Greif Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

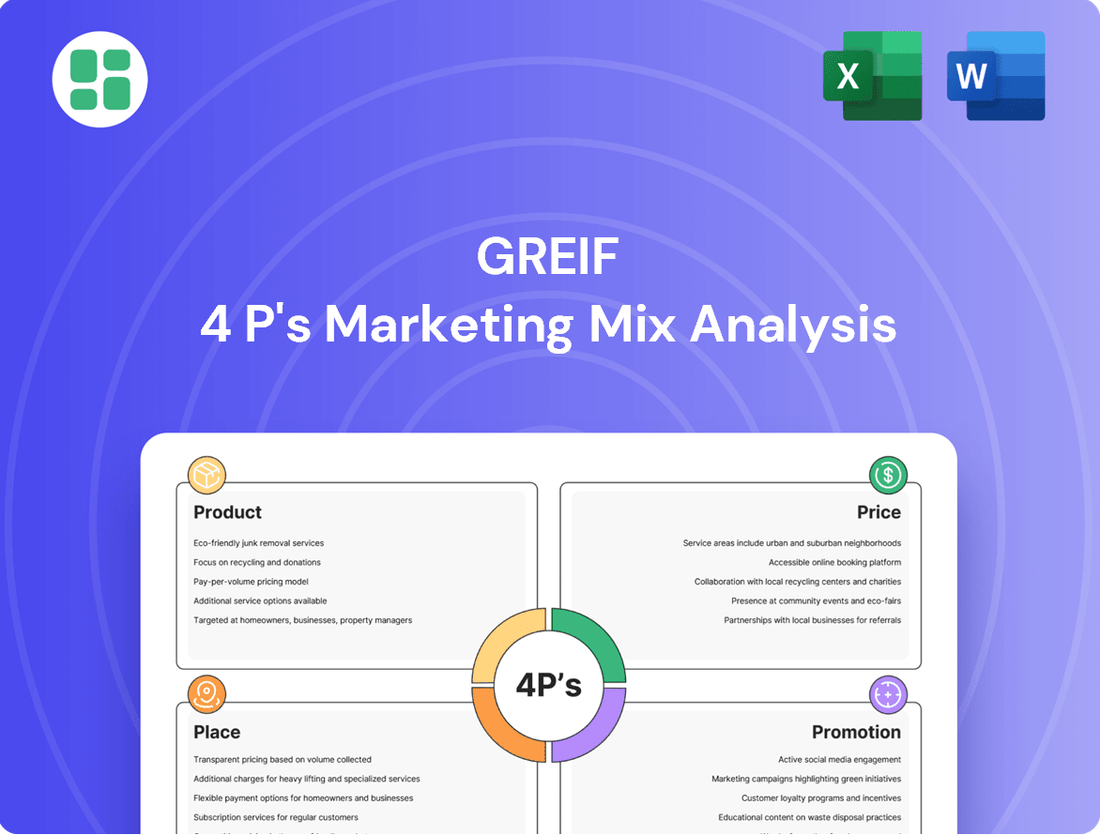

Greif's marketing success hinges on a carefully orchestrated blend of Product, Price, Place, and Promotion. Understanding how they innovate their industrial packaging solutions, price them competitively, distribute them globally, and promote their value proposition is key to grasping their market dominance. Dive deeper into these strategies to uncover the actionable insights that drive Greif's consistent performance.

Want to truly understand what makes Greif a leader in industrial packaging? Our full 4Ps Marketing Mix Analysis breaks down their product innovation, pricing strategies, extensive distribution networks, and impactful promotional campaigns. Get the complete picture to inform your own business strategies.

Product

Greif's diversified industrial packaging portfolio is a cornerstone of its market strategy, encompassing steel, plastic, and fiber drums, alongside intermediate bulk containers (IBCs) and jerrycans. This broad offering caters to critical sectors like chemicals, food and beverage, and pharmaceuticals, providing essential containment solutions. In fiscal year 2023, Greif's Packaging segment, which includes these products, generated approximately $4.7 billion in revenue, highlighting the scale and importance of this product mix.

