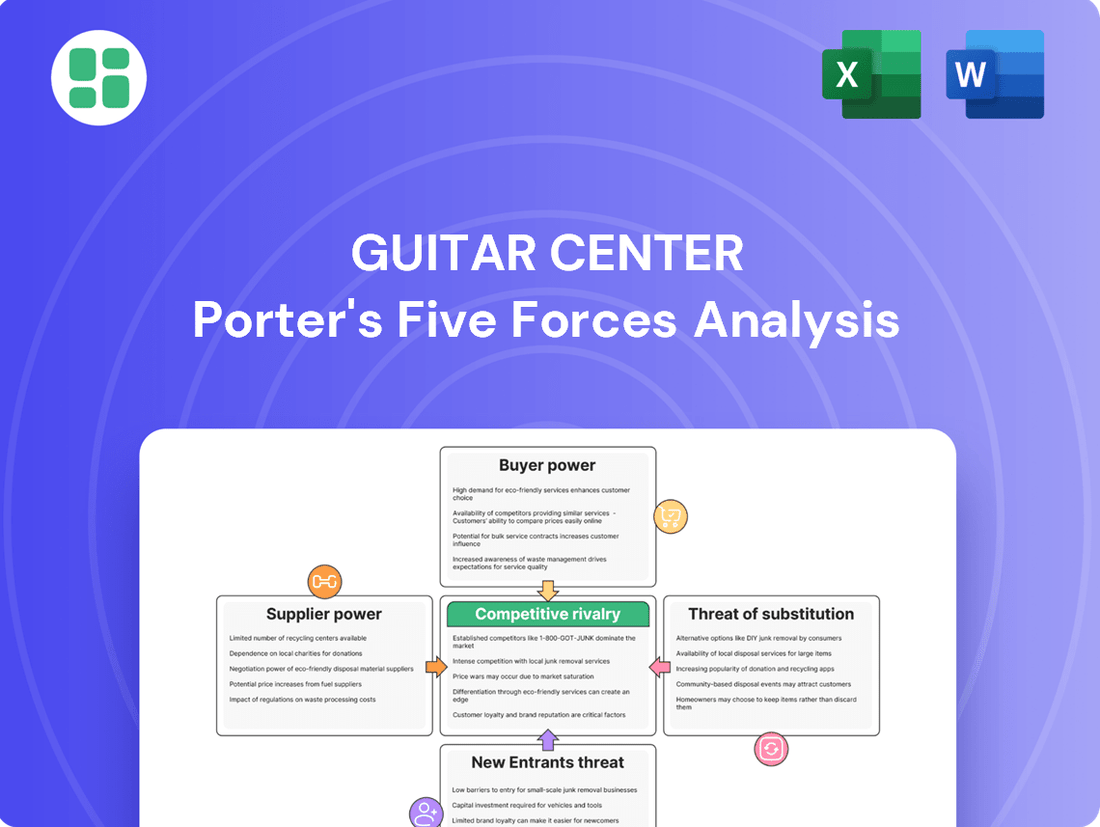

Guitar Center Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guitar Center Bundle

Guitar Center faces moderate buyer power due to the availability of online retailers and direct-to-consumer brands, while the threat of new entrants is somewhat limited by established brand recognition and inventory management complexities. The intensity of rivalry is high, with numerous brick-and-mortar stores and online competitors vying for market share.

The complete report reveals the real forces shaping Guitar Center’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Guitar Center's bargaining power with suppliers is significantly impacted by the concentration of key brands. Major manufacturers like Fender, Gibson, and Yamaha represent a substantial portion of the company's inventory and sales. In 2024, these brands continue to command strong customer loyalty, making it challenging for Guitar Center to exert substantial price pressure or dictate terms without risking a reduction in product availability or customer traffic.

Many high-end and iconic musical instruments boast significant product differentiation, featuring unique models and proprietary technologies from specific brands. This distinctiveness grants suppliers considerable bargaining power, particularly for sought-after premium gear, a segment Guitar Center is actively expanding its focus on. For instance, Fender's iconic Stratocaster or Gibson's Les Paul are not easily replicated, giving these manufacturers leverage in their dealings with retailers.

