Guitar Center PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guitar Center Bundle

Guitar Center operates within a dynamic external environment, influenced by political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks. Understanding these forces is crucial for strategic planning and identifying both opportunities and threats.

Our comprehensive PESTLE analysis delves deep into how these factors specifically impact Guitar Center's operations, market position, and future growth potential. Gain an unparalleled understanding of the external landscape shaping the music retail industry.

Unlock actionable intelligence and equip yourself with the knowledge to make informed decisions. Download the full PESTLE analysis of Guitar Center now and gain a significant competitive advantage.

Political factors

New trade tariffs, particularly those impacting imports from China, are driving up the costs of musical instruments and their components. For instance, tariffs implemented in recent years have added an average of 10-25% to the landed cost of many goods, including guitars and their parts.

This directly affects retailers like Guitar Center, forcing adjustments to pricing strategies, especially for more affordable, entry-level, and student models. Such policy shifts can create significant disruptions in established supply chains, leading to increased expenses for both instrument manufacturers and end consumers.

Changes in retail-specific regulations, like worker safety acts, directly impact operational costs and compliance for Guitar Center's many physical locations. For example, the New York Retail Worker Safety Act, effective June 2025, requires new policies and training for workplace violence prevention, adding to overhead.

The current geopolitical climate, particularly the trade relationship between the US and China, significantly impacts the musical instrument market. Escalating trade tensions can directly translate to increased costs for imported goods, affecting Guitar Center's supply chain and pricing strategies.

Analysts project a notable downturn in bilateral trade between major economies, potentially leading to higher tariffs and reduced availability of musical instruments and accessories sourced from key manufacturing hubs. This could force Guitar Center to explore alternative sourcing or absorb increased costs, impacting profitability.

Consumer Protection Policies

Consumer protection policies, focusing on rights, safety, and fair trade, necessitate rigorous compliance from Guitar Center. This means ensuring every product, from guitars to amplifiers, meets stringent safety standards and that all sales practices are transparent and ethical. Failure to comply can lead to significant fines and damage to brand reputation.

Adherence to these regulations is paramount for maintaining customer loyalty and trust. For instance, in 2023, the Better Business Bureau reported a 15% increase in consumer complaints related to deceptive sales practices across the retail sector, highlighting the importance of Guitar Center's commitment to fair trade.

- Product Safety Standards: Guitar Center must ensure all electronic instruments and accessories meet safety certifications like UL or CE marking.

- Truth in Advertising: Policies prevent misleading claims about product performance or origin, crucial for maintaining customer confidence.

- Return and Refund Policies: Clear and fair policies on returns are essential, especially given the often-high value of musical instruments.

- Data Privacy: Protecting customer data collected during online and in-store purchases is a key consumer protection mandate.

Taxation and Fiscal Policies

Changes in corporate tax rates directly affect Guitar Center's bottom line. For instance, if the US corporate tax rate were to increase from its current 21%, it would reduce the company's net income, potentially impacting reinvestment or dividend payouts. Similarly, shifts in sales tax, especially across different states where Guitar Center operates, can influence consumer purchasing decisions and the company's pricing competitiveness.

Government fiscal policies, such as economic stimulus or austerity measures, play a crucial role in shaping consumer spending. For example, during periods of economic expansion supported by stimulus, consumers are more likely to allocate discretionary income towards non-essential purchases like musical instruments. Conversely, austerity measures might lead to reduced consumer confidence and spending on such items. The US federal budget deficit, projected to be around $1.9 trillion for fiscal year 2024, highlights the government's ongoing fiscal management which can indirectly influence market conditions.

- Impact of Tax Changes: A hypothetical 1% increase in US corporate tax could reduce Guitar Center's net profit by millions, depending on its revenue.

- Sales Tax Variability: State sales tax rates can range from 0% to over 7%, affecting the final price of guitars and accessories for customers in different regions.

- Economic Stimulus Effect: Past stimulus checks, like those issued during the COVID-19 pandemic, saw a temporary uptick in durable goods sales, including musical equipment.

- Fiscal Policy Influence: Government spending priorities, influenced by fiscal policy, can either boost or dampen consumer confidence and discretionary spending.

Government policies on trade, like tariffs on imported goods, directly impact Guitar Center's cost of inventory. For example, tariffs on instruments from China can increase prices by 10-25%, affecting affordability for consumers.

