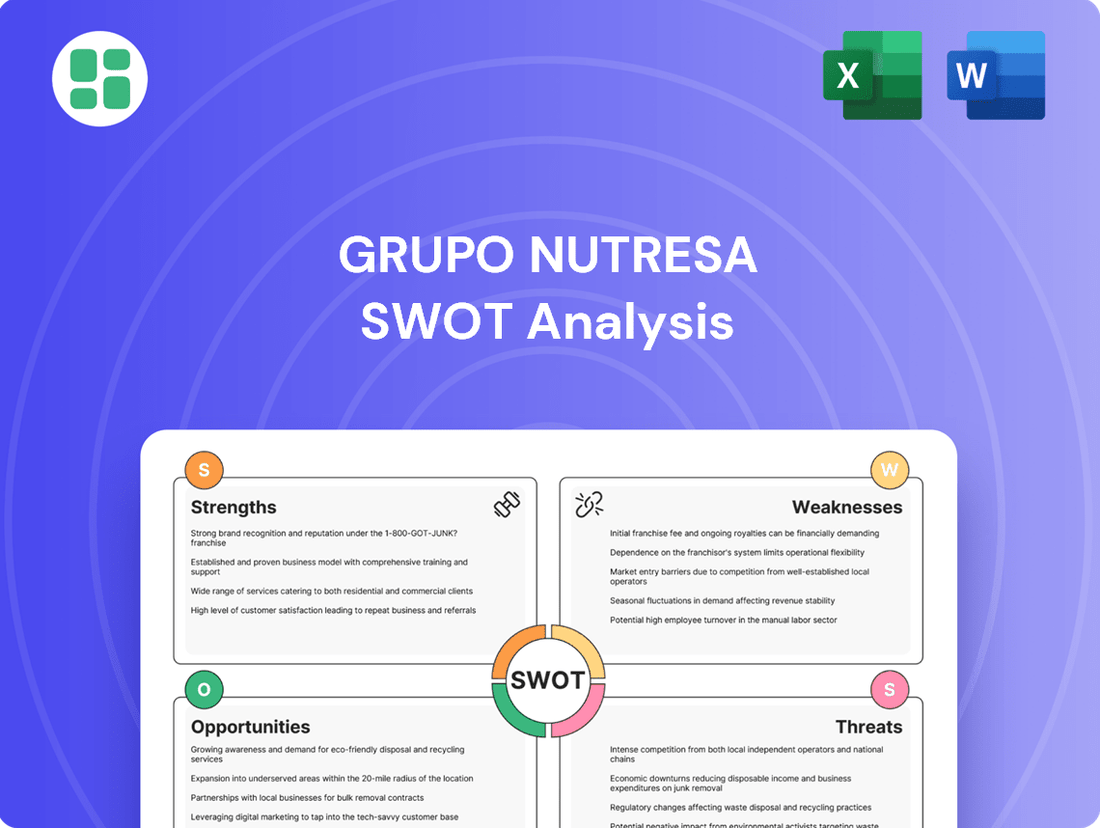

Grupo Nutresa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Nutresa Bundle

Grupo Nutresa, a leading food company, boasts strong brand recognition and a diversified product portfolio, giving it a significant competitive edge. However, it also navigates a complex regulatory environment and faces intense market competition, presenting key challenges.

Want the full story behind Grupo Nutresa's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Grupo Nutresa’s strength lies in its remarkably diverse product portfolio. This includes popular items like cold cuts, biscuits, chocolates, coffee, ice cream, and pasta. Such a broad range means they can appeal to many different tastes and needs, reducing the risk of depending too heavily on just one type of product.

This wide array of offerings is a key reason Grupo Nutresa holds strong market positions. It allows them to be flexible and respond effectively to shifts in what consumers want across various regions. For instance, in 2023, the company continued to see robust performance across its food segments, driven by innovation and strong brand recognition in these diverse categories.