Greif's customized packaging solutions are a cornerstone of their product strategy, offering tailored designs, features, and materials to precisely match customer needs. This adaptability is vital for tackling intricate industrial packaging requirements and boosting product value.

By integrating seamlessly into client operations, these bespoke solutions address specific challenges, demonstrating Greif's commitment to customer-centric innovation. Their introduction of the ModCan in 2024 exemplifies this focus on efficient, customer-driven packaging, a key differentiator in the market.

Greif is making significant strides in sustainable packaging, a key element of their product strategy. Their 2024 Sustainability Report showcases a remarkable 37% surge in post-consumer resin (PCR) usage, demonstrating a commitment to incorporating recycled materials.

The company's focus on circular manufacturing is evident in their 87% waste diversion rate from landfills. This commitment extends to product design, with an emphasis on reducing environmental impact throughout the packaging lifecycle.

Greif's Life Cycle Services program further reinforces their sustainable product offering by actively promoting the reconditioning and recycling of industrial containers, ensuring a more circular approach to packaging management.

Integrated Services and Solutions

Greif's "Integrated Services and Solutions" represent a significant evolution beyond traditional industrial packaging. These offerings encompass crucial services like filling, packaging, reconditioning, logistics, and warehousing, providing customers with a truly end-to-end solution. This holistic approach is designed to streamline customer supply chains and boost their operational efficiency, a key differentiator in the market.

The company's strategic realignment, effective in 2025, into material-based segments, notably including Integrated Solutions, underscores the growing importance of these value-added services. This move signals Greif's commitment to offering a comprehensive suite of capabilities that go far beyond the physical container itself, aiming to capture greater value and deepen customer relationships.

- Holistic Supply Chain Support: Greif offers filling, packaging, reconditioning, logistics, and warehousing.

- Customer Efficiency Focus: These services simplify supply chains and improve operational efficiencies for clients.

- Strategic Segmentation: The 2025 shift to include Integrated Solutions highlights the company's focus on these comprehensive offerings.

Strategic Portfolio Transformation

Greif's product strategy is undergoing a significant transformation, moving away from traditional segments like Containerboard, which is slated for divestiture in 2025. This strategic pivot is designed to streamline operations and concentrate on more lucrative markets.

The company is actively investing in and expanding into new areas such as Customized Polymer Solutions and Durable Metal Solutions. This includes the impactful acquisition of Ipackchem in 2024, a move that significantly bolsters Greif's capabilities in the polymer packaging sector.

This portfolio reshaping is driven by a clear objective: to capture higher-growth, higher-margin opportunities. By divesting non-core assets and acquiring strategic businesses, Greif aims to leverage its global manufacturing footprint more effectively.

- Divestiture: Containerboard operations and timberlands are planned for divestiture in 2025.

- Acquisition: Ipackchem acquisition in 2024 strengthens polymer solutions.

- Focus Areas: Growth in Customized Polymer Solutions and Durable Metal Solutions.

- Strategic Goal: Enhance efficiency and target higher-margin business segments.

Greif's product strategy centers on a diversified yet increasingly specialized portfolio of industrial packaging. This includes steel, plastic, and fiber drums, along with IBCs and jerrycans, serving essential industries. The company is actively reshaping this by divesting non-core assets like Containerboard in 2025 and acquiring strategic businesses, such as Ipackchem in 2024, to bolster its polymer solutions.

This strategic pivot aims to concentrate on higher-growth, higher-margin segments like Customized Polymer Solutions and Durable Metal Solutions. Greif also emphasizes sustainable packaging, evidenced by a 37% increase in post-consumer resin (PCR) usage in 2024 and an 87% waste diversion rate.

