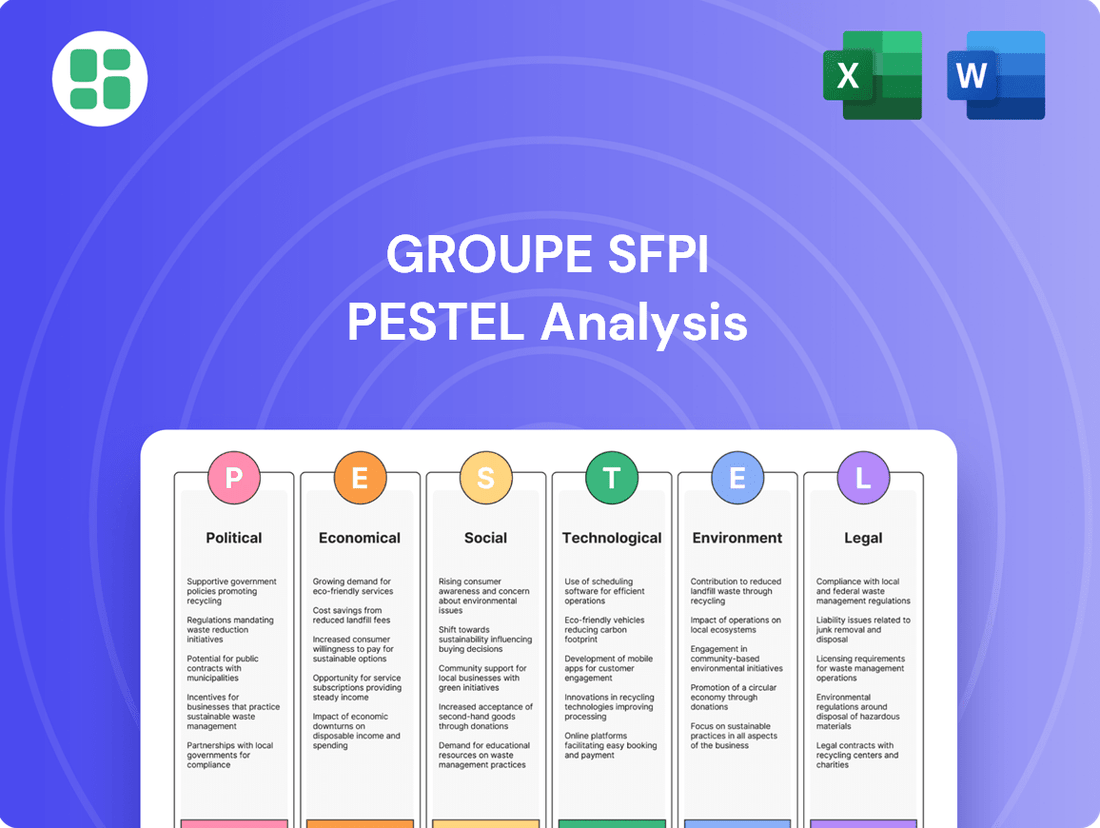

Groupe Sfpi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

Navigate the complex external landscape shaping Groupe Sfpi's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic direction. Gain critical insights into market dynamics and potential opportunities.

Understand how evolving regulations, economic shifts, and technological advancements present both challenges and growth avenues for Groupe Sfpi. This comprehensive PESTLE analysis provides the strategic intelligence you need to make informed decisions and stay ahead of the curve.

Unlock actionable intelligence on Groupe Sfpi's operating environment. From societal trends to environmental pressures, our PESTLE analysis offers a deep dive into the forces that will define their success. Download the full version now to gain a competitive edge.

Political factors

Groupe Sfpi's operations are significantly shaped by government regulations, especially those pertaining to industrial safety and building codes. For instance, in 2024, the European Union continued to emphasize stricter environmental and safety standards across industries, potentially increasing the need for Sfpi's advanced security and access control systems. These evolving mandates can either boost demand for their specialized offerings or require costly adjustments to existing product lines.

Fluctuations in international trade policies and geopolitical stability present significant risks for Groupe Sfpi. For instance, the ongoing trade tensions between major economies in 2024 and 2025 could lead to increased tariffs on key raw materials, directly impacting Groupe Sfpi's cost of goods sold and potentially reducing profit margins.

Geopolitical instability, such as regional conflicts or political unrest, can disrupt global supply chains. In 2024, disruptions stemming from conflicts in Eastern Europe and the Middle East led to a notable increase in shipping costs and lead times for many industries, a trend that could continue to affect Groupe Sfpi's ability to source components and deliver finished products efficiently.

Government incentives for smart infrastructure directly fuel demand for Groupe Sfpi's offerings. For instance, the European Union's Green Deal, with its €1 trillion investment plan through 2030, prioritizes energy efficiency and sustainable building solutions, areas where Groupe Sfpi's expertise in smart building technologies and energy management is highly relevant. This policy framework creates a fertile ground for the adoption of advanced security and intelligent systems.

