Groupe Sfpi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

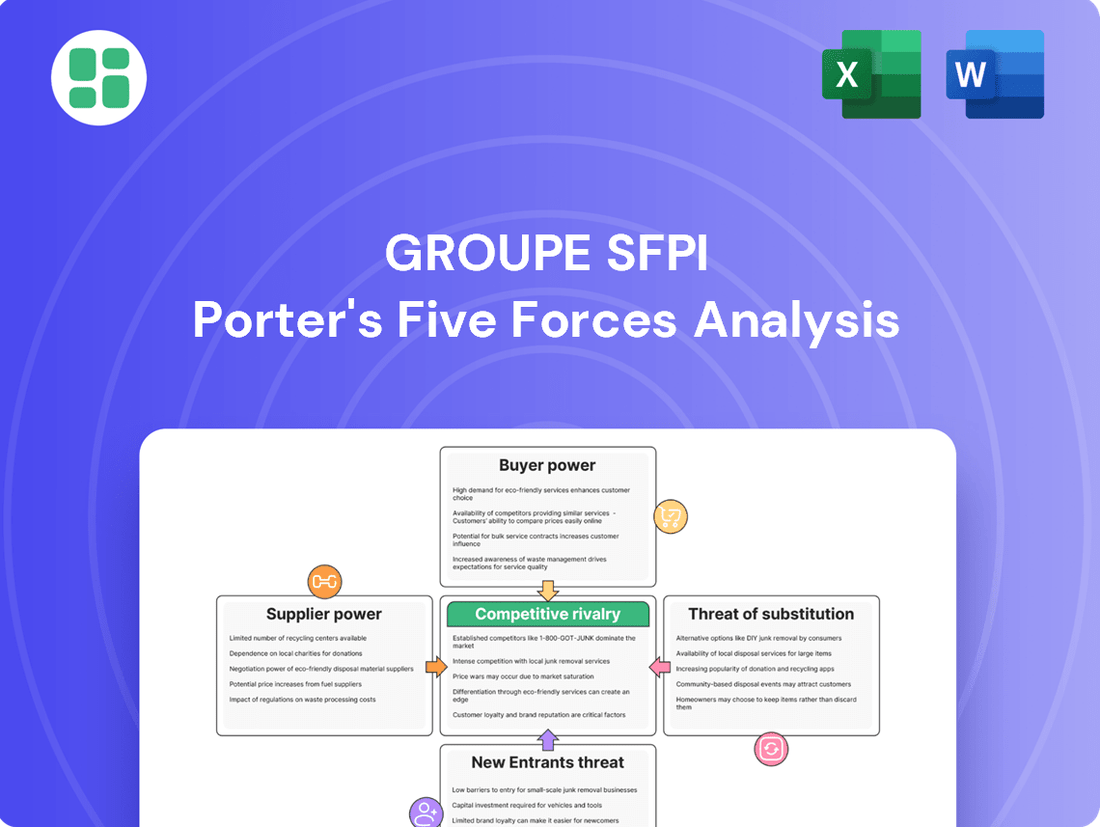

Groupe Sfpi operates within a landscape shaped by moderate buyer power and intense rivalry, but what about the looming threat of substitutes and the influence of suppliers? Our analysis delves into these critical forces, revealing the true competitive pressures Groupe Sfpi faces.

The complete report reveals the real forces shaping Groupe Sfpi ’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Groupe SFPI's dedication to engineered solutions within the industrial and building sectors means it often depends on specialized components, advanced materials, and unique technologies. When these inputs are proprietary or have limited availability, suppliers gain considerable leverage over pricing and delivery conditions. For instance, in 2024, the automotive supply chain experienced significant disruptions due to shortages of semiconductors, a critical specialized component, highlighting how such dependencies can empower suppliers.

Supplier concentration significantly impacts the bargaining power of suppliers for Groupe SFPI. If SFPI relies on a small number of vendors for critical, specialized components, these suppliers gain considerable leverage. For instance, if SFPI's advanced manufacturing processes depend on unique, high-tech parts only available from one or two manufacturers, those suppliers can dictate terms.