Beyond physical packaging, Greif's "Integrated Services and Solutions," including filling, reconditioning, and logistics, are becoming a key differentiator. The company's 2025 realignment to include Integrated Solutions as a distinct segment underscores their commitment to offering end-to-end supply chain support.

| Product Category | Key Developments | Fiscal Year 2023 Revenue (Packaging Segment) |

|---|---|---|

| Steel, Plastic, Fiber Drums & IBCs | Core offerings serving chemicals, food & beverage, pharma. | ~$4.7 billion |

| Customized Polymer Solutions | Strengthened by Ipackchem acquisition (2024). | Included in Packaging Segment |

| Durable Metal Solutions | Growth focus area. | Included in Packaging Segment |

| Integrated Services & Solutions | Filling, packaging, reconditioning, logistics, warehousing. | Growing importance, recognized in 2025 segmentation. |

What is included in the product

This analysis offers a comprehensive examination of Greif's Product, Price, Place, and Promotion strategies, providing actionable insights into their market positioning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic confusion.

Provides a clear framework for understanding and optimizing Greif's marketing efforts, reducing the burden of inefficient planning.

Place

Greif's extensive global manufacturing footprint, boasting over 250 facilities including 210 production sites in more than 35 countries, is a cornerstone of its marketing strategy. This vast network ensures immediate access to industrial packaging solutions for its multinational clientele across the globe.

The strategic positioning of these numerous plants significantly optimizes supply chain logistics, thereby shortening delivery times and effectively catering to localized market needs. For instance, in 2023, Greif's operational efficiency was bolstered by this widespread presence, allowing for responsive service delivery.

Greif primarily employs a direct sales strategy, focusing on building strong relationships with major industrial clients and key accounts. This business-to-business model is crucial for understanding and fulfilling the unique needs of these significant customers, fostering loyalty and enabling tailored solutions.

Dedicated account management teams are the backbone of this approach, offering personalized support from initial engagement through ongoing service. This ensures that complex industrial requirements are consistently met, reinforcing Greif's commitment to customer satisfaction and long-term partnerships.

Greif strategically enhances its physical presence and operational capacity through targeted acquisitions and new facility developments. In 2024, the company expanded its reconditioning network, a key component of its circular economy approach. This move, alongside the 2023 launch of a new bulk corrugated facility in Dallas, Texas, underscores Greif's commitment to bolstering its manufacturing and distribution footprint to better serve evolving customer needs and optimize supply chain efficiency.

Efficient Supply Chain and Logistics Management

Greif's commitment to efficient supply chain and logistics management is central to its marketing mix, ensuring its packaging products reach customers reliably and affordably. This focus translates into meticulous inventory control and strategically optimized transportation routes, minimizing lead times and costs. For instance, in 2023, Greif reported significant investments in logistics technology aimed at enhancing visibility and efficiency across its global network.

The company leverages advanced planning systems and data analytics to manage its complex supply chain effectively. This technological integration supports timely delivery and helps mitigate potential disruptions, crucial for maintaining customer trust in the industrial packaging sector. Greif's operational excellence is directly tied to its ability to deliver products when and where needed.

- Global Reach: Greif operates a vast network of manufacturing facilities and distribution centers worldwide, enabling localized production and delivery.

- Technology Integration: Investments in supply chain software and automation in 2024 aim to further streamline operations and improve forecasting accuracy.

- Customer Focus: Efficient logistics directly contribute to customer satisfaction by ensuring product availability and on-time delivery, a key differentiator in the market.

- Cost Optimization: By optimizing transportation and inventory, Greif aims to maintain competitive pricing for its packaging solutions.

Digital Engagement and Customer Access

Greif, while predominantly a business-to-business (B2B) enterprise, actively cultivates digital engagement to enhance customer access and convenience. Their robust online platform, Greif+, serves as a central hub, offering clients comprehensive product details, service information, and crucial sustainability reports. This digital infrastructure is designed to streamline communication and provide easy access to vital resources for their industrial clientele, reflecting a commitment to modern business interactions and efficient service delivery.

