Groupe Sfpi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

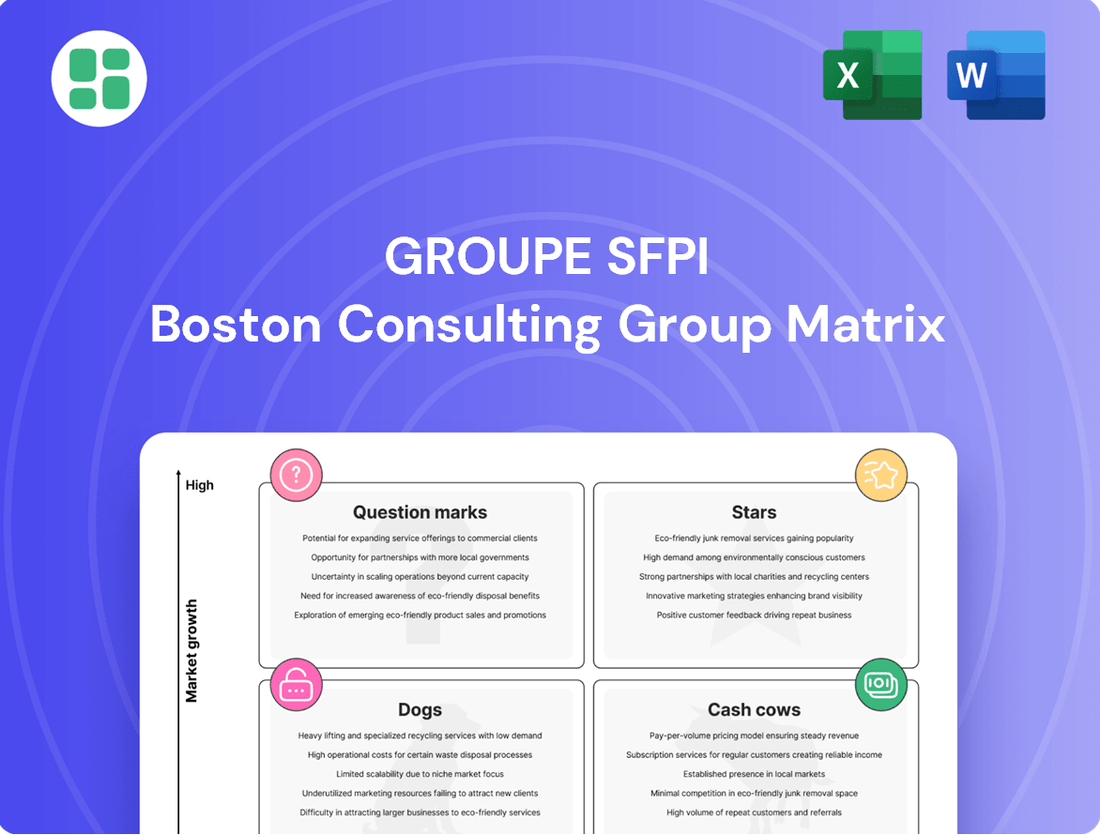

Curious about Groupe Sfpi's strategic positioning? This glimpse into their BCG Matrix highlights key product areas, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimizing their portfolio.

Stars

Integrated Smart Building Solutions, a key offering within Groupe Sfpi, are poised for significant expansion. This segment, encompassing access control, security, and automation, benefits from strong market tailwinds like digitalization and the increasing need for energy-efficient buildings. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, indicating robust growth potential.

Advanced AI-driven security systems represent a significant growth opportunity for Groupe SFPI, positioning them as a potential Star in the BCG matrix. The security market is rapidly adopting AI for enhanced threat detection, facial recognition, and predictive analytics, creating a high-growth niche. SFPI's strategic focus on security allows them to capitalize on this trend, aiming for a substantial market share through innovation.

These sophisticated AI systems necessitate considerable upfront investment in research, development, and market penetration, characteristic of a Star product. However, the promise of substantial future returns and the group's commitment to innovation make this a compelling strategic direction. For instance, the global AI in security market was projected to reach over $30 billion by 2024, highlighting the immense potential.

