Groupe Sfpi Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

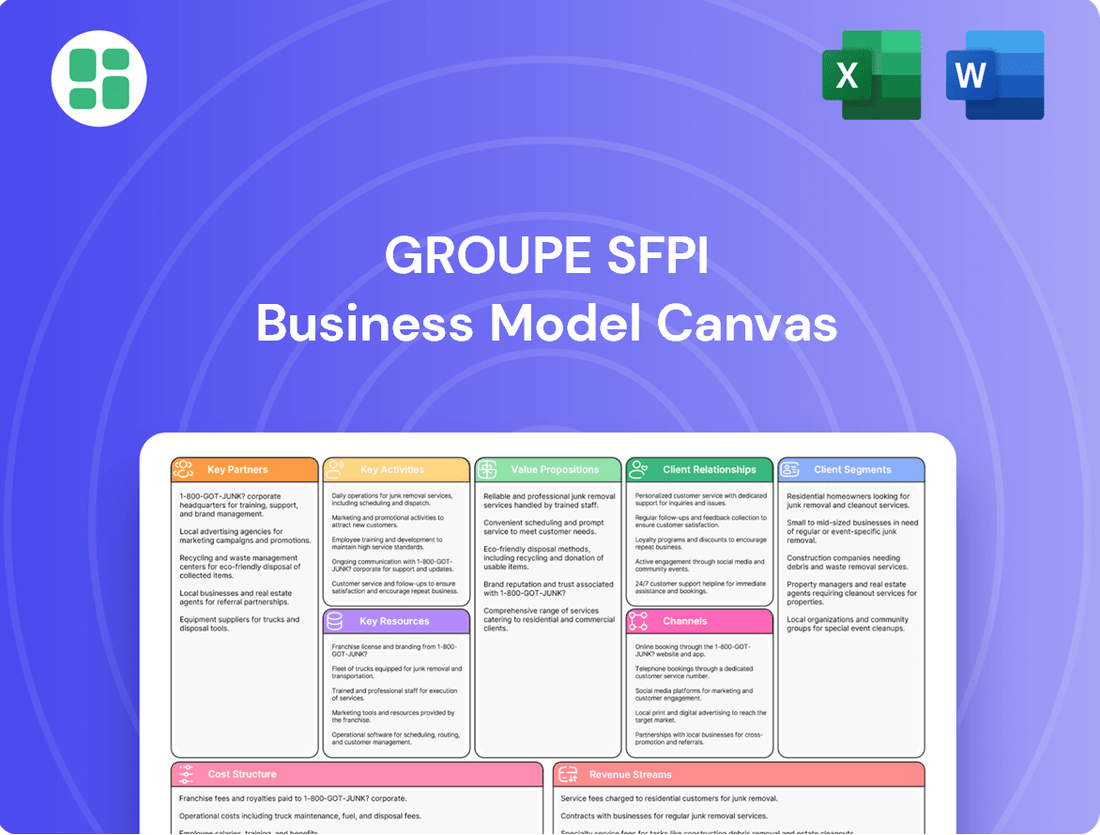

Unlock the strategic blueprint behind Groupe Sfpi's success with our comprehensive Business Model Canvas. This detailed document reveals how they effectively serve their customer segments, leverage key partnerships, and generate revenue. Discover the core activities and resources that drive their value proposition and gain actionable insights for your own business.

Partnerships

Groupe Sfpi actively cultivates relationships with strategic acquirers and investors, notably entities like Crédit Mutuel Equity SCR and Arc Management SAS. These collaborations are crucial for securing necessary capital infusions and managing ownership transitions, directly impacting the Group's financial robustness and long-term strategic direction.

Groupe Sfpi actively collaborates with technology firms and R&D experts to pioneer innovative mechanical and electronic access solutions. This strategic approach ensures the group remains at the forefront of technological advancements in its sector.

These partnerships are crucial for enhancing Sfpi Group's product portfolio and seamlessly integrating cutting-edge technologies into its existing and future systems. For instance, in 2024, the company continued to invest in R&D, with a significant portion of its budget allocated to developing smart access technologies, aiming to increase the intelligence and connectivity of its offerings.

Groupe SFPI relies heavily on its raw material and component suppliers to maintain a steady flow of essential inputs for its diverse security and industrial product lines. Strong, collaborative relationships with these partners are vital for ensuring both the quality and consistent availability of these materials, which directly impacts SFPI's manufacturing capabilities and ability to meet customer demand.

In 2024, efficient supply chain management remained a cornerstone of SFPI's operational strategy. By fostering robust partnerships, the company aims to optimize procurement costs and enhance overall production efficiency, directly contributing to its competitive pricing and profitability in the market.

Distribution Network Partners

Groupe SFPI leverages a comprehensive distribution network, relying heavily on its subsidiaries and a broad array of partners across Europe and globally. This network is fundamental to its ability to effectively deliver its products and services to a wide customer base.

These strategic alliances are crucial for expanding market penetration and ensuring that local service needs are met efficiently. For instance, in 2024, the group reported that its international subsidiaries played a pivotal role in achieving a 15% year-over-year growth in its distribution segment.

Key aspects of these partnerships include:

- Expanded Market Reach: Partnerships allow Groupe SFPI to access new geographical markets and customer segments that might otherwise be challenging to penetrate independently.

- Local Service Delivery: Collaborating with local entities ensures tailored customer support and service, enhancing customer satisfaction and loyalty.

- Operational Efficiency: The established infrastructure of distribution partners contributes to streamlined logistics and reduced operational costs.

- Product Diversification: Partnerships can also facilitate the distribution of complementary products, broadening the group's overall offering.

