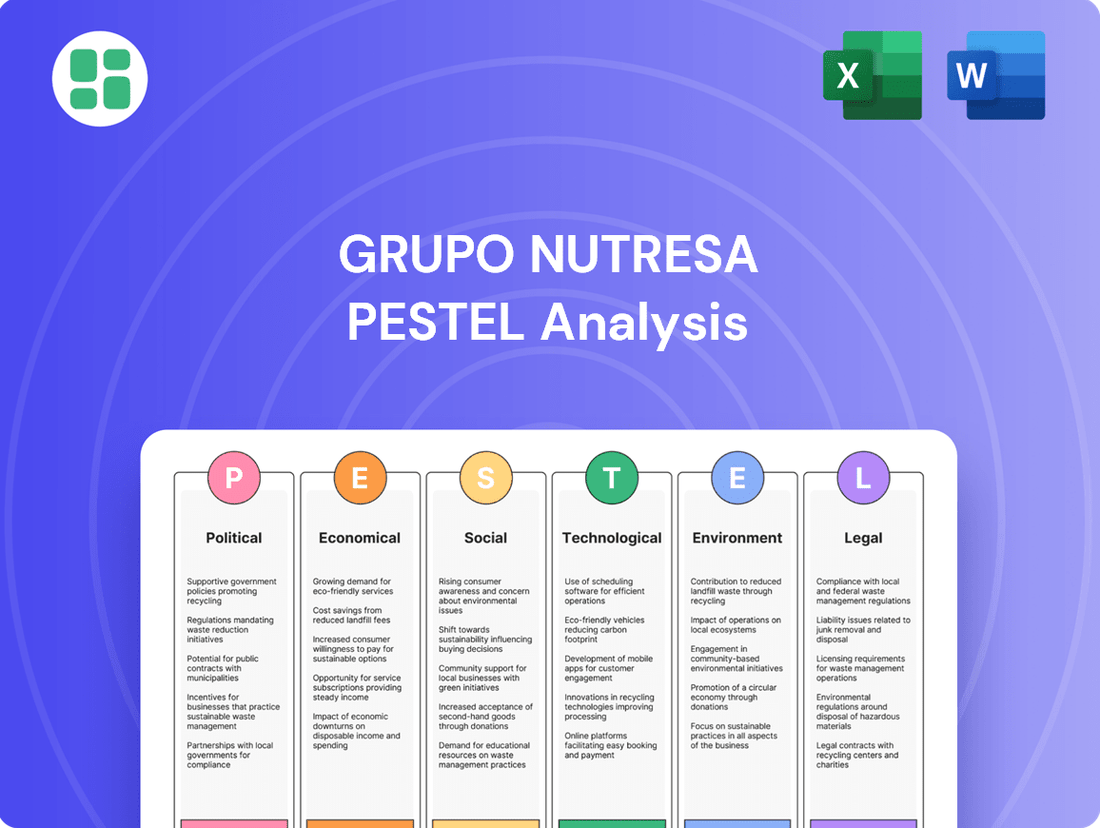

Grupo Nutresa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Nutresa Bundle

Grupo Nutresa operates within a dynamic global landscape, influenced by evolving political stability, economic fluctuations, and significant technological advancements. Understanding these external forces is crucial for anticipating market shifts and identifying strategic opportunities.

Our comprehensive PESTLE analysis delves deep into how these factors, along with social trends, environmental regulations, and legal frameworks, are shaping Grupo Nutresa's operations and future trajectory. Gain a competitive edge by leveraging these expert insights.

Don't miss out on actionable intelligence. Download the full PESTLE analysis of Grupo Nutresa now to empower your strategic planning and investment decisions.

Political factors

Grupo Nutresa's operations are heavily influenced by the political stability of its core markets, particularly Colombia and other Latin American nations. Political shifts can alter regulatory frameworks and economic policies, directly impacting the food processing industry.

Government policies concerning trade agreements, agricultural subsidies, and foreign direct investment are critical for Grupo Nutresa's growth and operational efficiency. Favorable policies can unlock new market opportunities and reduce operational costs.

Colombia's government has historically shown support for the food processing sector, which has been a positive driver for companies like Grupo Nutresa. For instance, initiatives aimed at boosting agricultural productivity and food export competitiveness, such as those seen in recent years, directly benefit the sector's expansion and investment climate.

Grupo Nutresa's significant operations across the Andean region, Central America, and the Caribbean make it highly sensitive to regional trade pacts such as MERCOSUR. These agreements are crucial as they streamline cross-border product flow, lower import duties, and harmonize trade regulations, ultimately improving market entry and streamlining supply chains.

