Greif SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

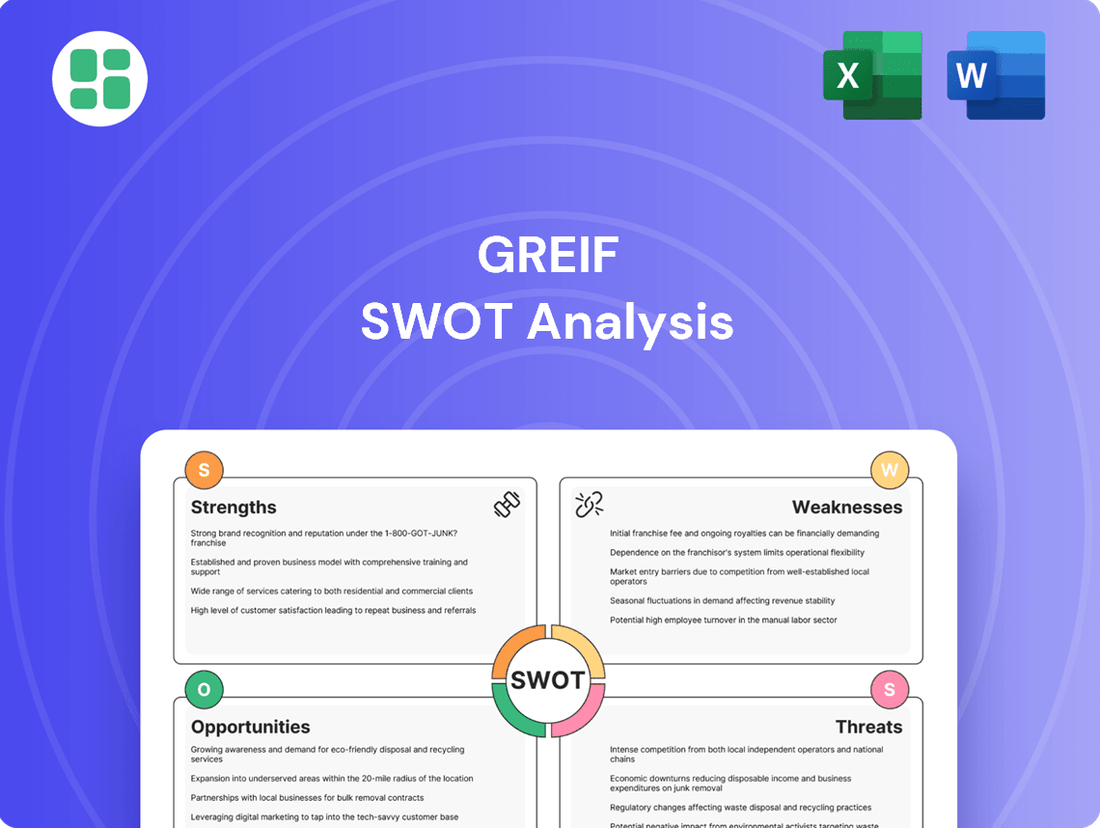

Grief's SWOT analysis reveals a company poised for growth, leveraging strong brand recognition and a diversified product portfolio. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for navigating future success.

Want the full story behind Grief's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Greif, Inc. stands as a titan in the industrial packaging sector, boasting a commanding global presence across more than 35 countries and operating over 250 facilities. This extensive reach, as of early 2024, allows them to effectively serve a broad international customer base.

The company's strength lies in its remarkably diverse product portfolio, encompassing steel, plastic, and fiber drums, along with intermediate bulk containers (IBCs), flexible packaging, and corrugated containers. This wide array of solutions ensures Greif can cater to a multitude of industry needs, from automotive to food and beverage.

This broad product offering and expansive geographic footprint provide Greif with a significant competitive edge. It enables the company to mitigate risks by not being overly dependent on any single product line or market, fostering resilience and sustained market leadership.

Greif's dedication to sustainability and circularity is a significant strength, underscored by its 2024 Sustainability Report. The company achieved an impressive 87% waste diversion from landfills and boosted its use of post-consumer resin (PCR) by 37% in 2024.