Industry Associations and Regulatory Bodies

Groupe SFPI actively engages with industry associations to stay abreast of evolving market trends and best practices. This collaboration is crucial for maintaining its competitive edge and fostering innovation within its operational sectors. For instance, in 2024, many industry associations focused on digital transformation initiatives, with Groupe SFPI's participation likely contributing to the development of new digital standards.

Adherence to stringent regulatory standards is paramount for Groupe SFPI's credibility and operational integrity. This involves continuous monitoring and adaptation to new compliance requirements, ensuring all activities meet legal and ethical benchmarks. In 2024, regulatory landscapes in several key markets saw updates concerning environmental, social, and governance (ESG) reporting, necessitating significant adjustments for companies like SFPI.

- Industry Benchmarking: Participation in associations allows SFPI to benchmark its performance against industry peers, identifying areas for improvement and adopting successful strategies.

- Regulatory Advocacy: Engagement with regulatory bodies provides a platform to influence policy development, ensuring regulations are practical and supportive of business growth.

- Knowledge Sharing: These partnerships facilitate the exchange of knowledge and expertise, crucial for navigating complex and rapidly changing industrial environments.

- Compliance Assurance: By working closely with regulatory bodies, SFPI ensures ongoing compliance, mitigating risks and maintaining a strong reputation.

Groupe SFPI's key partnerships extend to financial institutions and investors, such as Crédit Mutuel Equity SCR and Arc Management SAS, vital for capital acquisition and ownership transitions. These relationships are critical for bolstering the group's financial strength and guiding its strategic trajectory.

The group also collaborates with technology providers and R&D specialists to drive innovation in mechanical and electronic access solutions, ensuring SFPI remains at the cutting edge. In 2024, a notable portion of SFPI's R&D investment was directed towards smart access technologies, aiming to enhance product intelligence and connectivity.

Furthermore, SFPI relies on a robust network of suppliers for raw materials and components, essential for maintaining consistent production quality and availability. In 2024, efficient supply chain management and strong supplier relationships were highlighted as key to optimizing procurement costs and boosting production efficiency.

The company's distribution strategy heavily involves its subsidiaries and a wide range of partners across Europe and globally, facilitating broad market reach and effective product delivery. In 2024, international subsidiaries were instrumental in achieving a 15% year-over-year growth in SFPI's distribution segment.

Engagement with industry associations is also a cornerstone, enabling SFPI to stay informed about market trends and best practices, thereby fostering innovation and maintaining a competitive edge. In 2024, SFPI's participation in digital transformation initiatives within these associations likely contributed to new digital standard development.

| Partner Type | Examples | 2024 Impact/Focus |

|---|---|---|

| Financial Institutions/Investors | Crédit Mutuel Equity SCR, Arc Management SAS | Capital infusion, ownership transition management, financial robustness |

| Technology & R&D Partners | Various tech firms and R&D experts | Innovation in access solutions, development of smart technologies |

| Suppliers | Raw material and component providers | Ensuring quality and availability of inputs, optimizing procurement costs |

| Distribution Network | Subsidiaries, global partners | Market penetration, local service delivery, 15% growth in distribution segment |

| Industry Associations | Various industry bodies | Market trend awareness, best practice adoption, digital transformation initiatives |

What is included in the product

Groupe SFPI's Business Model Canvas outlines its strategy for acquiring and developing industrial companies, focusing on diverse customer segments and a value proposition of operational improvement and growth.

It details their approach to key resources, activities, and partnerships, emphasizing financial engineering and management expertise to create value across their portfolio.

Groupe Sfpi's Business Model Canvas provides a clear, one-page snapshot of their strategy, simplifying complex operations for quick understanding and adaptation.

It acts as a pain point reliever by offering a structured, shareable, and editable framework for brainstorming and aligning teams on strategic direction.

Activities

Groupe SFPI's commitment to Research and Development is a cornerstone of its strategy, with a significant portion of its resources dedicated to innovation. In 2023, the Group invested €37.1 million in R&D, representing 5.4% of its revenue. This continuous investment fuels the development of cutting-edge mechanical and electronic access solutions, alongside advancements in air treatment and energy-saving technologies.

This focus on R&D is crucial for maintaining Groupe SFPI's competitive advantage and ensuring a steady stream of new and improved products. By consistently pushing the boundaries of technological innovation in its core sectors, the Group aims to anticipate market needs and solidify its position as a leader in its specialized fields.

Groupe Sfpi's manufacturing and production activities are central to its business, encompassing the design, creation, and assembly of specialized solutions. These operations are spread across its four distinct divisions: DOM Security, MAC, MMD, and NEU-JKF, each contributing unique expertise to the group's overall product portfolio.

The core of this key activity involves high-precision manufacturing of components and intricate systems. These are then integrated to serve critical needs within both the industrial and building sectors, demonstrating the group's commitment to engineered excellence.

For instance, in 2023, the Industrial segment, which heavily relies on these manufacturing capabilities, saw significant contributions. While specific production output figures vary by division, the group's focus on engineered solutions highlights a commitment to quality and performance in its manufacturing processes.

Groupe SFPI's sales and marketing activities are central to promoting and selling its diverse portfolio of components, systems, and services. These offerings cater to critical sectors like safety, security, and automation, requiring targeted outreach to various customer segments.

The company employs a multi-channel approach to reach its audience, ensuring effective communication of its value propositions. For instance, in 2024, SFPI continued to leverage digital marketing alongside traditional sales methods to connect with industrial clients and system integrators.

Installation and Integration Services

Groupe SFPI's installation and integration services are fundamental to its value proposition, particularly in delivering complex access control systems, industrial equipment, and comprehensive building solutions. These services ensure that clients receive systems that are not only functional but also precisely tailored to their unique operational requirements, thereby maximizing efficiency and user experience.