Groupe SFPI's commitment to cutting-edge industrial automation, particularly for smart factories, places it in a dynamic growth sector. The global industrial automation market is expected to reach over $300 billion by 2025, fueled by AI and IIoT adoption. SFPI's focus on these advanced solutions positions them well within this expanding landscape.

High-Performance Energy-Saving Ventilation Systems

SFPI Group's NEU-JKF division, specializing in high-performance energy-saving ventilation and air treatment systems, is positioned in a market experiencing robust growth driven by global sustainability trends. In 2024, the demand for energy-efficient building solutions continued to surge, with the global ventilation market projected to reach over $38 billion by 2028, growing at a CAGR of approximately 5.5%.

Given the increasing emphasis on reducing energy consumption in industrial and commercial sectors, NEU-JKF's offerings are likely considered Stars within the BCG Matrix. This classification suggests they possess a high market share in a rapidly expanding industry, necessitating ongoing investment to sustain their leadership and capitalize on market momentum.

- Market Growth: The global HVAC (Heating, Ventilation, and Air Conditioning) market, which includes ventilation, is projected for significant expansion.

- Sustainability Driver: Increased regulatory focus and corporate commitments to ESG (Environmental, Social, and Governance) factors fuel demand for energy-efficient systems.

- Competitive Advantage: Superior technology and efficiency in NEU-JKF's products are key to maintaining a leading market share.

- Investment Need: Continued R&D and market penetration efforts are crucial to solidify their Star status.

Specialized Access Control for Critical Infrastructure

The demand for specialized access control for critical infrastructure is a burgeoning market. SFPI Group's DOM Security division, a key player in locking systems, is well-positioned here. This segment is characterized by high security needs and ongoing innovation, fitting the profile of a Star in the BCG matrix.

Critical infrastructure, including data centers and transportation hubs, requires highly secure access solutions. SFPI Group, through its DOM Security brand, offers expertise in these advanced systems. The market for such solutions is expanding, driven by increasing security threats and the sensitive nature of these facilities.

- Market Growth: The global critical infrastructure security market was valued at approximately USD 130 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030.

- SFPI's Position: DOM Security's advanced mechanical and electronic locking systems are integral to providing robust access control for these sensitive environments.

- Innovation Driver: Continuous investment in R&D is crucial to counter evolving cyber and physical security threats, a hallmark of Star products.

- Premium Pricing: The specialized nature and high security requirements of these solutions often allow for premium pricing, contributing to strong revenue potential.

Groupe SFPI's focus on advanced AI-driven security systems positions them as a Star within the BCG matrix. This segment benefits from the rapidly growing AI in security market, which was projected to exceed $30 billion by 2024.

Similarly, SFPI's specialized access control solutions for critical infrastructure, particularly through its DOM Security division, are also Stars. The critical infrastructure security market was valued at approximately USD 130 billion in 2023 and is expected to grow at a CAGR of over 7%.

These segments represent high market share in rapidly expanding industries, demanding significant ongoing investment to maintain leadership and capitalize on growth opportunities.

The NEU-JKF division, offering energy-saving ventilation and air treatment systems, also qualifies as a Star. The global ventilation market is projected to reach over $38 billion by 2028, with SFPI's efficient solutions driving strong demand.

| Business Unit/Product | BCG Matrix Category | Market Growth Rate | SFPI Market Share | Investment Rationale |

|---|---|---|---|---|

| Integrated Smart Building Solutions | Star | High | Growing | Capitalize on digitalization and energy efficiency trends. |

| Advanced AI-driven Security Systems | Star | Very High | Increasing | Leverage AI adoption for enhanced threat detection and analytics. |

| Industrial Automation (Smart Factories) | Star | High | Expanding | Benefit from AI and IIoT integration in manufacturing. |

| NEU-JKF (Ventilation & Air Treatment) | Star | High | Leading | Meet demand for energy-efficient building solutions driven by sustainability. |

| DOM Security (Critical Infrastructure Access Control) | Star | High | Significant | Address growing security needs in sensitive facilities. |

What is included in the product

Strategic insights for Groupe Sfpi's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Groupe Sfpi BCG Matrix offers a visual respite by clarifying complex portfolios, making strategic decisions less daunting.

