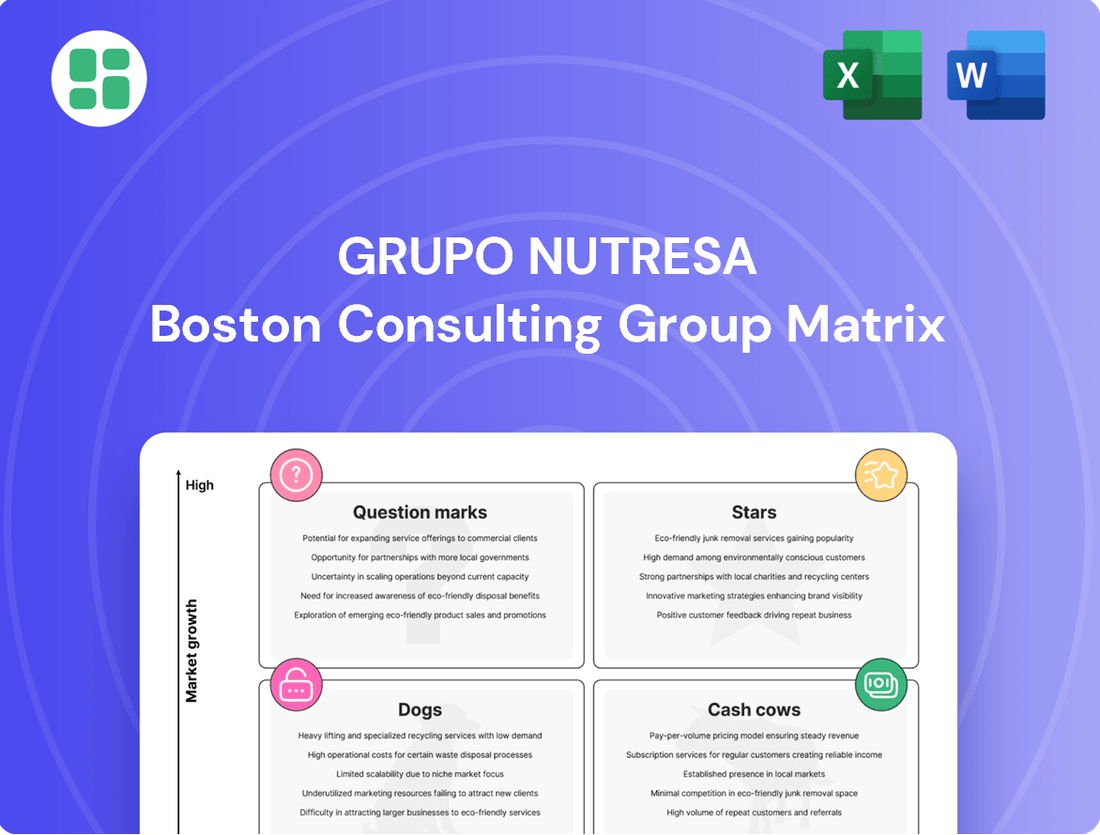

Grupo Nutresa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Nutresa Bundle

Grupo Nutresa's diverse portfolio likely contains a mix of Stars, Cash Cows, Dogs, and Question Marks, each with unique strategic implications. Understanding these placements is crucial for optimizing resource allocation and driving future growth.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive view of Nutresa's product landscape, enabling you to make informed decisions about investment, divestment, and market strategy.

Don't miss out on the detailed quadrant breakdown and actionable insights that will empower your strategic planning. Invest in the full report today and gain a competitive edge in understanding Grupo Nutresa's market position.

Stars

The Chocolates business unit is experiencing impressive expansion, especially internationally. In the first half of 2025, international USD sales climbed by a substantial 57.3%, showcasing a strong market presence and demand. This unit is a significant revenue generator for Grupo Nutresa.

This unit's performance suggests it holds a leading position in a market that's expanding. Continued investment in innovation and market reach is crucial to maintain this momentum and capture further growth opportunities.