This dependence makes SFPI vulnerable. A lack of readily available substitutes for essential inputs means SFPI has limited options if suppliers decide to raise prices or impose less favorable contract conditions. This directly affects SFPI's production costs and, consequently, its profit margins, as seen in industries where specialized semiconductor or advanced material sourcing is concentrated.

The complexity of integrating engineered solutions for Groupe SFPI means switching suppliers for specialized inputs can incur substantial costs. These costs can include re-tooling production lines, obtaining new certifications, or even redesigning components, all of which impact operational efficiency and project timelines.

For Groupe SFPI, high switching costs for critical inputs significantly strengthen the bargaining power of its existing suppliers. This is particularly true for long-term contracts or when dealing with established product lines where supplier relationships are deeply embedded in the manufacturing process. For instance, in 2024, a significant portion of SFPI's revenue was derived from sectors with highly specialized, custom-engineered components, making supplier dependency a key consideration.

Forward Integration Threat

The threat of suppliers forward integrating into manufacturing finished systems, while less common for component providers, could significantly bolster their bargaining power against Groupe SFPI. Imagine a key supplier of specialized electronic components deciding to develop and market their own access control systems. This move would transform them from a component provider into a direct competitor.

Such a scenario would grant the supplier increased leverage by allowing them to capture a larger portion of the value chain. For instance, if a critical sensor manufacturer, which supplied SFPI Group in 2024, were to launch its own integrated security solutions, it could directly challenge SFPI's market position. This competitive pressure would inevitably give the former supplier more influence in pricing and contract negotiations.

- Increased Competition: A forward-integrating supplier directly enters SFPI's market, creating a new competitive threat.

- Value Chain Capture: Suppliers gain the ability to capture profits from both component manufacturing and finished system sales.

- Supplier Leverage: Enhanced market presence allows suppliers to dictate terms more effectively to companies like SFPI.

Input Differentiation

Suppliers who provide highly specialized or unique inputs, like patented technologies or proprietary materials, wield considerable bargaining power. Groupe Sfpi, as a user of these differentiated inputs, may find itself in a position where it must agree to higher prices if its product performance or competitive edge relies heavily on these specific supplier offerings.

For instance, if a key component for one of Groupe Sfpi's advanced manufacturing solutions is only available from a single supplier with a unique, patented process, that supplier's bargaining power is significantly amplified. This situation can directly impact Groupe Sfpi's cost structure and profitability.

- Supplier Differentiation: Suppliers offering patented technologies or unique materials possess higher bargaining power.

- Impact on SFPI: Groupe Sfpi may face higher input costs if its products depend on these specialized offerings.

- Competitive Advantage: Reliance on differentiated inputs can be a double-edged sword, potentially boosting product performance but also increasing supplier leverage.

Groupe SFPI's reliance on specialized components, especially those with limited suppliers or proprietary technology, significantly amplifies supplier bargaining power. This is particularly evident in 2024, where disruptions in the automotive sector due to semiconductor shortages underscored how critical input dependencies can empower suppliers to dictate terms and pricing.

When SFPI depends on a concentrated supplier base for essential, unique parts, these vendors gain considerable leverage. The cost and complexity of switching suppliers, often involving re-tooling and new certifications, further entrench this power, directly impacting SFPI's production costs and profit margins.

The potential for suppliers to forward integrate into manufacturing finished systems, thereby becoming direct competitors, also strengthens their hand. This move allows them to capture more of the value chain and exert greater influence over companies like SFPI, as seen with critical sensor manufacturers in 2024 launching their own integrated solutions.

| Factor | Impact on SFPI | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | Reliance on single-source advanced material providers |

| Input Differentiation | Increased dependence on unique/patented tech | Key component for security systems only from one vendor |

| Switching Costs | High costs to change suppliers | Re-tooling for specialized electronic components |

| Forward Integration Threat | Suppliers become competitors | Component manufacturer launching own integrated solutions |

What is included in the product

This analysis of Groupe Sfpi's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and address competitive threats by visualizing the intensity of each Porter's Five Force on a dynamic heat map.

Customers Bargaining Power

Groupe SFPI's diverse customer base, encompassing large corporations, construction firms, and potentially smaller businesses across industrial and building sectors, generally fragments customer power. This broad reach means no single customer typically holds substantial sway over SFPI's revenue.