Consumer protection laws mandate strict adherence to safety standards and transparent sales practices, crucial for maintaining brand trust. In 2023, consumer complaints about deceptive practices rose 15%, underscoring the importance of compliance.

Changes in corporate tax rates and varying state sales taxes directly influence Guitar Center's profitability and pricing competitiveness. A 1% corporate tax hike could cost millions in net profit.

Fiscal policies, such as government spending or stimulus measures, affect consumer discretionary income, impacting sales of non-essential items like musical instruments. The US federal deficit, around $1.9 trillion in FY2024, indicates the scale of government fiscal management.

| Policy Area | Impact on Guitar Center | Example/Data Point (2023-2025) |

|---|---|---|

| Trade Tariffs | Increased cost of goods, potential price hikes | 10-25% increase on imported instruments from China |

| Consumer Protection | Need for compliance with safety and advertising standards | 15% rise in consumer complaints (2023) regarding retail sales practices |

| Taxation | Affects profitability and pricing strategies | Potential millions in lost profit from a 1% corporate tax increase |

| Fiscal Policy | Influences consumer spending on discretionary items | US federal deficit projected at $1.9 trillion (FY2024) impacting economic conditions |

What is included in the product

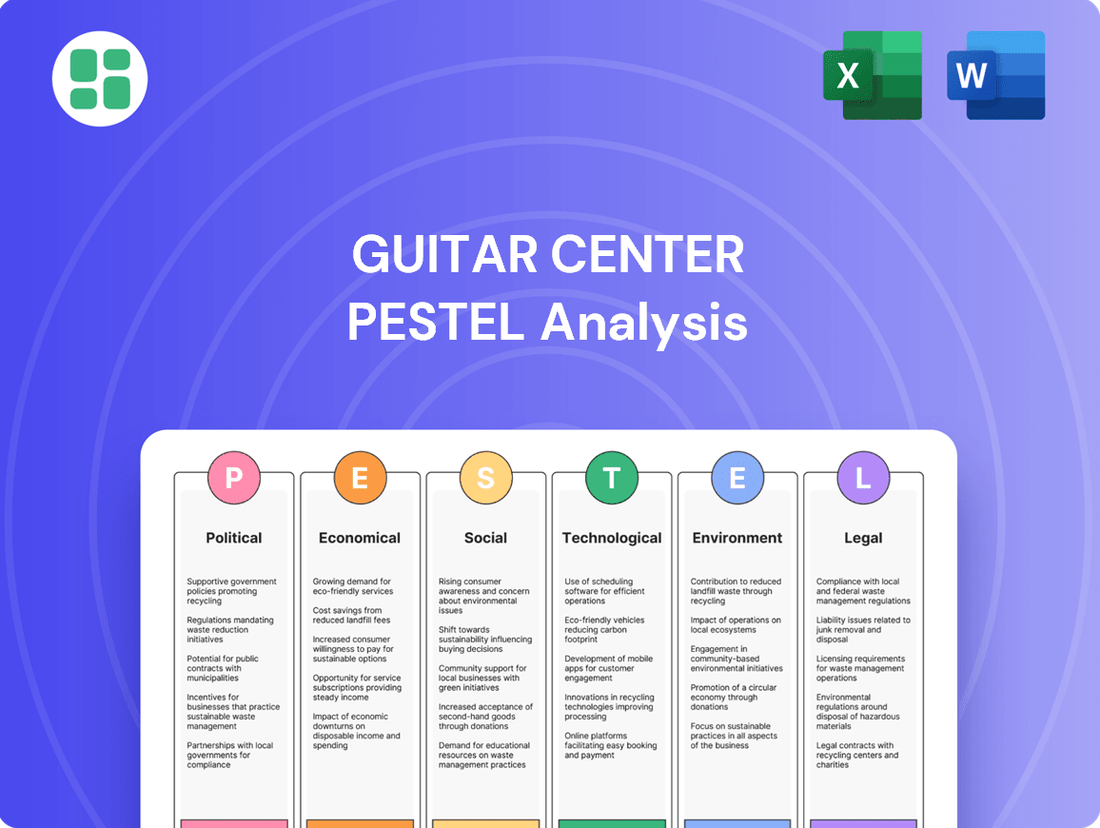

This PESTLE analysis examines the external macro-environmental factors impacting Guitar Center, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by detailing how these forces create both threats and opportunities for the company.