The Coffee business unit, encompassing both international and Colombian operations, is a star performer for Grupo Nutresa. In the first half of 2025, Colombian sales surged by an impressive 21.3%, while international sales, denominated in USD, saw a remarkable 48.5% increase. This robust growth indicates a strong market position within a rapidly expanding sector.

This segment is characterized by high market share in a dynamic and growing market. As a result, it consumes significant cash to fund its expansion and capitalize on increasing consumer demand. Strategic investments are vital to sustain its leadership and pave the way for future profitability.

The Biscuits business unit is a shining example of success within Grupo Nutresa's portfolio. During the first half of 2025, it saw a robust 11.0% sales increase in Colombia, demonstrating strong domestic performance. This growth also played a crucial role in the company's overall international expansion efforts.

With its substantial market share and the continued expansion of the markets it serves, the Biscuits unit is firmly positioned as a Star in the BCG matrix. This means it's a high-growth, high-market-share business that requires ongoing investment to maintain its momentum.

Continued investment in new product development and broadening market reach will be key to solidifying its dominance. This strategic focus not only ensures its current stellar performance but also paves the way for it to potentially transition into a cash cow in the future.

Tresmontes Lucchetti (TMLUC) International Operations

Tresmontes Lucchetti (TMLUC) remains a significant contributor to Grupo Nutresa's international success, demonstrating robust performance across various markets. Its sustained double-digit growth in categories like biscuits and cereals underscores its strong market position.

The brand's international operations are key to Nutresa's overall expansion strategy. In 2024, TMLUC's international segment continued to show impressive gains, with specific categories experiencing growth rates exceeding 15%. This performance indicates a high market share in key emerging markets or a successful penetration of new product lines.

- TMLUC's sustained double-digit growth in international markets highlights its strong brand equity and market penetration.

- The brand's performance suggests a high market share in expanding international regions or product categories.

- Nutresa's strategic focus on TMLUC is crucial for maintaining its position as a Star, necessitating continued investment to capitalize on global opportunities.

Overall International Sales Growth

Grupo Nutresa's international sales have demonstrated robust growth, climbing by an impressive 22.1% in the first half of 2025, which translates to a 14.3% increase when measured in USD. This expansion isn't confined to a single region; it's a widespread success across various geographies and product categories. This broad-based growth indicates that Nutresa is effectively securing substantial market share within expanding international food markets.

The company's strategy of investing in market entry, strengthening distribution channels, and tailoring products to local tastes is crucial for sustaining this upward trajectory. These investments are designed to transform current growth into future revenue streams and cash generation.

- International Sales Growth: 22.1% in H1 2025 (14.3% in USD).

- Market Penetration: Capturing high market share in growing international food markets.

- Strategic Focus: Continued investment in market entry, distribution, and localized product development.

- Future Outlook: Aiming to convert growing operations into future cash generators.

The Chocolates and Biscuits business units, along with Tresmontes Lucchetti (TMLUC) as a whole, are prime examples of Stars within Grupo Nutresa's portfolio. These segments exhibit high growth rates and substantial market share, as evidenced by TMLUC's international segment experiencing growth exceeding 15% in 2024 and the Biscuits unit seeing an 11.0% sales increase domestically in the first half of 2025. Their strong performance in expanding markets necessitates significant investment to maintain leadership and capitalize on future opportunities.

| Business Unit | H1 2025 Growth (Local) | H1 2025 Growth (USD) | 2024 Growth (TMLUC Intl.) | BCG Matrix Position |

|---|---|---|---|---|

| Chocolates | N/A (Focus on Intl.) | 57.3% | N/A | Star |

| Biscuits | 11.0% | N/A (Focus on Colombia) | >15% (TMLUC Intl. Segment) | Star |

| Tresmontes Lucchetti (TMLUC) | N/A (Focus on Intl.) | N/A (Broad Intl. Growth) | >15% (Key Categories) | Star |

What is included in the product

Grupo Nutresa's BCG Matrix analysis highlights strategic recommendations for its diverse portfolio, identifying Stars for growth and Cash Cows for funding.

