Greif PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

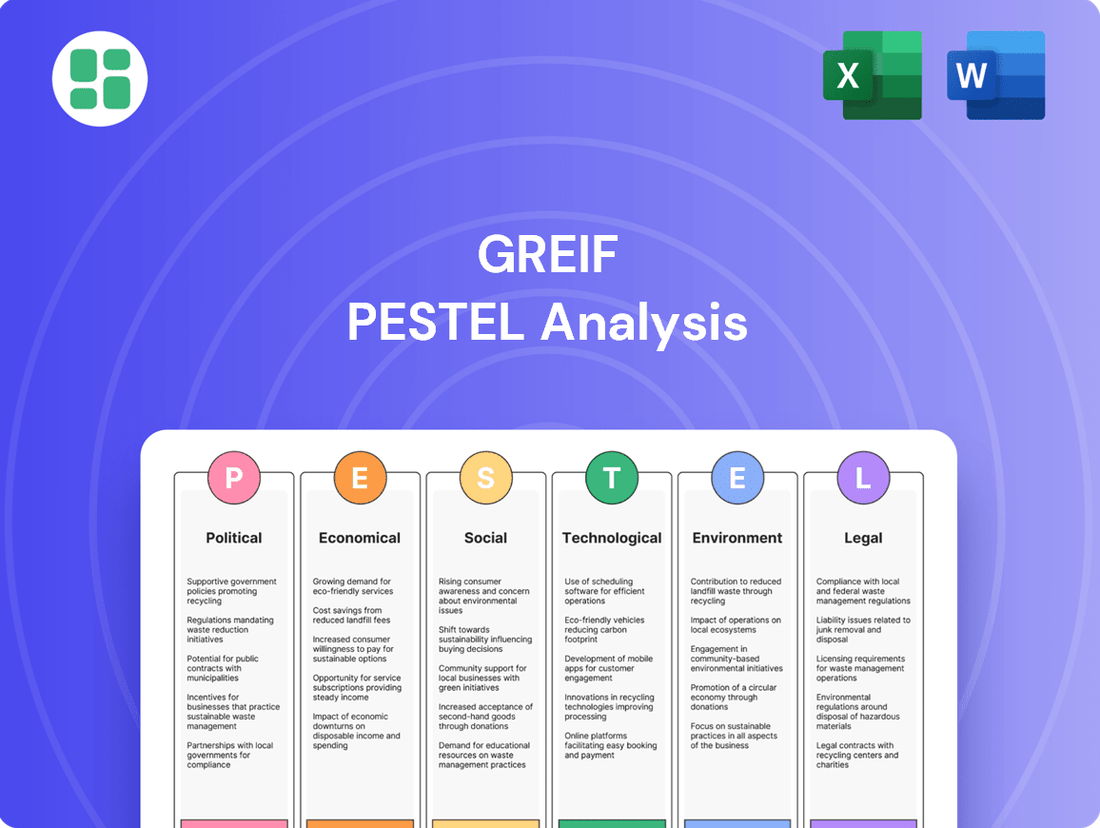

Unlock Greif's strategic landscape with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are directly impacting their operations and future growth. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full analysis now and gain a decisive advantage.

Political factors

Global trade policies, particularly tariffs on essential raw materials such as steel and aluminum, directly influence Greif's operational costs and the resilience of its supply chains. For instance, the US imposed tariffs on steel and aluminum imports in 2018, which, despite some adjustments, continued to affect material sourcing costs for many manufacturers throughout 2024 and into early 2025.

These trade measures can translate into higher prices for packaging components, potentially squeezing profit margins for companies like Greif. Navigating this dynamic trade landscape is crucial for Greif, a global entity, to ensure it can maintain competitive pricing for its products and secure reliable access to necessary materials.

Governments globally are tightening rules on packaging waste, with key initiatives like Extended Producer Responsibility (EPR) and the EU's Packaging and Packaging Waste Regulation (PPWR) taking center stage. These regulations, with substantial changes expected from 2025 onward, are pushing for higher recycling rates, more recycled materials in products, and a general reduction in packaging overall.

For companies like Greif, this means a necessary pivot in how products are designed and where materials are sourced to meet these new legal demands. Adapting to these evolving laws will likely require considerable investment and adjustments to current operational practices.

Geopolitical tensions, such as ongoing conflicts and trade disputes, directly impact global supply chains, influencing raw material availability and energy costs. For Greif, a company with operations in over 35 countries, political stability in its operating regions is paramount for maintaining consistent manufacturing and distribution networks.