The company's digital presence is a key component in its marketing mix, particularly within the 'Place' or distribution aspect. By offering digital channels for information and potentially order management, Greif caters to the evolving needs of its customers who expect seamless digital experiences. This focus supports efficient service delivery and reinforces Greif's position as a reliable partner in the industrial packaging sector.

- Website Accessibility: Greif+ offers 24/7 access to product catalogs, technical specifications, and company news, facilitating informed decision-making for customers.

- Customer Support Channels: Beyond the website, Greif likely utilizes digital tools for customer service inquiries, order tracking, and technical assistance, improving response times.

- Sustainability Reporting: The digital availability of sustainability reports underscores Greif's commitment to transparency and allows stakeholders to easily access ESG (Environmental, Social, and Governance) performance data.

- Digital Order Management: While specific details may vary, the trend in B2B is towards digital platforms for order placement and management, which Greif is likely leveraging to enhance operational efficiency and customer satisfaction.

Greif's physical presence as a key element of its 'Place' strategy is defined by its extensive global manufacturing and distribution network. With over 250 facilities worldwide, including 210 production sites across more than 35 countries, the company ensures proximity to its industrial customer base. This expansive footprint, bolstered by strategic acquisitions and facility expansions like the 2023 Dallas corrugated plant and 2024 reconditioning network enhancements, allows for localized production and efficient supply chain management, minimizing lead times and costs for clients.

| Metric | 2023 Data | 2024 Outlook/Activity |

|---|---|---|

| Total Facilities | 250+ | Continued strategic expansion |

| Production Sites | 210+ | Operating in 35+ countries |

| Key Expansion 2023 | New bulk corrugated facility in Dallas, Texas | |

| Key Expansion 2024 | Expansion of reconditioning network |

Same Document Delivered

Greif 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Greif 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion, offering deep insights into their strategic approach. You can confidently assess the quality and content before making your decision.

Promotion

Greif's promotional strategy is deeply rooted in targeted business-to-business (B2B) marketing, eschewing broad consumer advertising for a focused approach on industrial sectors. Their communication emphasizes critical factors for industrial buyers, such as product reliability and detailed technical specifications, showcasing the tangible value Greif offers to these clients.

This B2B focus translates into direct engagement with procurement teams and key decision-makers within large enterprises, ensuring their message resonates with those who influence purchasing. For instance, Greif's 2024 investor presentations consistently highlight their strong relationships with major industrial clients across various sectors, underscoring the effectiveness of this targeted approach.

Greif's promotion heavily features its commitment to sustainability, highlighted in its annual Sustainability Reports. The 16th such report was published in April 2025, detailing progress in circular economy initiatives, climate change mitigation, and social responsibility. This focus resonates with clients and stakeholders prioritizing environmental stewardship.

Further bolstering its promotional efforts, Greif's inclusion on prestigious lists like the Clean200 underscores its leadership in sustainable business practices. This recognition serves as a powerful testament to their dedication, attracting a segment of the market increasingly driven by ESG (Environmental, Social, and Governance) performance.

Greif's promotional strategy heavily leverages industry events and a strong digital footprint. Their participation in key trade shows, such as the upcoming 2025 FachPack, allows them to directly showcase innovations like their modular packaging solutions (ModCan) and foster vital client relationships. This hands-on approach is crucial for demonstrating the tangible benefits of their products.

Complementing their in-person engagement, Greif maintains a comprehensive digital presence. Their corporate website serves as a central hub for information, while regular press releases ensure timely dissemination of news and product updates. Professional social media channels, particularly LinkedIn, are actively used to highlight technological advancements and engage with a broad spectrum of industry professionals and potential clients.

Investor Relations and Corporate Communications

Greif actively engages with investors and the financial community through various channels to communicate its strategic vision and financial health. This includes investor days, quarterly earnings calls, and timely press releases, ensuring that stakeholders like analysts and individual investors are well-informed about the company's progress and future outlook.