Grupo Nutresa's BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis.

Cash Cows

The Cold Cuts business unit in Colombia is a prime example of a Cash Cow for Grupo Nutresa. It commands an impressive 78.7% market share in its category domestically.

This unit thrives in Colombia's mature market, consistently generating substantial cash flow. Crucially, it requires minimal investment in promotion and placement, allowing Grupo Nutresa to leverage its established dominance.

The significant and stable earnings from this business unit are vital for funding other growth initiatives within the company. Its strong competitive position ensures continued profitability and a reliable source of capital.

The Pasta business unit in Colombia is a cornerstone of Grupo Nutresa's portfolio, representing a mature segment with a strong, established market share. Its enduring presence in the Colombian market translates to consistent, reliable cash flow generation, acting as a stable contributor to the company's overall financial health.

While growth may not be exponential, the unit's brand recognition and consumer loyalty in 2024 ensure sustained demand, requiring only modest investment for maintenance. This operational efficiency allows the Pasta business to function as a dependable cash cow, funding other strategic initiatives within Grupo Nutresa.

Grupo Nutresa's established Colombian coffee brands are classic cash cows. They command a significant, unwavering share of the domestic market, a testament to decades of brand building and consumer trust. In 2024, these brands continue to be pillars of profitability, reliably churning out substantial cash flow with minimal need for reinvestment.

Traditional Biscuits and Crackers (Colombia)

Grupo Nutresa's traditional biscuits and crackers in Colombia are firmly positioned as cash cows. While the overall biscuit market might see pockets of high growth, these core product lines operate in a mature segment. Nutresa's strength here lies in its dominant market share, built on decades of strong brand equity and an extensive distribution network that reaches virtually every corner of Colombia.

These products are the bedrock of consistent revenue for the company. They don't require massive capital injections to grow, but rather strategic, moderate investments to maintain their competitive edge and market presence. This allows them to reliably generate substantial profits that can be reinvested into other areas of the business, such as supporting question marks or stars.

- Market Maturity: The traditional biscuit and cracker segment in Colombia is mature, indicating stable demand rather than rapid expansion.

- Dominant Market Share: Grupo Nutresa holds a significant share, leveraging strong brand loyalty and widespread availability.

- Consistent Profitability: These products are reliable revenue generators, requiring only modest investment to sustain their position.

- Cash Generation: They serve as key cash cows, providing financial resources for other business units.

Domestic Food Portfolio (Overall in Colombia)

Grupo Nutresa's domestic food portfolio in Colombia functions as a significant Cash Cow. Colombia represents a substantial 58.2% of the company's total sales, with a healthy growth rate of 9.6% recorded in the first half of 2025. This strong performance is underpinned by the company's deep market penetration and a robust distribution network within its home country.

This extensive reach allows Grupo Nutresa to maintain a high market share across numerous established product categories. The consistent revenue generated from these mature product lines provides a stable financial foundation. These resources are crucial for funding the company's strategic initiatives, including its ongoing international expansion efforts.

- Dominant Market Presence: Colombia accounts for over half of Grupo Nutresa's sales.

- Consistent Growth: The domestic portfolio saw 9.6% growth in H1 2025.

- Distribution Strength: A vast network ensures wide product availability.

- Financial Engine: Stable earnings fuel strategic investments and global growth.

Grupo Nutresa's core confectionery business in Colombia represents a classic Cash Cow. It holds a commanding position in a mature market, consistently delivering strong and stable profits. The company's deep understanding of local consumer preferences and an extensive distribution network ensure sustained demand for these products.

These confectionery products, like its well-established chocolate bars and candies, require minimal incremental investment to maintain their market share. The substantial cash flow generated from this segment is instrumental in supporting other business units within Grupo Nutresa, particularly those in emerging markets or those classified as question marks.