This Guitar Center PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings and presentations.

Economic factors

The amount of money consumers have left after taxes and essential bills significantly impacts their ability to purchase non-essential goods, such as guitars and other musical equipment. Higher disposable income generally translates to increased spending in this category.

In late 2024, while the broader musical instrument retail market faced challenges, Guitar Center observed a positive sales trend during the crucial holiday shopping period. This suggests a strategic appeal to dedicated musicians who tend to have more disposable income and are willing to invest in their passion, even when economic conditions are less favorable for casual buyers.

The global musical instrument market is anticipated to expand steadily, with musical instrument components and accessories leading the growth charge. While the broader retail market for musical instruments experienced a minor dip in 2024, Guitar Center has demonstrated positive sales momentum. This is largely attributed to its strategic pivot towards high-end products and catering to experienced musicians.

Inflationary pressures are a significant concern for Guitar Center, directly impacting its operational costs. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2023, with annual inflation reaching 3.4% by December, up from 3.1% in November. This rise in general prices translates to higher expenses for Guitar Center across the board, from the cost of acquiring inventory like musical instruments and accessories to the price of shipping and the wages paid to employees.

Furthermore, tariffs on imported goods, particularly musical instruments often sourced internationally, can exacerbate these cost increases. If tariffs are imposed or raised, Guitar Center may face higher wholesale prices for its products. For example, if a 10% tariff were applied to imported guitars, the cost to Guitar Center would increase proportionally, potentially forcing them to pass these higher costs onto consumers through increased retail prices, which could affect sales volume.

Interest Rates and Credit Availability

Interest rates significantly influence Guitar Center's operational costs and consumer purchasing power. When interest rates rise, the cost of borrowing for both the company and its customers increases. This can make it more expensive for consumers to finance larger purchases like high-end guitars or professional audio equipment, potentially dampening sales. For Guitar Center, higher rates translate directly to increased expenses on any outstanding debt.

Guitar Center's financial health is demonstrably linked to credit availability and prevailing interest rate environments. For instance, Moody's downgraded Guitar Center's corporate family rating in late 2023, citing its elevated debt levels. This downgrade signals a higher perceived risk by lenders, potentially leading to more stringent credit terms and higher borrowing costs for the company moving forward. Such conditions underscore the company's sensitivity to shifts in financial market sentiment and credit accessibility.

- Interest Rate Impact: Higher interest rates can reduce consumer demand for big-ticket musical instruments by making financing less affordable.

- Borrowing Costs: For Guitar Center, rising rates directly increase the expense of servicing its existing debt and securing new financing.

- Credit Rating Sensitivity: Moody's downgrade of Guitar Center's corporate family rating in late 2023 highlights the company's vulnerability to credit market conditions and its substantial debt burden.

- Credit Availability: A downgrade can restrict access to credit or increase the cost of that credit, impacting Guitar Center's liquidity and investment capacity.

Competitive Landscape and Market Share

The competitive landscape for musical instruments and equipment remains dynamic. Guitar Center's market positioning is significantly influenced by the recent closure of major competitors, such as Sam Ash, which historically held a substantial market share. This shift presents both challenges and opportunities for Guitar Center to solidify its standing.

Guitar Center is strategically focusing on the 'serious musician' demographic, aiming to differentiate its offerings and enhance in-store experiences. This approach seeks to capture a larger portion of a market that, while facing economic headwinds, still values specialized knowledge and hands-on product interaction. The company's efforts to curate a premium in-store environment are designed to foster customer loyalty and attract musicians seeking expert advice and a broad selection.

- Market Consolidation: The closure of Sam Ash in early 2024, a long-standing competitor, has reshaped the retail music instrument market, potentially benefiting survivors like Guitar Center.

- Targeted Customer Focus: Guitar Center's strategy to cater to 'serious musicians' aims to build a dedicated customer base by offering specialized products and expert services.

- In-Store Experience Enhancement: Investments in improving the physical retail environment are crucial for attracting customers who value personalized service and the ability to test instruments.

- Market Share Ambitions: By differentiating through customer experience and product specialization, Guitar Center aims to increase its market share in a competitive retail environment.