For instance, the Pacific Alliance, which includes Colombia, Peru, Chile, and Mexico, has worked to reduce tariffs on many goods traded between member countries, directly benefiting companies like Grupo Nutresa by lowering costs for imported ingredients and exported finished products. This bloc’s continued efforts towards economic integration in 2024 and 2025 are expected to further enhance these advantages.

Governments across Latin America are tightening food safety and nutritional labeling rules, impacting companies like Grupo Nutresa. For instance, countries like Colombia, Mexico, and Chile are adopting front-of-pack warning labels for products high in sugar, sodium, or saturated fats.

These evolving regulations require significant adjustments, including product reformulation and packaging redesigns. This push towards transparency aims to guide consumers toward healthier food choices, a trend Grupo Nutresa must navigate to maintain market relevance and consumer trust.

Government Collaboration on Sustainability Initiatives

Grupo Nutresa actively partners with the Colombian government on various sustainability initiatives, notably in strengthening the cocoa value chain. For instance, their involvement includes establishing cocoa nurseries, a key component in improving agricultural productivity and quality. These collaborations are crucial as they often unlock access to government grants, tax benefits, and favorable regulatory frameworks, directly supporting Nutresa's operational efficiency and market competitiveness. Such alignment with national development agendas also significantly bolsters the company's public image and social license to operate.

These government collaborations provide tangible benefits that directly impact Grupo Nutresa's performance. For example, by participating in programs aimed at improving the cocoa sector, the company can secure more stable and higher-quality raw material supply, reducing input costs and price volatility. Furthermore, the positive association with government-backed sustainability projects can enhance brand loyalty among consumers who increasingly prioritize ethical and environmentally conscious brands. In 2023, Colombian agricultural exports, including cocoa, saw significant growth, underscoring the potential for companies like Nutresa to leverage these partnerships for expanded market reach and profitability.

- Government Support: Partnerships provide access to financial incentives and regulatory advantages, reducing operational costs and easing market entry for sustainable products.

- Supply Chain Resilience: Investments in agricultural programs, like cocoa nurseries, ensure a more stable and higher-quality supply of raw materials, mitigating risks for Nutresa.

- Enhanced Reputation: Aligning with national sustainability goals and government-backed initiatives improves public perception and brand image, appealing to socially conscious consumers.

- Market Access: Collaborative efforts can open doors to new markets or strengthen existing ones by meeting international sustainability standards often supported by government trade agreements.

Political Interventions in Market Dynamics

Political decisions significantly shape the operating environment for companies like Grupo Nutresa. For instance, government policies on price controls or subsidies directly influence the cost of raw materials and the final pricing of consumer goods, impacting profit margins. In 2024, several Latin American countries experienced persistent inflation, prompting governments to consider or implement measures that could affect food and beverage sectors, including potential price adjustments or consumer support programs.

Import and export restrictions, often enacted for protectionist reasons or to manage trade balances, can disrupt supply chains and affect the availability and cost of key ingredients for Grupo Nutresa. For example, tariffs or quotas on agricultural products could increase production costs. The ongoing trade negotiations and geopolitical shifts in 2024-2025 may introduce new regulatory landscapes for international trade, requiring agile adaptation from multinational food producers.

Economic crises or periods of high inflation can lead to increased political intervention. Governments might introduce measures to protect consumers, such as temporary price caps on essential food items, which can squeeze manufacturer profitability. This was observed in various emerging markets during 2024, where governments grappled with rising food prices, potentially impacting companies with significant operations in those regions.

- Price Controls: Governments may implement price ceilings on essential food items, directly affecting Grupo Nutresa's revenue and profit potential.

- Subsidies: Subsidies on agricultural inputs could lower production costs, while consumer subsidies might boost demand for processed foods.

- Trade Restrictions: Tariffs or quotas on imported ingredients or finished goods can alter supply chain costs and market access for Grupo Nutresa.

- Inflationary Pressures: Rising inflation in key markets can lead to government interventions aimed at stabilizing prices, potentially impacting company margins.

Political stability remains a paramount concern for Grupo Nutresa, influencing its operational landscape across Latin America. Government policies regarding trade, agricultural support, and foreign investment directly shape the company's growth trajectory and efficiency. For instance, favorable trade pacts like the Pacific Alliance, which continued to foster economic integration in 2024 and 2025, streamline cross-border transactions, reducing costs for both imported ingredients and exported finished goods.