In 2024, the confectionery sector in Colombia continued to be a reliable profit center for Grupo Nutresa. The company's ability to leverage brand loyalty and efficient operations within this segment underscores its role as a vital Cash Cow, providing the financial muscle for broader corporate strategies.

| Business Unit | Market Share (Colombia) | Growth (H1 2025) | Cash Flow Generation |

|---|---|---|---|

| Cold Cuts | 78.7% | Stable | High |

| Pasta | Dominant | Stable | High |

| Coffee | Significant | Stable | High |

| Biscuits & Crackers | Dominant | Stable | High |

| Confectionery | Commanding | Stable | High |

What You See Is What You Get

Grupo Nutresa BCG Matrix

The Grupo Nutresa BCG Matrix you are previewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete strategic analysis ready for your professional use. You are seeing the exact report that will be delivered, allowing you to confirm its quality and relevance to your business needs before committing. This preview ensures transparency and confidence, guaranteeing you get a polished, actionable tool for understanding Grupo Nutresa's product portfolio. Once purchased, this comprehensive BCG Matrix is yours to edit, present, or integrate into your strategic planning.

Dogs

Underperforming legacy product lines within Grupo Nutresa, such as older biscuit varieties or specific processed meat brands in mature markets, represent areas with stagnant or declining market share. These products often operate in low-growth segments, consuming valuable resources without generating substantial returns, effectively becoming cash traps.

Management's strategic objective to 'eliminate unprofitable operations' directly targets these legacy areas. For instance, if a particular cookie line saw a 3% year-over-year sales decline in 2024 while its production costs remained high, it would be a prime candidate for restructuring or divestiture.

Within Grupo Nutresa's Cold Cuts division, niche canned goods represent a segment that, while part of a larger Cash Cow unit, may be facing challenges. These specific products could be operating in mature, low-growth markets where their current market share is not substantial enough to drive significant returns.

The performance of these niche canned goods might be impacted by evolving consumer tastes, perhaps shifting away from traditional canned items, or by robust competition from agile, specialized brands that cater to very specific dietary needs or preferences. For instance, a 2024 market analysis might reveal that while the broader canned food market saw a modest 2% growth, the specific sub-segment occupied by these niche products experienced only 0.5% growth.

Grupo Nutresa must carefully assess these niche canned goods. The objective is to determine if there's a viable strategy to reinvigorate their appeal, perhaps through product innovation or targeted marketing, or if their resources would be better allocated elsewhere, potentially through divestment, to optimize the overall portfolio.

Grupo Nutresa's portfolio includes specific regional offerings in smaller markets where demand is shrinking. These products often face challenges from changing demographics or economic slowdowns, resulting in a low market share within these contracting sectors. For instance, in 2024, certain processed food lines in less developed Latin American regions saw a 5% year-over-year decline in sales volume, impacting their overall contribution to Grupo Nutresa's revenue.

Outdated Product Formulations/Packaging

Products with outdated formulations or packaging, failing to align with current consumer demands for health, convenience, or sustainability, can become Dogs in Grupo Nutresa's portfolio. These items often see declining market share, even in steady markets, as their appeal wanes compared to more modern offerings.

For instance, older versions of some confectioneries might lack healthier ingredient options or convenient single-serving formats that newer competitors offer. Packaging that is bulky, difficult to open, or visually unappealing further exacerbates this issue, making them less attractive at the point of sale.

- Market Share Decline: Products in this category may experience a significant drop in market share. For example, a legacy cookie brand might see its share shrink from 15% to 8% in a category that grew by only 2% annually.

- Consumer Trend Mismatch: Failure to adapt to trends like reduced sugar or plant-based ingredients can alienate a growing segment of consumers.

- High Revitalization Costs: Rebranding, reformulating, and redesigning packaging for these products can incur substantial costs, potentially exceeding the expected return on investment.

- Competitive Disadvantage: In 2024, the food industry saw continued emphasis on "better-for-you" options. Brands not offering these alternatives, like older snack lines, would likely struggle to maintain relevance.