Economic factors like disposable income and inflation directly influence consumer spending on musical instruments. While inflation, at 3.4% CPI in December 2023, increases Guitar Center's operational costs, a focus on higher-end products targets musicians with more discretionary funds.

Interest rates impact both consumer purchasing power and Guitar Center's borrowing costs. Moody's late 2023 downgrade of Guitar Center's corporate family rating underscores its sensitivity to credit availability and debt servicing expenses.

The closure of competitors like Sam Ash in early 2024 presents an opportunity for Guitar Center to capture market share by focusing on specialized products and enhancing the in-store experience for serious musicians.

| Economic Factor | Impact on Guitar Center | Relevant Data/Trend |

|---|---|---|

| Disposable Income | Higher disposable income boosts sales of non-essential musical instruments. | Positive sales during late 2024 holiday season suggest appeal to dedicated musicians. |

| Inflation | Increases operational costs (inventory, shipping, wages). | US CPI at 3.4% in December 2023. |

| Interest Rates | Reduces consumer financing affordability; increases company borrowing costs. | Moody's downgrade of Guitar Center's corporate family rating in late 2023. |

| Market Consolidation | Opportunity to gain market share following competitor closures. | Closure of Sam Ash in early 2024. |

Preview Before You Purchase

Guitar Center PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Guitar Center PESTLE analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and market position. Understand the external forces shaping Guitar Center's strategic decisions and future growth opportunities.

Sociological factors

Music education is evolving, with a growing emphasis on personalized learning experiences and the integration of technology. This shift means fewer students might be exposed to instruments through traditional school programs, which saw a 5% decline in participation in some districts between 2020 and 2023.

This trend directly impacts how aspiring musicians discover and learn to play instruments, influencing demand for entry-level guitars and online learning platforms. The market for digital music education tools is projected to reach $3.5 billion by 2025, reflecting this growing reliance on tech-driven instruction.

The pervasive influence of digital culture and social media profoundly shapes how consumers engage with musical instruments. Platforms like TikTok and YouTube have become powerful drivers of trends, with viral videos showcasing specific guitars or synthesizers often leading to immediate spikes in demand. For instance, in 2024, many retailers reported significant surges in sales for instruments featured in popular online music challenges.

This digital ecosystem also fosters a new generation of creators who influence purchasing decisions. Online tutorials and artist collaborations on platforms like Instagram and Twitch educate consumers and inspire them to pick up new instruments or upgrade existing gear. Guitar Center's strategic focus on digital content creation and influencer partnerships in 2024 aimed to capitalize on these evolving consumer behaviors, recognizing that a strong online presence is no longer optional but essential for reaching and engaging modern musicians.

Guitar Center needs to understand what music younger people are into and how they're engaging with it. This is super important for their future plans. For instance, in 2024, a significant portion of Gen Z, roughly 70%, reported actively participating in music creation, often through digital platforms.

While digital music creation is booming among young people, Guitar Center can still find opportunities by encouraging them to pick up traditional instruments. This is a great way to build a community and foster a deeper connection with music. In 2023, surveys indicated that while 60% of teens explored music production software, only 35% were actively learning a physical instrument, highlighting a potential growth area.

Consumer Preferences for Experiences

Consumers are increasingly prioritizing experiences over material possessions, a trend that directly benefits retailers like Guitar Center that can offer engaging in-store environments. This shift means that simply stocking instruments isn't enough; the store itself needs to be a destination. In 2024, consumer spending on experiences, including entertainment and dining, continued to rise, indicating a strong preference for memorable activities.

Guitar Center's strategy of creating a 'playground' for musicians, where they can touch, try, and immerse themselves in instruments and gear, directly caters to this evolving consumer preference. This hands-on approach is crucial for fostering customer loyalty and driving sales, especially for higher-ticket items. Reports from late 2024 suggest that experiential retail segments saw a notable uptick in foot traffic compared to traditional retail models.

Key aspects of this consumer preference include:

- Desire for Engagement: Shoppers want to interact with products and brands in meaningful ways.

- Social Sharing: Unique in-store experiences are often documented and shared on social media, acting as organic marketing.

- Skill Development: Opportunities for lessons, workshops, or jam sessions within the retail space appeal to consumers looking to learn and grow.