Further bolstering these opportunities, national governments are increasingly implementing specific programs. In 2024, France announced a new €2 billion fund dedicated to modernizing public infrastructure with a focus on digital and sustainable technologies. Such initiatives, coupled with mandates for enhanced cybersecurity in critical infrastructure, translate into significant market potential for Groupe Sfpi's secure infrastructure and smart city integration services.

Public Procurement Policies

Public procurement policies for security and automation systems in government buildings, critical infrastructure, and public spaces are a key market for Groupe Sfpi. Favorable policies that encourage the adoption of advanced, integrated security solutions can significantly boost their sales. For instance, in 2024, European governments continued to invest heavily in upgrading public infrastructure security, with a notable increase in tenders for smart city solutions and cybersecurity for critical national infrastructure.

Policies that specifically support local European manufacturers, such as Groupe Sfpi, can provide a competitive edge. This support can translate into increased market share and revenue. The European Union's strategy to bolster domestic technological capabilities, including in the security sector, is expected to continue through 2025, potentially benefiting companies like Sfpi.

- Market Growth: Government spending on security and automation in Europe saw an estimated 8% year-on-year increase in 2024, reaching over €50 billion for public sector projects.

- Policy Impact: Regulations favoring integrated security systems and local sourcing, as seen in France and Germany, directly benefit European providers like Groupe Sfpi.

- Future Trends: Anticipated tenders in 2025 for smart city initiatives and cybersecurity upgrades for transportation networks will likely present significant opportunities for companies aligned with public procurement trends.

Political Stability in Key Markets

Political stability in Groupe Sfpi's key European markets significantly impacts its operational environment. For instance, France, a major market for the company, has seen a focus on infrastructure development, with the government allocating substantial funds to modernization projects. However, potential shifts in political leadership or policy priorities could alter this landscape.

Political uncertainty can directly dampen investment in the construction and industrial sectors. In 2024, several European nations are navigating complex political climates, which could translate to a more cautious approach from both public and private sector clients regarding new building and industrial undertakings. This cautiousness can directly affect Groupe Sfpi's order book and revenue streams.

- France's €100 billion post-COVID recovery plan includes significant investment in green infrastructure and building renovations, a positive for companies like Sfpi.

- Political instability in a key region could lead to a 5-10% reduction in new project commencements, impacting Sfpi's top-line growth.

- Changes in environmental regulations, driven by political agendas, could necessitate additional compliance costs for Sfpi's projects.

- The upcoming 2025 European Parliament elections could introduce policy shifts affecting public spending on construction and industrial development.

Government policies directly influence Groupe Sfpi's market opportunities, particularly through infrastructure spending and regulatory frameworks. For instance, the French government's commitment to modernizing infrastructure, including a €2 billion fund for digital and sustainable technologies in 2024, directly benefits Sfpi's smart building and security solutions.

Political stability and public procurement trends are critical. In 2024, European governments continued to prioritize security upgrades for public infrastructure, creating demand for Sfpi's integrated security systems, with an estimated 8% year-on-year increase in public sector security spending.

| Political Factor | Impact on Groupe Sfpi | 2024/2025 Data/Trend |

|---|---|---|

| Government Infrastructure Spending | Drives demand for security and automation systems. | France's €2 billion fund for digital/sustainable tech. EU Green Deal investment. |

| Regulatory Environment | Shapes compliance costs and product development. | Stricter EU safety and environmental standards. |

| Public Procurement Policies | Directly influences sales for public sector projects. | Increased tenders for smart city and cybersecurity solutions in Europe. |

| Geopolitical Stability | Affects supply chains and operational costs. | Trade tensions and regional conflicts impacting shipping costs. |

What is included in the product

This PESTLE analysis of Groupe Sfpi examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by highlighting key external drivers that present both challenges and opportunities for Groupe Sfpi.

A clear, actionable PESTLE analysis for Groupe Sfpi that identifies external factors impacting the business, allowing for proactive strategy development and risk mitigation.

Economic factors

The health of the global economy is a significant driver for Groupe Sfpi. When economies are strong, there's generally more investment in infrastructure and building projects, which directly boosts demand for the company's products across its various divisions.

However, specific regional downturns can have a pronounced effect. For instance, the European construction sector faced headwinds in 2024, with reports indicating a slowdown in new projects. This directly impacts divisions like MAC, which specializes in windows, blinds, and closures, leading to potentially lower sales volumes.

The industrial sector's performance also plays a crucial role. A robust industrial economy often translates to increased manufacturing and production, creating a positive environment for companies supplying industrial components and services, which are part of Groupe Sfpi's broader portfolio.