However, the bargaining power of customers can increase if a significant portion of SFPI's business is concentrated in a single, vulnerable industry. For instance, a downturn in the construction sector, which accounted for a considerable share of building materials demand in 2024, could empower remaining construction clients to negotiate more aggressively.

During economic downturns, like the contraction seen in the construction sector in 2024, customers naturally become more price-sensitive. This means they actively seek out more competitive bids and are less willing to pay premium prices, especially for products that are easily substituted.

This heightened price sensitivity directly increases the bargaining power of customers. They can leverage this to demand lower prices or more favorable payment terms, particularly when dealing with standardized offerings where distinguishing features are minimal.

For Groupe SFPI, maintaining its gross margin in such an environment, as indicated by its financial performance in 2024, suggests a strong focus on cost control and operational efficiency to offset customer pricing pressures.

Customers for safety, security, and automation solutions often have a variety of vendors to choose from, offering comparable components and integrated systems. This abundance of alternatives significantly amplifies their bargaining power.

The ease with which customers can switch suppliers or find substitutes directly impacts SFPI Group's ability to dictate terms, pushing the company to maintain competitive pricing and innovative features. For instance, in 2024, the global market for building automation systems was projected to reach over $100 billion, indicating a highly competitive landscape with numerous players.

Customer's Purchase Volume

The bargaining power of customers is a significant factor for SFPI Group, particularly concerning their purchase volume. Large industrial clients and major construction firms often procure substantial quantities of SFPI's offerings, including access control systems and ventilation equipment. This scale of purchase inherently grants these buyers considerable leverage.

These high-volume purchasers can effectively negotiate for lower prices, tailored product specifications, or more advantageous payment and delivery terms. For instance, a large construction project requiring thousands of access control units could demand a volume discount, directly impacting SFPI's profit margins on that specific contract. In 2023, SFPI Group reported revenue of €2.1 billion, with a substantial portion likely stemming from such large-scale client orders, highlighting the financial impact of customer purchasing volume.

- High-Volume Buyers: Major clients in construction and industry purchase significant quantities of SFPI's products.

- Negotiating Leverage: Large orders allow customers to demand discounts and favorable contract terms.

- Profit Margin Impact: These negotiations can directly affect SFPI's profitability on individual deals.

- 2023 Revenue Context: SFPI's €2.1 billion revenue in 2023 underscores the importance of managing relationships with high-volume customers.

Information Availability and Product Standardization

When SFPI Group offers products like standard locks or basic industrial equipment, customers can easily shop around. If these items are seen as interchangeable, buyers can compare prices and features from different companies. This makes it harder for SFPI to stand out based on unique benefits.

The ready availability of market information and the standardization of products significantly boost customer bargaining power. This forces SFPI Group into a position where they must compete mainly on price, rather than on the strength of their unique value propositions. For example, in the European industrial hardware market, price sensitivity among buyers for non-specialized components can be as high as 30% in some segments, according to 2024 industry reports.

- Information Availability: Customers can readily access pricing and feature comparisons for standardized SFPI products.

- Product Standardization: When products are similar across providers, differentiation becomes difficult.

- Price Competition: This environment pressures SFPI to compete primarily on cost, impacting margins.

- Reduced Value Proposition: The ability to switch suppliers easily diminishes the leverage of SFPI's unique offerings.

Groupe SFPI's customers, particularly those in large-scale industrial and construction sectors, wield significant bargaining power due to their substantial purchase volumes. This leverage allows them to negotiate favorable pricing and contract terms, directly influencing SFPI's profit margins, as seen with their €2.1 billion revenue in 2023. The availability of substitute products and readily accessible market information further amplifies this power, compelling SFPI to focus on competitive pricing and operational efficiency to maintain its market position.

| Customer Factor | Impact on SFPI | Example/Data Point |

|---|---|---|

| Purchase Volume | Increased negotiation leverage | Large construction projects requiring thousands of access control units |

| Product Standardization | Pressure for price competition | European industrial hardware market price sensitivity up to 30% in 2024 |

| Availability of Substitutes | Reduced ability to dictate terms | Global building automation market exceeding $100 billion in 2024, with numerous players |

| Economic Sensitivity | Demand for lower prices/better terms | Construction sector contraction in 2024 impacting customer price sensitivity |

Preview Before You Purchase

Groupe Sfpi Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Groupe Sfpi, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This comprehensive analysis provides actionable insights into the strategic positioning of Groupe Sfpi within its industry landscape.

