Grupo Nutresa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Nutresa Bundle

Grupo Nutresa navigates a competitive landscape shaped by moderate buyer power and the ever-present threat of substitutes in the food and beverage sector. While supplier power is generally manageable, the intensity of rivalry among established players and emerging brands presents a significant challenge.

The complete report reveals the real forces shaping Grupo Nutresa’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Grupo Nutresa’s diversified raw material sourcing strategy significantly weakens supplier bargaining power. By procuring inputs from a wide array of global and local suppliers, the company reduces its dependence on any single source, thereby limiting individual suppliers' ability to dictate terms or prices.

In 2023, for instance, Grupo Nutresa navigated a complex global supply chain environment, characterized by fluctuating commodity prices and geopolitical tensions. Its robust supply chain management, which includes strategic partnerships and forward-buying initiatives, helped to stabilize input costs, particularly for key ingredients like sugar and palm oil, which experienced significant price volatility throughout the year.

This proactive approach to supply chain resilience not only shields Grupo Nutresa from abrupt cost increases but also ensures uninterrupted production, a critical factor in maintaining market share and operational efficiency in the competitive food industry.

Grupo Nutresa actively manages its exposure to raw material price swings through strategic commodity hedging. This financial maneuver allows the company to secure prices for essential inputs, effectively dampening the suppliers' ability to dictate terms based on market volatility. By locking in costs, Grupo Nutresa gains greater control over its production expenses, a critical factor for sustained profitability, especially in sectors prone to price fluctuations.

Grupo Nutresa's strategic investment in developing its local supply chains, exemplified by its commitment to the cocoa sector in Colombia, directly addresses the bargaining power of suppliers. By establishing nurseries and providing direct support to cocoa farmers, the company cultivates more stable and reliable sourcing.

This proactive approach, which includes fostering strong relationships and contributing to supplier development, aims to enhance supply chain resilience and potentially negotiate more favorable terms. Such investments can mitigate the risk of being overly dependent on powerful external suppliers, thereby strengthening Grupo Nutresa's position.

Supplier Dependence on Grupo Nutresa

Grupo Nutresa's substantial presence in the Latin American processed food market means many suppliers rely heavily on its business. For instance, a significant portion of a smaller supplier's annual revenue might come directly from Nutresa, making them hesitant to push for unfavorable terms for fear of losing this crucial client.

This reliance inherently diminishes the suppliers' leverage. The potential loss of Grupo Nutresa as a customer would translate to a considerable blow to their financial stability, thereby weakening their ability to negotiate price increases or demand better contract conditions.

Grupo Nutresa's considerable purchasing power, stemming from its large-scale operations, further tips the scales in its favor. The sheer volume of goods and services it procures provides significant leverage in negotiations.

- Supplier Dependence: Individual suppliers often derive a substantial percentage of their sales from Grupo Nutresa, creating a significant risk for them if they lose this business.

- Reduced Bargaining Power: This dependence limits suppliers' ability to demand higher prices or more favorable terms, as the cost of losing Nutresa as a client is high.

- Leverage from Volume: Grupo Nutresa's large purchasing volumes allow it to negotiate better prices and terms due to the significant business it represents for its suppliers.

Sustainability and Ethical Sourcing Requirements

Grupo Nutresa's robust commitment to sustainability and ethical sourcing, acknowledged by S&P Global, significantly shapes its supplier dynamics. For instance, in 2023, the company reported that 98.4% of its key suppliers adhered to its Supplier Code of Conduct, which includes sustainability criteria.

By establishing clear sustainability benchmarks, Grupo Nutresa can effectively steer supplier behavior, potentially granting preferential treatment to those who align with its values. This strategic approach can foster deeper integration and more dependable partnerships within its supply chain.

- Supplier Compliance: In 2023, 98.4% of Grupo Nutresa's key suppliers met its Supplier Code of Conduct, highlighting a strong adherence to sustainability and ethical standards.

- Strategic Integration: The company's sustainability requirements encourage suppliers to adopt greener practices, potentially leading to more stable and collaborative relationships.