Cash Cows

Groupe SFPI's DOM Security division, a leader in mechanical and electronic locking, is a prime example of a Cash Cow. Holding a top 3 European spot for safety cylinders, these established products thrive in a mature, albeit low-growth, market. Their significant market share, built on strong brand trust and widespread use, ensures consistent cash generation with minimal promotional spending.

The stable performance of DOM Security, evidenced by a slight sales increase in 2024, highlights its role as a reliable cash generator for the group. This division’s consistent profitability allows SFPI to reinvest in other areas of its portfolio or return capital to shareholders.

Standard industrial ventilation and filtration equipment, exemplified by Groupe SFPI's NEU-JKF division, typically represent established offerings in a mature market. These foundational systems, while perhaps not experiencing rapid growth, benefit from a solid market position and a loyal customer base. This stability translates into predictable revenue streams and healthy profit margins, making them reliable cash generators for the group.

In 2024, the NEU-JKF division demonstrated stable sales performance, reinforcing its status as a cash cow. This consistency underscores the enduring demand for essential ventilation and air treatment solutions in various industrial sectors. The consistent cash flow generated by these products is crucial for funding innovation, strategic acquisitions, or supporting other business units within Groupe SFPI.

Groupe SFPI's MAC division, focused on essential building closure systems like windows and blinds, fits the Cash Cow profile. Despite a challenging 2024 construction market marked by contraction, this segment is characterized by low growth but high volume. SFPI's established presence and extensive product range likely secure a substantial market share, ensuring consistent revenue generation with limited need for reinvestment.

Standard Heat Exchange and Sterilization Solutions (MMD Division)

The MMD division, specializing in heat exchangers and sterilizers, demonstrated robust performance in 2024. Sales saw a notable increase of 8.7%, reflecting sustained demand for these critical industrial components.

While the market for specialized heat exchange and sterilization solutions may not be experiencing explosive growth, it typically enjoys stable demand from established industries. SFPI Group's expertise in this niche likely translates into a significant market share.

This strong market position allows the MMD division to generate consistent and reliable cash flows. Consequently, it requires minimal investment in aggressive marketing or extensive research and development, characteristic of a Cash Cow.

- MMD Division Sales Growth: 8.7% increase in 2024.

- Market Position: Stable demand in specialized industrial sectors.

- Cash Flow Generation: Reliable and consistent due to high market share.

- Investment Needs: Limited need for aggressive marketing or R&D.

Routine Maintenance and Associated Services

Groupe SFPI’s Routine Maintenance and Associated Services function as a classic Cash Cow within its business portfolio. These services, encompassing technical support, spare parts, and upkeep for installed systems, benefit from high customer loyalty and consistent, predictable income. The market for these services is mature and stable, meaning they don't demand substantial new capital outlays for growth.

These offerings are critical for ensuring the sustained performance and extended lifespan of SFPI’s product installations. By providing these essential support functions, the group solidifies its customer relationships and generates a steady flow of cash. This reliable revenue stream is vital for funding other areas of the business, such as research and development or expansion into new markets.

For instance, in 2024, SFPI’s service divisions are projected to contribute a significant portion of the group’s overall revenue, with margins typically exceeding those of their core product sales. This is common in industries where after-sales support is a key differentiator and a revenue stabilizer.

- High Customer Retention: Services often lock in customers, reducing churn.

- Predictable Revenue: Maintenance contracts and recurring support fees create a stable income.

- Low Investment Needs: Unlike product innovation, these services require less capital for expansion.

- Significant Cash Flow Generation: They provide a reliable source of funds for the group.

Groupe SFPI’s MMD division, specializing in heat exchangers and sterilizers, demonstrated robust performance in 2024 with an 8.7% sales increase, highlighting sustained demand for critical industrial components. While this niche market isn't experiencing explosive growth, it enjoys stable demand from established industries, and SFPI's expertise likely translates to a significant market share.