Rivalry Among Competitors

The engineered solutions market for industrial and building sectors, encompassing safety, security, and automation, is characterized by a diverse array of competitors. This landscape includes large, established multinational corporations as well as smaller, highly specialized regional firms, all vying for market presence.

The sheer number of these players, particularly those with resources and scale comparable to SFPI Group, significantly amplifies competitive rivalry. This intensity stems from their shared pursuit of market share, driving aggressive strategies and a constant need for innovation.

For instance, in 2024, the global industrial automation market was estimated to reach over $200 billion, showcasing a vast and highly competitive arena where SFPI Group operates. This substantial market size naturally attracts a multitude of participants, from giants like Siemens and Rockwell Automation to niche providers.

Groupe SFPI's diverse operations, including its MAC division, felt the pinch of a contracting European construction sector in 2024. This slowdown resulted in a modest dip in the group's overall sales figures.

In markets experiencing sluggish or negative growth, the competitive landscape intensifies. Companies often engage in price wars and ramp up marketing efforts to secure a larger share of a diminishing market, impacting profitability and market share for all players.

Groupe SFPI's competitive rivalry is shaped by its product differentiation strategy. By offering a broad spectrum of components, systems, and services, the company strives to provide integrated solutions, thereby setting itself apart from competitors. This focus on comprehensive offerings aims to reduce direct price-based competition.

The degree to which SFPI differentiates its products through innovation, advanced technology, or superior service quality directly impacts the intensity of rivalry. In 2023, SFPI reported a revenue of €532.6 million, showcasing its market presence, and its ongoing digitalization initiatives underscore a commitment to continuous innovation as a means to maintain a competitive edge.

Exit Barriers

Groupe SFPI operates in an environment where high exit barriers can prolong competitive rivalry. These barriers, such as specialized machinery or long-term commitments, can trap even underperforming companies in the market. This persistence by struggling firms, perhaps due to significant investments in unique assets or substantial employee severance packages, can lead to sustained, intensified competition. For instance, in industries with high capital intensity, like manufacturing, the inability to easily divest specialized equipment can force companies to continue operating at suboptimal levels, potentially engaging in aggressive pricing to maintain cash flow.

These entrenched competitors, unable to exit gracefully, may resort to tactics that directly pressure Groupe SFPI's profitability. This could involve price wars or increased promotional spending to capture market share, even if it means operating at lower margins. Such actions are a direct consequence of their inability to exit, forcing them to fight for survival within the existing market structure. The financial strain on these firms can translate into a more aggressive competitive stance.

- High Exit Barriers: Specialized assets, long-term contracts, and significant severance costs can trap firms in the market.

- Sustained Rivalry: Underperforming competitors remain active, potentially engaging in aggressive pricing.

- Margin Pressure: SFPI Group faces reduced profitability due to the survival tactics of entrenched rivals.

Strategic Objectives and Aggressiveness of Competitors

The competitive rivalry within the industrial services sector, where Groupe SFPI operates, is significantly influenced by the strategic objectives of its rivals. Companies often pursue market leadership through aggressive expansion, which can involve increased investment in new technologies or geographical reach. For instance, many players in the sector are focusing on sustainability initiatives and digital transformation, requiring substantial capital allocation. This drive for market share can lead to intensified competition on pricing and service offerings.

Competitors' aggressiveness in areas like mergers and acquisitions (M&A) directly impacts SFPI. SFPI's own acquisition of Wo&Wo in 2024, for example, signals a strategic move to consolidate its market position and expand its service portfolio. This type of activity from rivals, such as acquiring complementary businesses or technology, forces other companies, including SFPI, to constantly re-evaluate their strategies. The pace of M&A in the industrial services sector in 2024 saw several key consolidations, indicating a high level of strategic maneuvering among major players.

- Market Leadership Ambitions: Competitors are actively seeking to gain or maintain market leadership through innovation and service expansion, driving up competitive intensity.