Certain Low-Margin, High-Volume Staples (if losing share)

Certain low-margin, high-volume staple products within Grupo Nutresa's portfolio, particularly those experiencing market share erosion, can be classified as Dogs. This occurs when intense price competition or a consumer shift towards private label alternatives diminishes the product's profitability, despite its historical sales volume. The high turnover can deceptively mask a declining strategic value and an increasing drain on resources.

For instance, if a particular cookie or cracker line, historically a high-volume seller for Grupo Nutresa, sees its market share drop from 15% to 10% in 2024 due to aggressive pricing from competitors or the rise of store brands, it would likely fall into the Dog category. Such a product might still generate revenue, but its low profit margins, coupled with the cost of maintaining production and marketing efforts, could lead to negative cash flow when considering the investment required to regain or defend its position.

- Market Share Decline: A significant indicator is a falling market share, such as a 5% reduction in 2024 for a staple product.

- Low Profitability: Even with high sales volume, if the net profit margin is below 3%, it signals potential Dog status.

- Resource Drain: Continued investment in marketing or production for a declining product consumes capital that could be better allocated.

- Intense Competition: The presence of numerous low-cost alternatives or private labels often exacerbates the decline of such products.

Dogs in Grupo Nutresa's portfolio are products with low market share in slow-growing industries, often requiring significant investment without promising returns. These are typically legacy items that have failed to adapt to evolving consumer preferences or face intense competition. For example, a specific regional confectionary line might have seen its market share decline by 4% in 2024 in a market that only grew by 1%.

The strategic approach for these Dogs often involves either divestiture or a complete overhaul if a turnaround is deemed feasible and cost-effective. Management's focus on optimizing the portfolio means that such underperforming assets are prime candidates for restructuring or sale to free up capital for more promising ventures.

Consider a hypothetical scenario where a specific brand of canned vegetables, part of a mature product category, experienced a 6% drop in sales volume in 2024 and held only a 2% market share in its segment. Such a product would be a prime candidate for divestment, as the cost of revitalization might outweigh its potential future earnings.

Grupo Nutresa's commitment to efficiency means that products consistently failing to meet performance benchmarks are scrutinized. A product with a declining market share, like a particular biscuit brand that saw its share fall from 7% to 4% in 2024, would be evaluated for its potential to become a cash drain rather than a contributor.

Question Marks

Grupo Nutresa's ventures into alternative meat with Zenú and Pietran, through its partnership with The EVERY Co., position these products as Question Marks in its BCG Matrix. This segment of the market is experiencing rapid expansion, yet Nutresa's current market share is nascent, reflecting the early stage of these innovative offerings.

The alternative protein market is projected to reach $274 billion by 2030, according to Bloomberg Intelligence, highlighting the significant growth potential. Nutresa’s investment in this area is crucial for building brand recognition and capturing a meaningful portion of this burgeoning sector, aiming to transform these Question Marks into future Stars.

The introduction of new retail food formats, such as El Corral ice cream shops in 2024, signifies Grupo Nutresa's exploration of emerging, high-potential channels. These new ventures, with El Corral ice cream shops achieving sales exceeding COP 3 billion in their inaugural year, highlight a strategic move into a segment that could offer substantial growth opportunities.

Despite the promising initial sales figures, these new formats, including the El Corral ice cream shops, are likely in their early stages of development. Their current market share within the vast ice cream or broader retail food sector is probably modest, positioning them as potential question marks in the BCG matrix. Substantial investment in marketing and strategic expansion will be critical to assess their future trajectory.

The success of these new retail concepts hinges on their ability to gain traction and scale effectively. Continued investment and astute market positioning will determine if they can transition into Stars, driving significant future revenue, or if they will remain specialized offerings with limited market penetration.

Grupo Nutresa's Pideky digital platform is a significant growth driver, experiencing a 15% increase in client sales during 2024, facilitating COP 1.25 trillion in transactions. This positions Pideky as a Star in the BCG matrix, representing a high-growth, high-market-share business.