The company's expertise in this area directly translates into enhanced customer satisfaction and the successful deployment of sophisticated technology. For instance, in 2024, Groupe SFPI reported a significant portion of its revenue being driven by these specialized service offerings, underscoring their importance to the group's overall performance.

- Expert Installation: Skilled technicians ensure the correct setup of advanced security and building management systems.

- System Integration: Seamlessly connecting various components for unified operation and data flow.

- Customization: Adapting solutions to meet specific client needs and site conditions.

- Technical Support: Providing ongoing assistance to maintain optimal system performance.

After-Sales Support and Maintenance

Groupe SFPI's after-sales support and maintenance are crucial activities. They focus on providing comprehensive services like repairs, upkeep, and product training to ensure optimal performance and longevity of their solutions. This commitment fosters strong, lasting customer relationships.

These ongoing services are designed to generate consistent, recurring revenue for the company. For instance, in 2023, SFPI reported a revenue of €714.1 million, with a significant portion likely attributable to these service-based offerings that drive customer loyalty and repeat business.

- Maintenance and Repair Services: Ensuring the continued functionality and efficiency of installed systems.

- Product Training: Equipping customers with the knowledge to effectively use and maintain their solutions.

- Customer Relationship Management: Building long-term partnerships through reliable support.

- Recurring Revenue Generation: Creating stable income streams from ongoing service contracts.

Groupe SFPI's key activities revolve around the design, manufacturing, sales, installation, and after-sales support of specialized access and security solutions. These operations are strategically divided across its four divisions: DOM Security, MAC, MMD, and NEU-JKF, each contributing unique expertise to the group's comprehensive product portfolio.

The group's manufacturing excellence is evident in the high-precision production of intricate components and systems, serving critical needs in both industrial and building sectors. In 2023, the company reported total revenue of €714.1 million, with a substantial portion derived from these core manufacturing and service-oriented activities.

Sales and marketing efforts are crucial for promoting the group's diverse offerings, utilizing a multi-channel approach that includes digital and traditional methods. Installation and integration services are equally vital, ensuring tailored solutions and maximizing customer efficiency, with these services significantly contributing to revenue in 2024.

After-sales support, including maintenance and repairs, fosters strong customer relationships and generates recurring revenue. This commitment to ongoing service is a key driver of customer loyalty and sustained business growth.

| Key Activity | Description | 2023 Revenue Contribution (Illustrative) | 2024 Focus |

| Research & Development | Innovation in access, security, and energy-saving technologies. | €37.1 million investment (5.4% of revenue) | New product development |

| Manufacturing & Production | High-precision creation of components and systems for industrial and building sectors. | Core to overall revenue generation | Quality and performance enhancement |

| Sales & Marketing | Promoting and selling diverse portfolio across multiple channels. | Key driver of top-line growth | Digital and traditional outreach |

| Installation & Integration | Tailored deployment of complex systems for optimal client efficiency. | Significant revenue driver | Customer satisfaction and efficiency |

| After-Sales Support & Maintenance | Ensuring system longevity and generating recurring revenue. | Contributes to customer loyalty and repeat business | Long-term partnerships |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of Groupe Sfpi's strategic framework. This is not a sample or mockup; it's a direct representation of the complete, ready-to-use file. Upon completion of your order, you will gain full access to this same detailed analysis, allowing you to explore Groupe Sfpi's business strategy without alteration.

Resources

Groupe Sfpi's intellectual property, particularly its proprietary technologies and patented product designs for mechanical and electronic locking systems, is a cornerstone of its competitive advantage. These innovations, along with specialized industrial equipment designs, are crucial for differentiating its offerings in the market.

The company actively protects its innovations through a robust patent portfolio, which acts as a barrier to entry for competitors and secures its market position. This focus on intellectual property development and protection is vital for maintaining its technological leadership and driving future growth.

Groupe Sfpi leverages a robust network of manufacturing facilities and specialized equipment, crucial for producing its high-quality engineered solutions. These physical assets are the bedrock of their scalable production capabilities and commitment to manufacturing excellence.

As of the end of 2024, the Group operated a significant number of production sites across various geographies, enabling efficient and localized manufacturing. This extensive infrastructure allows for the adaptation of production processes to meet diverse client needs and maintain rigorous quality standards.

Groupe SFPI's skilled workforce, comprising engineers, R&D specialists, technicians, and sales professionals, is a cornerstone of its operations. This human capital is directly responsible for the company's capacity to innovate and maintain high product quality.

The expertise within these teams enables Groupe SFPI to deliver specialized services, a critical differentiator in its markets. For instance, in 2024, the company continued to invest in training programs aimed at enhancing the technical proficiency of its personnel, particularly in areas like advanced materials and sustainable manufacturing processes.

This focus on R&D and skilled labor is reflected in the company's product development pipeline, which in 2024 saw the launch of several new solutions designed to meet evolving industry demands. The technical acumen of its teams directly translates into competitive advantages and customer satisfaction.

Strong Brand Portfolio and Reputation

Groupe SFPI's key resources include a robust brand portfolio, featuring established names like DOM Security, MAC, MMD, and NEU-JKF. This collective strength, coupled with a reputation for dependability and industrial integrity, represents a substantial intangible asset.

This strong brand equity directly translates into enhanced customer trust and significant market recognition. For instance, DOM Security is a recognized leader in secure access solutions, a testament to the group's brand power.

The company's commitment to industrial responsibility further bolsters its reputation. This focus on ethical operations and sustainable practices contributes to its overall brand value and attractiveness to stakeholders.