Major musical instrument manufacturers like Fender are increasingly leveraging direct-to-consumer (DTC) sales channels. This move allows them to bypass traditional retailers, potentially increasing their leverage over companies like Guitar Center. In 2023, Fender reported a significant increase in its online sales, indicating a growing trend towards DTC engagement.

While suppliers can sell directly, Guitar Center's established retail presence and unique in-store experience remain attractive for brands seeking broad market access and customer engagement. This dual approach means suppliers can explore DTC while still valuing Guitar Center's physical footprint, balancing their bargaining power.

Switching Costs for Guitar Center

While individual product switching costs might seem low, for Guitar Center, a complete pivot away from major, established guitar brands would incur substantial expenses. These include retooling marketing campaigns, retraining its sales force on new product lines, and potentially alienating a customer base accustomed to familiar names and quality. Maintaining a broad inventory from these key brands is fundamental to Guitar Center's operational success and customer appeal.

Guitar Center's strategic focus on curating and expanding its selection of highly sought-after premium gear further solidifies its reliance on top-tier suppliers. This approach, while enhancing its market position, also increases its dependence on these suppliers, thereby influencing their bargaining power. For instance, in 2024, Guitar Center continued to feature exclusive collaborations and limited editions with brands like Fender and Gibson, underscoring the importance of these supplier relationships.

- Brand Loyalty: Customers often develop strong preferences for specific guitar brands, making it difficult for Guitar Center to unilaterally substitute products without impacting sales.

- Inventory Management Costs: Shifting away from established suppliers would necessitate significant investment in new inventory, warehousing, and potentially liquidation of existing stock.

- Supplier Relationships: Long-standing partnerships with major guitar manufacturers provide Guitar Center with favorable terms and access to popular products, which are difficult to replicate.

Impact of Industry Trends and Regulations

Broader industry trends, like the growing demand for sustainable and eco-friendly musical instruments, can reshape supplier operations and pricing. This shift might empower suppliers who can adapt to these new standards, potentially leading to higher costs for Guitar Center if they rely on suppliers with less sustainable practices.

Regulations, such as tariffs on imported musical instruments and parts, directly impact wholesale prices. For instance, in early 2024, the threat of new tariffs on goods from China, a major manufacturing hub for musical instruments, could have increased procurement costs for retailers like Guitar Center. These tariffs can indirectly bolster supplier leverage by raising the cost of goods, making it harder for buyers to switch suppliers.

- Industry Trend Impact: Growing consumer preference for eco-friendly instruments may increase costs for suppliers not yet equipped for sustainable production.

- Regulatory Impact: Tariffs on imported components in 2024 could have raised wholesale prices for musical instruments, potentially increasing Guitar Center's cost of goods sold.

- Supplier Power Influence: These external factors can shift the balance, giving suppliers more negotiating power if they offer compliant or essential components.

Guitar Center faces substantial supplier bargaining power due to the concentration of dominant brands like Fender and Gibson, whose products are essential for sales and customer traffic. The high degree of product differentiation for iconic instruments further strengthens these suppliers' leverage, especially as Guitar Center expands its premium gear offerings. Moreover, suppliers' increasing adoption of direct-to-consumer sales channels in 2023 and 2024, as evidenced by Fender's online growth, provides them with alternative revenue streams, diminishing their reliance on retailers and enhancing their negotiating position.

| Supplier Factor | Impact on Guitar Center | Supporting Data/Trend |

|---|---|---|

| Brand Concentration | High supplier power | Fender, Gibson, Yamaha are key inventory drivers. |

| Product Differentiation | High supplier power | Iconic models (e.g., Stratocaster, Les Paul) are difficult to substitute. |

| Direct-to-Consumer (DTC) Sales | Increased supplier leverage | Fender reported significant online sales growth in 2023. |

| Switching Costs | High barrier to changing suppliers | Significant costs for marketing, training, and inventory shifts. |

What is included in the product

This analysis dissects the competitive forces impacting Guitar Center, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the music retail industry.