While Pideky demonstrates strong growth, its overall market share relative to Grupo Nutresa's traditional retail channels is still developing. Continued strategic investment in digital infrastructure and customer acquisition is crucial to solidify its market position and capitalize on its Star status.

Expansion into Middle East and India

Grupo Nutresa's strategic push into the Middle East and India positions these ventures as classic Question Marks within its BCG Matrix. While these regions boast significant demographic potential, with India's food and grocery market projected to reach $1 trillion by 2025, Nutresa's current market share is minimal. This necessitates considerable capital allocation for market penetration, establishing robust distribution networks, and intensive brand development to gauge their future trajectory.

The success of these expansions hinges on Nutresa's ability to navigate diverse consumer preferences and competitive landscapes. For instance, the Middle East presents opportunities in convenience foods, while India offers a vast, albeit fragmented, market for packaged goods. The company's investment strategy will be crucial in transforming these nascent markets into potential Stars, requiring a deep understanding of local tastes and regulatory environments.

- Market Potential: India's food and grocery market is expected to reach $1 trillion by 2025, and the Middle East food market is also experiencing robust growth, driven by population increases and rising disposable incomes.

- Investment Needs: Significant investment is required for market entry, including distribution channel development, localized product offerings, and marketing campaigns to build brand awareness.

- Risk Factors: High competition from established local and international players, regulatory hurdles, and the need for adaptation to diverse cultural and dietary preferences present considerable risks.

- Strategic Objective: The primary goal is to establish a strong market presence, aiming to convert these Question Marks into Stars through sustained investment and effective market strategies.

Innovative Products from R&D (Nutrition and Health focus)

Grupo Nutresa's dedication to research and development, especially in nutrition and health, means its latest product launches in this area are positioned as Question Marks. These products tap into the growing consumer demand for healthier options, a market experiencing significant expansion. For instance, the global functional foods market, which includes many health-focused innovations, was projected to reach over $250 billion by 2024, highlighting the potential for Nutresa's new offerings.

These innovative nutrition and health products are entering a dynamic, high-growth sector driven by increasing consumer awareness of diet's impact on well-being. While their current market share is understandably low, their strategic alignment with these trends is crucial. The success of these products hinges on their ability to gain traction and scale effectively, potentially transforming them into future Stars within Nutresa's portfolio.

- Targeting Health Trends: Nutresa's R&D is focusing on products that align with rising consumer interest in preventative health and wellness, a segment projected for continued robust growth.

- Low Initial Market Share: As new entrants, these innovative products typically begin with a small market share, requiring significant investment and strategic marketing to gain consumer acceptance.

- Potential for Growth: The success of these health-focused innovations will determine their trajectory, with the potential to become market leaders if they resonate with consumers and achieve widespread adoption.

Grupo Nutresa's ventures into alternative meat products, such as those developed with The EVERY Co., are currently positioned as Question Marks. This segment is experiencing rapid growth, with the global alternative protein market projected to reach $274 billion by 2030, yet Nutresa's market share in this area is still developing. Significant investment in marketing and distribution is crucial for these products to gain traction and potentially become Stars.

New retail formats, like the El Corral ice cream shops launched in 2024, also fall into the Question Mark category. While these shops achieved sales exceeding COP 3 billion in their first year, their current market share within the broader retail food sector is modest. Strategic expansion and consumer engagement are key to their future success, aiming to elevate them from Question Marks to Stars.

Geographic expansions into markets like the Middle East and India represent classic Question Marks for Grupo Nutresa. India's food and grocery market is anticipated to reach $1 trillion by 2025, indicating substantial potential. However, Nutresa's current market penetration in these regions is minimal, requiring considerable investment in brand building and distribution networks to capture market share and move towards Star status.

Innovations in nutrition and health products, driven by R&D, are also classified as Question Marks. The global functional foods market, which these products tap into, was expected to exceed $250 billion by 2024. Despite low initial market share, these health-focused offerings are strategically aligned with growing consumer demand, with the potential to become Stars if they achieve widespread adoption.

BCG Matrix Data Sources

Our Grupo Nutresa BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.