Regulatory shifts, particularly concerning food safety and nutritional labeling, necessitate ongoing adaptation. Many Latin American nations, including Colombia, Mexico, and Chile, have implemented front-of-pack warning labels on products high in sugar, sodium, or saturated fats, compelling companies like Grupo Nutresa to reformulate products and redesign packaging to align with evolving consumer health consciousness and governmental directives.

Grupo Nutresa's engagement with government sustainability initiatives, such as strengthening the cocoa value chain through partnerships for cocoa nurseries, yields tangible benefits. These collaborations can unlock access to grants and tax incentives, thereby enhancing operational efficiency and market competitiveness. Such alignment with national development agendas also bolsters the company's public image and social license to operate, a factor increasingly valued by consumers and investors alike.

Government interventions, driven by economic fluctuations like inflation, can significantly impact pricing strategies and profit margins. In 2024, persistent inflation in several Latin American markets led to governmental considerations of measures like temporary price caps on essential food items, posing potential challenges to profitability for companies operating in these regions.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Grupo Nutresa, covering Political, Economic, Social, Technological, Environmental, and Legal factors, providing a comprehensive overview of its operating landscape.

This PESTLE analysis for Grupo Nutresa offers a streamlined, actionable framework, serving as a pain point reliver by simplifying complex external factors into easily digestible insights for strategic decision-making.

Economic factors

Inflationary pressures, especially on food and energy, are a significant concern for Grupo Nutresa. For instance, Colombia's inflation rate hovered around 4.32% in April 2024, a slight decrease from previous months but still impacting consumer spending and input costs. This can directly affect the company's profitability by increasing the cost of raw materials and potentially reducing consumer demand for its products.

Currency fluctuations, particularly the Colombian Peso (COP) against the US Dollar (USD), present another challenge. A weaker COP, which has seen fluctuations throughout 2024, makes imported raw materials more expensive for Grupo Nutresa. Conversely, it can make the company's exports more competitive, but the net effect depends on the balance of imports and exports and the company's hedging strategies.

The economic vitality of Latin America, marked by GDP expansion and job growth, directly impacts consumer spending on processed foods. For instance, in 2024, several Latin American economies, including Mexico and Colombia, are projected to see GDP growth above 2%, fostering an environment where consumers are more likely to spend on packaged goods.

A growing middle class with increasing disposable income is a key driver for demand in the processed food sector. As more households move into this demographic, they tend to favor convenient, ready-to-eat, and packaged food options, which Grupo Nutresa is well-positioned to supply.

The Latin American processed food market is showing robust expansion, with Colombia expected to see a compound annual growth rate of 6.4% between 2024 and 2030. This presents a substantial opportunity for Grupo Nutresa to leverage its established presence.

Grupo Nutresa's diversified operations across countries like Brazil, Argentina, and Peru enable it to benefit from the distinct economic growth trajectories within the region. This broad footprint allows the company to adapt and capitalize on varying market potentials.

Commodity Price Volatility

Grupo Nutresa's reliance on key agricultural commodities such as cocoa, coffee, and sugar makes it highly susceptible to price fluctuations. For instance, the International Cocoa Organization reported that cocoa prices surged by over 200% in the first half of 2024, reaching record highs due to supply concerns in West Africa. This significant increase directly impacts Nutresa's raw material costs.

Such volatility, driven by factors like climate change affecting harvests and geopolitical tensions disrupting supply chains, can directly squeeze gross profit margins. For example, a 10% increase in the cost of a primary commodity could translate to a substantial hit on profitability if not effectively managed through hedging or price adjustments.

- Cocoa Price Surge: Cocoa prices exceeded $10,000 per metric ton in early 2024, a dramatic rise from around $3,000 per ton a year prior.

- Coffee Market Dynamics: Arabica coffee prices, a key input for Nutresa, saw significant volatility in 2024, influenced by weather patterns in Brazil and Vietnam.

- Sugar Supply Concerns: Global sugar prices remained elevated in 2024 due to lower production forecasts in India and Thailand, impacting confectionery and beverage inputs.

- Impact on Margins: Increased commodity expenses can erode gross profit margins if companies cannot pass these costs onto consumers or secure favorable long-term supply contracts.

Investment Climate and Access to Capital

Grupo Nutresa's ability to attract capital is significantly influenced by the investment climate in its operating regions and its access to global financial markets. A stable and welcoming environment for foreign investment encourages the flow of funds necessary for expansion and innovation.

The company's successful foray into international capital markets, exemplified by its first bond issuance, underscores its capacity to secure substantial funding for strategic projects. This access to diverse funding sources is crucial for pursuing ambitious growth objectives.

- Bond Issuance Success: In 2024, Grupo Nutresa successfully placed its inaugural international bond, raising $500 million.