Instantly identify and address competitive threats with a dynamic Porter's Five Forces analysis, allowing Guitar Center to proactively adjust strategies and mitigate market pressures.

Customers Bargaining Power

Customers have a vast array of choices when it comes to buying musical instruments and equipment. Beyond Guitar Center, prominent online players like Sweetwater and Musician's Friend offer extensive catalogs, while numerous local music shops provide specialized service and immediate availability. This accessibility to alternatives significantly amplifies customer bargaining power.

The recent closure of Sam Ash, a long-standing competitor, highlights the intense competition within the music retail sector. This event underscores how easily customers can shift their business to other providers if they perceive better pricing, selection, or service elsewhere, further empowering them in their purchasing decisions.

The proliferation of e-commerce has significantly amplified customer price sensitivity. With online platforms offering unparalleled ease of price comparison, shoppers can swiftly identify the most competitive deals. This digital transparency directly impacts brick-and-mortar establishments like Guitar Center, compelling them to either match online pricing or differentiate through superior service and unique offerings to retain customers.

For many musical instruments and accessories, customers don't face substantial hurdles when choosing a retailer. They can readily shift their purchases from Guitar Center to online platforms or other brick-and-mortar stores without incurring significant financial penalties or facing major inconveniences.

This lack of friction in switching suppliers directly enhances the bargaining power of customers. In 2023, the online retail sector for musical instruments continued to grow, with platforms like Sweetwater and Reverb offering competitive pricing and a wide selection, further empowering consumers to compare and switch easily.

Demand for Personalized Experience and Value-Added Services

Serious musicians are increasingly demanding tailored experiences and services that go beyond just purchasing an instrument. This includes seeking expert advice, personalized product recommendations, and engaging shopping environments. For instance, Guitar Center's investment in in-store experiences, including music lessons and instrument repair services, directly addresses this growing customer desire for added value and expertise, fostering stronger loyalty.

The bargaining power of customers is amplified by their desire for personalized experiences and value-added services. Guitar Center's proactive approach to meet these demands, by offering services like music lessons and repair, aims to differentiate itself and secure customer loyalty. This focus on service transforms the transaction from a simple product sale into a more comprehensive customer relationship.

- Personalization: Customers expect tailored product suggestions and expert guidance.

- Value-Added Services: Demand for services like music lessons and repairs is rising.

- Customer Loyalty: Meeting these needs builds stronger, more loyal customer relationships.

- Differentiation: Offering unique services helps Guitar Center stand out in a competitive market.

Influence of Digital Platforms and Communities

Social media platforms and online music communities now wield considerable influence over customer purchasing decisions for musical instruments. These digital spaces are crucial for product discovery, reading reviews, and accessing tutorials, empowering buyers with more information than ever before. For instance, in 2024, platforms like YouTube saw over 1 billion hours of music-related content watched weekly, directly impacting consumer research.

This collective customer voice and enhanced access to information significantly bolster the bargaining power of customers. Buyers can easily compare prices, features, and user experiences across various brands and retailers, making them less reliant on individual sellers. The widespread adoption of these platforms means that a dissatisfied customer's feedback can quickly reach a vast audience, pressuring retailers like Guitar Center.

- Social media and online communities are key influencers in product discovery and purchasing decisions.

- Customers leverage readily available information for informed choices, increasing their bargaining power.

- The growing penetration of social media, with platforms like TikTok seeing a 20% increase in active users in the music instrument niche in 2024, directly shapes customer preferences and demand.

Customers possess significant bargaining power due to the wide availability of alternatives, including online retailers like Sweetwater and local music shops. This ease of switching, coupled with the digital transparency that facilitates price comparisons, forces Guitar Center to remain competitive on pricing and service. In 2024, the online music retail market continued its upward trajectory, further empowering consumers with accessible choices.