These communications are vital for demonstrating Greif's market position, growth strategies, and financial performance, thereby fostering trust and confidence among its financially-literate audience. For instance, in its fiscal year 2023 earnings, Greif reported net sales of $5.4 billion, highlighting its substantial market presence and operational scale.

- Investor Days: Providing in-depth strategic updates and outlooks.

- Earnings Calls: Discussing financial results and answering analyst questions.

- Press Releases: Announcing significant corporate developments and financial performance.

- Transparency: Building credibility and investor confidence through open communication.

Customer-Centric Approach and Awards Recognition

Greif's promotional strategy is deeply rooted in a customer-centric philosophy, striving for exceptional service that resonates with their clientele. This dedication is clearly reflected in their impressive Net Promoter Score (NPS) of 70 achieved in 2024, a significant indicator of customer loyalty and satisfaction.

Further validating their commitment to excellence, Greif has garnered prestigious awards. These include the Gallup Exceptional Workplace Award and the Stevie Award for business excellence, underscoring their operational quality and unwavering focus on customer needs.

- Customer-Centric Focus: Greif prioritizes legendary customer service in all its promotional efforts.

- 2024 NPS: Achieved a world-class Net Promoter Score of 70 in 2024.

- Award Recognition: Honored with the Gallup Exceptional Workplace Award and the Stevie Award for business excellence.

- Brand Reinforcement: These accolades serve as strong testimonials to their commitment to quality and customer satisfaction.

Greif's promotional approach is highly targeted, focusing on industrial sectors and emphasizing product reliability and technical details. This B2B strategy is supported by strong client relationships, as evidenced by their 2023 net sales of $5.4 billion, demonstrating significant market presence.

Sustainability is a key promotional pillar, with their 16th Sustainability Report released in April 2025 highlighting circular economy and climate initiatives. Recognition on lists like the Clean200 further amplifies this message, appealing to ESG-conscious stakeholders.

Active participation in industry events like FachPack 2025 and a robust digital presence, including their corporate website and LinkedIn, are crucial for showcasing innovations and engaging with professionals. Investor communications, including earnings calls and press releases, ensure transparency and build confidence with the financial community.

Greif's commitment to customer service is a significant promotional asset, reflected in their 2024 Net Promoter Score of 70 and awards such as the Gallup Exceptional Workplace Award. These achievements reinforce their brand as a leader in quality and customer satisfaction.

Price

Greif's value-based pricing for industrial applications centers on the tangible benefits clients receive, such as enhanced product protection and reduced transportation costs. For instance, their advanced steel drums can significantly lower damage rates in transit, a key value proposition for chemical and industrial goods manufacturers. This approach means pricing reflects the total economic advantage, not just the manufacturing cost.

Greif's pricing strategy is deeply intertwined with the cost of essential raw materials like steel, plastic resins, and pulp. These input costs directly influence the final price of their diverse product range, from industrial packaging to paperboard solutions.

In 2024, Greif demonstrated this dynamic by implementing price increases on products such as tubes and cores. This move was a direct response to the escalating expenses associated with these key raw materials, aiming to protect the company's profitability.

The company's agility in adjusting prices is paramount. For instance, in Q1 2024, Greif reported that higher raw material costs, particularly for steel and resin, had a notable impact on their Industrial Packaging segment, underscoring the need for responsive pricing to maintain healthy margins in a fluctuating market.

Greif's strategic cost optimization program, aiming for at least $100 million in reductions from a 2024 baseline by fiscal year 2027, directly impacts its pricing strategy. This aggressive cost management enhances profitability and provides greater agility in setting competitive prices for its diverse product offerings.

By focusing on operational efficiencies and expense control, Greif strengthens its market position. These efforts are crucial for maintaining a competitive edge, especially in a market where cost-effectiveness is a key differentiator for customers seeking reliable packaging solutions.