This strong market position allows the MMD division to generate consistent and reliable cash flows, requiring minimal investment in aggressive marketing or extensive research and development, a hallmark of a Cash Cow. The stable demand and SFPI's established presence solidify MMD's role as a dependable cash generator for the group.

| Division | 2024 Sales Growth | Market Characteristics | Cash Cow Attributes |

| MMD | +8.7% | Stable demand, established industries | High market share, consistent cash flow, low investment needs |

| DOM Security | Slight increase | Mature, low-growth market | Top 3 European player, strong brand trust, minimal promotion |

| NEU-JKF | Stable | Mature market, essential solutions | Solid market position, loyal customer base, predictable revenue |

What You See Is What You Get

Groupe Sfpi BCG Matrix

The Groupe Sfpi BCG Matrix preview you're viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered directly to you without any watermarks or demo content, ready for immediate professional application.

Dogs

Obsolete analog security systems, like those potentially held by Groupe SFPI, are firmly in the Dogs quadrant of the BCG Matrix. These systems, characterized by their lack of digital integration and advanced features, are part of a declining market. For instance, the global market for traditional analog CCTV cameras, a core component of such systems, saw a significant decline in shipments throughout the early 2020s, with many manufacturers shifting focus to IP-based solutions.

While Groupe SFPI might retain a small market share for maintenance or highly specialized legacy applications, this segment offers very low growth and demand. Continued investment in these outdated systems would likely result in minimal returns and could be seen as a drain on valuable resources. Strategic options for such products typically involve divestiture or a carefully planned phased discontinuation to optimize resource allocation.

Legacy Manual Industrial Equipment, as part of Groupe SFPI's BCG Matrix, would likely be classified as a Dog. These are products with low market share in a low-growth or declining market, often due to technological advancements making them obsolete. For example, if SFPI still offers older manual lathes, their market share would be minimal compared to CNC machines, and the demand for such equipment is shrinking.

These legacy items, while perhaps still generating some revenue from replacement parts or niche users, are likely resource-intensive to maintain and support. In 2024, SFPI might find that the operational costs associated with these older product lines outweigh the minimal returns, making them a drain on capital that could be better allocated to more promising ventures within the group's portfolio.

Traditional standalone mechanical locks in commoditized markets, even under the DOM Security brand within Groupe SFPI, likely fall into the Dogs quadrant of the BCG Matrix. These products operate in highly competitive, low-barrier-to-entry environments where price is the primary differentiator.

In 2024, the market for basic mechanical locks is characterized by intense price competition, squeezing profit margins for manufacturers like SFPI. While DOM Security has brand recognition, its standalone, non-specialized mechanical locks might struggle to command premium pricing against numerous generic alternatives, potentially leading to a low market share in these specific segments.

These products, while perhaps contributing some revenue, are unlikely to be significant cash generators for SFPI. They could also tie up valuable capital in inventory and production that could be better allocated to more innovative or higher-growth product lines, further solidifying their position as Dogs.

Inefficient or Outdated Air Filtration Units

Inefficient or outdated air filtration units, particularly those from Groupe SFPI's older product lines, would likely fall into the Dogs category of the BCG Matrix. These are units that no longer meet current energy efficiency standards or the increasingly stringent environmental regulations being implemented globally.

The market for these older filtration systems is experiencing a significant downturn. As customers increasingly prioritize compliance and operational cost savings, they are actively upgrading to newer, more efficient solutions. This trend suggests a stagnant or even declining demand for SFPI's legacy products in this segment.

Groupe SFPI's market share in this specific niche is expected to be minimal. The cost associated with re-engineering or significantly improving these older units to meet modern standards would likely outweigh the potential revenue generated from their sales, making them a poor investment for the company.

- Market Trend: Declining due to obsolescence and regulatory changes.

- SFPI's Position: Low market share in this segment.

- Investment Potential: Low, as revival efforts are likely cost-prohibitive.

- Strategic Action: Divestment or phasing out of these product lines is often the recommended approach for Dogs.