- Value Chain Enhancement: By favoring compliant suppliers, Grupo Nutresa can strengthen its overall value chain, ensuring ethical and sustainable inputs.

Grupo Nutresa's bargaining power with suppliers is considerably strong due to its diversified sourcing, large purchasing volume, and strategic supplier development initiatives. This multifaceted approach minimizes dependence on any single supplier, thereby limiting their ability to unilaterally dictate terms or prices.

In 2023, for example, Grupo Nutresa's commitment to local sourcing, particularly in the cocoa sector, demonstrated a strategy to cultivate more reliable and potentially more favorable supply relationships. This reduces reliance on external, potentially more powerful, suppliers.

Furthermore, the company's substantial market presence means many suppliers depend on Nutresa for a significant portion of their revenue, making them less inclined to risk their relationship by demanding unfavorable terms.

Grupo Nutresa's proactive commodity hedging and sustainability compliance requirements, with 98.4% of key suppliers adhering to its code of conduct in 2023, further solidify its advantageous position by stabilizing input costs and fostering aligned partnerships.

| Factor | Impact on Supplier Bargaining Power | Grupo Nutresa's Position |

|---|---|---|

| Diversified Sourcing | Reduces dependence on any single supplier. | Weakens individual supplier leverage. |

| Purchasing Volume | Suppliers rely on Nutresa for significant business. | Increases Nutresa's negotiation leverage. |

| Supplier Development | Fosters stable, potentially favorable sourcing. | Mitigates reliance on powerful external suppliers. |

| Commodity Hedging | Stabilizes input costs against market volatility. | Reduces supplier ability to exploit price fluctuations. |

| Sustainability Compliance (2023: 98.4%) | Encourages supplier alignment with Nutresa's values. | Strengthens partnerships and supply chain resilience. |

What is included in the product

This analysis tailors Porter's Five Forces to Grupo Nutresa, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its competitive position within the food industry.

Effortlessly identify and mitigate competitive threats by visualizing Grupo Nutresa's bargaining power of suppliers and buyers.

Customers Bargaining Power

Grupo Nutresa's extensive product portfolio, encompassing everything from cold cuts and biscuits to chocolates, coffee, ice cream, and pasta, significantly dilutes customer bargaining power. This broad offering, available across Colombia and other Latin American markets, provides consumers with abundant choices, making it difficult for any single product or segment to exert substantial leverage.

Grupo Nutresa's extensive distribution network significantly dilutes customer bargaining power. By serving a diverse range of channels, from convenience stores and supermarket chains to institutional and industrial clients, the company avoids over-reliance on any single customer segment. This broad market penetration, evidenced by their presence across numerous retail formats, ensures widespread product availability and limits the ability of any one customer group to dictate terms.

Grupo Nutresa cultivates deep brand loyalty by consistently delivering products that consumers recognize, trust, and enjoy, focusing on nourishment, well-being, and pleasure. This enduring connection means customers are less likely to switch brands based solely on price, effectively reducing their bargaining power.

In 2023, Grupo Nutresa's commitment to its core brands resonated strongly, with its portfolio including over 40 brands that hold leading market positions across various categories in Colombia and other Latin American countries. This widespread recognition and consumer preference significantly anchor customer relationships, making them less susceptible to competitive price pressures.

Digital Channel Engagement

Grupo Nutresa's digital engagement, particularly through platforms like Pideky in Colombia, significantly influences customer bargaining power. Pideky has demonstrated robust growth, with client sales and monthly orders increasing substantially. This digital presence, while convenient for consumers, also allows Grupo Nutresa to collect valuable data, enabling personalized offers and fostering stronger customer loyalty.

- Pideky's Growth: The platform has experienced considerable expansion in client sales and monthly orders, indicating a growing customer preference for digital channels.

- Data-Driven Personalization: Grupo Nutresa leverages digital interactions to gather customer data, facilitating tailored product offerings and promotions.

- Enhanced Customer Relationships: Direct engagement via digital channels allows for the cultivation of deeper customer relationships, potentially increasing stickiness and reducing price sensitivity.