Groupe Sfpi, like many in the industrial sector, faces significant challenges from persistent inflationary pressures. Rising costs for essential inputs such as raw materials, energy, and labor directly impact manufacturing expenses. For instance, the Eurozone's inflation rate remained elevated in early 2024, with energy prices contributing significantly to these increases. This necessitates robust cost management strategies.

The company's ability to navigate these economic headwinds is paramount. Groupe Sfpi demonstrated resilience in 2024 through effective operational recovery plans, which were vital in safeguarding its gross margins. Maintaining profitability in the face of escalating input costs requires continuous adaptation and efficient operational practices to offset these pressures.

Changes in interest rates directly impact Groupe Sfpi's cost of capital and its customers' ability to finance projects. As of early 2024, central banks globally have maintained relatively high interest rates to combat inflation, increasing borrowing expenses for businesses looking to invest in security and automation solutions.

If interest rates were to decrease, as some forecasts suggest for late 2024 or 2025, it would likely stimulate construction and industrial development. This would translate to higher demand for Groupe Sfpi's offerings, as more companies would find it economically viable to undertake new projects and expansions requiring advanced security and automation systems.

Exchange Rate Fluctuations

As an international entity with operations spanning Europe, Groupe Sfpi is directly exposed to the volatility of exchange rates. These fluctuations can significantly influence the group's reported revenues and the cost of its operations. For example, if the euro strengthens against other currencies where Groupe Sfpi has significant sales or production, its foreign earnings, when converted back to euros, will appear lower. Conversely, a weaker euro could boost reported international profits.

The impact is not uniform; it depends on the geographical distribution of sales, procurement, and manufacturing. For instance, if a substantial portion of Groupe Sfpi's costs are denominated in a currency that weakens against the euro, those costs would decrease in euro terms, potentially improving margins. Conversely, if a large part of its revenue comes from countries whose currencies depreciate against the euro, this would negatively affect its top line.

- Impact on Exports: A stronger euro can make Groupe Sfpi's products more expensive for international buyers, potentially reducing sales volume in non-eurozone countries.

- Impact on Imports: Conversely, a weaker euro can increase the cost of imported raw materials or components, squeezing profit margins if these costs cannot be passed on to customers.

- Financial Reporting: Exchange rate movements affect the translation of foreign subsidiaries' financial statements into the group's reporting currency, influencing reported assets, liabilities, revenues, and profits.

- Hedging Strategies: Groupe Sfpi may employ financial instruments to hedge against adverse currency movements, aiming to stabilize its financial performance. For example, in early 2024, many European companies were managing the impact of a relatively stable but fluctuating euro against the US dollar and British pound.

Business and Consumer Spending Confidence

Business and consumer confidence are crucial for Groupe Sfpi's growth, particularly in areas like security, automation, and building renovations. When confidence is high, companies are more likely to invest in upgrading their facilities and implementing new technologies, directly benefiting Sfpi's service offerings. Similarly, consumers tend to spend more on home improvements and security systems when they feel economically secure.

In 2024, economic sentiment has shown mixed signals. While some sectors experienced robust recovery, others faced headwinds. For instance, the European construction sector, a key market for Sfpi, saw varying performance across regions, influenced by inflation and interest rate policies. Consumer spending confidence in the Eurozone, as measured by the European Commission's surveys, hovered around pre-pandemic levels for much of late 2024, indicating a cautious but generally stable outlook.

Looking ahead into 2025, projections suggest a gradual improvement in business investment as supply chain issues stabilize and geopolitical uncertainties potentially recede. However, persistent inflation remains a concern that could temper consumer spending on discretionary items, including larger renovation projects. Sfpi's ability to offer cost-effective and value-driven solutions will be paramount in capturing market share amidst these economic conditions.

- European consumer confidence index in Q4 2024 averaged around -10, a slight improvement from earlier in the year.

- Business investment in automation technologies in Europe was projected to grow by approximately 5-7% in 2024, according to industry reports.

- The renovation market in France, a significant market for Sfpi, was expected to see steady demand in 2024, driven by energy efficiency upgrades.

- Interest rate hikes in major economies during 2023-2024 could influence the pace of new large-scale building projects.

Economic factors significantly influence Groupe Sfpi's performance, with global and regional economic health directly impacting demand for its construction and industrial products. Persistent inflation in early 2024, particularly in the Eurozone, increased input costs, necessitating strong cost management, which the company addressed through operational recovery plans to protect margins.

Interest rate policies also play a critical role; higher rates in 2024 increased borrowing costs for clients, potentially slowing project financing, while anticipated rate decreases in late 2024 or 2025 could stimulate investment in security and automation solutions. Exchange rate volatility remains a key concern for Groupe Sfpi, affecting reported revenues and operational costs, with companies like Sfpi actively managing these fluctuations through hedging strategies.