The trend of reshoring supply chains to mitigate geopolitical risks presents a dual-edged sword for industrial players like Greif. While it can create new domestic production opportunities, it also necessitates adaptation to evolving trade policies and regional economic dynamics, potentially impacting cost structures and market access.

Government Incentives for Sustainable Practices

Governments worldwide are increasingly using financial levers to promote environmental responsibility. For instance, the European Union's Green Deal aims to mobilize significant investment in sustainable solutions, with specific programs supporting circular economy initiatives. These initiatives can translate into direct benefits for companies like Greif, potentially lowering the cost of adopting greener technologies.

These political measures can significantly influence Greif's strategic investment decisions. By offering tax credits or grants for adopting recycled content or developing advanced recycling capabilities, governments make these ventures more financially attractive. For example, a tax credit on capital expenditure for new recycling equipment could directly improve the return on investment for such projects, aligning with Greif's stated commitment to environmental, social, and governance (ESG) principles.

- Government Support for Circular Economy: Many nations are enacting policies to boost the circular economy, which can include subsidies for companies that reuse or recycle materials, directly benefiting Greif's industrial packaging solutions.

- Tax Incentives for Sustainable Packaging: Tax benefits are being offered for the use of recycled content and the development of biodegradable or easily recyclable packaging, encouraging Greif to further invest in these areas.

- Investment in Recycling Infrastructure: Public funding for advanced recycling technologies and collection infrastructure can reduce operational costs and increase the availability of high-quality recycled materials for Greif's production.

Anti-Dumping and Competition Laws

Changes in anti-dumping duties and competition laws across key markets significantly impact Greif's operating environment. For instance, the European Union's ongoing scrutiny of state aid and potential anti-dumping measures on imported steel packaging could affect raw material costs for Greif's rigid containers. Similarly, shifts in antitrust regulations, such as those focusing on market dominance in the industrial packaging sector, could influence acquisition strategies or pricing power.

These legal frameworks are designed to foster fair play, but their enforcement can create both hurdles and openings. Greif's proactive engagement with these evolving regulations is crucial. For example, in 2024, several countries updated their competition laws to address digital platforms, which, while not directly related to packaging, signals a broader trend of increased regulatory oversight that could extend to industrial supply chains. Staying compliant is essential to prevent legal repercussions and maintain access to vital markets.

- Monitoring anti-dumping duties: Greif needs to track changes in duties on steel and aluminum, key inputs for its products, which can vary significantly by region.

- Adherence to competition laws: Compliance with antitrust regulations in major markets like North America and Europe is vital to avoid fines and maintain market access.

- Impact on pricing and supply chains: Legal changes can influence raw material costs and the competitive landscape, affecting Greif's pricing strategies and supply chain stability.

Government support for the circular economy is a significant political factor, with many nations actively promoting recycling and the use of recycled materials. For instance, the EU's Green Deal, with substantial funding allocated, encourages initiatives that directly benefit companies like Greif in their adoption of sustainable practices.

Tax incentives for sustainable packaging are also on the rise, encouraging investment in recycled content and biodegradable materials. These financial benefits can improve the return on investment for Greif's environmental projects, aligning with ESG goals.

Public investment in recycling infrastructure is another key area, aiming to reduce operational costs and enhance the availability of quality recycled materials. This governmental push supports Greif's material sourcing strategies and operational efficiency.

Governmental policies also influence global trade, with tariffs on raw materials like steel and aluminum impacting Greif's costs. The US tariffs, for example, continued to affect sourcing costs for manufacturers into early 2025.

| Policy Area | Impact on Greif | Example/Data Point (2024-2025) |

|---|---|---|

| Circular Economy Support | Increased viability of recycled materials, potential cost reductions | EU Green Deal funding for circular initiatives |

| Tax Incentives (Sustainable Packaging) | Improved ROI for ESG investments, drive for innovation | Tax credits for recycled content adoption |

| Recycling Infrastructure Investment | Enhanced supply of recycled materials, operational efficiencies | Public funding for advanced recycling technologies |

| Trade Tariffs (Steel/Aluminum) | Increased raw material costs, supply chain pressure | Continued impact of 2018 US tariffs into 2025 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Greif, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Greif's operating landscape.

Provides a concise overview of the external factors impacting Greif, simplifying complex market dynamics for strategic decision-making.

Economic factors

The global economy's vitality and the pace of industrial production are key drivers for demand in industrial packaging. While the sector saw a rebound from 2022-2023 lows, projections for 2025 indicate continued, albeit uneven, growth. For instance, the IMF's April 2024 World Economic Outlook projected global growth at 3.2% for both 2024 and 2025, a slight uptick from previous years.