These achievements reflect a deep commitment to environmental stewardship. This focus on ESG principles not only strengthens Greif's brand image but also resonates with a growing segment of environmentally aware consumers and investors.

Greif's commitment to exceptional customer service is a significant strength, highlighted by an industry-leading Net Promoter Score (NPS) of 70 achieved in 2024. This score underscores a deep understanding of customer needs and a dedication to exceeding expectations.

The company's strategic investment in digital transformation, exemplified by the 2024 launch of the Greif+ platform, further amplifies this strength. Greif+ offers customers real-time order visibility and 24/7 accessibility, streamlining interactions and enhancing overall client experience.

This dual focus on legendary service and cutting-edge digital solutions not only strengthens existing client relationships but also positions Greif for greater operational efficiency and market competitiveness.

Strategic Acquisitions and Portfolio Optimization

Greif's strategic acquisitions are a key strength, notably the March 2024 purchase of Ipackchem. This move significantly bolstered its position in high-performance small plastic products and expanded its reconditioning capabilities, aligning with a push towards higher-growth, higher-margin polymer-based solutions.

These acquisitions are instrumental in optimizing Greif's overall portfolio. By integrating companies like Ipackchem, Greif actively shifts its business mix towards more specialized and profitable segments, enhancing its resilience and ability to capture value in evolving markets.

- Strategic Acquisitions: The acquisition of Ipackchem in March 2024 is a prime example, expanding Greif's footprint in niche polymer packaging.

- Portfolio Enhancement: This strategy focuses on developing higher-growth, higher-margin solutions, particularly within the polymer product sector.

- Market Adaptation: By strategically acquiring and integrating businesses, Greif demonstrates an ability to adapt to changing customer needs and industry trends.

Proactive Cost Optimization and Operational Efficiency

Greif's commitment to proactive cost optimization is a significant strength. The company launched a substantial $100 million cost optimization program, slated for completion by the end of fiscal year 2027. This initiative is strategically focused on streamlining Selling, General, and Administrative (SG&A) expenses, optimizing its supply chain network, and driving overall operational efficiency.

Further bolstering its operational framework, Greif has embarked on a business model optimization project. This involves a strategic reorganization into four distinct reportable segments. This restructuring is designed to capitalize on and amplify its core competitive advantages, leading to more focused execution and resource allocation.

- Cost Optimization Program: Targeting $100 million in savings by FY2027.

- SG&A Rationalization: Reducing overhead and administrative costs.

- Network Optimization: Enhancing supply chain efficiency and logistics.

- Business Model Restructuring: Reorganizing into four reportable segments for improved leverage of competitive strengths.

Greif's diversified product portfolio, spanning steel, plastic, and fiber drums, along with IBCs and corrugated containers, provides a robust foundation for serving a wide array of industries. This breadth of offerings, combined with a significant global footprint across over 250 facilities in more than 35 countries as of early 2024, mitigates reliance on any single market or product line, ensuring resilience.

The company's commitment to sustainability is a notable strength, evidenced by its 2024 achievements of 87% waste diversion from landfills and a 37% increase in post-consumer resin (PCR) usage. This focus not only enhances brand reputation but also appeals to environmentally conscious stakeholders.

Greif's strategic acquisitions, such as the March 2024 purchase of Ipackchem, are instrumental in expanding its presence in high-growth polymer packaging segments and strengthening its reconditioning capabilities. This proactive portfolio enhancement strategy aims to capture value in specialized, higher-margin markets.

Furthermore, Greif's $100 million cost optimization program, targeting completion by FY2027, coupled with a business model restructuring into four reportable segments, underscores a commitment to operational efficiency and leveraging core competitive advantages.

| Strength Category | Key Initiative/Metric | Data Point | Impact |

| Product & Geographic Diversification | Global Facilities | 250+ (as of early 2024) | Reduced market/product dependency, enhanced resilience |

| Sustainability | Waste Diversion Rate | 87% (2024) | Improved environmental profile, brand appeal |

| Sustainability | Post-Consumer Resin (PCR) Usage Increase | 37% (2024) | Supports circular economy goals, meets customer demand |

| Strategic Acquisitions | Ipackchem Acquisition | March 2024 | Expanded polymer packaging presence, enhanced reconditioning |

| Operational Efficiency | Cost Optimization Program | $100 million target by FY2027 | Streamlined operations, improved profitability |

What is included in the product

Delivers a strategic overview of Greif’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic planning by offering a clear, actionable framework for identifying and addressing core business challenges.