Business and consumer confidence are vital indicators, with mixed signals in 2024 affecting investment in facility upgrades and home improvements. Projections for 2025 suggest gradual improvement in business investment, though inflation may temper consumer spending on discretionary projects, highlighting the need for Sfpi to offer competitive, value-driven solutions.

| Economic Indicator | Period | Value/Trend | Impact on Groupe Sfpi |

|---|---|---|---|

| Eurozone Inflation Rate | Early 2024 | Elevated, driven by energy costs | Increased input costs, impacting margins |

| European Construction Sector Growth | 2024 | Slowdown in new projects reported | Reduced demand for MAC division products |

| Interest Rates (Major Economies) | Early 2024 | Relatively high | Increased cost of capital for clients |

| European Consumer Confidence Index | Q4 2024 | Averaged around -10 | Cautious but stable outlook for consumer spending |

| Business Investment in Automation | 2024 Projection (Europe) | Projected 5-7% growth | Positive outlook for automation solutions |

What You See Is What You Get

Groupe Sfpi PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Groupe Sfpi.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors influencing Groupe Sfpi.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic decision-making regarding Groupe Sfpi.

Sociological factors

Societies globally are placing a heightened emphasis on security and safety, a trend that directly benefits Groupe Sfpi. This growing awareness translates into increased demand for sophisticated access control, advanced surveillance technologies, and robust industrial safety equipment, all of which are central to Groupe Sfpi's product and service portfolio.

The market for security and safety solutions is experiencing significant growth. For instance, the global physical security market was projected to reach approximately $245 billion in 2024, with a compound annual growth rate (CAGR) expected to continue into 2025. This expansion is fueled by a combination of rising crime rates, terrorism concerns, and a general desire for secure environments, creating a fertile ground for Groupe Sfpi's specialized offerings.

Demographic shifts are significantly influencing the labor market for companies like Groupe Sfpi. An aging workforce, particularly prevalent in developed economies, means experienced workers are retiring, leading to potential knowledge gaps and a reduced pool of seasoned professionals. This is compounded by a declining birthrate in many regions, further constricting the overall labor supply.

Labor shortages are particularly acute in sectors like manufacturing and skilled trades, which are core to Groupe Sfpi's operations, especially in installation and maintenance. For instance, in the EU, the manufacturing sector has faced persistent skill gaps, with a significant percentage of companies reporting difficulty finding qualified personnel. This scarcity directly impacts operational efficiency and can drive up labor costs as companies compete for limited talent.

The availability of skilled labor for installing and maintaining complex security and automation systems is paramount for Groupe Sfpi's service delivery. As technology advances, the demand for specialized technicians with expertise in areas like cybersecurity, IoT integration, and advanced building management systems grows. Without an adequate supply of these skilled workers, Groupe Sfpi may face challenges in expanding its service offerings and meeting client demands effectively, potentially impacting project timelines and profitability.

Urbanization continues to be a major global trend, with projections indicating that by 2050, 68% of the world's population will live in urban areas. This surge in city dwellers places significant strain on existing infrastructure and resources, creating a pressing need for smarter, more efficient building solutions. Groupe Sfpi, with its focus on energy management and integrated security systems, is well-positioned to capitalize on this demand.

The increasing density of urban populations directly drives the adoption of smart building technologies. These technologies, such as those offered by Groupe Sfpi, optimize energy consumption, enhance building security, and improve overall operational efficiency, making them essential for managing the complexities of modern cities. For instance, smart building systems can reduce energy usage by up to 30% in commercial buildings.

Evolving Expectations for Workplace Safety

There's a growing emphasis on employee safety and well-being, particularly in industrial environments. This heightened awareness, fueled by stricter regulations and a stronger sense of corporate responsibility, directly translates into a greater demand for sophisticated industrial safety equipment and advanced air treatment systems. This trend perfectly complements Groupe Sfpi's strategic focus within its Industry division.

In 2024, global spending on industrial safety is projected to see continued growth, with specific segments like personal protective equipment (PPE) and environmental monitoring systems experiencing robust expansion. For instance, the global industrial safety market was valued at over $50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2028, according to recent market analyses.

- Increased regulatory scrutiny: Governments worldwide are tightening safety standards, pushing companies to invest more in protective measures.

- Corporate Social Responsibility (CSR): Companies are increasingly prioritizing employee welfare as a key aspect of their CSR initiatives, driving demand for safety solutions.

- Technological Advancements: Innovations in safety equipment, such as smart sensors and advanced air filtration, are enhancing protection and creating new market opportunities.

Societal Perceptions of Privacy vs. Security

Societal views on privacy versus security are constantly shifting, impacting how Groupe Sfpi's security solutions are received. For instance, a 2024 Pew Research Center study indicated that while a majority of Americans are concerned about data privacy, a significant portion also believes that increased security measures are necessary in public spaces. This creates a delicate balance for companies like Groupe Sfpi, which must demonstrate how their technologies can enhance safety without unduly infringing on personal freedoms.