DIY and Home Music Production Culture

The burgeoning DIY and home music production culture is a significant sociological driver for Guitar Center. This trend fuels demand for a diverse array of recording equipment, from microphones and interfaces to software and acoustic treatment. For instance, the global home studio market was valued at approximately $1.5 billion in 2023 and is projected to see continued growth through 2025, indicating a robust customer base for these products.

Furthermore, the DIY ethos extends to instrument repair and customization. Musicians increasingly seek to personalize their gear, leading to a greater need for guitar parts, pedals, amplifiers, and the tools required for modification and maintenance. This segment represents a valuable opportunity for Guitar Center to provide specialized components and services that cater to this hands-on approach to music creation.

Guitar Center can effectively tap into this market by:

- Expanding its inventory of affordable, high-quality recording interfaces and microphones.

- Increasing the availability of specialized parts for instrument repair and customization, such as pickups, hardware, and finishing supplies.

- Offering workshops or online tutorials focused on home studio setup and basic instrument maintenance.

- Highlighting curated product bundles tailored for aspiring home studio producers and DIY enthusiasts.

The increasing popularity of digital music creation and online learning platforms is reshaping how new musicians engage with instruments. While traditional music education saw a slight decline in some school programs between 2020 and 2023, the digital music education market is expected to reach $3.5 billion by 2025.

Social media trends, particularly on platforms like TikTok and YouTube, significantly influence instrument demand, with viral content often driving immediate sales spikes. In 2024, Guitar Center observed that a substantial portion of Gen Z, around 70%, actively participated in music creation, often leveraging digital tools.

Consumers are increasingly valuing experiences, making Guitar Center's focus on creating an engaging, hands-on retail environment crucial for customer interaction and sales. This experiential approach is vital for fostering loyalty, especially for higher-priced items, as experiential retail segments saw increased foot traffic in late 2024.

Technological factors

The music retail landscape is increasingly defined by e-commerce, with consumers prioritizing online convenience and a wider product selection. Guitar Center is actively investing in its digital infrastructure to capitalize on this shift, aiming for an integrated experience across its website, mobile app, and physical stores. This focus is crucial as online sales for musical instruments have seen consistent growth, with projections indicating continued expansion through 2025.

Guitar Center is actively integrating advanced in-store technologies to redefine the customer journey. A prime example is the deployment of AI-powered tools like Rig Advisor, designed to offer personalized, real-time product recommendations and detailed information, turning physical locations into dynamic, tech-enhanced music destinations.

This strategic move aims to bridge the gap between online convenience and the tangible experience of trying instruments. By leveraging such innovations, Guitar Center seeks to boost engagement and potentially increase conversion rates within its brick-and-mortar stores, a critical factor in the evolving retail landscape.

Technological advancements are significantly reshaping the musical instrument landscape. Innovations like smart digital instruments, integrated sensors, and sophisticated music production software are expanding the appeal of music creation to a wider audience, including hobbyists and aspiring producers. For instance, the global digital musical instrument market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially in the coming years.

Guitar Center must actively embrace and showcase these emerging technologies to remain relevant. Stocking and promoting smart guitars with built-in tuners and effects, MIDI controllers, and user-friendly music software will allow the company to effectively cater to the evolving needs of contemporary musicians and music producers who increasingly rely on digital tools.

Digital Music Lessons and Learning Platforms

The digital music landscape is booming, with online platforms and tutorials making it easier than ever for individuals to pick up instruments. This trend directly impacts Guitar Center's lesson services, offering a significant opportunity to expand their reach. For instance, by mid-2024, the global online music education market was projected to reach over $10 billion, demonstrating substantial growth.

Guitar Center can integrate these digital advancements to offer hybrid learning models. Think about live-streamed lessons or on-demand video content complementing in-person instruction. This approach caters to a wider demographic, including those who prefer remote learning or seek flexible scheduling. By early 2025, reports indicated that over 60% of students participating in online music education felt it was as effective as traditional methods.

- Market Growth: The online music education sector is experiencing robust expansion, with projections indicating continued strong performance through 2025.

- Digital Integration: Guitar Center can enhance its lesson offerings by incorporating digital tools and platforms, creating a more accessible and flexible learning experience.