Weaknesses

Greif experienced a noticeable downturn in its financial results for fiscal year 2024. The company reported a significant drop in both net income and adjusted EBITDA for the fourth quarter and the entire fiscal year when compared to 2023.

Specifically, net income for fiscal year 2024 saw a decrease of 27.0%, while adjusted EBITDA declined by 15.6%. These figures underscore the financial headwinds the company encountered, likely influenced by a prolonged period of industrial slowdown.

Greif's financial footing in fiscal year 2024 shows a notable increase in total debt, with its leverage ratio climbing to 3.53x, a significant jump from 2.2x in the preceding year. This heightened leverage suggests a greater reliance on borrowed funds.

Although Greif has undertaken divestitures with the stated goal of reducing debt, the current elevated debt levels present a potential constraint. This financial pressure could impact the company's capacity for future strategic investments and potentially increase its interest expense burden.

Greif's operations are significantly susceptible to downturns in the industrial sector. The company has experienced a substantial impact from a prolonged industrial contraction, which lasted for 25 months ending in November 2024. This economic slowdown has directly affected key business segments, leading to reduced volumes, particularly in areas like metals and containerboard.

The current economic climate creates uncertainty regarding Greif's prospects for near-term volume expansion. Management has noted that this industrial contraction is the most extended period of weakness the company has encountered.

Short-Term Headwinds from Restructuring and Divestments

Greif's strategic decision to close underperforming paperboard and containerboard facilities, alongside the planned divestment of its Containerboard business, is expected to create short-term headwinds. These operational shifts, while beneficial for long-term efficiency, will likely impact EBITDA in the near term due to closure costs and the complexities of operational adjustments. For instance, the company has been actively managing its manufacturing footprint, which can lead to temporary disruptions.

These transitions necessitate significant operational and financial adjustments. The company is navigating the costs associated with facility closures and the intricate processes of relocating production or streamlining existing operations. While these moves are designed to bolster future performance, they introduce immediate challenges that will need careful management throughout 2024 and into 2025.

- Facility Closures: Strategic closure of underperforming paperboard and containerboard production sites.

- Divestment Plans: Planned divestment of the Containerboard business unit.

- EBITDA Impact: Anticipated short-term negative impact on EBITDA due to restructuring costs.

- Operational Adjustments: Incurrence of costs related to production relocation and operational streamlining.

Competitive Market Share Position

Greif's competitive market share position presents a notable weakness. While a global leader, its overall company revenue growth in Q1 2025 lagged behind some rivals in its industry segment. This slower growth, coupled with a Q1 2025 market share of 4.66%, underscores the intense competition Greif faces.

The company operates within a highly competitive landscape where larger entities, such as International Paper, command a substantially greater market share. This dynamic indicates persistent pressure on Greif to not only retain but also expand its market standing against formidable competitors.

- Market Share: Greif held a 4.66% market share in Q1 2025.

- Competitor Dominance: International Paper possesses a significantly larger market share, highlighting competitive pressure.

- Growth Comparison: Greif's Q1 2025 revenue growth was slower than some key competitors in its sector.

Greif's financial performance in fiscal year 2024 was marked by a significant increase in total debt, pushing its leverage ratio to 3.53x from 2.2x in the prior year. This heightened debt level, despite divestiture efforts, could constrain future investments and increase interest expenses.

The company's operations are highly sensitive to industrial sector downturns, as evidenced by a 25-month industrial contraction ending November 2024, which directly impacted volumes in segments like metals and containerboard. This prolonged slowdown presents uncertainty for near-term volume growth.