Impact of Health and Wellness Trends

The increasing consumer focus on health and wellness significantly amplifies the bargaining power of customers. This is evident in the growing demand for products perceived as healthier, such as organic, low-fat, or gluten-free options. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is projected to grow substantially, indicating a strong shift in consumer preferences.

Grupo Nutresa actively addresses this trend by reformulating its product portfolio to enhance nutritional profiles and align with evolving consumer expectations. This proactive approach aims to secure customer loyalty among health-conscious demographics. The company's investment in research and development for healthier alternatives directly responds to this heightened customer scrutiny and demand for specific product attributes.

- Growing Demand for Health-Conscious Products: Consumers increasingly seek organic, low-fat, and gluten-free options, influencing purchasing decisions.

- Grupo Nutresa's Nutritional Improvements: The company is enhancing product nutrition to meet these evolving health demands and retain customers.

- Increased Customer Scrutiny: Health trends empower customers to demand specific attributes, raising expectations for food manufacturers.

Grupo Nutresa's broad product range and extensive distribution across various channels limit individual customer leverage. However, the growing consumer emphasis on health and wellness, a market valued at approximately $4.5 trillion in 2023, empowers customers to demand specific product attributes, increasing their bargaining power.

| Factor | Impact on Bargaining Power | Grupo Nutresa's Response |

|---|---|---|

| Product Diversity | Dilutes Power | Extensive portfolio reduces reliance on single products. |

| Distribution Reach | Dilutes Power | Presence in multiple channels limits power of any one customer segment. |

| Brand Loyalty | Dilutes Power | Strong brand recognition reduces price sensitivity. |

| Health & Wellness Trends | Amplifies Power | Consumers seek specific attributes, increasing demand for healthier options. |