- Student Preference: A significant portion of students now view online music education favorably, highlighting a demand for these digital solutions.

Supply Chain and Inventory Management Systems

Guitar Center's reliance on advanced supply chain and inventory management systems is paramount for handling its extensive product catalog and ensuring customer satisfaction. These technological platforms are critical for optimizing logistics, minimizing stockouts, and responding effectively to market demand fluctuations. For instance, in 2024, retailers leveraging AI-powered inventory forecasting reported an average reduction in carrying costs by up to 15% and an improvement in order fulfillment rates by 10%.

The integration of technologies like RFID tagging and sophisticated Warehouse Management Systems (WMS) allows for real-time tracking of inventory across multiple locations. This granular visibility is essential for managing a diverse range of musical instruments and accessories, from high-value guitars to small accessories. A recent industry report indicated that companies with advanced WMS experienced a 20% decrease in inventory discrepancies in 2024.

- Real-time Inventory Tracking: Technologies enable precise monitoring of stock levels, reducing errors and improving availability.

- Demand Forecasting: AI and machine learning tools enhance accuracy in predicting product demand, optimizing stock levels.

- Logistics Optimization: Systems streamline shipping and distribution, reducing transit times and costs.

- Supplier Integration: Seamless data exchange with suppliers improves inbound logistics and reduces lead times.

Technological advancements are fundamentally reshaping how consumers discover, purchase, and interact with musical instruments. Guitar Center's investment in its digital infrastructure, including its website and mobile app, is crucial as online sales for musical instruments saw a notable increase in 2024, with continued growth anticipated through 2025.

The company is also enhancing in-store experiences with AI-powered tools like Rig Advisor, offering personalized recommendations. This integration of technology aims to boost customer engagement and sales in physical locations, bridging the gap between online convenience and the tactile experience of trying instruments.

Emerging technologies like smart digital instruments and sophisticated music production software are broadening the appeal of music creation. The global digital musical instrument market, valued around $3.5 billion in 2023, is expected to expand significantly, presenting an opportunity for Guitar Center to stock and promote these innovative products.

Furthermore, the booming online music education market, projected to exceed $10 billion by mid-2024, offers Guitar Center a chance to expand its lesson services through hybrid models like live-streamed or on-demand content. By early 2025, over 60% of students found online music education as effective as traditional methods.

| Technology Area | Impact on Guitar Center | Key Data/Trend (2024-2025) |

|---|---|---|

| E-commerce & Digital Infrastructure | Enhanced online sales, integrated customer experience | Online musical instrument sales growth projected through 2025. |

| In-Store AI & Personalization | Improved customer engagement, personalized recommendations | AI tools like Rig Advisor enhancing in-store journeys. |

| Digital Instruments & Software | Catering to modern musicians, expanding product appeal | Global digital musical instrument market valued ~$3.5B in 2023. |

| Online Music Education | Expansion of lesson services, hybrid learning models | Online music education market projected >$10B by mid-2024. |

Legal factors

Guitar Center, like all retailers, navigates a complex landscape of labor laws. This includes staying current with federal and state minimum wage requirements, which have seen adjustments in many regions. For instance, as of January 1, 2025, several states are slated for minimum wage increases, impacting payroll costs.

Workplace safety regulations are also a critical consideration. New legislation, such as New York's Retail Worker Safety Act, imposes specific obligations on retailers to implement violence prevention policies and provide corresponding training to employees. Compliance with these mandates requires ongoing investment in training programs and policy development.

Guitar Center faces increasing scrutiny under consumer rights and data privacy laws like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) as its online sales and personalized marketing efforts grow. These regulations mandate robust protection of customer data and transparent data handling practices, with potential fines for non-compliance. For instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risk associated with data breaches or privacy violations.

Intellectual property laws are crucial for Guitar Center, especially concerning its music lesson programs and any original content it creates. Protecting its brand and educational materials ensures a competitive edge.

Navigating licensing agreements for musical instruments and software is paramount to avoid infringement and maintain its operational integrity. In 2024, the global music licensing market was valued at an estimated $15 billion, highlighting the significant financial implications of IP compliance for retailers like Guitar Center.