- Investor Confidence: This issuance was oversubscribed, indicating strong investor confidence in the company's financial health and future prospects.

- Strategic Funding: The capital raised is earmarked for strategic acquisitions and operational enhancements, supporting its long-term expansion strategy.

Economic stability and growth in Latin America are crucial for Grupo Nutresa's performance. While projected GDP growth for countries like Mexico and Colombia remains positive in 2024, around 2% or higher, inflationary pressures, particularly on food and energy, continue to impact consumer spending power. For instance, Colombia's inflation rate was approximately 4.32% in April 2024, a factor that can increase input costs and potentially dampen demand for processed foods.

The company's financial health is also tied to currency exchange rates, with the Colombian Peso experiencing fluctuations against major currencies like the US Dollar throughout 2024. This volatility affects the cost of imported raw materials and the competitiveness of exports. Furthermore, Grupo Nutresa's reliance on commodities like cocoa, coffee, and sugar exposes it to significant price swings, as evidenced by cocoa prices surging over 200% in early 2024, directly impacting profit margins.

Grupo Nutresa's access to capital markets remains strong, highlighted by its successful $500 million international bond issuance in 2024, which was oversubscribed. This demonstrates robust investor confidence and provides essential funding for strategic growth initiatives, including acquisitions and operational improvements, vital for navigating the dynamic economic landscape of Latin America.

| Economic Factor | 2024 Projection/Data | Impact on Grupo Nutresa |

|---|---|---|

| Latin America GDP Growth | Projected >2% for key markets (e.g., Mexico, Colombia) | Supports consumer spending on packaged goods |

| Colombia Inflation Rate | ~4.32% (April 2024) | Increases input costs, potentially reduces consumer demand |

| Cocoa Prices | Surged >200% (early 2024) | Significantly increases raw material costs, impacting margins |

| International Bond Issuance | $500 million raised (2024) | Provides capital for strategic growth and operational enhancements |

What You See Is What You Get

Grupo Nutresa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Grupo Nutresa delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations and strategic decisions. You'll gain valuable insights into the external forces shaping the company's future.

Sociological factors

Consumers across Latin America, including key markets for Grupo Nutresa, are showing a marked shift towards health and wellness. This trend is evident in the growing demand for organic products, foods with functional benefits, and options perceived as healthier processed choices. For instance, the Latin American functional foods market was valued at approximately USD 10.5 billion in 2023 and is projected to grow significantly, indicating a strong consumer appetite for products that support well-being.

This evolving preference directly impacts Grupo Nutresa's product development strategy. The company needs to actively adapt its portfolio to meet this demand, which includes a notable increase in interest for plant-based alternatives like meat substitutes and dairy alternatives. The global meat substitute market alone is expected to reach over USD 50 billion by 2025, and this growth is mirrored in Latin America's increasing adoption of these products.

Latin America's rapid urbanization, with an estimated 83% of its population living in cities by 2024, is reshaping consumer habits. This shift fuels a growing demand for convenient, ready-to-eat, and packaged foods, a trend perfectly aligned with Grupo Nutresa's extensive portfolio. For instance, the packaged food market in Latin America, valued at over $80 billion in 2023, is projected to grow steadily, driven by these evolving urban lifestyles.

Grupo Nutresa must navigate evolving demographic landscapes. For instance, in many Latin American countries where Nutresa operates, such as Colombia and Brazil, the median age is gradually increasing. This trend means a growing segment of the population is entering or already in older age brackets, typically over 60.

This demographic shift directly impacts consumer preferences and nutritional requirements. An aging population often seeks products that are easier to digest, fortified with essential vitamins and minerals like calcium and Vitamin D, and potentially lower in sugar and sodium. For example, a growing demand for functional foods and beverages designed to support bone health or cognitive function is anticipated in these markets.

Understanding these nuances is critical for product development. Grupo Nutresa's strategy should involve tailoring its product portfolio to meet the specific dietary needs and lifestyle choices of different age cohorts. This could include expanding offerings in categories like dairy with added benefits, convenient meal solutions, and healthier snack options designed for older consumers, while still catering to younger demographics.

Growing Demand for Sustainable and Ethically Sourced Products

Latin American consumers are placing a growing emphasis on sustainability and ethical sourcing, directly impacting the food industry. This societal shift means consumers are scrutinizing environmental claims on food packaging and demanding greater transparency regarding product origins. For Grupo Nutresa, this translates into a strategic imperative to bolster its supply chain visibility and actively invest in sustainable practices.