Preview the Actual Deliverable

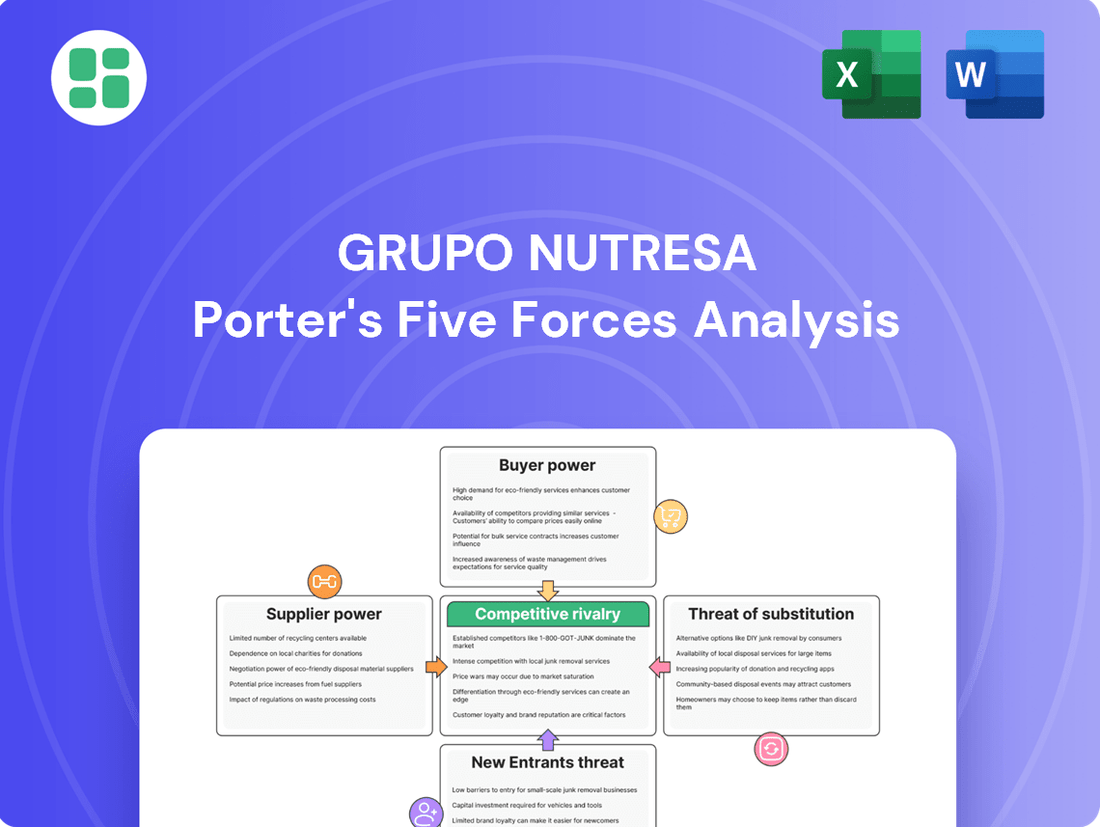

Grupo Nutresa Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Grupo Nutresa, providing an in-depth examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ready for your immediate use and strategic planning.

Rivalry Among Competitors

Grupo Nutresa enjoys a commanding presence in its domestic market, notably securing a substantial 78.7% market share in Colombia's cold cuts segment. This robust position highlights its formidable competitive strength within its primary operating region.

However, this leadership necessitates ongoing strategic efforts, including consistent product innovation and a keen ability to adapt to evolving consumer preferences and market trends to sustain its advantage.

Grupo Nutresa's extensive regional and international presence, spanning 18 countries across the Americas, significantly intensifies competitive rivalry. This broad geographic footprint means the company faces a diverse set of competitors in each market, from local players to other multinational corporations.

The substantial contribution of international sales to Grupo Nutresa's revenue underscores its ability to vie for market share on a global stage. For instance, in 2023, international operations represented a significant portion of its sales, demonstrating its established competitive strength beyond Colombia.

This wide operational scope diversifies the arenas in which Grupo Nutresa must contend with rivals. Each country presents unique competitive dynamics, requiring tailored strategies to navigate local market conditions and competitor strengths, thereby amplifying the overall intensity of competitive rivalry.

Grupo Nutresa's dedication to innovation, evidenced by its recognition as Colombia's most innovative company, significantly intensifies competitive rivalry. The company consistently invests in research, development, and innovation (R&D+i), leading to a steady stream of new products and improved existing ones. This proactive approach allows Nutresa to carve out distinct market positions, forcing rivals to either match its innovative output or risk falling behind.

Intense Competition in the Processed Food Sector

The processed food sector in Latin America, where Grupo Nutresa operates, is characterized by vigorous rivalry. This dynamic market is home to a mix of established multinational corporations and nimble local businesses, all vying for market share. In 2023, the Latin American food and beverage market was valued at approximately $300 billion, highlighting the significant scale of this competitive landscape.

Grupo Nutresa, despite its strong position, contends with numerous competitors. These range from global giants with extensive resources to smaller, specialized companies that can quickly adapt to local tastes and trends. For instance, Nestlé and Unilever are significant international players with substantial operations across the region, directly challenging Nutresa's market presence.

Competition within this sector often hinges on several key factors:

- Price: Many consumers in Latin America are price-sensitive, making competitive pricing a crucial differentiator.

- Quality and Innovation: Brands that consistently offer high-quality products and introduce innovative new offerings can capture consumer loyalty.

- Distribution Networks: Extensive and efficient distribution is vital to reach a broad customer base across diverse geographies.

- Brand Recognition and Marketing: Strong brand equity and effective marketing campaigns play a significant role in influencing purchasing decisions.

Strategic Restructuring and Expansion Initiatives

The Gilinski Group's recent consolidation of ownership in Grupo Nutresa, a significant move completed in early 2024, has unlocked substantial strategic flexibility. This restructuring is a direct catalyst for more aggressive international expansion, allowing the company to explore and capitalize on regional food consolidation opportunities. For instance, by early 2024, Grupo Nutresa had already secured a dominant ownership stake, paving the way for these ambitious plans.

This enhanced corporate structure directly bolsters Grupo Nutresa's competitive capabilities. The increased operational efficiency and greater financial capacity, particularly evident following the acquisition phases in 2023 and early 2024, empower the company to pursue strategic acquisitions more effectively. This financial strengthening is crucial for outmaneuvering rivals in a consolidating market.