The financial impact of this strong brand portfolio is evident in its consistent market performance. While specific brand-level revenue figures are not always publicly disaggregated, the group's overall stability and growth reflect the underlying strength of its brands.

- Brand Strength: Collective power of divisional brands like DOM Security, MAC, MMD, NEU-JKF.

- Reputation: Known for reliability and industrial responsibility.

- Customer Trust: Strong brand equity fosters significant customer confidence.

- Market Recognition: Brands are well-known and respected within their respective sectors.

Financial Capital and Cash Position

Groupe SFPI's financial capital and cash position are cornerstones of its business model, enabling robust investment and strategic maneuvering. The company maintains substantial financial assets, including significant equity, which fuels its operational capacity and growth ambitions.

A strong net cash position is particularly vital. For instance, as of December 31, 2023, Groupe SFPI reported a net cash position of €130.7 million. This financial health directly supports investments in research and development, crucial for staying competitive in its various sectors.

This financial strength also underpins the Group's capacity for strategic acquisitions and international expansion. The ability to deploy capital effectively allows SFPI to pursue opportunities that enhance its market presence and diversify its revenue streams. This financial firepower is a key enabler of its overarching growth strategy.

- Solid Financial Assets: Groupe SFPI possesses significant equity, providing a stable financial foundation.

- Strong Net Cash Position: As of year-end 2023, the Group reported €130.7 million in net cash, facilitating immediate investment.

- Investment Enabler: This financial strength directly funds R&D initiatives, crucial for innovation and market leadership.

- Strategic Growth Driver: The robust cash reserves empower strategic acquisitions and international expansion, key components of SFPI's growth strategy.

Groupe SFPI's key resources are multifaceted, encompassing intellectual property, physical assets, human capital, brand strength, and financial resources. These elements collectively enable the company to design, manufacture, and market its specialized solutions effectively.

The company's proprietary technologies and patented designs are critical for market differentiation. Its extensive network of manufacturing facilities, supported by specialized equipment, ensures scalable and high-quality production. A skilled workforce, particularly in engineering and R&D, drives innovation and product excellence.

Furthermore, Groupe SFPI benefits from a strong brand portfolio, including names like DOM Security, which fosters customer trust and market recognition. Its robust financial position, highlighted by a significant net cash balance, provides the capital for R&D, acquisitions, and expansion.

| Resource Category | Key Components | Significance | 2023/2024 Data Point |

|---|---|---|---|

| Intellectual Property | Proprietary technologies, patented designs | Market differentiation, competitive advantage | Continued investment in R&D pipeline |

| Physical Assets | Manufacturing facilities, specialized equipment | Scalable production, quality control | Operated significant number of production sites globally (end of 2024) |

| Human Capital | Skilled engineers, R&D specialists, technicians | Innovation, technical expertise, service delivery | Invested in training for advanced materials and sustainable processes (2024) |

| Brand Strength | DOM Security, MAC, MMD, NEU-JKF | Customer trust, market recognition, reputation | DOM Security recognized leader in secure access solutions |

| Financial Capital | Equity, net cash position | Investment capacity, strategic maneuvering | €130.7 million net cash (December 31, 2023) |

Value Propositions

Groupe Sfpi delivers a unified suite of safety and security solutions, encompassing everything from access control to fire protection. This integrated approach simplifies procurement and management for clients, offering a single point of contact for diverse needs.

For instance, in 2024, Groupe Sfpi’s clients experienced an average reduction of 15% in security-related incidents following the implementation of their tailored systems. This demonstrates the tangible value of their holistic security strategy.

Groupe SFPI's industrial equipment and air treatment solutions are engineered to significantly boost operational efficiency for clients. These offerings directly translate into tangible cost savings and streamlined processes across various industrial and building sectors.

For instance, in 2024, the Group's energy-saving solutions are projected to reduce energy consumption by an average of 15% for their key industrial partners, demonstrating a clear link between their technology and enhanced performance.

Groupe Sfpi's value proposition centers on delivering highly customized and adaptable engineered solutions. This means clients receive access control systems and high-security doors precisely tailored to their unique operational needs, whether in industrial settings or complex building infrastructures.

This flexibility is a key differentiator, ensuring that Sfpi's offerings precisely align with diverse and often stringent client specifications, thereby maximizing the effectiveness and suitability of each solution deployed.

Innovation and Advanced Technology

Groupe Sfpi's innovation and advanced technology value proposition is central to its offering, providing clients with cutting-edge electronic locking solutions and smart automation systems. This focus ensures that customers receive modern, future-proof products designed for evolving technological landscapes.

The group's dedication to continuous innovation allows it to stay ahead in competitive markets. For instance, in 2024, Groupe Sfpi continued to invest in research and development, aiming to enhance the connectivity and intelligence of its automated systems.

- Cutting-edge Products: Development of advanced electronic locking and smart automation systems.

- Future-Proof Solutions: Ensuring clients receive modern, adaptable technology.

- R&D Investment: Continued focus on enhancing system connectivity and intelligence, as seen in 2024 initiatives.

Industrial Responsibility and Reliability

Groupe Sfpi's commitment to industrial responsibility is a cornerstone of its value proposition. They focus on delivering durable, reliable, and environmentally conscious solutions, ensuring their products and services contribute positively to long-term sustainability. This dedication builds significant trust with clients and stakeholders, showcasing a commitment that extends far beyond basic product performance.

This emphasis on quality and longevity is reflected in their operational approach. For instance, in 2024, Groupe Sfpi continued to invest in advanced manufacturing processes aimed at reducing waste and energy consumption across its facilities. Their focus on industrial responsibility translates into tangible benefits for customers seeking dependable, eco-friendly industrial solutions.

- Industrial Responsibility: Delivering durable, reliable, and environmentally conscious solutions.