A robust industrial sector, bolstered by trends such as restocking cycles and the reshoring of manufacturing, typically correlates with increased demand for Greif's packaging solutions. This is because as factories ramp up production and supply chains become more localized, the need for secure and efficient packaging materials rises significantly.

Fluctuations in the prices of steel, plastic resins, and fiber directly affect Greif's cost of goods sold, impacting overall profitability. For instance, the average price of hot-rolled coil steel, a key input for steel drums, saw significant volatility throughout 2023 and into early 2024, influenced by global demand and production levels.

Inflationary pressures and ongoing global supply chain disruptions continue to create price volatility for these essential raw materials. In 2024, many industrial commodities experienced price swings, with some, like virgin plastic resins, facing upward pressure due to petrochemical market dynamics and energy costs.

Greif's ability to manage these raw material costs through strategic sourcing, hedging strategies, and securing long-term contracts is paramount for maintaining its competitive edge and profitability in the packaging industry.

High inflation, which saw the US CPI peak at 9.1% in June 2022, directly impacts Greif by increasing operational expenses like raw materials, labor, and logistics. For instance, the cost of steel, a key component for many of Greif's products, experienced significant volatility.

Rising interest rates, with the Federal Reserve Funds Rate reaching a target range of 5.25%-5.50% in July 2023, elevate Greif's borrowing costs for essential capital expenditures and potential acquisitions, thereby influencing profitability and investment strategies. This can make large-scale projects or mergers more expensive to finance.

However, the anticipated moderation of interest rate hikes throughout 2025, as projected by many economic forecasts, could provide a tailwind for industrial sectors like the one Greif operates in, potentially stimulating demand and improving the financial landscape for capital-intensive businesses.

Exchange Rate Fluctuations

Greif, as a global entity with extensive operations across numerous countries, faces inherent risks from exchange rate fluctuations. A strengthening US dollar, for instance, can price Greif’s exports higher in international markets, potentially dampening demand. Conversely, a weaker dollar can escalate the cost of imported raw materials, impacting production expenses.

Furthermore, when international earnings are repatriated, a weaker dollar diminishes their value when converted back into USD. This currency volatility directly influences Greif's financial performance and the predictability of its earnings. Effective currency risk management is therefore crucial for maintaining stable financial results and achieving strategic objectives.

- US Dollar Strength Impact: A stronger USD in 2024 and projected into 2025 can make Greif's products more expensive for overseas buyers.

- Raw Material Costs: Fluctuations in the USD against currencies of key raw material suppliers (e.g., for steel or pulp) directly affect Greif's input costs.

- International Earnings Conversion: For example, if Greif earns a significant portion of its revenue in Euros or Brazilian Reals, a depreciating Euro or Real against the USD in 2024 would reduce the USD value of those earnings.

- Hedging Strategies: Greif likely employs financial instruments to hedge against adverse currency movements, aiming to stabilize its reported financial results.

Consumer and Business Spending Power

The spending power of industrial customers and end-consumers directly impacts the demand for packaged goods, and consequently, for industrial packaging solutions like those offered by Greif. For instance, a robust economy in 2024, with projected GDP growth of around 2.5% in the US, generally translates to higher consumer spending and increased business investment, both of which boost demand for packaging.

Evolving consumer preferences, such as a growing willingness to pay a premium for sustainable products, are also shaping the industrial packaging market. Reports in late 2024 indicate that over 60% of consumers consider sustainability when making purchasing decisions, pushing companies like Greif to innovate in eco-friendly packaging materials and designs.

A sustained recovery in consumer and business confidence is crucial for supporting market demand for Greif's offerings. When confidence is high, businesses are more likely to expand production and consumers are more inclined to spend, creating a positive feedback loop for the packaging industry. For example, the Consumer Confidence Index in the US reached a strong reading of 105 in early 2024, signaling a healthy environment for spending.

- Consumer spending growth: Expected to remain positive throughout 2024, supporting demand for packaged goods.

- Business investment: Increased capital expenditure by businesses often leads to higher demand for industrial packaging.

- Sustainability premium: Consumers' willingness to pay more for eco-friendly packaging creates opportunities for Greif's sustainable product lines.

- Confidence indicators: High consumer and business confidence levels are a strong predictor of increased demand for packaging solutions.

Global economic growth directly influences demand for industrial packaging. The IMF projected global growth at 3.2% for both 2024 and 2025, indicating continued, albeit uneven, expansion. This growth underpins the need for robust industrial production and associated packaging needs.