Grupo Nutresa boasts a formidable market presence, especially within Colombia and across the Andean region, Central America, and the Caribbean. International sales constituted a substantial 36.8% of its total revenue in 2024, underscoring its global reach.

The company's sophisticated distribution network, which includes a growing emphasis on digital channels, is a significant asset. This network facilitated COP 1.25 trillion in revenues in 2024, demonstrating its efficiency in reaching a vast customer base and ensuring timely product delivery.

Grupo Nutresa's dedication to sustainability is a significant strength, evidenced by its inclusion in S&P Global's Sustainability Yearbook. The company has made tangible progress in environmental stewardship, notably reducing greenhouse gas emissions and boosting renewable energy consumption throughout 2024.

Innovation is another core pillar, with Grupo Nutresa earning the top spot in Colombia's 2024 Entrepreneurial Innovation Ranking. This achievement is backed by substantial investments in research, development, and innovation (R&D+i), fostering the creation of novel business models and product offerings.

This combined emphasis on sustainability and innovation strengthens Grupo Nutresa's market standing and brand image. It also positions the company for sustained long-term value creation and improved operational efficiency, aligning with evolving consumer and investor expectations.

Solid Financial Performance and Profitability

Grupo Nutresa demonstrates robust financial health, a key strength. In 2024, the company reported impressive revenues of COP 18.6 trillion. This strong performance is further underscored by a healthy EBITDA margin, which stood at 12.8% in 2024 and saw a notable improvement to 15.0% in the first quarter of 2025. This Q1 2025 margin represents the company's highest in over five years.

The company's profitability has seen significant upward momentum. For the first half of 2025, Grupo Nutresa achieved a remarkable 94.8% increase in net profit, effectively nearly doubling its earnings. This substantial growth is attributable to strategic international expansion initiatives and the successful implementation of internal efficiency measures. Such strong financial performance provides a solid foundation for future investments and operational growth.

- Revenue Growth: COP 18.6 trillion in 2024.

- EBITDA Margin: 12.8% in 2024, improving to 15.0% in Q1 2025.

- Net Profit Surge: 94.8% increase in H1 2025.

- Financial Stability: Enables strategic investments and shareholder returns.

Strategic Alliances and Acquisitions

Grupo Nutresa consistently leverages strategic alliances and acquisitions to broaden its international presence and diversify its product range. A notable example is its collaboration with Mitsubishi Corporation, which has bolstered its standing in the Asian coffee sector. This proactive approach to expansion is a core strength, enabling the company to tap into new markets and integrate valuable capabilities.

Further demonstrating this strength, Grupo Nutresa recently completed the acquisition of Alimentos Yupi S.A. in June 2025, a move that significantly enhances its portfolio diversity. Such strategic integrations not only sharpen its competitive edge but also streamline market entry and foster sustainable growth by incorporating new operational strengths and extending market reach.

- Global Expansion: Partnerships like the one with Mitsubishi Corporation in the Asian coffee market exemplify successful global footprint expansion.

- Portfolio Diversification: The June 2025 acquisition of Alimentos Yupi S.A. highlights the company's commitment to broadening its product offerings.

- Competitive Advantage: These strategic moves enhance market positioning and facilitate entry into new territories.

- Capability Integration: Acquisitions and alliances allow for the seamless incorporation of new technologies and operational expertise.

Grupo Nutresa's diverse product range, spanning from biscuits to coffee, is a significant strength, allowing it to cater to a wide array of consumer preferences and reducing reliance on single product categories.

Its strong market presence, particularly in Colombia and the Andean region, is bolstered by international sales that accounted for 36.8% of its total revenue in 2024, showcasing its global reach.

The company's efficient distribution network, incorporating digital channels, facilitated COP 1.25 trillion in revenues in 2024, highlighting its ability to reach customers effectively.