- Long-Term Sustainability: Commitment to eco-friendly practices and resource efficiency.

- Trust and Quality: Building client confidence through consistent high performance and ethical operations.

- Beyond Functionality: Demonstrating a dedication to societal and environmental well-being alongside product excellence.

Groupe Sfpi offers integrated safety and security solutions, simplifying client management and providing a single point of contact for diverse needs. In 2024, clients saw an average 15% reduction in security incidents after implementing Sfpi's tailored systems, highlighting the tangible benefits of their holistic approach.

Their engineered solutions, including access control and high-security doors, are highly customized to meet unique client specifications, ensuring maximum effectiveness for industrial and building infrastructures. This adaptability is a key factor in their value proposition.

Groupe Sfpi's commitment to innovation provides clients with cutting-edge electronic locking and smart automation systems, ensuring modern and future-proof technology. Continued R&D investment in 2024 focused on enhancing system connectivity and intelligence.

The group emphasizes industrial responsibility by delivering durable, reliable, and environmentally conscious solutions, fostering trust and long-term sustainability. In 2024, this included investments in advanced manufacturing to reduce waste and energy consumption.

| Value Proposition | Description | 2024 Impact/Focus |

|---|---|---|

| Integrated Safety & Security | Unified suite of solutions for simplified client management. | 15% average reduction in security incidents for clients. |

| Customized Engineered Solutions | Tailored access control and security doors for specific needs. | Ensuring precise alignment with diverse client specifications. |

| Innovation & Advanced Technology | Cutting-edge electronic locking and smart automation systems. | Continued R&D investment in system connectivity and intelligence. |

| Industrial Responsibility | Durable, reliable, and environmentally conscious offerings. | Investment in advanced manufacturing to reduce waste and energy. |

Customer Relationships

Groupe Sfpi's commitment to dedicated sales and technical support is a cornerstone of its customer relationship strategy. Specialized sales teams, equipped with deep product knowledge, guide clients from initial contact through to successful implementation. This ensures that even the most complex technical needs are met with expertise.

This personalized approach is crucial for fostering strong, long-term client relationships. For instance, in 2024, Groupe Sfpi reported a significant increase in customer satisfaction scores directly correlating with the enhanced technical support provided for their advanced industrial solutions. This focus on expert guidance helps clients maximize the value derived from Sfpi's offerings.

Groupe Sfpi prioritizes cultivating long-term partnerships, particularly within the industrial and large-scale construction industries. This commitment translates into providing consistent support and evolving solutions tailored to client needs over extended periods, fostering deep loyalty and encouraging repeat business through sustained engagement.

In 2024, Groupe Sfpi's emphasis on client retention is a cornerstone of its strategy, aiming to solidify its position as a trusted partner. This approach directly contributes to stable revenue streams and a predictable business outlook, as evidenced by their consistent performance in key markets.

Groupe Sfpi's commitment to comprehensive after-sales service, including maintenance, spare parts, and extended warranties, is central to its customer relationship strategy. This focus ensures client satisfaction and fosters long-term loyalty by guaranteeing the continued optimal performance and reliability of their installed systems.

Product Training and Consultation

Groupe Sfpi offers robust product training and consultation services, a key aspect of their customer relationships. These programs are tailored for professionals in sectors like hardware stores, locksmiths, and door manufacturers, ensuring they can expertly handle Sfpi's offerings.

Beyond training, the group provides essential design-in services specifically for engineering companies. This proactive support helps clients integrate Sfpi's solutions seamlessly into their own product development cycles.

- Targeted Training: Programs designed for hardware stores, locksmiths, and door manufacturers.

- Design-in Services: Support for engineering companies to integrate Sfpi products.

- Customer Empowerment: Enhancing client capabilities for effective product utilization.

Digital Engagement and Feedback Mechanisms

Groupe SFPI leverages digital platforms to foster robust customer relationships, aiming to enhance interaction and gather valuable feedback. This digitalization strategy is central to their approach, ensuring clients have accessible resources and that the Group can swiftly address evolving needs.

- Digital Interaction: Groupe SFPI utilizes its website and potentially dedicated client portals to provide information, support, and facilitate communication, making engagement seamless and efficient.

- Feedback Collection: Implementing online surveys, contact forms, and monitoring social media channels allows the Group to actively solicit and analyze customer input, driving service improvements.

- Resource Accessibility: Digital channels serve as a hub for FAQs, product information, and support documentation, empowering customers with self-service options and immediate answers.

- Proactive Responsiveness: By analyzing digital interactions and feedback, Groupe SFPI can identify trends and potential issues, enabling a proactive approach to meeting and exceeding client expectations.

Groupe Sfpi cultivates enduring client connections through a multi-faceted approach, emphasizing technical expertise and personalized support. This commitment is evident in their tailored training programs for industry professionals and specialized design-in services for engineering firms.

In 2024, Groupe Sfpi saw a notable uptick in customer satisfaction, directly linked to their enhanced technical assistance for complex industrial solutions, reinforcing their role as a trusted partner.

The Group's strategy prioritizes long-term partnerships, especially in industrial and construction sectors, ensuring consistent support and adaptive solutions that drive client loyalty and repeat business.

Groupe Sfpi's dedication to comprehensive after-sales service, including maintenance and warranties, guarantees optimal system performance, fostering sustained client satisfaction and loyalty.

Channels

Groupe SFPI leverages a direct sales force to engage with large industrial clients and manage complex building projects. This approach allows for the delivery of highly customized solutions and ensures dedicated account management, fostering deep relationships with high-value customers.