- Ownership Consolidation: Gilinski Group's majority stake solidified in early 2024.

- Expansion Focus: Strategic pivot towards aggressive international market penetration.

- Acquisition Capacity: Enhanced financial and operational leverage for M&A activities.

- Competitive Edge: Improved efficiency and financial muscle to outpace competitors.

Grupo Nutresa operates within a highly competitive processed food sector across the Americas, facing both global giants like Nestlé and Unilever and agile local players. The company's extensive reach across 18 countries means it must constantly adapt to diverse market dynamics and competitor strategies to maintain its significant market share, such as its 78.7% dominance in Colombia's cold cuts segment.

Innovation is a key battleground, with Grupo Nutresa recognized as Colombia's most innovative company, consistently launching new products which forces rivals to respond. The Latin American food and beverage market, valued at approximately $300 billion in 2023, is a testament to the scale of competition where price, quality, distribution, and brand strength are critical differentiators.

The consolidation of ownership by the Gilinski Group in early 2024 has provided Grupo Nutresa with enhanced financial capacity and strategic flexibility, enabling more aggressive international expansion and acquisitions. This increased financial muscle, evident from its 2023 and early 2024 acquisition activities, positions the company to better compete and potentially consolidate its standing against rivals in a dynamic regional market.

| Competitive Factor | Grupo Nutresa's Position | Key Competitors | Market Context (2023/2024) |

|---|---|---|---|

| Market Share (Colombia Cold Cuts) | 78.7% | Local & International Brands | Demonstrates strong domestic leadership |

| Geographic Presence | 18 Countries | Nestlé, Unilever, Regional Players | Intensifies rivalry across diverse markets |

| Innovation | Colombia's Most Innovative Company | Competitors investing in R&D | Drives product differentiation |

| Financial Strength (Post-Acquisition) | Enhanced by Gilinski Group (Early 2024) | Multinationals with deep pockets | Enables aggressive M&A and expansion |

SSubstitutes Threaten

Consumers are increasingly prioritizing health and wellness, driving a significant demand for fresh, organic, low-fat, gluten-free, and non-GMO food options. This growing preference for healthier alternatives directly challenges traditional processed food manufacturers like Grupo Nutresa. For instance, the global market for organic food was valued at approximately $250 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer spending away from conventional processed goods.

These evolving consumer tastes mean that unprocessed or minimally processed foods are becoming viable substitutes for many of Grupo Nutresa's product lines. If consumers perceive these fresh options as healthier and more aligned with their lifestyle goals, they may reduce their purchases of packaged snacks, processed meats, and other items in Grupo Nutresa's portfolio. This trend necessitates a strategic adaptation by the company to incorporate or highlight healthier, more natural product offerings to remain competitive.

New nutritional regulations in Colombia, such as front-of-pack labeling and stricter sodium content requirements, are set to significantly influence consumer choices. These changes, implemented in 2023 and with further phases expected, could push consumers towards alternatives that appear to meet these new health standards, thereby increasing the threat of substitutes.

Home cooking and meal preparation represent a persistent threat of substitution for processed food companies like Grupo Nutresa. Consumers increasingly value control over ingredients, freshness, and cost, making homemade meals an attractive alternative. In 2024, a significant portion of household food spending continues to be directed towards groceries for home preparation, reflecting this underlying trend.

Emergence of Specialized Dietary Products

The growing popularity of specialized dietary products, such as plant-based foods and allergen-free options, poses a significant substitution threat to Grupo Nutresa's traditional offerings. Consumers increasingly seek out these niche products, driven by health consciousness, ethical concerns, or specific dietary needs. This trend is particularly evident in markets where awareness of these alternatives is high.