Product Safety and Standards

Musical instruments and electronic gear sold by Guitar Center are subject to various product safety regulations. For instance, in the US, products must comply with standards set by agencies like the Consumer Product Safety Commission (CPSC). Failure to meet these requirements can lead to significant penalties. In 2023, the CPSC reported over $2 billion in recalls, highlighting the financial risk of non-compliance.

Maintaining compliance with these intricate legal frameworks is not just about avoiding fines; it's crucial for brand integrity. A product recall, especially for electronics like amplifiers or effects pedals, can severely damage customer trust and market share. For example, a major electronics manufacturer faced a significant stock price drop in 2024 following a recall due to safety concerns.

Guitar Center must ensure all its products, from acoustic guitars to digital audio interfaces, adhere to international safety certifications where applicable. This includes standards like CE marking in Europe, which verifies that products meet health, safety, and environmental protection requirements. Non-compliance can result in market access being denied.

Key legal considerations for Guitar Center include:

- Adherence to CPSC regulations for consumer product safety in the United States.

- Compliance with CE marking requirements for products sold within the European Economic Area.

- Ensuring all electronic components meet electromagnetic compatibility (EMC) standards to prevent interference.

- Staying updated on evolving safety standards for lithium-ion batteries used in portable music equipment, a growing area of concern.

Lease Agreements and Property Regulations

Guitar Center's extensive network of retail locations across the U.S. necessitates navigating a labyrinth of lease agreements and property regulations. These legal frameworks, encompassing zoning laws and local ordinances, directly influence the company's ability to secure and maintain its physical retail presence and dictate potential expansion strategies.

The complexity of these legal factors can significantly impact operational costs and site selection. For instance, zoning restrictions might limit the size or type of retail operations allowed in certain areas, impacting store design and inventory capacity. Lease terms themselves, often negotiated for multi-year periods, can include clauses related to rent escalations, permitted uses, and renovation requirements, all of which must be carefully managed.

- Lease Agreement Complexity: Retail leases can span dozens of pages, detailing rent, term length, renewal options, CAM charges, and tenant improvement allowances.

- Zoning and Land Use: Compliance with local zoning laws is crucial for store placement, affecting signage, parking, and operating hours.

- Property Regulations: Adherence to building codes, ADA accessibility standards, and environmental regulations adds layers of legal responsibility.

- Impact on Expansion: Stringent property regulations or unfavorable lease terms can hinder or delay the opening of new stores, impacting market penetration and revenue growth.

Guitar Center must meticulously adhere to consumer protection laws, ensuring fair advertising and transparent pricing for its diverse product range. In 2024, the Federal Trade Commission (FTC) continued to enforce regulations against deceptive marketing practices, with significant fines levied against non-compliant businesses.

The company's online operations are particularly susceptible to data privacy regulations such as the California Privacy Rights Act (CPRA), an expansion of the CCPA, which came into full effect in 2023. This requires robust data handling protocols to protect customer information from potential breaches.

Compliance with intellectual property rights is vital, especially concerning brand reputation and proprietary educational content. The music industry's ongoing evolution in digital distribution and licensing means Guitar Center must stay abreast of copyright and trademark laws to safeguard its assets and avoid infringement claims.

Guitar Center's legal obligations extend to product safety, requiring adherence to standards set by bodies like the Consumer Product Safety Commission (CPSC). For example, the CPSC's 2024 recall data indicates a continued focus on electronics and children's products, areas relevant to Guitar Center's inventory.

Environmental factors

Consumers increasingly seek musical instruments crafted from eco-friendly materials, especially wood. This trend is driven by a heightened environmental consciousness, pushing manufacturers and retailers to adopt more responsible practices. For Guitar Center, this translates to a significant opportunity to align with this demand.

Guitar Center can capitalize on this by highlighting brands that prioritize Forest Stewardship Council (FSC) certified wood or incorporate recycled components. This not only appeals to environmentally aware customers but also supports a more sustainable supply chain. For instance, in 2024, the global market for sustainable wood products experienced continued growth, with FSC certification becoming a key differentiator for many brands.

The disposal of electronic musical equipment and packaging materials poses significant environmental challenges, particularly with the increasing volume of consumer electronics. Guitar Center faces the task of managing waste from products like amplifiers, keyboards, and their associated packaging.