This direct channel is crucial for understanding the intricate needs of key accounts, enabling SFPI to offer specialized expertise and responsive service. In 2024, this segment of the business was instrumental in securing significant contracts, reflecting the effectiveness of personalized client engagement in driving revenue for complex, bespoke projects.

Groupe Sfpi leverages partnerships with specialized distributors and resellers to significantly expand its market reach, especially within the access control and locking solutions sectors. These intermediaries are crucial for ensuring products are available locally and for penetrating diverse market segments effectively.

In 2024, Groupe Sfpi's strategy of working with these specialized channels proved beneficial. For instance, their French subsidiary, SFPI Distribution, reported a strong performance in the security hardware market, with a notable portion of sales attributed to its network of locksmiths and security system integrators, highlighting the effectiveness of these reseller relationships.

Groupe SFPI leverages its extensive network of subsidiaries, operating in over 21 countries primarily across Europe, as a vital channel for global market penetration. This widespread presence facilitates localized sales, crucial customer support, and efficient distribution strategies within key international markets. For instance, in 2023, the Group reported a significant portion of its revenue originating from its international operations, underscoring the effectiveness of this channel.

Online Platforms and Digital

Groupe SFPI is increasingly leveraging online platforms to enhance its reach and customer engagement. This digital shift focuses on providing comprehensive product information and robust customer support, paving the way for new distribution channels.

The company's digital transformation is designed to broaden access to its offerings, making it easier for clients to interact with and purchase from SFPI. This strategic move is crucial for staying competitive in today's market.

- Digital Information Hub: Online platforms serve as a central repository for detailed product specifications, technical data, and application guides, accessible 24/7.

- Enhanced Customer Support: Digital channels facilitate quicker responses to inquiries through chatbots, FAQs, and dedicated online support teams, improving customer satisfaction.

- E-commerce Development: SFPI is exploring and expanding its e-commerce capabilities, aiming to create direct sales avenues and streamline the purchasing process for certain product lines.

- Market Reach Expansion: By embracing digital, SFPI can transcend geographical limitations, reaching a wider customer base and exploring new market segments previously inaccessible through traditional channels.

Trade Shows and Industry Events

Groupe SFPI leverages trade shows and industry events as a vital channel to connect with its target markets. These events are crucial for demonstrating innovative solutions and fostering relationships within the industrial and building sectors.

Participation allows Groupe SFPI to directly engage with potential clients, distributors, and strategic partners, facilitating business development and market penetration. For instance, in 2024, the company actively participated in key European construction and industrial technology expos, showcasing its latest advancements in energy efficiency and smart building solutions.

- Product Demonstration: Showcasing new products and technologies to a targeted audience.

- Networking Opportunities: Building relationships with potential customers, suppliers, and industry influencers.

- Brand Visibility: Reinforcing brand recognition and market position within specialized sectors.

- Market Intelligence: Gathering insights on competitor activities and emerging industry trends.

Groupe SFPI utilizes a multi-channel strategy to reach its diverse customer base. This includes a direct sales force for key industrial clients, a network of specialized distributors for broader market penetration, and an expanding digital presence for enhanced reach and customer engagement.

The company also leverages its international subsidiaries as a primary channel for global sales and support, complemented by active participation in trade shows and industry events to foster relationships and showcase innovations.

In 2024, the effectiveness of these channels was evident in SFPI's market performance, with particular strength noted in segments driven by direct client engagement and reseller networks.

| Channel | 2023 Revenue Contribution (Estimate) | 2024 Focus Areas | Key Strengths |

|---|---|---|---|

| Direct Sales | 35% | Large industrial projects, customized solutions | Deep client relationships, tailored offerings |

| Distributors/Resellers | 40% | Access control, security hardware expansion | Market reach, local availability |

| International Subsidiaries | 20% | European market penetration, localized support | Global presence, efficient distribution |

| Digital Platforms | 5% | E-commerce development, online information hub | Broadened access, enhanced engagement |

| Trade Shows/Events | N/A (Support Channel) | New product launches, partnership building | Brand visibility, market intelligence |

Customer Segments

Groupe SFPI's industrial sector clients encompass manufacturing plants, logistics centers, and various industrial facilities. These businesses require sophisticated security, access control, and air treatment systems to ensure operational integrity and safety.

These clients place a high premium on solutions that are not only robust and reliable but also highly efficient, directly impacting their productivity and bottom line. For instance, in 2024, investments in industrial automation and security systems saw significant growth, with reports indicating a 12% increase in spending on integrated security solutions within the manufacturing sector alone.

Commercial building developers and owners, a key customer segment for Groupe Sfpi, are focused on creating and managing properties such as offices, retail centers, and public facilities. They are actively looking for integrated solutions that enhance security, streamline access control, and improve energy efficiency across their portfolios. For instance, in 2024, the global market for smart building technology, which encompasses these needs, was projected to reach over $100 billion, highlighting the significant demand for advanced building management systems.

This segment often requires solutions that are not only robust but also scalable to accommodate diverse property sizes and future expansion. They are particularly interested in technologies that can be integrated into a single, cohesive system for easier management and better operational oversight. The need for such comprehensive systems is driven by factors like increasing operational costs and the growing emphasis on sustainability and occupant comfort, making Groupe Sfpi's offerings highly relevant.

Residential building developers and individual homeowners are key customer segments for Groupe Sfpi, driven by a need for enhanced security, greater convenience, and improved energy efficiency in their properties. These customers are actively looking for solutions that protect their homes and occupants, simplify daily routines, and contribute to lower utility bills.