Grupo Nutresa's commitment to sustainability and innovation, recognized by its inclusion in S&P Global's Sustainability Yearbook and its top ranking in Colombia's 2024 Entrepreneurial Innovation Ranking, strengthens its brand and market position.

| Metric | 2024 Data | Q1 2025 Data |

|---|---|---|

| Total Revenue | COP 18.6 trillion | N/A |

| EBITDA Margin | 12.8% | 15.0% |

| Net Profit Growth (H1) | N/A | 94.8% |

What is included in the product

Delivers a strategic overview of Grupo Nutresa’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats and opportunities.

Offers a clear, actionable framework to identify and address Grupo Nutresa's strategic challenges and opportunities.

Weaknesses

Despite Grupo Nutresa's international growth, its heavy reliance on the Colombian market remains a significant weakness. In 2024, approximately 60% of its sales were generated domestically, a figure that slightly decreased to 58.2% in the first half of 2025. This concentration exposes the company to considerable risk from Colombia's economic and political fluctuations.

Any downturn in Colombian consumer spending or adverse economic shifts within the country could have a disproportionately negative effect on Grupo Nutresa's overall financial results. While a strong presence in its home market is beneficial, this dependence makes the company particularly vulnerable to localized economic downturns or unexpected regulatory changes.

Grupo Nutresa's reliance on agricultural commodities like cocoa and coffee makes it vulnerable to price swings. For instance, cocoa prices saw a dramatic surge in early 2024, reaching record highs due to supply concerns, which directly impacts companies like Nutresa that use these as key ingredients.

While hedging strategies are in place, prolonged periods of high commodity prices can still squeeze profit margins. If the cost of raw materials increases significantly, Nutresa might face the difficult choice of absorbing these costs, thus reducing profitability, or passing them on to consumers, potentially affecting sales volume.

Grupo Nutresa operates within a highly saturated processed food sector, facing formidable competition from both global giants and robust regional players. This intense rivalry, evident in markets like Colombia where major international food companies have significant presence, often translates into downward pressure on prices and necessitates substantial investments in marketing and product development to stand out.

Integration Risks from Acquisitions

Grupo Nutresa faces significant integration risks with its recent acquisitions, such as gaining control of Alimentos Yupi S.A. Merging different operational systems, corporate cultures, and supply chains can prove challenging and time-consuming. Failure to manage these integrations effectively could undermine the expected synergies and lead to inefficiencies.

The company's strategy of growth through acquisition, while potentially beneficial, inherently carries the risk of integration difficulties. For instance, the successful assimilation of Alimentos Yupi S.A. will require meticulous planning and execution to ensure its operations align smoothly with Grupo Nutresa's existing structure. This process is critical for realizing the full value of the acquisition.

- Operational Disruption: Integrating new businesses can disrupt existing workflows, impacting productivity and potentially leading to higher costs.

- Cultural Clashes: Divergent corporate cultures can hinder collaboration and employee morale, impacting the overall success of the combined entity.

- Synergy Realization: If integration is poorly managed, anticipated cost savings and revenue enhancements from acquisitions may not materialize, affecting financial performance.

- Management Bandwidth: Focusing on integrating multiple acquisitions can strain management resources, potentially diverting attention from core business operations.

Currency Exchange Rate Volatility

Grupo Nutresa's extensive international operations, particularly its exposure to the Colombian Peso (COP) and US Dollar (USD) exchange rates, present a significant weakness. For instance, a revaluation of the COP, as seen in early 2024, can diminish the reported value of its overseas earnings when translated back into pesos, impacting topline revenue growth. This inherent volatility necessitates robust currency risk management strategies to ensure stable financial reporting and sustained international profitability.

Key impacts of currency volatility include:

- Reduced Peso Value of Foreign Earnings: A stronger COP directly lowers the peso-denominated value of sales generated in USD or other foreign currencies.

- Increased Hedging Costs: The need to mitigate currency fluctuations often incurs significant costs for hedging instruments, impacting margins.

- Unpredictable Revenue Streams: Exchange rate swings can make it challenging to forecast and achieve consistent revenue growth from international markets.

Grupo Nutresa's significant reliance on the Colombian market, accounting for approximately 58.2% of its sales in the first half of 2025, exposes it to substantial domestic economic and political risks. This concentration makes the company particularly vulnerable to fluctuations in Colombian consumer spending and regulatory changes.