Greif's strategic restructuring, including facility closures and the planned divestment of its Containerboard business, is expected to create short-term EBITDA headwinds due to restructuring costs and operational adjustments.

In Q1 2025, Greif's market share stood at 4.66%, lagging behind larger competitors like International Paper, indicating intense competition and slower revenue growth compared to some industry peers.

| Metric | FY 2023 | FY 2024 | Change |

|---|---|---|---|

| Net Income | $215.0M | $157.0M | -27.0% |

| Adjusted EBITDA | $780.0M | $658.0M | -15.6% |

| Total Debt | $1,760.0M | $2,350.0M | +33.5% |

| Leverage Ratio | 2.2x | 3.53x | +60.5% |

Same Document Delivered

Greif SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing a genuine excerpt from the complete Greif SWOT analysis. Purchase unlocks the entire in-depth version, giving you all the insights.

Opportunities

Greif's strategic focus on high-growth polymer-based solutions, bolstered by acquisitions like Ipackchem, presents a significant opportunity. These segments offer higher margins and are less susceptible to economic downturns.

The company is capitalizing on increasing demand in key sectors such as agrochemicals and food and beverage, where polymer packaging solutions are experiencing robust volume growth. This expansion into polymer-based products positions Greif to capture a larger share of a dynamic and expanding market.

Greif's commitment to digital transformation, exemplified by its Greif+ platform and the 2024 Business Modernization Program, offers a substantial opportunity to elevate customer experience and streamline operations. These investments are designed to embed advanced technologies, including AI, directly into manufacturing, promising a more agile and responsive business model.

By further embracing automation and digital solutions, Greif can unlock significant cost efficiencies and elevate product quality. This strategic push is anticipated to yield tangible benefits in operational performance and workplace safety, reinforcing its competitive edge in the packaging industry.

The escalating global appetite for packaging that is both sustainable and part of a circular economy offers a significant avenue for Greif's expansion. This trend is driven by consumer preferences and increasing regulatory pressures worldwide.

Greif's demonstrated success in diverting waste from landfills, its commitment to incorporating more post-consumer recycled (PCR) content, and its investments in renewable energy sources position it favorably to meet this burgeoning demand. For instance, in fiscal year 2023, Greif reported significant progress in its sustainability initiatives, including a 10% increase in PCR content across its rigid packaging portfolio.

By consistently advancing its development of environmentally sound materials and adopting circular manufacturing processes, Greif is well-positioned to not only attract new environmentally conscious clients but also to solidify its competitive standing in the packaging industry.

Debt Reduction and Financial Flexibility from Divestments

Greif's planned divestment of its Containerboard business for $1.8 billion, anticipated by the close of fiscal year 2025, presents a significant opportunity. This strategic sale is poised to substantially reduce the company's outstanding debt, thereby improving its overall financial health and flexibility. The anticipated reduction in leverage is a key benefit, directly impacting the company's risk profile and its capacity for future growth initiatives.

The proceeds from this divestment are projected to generate considerable annual interest savings, freeing up valuable capital. This financial maneuver is not merely about debt reduction; it's about strategically reallocating resources. The freed-up capital is earmarked for reinvestment into high-return opportunities that are more closely aligned with Greif's long-term 'Build to Last' strategic vision.

- $1.8 billion expected from Containerboard sale by end of FY2025.

- Significant reduction in pro forma leverage ratio.

- Anticipated substantial annual interest expense savings.

- Capital available for reinvestment in core, high-return initiatives.

Growth in Emerging Markets and Niche Sectors

Greif's strategic push into GDP-plus growth markets and its focus on higher-margin, value-added corrugated products within niche sectors present significant opportunities. This targeted approach allows the company to capitalize on expanding industrial activities globally.

The broader industrial packaging market is anticipated to experience robust expansion, with a projected compound annual growth rate (CAGR) of 5% between 2024 and 2034. This growth is fueled by escalating industrial output and increasing demand across various specialized industries.

- Targeted Market Expansion: Greif's strategy to grow in markets with GDP-plus growth rates offers a strong foundation for increased sales volume.

