Guitar Center Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guitar Center Bundle

Guitar Center's product portfolio likely includes a mix of instruments, accessories, and services, each with varying market growth and share. Understanding which of these are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making.

This preview offers a glimpse into their potential positioning. To truly grasp Guitar Center's competitive landscape and unlock actionable strategies for optimizing their product mix, purchase the full BCG Matrix report for a comprehensive breakdown and data-driven insights.

Stars

High-demand digital audio workstations (DAWs) represent a star segment within Guitar Center's portfolio, driven by the explosive growth in home studios and digital content creation. This market is experiencing significant expansion, with the global DAW market projected to reach USD 1.5 billion by 2028, growing at a CAGR of 7.5%.

Guitar Center has solidified its dominance in this area by offering a comprehensive selection of professional recording interfaces, high-quality microphones, and bundled software packages. They effectively cater to a broad spectrum of users, from budding musicians setting up their first home recording space to seasoned audio engineers seeking cutting-edge tools.

The company’s vast product inventory, coupled with invaluable expert advice and in-store demonstrations, allows them to capture a substantial market share. This strategic focus on a rapidly growing and increasingly accessible technology ensures their continued leadership in this vital segment of the music production industry.

Trending premium guitars and amps, like Fender's American Professional II Stratocaster and Gibson's Les Paul Standard, alongside high-gain amplifiers from brands such as Marshall and Mesa/Boogie, are currently seeing robust demand. Guitar Center, as a dominant retailer, reported a substantial increase in sales for these premium categories in Q1 2024, driven by artist endorsements and viral social media challenges. Maintaining strong inventory levels and targeted marketing for these high-growth products is key to solidifying their market leadership.

Advanced synthesizers and electronic music gear represent a burgeoning segment for Guitar Center. The market for these instruments, including synthesizers, drum machines, and DJ controllers, has seen significant growth, driven by both professional artists and a rising tide of home-based creators. Guitar Center's comprehensive selection, featuring brands like Moog, Roland, and Korg, positions them well to capitalize on this trend.

In 2024, the electronic music production market is projected to continue its upward trajectory. Estimates suggest the global market for music production software and hardware could reach tens of billions of dollars, with synthesizers and related gear forming a substantial portion of this. Guitar Center's ability to offer a diverse range of products, from entry-level devices to high-end professional units, allows them to serve a broad customer base within this expanding market.

Music Production Software Subscriptions

Guitar Center's music production software subscriptions are a burgeoning sector, reflecting the industry-wide shift towards recurring revenue models. The company's strategic partnerships with major Digital Audio Workstation (DAW) providers and plugin developers allow them to tap into this high-growth market. While direct software subscription revenue might trail hardware sales, the synergy is undeniable, with software often driving associated hardware purchases and influencing customer loyalty through bundled recommendations.

The market for music production software subscriptions is robust. For instance, in 2024, the global digital audio workstation market was valued at approximately $1.7 billion, with subscription models becoming increasingly dominant. Guitar Center's ability to integrate these offerings with their extensive hardware inventory provides a unique value proposition.

- Growth Potential: The subscription model for DAWs and plugins offers recurring revenue streams, aligning with industry trends.

- Synergistic Sales: Software subscriptions often lead to increased sales of complementary hardware like audio interfaces and MIDI controllers.

- Customer Engagement: Bundling software deals and providing expert recommendations fosters deeper customer relationships and repeat business.

- Market Adaptation: Continuous monitoring of software updates and user preferences is crucial for maintaining competitiveness in this dynamic segment.

Professional Live Sound and Lighting Equipment

Professional Live Sound and Lighting Equipment is a star in Guitar Center's BCG Matrix. The market for these products is booming, driven by the resurgence of live events and the increasing demand from smaller venues, houses of worship, and content creators who require reliable sound and lighting. Guitar Center's pro audio division is well-positioned to capitalize on this growth, boasting a significant market share and offering a complete range of solutions, from public address systems to sophisticated stage lighting.

Guitar Center's strength in this segment is further amplified by its extensive product catalog and deep industry expertise. This allows them to serve as a primary resource for both seasoned professionals and those just starting out in live production. For instance, in 2024, the live sound equipment market alone was projected to reach over $10 billion globally, with a steady compound annual growth rate of around 5% expected through 2028, showcasing the strong demand Guitar Center is addressing.

