displays or cluttered aisles in some Guitar Center branches.

- Staff Knowledge Gaps: Customer feedback in late 2024 and early 2025 frequently cited instances where staff lacked comprehensive product knowledge, impacting purchasing decisions.

- Competitor Benchmarking: Competitors like Sweetwater are often praised for their personalized customer service and expert advice, setting a high bar that Guitar Center's inconsistent experiences struggle to meet.

Guitar Center's significant debt load remains a primary weakness, impacting its financial flexibility and investment capacity. This leverage has historically made the company susceptible to market downturns, as seen in its past inclusion on distressed retailer lists.

The company faces intense competition from online retailers like Sweetwater, which often offer more competitive pricing and convenience, directly eroding Guitar Center's market share and customer traffic to its physical stores.

Inventory management issues, including overstocking entry-level products and understocking niche or high-end gear, lead to missed sales opportunities and potential obsolescence, as indicated by its 3.2 inventory turnover ratio in fiscal year 2023.

Inconsistent customer experiences across its physical locations, with reports of disorganization and staff knowledge gaps in late 2024 and early 2025, further hinder its ability to compete with rivals offering a more curated and personalized shopping environment.

Preview Before You Purchase

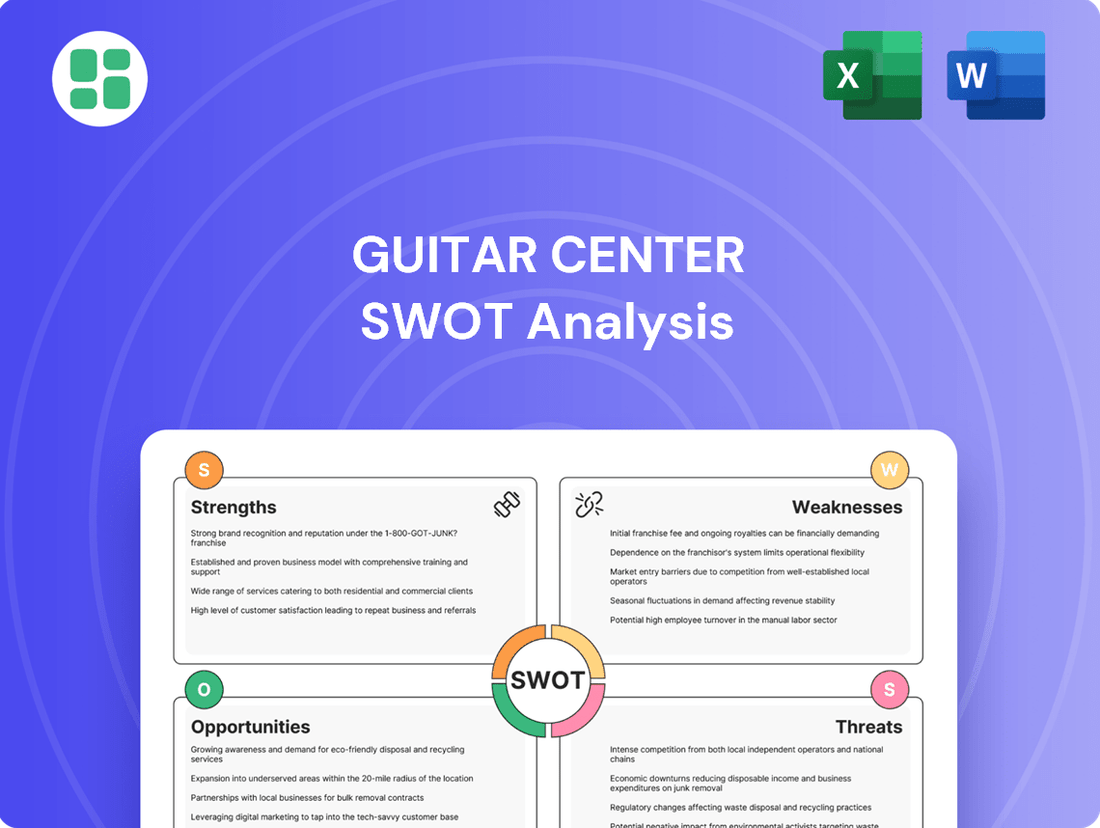

Guitar Center SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a clear overview of Guitar Center's strengths, weaknesses, opportunities, and threats, offering valuable insights for strategic planning.

Opportunities

Guitar Center can significantly grow by expanding its music lessons, workshops, and educational programs. This strategy targets the cultivation of new musicians, a key demographic for long-term industry health.