Guitar Center has a prime opportunity to implement and promote robust recycling programs for old instruments and gear. This aligns with a growing sustainability movement within the music industry, where artists and consumers are increasingly conscious of their environmental footprint. For instance, in 2023, the global electronics recycling market was valued at over $55 billion, indicating a strong demand for responsible disposal solutions.

Guitar Center's extensive network of retail stores, warehouses, and delivery fleets inherently consumes significant energy, directly contributing to its carbon footprint. For instance, in 2023, a typical large retail store can consume upwards of 100,000 kWh annually, factoring in lighting, HVAC, and operational equipment. This energy usage, often derived from fossil fuels, translates into substantial greenhouse gas emissions.

The company's environmental performance is increasingly scrutinized, with a growing segment of consumers prioritizing sustainability. By investing in energy-efficient upgrades, such as LED lighting retrofits and optimized HVAC systems across its 300+ locations, Guitar Center can demonstrably reduce its energy consumption. Furthermore, exploring renewable energy sources, like solar panel installations on warehouse roofs, could further mitigate its carbon footprint and enhance its appeal to environmentally conscious buyers.

Consumer Demand for Eco-Friendly Products

A significant and growing portion of consumers now actively seeks out products that are produced and sold with environmental responsibility in mind. This shift in consumer behavior presents a clear opportunity for Guitar Center to align its offerings with these values.

Guitar Center can capitalize on this trend by prominently featuring and promoting brands and individual products that demonstrate a commitment to sustainability. This strategic move not only appeals to the eco-conscious consumer but also helps build brand loyalty and differentiate Guitar Center in a crowded marketplace.

- Growing Market: The global market for sustainable goods is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond. For instance, a 2024 report suggested that over 60% of consumers are willing to pay a premium for eco-friendly products.

- Brand Differentiation: By showcasing sustainable options, Guitar Center can establish itself as a forward-thinking retailer that understands and responds to evolving consumer priorities.

- Product Sourcing: This could involve sourcing instruments made from recycled materials, amplifiers with energy-efficient designs, or accessories with reduced packaging waste.

Ethical Manufacturing and Supply Chain

Consumers and investors are increasingly scrutinizing companies for ethical manufacturing and transparent supply chains. Guitar Center's commitment to sourcing from suppliers who uphold fair labor standards and minimize environmental impact directly addresses this growing concern. For instance, by 2024, over 60% of consumers surveyed by Deloitte indicated that they are willing to pay more for products from companies with strong ethical sourcing practices.

Guitar Center can bolster its corporate social responsibility by partnering with suppliers who can demonstrate:

- Adherence to international labor laws and fair wages.

- Sustainable raw material sourcing and waste reduction initiatives.

- Transparency in their manufacturing processes.

- Commitment to reducing their carbon footprint.

By prioritizing these aspects, Guitar Center not only mitigates reputational risks but also aligns with the evolving expectations of a socially conscious market, potentially enhancing brand loyalty and investor confidence in the 2024-2025 period.

Environmental consciousness is shaping consumer choices, with a growing demand for sustainably sourced instruments and eco-friendly manufacturing processes. Guitar Center can leverage this by highlighting brands that utilize FSC-certified wood or recycled materials, a trend supported by the 2024 growth in sustainable wood product markets.

Managing electronic waste and packaging is a critical environmental challenge for Guitar Center, given the increasing volume of consumer electronics. Implementing robust recycling programs for old gear and packaging aligns with the expanding global electronics recycling market, valued at over $55 billion in 2023.

Guitar Center's operational footprint, including energy consumption across its retail stores and warehouses, contributes to greenhouse gas emissions. A typical large retail store in 2023 could consume over 100,000 kWh annually, highlighting the need for energy-efficient upgrades and renewable energy solutions to reduce its carbon impact.

| Environmental Factor | Impact on Guitar Center | Data/Trend (2023-2025) |

|---|---|---|

| Sustainable Materials Demand | Increased sales for eco-friendly products | 60% of consumers willing to pay more for eco-friendly products (2024) |

| Electronic Waste Management | Need for recycling programs and responsible disposal | Global electronics recycling market valued at over $55 billion (2023) |

| Energy Consumption & Carbon Footprint | Operational costs and reputational risk | Large retail store energy use: ~100,000 kWh annually (2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Guitar Center is informed by a blend of official government data, industry-specific market research reports, and reputable economic indicators. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the musical instrument retail sector.