The company's dependence on agricultural commodities like cocoa and coffee, which experienced price surges in early 2024, directly impacts its cost of goods sold and can squeeze profit margins if not effectively hedged. This vulnerability to raw material price volatility requires careful management to avoid absorbing costs or losing sales volume.

Operating in a highly saturated processed food sector, Grupo Nutresa faces intense competition from global and regional players. This competitive landscape often leads to price pressures and necessitates ongoing investment in marketing and product innovation to maintain market share and profitability.

Integration challenges with recent acquisitions, such as Alimentos Yupi S.A., pose a risk to operational efficiency and synergy realization. Poorly managed integration can lead to cultural clashes, workflow disruptions, and strain management resources, potentially hindering the expected benefits of expansion.

Grupo Nutresa's international operations are exposed to currency exchange rate volatility, particularly between the Colombian Peso and the US Dollar. A strengthening COP, as observed in early 2024, can diminish the peso-denominated value of foreign earnings, impacting reported revenue and necessitating costly hedging strategies.

What You See Is What You Get

Grupo Nutresa SWOT Analysis

This preview reflects the real Grupo Nutresa SWOT analysis document you'll receive. It's a professionally structured and comprehensive report, offering valuable insights into the company's strategic position. Upon purchase, you'll unlock the full, detailed analysis, ready for immediate use.

Opportunities

Grupo Nutresa can capitalize on its established success in Latin America to expand into other emerging markets with robust growth potential, such as Southeast Asia or Africa. This strategic move could tap into burgeoning middle classes and increasing demand for processed foods. For instance, by 2024, the global processed food market was projected to reach over $1.1 trillion, offering significant room for expansion.

The company has the opportunity to deepen its penetration in existing, less-saturated international markets, rather than solely focusing on entirely new regions. This approach allows for leveraging existing distribution networks and brand recognition, potentially leading to quicker market share gains. In 2023, Grupo Nutresa's international sales already represented a substantial portion of its revenue, highlighting the existing appetite for its products abroad.

Grupo Nutresa has a prime opportunity to innovate by developing healthier, sustainable, and plant-based food options, directly addressing a significant consumer shift. This aligns with a global market growth in plant-based foods, projected to reach $162 billion by 2030, according to Bloomberg Intelligence. By reformulating existing products, like reducing sodium in biscuits, or exploring novel ingredients, such as alternative proteins through potential collaborations, the company can tap into this expanding market.

This strategic focus on health and wellness not only appeals to a growing segment of health-conscious consumers but also enhances Grupo Nutresa's brand image and market competitiveness. For instance, the company's investment in advanced food technologies, potentially including partnerships for alternative proteins, positions it to lead in a category that saw a 7% increase in sales in the US during 2023, as reported by the Good Food Institute.

Grupo Nutresa's commitment to e-commerce and digital transformation presents a significant opportunity for growth. By further investing in these areas, the company can broaden its direct-to-consumer (DTC) reach and boost operational efficiency. In 2023, digital channels already accounted for a notable portion of their sales, and expanding these capabilities promises to refine customer interactions and streamline logistics.

This digital acceleration is key to unlocking future sales expansion and enhancing overall business agility. For instance, by leveraging data analytics from these digital platforms, Grupo Nutresa can gain deeper insights into consumer preferences, allowing for more targeted marketing campaigns and product development. This data-driven approach is crucial for staying competitive in the evolving retail landscape.

Strategic Partnerships and Collaborations

Grupo Nutresa can significantly expand its reach and capabilities by actively seeking and nurturing strategic partnerships. For instance, building on its existing collaboration with Mitsubishi Corporation in the Asian coffee market, the company could explore similar alliances to penetrate new geographic regions or product categories. These ventures can unlock access to novel technologies and established distribution networks, crucial for sustained growth in competitive sectors.