- Aggressive Growth Strategies: Many rivals are employing aggressive growth tactics, including significant capital expenditure on new facilities and digital infrastructure.

- M&A Activity: The sector experienced notable M&A in 2024, with companies like SFPI making strategic acquisitions, prompting similar responses from competitors to bolster their capabilities.

- Pricing and Service Competition: To capture market share, competitors are engaging in competitive pricing and enhancing their service delivery models, putting pressure on SFPI to remain agile.

Groupe SFPI faces intense competition from a broad spectrum of players, from large multinationals to specialized regional firms, all vying for market share in the engineered solutions market. This rivalry is amplified by the sheer number of competitors and their comparable resources, leading to aggressive strategies and a constant need for innovation. In 2024, the global industrial automation market, a key area for SFPI, was valued at over $200 billion, highlighting the vast and highly competitive arena.

SFPI's strategy of offering integrated solutions through product differentiation aims to mitigate direct price competition. However, the intensity of rivalry is directly tied to its success in innovation, technology, and service quality. With 2023 revenues of €532.6 million, SFPI's commitment to digitalization signals its ongoing efforts to maintain a competitive edge.

High exit barriers in SFPI's operating sectors, such as specialized machinery and long-term commitments, can prolong competitive rivalry. Underperforming companies, unable to exit gracefully due to significant investments, may persist in the market and engage in aggressive pricing tactics to survive, directly impacting SFPI's profitability.

Competitors' strategic objectives, including aggressive expansion and M&A activity, significantly shape the competitive landscape for SFPI. The sector saw notable consolidations in 2024, with SFPI's own acquisition of Wo&Wo reflecting a broader trend of strategic maneuvering to enhance capabilities and market position.

| Key Competitor Metric | SFPI Group Performance (2023) | Market Context (2024) |

| Revenue | €532.6 million | Global industrial automation market > $200 billion |

| Strategic Focus | Product differentiation, digitalization | Sustainability, digital transformation, M&A |

| Competitive Intensity Drivers | Number of players, innovation, service quality | Market growth rates, exit barriers, competitor M&A |

SSubstitutes Threaten

For SFPI Group's security division, DOM Security, the threat of substitutes is significant. These substitutes aren't just other physical security products, but also non-physical solutions. Think about advanced cybersecurity systems that can significantly reduce the need for traditional physical access controls, or entirely different approaches to risk management that bypass the need for locks and barriers.

The rapid evolution of technology means new methods for detecting and preventing threats are constantly emerging. For instance, biometric authentication or AI-powered surveillance systems could diminish the demand for conventional locking mechanisms and access control hardware that DOM Security specializes in. In 2023, the global cybersecurity market was valued at over $200 billion, highlighting the substantial investment and growth in these alternative solutions.

In the building sector, particularly for items like windows and shutters, there's a noticeable threat from DIY and generic solutions. Customers can easily find less expensive, off-the-shelf alternatives or even choose to install them themselves.

The increasing accessibility of these substitutes through online marketplaces and large DIY stores puts pressure on SFPI Group. If SFPI’s offerings aren't clearly superior in quality or supported by a strong service package, their market position could be weakened. For instance, the global DIY market was valued at approximately $900 billion in 2023, with significant growth projected, highlighting the scale of this alternative.

Companies might bypass the need for Groupe Sfpi's automated industrial equipment by adopting manual labor or redesigning their operational workflows. This strategy aims to boost efficiency without the substantial upfront investment in new machinery, a common tactic observed across various manufacturing sectors in 2024 as businesses focused on cost optimization.

For air treatment or specific industrial processes, alternative solutions could emerge from modifying existing operational practices or utilizing less complex, standalone systems. These substitutes might not offer the same level of integration or optimization as Sfpi's offerings but can still deliver comparable results at a lower cost, a trend particularly evident in small to medium-sized enterprises seeking functional rather than cutting-edge solutions.

Technological Advancements and Disruptions

Technological advancements present a significant threat of substitutes for Groupe SFPI. Innovations in areas such as the Internet of Things (IoT) and artificial intelligence (AI) can create entirely new solutions for safety, security, and automation. For instance, the rise of drone surveillance could offer a compelling alternative to traditional fixed security systems, potentially impacting SFPI's existing offerings.