For instance, a 2024 survey indicated that over 65% of consumers in key Latin American markets consider sustainability a significant factor in their purchasing decisions for food products. This growing awareness is pushing companies like Grupo Nutresa to adopt initiatives such as fair trade certifications for ingredients like cocoa and implement more robust responsible sourcing policies across their operations. These efforts are not just about compliance but are becoming a critical differentiator in a competitive market.

- Consumer Preference Shift: A significant portion of Latin American consumers now prioritize eco-friendly and ethically produced goods, influencing purchasing behavior.

- Supply Chain Transparency: Companies are pressured to provide clear information about their sourcing practices and environmental impact.

- Investment in Sustainability: Grupo Nutresa, like its peers, must allocate resources towards sustainable agriculture and fair labor practices.

- Market Differentiation: Demonstrating commitment to sustainability can enhance brand reputation and attract a growing segment of conscious consumers.

Cultural Eating Habits and Brand Loyalty

Deep-rooted cultural eating habits significantly shape consumer preferences in the processed food sector, creating a foundation for strong brand loyalty. Grupo Nutresa, with its extensive history and established brands in markets like Colombia, benefits from this ingrained consumer trust. For instance, in 2024, the Colombian processed food market continued to show resilience, with consumers often opting for familiar brands that align with traditional culinary practices.

Grupo Nutresa's ability to tap into this loyalty is a key competitive advantage. However, evolving consumer tastes, influenced by global trends and health consciousness, necessitate continuous innovation. The company must balance its heritage brands with new product development that caters to changing dietary needs and preferences. This dynamic requires ongoing market research to understand emerging cultural shifts in food consumption.

Key considerations for Grupo Nutresa regarding cultural eating habits and brand loyalty include:

- Leveraging Heritage: Capitalizing on the trust and familiarity associated with established brands that are woven into the cultural fabric of key markets.

- Adapting to Trends: Innovating product offerings to meet growing demand for healthier options, plant-based alternatives, and convenience foods, reflecting evolving cultural norms.

- Regional Nuances: Recognizing and respecting distinct cultural eating patterns across different geographies to tailor product portfolios effectively.

- Brand Communication: Reinforcing brand values that resonate with cultural identity while also signaling modernity and responsiveness to consumer evolution.

Sociological factors significantly influence Grupo Nutresa's market position, driven by evolving consumer values and lifestyles across Latin America. A notable trend is the increasing demand for healthier and more sustainable food options, with a 2024 survey revealing over 65% of consumers in key markets consider sustainability in their food purchases. This shift necessitates greater supply chain transparency and investment in ethical sourcing practices, impacting brand perception and market competitiveness.

Technological factors

Technological advancements are fundamentally reshaping food production, with automation and efficiency at the forefront. These innovations are critical for companies like Grupo Nutresa to enhance output, lower operational expenses, and ensure consistent product quality. For instance, the adoption of advanced robotics and AI-driven process control in packaging lines can significantly reduce manual labor, minimize errors, and speed up throughput, directly impacting cost of goods sold.

In 2024, the global food processing automation market was valued at approximately $15.5 billion and is projected to grow substantially. Grupo Nutresa's investment in modernizing its manufacturing facilities, incorporating smart factory technologies, and implementing data analytics for predictive maintenance allows for optimized resource utilization and greater agility in responding to market demands. This focus on efficiency is key to maintaining a competitive edge in the dynamic food industry.

Grupo Nutresa is actively leveraging technological advancements to streamline its supply chain. By implementing real-time data-driven dynamic routing, the company is optimizing transport routes, which directly translates to reduced logistical costs and a lower carbon footprint. This focus on efficiency is crucial in today's competitive market.

These digital solutions not only enhance operational efficiency but also contribute to Grupo Nutresa's sustainability goals. For instance, improved route planning can lead to fewer miles driven, thereby decreasing fuel consumption and associated emissions. This commitment to technological integration signifies a forward-thinking approach to logistics management.

The surge in e-commerce is reshaping how consumers buy food and beverages, making it imperative for Grupo Nutresa to enhance its digital sales channels. As of early 2024, online grocery sales in Latin America are projected to grow significantly, with some markets seeing double-digit year-over-year increases, presenting a substantial opportunity for Nutresa to expand its reach beyond traditional retail.

To capitalize on this trend, Grupo Nutresa needs to invest in sophisticated online product recommendation engines and bolster its digital marketing efforts. This adaptation is crucial for engaging with a growing segment of consumers who prefer the convenience of online shopping and expect personalized digital experiences.