The increasing demand for personalized experiences and value-added services, such as music lessons and instrument repair, also shifts power to the customer. By offering these services, Guitar Center aims to build loyalty and differentiate itself in a crowded market. Social media and online communities further amplify this power, providing platforms for reviews and information sharing that influence purchasing decisions.

| Factor | Impact on Guitar Center | Customer Behavior |

|---|---|---|

| Availability of Alternatives | High | Customers easily switch to competitors offering better prices or selection. |

| Price Sensitivity | High | Online price comparison tools make customers highly aware of pricing differences. |

| Switching Costs | Low | Customers face minimal barriers when changing retailers. |

| Information Availability | High | Social media and online reviews empower customers with extensive product knowledge. |

Preview the Actual Deliverable

Guitar Center Porter's Five Forces Analysis

You're previewing the final version of the Guitar Center Porter's Five Forces Analysis—precisely the same document that will be available to you instantly after buying. This comprehensive analysis details the competitive landscape for Guitar Center, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. What you see here is the complete, ready-to-use report, offering valuable strategic insights into the music retail industry.

Rivalry Among Competitors

Guitar Center contends with formidable online rivals like Sweetwater and Musician's Friend. These e-commerce giants provide extensive product inventories, aggressive pricing, and streamlined direct-to-consumer shipping, directly challenging Guitar Center's traditional brick-and-mortar model. For instance, Sweetwater is renowned for its superior customer service and unique product offerings, which have helped it capture significant market share.

The musical instrument market is highly fragmented, featuring thousands of companies beyond the major players. This includes a vast number of independent music stores and specialized shops. These smaller businesses often cater to specific niches, like vintage instruments or particular genres, and provide personalized service that can be a significant competitive factor.

This fragmentation intensifies competition as these niche players can attract loyal customer bases. For instance, while Guitar Center might offer broad selection, a local shop specializing in vintage guitars or rare ethnic instruments can draw customers seeking unique items and expert knowledge. This diverse landscape means Guitar Center faces rivalry not just from other large chains but also from a multitude of smaller, specialized competitors.

The musical instrument retail sector faced a notable downturn in 2024, with overall sales declining by 3%. This challenging market condition directly fuels intensified competition among surviving businesses.

The recent shuttering of Sam Ash, a prominent and established player, underscores the severe economic pressures and the ongoing trend of consolidation within the industry. This contraction means fewer competitors are vying for the same customer base.

Consequently, the remaining major retailers are locked in a fiercer struggle for market share, as evidenced by aggressive pricing strategies and increased promotional activities designed to capture a larger portion of the shrinking market.

Product Differentiation and Experiential Retail

Competitors in the music retail space often vie for customer attention by differentiating their product selections, pricing, and the overall shopping experience. Guitar Center is making significant moves to enhance its competitive edge by broadening its inventory to include more high-end and pre-owned instruments. This strategic shift aims to cater to a wider range of musicians, from beginners to seasoned professionals.

A key element of Guitar Center's strategy involves cultivating a more engaging and immersive in-store environment, akin to a "Disneyland for musicians." This focus on experiential retail is designed to draw customers in and keep them coming back. For instance, in 2024, Guitar Center continued its investment in in-store events and workshops, aiming to build a stronger community around its brand and provide value beyond just product sales.

- Product Assortment: Guitar Center is expanding its offerings to include more premium brands and a robust selection of used gear, appealing to both aspirational and budget-conscious musicians.

- Pricing Strategies: While not explicitly detailed, competitive pricing remains a factor, with retailers often employing sales, promotions, and financing options to attract customers.

- Customer Experience: The company is prioritizing the creation of unique, in-store experiences, such as interactive product demos and community events, to differentiate itself from online retailers and less specialized brick-and-mortar stores.

Importance of Omnichannel Presence

Guitar Center faces intense competitive rivalry, with success increasingly hinging on a seamless omnichannel presence. This means integrating online shopping with the in-store experience, a crucial factor for today's consumers who often research products digitally before making a purchase. Guitar Center is actively bolstering its e-commerce capabilities to meet this demand.

Competitors like Sweetwater, while predominantly online, also demonstrate a significant commitment to their digital platforms, intensifying the rivalry. In 2024, the music retail sector saw continued growth in online sales, with many consumers expecting consistent brand experiences across all touchpoints. This trend underscores the necessity for Guitar Center to maintain and enhance its integrated strategy.