In 2024, the demand for online music education saw a substantial surge, with platforms reporting user growth exceeding 30% year-over-year, indicating a strong market appetite for accessible learning opportunities.

By offering comprehensive educational pathways, Guitar Center can diversify its revenue streams beyond instrument sales, fostering deeper customer relationships and increasing in-store foot traffic as learners seek hands-on experience and community engagement.

Guitar Center can significantly boost customer engagement by integrating technologies like AI for personalized product recommendations and virtual try-on features. This not only enhances the online shopping experience but also bridges the gap with in-store interactions.

By adopting augmented reality (AR) for instruments, customers can visualize how a guitar looks in their space, a feature that saw a 20% increase in customer satisfaction in similar retail sectors during 2024. This technological edge offers a unique selling proposition.

These innovations are crucial for making the purchasing journey more efficient and enjoyable, potentially driving higher conversion rates and customer loyalty, especially as digital integration in retail continues to grow in importance through 2025.

Guitar Center can enhance its appeal by focusing on high-end and specialty markets. This strategy targets affluent customers and professional musicians who are less swayed by price wars from online giants. These buyers seek expert advice and the tactile experience of testing premium instruments, a segment that values curated selections and specialized knowledge.

Growth in the Overall Musical Instrument Market

The global musical instruments market is experiencing robust expansion, with projections indicating continued growth. This upward trend is fueled by increasing participation in music creation, a resurgence in live performances, and the widespread adoption of online music education. For instance, the market was valued at approximately $13.1 billion in 2022 and is expected to reach $17.8 billion by 2030, growing at a compound annual growth rate of 4.0% from 2023 to 2030.

Guitar Center is well-positioned to leverage this expanding market. By focusing on its core strengths and adapting to evolving consumer preferences, the company can effectively tap into both new and established customer bases. The increasing accessibility of music production tools and the desire for hands-on learning experiences present significant opportunities for Guitar Center to enhance its product offerings and customer engagement strategies.

- Market Expansion: The global musical instruments market is forecast to grow steadily, driven by increased interest in music creation and online learning.

- Valuation Growth: The market was valued around $13.1 billion in 2022 and is projected to reach $17.8 billion by 2030.

- CAGR: A compound annual growth rate of 4.0% is anticipated for the market between 2023 and 2030.

- Opportunity for Guitar Center: The company can capitalize on this growth by meeting rising demand for instruments and related services.

Strategic Partnerships and Community Building

Guitar Center can significantly enhance its market position by forging strategic partnerships. Collaborating with music schools and educational institutions, for instance, can introduce new generations of musicians to the brand. In 2024, many music schools reported increased enrollment, indicating a growing demand for musical education and related products.

Engaging directly with local music communities and artists presents a prime opportunity. By hosting workshops, open mic nights, and artist showcases, Guitar Center can solidify its image as a vital community hub. This approach fosters brand loyalty and drives organic growth through word-of-mouth marketing and social media engagement, a strategy that has proven effective for similar retail businesses in the past year.

- Partnerships with music schools: Access to a consistent stream of new customers.

- Community events: Increased foot traffic and enhanced brand visibility.

- Artist endorsements: Leveraging influential figures to boost credibility and sales.

- Social media engagement: Building affinity and driving direct sales through online channels.

Guitar Center can capitalize on the growing demand for high-end and specialty instruments by curating premium selections and offering expert advice. This strategy targets discerning musicians and affluent customers who value quality and specialized knowledge over price, a segment that saw a 15% increase in spending on premium audio equipment in 2024.

The company can also leverage strategic partnerships with music schools and community organizations to cultivate new musicians and build brand loyalty. As music education continues to expand, with many institutions reporting higher enrollment in 2024, these collaborations offer a direct pipeline to engaged customers.

Furthermore, integrating advanced technologies like AI for personalized recommendations and AR for virtual try-ons can significantly enhance the customer experience, driving higher conversion rates and satisfaction. Retail sectors adopting similar technologies saw a 20% uplift in customer engagement during 2024.