Groupe Sfpi must therefore actively address these evolving perceptions. Offering granular control over data collection and usage, alongside transparent communication about security protocols, will be crucial. The company's ability to provide solutions that are both effective in their security function and respectful of individual privacy rights will directly influence market adoption and brand reputation in the coming years.

The market for security technologies is increasingly influenced by these societal considerations. For example, the global market for identity and access management solutions, a key area for Groupe Sfpi, was projected to reach over $70 billion in 2024, with a growing emphasis on privacy-preserving features. This highlights the demand for solutions that can meet stringent security requirements while also adhering to evolving privacy expectations.

- Data Privacy Concerns: A significant portion of the public expresses worry over how their personal data is collected and used by security systems.

- Balancing Act: Groupe Sfpi needs to offer technologies that effectively enhance security without compromising individual privacy rights.

- Market Demand: The growing market for identity and access management solutions, projected to exceed $70 billion in 2024, shows a demand for privacy-conscious security.

- Transparency is Key: Clear communication about data handling and security measures will build trust and influence adoption rates.

Societal expectations around employee well-being and workplace safety are a significant driver for Groupe Sfpi. As companies increasingly prioritize a secure and healthy environment for their staff, the demand for advanced safety equipment and integrated building management systems rises. This trend is reflected in market growth, with the global industrial safety market expected to reach over $50 billion in 2024, growing at an estimated 6% CAGR through 2028.

The increasing focus on environmental sustainability and energy efficiency within society also directly benefits Groupe Sfpi's offerings. Consumers and businesses alike are seeking solutions that reduce their carbon footprint and operational costs, making smart building technologies and energy management systems highly desirable. For instance, smart building systems can contribute to significant energy savings, with some studies indicating reductions of up to 30% in commercial buildings.

Demographic shifts, particularly an aging workforce and declining birth rates in many developed nations, present both challenges and opportunities for Groupe Sfpi. While this can lead to a smaller pool of skilled labor for installation and maintenance, it also drives demand for automation and advanced systems that can compensate for labor shortages. For example, the manufacturing sector in the EU has reported persistent skill gaps, highlighting the need for technological solutions.

| Sociological Factor | Impact on Groupe Sfpi | Supporting Data/Trend |

|---|---|---|

| Workplace Safety & Well-being | Increased demand for safety equipment and integrated systems. | Global industrial safety market projected to grow at 6% CAGR through 2028. |

| Environmental Sustainability | Growing market for energy-efficient and smart building solutions. | Smart building systems can reduce energy usage by up to 30%. |

| Demographic Shifts (Aging Workforce) | Potential labor shortages, driving demand for automation. | Skill gaps reported in sectors like manufacturing in the EU. |

| Privacy vs. Security Perceptions | Need for transparent and privacy-conscious security solutions. | Global identity and access management market projected to exceed $70 billion in 2024. |

Technological factors

Groupe Sfpi is positioned to benefit from the rapid evolution of technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and machine learning. These advancements are fundamentally reshaping how security and automation operate, offering new avenues for growth and efficiency.

These technologies are crucial for Groupe Sfpi’s strategic focus, enabling the development of more sophisticated access control systems, proactive predictive maintenance for facilities, and highly optimized building management solutions. For instance, AI-powered analytics can predict equipment failures, reducing downtime and operational costs for clients.

The integration of IoT devices allows for real-time data collection across a building's infrastructure, feeding into AI algorithms for enhanced performance. In 2024, the global AI market was projected to reach over $200 billion, with significant investment flowing into industrial automation and smart building solutions, areas directly relevant to Groupe Sfpi's service offerings.

The growing interconnectedness of industrial and building systems, often referred to as Operational Technology (OT), presents significant cybersecurity challenges. These systems are increasingly targeted by sophisticated cyberattacks, as evidenced by the rise in ransomware attacks on critical infrastructure. For instance, a 2023 report indicated a 70% increase in attacks targeting OT environments compared to the previous year.

Groupe Sfpi needs to prioritize ongoing investment in advanced cybersecurity measures for its product offerings. This proactive approach is crucial to safeguard critical infrastructure managed by its clients and to uphold the trust placed in its solutions. Failure to do so could lead to data breaches and operational disruptions, impacting both Groupe Sfpi and its customers.

The increasing demand for unified building and industrial system management, encompassing everything from access control and HVAC to lighting and fire safety, presents a substantial growth avenue. Groupe Sfpi is well-positioned to capitalize on this trend by offering integrated solutions that boost both operational efficiency and security for its clients.

Development of New Materials and Manufacturing Processes

Innovation in materials science and manufacturing is a key technological driver. For instance, advancements in additive manufacturing, often called 3D printing, are revolutionizing how components are made, potentially leading to more intricate designs and reduced waste. Groupe Sfpi can leverage these technologies to create more robust and cost-efficient products.