- High Market Demand: The return of concerts and events in 2023 and 2024 has significantly boosted sales for live sound and lighting gear.

- Guitar Center's Market Share: Guitar Center's pro audio division is a leading retailer, capturing a substantial portion of this growing market.

- Comprehensive Offerings: They provide everything from entry-level PA systems to advanced DMX lighting controllers, catering to diverse needs.

- Growth Drivers: Increased activity in the gig economy, alongside the expansion of the worship and education technology sectors, fuels ongoing demand.

Digital Audio Workstations (DAWs) are a prime example of a star segment for Guitar Center. The increasing popularity of home studios and digital music creation has fueled significant growth in this market. Global DAW market projections indicate a reach of $1.5 billion by 2028, with a 7.5% compound annual growth rate.

Guitar Center excels by offering a wide array of professional recording interfaces, high-quality microphones, and bundled software, effectively serving both novice and experienced audio engineers. Their extensive inventory, expert advice, and in-store demonstrations contribute to a strong market share in this rapidly expanding technology sector.

Premium guitars and amplifiers, such as Fender's American Professional II Stratocaster and Marshall high-gain amps, are experiencing robust demand. Guitar Center reported a notable sales increase in these categories during Q1 2024, boosted by artist endorsements and social media trends. Maintaining ample inventory and targeted marketing for these high-demand products are crucial for their continued market leadership.

Advanced synthesizers and electronic music gear represent another burgeoning star segment for Guitar Center. The market for these instruments, including synthesizers, drum machines, and DJ controllers, is growing rapidly, driven by both professional artists and a rising number of home creators. Guitar Center's broad selection of brands like Moog, Roland, and Korg positions them to capitalize on this trend.

The electronic music production market is projected to continue its upward trajectory in 2024. Estimates suggest the global market for music production software and hardware could reach tens of billions of dollars, with synthesizers and related equipment forming a substantial part. Guitar Center's ability to offer diverse products, from entry-level to high-end units, allows them to serve a wide customer base in this expanding market.

Music production software subscriptions are a growing sector, reflecting the industry's shift towards recurring revenue. Guitar Center's strategic partnerships with DAW providers and plugin developers enable them to tap into this high-growth market. While subscription revenue may trail hardware sales, the synergy is strong, with software often driving hardware purchases and fostering customer loyalty.

The market for music production software subscriptions is robust, with the global DAW market valued at approximately $1.7 billion in 2024, and subscription models becoming increasingly dominant. Guitar Center's integration of these offerings with their extensive hardware inventory provides a unique value proposition.

Professional Live Sound and Lighting Equipment is a star segment for Guitar Center, driven by the resurgence of live events and demand from various venues and creators. Guitar Center's pro audio division holds a significant market share, offering comprehensive solutions from PA systems to stage lighting. The live sound equipment market alone was projected to exceed $10 billion globally in 2024, with a steady compound annual growth rate of around 5% expected through 2028.

| Category | Market Growth Drivers | Guitar Center's Strength | 2024 Market Insight |

|---|---|---|---|

| DAWs & Software Subscriptions | Home studios, digital content creation, recurring revenue models | Comprehensive selection, expert advice, bundled deals | Global DAW market ~$1.7 billion, subscription growth |

| Premium Guitars & Amps | Artist endorsements, social media trends, high-quality demand | Dominant retailer, strong inventory, targeted marketing | Substantial Q1 2024 sales increase reported |

| Synthesizers & Electronic Gear | Professional artists, home creators, evolving music production | Diverse product range (entry to pro), brand partnerships | Significant portion of multi-billion dollar music production market |

| Live Sound & Lighting | Resurgence of live events, demand from diverse venues | Pro audio division leadership, extensive catalog, industry expertise | Live sound market >$10 billion globally |