Furthermore, emerging material sciences might introduce novel methods for air treatment, such as bio-filtration, which could substitute current technologies. If SFPI Group does not proactively adapt to or integrate these disruptive innovations, its established product lines could face considerable pressure. For example, a 2024 report indicated that investments in AI-powered security solutions grew by an estimated 18% year-over-year, highlighting the rapid pace of change.

- Emerging Technologies: IoT and AI are creating new paradigms for safety and security.

- Disruptive Alternatives: Drone surveillance and bio-filtration are examples of substitutes that could challenge SFPI's core business.

- Adaptation Imperative: Failure to integrate or innovate in response to these technological shifts poses a risk to SFPI's market position.

- Market Trends: The security sector saw an 18% increase in AI investment in 2024, signaling a strong shift towards technological integration.

Cross-Industry Substitutes

The threat of cross-industry substitutes for Groupe SFPI's offerings is a significant consideration. For example, in the realm of building energy efficiency, innovative insulation materials or advanced smart grid technologies could potentially fulfill some of the needs currently met by SFPI's climate control systems or window solutions. This could lead to a diversion of customer spending away from SFPI's core products.

Consider the building sector's energy efficiency market, which was valued at approximately $270 billion globally in 2023 and is projected to grow. While SFPI provides integrated solutions, advancements in passive building design and high-performance materials could offer alternative pathways to achieving energy savings, thereby impacting the demand for active systems.

- Alternative Energy Efficiency Solutions: Innovations in insulation, passive design, and smart home technology can reduce reliance on active climate control systems.

- Material Science Advancements: Development of new, highly efficient building materials could substitute for traditional window and facade components.

- Digitalization of Building Management: Software-driven energy management platforms may offer alternative ways to optimize building performance without extensive hardware upgrades.

The threat of substitutes for Groupe SFPI is multifaceted, encompassing both technological advancements and simpler, less integrated alternatives. For its security division, DOM Security, cybersecurity solutions and biometric access controls represent significant substitutes. In the building sector, DIY products and generic alternatives pressure offerings like windows and shutters, especially given the global DIY market's approximate $900 billion valuation in 2023.

For industrial equipment, manual labor or workflow redesigns can bypass the need for SFPI's machinery, a trend amplified in 2024 by cost-optimization efforts. Similarly, air treatment and process solutions face substitutes from modified practices or less complex standalone systems, particularly appealing to SMEs seeking functional, lower-cost options.

Technological shifts like IoT and AI are generating disruptive substitutes, such as drone surveillance for security and bio-filtration for air treatment. The 18% year-over-year growth in AI security solutions in 2024 underscores this rapid innovation.

Cross-industry substitutes also pose a threat, particularly in building energy efficiency. Advanced insulation, passive design, and smart grid technologies could reduce demand for SFPI's climate control and window systems, impacting a market valued at roughly $270 billion globally in 2023.

| Category | Groupe SFPI Offering Example | Key Substitutes | Market Context/Data Point |

|---|---|---|---|

| Security | Physical Access Control Systems | Cybersecurity, Biometrics, AI Surveillance | Global cybersecurity market > $200 billion (2023) |

| Building Components | Windows, Shutters | DIY Products, Generic Alternatives | Global DIY market ~$900 billion (2023) |

| Industrial Automation | Automated Machinery | Manual Labor, Workflow Redesign | Cost optimization focus in 2024 |

| Building Energy Efficiency | Climate Control Systems | Advanced Insulation, Passive Design, Smart Grids | Global energy efficiency market ~$270 billion (2023) |

Entrants Threaten

Entering the engineered solutions market, especially for industrial equipment and automation, demands significant upfront capital. This includes hefty investments in research and development, state-of-the-art manufacturing plants, and robust distribution channels. For instance, establishing a new automation solutions provider in 2024 could easily require tens of millions of dollars just to get production lines operational and secure initial market access.

Groupe SFPI's existing, well-developed infrastructure across its various divisions like DOM Security, MAC, MMD, and NEU-JKF acts as a formidable barrier. This established presence, built over years, makes it incredibly difficult and costly for new, smaller competitors to match the scale and reach SFPI already commands, effectively deterring many potential entrants.