Niche, Non-Integrated Industrial Components with Limited Demand

Niche, Non-Integrated Industrial Components with Limited Demand, often found within a company like Groupe Sfpi, would be categorized as Dogs in the BCG Matrix. These are individual parts that don't connect to a bigger system and cater to very specific, shrinking markets. Their demand is low, making it hard to grow or scale, and they typically bring in very little money while demanding significant resources to keep them going. For SFPI Group, this means these product lines are likely not strategic and might be candidates for divestment or a planned exit.

These "Dog" products are characterized by their low market share and low growth potential. For example, if SFPI Group had a component used exclusively in a now-obsolete manufacturing process, its demand would be minimal. In 2024, such a component might represent less than 0.5% of SFPI's total revenue, with a projected market decline of 5% annually. The effort to maintain production and sales for such an item often outweighs the financial return.

- Low Market Share: These components typically hold a very small percentage of their specific niche market.

- Limited Growth Potential: The markets they serve are often stagnant or declining, offering no significant expansion opportunities.

- Resource Drain: Maintaining these product lines can consume disproportionate management attention and capital relative to their revenue generation.

- Strategic Review: Companies like SFPI Group often consider divesting or discontinuing these "Dog" products to reallocate resources to more promising areas.

Groupe SFPI's legacy manual industrial equipment, such as older model lathes, are classified as Dogs. These products have a low market share in a declining market, often due to technological advancements. For instance, the demand for manual lathes has been steadily decreasing, with CNC machines dominating the market. In 2024, these legacy items might cost more to maintain than they generate in revenue, making them a drain on resources.

Standalone mechanical locks, even under the DOM Security brand, likely fall into the Dogs quadrant. These operate in highly competitive, low-margin markets where price is key. In 2024, basic mechanical locks face intense price competition, squeezing profits for manufacturers like SFPI. These products might tie up capital in inventory that could be better used for more innovative lines.

Obsolete analog security systems represent Dogs for Groupe SFPI. These systems lack digital integration and are in a declining market, with global shipments of traditional analog CCTV cameras falling as manufacturers shift to IP-based solutions. While SFPI might retain a small share for legacy applications, this segment offers low growth and minimal returns, suggesting divestiture as a strategic option.

| Product Category | BCG Quadrant | Market Share (Est.) | Market Growth (Est.) | SFPI Relevance (2024) |

|---|---|---|---|---|

| Legacy Manual Industrial Equipment | Dogs | < 1% | -5% | Low revenue, high maintenance cost |

| Standalone Mechanical Locks | Dogs | Low (niche) | Stagnant/Declining | Squeezed margins, capital intensive |

| Obsolete Analog Security Systems | Dogs | Minimal | Declining | Resource drain, low ROI |

Question Marks

IoT-enabled smart home security devices represent a burgeoning sector within the broader smart home market, which is projected to reach $150 billion globally by 2025, with security being a key driver. While this segment offers considerable growth potential, Groupe SFPI's presence might be nascent, positioning these devices as potential Question Marks in the BCG matrix. Significant investment in brand building and distribution networks will be crucial to capture market share in this competitive consumer-facing arena.

The market for robotics and collaborative automation is indeed a vibrant space, with projections indicating significant expansion. For instance, the global collaborative robot market was valued at approximately $1.5 billion in 2023 and is expected to reach over $10 billion by 2030, growing at a compound annual growth rate (CAGR) of over 25%. This presents a substantial opportunity for companies like SFPI Group.

Given the specialized nature and competitive landscape of this segment, SFPI Group's current market share in robotics and collaborative automation for SMEs might be relatively modest. However, this can be viewed as a potential opportunity rather than a weakness. Early investment in research and development, coupled with efforts to educate the market about the benefits of these solutions for smaller businesses, are crucial for capturing future growth.

These initiatives, while demanding significant cash outlays, position SFPI's robotics and collaborative automation offerings as potential Stars within the BCG Matrix. If SFPI can successfully innovate and scale solutions that precisely address the unique automation needs of SMEs, capitalizing on the increasing demand, these segments could transition from question marks to high-growth, high-market-share Stars in the coming years.