Collaborations with academic institutions or specialized research firms are also vital for driving innovation. By pooling resources and expertise, Grupo Nutresa can accelerate product development cycles and tackle intricate supply chain issues. Such alliances not only provide access to cutting-edge research but also foster a culture of shared learning, ultimately enhancing the company's competitive edge. For example, in 2024, many food companies are investing more in R&D through partnerships to develop sustainable packaging solutions.

- Market Expansion: Partnerships can provide immediate access to new consumer bases and distribution channels, bypassing costly organic market entry.

- Technological Advancement: Collaborations with tech firms or research bodies can accelerate the adoption of new processing technologies or digital solutions, improving efficiency and product quality.

- Risk Mitigation: Sharing the investment burden and expertise in new ventures or market entries can reduce financial and operational risks for Grupo Nutresa.

- Supply Chain Resilience: Joint initiatives with suppliers or logistics providers can strengthen the supply chain, ensuring greater stability and cost-effectiveness, particularly in light of global supply chain disruptions observed in 2023-2024.

Sustainability Leadership and ESG Investment

Grupo Nutresa's existing strong sustainability record presents a significant opportunity to solidify its position as a leader in Environmental, Social, and Governance (ESG) practices. This focus can attract a growing segment of socially conscious investors and consumers. For instance, in 2023, global ESG assets were projected to reach $33.9 trillion, highlighting the market's demand for sustainable investments.

Further investment in areas like sustainable sourcing, circular economy models, and social initiatives, such as its established cocoa sustainability program, will reinforce its brand reputation and generate enduring value. Companies with strong ESG performance often see improved access to capital and more robust risk management frameworks. In 2024, companies demonstrating clear ESG progress reported an average 10% lower cost of capital compared to their peers.

Grupo Nutresa can leverage its commitment to sustainability to differentiate itself in the market and appeal to a broader customer base. This includes:

- Expanding its portfolio of sustainable products and packaging solutions.

- Enhancing transparency in its supply chain reporting.

- Deepening community engagement through its social programs.

- Setting ambitious science-based targets for emissions reduction.

Grupo Nutresa can expand its product offerings by developing healthier, plant-based, and sustainable options, tapping into a growing market segment. This aligns with the projected growth of the plant-based food market, expected to reach $162 billion by 2030, and a 7% sales increase in US plant-based foods in 2023. By reformulating products and exploring innovative ingredients, the company can enhance its brand image and competitiveness.

Threats

Economic slowdowns in key markets like Colombia and Brazil could reduce consumer spending on packaged goods, a segment where Grupo Nutresa operates significantly. For instance, if consumer confidence dips, shoppers might opt for store brands or smaller pack sizes, directly impacting Nutresa's sales volume and revenue streams. This economic contraction is a tangible threat to their market share and profitability.

Persistent inflation, especially in raw materials like sugar, cocoa, and packaging, directly squeezes Grupo Nutresa's profit margins. In 2024, global commodity prices for many of these inputs saw increases, and if these trends continue into 2025, the company faces a dilemma: absorb costs and reduce margins, or pass them on through price hikes, potentially alienating price-sensitive consumers. This delicate balancing act is crucial for maintaining financial health.

Grupo Nutresa faces heightened regulatory scrutiny across its operating regions, impacting everything from food labeling to environmental standards. For instance, the European Union's proposed "Farm to Fork" strategy, aiming for a more sustainable food system by 2030, could necessitate costly reformulation and sourcing changes for Nutresa's products sold in Europe, a significant market. This increasing complexity in compliance across diverse international markets presents a substantial operational challenge.

Trade barriers and protectionist policies represent another significant threat. As of early 2024, several countries are re-evaluating trade agreements, potentially leading to increased tariffs or non-tariff barriers that could directly affect Nutresa's export volumes and profitability in key markets like the United States and certain Latin American nations. Navigating these evolving trade landscapes requires constant vigilance and strategic adaptation to maintain market access and competitive pricing.