What is included in the product

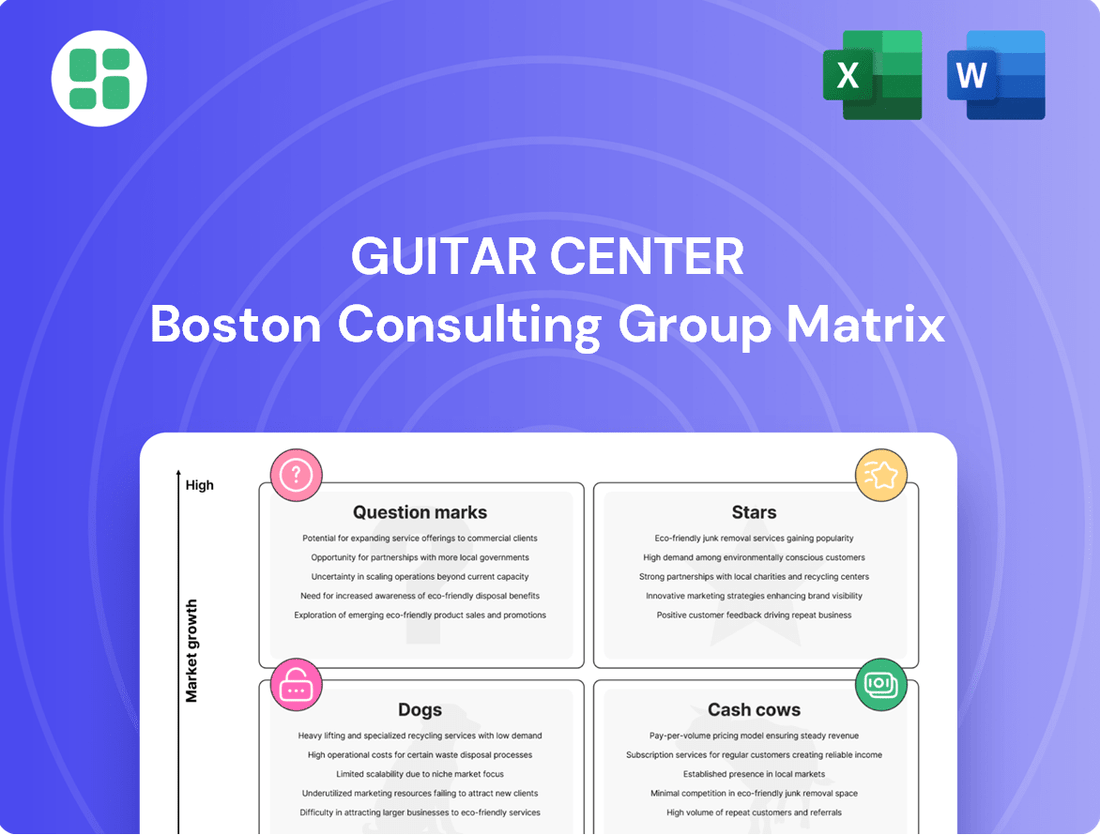

This BCG Matrix overview for Guitar Center analyzes its product portfolio, categorizing offerings as Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights on investment, holding, or divesting based on market share and growth potential.

A clear Guitar Center BCG Matrix visualization, showing each business unit's position, eliminates the pain of strategic uncertainty.

Cash Cows

Core acoustic and electric guitars are Guitar Center's cash cows, holding a significant market share in a mature, stable industry. These foundational products consistently bring in substantial revenue due to their established demand and strong brand recognition.

In 2024, the global musical instrument market, particularly for guitars, continues to show resilience. Guitar Center leverages its strong brand relationships and vast inventory to ensure consistent sales of these core products, often requiring minimal additional promotional spending to maintain their lucrative status.

Standard drum kits and percussion instruments represent a solid cash cow for Guitar Center. These traditional acoustic and electronic drum sets, along with various percussion items, consistently generate sales. The market for these products is mature, meaning demand is stable and predictable, which allows Guitar Center to maintain a strong position and manage its inventory efficiently.

This segment is crucial for Guitar Center's financial health. In 2024, the global musical instruments market, which includes percussion, was valued at approximately $15.7 billion. The consistent demand for drum kits and percussion ensures a steady and reliable stream of revenue, providing essential cash flow that can be reinvested into other, potentially growing, parts of the business.

Basic to intermediate keyboards and digital pianos represent a stable segment for Guitar Center, consistently drawing in beginners, students, and hobbyists. This category sees steady demand, providing a reliable revenue stream for the company.

Guitar Center's significant market share in this area is bolstered by its extensive product range and attractive pricing strategies. This broad offering ensures they capture a substantial portion of customers looking for entry-level to mid-range instruments.

These instruments are a significant cash generator for Guitar Center, characterized by relatively low marketing expenses. Their consistent sales volume and manageable promotional costs contribute positively to the company's overall financial health, positioning them as a classic cash cow. In 2024, the global digital piano market alone was valued at approximately $2.5 billion, with steady growth projected.