AI-powered predictive maintenance services represent a burgeoning sector within the industrial services landscape. By utilizing AI and sophisticated data analytics, these services aim to preempt equipment malfunctions in factories and other industrial environments, thereby minimizing downtime and operational costs. This market is experiencing rapid expansion, driven by the increasing adoption of Industry 4.0 technologies.

Groupe SFPI, with its established foundation in industrial equipment, is well-positioned to venture into offering these advanced predictive maintenance solutions. Their existing expertise in managing and servicing industrial assets provides a strong starting point for developing and delivering these AI-driven services. However, it's likely that their current penetration in this specific, high-tech service area is still developing.

Developing robust AI-powered predictive maintenance capabilities demands substantial upfront investment in AI technologies, specialized talent, and extensive data infrastructure. Despite these initial costs, successful scaling of these services could transform them into highly lucrative Stars within SFPI's portfolio. For instance, the global predictive maintenance market was valued at approximately $6.9 billion in 2023 and is projected to reach over $28 billion by 2030, showcasing significant growth potential.

Advanced Digital Access Credentials (e.g., Biometrics, Mobile Access)

Groupe SFPI's DOM Security division, while robust in traditional access control, faces a dynamic shift towards advanced digital credentials. The market for biometrics, mobile access, and cloud-based solutions is experiencing significant growth, with specialized tech firms often leading the charge. This presents a potential challenge for SFPI, where their current market share in these cutting-edge areas might be relatively low compared to agile innovators.

These advanced digital access solutions represent a high-growth segment within the security market. However, capturing and expanding market share requires considerable investment in research and development, talent acquisition, and the creation of sophisticated, user-friendly platforms. For SFPI, strategically investing in these areas is crucial to remain competitive and capitalize on future market trends.

- Market Growth: The global biometrics market alone was projected to reach over $130 billion by 2027, indicating substantial expansion potential.

- Investment Needs: Developing secure and scalable mobile access and cloud credential management systems demands significant R&D expenditure.

- Competitive Landscape: SFPI may find itself competing with established tech giants and nimble startups that have a head start in digital security innovation.

- Strategic Focus: A key consideration for SFPI is how to allocate resources to build a strong position in this high-potential, yet investment-intensive, digital security domain.

Solutions for Sustainable/Green Buildings Certification

The market for green building certifications like LEED and BREEAM is expanding rapidly, fueled by increasing environmental awareness and stricter regulations. For Groupe SFPI, their expertise in air treatment, energy efficiency, and smart building technology positions them well to serve this niche, though their current dedicated market share may require focused development. This segment represents a potential growth area needing strategic investment to capture market share. Indeed, the global green building market was valued at approximately $297.5 billion in 2023 and is projected to reach $1.3 trillion by 2030, demonstrating significant upside potential.

Groupe SFPI's existing product portfolio, particularly in areas like advanced HVAC systems and intelligent energy management, can be directly tailored to meet the stringent requirements of various green building standards. For instance, implementing SFPI's energy-saving solutions could significantly contribute to a building achieving higher LEED points in energy and atmosphere categories. The company's stated commitment to industrial responsibility and sustainable development provides a strong foundation for pursuing this market, aligning their business strategy with growing global demand for eco-friendly infrastructure.

To effectively capitalize on this growing market, SFPI could consider the following strategic adaptations:

- Develop specialized product bundles designed to meet specific certification criteria for LEED, BREEAM, or other regional standards.

- Invest in marketing and sales channels that specifically target developers, architects, and building owners focused on sustainable construction.

- Form strategic partnerships with certification bodies or green building consultants to enhance credibility and market access.

- Enhance R&D to further integrate smart technologies that optimize building performance and reduce environmental impact, aligning with the projected growth of smart building solutions which are expected to see a CAGR of over 12% through 2027.

Groupe SFPI's IoT-enabled smart home security devices, while in a rapidly expanding market, likely represent a Question Mark. The global smart home market is projected to reach $150 billion by 2025, with security being a significant driver. SFPI's current market share in this specific niche is probably small, requiring substantial investment in branding and distribution to gain traction against established players.

BCG Matrix Data Sources

Our Groupe SFPI BCG Matrix leverages comprehensive data from financial statements, internal sales figures, and industry growth projections to accurately position each business unit.