Global supply chain disruptions, exacerbated by geopolitical tensions and climate events, pose a significant threat to Grupo Nutresa. For instance, the ongoing conflicts in Eastern Europe have continued to impact energy prices and shipping routes throughout 2024, potentially increasing the cost of key ingredients and logistics for Nutresa.

Reliance on specific regions for sourcing, such as coffee beans from Latin America or palm oil from Southeast Asia, leaves the company vulnerable to localized political instability or economic downturns. A drought in Brazil in late 2023, for example, affected coffee yields, highlighting the fragility of single-source dependencies.

Mitigating these threats requires robust strategies like diversifying sourcing partners and investing in more resilient supply chain infrastructure. Companies that proactively build redundancy and flexibility into their operations are better positioned to navigate the volatility expected in 2025.

Changing Consumer Preferences and Brand Loyalty Erosion

Grupo Nutresa faces the threat of rapidly changing consumer preferences, particularly a growing demand for healthier options and products aligned with ethical sourcing and new dietary trends. Failure to quickly adapt its product portfolio could result in decreased demand for its traditional offerings.

The increasing prominence of niche brands and private labels poses a significant risk to brand loyalty and market share. Grupo Nutresa must continuously invest in robust brand building initiatives and product innovation to maintain its competitive edge and relevance in the evolving market landscape.

- Evolving Tastes: Consumers are increasingly prioritizing natural ingredients, reduced sugar, and plant-based alternatives. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow significantly.

- Brand Dilution: The proliferation of smaller, agile brands can capture specific consumer segments, potentially fragmenting market share and weakening established brand loyalty.

- Innovation Lag: If Grupo Nutresa's innovation pipeline doesn't align with emerging trends, it risks becoming perceived as outdated, impacting sales and brand perception.

Increased Competition from Local and Global Players

Grupo Nutresa faces a growing threat from both established international food giants and agile local players entering the market, particularly in high-growth segments. For instance, in 2024, the Latin American food and beverage market saw significant investment from global players seeking to diversify their portfolios, with companies like Nestlé and Unilever continuing to expand their offerings and distribution networks within regions where Nutresa operates. This intensified competition can lead to price wars and a squeeze on profit margins.

The rise of digitally native brands and those with innovative, niche product lines also poses a challenge. These competitors often leverage direct-to-consumer models and agile supply chains, allowing them to respond quickly to changing consumer preferences and potentially capture market share from traditional players like Grupo Nutresa. For example, the direct-to-consumer food delivery sector in Latin America experienced a growth rate of over 15% in 2024, indicating a shift in consumer purchasing habits that smaller, more adaptable companies can exploit.

- Intensified Price Competition: Global players entering markets like Colombia and Peru in 2024 have been observed to use aggressive pricing strategies to gain initial market traction.

- Niche Market Disruption: Smaller, specialized food producers are increasingly gaining traction by focusing on health-conscious or ethically sourced products, appealing to specific consumer segments.

- Digital Channel Dominance: Competitors with robust e-commerce platforms and efficient last-mile delivery systems are capturing market share from traditional retailers and manufacturers.

Grupo Nutresa must navigate a landscape of increasing competition from both established global food corporations and nimble local entities. This intensified rivalry, particularly in high-growth areas, can trigger price wars and compress profit margins. For instance, in 2024, major international food companies continued to invest heavily in Latin America, expanding their product lines and distribution networks, directly challenging Nutresa's market presence.

The rise of digitally focused brands and those offering unique, niche products presents a significant challenge. These competitors often utilize direct-to-consumer models and agile supply chains, enabling rapid adaptation to evolving consumer demands. For example, the direct-to-consumer food delivery sector in Latin America saw substantial growth in 2024, highlighting a consumer shift that smaller, more adaptable companies can leverage effectively.

Intensified price competition is a notable threat, with new market entrants in 2024 employing aggressive pricing tactics to establish a foothold. Furthermore, smaller, specialized food producers are gaining ground by focusing on health-conscious or ethically sourced items, appealing to specific consumer demographics and potentially fragmenting market share.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Grupo Nutresa's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded strategic perspective.