Long-Term Contracts and Volume Agreements

Greif leverages long-term contracts and volume agreements as a cornerstone of its B2B strategy. These arrangements offer significant advantages, ensuring consistent demand and predictable revenue streams. For instance, many of Greif's major customers commit to multi-year supply agreements, often tied to specific production volumes.

These contracts frequently incorporate volume-based pricing structures, where larger commitments translate into more favorable pricing for the client. This incentivizes customers to consolidate their packaging needs with Greif, fostering loyalty and reducing the churn typically seen in more transactional B2B relationships. This approach is crucial for securing substantial orders and building robust, long-lasting partnerships within the industrial packaging sector.

- Secured Revenue: Long-term contracts provide a stable revenue base, insulating Greif from short-term market fluctuations.

- Volume Discounts: Agreements often include tiered pricing, rewarding higher purchase volumes and enhancing customer commitment.

- Predictable Demand: These contracts allow for better production planning and inventory management, optimizing operational efficiency.

- Customer Loyalty: The strategic nature of these agreements fosters strong, enduring relationships with key industrial clients.

Portfolio Optimization and Capital Allocation Impact

Greif's strategic divestitures, including the planned sale of its Containerboard business and timberlands in 2025, are pivotal for optimizing capital allocation. This move is projected to significantly reduce debt, thereby strengthening the company's financial foundation.

This financial discipline directly supports the 'Build to Last' strategy by fostering profitable growth and enhancing resilience. The resulting improved financial health could enable more competitive pricing or strategic investments in higher-margin product lines.

- Divestiture Impact: Greif anticipates substantial debt reduction through the 2025 sales.

- Capital Allocation: Funds freed up will be strategically reinvested for growth.

- Strategic Alignment: These actions reinforce the 'Build to Last' commitment to profitable expansion.

Greif's pricing strategy is rooted in value-based principles, reflecting the tangible benefits clients gain, such as improved product protection and reduced shipping expenses. This approach ensures pricing aligns with the overall economic advantage delivered, rather than solely manufacturing costs. For instance, their advanced steel drums can significantly lower damage rates in transit, a key value proposition for chemical and industrial goods manufacturers.

The company's pricing is directly influenced by the cost of key raw materials like steel, plastic resins, and pulp, with fluctuations in these inputs impacting the final price of their diverse packaging solutions. In 2024, Greif implemented price increases on products like tubes and cores, a direct consequence of rising expenses for these essential components. This responsiveness is crucial for maintaining profitability, as seen in Q1 2024 when higher raw material costs notably affected their Industrial Packaging segment.

Greif's commitment to cost optimization, targeting at least $100 million in reductions from a 2024 baseline by fiscal year 2027, directly supports its pricing flexibility. This focus on operational efficiencies and expense control strengthens their market position and enables competitive pricing, particularly in a market where cost-effectiveness is a key customer consideration.

Long-term contracts and volume agreements are central to Greif's B2B strategy, providing a stable revenue base and predictable demand. These agreements often feature volume-based pricing, incentivizing larger customer commitments and fostering loyalty. For example, many of Greif's major clients engage in multi-year supply agreements, often tied to specific production volumes, which allows for better production planning and inventory management.

Greif's strategic divestitures, including the planned sale of its Containerboard business and timberlands in 2025, are designed to optimize capital allocation and significantly reduce debt, thereby strengthening the company's financial foundation. This financial discipline is integral to their 'Build to Last' strategy, aiming to foster profitable growth and enhance resilience, which could translate into more competitive pricing or strategic investments in higher-margin product lines.

4P's Marketing Mix Analysis Data Sources

Our Greif 4P's Marketing Mix Analysis is constructed using a comprehensive blend of primary and secondary data. We leverage official Greif investor relations reports, annual filings, and company press releases to understand their product portfolio, pricing strategies, and distribution networks. Additionally, we incorporate insights from industry analysis reports and competitor benchmarking to provide a robust view of their promotional activities and market positioning.