- Niche Sector Focus: Concentrating on value-added, higher-margin corrugated products in specialized segments allows for improved profitability and competitive differentiation.

- Market Growth Projections: The global industrial packaging market's expected 5% CAGR from 2024 to 2034 underscores the overall positive demand environment.

- Revenue Growth Potential: By effectively targeting these specific growth areas, Greif is well-positioned for sustained revenue enhancement and market share gains.

Greif's strategic expansion into polymer-based packaging, amplified by acquisitions, presents a significant opportunity for higher margins and resilience against economic downturns. The company is also benefiting from increased demand in sectors like agrochemicals and food and beverage, where its polymer solutions are seeing strong volume growth.

The company's investment in digital transformation, including its Greif+ platform and the 2024 Business Modernization Program, is set to enhance customer experience and operational efficiency through AI integration. This focus on automation and digital solutions is expected to drive cost savings and improve product quality.

The growing global demand for sustainable and circular economy-aligned packaging offers Greif a prime opportunity for expansion, driven by consumer preferences and regulatory pressures. Greif's progress in waste diversion, increased use of post-consumer recycled (PCR) content, and renewable energy investments position it well to meet this demand, with a 10% increase in PCR content reported in fiscal year 2023 for its rigid packaging.

The planned divestment of its Containerboard business for $1.8 billion by the end of fiscal year 2025 is a key opportunity to significantly reduce debt, improve its financial health, and free up capital for reinvestment in high-return initiatives aligned with its 'Build to Last' strategy. This move is projected to yield substantial annual interest savings.

Greif is also capitalizing on opportunities in GDP-plus growth markets and higher-margin corrugated products within niche sectors, aligning with the projected 5% CAGR of the industrial packaging market between 2024 and 2034. This targeted approach supports sustained revenue growth and market share gains.

| Opportunity Area | Key Drivers | Financial Impact/Data |

|---|---|---|

| Polymer Packaging Expansion | Higher margins, less economic sensitivity, demand in agrochemicals & F&B | Acquisition of Ipackchem |

| Digital Transformation | Enhanced customer experience, operational efficiency, AI integration | Greif+ platform, 2024 Business Modernization Program |

| Sustainability & Circular Economy | Consumer preference, regulatory pressure, waste diversion | 10% increase in PCR content (FY2023), renewable energy investments |

| Containerboard Divestment | Debt reduction, improved financial flexibility, capital reallocation | $1.8 billion sale by end of FY2025, substantial interest savings |

| Niche Market Growth | GDP-plus markets, value-added corrugated products | Industrial packaging market CAGR of 5% (2024-2034) |

Threats

Greif, like many in the industrial packaging sector, faces significant headwinds from fluctuating raw material costs. Increases in key inputs such as corrugated cardboard and petrochemical-based plastics were observed in the latter half of 2024, directly increasing Greif's production expenses. This volatility poses a persistent challenge to maintaining healthy profit margins and requires ongoing strategic management.

Greif operates within a highly competitive packaging industry, facing rivals ranging from large, integrated players to niche specialists. This crowded field means constant pressure on pricing, as the market is notably sensitive to fluctuations. For instance, in 2023, Greif reported net sales of $4.2 billion, a figure achieved amidst this intense rivalry, underscoring the challenge of maintaining margins and market share.

The need to stand out is paramount, pushing Greif to differentiate through product design, unwavering quality, and superior customer service. However, this competitive intensity often constrains the company's ability to fully leverage its pricing power. This dynamic directly impacts potential market share expansion, requiring strategic agility to navigate the crowded landscape effectively.

Greif faces a significant threat from a prolonged industrial economic downturn. The company experienced a 25-month industrial contraction through November 2024, directly impacting its volume growth and the demand for its packaging solutions.

This extended period of economic softness in crucial industrial sectors, such as manufacturing and construction, could further suppress Greif's sales volumes and negatively affect its financial performance in the coming periods.