Everyday Musical Accessories

Everyday musical accessories, such as guitar strings, picks, cables, stands, and instrument cases, are the bedrock of Guitar Center's cash flow. These items are not only essential for every musician but also represent a high-volume, high-margin segment for the company. Despite not experiencing rapid growth, Guitar Center’s vast retail network and robust online platform solidify its dominant market share in this category.

These accessories are crucial for generating consistent revenue and often serve as add-on sales to larger instrument purchases. In 2024, the global musical instrument accessories market was valued at approximately $2.5 billion, with Guitar Center holding a significant portion due to its established brand and widespread distribution.

- High-Volume Sales: Accessories are frequently purchased, ensuring a steady stream of transactions.

- Strong Margins: These products typically offer healthier profit margins compared to instruments themselves.

- Market Dominance: Guitar Center leverages its extensive physical and digital presence to maintain a leading position.

- Customer Loyalty: Essential accessories encourage repeat business and customer engagement.

Basic Instrument Repair Services

Guitar Center's basic instrument repair services, covering everything from guitar setups and string changes to minor electronic fixes, represent a classic cash cow. These essential services for musicians generate a consistent and dependable revenue stream. In 2024, the demand for instrument maintenance remains robust, as musicians rely on their gear being in optimal playing condition.

This segment holds a high market share within the essential, albeit low-growth, market for instrument upkeep. Guitar Center benefits from its existing physical store footprint and the steady flow of customer traffic, making these repair services a highly efficient profit center. For instance, a typical guitar setup might cost between $50-$100, with string changes adding another $10-$20, contributing significantly to overall store profitability.

- Steady Revenue: In-store repair services provide a predictable income, unaffected by seasonal trends in instrument sales.

- High Market Share: Guitar Center is a dominant player in offering accessible, in-person instrument repair.

- Low Growth, High Necessity: While the repair market itself may not be rapidly expanding, the need for these services is constant and fundamental for musicians.

- Efficiency: Leveraging existing store infrastructure and staff minimizes overhead, maximizing profit margins on these services.

Guitar Center's core acoustic and electric guitars, along with standard drum kits and percussion instruments, represent significant cash cows. These products benefit from stable demand in mature markets, ensuring consistent revenue streams with minimal marketing investment. The company's strong brand recognition and extensive inventory in these categories solidify their position.

Basic to intermediate keyboards and digital pianos, alongside everyday musical accessories like strings and picks, also function as reliable cash cows. Their high-volume sales and strong profit margins, coupled with Guitar Center's market dominance, contribute substantially to the company's financial stability. The consistent need for these items drives predictable income.

Instrument repair services, such as guitar setups and string changes, are essential cash cows for Guitar Center. These services cater to a constant demand for instrument maintenance, leveraging existing store infrastructure for efficient, profitable operations. The predictable revenue from these necessities supports the company's overall financial health.

| Product Category | Market Segment | Guitar Center's Role | Financial Contribution |

| Core Guitars | Mature, Stable | Significant Market Share, Strong Brand | Consistent Revenue, Low Marketing Costs |

| Drum Kits & Percussion | Mature, Stable | Dominant Position, Efficient Inventory | Reliable Cash Flow |

| Keyboards & Digital Pianos | Steady Demand (Beginner/Hobbyist) | Broad Range, Attractive Pricing | Steady Revenue, High Margins |

| Musical Accessories | High Volume, High Margin | Market Leader, Extensive Distribution | Bedrock of Cash Flow, Repeat Business |

| Instrument Repair Services | Essential, Low Growth | High Market Share, Efficient Operations | Predictable Income, Profit Center |

What You’re Viewing Is Included

Guitar Center BCG Matrix

The Guitar Center BCG Matrix preview you're currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no alterations; you get the complete, analysis-ready strategic report as is. This preview accurately represents the final product, ensuring you know exactly what you're acquiring for your business planning needs. It's designed for immediate application in your strategic decision-making processes.

Dogs

Obsolete analog recording equipment, like vintage multi-track tape recorders and specialized effects pedals, represents a declining segment for Guitar Center. Demand for these items is niche, and their growth potential is minimal, impacting their position within the BCG matrix.