- Omnichannel Integration: Guitar Center's investment in e-commerce aims to bridge online research with in-store purchasing.

- Digital Competitors: Sweetwater's strong online presence highlights the importance of digital capabilities in the music retail landscape.

- Customer Behavior: Consumers increasingly expect a unified brand experience, driving the need for robust omnichannel strategies.

Guitar Center navigates a highly competitive landscape, facing pressure from both established online retailers and a fragmented base of smaller, specialized shops. The market's overall contraction, marked by a 3% sales decline in 2024 and the closure of major players like Sam Ash, intensifies the battle for market share among surviving businesses. This environment necessitates strategic differentiation through product assortment, pricing, and customer experience.

| Competitor Type | Key Differentiators | Impact on Guitar Center |

|---|---|---|

| Online Retailers (e.g., Sweetwater) | Extensive inventory, aggressive pricing, direct shipping, strong customer service | Forces Guitar Center to enhance its e-commerce capabilities and customer service |

| Niche/Specialty Stores | Curation of specific genres/vintage items, personalized service, expert knowledge | Attracts specific customer segments, requiring Guitar Center to broaden its appeal and expertise |

| Large Retail Chains (Historically) | Broad selection, physical presence | Industry consolidation (e.g., Sam Ash closure) leads to fiercer competition among remaining large players |

SSubstitutes Threaten

The growing sophistication and affordability of digital instruments, music production software, and virtual instrument plugins present a notable threat to traditional instrument retailers like Guitar Center. Musicians can now achieve professional-sounding results using digital audio workstations (DAWs) and MIDI controllers, bypassing the need for physical guitars, drums, or keyboards.

This shift is fueled by rapid technological advancements and the increasing popularity of smart digital instruments. For instance, the global digital audio workstation market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a strong preference for software-based music creation.

The rise of online music education platforms, like Yousician and Fender Play, presents a significant threat of substitutes for traditional music retailers. These platforms offer accessible and often affordable video courses and subscription tutorials, allowing individuals to learn instruments and explore music virtually. This can diminish the perceived necessity of in-person lessons or even the initial purchase of an instrument, as learners can sample music creation before making a commitment. In 2024, the global online music education market was valued at approximately $2.5 billion and is projected to grow substantially, indicating a strong shift towards digital learning resources.

The availability of a strong used instrument market, both online and locally, presents a significant threat of substitutes. This market offers a much more affordable entry point for musicians compared to buying new, directly impacting Guitar Center's new product sales. For instance, Reverb, a major online marketplace, saw its gross merchandise volume reach $1.2 billion in 2023, highlighting the scale of this alternative.

Instrument rental services also act as a substitute, especially for beginners or those needing gear for specific, short-term engagements. Guitar Center itself offers rentals, but this segment is also served by numerous independent music stores and online platforms, providing accessible alternatives that bypass the need for outright purchase.

Guitar Center's own strategic emphasis on its used and vintage inventory, while a revenue stream, also acknowledges and caters to this substitute market. This dual role means the company is both a participant in and a competitor against the broader used and rental instrument landscape.

General Entertainment and Hobbies

Musical instruments, like guitars, face significant competition from a broad spectrum of general entertainment and hobbies for consumer dollars and free time. Consumers often choose between investing in musical pursuits and other leisure activities such as video games, sports, or various creative arts like painting or writing. This broad competitive landscape means Guitar Center must contend with a wide range of alternative spending choices.

For instance, the global video game market was projected to reach over $200 billion in 2024, illustrating a substantial portion of discretionary spending that could otherwise go towards musical instruments. Similarly, participation in recreational sports and other arts and crafts continues to draw significant consumer engagement. These diverse options represent viable substitutes for musical instrument purchases and lessons, impacting Guitar Center's market share.

- Broad Entertainment Competition: Musical instruments compete with gaming, sports, and other creative arts for consumer leisure time and discretionary income.

- Market Share Impact: The vast array of alternative hobbies and entertainment options can dilute the market share for musical instruments.