Increasing Regulatory and Compliance Burdens

The packaging sector, including companies like Greif, is navigating a complex web of evolving regulations. New Extended Producer Responsibility (EPR) laws are being rolled out across North America and Europe, placing a greater onus on manufacturers for the end-of-life management of their products. For instance, California's SB 54, the Plastic Pollution Prevention and Packaging Producer Responsibility Act, enacted in 2022, aims to significantly reduce plastic waste by 2032, impacting packaging design and material choices.

These mounting compliance demands translate directly into increased operational costs. Companies must invest in new technologies for recycling, material innovation, and data tracking to meet stringent environmental standards. Failure to adapt can lead to fines and reputational damage, making continuous process and product adjustments a critical, albeit costly, necessity for market participation.

The financial implications are substantial. For example, the European Union's Packaging and Packaging Waste Regulation (PPWR) proposals, expected to be finalized in 2024, could mandate higher recycled content percentages and stricter labeling requirements, potentially increasing raw material costs and requiring significant capital expenditure for process upgrades.

- Evolving EPR Laws: Regions like California (SB 54) and the EU are implementing EPR, increasing manufacturer responsibility for product lifecycles.

- Increased Operational Costs: Compliance necessitates investment in new technologies, recycled materials, and data management systems.

- Stricter Environmental Standards: Regulations like the EU's PPWR proposals are pushing for higher recycled content and improved recyclability, impacting material sourcing and production.

Geopolitical Risks and Supply Chain Disruptions

Geopolitical tensions and ongoing supply chain fragilities present a significant threat to Greif's global operations. Events like the ongoing conflicts in Eastern Europe and the Middle East, coupled with trade disputes, can create unpredictable disruptions. For instance, in 2024, many manufacturers experienced extended lead times and increased freight costs due to these global instabilities, directly impacting inventory management and production schedules.

Greif's reliance on a vast international network for sourcing raw materials and distributing finished goods makes it particularly susceptible to these volatile conditions. The potential for new tariffs or trade barriers, such as those seen in past trade negotiations, could escalate costs for key inputs or restrict market access. In 2024, the average cost of shipping a container from Asia to Europe saw significant fluctuations, at times exceeding $5,000, a direct consequence of these geopolitical and logistical challenges.

- Supply Chain Volatility: Continued geopolitical instability in 2024 and early 2025 has led to increased shipping costs and longer delivery times for essential raw materials like steel and resins, impacting Greif's manufacturing efficiency.

- Trade Policy Risks: The threat of new tariffs or trade restrictions in key markets could directly increase the cost of goods sold or limit Greif's ability to compete by raising prices for its customers.

- Operational Disruptions: Events such as port congestion or regional conflicts can halt or delay shipments, forcing Greif to seek alternative, often more expensive, supply routes and logistics solutions.

Greif faces significant threats from escalating raw material costs, particularly for steel and resins, which saw notable price increases throughout 2024 impacting production expenses. Intense competition within the industrial packaging sector also constrains pricing power, as evidenced by Greif's $4.2 billion in net sales in 2023 amidst market pressures. Furthermore, a prolonged industrial economic downturn, with a 25-month contraction observed through November 2024, directly suppresses sales volumes and negatively affects financial performance.

| Threat Category | Specific Threat | Impact on Greif | 2024/2025 Data/Context |

|---|---|---|---|

| Economic Conditions | Industrial Downturn | Reduced demand for packaging, lower sales volumes. | 25-month industrial contraction through November 2024 impacted volume growth. |

| Competition | Intense Market Rivalry | Price pressure, limited ability to increase prices. | Net sales of $4.2 billion in 2023 achieved amidst high competition. |

| Input Costs | Raw Material Volatility | Increased production expenses, reduced profit margins. | Increases in steel and resins observed in late 2024. |

| Regulatory Environment | Evolving Environmental Regulations (EPR) | Increased operational costs for compliance, potential fines. | California's SB 54 (2022) and EU PPWR proposals (2024) mandate changes. |

| Geopolitics & Supply Chain | Global Instability & Disruptions | Higher freight costs, extended lead times, potential trade barriers. | Container shipping costs from Asia to Europe exceeded $5,000 at times in 2024. |

SWOT Analysis Data Sources

This Greif SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.