The market for plant-based foods, for instance, has seen substantial growth. In 2023, the global plant-based food market was valued at approximately $40.2 billion and is projected to reach over $77 billion by 2030, indicating a strong consumer shift. Similarly, the demand for gluten-free and dairy-free products continues to expand, offering consumers alternatives to conventional dairy and grain-based items. These evolving consumer preferences mean that even if a specialized product is still processed, it can directly compete with and displace purchases of Grupo Nutresa's conventional product lines.

- Plant-based food market growth: Projected to exceed $77 billion by 2030.

- Consumer drivers: Health, ethics, and specific dietary needs.

- Substitution impact: Specialized products can displace conventional food purchases.

Grupo Nutresa's Proactive Product Reformulation

Grupo Nutresa is actively reformulating its products to counter the threat of substitutes, particularly healthier alternatives. For instance, they are working to reduce sodium content in their biscuit lines, aiming to enhance their appeal to health-conscious consumers. This strategy is crucial as consumers increasingly seek out products with improved nutritional profiles.

This proactive approach helps Grupo Nutresa maintain its market share by offering processed food options that are more competitive against fresh produce and other perceived healthier substitutes. By adapting to evolving consumer preferences, the company aims to retain brand loyalty and attract new customers who prioritize well-being in their purchasing decisions.

- Product Reformulation: Reducing sodium in biscuits and improving nutritional content.

- Competitive Edge: Making processed foods more appealing against healthier alternatives.

- Consumer Retention: Keeping health-conscious consumers within Grupo Nutresa's brand portfolio.

The threat of substitutes for Grupo Nutresa is significant, driven by evolving consumer preferences towards healthier and minimally processed foods. This includes a strong demand for fresh produce, organic options, and specialized dietary products like plant-based and allergen-free items. The global plant-based food market, for example, reached approximately $40.2 billion in 2023 and is expected to grow substantially, directly challenging traditional processed food offerings.

Home-cooked meals also represent a considerable substitute, as consumers increasingly seek control over ingredients, freshness, and cost. In 2024, a notable portion of household food budgets continues to be allocated to groceries for home preparation, underscoring this persistent trend. Furthermore, new nutritional regulations, such as front-of-pack labeling implemented in Colombia in 2023, can steer consumers towards alternatives perceived as healthier, thereby amplifying the substitution threat.

Grupo Nutresa is actively addressing this by reformulating products, such as reducing sodium in biscuits, to align with consumer demand for improved nutritional profiles. This strategy aims to make their processed offerings more competitive against healthier substitutes and retain health-conscious consumers.

| Substitute Category | Market Size (2023/2024 Estimate) | Key Drivers | Impact on Grupo Nutresa |

|---|---|---|---|

| Healthier Processed Foods | Growing; specific data varies by sub-category | Consumer health consciousness, demand for natural ingredients | Requires product reformulation and innovation |

| Fresh & Organic Foods | Global organic food market ~$250 billion (2023) | Wellness trends, perceived health benefits | Direct competition with packaged goods |

| Plant-Based Foods | Global market ~$40.2 billion (2023) | Health, ethical concerns, dietary needs | Displacement of conventional product lines |

| Home-Cooked Meals | Significant portion of household food spending (2024) | Cost control, ingredient transparency, freshness | Reduces demand for convenience foods |

Entrants Threaten

The processed food industry, especially for a company like Grupo Nutresa with its vast network of 47 production facilities, demands immense capital. Newcomers must be prepared for substantial upfront costs to build competitive manufacturing infrastructure and secure market presence.

Achieving economies of scale is crucial for profitability in this sector. Without the sheer volume of production that established players like Grupo Nutresa enjoy, new entrants will struggle to lower their per-unit costs and compete effectively on price.

For instance, setting up a modern food processing plant can easily cost tens of millions of dollars, covering machinery, logistics, and regulatory compliance. This high barrier makes it difficult for smaller, less capitalized businesses to enter and challenge incumbents.

Grupo Nutresa enjoys significant advantages due to its deeply ingrained brand recognition and the strong loyalty consumers have developed over many years. Brands like Jet, Corona, and Noel are household names in their respective markets, making it challenging for newcomers to gain traction.