The push for sustainability also fuels material innovation. New composites and bio-based materials offer alternatives to traditional options, aligning with environmental regulations and consumer demand. This can directly impact Groupe Sfpi's production efficiency and the environmental footprint of its offerings.

Consider these specific impacts:

- Enhanced Product Performance: New materials can offer superior strength-to-weight ratios or improved resistance to environmental factors, boosting the durability and reliability of Groupe Sfpi's products.

- Cost Reduction: Innovations in manufacturing processes, such as automation and advanced robotics, can significantly lower production costs by increasing speed and precision.

- Environmental Benefits: The adoption of eco-friendly materials and lean manufacturing techniques can help Groupe Sfpi meet stricter environmental standards and appeal to a growing market segment focused on sustainability.

Rise of Predictive Maintenance and Remote Monitoring

The industrial sector is increasingly adopting predictive maintenance and remote monitoring, transforming how equipment is managed. This shift allows for proactive issue identification, minimizing unexpected downtime and enhancing operational efficiency.

Groupe Sfpi can capitalize on this trend by integrating these advanced technologies into its service offerings. By providing clients with enhanced equipment uptime and reduced operational expenditures, the company can create significant value and strengthen its competitive position.

For instance, the global predictive maintenance market was valued at approximately $6.9 billion in 2023 and is projected to reach over $20 billion by 2030, indicating substantial growth potential. This surge is driven by the increasing complexity of industrial machinery and the demand for optimized performance.

- Increased Uptime: Predictive maintenance, by forecasting potential failures, can boost equipment availability by up to 25%.

- Reduced Costs: Proactive repairs are typically 10-40% cheaper than reactive repairs, leading to significant operational savings.

- Enhanced Safety: Identifying and addressing potential equipment malfunctions before they occur can prevent hazardous situations.

- Data-Driven Insights: Remote monitoring provides real-time data, enabling better decision-making and continuous improvement strategies.

Technological advancements in AI, IoT, and predictive maintenance offer significant opportunities for Groupe Sfpi to enhance its security and automation solutions. These technologies are driving demand for integrated systems, with the global AI market projected to exceed $200 billion in 2024, directly impacting smart building and industrial automation sectors.

Groupe Sfpi's focus on integrating these technologies allows for more sophisticated access control and optimized building management, with AI-powered analytics improving efficiency and reducing costs. The company must also address the growing cybersecurity risks associated with interconnected Operational Technology (OT) systems, as evidenced by a reported 70% increase in OT attacks in 2023.

Innovations in materials science and additive manufacturing can lead to more robust and cost-effective products for Groupe Sfpi, while also supporting sustainability goals. The adoption of predictive maintenance, a market valued at $6.9 billion in 2023, presents a key growth area, promising increased equipment uptime and reduced operational expenditures for clients.

Groupe Sfpi's strategic integration of advanced technologies like AI and IoT is crucial for developing next-generation security and automation solutions. The company is well-positioned to capitalize on the growing demand for unified building management systems, which are becoming increasingly vital for operational efficiency and security.

Legal factors

Strict data privacy regulations, like the General Data Protection Regulation (GDPR) in Europe, profoundly influence how Groupe Sfpi designs and implements its access control and surveillance systems. Compliance is paramount, requiring careful consideration of personal data collection, storage, and processing.

For instance, GDPR mandates explicit consent for data processing and grants individuals rights over their data. Failure to comply can result in substantial fines; in 2023, GDPR fines reached over €1.5 billion globally, underscoring the financial risk for non-adherence.

Groupe Sfpi's operations in industrial equipment and building components necessitate strict adherence to product liability laws and evolving safety standards across its diverse markets. Failure to comply can lead to significant financial penalties and reputational damage.

For instance, in 2024, the European Union continued to emphasize product safety directives, impacting how components are designed and manufactured. Groupe Sfpi must ensure its products meet these rigorous requirements, which can involve extensive testing and certification processes.

The company's commitment to safety is crucial for mitigating risks associated with potential product defects. In 2025, we anticipate continued regulatory scrutiny, particularly in areas like fire safety for building materials and operational safety for industrial machinery, directly influencing Groupe Sfpi's product development and market access.

Groupe Sfpi's manufacturing operations are increasingly shaped by evolving environmental regulations. These include stricter mandates on carbon emissions, waste management practices, and energy efficiency targets, directly influencing operational costs and investment decisions. For example, the EU's Fit for 55 package aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a benchmark that will necessitate significant adjustments for industrial players.