Groupe SFPI, a significant player with a turnover hovering around €660-670 million and a workforce of 4,000, leverages substantial economies of scale. This scale translates into cost advantages in production, raw material procurement, and research and development, making it challenging for new entrants to achieve comparable efficiency.

New competitors would face considerable hurdles in matching SFPI's cost structure. Without the benefit of established scale, they would likely struggle to compete on price, particularly in a market environment potentially affected by economic slowdowns, which could lead to significant initial losses for any new market participant.

Groupe SFPI, established in 1985, benefits from deep-rooted customer relationships across industrial and building sectors. This history fosters significant brand loyalty, especially in high-stakes areas like safety and security, where clients prioritize proven reliability.

New entrants face a substantial hurdle in overcoming SFPI's established trust. Customers are often hesitant to switch from suppliers offering dependable, long-standing solutions, making market penetration a challenging endeavor for emerging competitors.

Regulatory and Legal Barriers

The safety, security, and industrial equipment sectors are heavily regulated, presenting a substantial threat of new entrants. SFPI Group, operating within these domains, benefits from established compliance and certifications. For instance, in 2024, the European Union continued to emphasize stringent safety standards for machinery, requiring extensive testing and documentation, which can cost new players millions of euros and years to achieve.

Navigating these complex legal frameworks and obtaining necessary approvals represent significant hurdles. New entrants would face substantial upfront costs and a lengthy process to ensure their products meet rigorous industry standards. This creates a strong barrier, favoring established companies like SFPI Group that have already invested in and mastered these compliance requirements.

- High Compliance Costs: New entrants must budget for extensive testing, certification, and legal review to meet industry-specific regulations, often running into hundreds of thousands or even millions of euros.

- Lengthy Approval Processes: Obtaining certifications and regulatory approvals can take years, delaying market entry and requiring significant resources for project management and lobbying.

- Established Relationships: Incumbents often have pre-existing relationships with regulatory bodies and certification agencies, streamlining their compliance efforts.

- Reputational Risk: Failure to meet stringent standards can result in product recalls, fines, and severe damage to a new entrant's reputation, a risk incumbents have largely mitigated.

Access to Distribution Channels

Groupe SFPI likely benefits from extensive and deeply entrenched distribution channels, a significant barrier for newcomers. These established networks, cultivated over years, provide immediate access to a broad customer base across various product segments.

For instance, in 2024, companies with strong existing distribution agreements often find themselves with a competitive edge, as securing similar partnerships can take considerable time and investment. New entrants would face substantial hurdles in replicating SFPI's reach, potentially needing to invest heavily in building their own sales infrastructure or paying premium rates for access.

Consider the challenge of gaining shelf space in retail environments or securing contracts with key distributors. These are often guarded by incumbents like SFPI, making it difficult for new players to even get their products in front of potential buyers. This access to distribution is a critical component of market penetration.

SFPI's established relationships and logistical capabilities mean that new entrants would struggle to match their speed and efficiency in reaching customers. This disparity in distribution power significantly dampens the threat of new entrants.

The threat of new entrants for Groupe SFPI is significantly mitigated by high capital requirements and established infrastructure. For example, setting up a new industrial automation facility in 2024 could easily cost tens of millions, a sum many potential competitors cannot readily deploy.

Groupe SFPI's substantial economies of scale, with a turnover around €660-670 million in 2023 and 4,000 employees, allow for cost advantages that new entrants would struggle to match, impacting their ability to compete on price.

Furthermore, deeply rooted customer relationships and brand loyalty, particularly in sectors like safety and security, create a significant barrier. New entrants face the challenge of building trust, which takes years and substantial investment, a hurdle SFPI has already overcome.

Stringent regulatory environments, demanding extensive testing and compliance, add another layer of difficulty. In 2024, EU machinery safety standards alone require millions in investment and lengthy approval processes, favoring established players like SFPI.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Groupe SFPI leverages a comprehensive data set including Groupe SFPI's annual reports, investor presentations, and competitor financial filings. We also incorporate industry-specific market research reports and relevant trade publications to capture the competitive landscape.