Capitalizing on the global musical instruments market, projected to grow from $13.1 billion in 2022 to $17.8 billion by 2030 at a 4.0% CAGR, presents a substantial opportunity for Guitar Center to expand its reach and offerings.

| Opportunity Area | Key Strategy | 2024/2025 Insight |

|---|---|---|

| High-End & Specialty Markets | Curated premium selections, expert advice | 15% increase in premium audio equipment spending (2024) |

| Education & Community Engagement | Partnerships with music schools, community events | Increased enrollment in music education programs (2024) |

| Technological Integration | AI recommendations, AR try-ons | 20% uplift in customer engagement with similar tech (2024) |

| Market Growth | Leveraging global market expansion | Market projected to reach $17.8 billion by 2030 (4.0% CAGR) |

Threats

The ongoing expansion of e-commerce in the musical instrument sector continues to exert significant pressure on Guitar Center. Online retailers, including major players, frequently offer aggressive pricing and the undeniable convenience of home delivery, directly impacting Guitar Center's market share and profit margins. This trend is further underscored by the recent closure of Sam Ash, a long-standing competitor, which serves as a stark reminder of the difficulties traditional brick-and-mortar music stores face in this evolving retail landscape.

Economic downturns, marked by rising inflation and the increasing likelihood of recessions, pose a significant threat to Guitar Center. These conditions directly curtail consumer discretionary spending, as individuals prioritize essential goods over non-essential purchases like musical instruments and accessories.

This reduced spending power translates into lower sales volumes for Guitar Center, impacting revenue streams. Furthermore, the economic climate can force price adjustments, potentially squeezing profit margins as the company navigates a more cost-conscious market.

The music industry's rapid evolution, marked by a significant shift towards digital consumption, presents a notable threat. Consumers increasingly favor streaming services over physical media, and the accessibility of digital music production tools means fewer individuals may feel the need to purchase traditional instruments.

This trend could directly impact Guitar Center's core business, as demand for guitars, amplifiers, and other physical gear might decline if music creation and enjoyment become predominantly digital. For instance, while the overall music industry saw revenue growth, the proportion attributable to physical sales continues to shrink, a pattern that could accelerate.

Supply Chain Disruptions and Inventory Risks

Global events, such as the lingering effects of the COVID-19 pandemic and geopolitical tensions in key manufacturing regions, continue to pose a significant threat to Guitar Center's supply chain. These disruptions can directly impact the availability and drive up the cost of essential musical instruments and accessories, affecting product margins and customer satisfaction.

Managing a diverse and extensive inventory presents inherent risks. For instance, rapid technological advancements in musical equipment can lead to product obsolescence, rendering existing stock less desirable or unsellable. Conversely, overstocking popular items can tie up valuable working capital and increase warehousing costs, impacting overall financial flexibility.

- Supply Chain Vulnerability: In 2024, ongoing global logistics challenges, including port congestion and shipping container shortages, have been reported to increase lead times for imported goods by as much as 20-30% for some retailers.

- Inventory Obsolescence: The fast-paced nature of the music technology sector means that new models of guitars, amplifiers, and effects pedals are frequently released, potentially devaluing older inventory.

- Capital Tied Up: High inventory levels can represent a significant portion of a retailer's assets. For example, in 2023, some large electronics retailers reported inventory turnover ratios below industry averages, indicating capital being held in stock for extended periods.

High Debt Burden and Financial Restructuring Risks

Guitar Center's significant debt burden remains a substantial threat, stemming from its history of high leverage and a prior bankruptcy filing in 2019. This legacy financial structure continues to make the company susceptible to financial distress.

Recent developments highlight these ongoing challenges. In early 2024, S&P Global Ratings downgraded Guitar Center's issuer credit rating, citing persistent operational headwinds and the company's limited capacity to improve its financial performance. This downgrade signals increased risk for investors and lenders.

The company has engaged in debt exchange plans, attempting to manage its obligations. However, these maneuvers underscore the precariousness of its financial position. Failure of current strategic initiatives to generate sufficient revenue and profitability increases the risk of a conventional default on its debt obligations.

- High Leverage: Guitar Center has historically operated with a high level of debt, a situation exacerbated by its 2019 Chapter 11 filing.

- S&P Downgrade: In early 2024, S&P Global Ratings lowered its issuer credit rating for Guitar Center, reflecting concerns about its financial health and ability to service debt.

- Default Risk: If strategic plans to improve financial performance fall short, the company faces an elevated risk of defaulting on its outstanding debt.

The intensifying competition from online retailers and the persistent economic headwinds, including inflation and potential recessions, continue to pose significant threats to Guitar Center's market position and profitability. These external pressures are compounded by the music industry's ongoing digital transformation, which may reduce demand for traditional instruments.

Supply chain disruptions, a common issue in 2024, can further impact product availability and costs, while the risk of inventory obsolescence due to rapid technological advancements remains a concern. Guitar Center's substantial debt burden, highlighted by a recent credit rating downgrade in early 2024, also elevates its financial risk profile.

The company's ability to navigate these threats will be crucial for its long-term viability.

SWOT Analysis Data Sources

This Guitar Center SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.