New EU directives, such as the Corporate Sustainability Reporting Directive (CSRD) and the upcoming Corporate Sustainability Due Diligence Directive (CS3D), place substantial obligations on companies like Groupe Sfpi. The CSRD, fully applicable from January 2024 for many large companies, mandates detailed environmental, social, and governance (ESG) reporting, requiring comprehensive data disclosure and assurance. The CS3D, expected to come into force in 2024 or 2025, will extend due diligence requirements across supply chains, meaning Groupe Sfpi must actively monitor and address environmental risks within its entire value chain.

Intellectual Property Rights and Patents

Protecting its innovative security and automation solutions through intellectual property rights, including patents and trademarks, is a cornerstone for Groupe Sfpi. These legal safeguards are vital for maintaining its competitive advantage in the market.

The robust legal frameworks that support intellectual property rights allow Groupe Sfpi to deter unauthorized replication of its proprietary technologies, ensuring its market position remains strong. For instance, in 2023, the company continued to invest in R&D, a significant portion of which is dedicated to securing new patents for its advanced systems.

- Patent Filings: Groupe Sfpi actively pursues patent protection for its cutting-edge security and automation technologies.

- Trademark Protection: Brand names and logos are legally protected to prevent counterfeiting and brand dilution.

- Competitive Edge: IP rights are instrumental in maintaining Groupe Sfpi's differentiation and market leadership.

- Enforcement: Legal recourse is available to address any infringement of its intellectual property.

Labor Laws and Employment Regulations

Groupe Sfpi's operations are significantly shaped by a patchwork of labor laws and employment regulations across its international footprint. These variations directly influence its human resource strategies, affecting hiring practices, compensation structures, and the overall cost of labor. For instance, differing regulations on working hours and benefits can create complexities in managing a global workforce and ensuring fair compensation.

Navigating these diverse legal landscapes is crucial for maintaining operational stability and mitigating risks. Compliance with specific mandates, such as those concerning workplace safety standards or the evolving regulations around remote work arrangements, requires constant vigilance and adaptation. Failure to adhere to these laws can lead to penalties, operational disruptions, and reputational damage.

Key areas of labor law that impact Groupe Sfpi include:

- Minimum Wage and Overtime Rules: Adherence to varying minimum wage requirements and overtime pay regulations across different operating countries.

- Worker Safety and Health Standards: Ensuring compliance with occupational safety and health regulations to prevent accidents and maintain a secure work environment.

- Termination and Severance Packages: Understanding and implementing country-specific laws regarding employee termination, notice periods, and severance pay.

- Collective Bargaining and Union Relations: Managing relationships with labor unions and adhering to collective bargaining agreements where applicable.

Groupe Sfpi must navigate a complex web of international and national laws governing data privacy, product safety, and intellectual property. Compliance with regulations like GDPR, which saw global fines exceeding €1.5 billion in 2023, is critical for its security and automation solutions. Furthermore, adherence to evolving product safety standards, as emphasized by the EU in 2024 for building components and industrial machinery, directly impacts design and manufacturing processes.

The company's commitment to intellectual property protection through patents and trademarks is vital for its competitive edge, with ongoing R&D investments in 2023 aimed at securing new patents. Labor laws and employment regulations across its global operations also necessitate careful management of hiring, compensation, and workplace safety, with constant adaptation required for evolving rules like those concerning remote work.

| Legal Area | Key Considerations for Groupe Sfpi | Recent/Upcoming Developments | Impact Example |

|---|---|---|---|

| Data Privacy | GDPR compliance for access control and surveillance systems | Global GDPR fines exceeded €1.5 billion in 2023 | Requires explicit consent and data rights management |

| Product Safety | Adherence to evolving safety standards for industrial equipment and building components | EU emphasizing product safety directives in 2024 | Mandates rigorous testing and certification |

| Intellectual Property | Protection of security and automation technologies via patents and trademarks | Continued R&D investment in 2023 for patent acquisition | Deters unauthorized replication and maintains market leadership |

| Labor Law | Compliance with diverse international employment regulations | Evolving rules on remote work and workplace safety | Influences HR strategies, compensation, and operational stability |

Environmental factors

The increasing global focus on sustainability is significantly boosting the market for energy-efficient building solutions. This trend directly benefits Groupe Sfpi, whose advanced HVAC systems and smart lighting controls help buildings reduce their energy consumption and carbon footprint. For instance, the global smart buildings market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2028, indicating substantial growth opportunities for companies like Groupe Sfpi.

Groupe Sfpi faces increasing regulatory pressure globally to curb carbon emissions and minimize its environmental footprint. This directly impacts its manufacturing operations and the very design of its products, pushing for more sustainable practices.

To comply, the company must adapt its operational strategies and supply chain, likely necessitating investments in cleaner production technologies and eco-friendly materials. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), phased in during 2023 and fully operational by 2026, will impose costs on carbon-intensive imports, incentivizing greener manufacturing across industries like those Sfpi serves.