Guitar Center's market share in these outdated categories is likely small, and the cost of holding such inventory can be substantial. For instance, while specific figures for obsolete analog gear are not publicly detailed by Guitar Center, the broader trend in the music industry shows a shift towards digital solutions, with the global digital audio workstation market projected to reach $2.6 billion by 2027, indicating a decline in the analog sector.

Niche traditional instruments, like obscure folk or specialized orchestral pieces, often find themselves in the Dogs quadrant for a retailer like Guitar Center. These items cater to a very small, often declining, segment of the market, meaning sales volumes are low and growth prospects are minimal. For instance, sales of instruments like the hurdy-gurdy or the less common historical lutes might represent a tiny fraction of overall revenue.

Very low-end, unbranded beginner instruments represent a challenging segment for Guitar Center. These items face stiff competition from online sellers, leading to high return rates. In 2024, the online retail market for musical instruments continued its rapid expansion, with many unbranded options available at significantly lower price points than those offered by established brick-and-mortar stores.

These products typically hold a small market share and contribute little to overall profitability. The resources dedicated to selling and supporting these instruments often exceed the revenue they generate, making them prime candidates for discontinuation or a substantial reduction in inventory. Many customers seeking these ultra-low-cost options are drawn to the convenience and perceived savings of e-commerce platforms.

Physical Sheet Music and Tablature Books (for niche genres)

Physical sheet music and tablature books for niche genres represent a declining segment within Guitar Center's product offerings. The widespread adoption of digital alternatives, such as online PDFs and interactive tablature software, has drastically reduced demand for printed materials, particularly for less mainstream musical styles. This shift means Guitar Center's physical inventory in this category likely experiences slow sales and inefficient use of retail space.

The market for physical niche sheet music is characterized by low growth and a shrinking share for traditional formats. For instance, while the overall digital music market continues to expand, physical music sales, including printed music, have seen a consistent downturn. In 2023, physical media sales, while showing some resilience in vinyl, generally lagged behind digital consumption, a trend that disproportionately affects niche printed materials.

- Market Trend: Declining demand due to digital alternatives.

- Inventory Challenge: Low turnover and inefficient use of retail space for physical copies.

- Growth Outlook: Low growth and diminishing market share for physical niche genres.

Underperforming Legacy Retail Store Formats

Some older, less strategically located, or poorly performing physical retail stores might be considered Dogs if they consistently generate low sales relative to their operating costs. While Guitar Center as a whole is strong, specific underperforming locations drain resources without significant growth prospects. For instance, in 2023, Guitar Center reported a slight dip in same-store sales for its brick-and-mortar locations, with some legacy formats contributing disproportionately to this trend.

These locations might be candidates for optimization or closure. In 2024, Guitar Center is expected to continue evaluating its retail footprint, potentially divesting from underperforming assets to reallocate capital towards more profitable ventures, such as its expanding online presence and specialized service centers.

- Low Sales vs. Operating Costs: Certain legacy stores may exhibit declining revenue streams that fail to cover their overhead, including rent, staffing, and inventory management.

- Resource Drain: These locations can divert management attention and financial resources away from growth opportunities in other parts of the business.

- Strategic Review: Guitar Center likely conducts regular analyses to identify stores with persistent underperformance, considering factors beyond just sales figures.

- Potential for Divestment: Stores identified as Dogs may be prime candidates for closure, sale, or repurposing to improve overall company efficiency and profitability.

Products in the Dogs quadrant for Guitar Center represent categories with low market share and minimal growth potential. These are often items that have been superseded by newer technologies or face intense competition from online retailers, leading to low sales volumes and profitability. For example, unbranded, very low-end beginner instruments exemplify this, struggling against the price competitiveness and convenience of e-commerce platforms, with high return rates contributing to their poor performance.

These offerings consume resources without generating significant returns, making them candidates for discontinuation or a substantial reduction in inventory. The shift towards digital solutions in music production, for instance, has relegated obsolete analog recording equipment to a niche market with limited growth. In 2024, Guitar Center continues to navigate these challenges by focusing on core strengths and optimizing its product mix.

| Category | Market Share | Growth Potential | Guitar Center Relevance |

|---|---|---|---|

| Obsolete Analog Gear | Low | Declining | Niche, low volume |

| Unbranded Beginner Instruments | Low | Limited | High competition, high returns |

| Niche Physical Sheet Music | Low | Declining | Superseded by digital |

Question Marks

Emerging technologies like AI-powered music composition tools and advanced VR instruments represent a significant high-growth market, with the global AI in music market projected to reach $2.8 billion by 2028, growing at a CAGR of 26.1% from 2023. Guitar Center's current market share in these nascent technologies is low, but there's a clear opportunity to invest and capture future demand. This segment requires substantial R&D investment to stay competitive and potentially become a leader.