To effectively compete, new entrants would need to allocate substantial resources towards marketing and brand development. For instance, in 2023, the food and beverage industry saw significant marketing spend, with major players investing millions to maintain their market presence, a cost barrier new entrants must overcome.

Grupo Nutresa's formidable distribution and supply chain networks present a significant barrier to new entrants. Replicating their established reach, which spans numerous countries and countless retail points, demands immense capital investment and years of cultivation of supplier relationships and logistical expertise. For instance, in 2023, the company's reach extended across 14 countries, serving millions of consumers daily, a scale that is exceptionally challenging for newcomers to match swiftly.

Complex Regulatory Environment

The food industry in Latin America, particularly in Colombia, faces a dynamic and often intricate web of regulations. These cover crucial areas like food safety, precise labeling mandates, and import/export standards, creating a significant barrier for newcomers. For instance, in 2024, Colombia's Ministry of Health and Social Protection continued to enforce stringent food safety protocols, requiring new entrants to invest heavily in compliance infrastructure.

Successfully navigating these evolving regulatory landscapes demands substantial legal expertise and established compliance frameworks, resources that new entrants may lack. This complexity can deter potential competitors who are not yet equipped to manage the administrative and legal overhead associated with adhering to these rules. In 2023, the Colombian food sector saw several new product launches delayed due to unforeseen regulatory hurdles, highlighting the cost and time implications.

- Evolving Food Safety Standards: New entrants must adapt to updated regulations on ingredients, processing, and hygiene.

- Complex Labeling Requirements: Compliance with nutritional information, allergen warnings, and origin labeling adds significant cost.

- Import/Export Regulations: Navigating customs, tariffs, and specific country requirements poses a challenge for cross-border expansion.

- Investment in Legal and Compliance Teams: Start-ups often lack the dedicated resources to manage these complexities effectively.

Innovation and R&D Capabilities

Grupo Nutresa's robust investment in innovation, evidenced by its significant R&D+i spending and a consistently high innovation rate, presents a formidable barrier to new entrants. For instance, in 2023, the company launched 26 new products, a testament to its ongoing commitment to developing novel offerings.

Newcomers face the challenge of not only matching existing product portfolios but also demonstrating superior innovation capabilities to introduce genuinely differentiated products. This necessitates substantial upfront investment in research and development, making it difficult for less-resourced entities to gain traction.

- Innovation Investment: Grupo Nutresa's commitment to R&D+i is a key factor.

- Product Pipeline: A history of successful new product launches indicates strong ongoing innovation.

- Market Adaptation: Entrants must also innovate to meet evolving consumer tastes.

The threat of new entrants for Grupo Nutresa is relatively low due to substantial capital requirements for manufacturing, distribution, and brand building. For example, establishing a single, modern food processing facility can cost upwards of $50 million, a significant hurdle for startups.

Grupo Nutresa's established brand loyalty and extensive distribution network, reaching millions across 14 countries in 2023, create formidable barriers. Newcomers would need to invest heavily in marketing and logistics to even approach this scale, a challenge compounded by complex and evolving food safety regulations in markets like Colombia, where compliance investments are substantial in 2024.

The company's commitment to innovation, demonstrated by 26 new product launches in 2023, further deters new entrants. Matching this pace requires significant R&D investment, making it difficult for less capitalized competitors to gain market share.

| Barrier Type | Description | Estimated Cost/Effort |

|---|---|---|

| Capital Requirements | Building production facilities, securing raw materials, and establishing logistics. | Tens to hundreds of millions of dollars. |

| Brand Loyalty & Marketing | Overcoming established brand recognition and consumer preference. | Millions invested annually in marketing and brand development. |

| Distribution Network | Replicating extensive supply chain and retail access. | Years of relationship building and significant logistical investment. |

| Regulatory Compliance | Adhering to food safety, labeling, and import/export laws. | Ongoing investment in legal expertise and compliance infrastructure. |

| Innovation Capabilities | Matching R&D investment and new product development pace. | Substantial ongoing investment in research and development. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grupo Nutresa is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and financial statements. We also leverage industry-specific market research reports and data from reputable financial news outlets to capture competitive dynamics.