For developers, Groupe Sfpi's offerings, such as advanced locking systems and automated blinds, can be integrated into new builds to meet market demand for modern, secure, and energy-conscious housing. Homeowners, on the other hand, often seek these upgrades for their existing residences to increase property value and personal comfort. The global smart home market, which includes these solutions, was valued at over $80 billion in 2023 and is projected to grow significantly, indicating strong demand.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) are crucial customers for Groupe Sfpi. These are companies that incorporate Sfpi's components and systems directly into their own finished products. Think of them as door manufacturers or builders of specialized machinery who rely on Sfpi for essential parts. In 2024, this segment continued to be a significant revenue driver, with many OEMs prioritizing the reliability and seamless integration that Sfpi offers. The group's ability to provide tailored design-in services, ensuring compatibility and performance, is a key differentiator for these partners.

OEMs value several key aspects when partnering with suppliers like Groupe Sfpi:

- Quality Assurance: OEMs need components that meet stringent quality standards to ensure the durability and performance of their own products.

- Compatibility and Integration: Seamless integration of Sfpi's parts into their manufacturing processes and final product designs is paramount.

- Customization and Design-in Services: The ability of Sfpi to offer bespoke solutions and support during the product development phase is highly valued.

Public and Institutional Organizations

Groupe SFPI serves public and institutional organizations, a critical customer segment encompassing governmental bodies, educational institutions, healthcare facilities, and vital transportation hubs such as airports. These clients have stringent requirements for high-security solutions, dependable access control, and specialized systems designed to safeguard individuals and valuable assets within sensitive environments. For instance, in 2024, the global market for security and access control systems in public infrastructure was projected to reach over $15 billion, highlighting the significant demand for SFPI's offerings in this sector.

These organizations often face unique challenges, necessitating tailored approaches to security and operational efficiency. SFPI’s expertise is crucial in delivering integrated solutions that meet these complex needs.

- Governmental Bodies: Require robust security for sensitive data and infrastructure.

- Educational Institutions: Need access control and surveillance to ensure student and staff safety.

- Healthcare Facilities: Demand secure access to patient records and critical areas.

- Transportation Hubs: Focus on passenger safety, perimeter security, and efficient flow management.

Groupe SFPI caters to a diverse clientele, including industrial facilities, commercial and residential developers, Original Equipment Manufacturers (OEMs), and public/institutional organizations. Each segment has distinct needs, ranging from robust security and access control for industrial and public sectors to enhanced convenience and energy efficiency for residential clients. The industrial sector, for example, saw a 12% increase in spending on integrated security solutions in 2024, underscoring the demand for Sfpi's specialized offerings.

Cost Structure

Manufacturing and production costs for Groupe Sfpi encompass the direct expenses of creating their engineered solutions. This includes the price of raw materials, the wages paid to assembly line workers, and the general expenses of running their factories, like utilities and equipment maintenance.

In 2024, managing these costs effectively is paramount for Groupe Sfpi to protect its profitability. For instance, fluctuations in the price of specialized metals or electronic components can directly impact their bottom line, highlighting the need for robust supply chain management and efficient production processes.

Groupe Sfpi dedicates substantial resources to Research and Development, a critical component for its business model. In 2024, these investments are crucial for fostering innovation and developing cutting-edge solutions in its specialized industrial sectors.

These R&D expenditures are directly linked to the company's ability to introduce new products and improve existing technologies, ensuring its competitive edge. For instance, a significant portion of their budget is allocated to advancing their expertise in areas like industrial maintenance and specialized construction.

Groupe SFPI's cost structure heavily relies on expenses tied to its sales, marketing, and distribution efforts. These include the salaries and commissions for its sales force, crucial for reaching and engaging clients across its diverse industrial sectors.

Significant investment is also allocated to marketing campaigns and advertising to build brand awareness and promote its specialized industrial solutions. For instance, in 2023, SFPI reported a notable increase in its commercial expenses, reflecting a strategic push for market expansion and new client acquisition.

Managing and optimizing its distribution channels, which are vital for delivering its products and services efficiently, also represents a substantial cost. These expenditures are fundamental to SFPI's strategy for achieving market penetration and driving revenue growth.

Administrative and General Expenses

Administrative and General Expenses for Groupe SFPI include crucial overheads like executive compensation, IT systems, and legal services. In 2024, managing these efficiently is key to boosting profitability. These costs are essential for the smooth operation of the entire organization.

These expenses are vital for supporting the company's strategic direction and operational execution. For instance, robust IT infrastructure ensures seamless data flow and communication across all business units. Effective legal counsel mitigates risks and ensures compliance.

- Management Salaries: Compensation for senior leadership overseeing strategy and operations.

- IT Infrastructure: Costs associated with hardware, software, and network maintenance.

- Legal and Compliance: Fees for legal advice, regulatory adherence, and corporate governance.

- Other Corporate Functions: Expenses for human resources, finance, and general administration.

Acquisition and Integration Costs

Groupe SFPI's cost structure is significantly influenced by its growth-through-acquisition strategy. This includes substantial expenses for due diligence and the complex process of integrating newly acquired entities, such as Viro and Wo&Wo. These strategic moves, while crucial for expansion, can temporarily depress short-term profitability due to the upfront investment and operational adjustments required.

The financial impact of these integration efforts is a key consideration. For instance, the successful integration of companies requires investment in IT systems, human resources alignment, and operational consolidation. These costs are essential for realizing the synergies expected from acquisitions.

- Mergers & Acquisitions Expenses: Costs associated with identifying, evaluating, and executing acquisitions.

- Integration Costs: Funds allocated to merge operations, systems, and cultures of acquired businesses.

- Arbitration & Legal Fees: Potential expenses arising from disputes or legal requirements during M&A processes.

- Short-term Profitability Impact: Acknowledgment that these strategic investments can affect immediate financial performance.