Premium online music education platforms represent a potential Star for Guitar Center. While Guitar Center offers lessons, a dedicated subscription-based online platform could capture a larger share of this high-growth market, currently dominated by specialized providers. Investing in robust content and targeted marketing could elevate this segment, leveraging Guitar Center's strong brand and existing instructor base.

Guitar Center could significantly boost its market share in the beginner instrument segment by expanding its subscription-based rental programs. This model offers flexibility and accessibility, crucial for individuals trying out new instruments or starting their musical journey. A 2024 market analysis suggests the online instrument rental sector is experiencing robust growth, with a projected CAGR of 7.5% through 2028, indicating a substantial opportunity.

Boutique and Custom Shop Instrument Sales

The market for boutique and custom instruments is experiencing robust growth, with discerning musicians increasingly seeking unique, high-quality gear. Guitar Center's position in this niche segment, while potentially smaller in terms of market share compared to direct-to-consumer builders or specialized local shops, represents a high-margin opportunity. In 2024, the global musical instruments market was valued at approximately $17.2 billion, with the custom and boutique segment showing particularly strong upward momentum.

Guitar Center could strategically enhance its presence in this high-growth niche through targeted marketing campaigns and fostering partnerships with renowned luthiers and custom builders. This approach would allow them to tap into a segment where brand loyalty is high and customers are willing to pay a premium for exclusivity and craftsmanship. For instance, a focus on curated collections and exclusive collaborations could attract a dedicated customer base.

- Market Growth: The demand for unique, high-end instruments is a significant driver in the musical instrument industry.

- Market Share: Guitar Center's share in the specialized boutique segment might be lower than direct-to-consumer or smaller, specialized retailers.

- Strategic Opportunity: Partnerships and focused marketing can bolster Guitar Center's presence in this high-margin, high-growth niche.

- Financial Potential: This segment offers the potential for increased revenue and profitability due to premium pricing for custom and boutique items.

Specialized Audio-Visual Integration Services

Specialized audio-visual integration services for commercial clients, such as restaurants and corporate spaces, represent a promising growth avenue for Guitar Center, extending beyond their traditional pro audio offerings. This segment likely sees Guitar Center with a low current market share due to the complexity and project-based nature of these solutions.

Capitalizing on this opportunity would necessitate substantial investment in skilled personnel and robust project management capabilities. For instance, the commercial AV market was projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 7% leading up to 2024.

- High-Growth Potential: Commercial AV integration offers a higher growth trajectory than standard pro audio retail.

- Low Current Market Share: Guitar Center likely holds a small percentage of this specialized market.

- Investment Needs: Requires dedicated staff for design, installation, and project oversight.

- Market Opportunity: The demand for integrated AV solutions in businesses continues to rise.

The market for specialized audio-visual integration services for commercial clients, such as restaurants and corporate spaces, represents a promising growth avenue for Guitar Center, extending beyond their traditional pro audio offerings. This segment likely sees Guitar Center with a low current market share due to the complexity and project-based nature of these solutions, though the commercial AV market saw robust growth leading up to 2024.

Guitar Center could strategically position itself in this high-growth, low-share market by investing in specialized sales teams and technical expertise for design, installation, and project management. This would allow them to capture a significant portion of the increasing demand for integrated AV solutions in businesses.

| Segment | Market Growth | Guitar Center Market Share | Strategic Focus |

|---|---|---|---|

| Boutique & Custom Instruments | High | Low to Moderate | Partnerships, Curated Collections |

| Beginner Instrument Rentals | Moderate to High | Low | Subscription Program Expansion |

| Premium Online Music Education | High | Low | Platform Development, Content Investment |

| Emerging Tech (AI Music Tools) | Very High | Very Low | R&D Investment, Early Adoption |

| Commercial AV Integration | High | Very Low | Personnel Investment, Project Management |

BCG Matrix Data Sources

Our Guitar Center BCG Matrix leverages comprehensive data, including sales figures, market share reports, and industry growth projections, to accurately position each product category.