Raw material costs, particularly for steel, plastic resins, and fiber, are critical to Greif's profitability. Steel prices, for example, showed volatility in 2023-2024 due to global demand shifts. Inflationary pressures in 2024 continued to impact commodity prices, with virgin plastic resins facing upward pressure from petrochemical market dynamics.

Interest rate environments affect Greif's borrowing costs for capital expenditures. The Federal Reserve Funds Rate reached 5.25%-5.50% in mid-2023, increasing financing expenses. However, anticipated moderation of rate hikes in 2025 could offer financial relief and stimulate industrial investment.

Currency exchange rate fluctuations pose risks to Greif's global operations. A strengthening US dollar can make exports more expensive, while a weaker dollar increases the cost of imported raw materials and reduces the value of repatriated foreign earnings.

Full Version Awaits

Greif PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Greif PESTLE analysis covers all key external factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape relevant to Greif.

The content and structure shown in the preview is the same document you’ll download after payment. Equip yourself with a thorough understanding of the external forces shaping Greif's industry and competitive environment.

Sociological factors

Societal pressure for eco-friendly options is escalating, with consumers actively seeking out brands committed to sustainability. Surveys in 2024 indicated that over 70% of consumers consider sustainability when making purchasing decisions, and a significant portion are willing to pay more for products with environmentally responsible packaging.

This growing demand directly influences Greif's product development, pushing for greater use of recycled materials and the creation of more easily recyclable or reusable packaging solutions. For instance, Greif reported a 5% increase in the use of recycled content in its steel drums during 2024, a direct response to market expectations.

Stakeholders, from investors to customers, are increasingly demanding that companies like Greif actively demonstrate corporate social responsibility. This translates into expectations for ethical sourcing, fair labor, community involvement, and clear reporting on environmental, social, and governance (ESG) efforts. Greif's 2024 Sustainability Report underscores its dedication to circular economy principles, climate change mitigation, and fostering colleague engagement.

The industrial and manufacturing sectors, including packaging, are grappling with persistent labor shortages for both skilled and unskilled positions. This ongoing challenge, particularly acute in 2024 and projected into 2025, is driving a greater need for investment in automation technologies and robust workforce development programs to maintain operational efficiency and fulfill production targets.

Greif's strategic emphasis on colleague engagement and its comprehensive Zero Harm safety program are critical in addressing the human capital aspect of these labor market dynamics. By prioritizing employee well-being and fostering a positive work environment, Greif aims to attract and retain talent, mitigating the impact of broader workforce development issues.

Shifting Consumer Lifestyles and E-commerce Growth

The surge in e-commerce, projected to reach $8.1 trillion globally by 2024, fundamentally alters consumer lifestyles and packaging demands. Consumers increasingly expect convenient, direct-to-door delivery, necessitating packaging that is not only robust enough for parcel transit but also adaptable and sustainable. Greif's ability to offer a range of solutions, from fiber drums to steel containers, positions it to meet these evolving requirements.

This shift means a greater need for packaging that can protect goods during individual shipments, often involving multiple handling points. For instance, the growth in online grocery delivery, a sector that saw significant expansion in 2023, highlights the demand for packaging that maintains product integrity and temperature control. Greif's focus on durable and protective packaging aligns with these consumer-driven trends.

- Global e-commerce sales are expected to grow by 8.8% in 2024.

- The demand for sustainable packaging solutions is increasing, with consumers willing to pay more for eco-friendly options.

- Direct-to-consumer (DTC) shipments require packaging designed for individual parcel delivery, emphasizing durability and protection.

- Greif's portfolio includes solutions suitable for a variety of e-commerce fulfillment needs, from consumer goods to industrial products.

Health and Safety Concerns

Public and regulatory scrutiny regarding the safety of packaging materials, especially for sensitive sectors like food and pharmaceuticals, is intensifying. Greif must consistently meet rigorous health and safety standards, ensuring its products are free from hazardous substances. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, impacting the types of materials permissible in packaging, with ongoing assessments of substances like bisphenol A (BPA) in food-contact materials.

Companies are increasingly expected to demonstrate a proactive approach to safety. Greif's commitment to robust safety programs and maintaining product integrity is not just a compliance issue but a critical factor in maintaining consumer trust and market access. In 2024, the global packaging market saw continued emphasis on sustainable and safe materials, with reports indicating a growing preference for recyclable and biodegradable options that also meet strict safety protocols.

- Evolving Regulations: Ongoing updates to chemical safety regulations globally, such as those from the FDA and EFSA, directly impact packaging material choices.

- Consumer Demand for Safety: Consumers are increasingly aware and concerned about potential health risks associated with packaging, driving demand for transparent and safe products.