Growing concerns over resource scarcity are driving a global push towards circular economy models, emphasizing product durability, repairability, and efficient recycling. For Groupe Sfpi, this means a strategic imperative to embed these principles throughout its operations, from initial product design to responsible end-of-life management, aligning with evolving market expectations and regulatory landscapes.

The European Union’s Green Deal, for instance, aims to significantly reduce waste and promote sustainable resource use, with targets for recycling and the reduction of landfill waste. By 2030, the EU plans to halve the amount of municipal waste generated per capita compared to 2020 levels, a trend that will increasingly influence supply chains and product lifecycles for companies like Groupe Sfpi.

Climate Change Risks to Infrastructure

Climate change presents significant physical risks to infrastructure globally. Extreme weather events, like intensified storms and heatwaves, can disrupt supply chains and damage critical assets. For instance, the World Economic Forum's 2024 Global Risks Report highlights extreme weather events as the most likely risk to materialize in the next two years, impacting transportation networks and energy grids.

Groupe Sfpi's expertise in building resilience and security becomes increasingly crucial in this evolving landscape. Their solutions, focused on protecting buildings and industrial sites from physical threats, are directly applicable to mitigating the impacts of climate change. This positions them to offer essential services for adaptation and long-term infrastructure stability.

- Increased demand for climate-resilient infrastructure solutions

- Potential for supply chain disruptions due to extreme weather

- Groupe Sfpi's role in enhancing building security and adaptability

Corporate Social Responsibility (CSR) Expectations

Growing expectations from stakeholders regarding Corporate Social Responsibility (CSR) are increasingly pushing companies like Groupe Sfpi to demonstrate their commitment to environmental stewardship. This trend is particularly evident in the 2024-2025 period, where investors and consumers are scrutinizing corporate environmental impact more closely than ever.

Groupe Sfpi's proactive approach to environmental performance, including transparent reporting on its initiatives, directly influences its brand image. A strong CSR profile enhances its attractiveness to both investors seeking sustainable portfolios and customers who prioritize eco-conscious brands. For instance, companies with robust ESG (Environmental, Social, and Governance) ratings often see improved access to capital and a more loyal customer base.

- Stakeholder Pressure: Increased demand from investors, employees, and the public for demonstrable environmental action.

- Brand Reputation: Positive environmental performance directly bolsters brand image, fostering trust and loyalty.

- Investor Attractiveness: Growing emphasis on ESG criteria means companies with strong environmental commitments are more appealing to a wider pool of investors.

- Regulatory Landscape: Anticipation of stricter environmental regulations in 2024-2025 further incentivizes proactive CSR efforts.

The increasing global focus on sustainability is significantly boosting the market for energy-efficient building solutions, directly benefiting Groupe Sfpi's HVAC and smart lighting offerings. The global smart buildings market, valued at approximately $80 billion in 2023, is projected to exceed $200 billion by 2028, highlighting substantial growth potential.

Groupe Sfpi faces mounting regulatory pressure worldwide to reduce carbon emissions, impacting its manufacturing and product design. The EU's Carbon Border Adjustment Mechanism, fully operational by 2026, will add costs for carbon-intensive imports, encouraging greener production methods.

Resource scarcity concerns are driving a shift towards circular economy models. Groupe Sfpi must integrate durability, repairability, and recycling into its operations, aligning with market expectations and regulations like the EU Green Deal, which aims to halve municipal waste per capita by 2030.

Climate change poses physical risks, with extreme weather events disrupting supply chains and infrastructure. The World Economic Forum's 2024 Global Risks Report identifies extreme weather as a top near-term risk, underscoring the importance of Groupe Sfpi's resilience and security solutions for infrastructure adaptation.

| Environmental Factor | Impact on Groupe Sfpi | Supporting Data/Trend (2024-2025 Focus) |

|---|---|---|

| Sustainability & Energy Efficiency | Increased demand for energy-efficient building solutions. | Global smart buildings market projected to grow from ~$80B (2023) to over $200B by 2028. |

| Climate Change & Extreme Weather | Need for climate-resilient infrastructure and potential supply chain disruptions. | World Economic Forum 2024 report highlights extreme weather as a top near-term risk. |

| Circular Economy & Resource Scarcity | Imperative to embed durability, repairability, and recycling in products and operations. | EU Green Deal targets for waste reduction and sustainable resource use by 2030. |

| Regulatory Compliance (Emissions) | Pressure to adapt manufacturing and product design for lower carbon footprint. | EU's Carbon Border Adjustment Mechanism (CBAM) phasing in, impacting imports based on carbon intensity. |

| Stakeholder Expectations (CSR) | Growing demand for demonstrable environmental action, impacting brand image and investor appeal. | Increased scrutiny of ESG performance by investors and consumers in the 2024-2025 period. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Groupe SFPI is meticulously constructed using data from reputable financial news outlets, official company reports, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the group.