Food Innovation and Research & Development

Grupo Nutresa recognizes that continuous investment in research and development (R&D) is vital for creating new, healthier, and innovative food products that resonate with evolving consumer preferences. This commitment is demonstrated through their active participation in open innovation projects and substantial R&D expenditures aimed at solidifying their market leadership.

In 2023, Grupo Nutresa reported investing approximately COP 125,000 million (around USD 32 million) in R&D and innovation initiatives, a significant increase from previous years. This investment fuels the development of products catering to growing demands for reduced sugar, plant-based options, and functional ingredients.

- Product Diversification: R&D efforts focus on expanding product lines to meet diverse dietary needs and preferences, including gluten-free and allergen-friendly options.

- Process Optimization: Innovation extends to manufacturing processes, aiming for greater efficiency, sustainability, and improved product quality.

- Consumer Insights: Leveraging data analytics and market research, R&D teams identify emerging consumer trends to guide product development pipelines.

- Strategic Partnerships: Collaborations with universities and research institutions accelerate the discovery and implementation of new food technologies.

Adoption of AI and Data Analytics

Grupo Nutresa is actively integrating Artificial Intelligence (AI) and data analytics across its operations to drive efficiency and innovation. The company is exploring AI applications in critical areas like cybersecurity, supply chain optimization, and commercial strategy development. This strategic focus aims to leverage advanced analytical capabilities for better decision-making and operational performance.

Looking ahead to 2025, Grupo Nutresa plans to implement digital twins and generative AI technologies. These advanced tools are expected to significantly boost productivity by simulating complex processes and automating content creation for sales and marketing efforts. Such advancements signal a commitment to staying at the forefront of technological adoption in the food industry.

- AI Integration: Cybersecurity, supply chain, and commercial processes are key areas for AI adoption.

- Digital Twins: Planned for 2025 to enhance operational simulations and efficiency.

- Generative AI: Also slated for 2025 to improve productivity and sales-related content.

- Data-Driven Strategy: Focus on leveraging analytics for informed business decisions.

Grupo Nutresa is enhancing operational efficiency through automation and smart factory technologies, aiming to reduce costs and improve product consistency. The global food processing automation market's growth, projected to exceed $15.5 billion in 2024, underscores the importance of these investments for maintaining competitiveness.

The company is also capitalizing on the rise of e-commerce, with online grocery sales in Latin America showing significant growth as of early 2024, necessitating robust digital sales channels and personalized consumer experiences.

Continuous R&D investment, exemplified by a COP 125,000 million (approx. USD 32 million) spend in 2023, is crucial for developing innovative products that meet evolving consumer demands for healthier and specialized options.

Looking towards 2025, Grupo Nutresa plans to integrate advanced technologies like digital twins and generative AI to further boost productivity and streamline operations, signaling a strong commitment to technological leadership.

Legal factors

Grupo Nutresa must navigate stringent food labeling and nutritional regulations across its operating markets. For instance, Mexico's front-of-pack warning labels, implemented in 2020 and expanding in scope, directly influence product formulation and packaging for items high in sugar, sodium, or saturated fats. This necessitates careful reformulation and redesign to comply with evolving standards in countries like Chile and Colombia, ensuring market access and avoiding significant financial penalties.

Grupo Nutresa faces increasing legal pressure regarding environmental practices. New regulations in 2024 and projected for 2025 are specifically targeting plastic packaging, demanding significant investment in sustainable alternatives. This includes mandates for reducing single-use plastics and promoting the use of recyclable materials, making compliance a critical legal challenge.

Grupo Nutresa, operating in numerous countries, faces a complex web of labor laws. These regulations cover everything from minimum wages and working hours to employee benefits and safety standards. For instance, in Colombia, the minimum wage for 2024 was set at COP 1,300,000 per month, a key factor in labor cost calculations.

Compliance with these diverse legal frameworks is not just about avoiding penalties; it's fundamental to Grupo Nutresa's reputation. Successfully navigating these employment regulations helps the company maintain a positive corporate image and fosters trust with its workforce, thereby preventing costly legal battles and ensuring operational continuity.

Intellectual Property Protection

Intellectual property protection is a cornerstone for Grupo Nutresa, safeguarding its valuable brand names, unique product formulations, and proprietary manufacturing processes. These legal mechanisms are crucial for maintaining its competitive edge in the dynamic food and beverage sector. By securing patents, trademarks, and trade secrets, the company shields the significant investments made in research and development, ensuring that its innovations translate into sustained market advantage.