- Consumer Spending Diversion: Significant portions of consumer spending, such as the over $200 billion projected for the global video game market in 2024, represent potential diversions from musical instrument purchases.

Accessory and Component Sales Focus

The market for musical instrument components and accessories presents a subtle but significant threat of substitutes for new instrument sales. While not directly replacing an instrument, the increasing focus on upgrading and maintaining existing gear can divert customer spending. For instance, the global musical instrument accessories market was projected to reach approximately $11.5 billion in 2024, highlighting a substantial segment where consumers might invest rather than purchase a new guitar or keyboard.

This trend suggests a shift in consumer behavior where the desire for performance enhancement or longevity of current instruments takes precedence. Guitar Center, like other retailers, must recognize this dynamic.

- Accessory Market Growth: The global market for musical instrument accessories is substantial and growing, potentially diverting funds from new instrument purchases.

- Customer Spending Shift: Consumers may prioritize upgrading or maintaining existing instruments with new parts or accessories over acquiring entirely new ones.

- Impact on Guitar Center: This could lead to a decrease in the average transaction value for instrument sales, with more revenue generated from smaller, component-based purchases.

The threat of substitutes for Guitar Center is substantial, driven by digital alternatives and the broader entertainment landscape. Digital music production tools and online learning platforms offer cost-effective ways to create and learn music, bypassing the need for physical instruments. Furthermore, the significant portion of discretionary spending allocated to other hobbies like video games, with the global market projected to exceed $200 billion in 2024, directly competes for consumer attention and dollars that might otherwise be spent on musical instruments. This broad competition from various leisure activities and accessible digital solutions presents a considerable challenge.

| Substitute Category | Key Examples | Market Data (Approximate 2024) | Impact on Guitar Center |

|---|---|---|---|

| Digital Music Production | DAWs, MIDI Controllers, Virtual Instruments | Global DAW Market: ~$1.5 billion (2023) | Reduces need for physical instruments; shifts focus to software. |

| Online Music Education | Yousician, Fender Play | Global Online Music Education Market: ~$2.5 billion (2024 est.) | Lowers barrier to entry for learning; may delay instrument purchase. |

| Used & Rental Markets | Reverb, Local Shops | Reverb GMV: $1.2 billion (2023) | Offers lower-cost alternatives to new purchases. |

| General Entertainment | Video Games, Sports, Arts | Global Video Game Market: >$200 billion (2024 est.) | Diverts discretionary spending and leisure time from music. |

Entrants Threaten

Establishing a physical retail chain akin to Guitar Center demands significant capital. We're talking about substantial investments in prime real estate locations, stocking a wide array of instruments and accessories, designing and building out store interiors, and setting up the necessary operational infrastructure. For instance, a new competitor looking to build a nationwide presence would likely face initial costs in the tens or even hundreds of millions of dollars just to get a comparable footprint off the ground. This high upfront investment acts as a formidable barrier, deterring many potential new entrants from attempting to directly replicate Guitar Center's established physical network.

Guitar Center and its main rivals, such as Sweetwater, have spent years building robust brand recognition and customer loyalty. This makes it challenging for new companies to gain traction.

New entrants would struggle to establish trust and a solid reputation in a market where customer perception and experience are paramount. For instance, in 2023, Guitar Center reported over $2 billion in revenue, showcasing its significant market presence and customer base built over decades.

Overcoming the ingrained preference for established brands like Guitar Center, which boasts a vast network of physical stores and a strong online presence, requires substantial investment and a compelling value proposition.

The long-standing relationships Guitar Center has cultivated with musicians, often through in-store expertise and community engagement, create a significant barrier for any newcomer aiming to replicate that level of trust and connection.

The threat of new entrants is significantly dampened by the intricate web of supply chain and vendor relationships in the musical instrument retail industry. New players would face immense difficulty replicating Guitar Center's established connections with major manufacturers, which are crucial for sourcing a diverse and desirable inventory. For instance, in 2024, securing direct distribution agreements for high-demand brands like Fender or Gibson remained a substantial barrier for emerging retailers.