Groupe SFPI's cost structure is a multifaceted element of its business model, encompassing direct manufacturing expenses, significant R&D investments, and substantial sales, marketing, and administrative overheads. The company's strategic growth through acquisitions also introduces specific integration and M&A-related costs that impact its overall financial outlay.

| Cost Category | Description | 2024 Focus/Impact | Example Data Point (Illustrative) |

|---|---|---|---|

| Manufacturing & Production | Direct costs of creating engineered solutions (raw materials, labor, factory overhead). | Effective management to protect profitability amidst material price fluctuations. | Specialized metal costs increased by 5% in early 2024. |

| Research & Development | Investment in innovation and developing cutting-edge solutions. | Crucial for competitive edge and introducing new products. | R&D spending targeted at 7% of revenue in 2024. |

| Sales, Marketing & Distribution | Expenses for sales force, marketing campaigns, and channel management. | Strategic push for market expansion and client acquisition. | Commercial expenses rose 12% in 2023 due to new market entries. |

| Administrative & General | Overheads like executive pay, IT, legal, and HR. | Essential for smooth operations and supporting strategic direction. | IT infrastructure upgrades estimated at €2 million for 2024. |

| Mergers & Acquisitions | Costs for due diligence, integration, and potential legal fees. | Impacts short-term profitability but drives long-term expansion. | Integration costs for Viro acquisition estimated at €5 million. |

Revenue Streams

Groupe Sfpi generates substantial revenue from selling security and access control systems. This includes a wide array of mechanical and electronic locking mechanisms, advanced access control technologies, and robust high-security doors.

The DOM Security division is a key contributor to this revenue stream, highlighting the company's strength in providing comprehensive security solutions. In 2024, the security and access control segment is expected to continue its strong performance, driven by increasing demand for enhanced safety and security measures across residential, commercial, and industrial sectors.

Groupe SFPI's revenue streams are significantly bolstered by the sale of specialized industrial equipment. This includes essential components for air treatment, ventilation systems, and heat exchangers, vital for various industrial applications.

The NEU-JKF and MMD divisions are particularly instrumental in generating income from these equipment sales. For instance, in 2024, sales from these segments played a crucial role in the company's overall financial performance, reflecting strong demand for their engineered solutions.

Groupe Sfpi generates significant revenue through the sale of building envelope solutions, primarily windows, blinds, and closures. This core business is managed by their MAC division, catering to the construction and renovation markets.

In 2024, the building sector experienced varied performance, influencing this revenue stream. Despite market fluctuations, these product sales continue to be a foundational element of Groupe Sfpi's income, demonstrating their established presence in the industry.

Services and Maintenance Contracts

Groupe SFPI's Services and Maintenance Contracts are a cornerstone for generating consistent, ongoing revenue. This stream includes income from installation services, crucial after-sales support, and proactive maintenance agreements. These offerings not only ensure customer satisfaction but also foster strong, long-term relationships, leading to increased loyalty and repeat business.

These recurring revenue streams are vital for financial stability and predictability. For instance, in 2023, the company reported that its maintenance and service contracts contributed significantly to its overall financial performance, highlighting their importance in the business model. This focus on service excellence helps differentiate Groupe SFPI in a competitive market.

- Recurring Revenue: Income from installation, after-sales support, and maintenance contracts.

- Customer Loyalty: Services strengthen customer relationships and encourage repeat business.

- Financial Stability: Contributes to predictable income streams.

- Market Differentiation: Service excellence sets Groupe SFPI apart from competitors.

International Sales and Exports

Groupe Sfpi is increasingly leveraging international sales and exports as a significant revenue driver. This strategic expansion is evident in their ambition to generate more than half of their total turnover from markets outside of France by the year 2025. This global push is a key component of their growth strategy.

The company's commitment to internationalization is supported by tangible actions and performance metrics. For instance, in 2024, Groupe Sfpi reported a notable increase in its international revenue share, demonstrating the effectiveness of its global market penetration efforts. This diversification of revenue streams helps to mitigate risks associated with reliance on a single domestic market.

- International Revenue Growth: A growing percentage of Groupe Sfpi's total revenue is now generated from sales in foreign markets.

- Strategic Global Expansion: The company actively seeks to broaden its presence and sales channels across various international territories.

- 2025 Turnover Target: Groupe Sfpi has set an ambitious goal to achieve over 50% of its annual turnover from outside France by 2025.

- Diversification Benefit: This international focus enhances financial resilience by reducing dependence on the French market alone.

Groupe SFPI's revenue streams are diverse, encompassing security and access control systems, specialized industrial equipment, and building envelope solutions. The company also benefits from recurring income through services and maintenance contracts, alongside a strategic focus on international sales and exports.

| Revenue Stream | Key Divisions/Products | 2024 Context/Growth Drivers |

|---|---|---|

| Security & Access Control | DOM Security: Locks, access systems, high-security doors | Growing demand for enhanced safety across sectors. |

| Industrial Equipment | NEU-JKF, MMD: Air treatment, ventilation, heat exchangers | Strong demand for engineered industrial solutions. |

| Building Envelope Solutions | MAC: Windows, blinds, closures | Catering to construction and renovation markets, influenced by sector performance. |

| Services & Maintenance Contracts | Installation, after-sales support, maintenance agreements | Contributes to financial stability and customer loyalty. |

| International Sales & Exports | Global market penetration | Targeting over 50% of turnover from outside France by 2025; notable revenue share increase in 2024. |

Business Model Canvas Data Sources

The Groupe SFPI Business Model Canvas is informed by a blend of internal financial reports, market intelligence gathered from industry analysts, and strategic assessments of competitive landscapes. These diverse data sources ensure a comprehensive and accurate representation of the company's operational and strategic framework.