Grupo Nutresa's commitment to intellectual property is evident in its robust patent portfolio. For instance, as of early 2024, the company holds numerous active patents across various product categories, including novel food preservation techniques and specialized ingredient combinations. This legal framework is essential for preventing competitors from replicating its R&D successes and for fostering continued innovation. The company's strategy involves actively monitoring and enforcing its IP rights globally, which is vital for protecting its market share and brand integrity.

- Brand Protection: Trademarks for brands like Nutresa, Pocillo, and Jet are legally protected, preventing unauthorized use and dilution of brand equity.

- Product Innovation: Patents cover unique product formulations and manufacturing processes, such as those for reduced-sugar confectioneries or extended shelf-life dairy products, developed through ongoing R&D.

- Trade Secrets: Confidential operational knowledge and proprietary recipes are safeguarded through strict internal controls and legal agreements, crucial for maintaining a competitive advantage in product quality and cost-efficiency.

- Enforcement: Grupo Nutresa actively pursues legal action against infringers to protect its intellectual property rights, ensuring market exclusivity for its innovations.

Antitrust and Competition Laws

Grupo Nutresa's significant market share in several food categories, particularly in Colombia and other Latin American countries, means it must navigate a complex web of antitrust and competition regulations. For instance, in 2023, regulatory bodies like the Superintendencia de Industria y Comercio (SIC) in Colombia continued to scrutinize market concentration, and Nutresa's operations are subject to ongoing review to prevent monopolistic practices. Failure to comply can lead to substantial fines and operational restrictions.

Adherence to these laws is crucial for maintaining fair competition and fostering a healthy market environment. This involves careful monitoring of pricing strategies, distribution agreements, and potential mergers or acquisitions to ensure they do not stifle competition. For example, any proposed consolidation within its key product lines, such as processed foods or confectionery, would likely face intense regulatory scrutiny in 2024 and 2025.

- Dominant Market Share: Grupo Nutresa holds leading positions in numerous food segments across its operating regions, requiring vigilant compliance with competition laws.

- Regulatory Scrutiny: Authorities like Colombia's SIC actively monitor market concentration, impacting Nutresa's strategic decisions regarding expansion and pricing.

- Compliance Costs: Maintaining robust compliance programs incurs significant costs but is essential to avoid penalties and legal disputes related to anti-competitive behavior.

Grupo Nutresa operates under strict food safety and quality regulations, with agencies like Colombia's INVIMA setting standards for product integrity and consumer health. Compliance involves rigorous testing, traceability, and adherence to Good Manufacturing Practices (GMPs), with potential fines and product recalls for deviations. For instance, the company must ensure its products meet the specific microbial limits and labeling requirements mandated by these bodies, especially for perishable goods, throughout 2024 and into 2025.

The company's global operations necessitate adherence to diverse data privacy laws, such as the EU's GDPR and similar regulations in Latin America. Protecting customer and employee data is paramount, requiring robust cybersecurity measures and transparent data handling policies. Failure to comply can result in substantial financial penalties and reputational damage, as seen with significant fines levied against other multinational corporations for data breaches in recent years.

Grupo Nutresa must also contend with consumer protection laws, ensuring fair advertising and transparent product information. Regulations regarding claims about health benefits or product origins are strictly enforced, with misleading advertising leading to legal challenges. For example, claims about natural ingredients or reduced sugar content must be substantiated by scientific evidence to avoid regulatory action in key markets like Peru and Ecuador.

Navigating international trade agreements and customs regulations is critical for Grupo Nutresa's import and export activities. Compliance with tariffs, product standards, and phytosanitary requirements in countries like the United States and Brazil impacts supply chain efficiency and costs. Changes in trade policies, such as potential new tariffs or import restrictions, could significantly affect the company's profitability and market access in 2024 and 2025.

Environmental factors

Climate change presents a substantial risk to Grupo Nutresa's agricultural supply chain, particularly for key ingredients like cocoa. Fluctuations in weather patterns directly impact crop yields and quality, potentially disrupting the availability and price stability of these essential raw materials. For instance, persistent droughts and increased instances of extreme weather events in major cocoa-producing regions could significantly affect output.

Grupo Nutresa's proactive approach to strengthening the cocoa supply chain and championing sustainable agricultural practices is a strategic imperative in mitigating these environmental risks. By investing in resilient farming techniques and supporting farmers, the company aims to ensure a more stable and predictable sourcing of its core ingredients, thereby safeguarding its production and profitability against the backdrop of a changing climate. This focus on sustainability is not just an environmental commitment but a critical business strategy for long-term resilience.

Grupo Nutresa recognizes that responsible water usage is a critical environmental consideration, particularly within its agricultural sourcing and manufacturing operations. The company actively works to optimize water resources, aiming to reduce consumption and improve efficiency throughout its value chain. This focus on eco-efficient practices is designed to proactively address the growing risks associated with water scarcity.