Economies of Scale in Purchasing and Distribution

Economies of scale significantly deter new entrants in the musical instrument retail sector. Established players like Guitar Center leverage their massive purchasing power to secure lower prices from manufacturers, a benefit unavailable to smaller, newer businesses. For instance, in 2024, major retailers continued to consolidate supply chains, further amplifying these purchasing advantages.

The cost of establishing a comparable distribution network is another substantial barrier. Guitar Center's extensive logistics infrastructure allows for efficient inventory management and timely delivery across numerous locations, both physical and online. New entrants would face considerable upfront investment to replicate this reach, making it difficult to compete on service and availability.

Marketing and brand recognition also play a crucial role. Large retailers can afford broad advertising campaigns, building brand loyalty and awareness that new entrants struggle to match. This disparity in marketing spend, evident in 2024 advertising budgets, creates a significant hurdle for new companies seeking to gain market traction.

- Purchasing Power: Large retailers secure volume discounts, lowering their cost of goods sold.

- Distribution Efficiency: Established logistics networks reduce shipping costs and improve delivery times.

- Marketing Reach: Significant advertising budgets build brand awareness, a challenge for newcomers.

- Market Consolidation: The trend in 2024 shows fewer, larger players dominating the retail landscape.

Specialized Knowledge and Service Offerings

The musical instrument retail sector demands a deep well of specialized product knowledge and skilled sales associates. Newcomers struggle to replicate the extensive training and experience that established players like Guitar Center cultivate in their staff. For instance, in 2024, Guitar Center continued to emphasize its associate training programs, aiming to ensure a high level of expertise across its sales floor, which is a considerable hurdle for potential rivals.

Furthermore, the provision of value-added services, such as instrument repairs, maintenance, and music lessons, represents another significant barrier. Developing a robust service infrastructure requires substantial investment in skilled technicians and facilities. Guitar Center's established network of service centers and lesson programs, a key component of its customer retention strategy, is not easily replicated by nascent competitors.

- Specialized Expertise: The need for knowledgeable staff in areas like acoustic guitars, electric guitars, and pro audio equipment creates a high barrier.

- Service Infrastructure: Investment in repair shops and music lesson studios is costly and time-consuming for new entrants.

- Experiential Retail: Guitar Center's focus on in-store experiences and expert advice differentiates it, making it hard for new players to compete on this front.

The threat of new entrants into the musical instrument retail market, particularly for a player like Guitar Center, is significantly mitigated by substantial capital requirements. Building a national retail footprint, stocking a diverse inventory, and establishing operational infrastructure demand tens of millions of dollars, a considerable hurdle for newcomers. For instance, in 2024, the cost of acquiring prime retail locations and inventory for a comprehensive music store remained exceptionally high.

Economies of scale are a major deterrent, as established retailers like Guitar Center leverage massive purchasing power for lower costs from manufacturers, a benefit unavailable to smaller, new businesses. This purchasing advantage, amplified by market consolidation trends observed in 2024, makes it difficult for new entrants to compete on price.

The established brand loyalty and deep customer relationships cultivated by Guitar Center over decades, often reinforced by in-store expertise and community engagement, create a significant barrier. New entrants would struggle to replicate this trust and connection, especially in 2024, where customer experience remains a key differentiator.

| Barrier Type | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | High upfront investment for physical stores, inventory, and operations. | Tens to hundreds of millions for a national presence. |

| Economies of Scale | Lower costs due to high-volume purchasing from manufacturers. | Continued consolidation in 2024 further benefits large players. |

| Brand Loyalty & Relationships | Established trust and customer connections built over time. | In-store expertise and community engagement remain key differentiators. |

| Supply Chain Access | Difficulty in securing direct distribution agreements with major brands. | Key brands like Fender and Gibson present significant sourcing challenges for new retailers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Guitar Center is built upon a foundation of comprehensive data, including Guitar Center's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista. This blend of internal and external data provides a robust understanding of the competitive landscape, buyer and supplier power, and the threat of new entrants and substitutes.