Grupo Nutresa is actively integrating circular economy principles, particularly concerning packaging. The company is investing in eco-design to ensure a significant portion of its packaging is recyclable, reusable, or compostable, aligning with growing global waste reduction mandates.

By 2023, Grupo Nutresa reported that 87% of its packaging was already recyclable, reusable, or compostable, demonstrating a strong commitment to this environmental factor. This initiative is crucial as regulatory pressures and consumer demand for sustainable practices intensify, influencing operational strategies and product development.

Greenhouse Gas Emissions Reduction and Renewable Energy Adoption

Grupo Nutresa is making significant strides in reducing its environmental impact, particularly concerning greenhouse gas emissions. The company is investing in initiatives like biomass projects to transition away from fossil fuels, aiming for a cleaner energy mix.

Furthermore, Grupo Nutresa is consolidating its solar power generation projects, a key strategy in adopting renewable energy sources. These actions directly support climate change mitigation efforts and bolster the company's overall environmental stewardship.

By focusing on these areas, Grupo Nutresa aligns with global sustainability goals and demonstrates a commitment to responsible business practices. For instance, in 2023, the company reported a 10% reduction in its Scope 1 and Scope 2 emissions compared to its 2019 baseline, a testament to its ongoing efforts.

- Biomass Projects: Replacing fossil fuels with biomass for energy generation.

- Solar Power Consolidation: Expanding and integrating solar energy capacity.

- Carbon Footprint Reduction: Aiming for measurable decreases in greenhouse gas emissions.

- Environmental Performance: Enhancing overall sustainability metrics.

Sustainable Sourcing and Biodiversity Preservation

Grupo Nutresa is deeply committed to responsible sourcing, aiming to integrate sustainable practices across its entire value chain. This involves active collaboration with suppliers to enhance traceability and secure raw materials that are sourced sustainably, with a keen eye on preserving biodiversity.

The company's focus on biodiversity preservation is crucial, especially considering the agricultural inputs for many of its products. For instance, in 2024, the agricultural sector, a key supplier for food companies like Nutresa, faced increasing scrutiny regarding its environmental footprint. Initiatives like the UN's Biodiversity Beyond National Jurisdiction (BBNJ) Agreement, which came into force in 2023, are shaping global expectations for companies to demonstrate robust biodiversity protection measures.

- Supplier Collaboration: Grupo Nutresa actively partners with its suppliers to implement and improve sustainable farming and sourcing methods.

- Traceability Enhancement: Efforts are ongoing to increase the transparency and traceability of raw materials from origin to final product.

- Biodiversity Focus: The company recognizes the importance of preserving natural habitats and ecosystems impacted by its sourcing activities.

- Sustainable Agriculture: This commitment aligns with broader industry trends and regulatory pressures pushing for more environmentally conscious agricultural practices, especially in light of global biodiversity targets for 2030.

Grupo Nutresa is actively addressing environmental concerns, from climate change impacts on its supply chain to responsible water usage and waste reduction. The company's commitment to sustainability is evident in its packaging initiatives, with 87% of its packaging being recyclable, reusable, or compostable by 2023. Furthermore, significant investments in biomass and solar energy projects are reducing its carbon footprint, with a reported 10% decrease in Scope 1 and 2 emissions by 2023 compared to a 2019 baseline.

The company's focus extends to responsible sourcing and biodiversity preservation, collaborating with suppliers to enhance traceability and promote sustainable agricultural practices. This aligns with increasing global expectations and regulatory pressures, such as the UN's BBNJ Agreement, to demonstrate robust biodiversity protection measures.

| Environmental Initiative | 2023 Status/Target | Impact/Goal |

|---|---|---|

| Recyclable/Reusable/Compostable Packaging | 87% of packaging | Reduce waste, meet regulatory demands |

| Greenhouse Gas Emissions Reduction (Scope 1 & 2) | 10% reduction vs. 2019 baseline | Climate change mitigation, operational efficiency |

| Renewable Energy Adoption | Investment in biomass and solar projects | Transition from fossil fuels, cleaner energy mix |

| Sustainable Sourcing & Biodiversity | Supplier collaboration, traceability enhancement | Preserve natural habitats, ensure raw material stability |

PESTLE Analysis Data Sources

Our Grupo Nutresa PESTLE Analysis is informed by a robust blend of data, including official reports from Colombian government bodies, international economic institutions like the World Bank and IMF, and reputable industry-specific market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.