- Industry Standards: Adherence to certifications like ISO 22000 for food safety management systems demonstrates a commitment to health and safety in the packaging supply chain.

- Product Integrity: Ensuring packaging protects contents from contamination and degradation is paramount, especially for pharmaceuticals and perishable food items.

Societal shifts toward sustainability and ethical consumption continue to shape consumer preferences, with a notable increase in demand for eco-friendly packaging solutions. By 2024, over 70% of consumers indicated that sustainability influences their purchasing decisions, and many are willing to pay a premium for products with environmentally responsible packaging. Greif responded by increasing recycled content in its steel drums by 5% in 2024.

The rise of e-commerce, projected to reach $8.1 trillion globally by 2024, necessitates packaging that is robust for parcel transit and adaptable for direct-to-door delivery. This trend, amplified by sectors like online grocery delivery, underscores the demand for packaging that maintains product integrity and protection. Greif's diverse product portfolio, including fiber and steel containers, is well-positioned to meet these evolving consumer-driven requirements.

Public and regulatory scrutiny regarding packaging safety, particularly for food and pharmaceuticals, is intensifying, with ongoing updates to chemical safety regulations like REACH. Companies are expected to proactively demonstrate safety and product integrity to maintain consumer trust and market access. In 2024, the packaging market saw continued emphasis on safe, recyclable, and biodegradable materials that adhere to strict safety protocols.

Technological factors

Advancements in automation and robotics are significantly reshaping manufacturing, particularly packaging lines. These technologies boost efficiency, precision, and speed, while simultaneously lowering reliance on manual labor and minimizing human error. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong trend towards automation.

Greif can capitalize on these innovations by integrating robots for critical tasks such as filling, sealing, labeling, and palletizing. This integration promises to streamline operations, enhance product quality consistency, and reduce operational costs. The company's strategic investments in both semi-automated and fully automated systems will be pivotal for maintaining and improving its competitive edge in the evolving industrial landscape.

The integration of the Internet of Things (IoT) and artificial intelligence (AI) into packaging is revolutionizing supply chain management. These smart technologies enable real-time tracking of product conditions, from temperature to humidity, offering predictive maintenance insights for sensitive goods. For instance, companies are increasingly using IoT-enabled packaging to monitor pharmaceutical shipments, ensuring they remain within strict temperature ranges, a critical factor for efficacy. This level of oversight not only enhances product integrity but also provides invaluable data for optimizing logistics and reducing waste.

Smart packaging solutions directly benefit Greif by offering enhanced traceability and improved inventory management for its clients. By embedding sensors, packaging can communicate its location and condition throughout transit, a significant advantage in complex global supply chains. This data can help prevent stockouts, reduce spoilage, and even combat the growing problem of product counterfeiting by providing a verifiable digital history. Greif's adoption of these technologies positions it to offer more sophisticated, data-driven packaging solutions that add tangible value beyond mere containment.

Developments in materials science are continuously introducing novel packaging solutions that are both more sustainable and offer enhanced performance. These innovations include lighter, stronger, and more environmentally friendly options, such as advanced biodegradable materials, increased use of post-consumer recycled (PCR) plastics, and cutting-edge fiber-based alternatives.

Greif's strategic focus on material innovation is evident in its increased integration of PCR content across its product lines. For instance, in fiscal year 2023, Greif reported a significant rise in its use of recycled content, underscoring its commitment to developing packaging solutions that meet growing market demands for circularity and reduced environmental impact.

Digital Transformation and Data Analytics

Digital transformation is fundamentally reshaping how companies like Greif operate. The integration of advanced data analytics and AI-powered systems, such as Enterprise Resource Planning (ERP), is becoming crucial for staying competitive. These technologies offer significant advantages in making smarter decisions, predicting demand more accurately, and optimizing everyday operations. For Greif, this means a more agile response to changing market needs and the ability to pinpoint and eliminate operational bottlenecks across its global footprint.

The benefits of embracing digital transformation are substantial. Companies leveraging data analytics can achieve greater efficiency and a clearer view of their entire supply chain. For instance, in 2024, many industrial manufacturers reported significant cost savings and improved delivery times by implementing AI-driven forecasting and real-time data monitoring. Greif can harness these capabilities to streamline its complex international operations, ensuring better resource allocation and enhanced customer service.

- Enhanced Decision-Making: AI and data analytics provide deeper insights for strategic planning and operational adjustments.

- Improved Demand Forecasting: Accurately predicting customer needs minimizes inventory costs and stockouts.

- Operational Optimization: Identifying and rectifying inefficiencies leads to cost reductions and faster processes.

- Supply Chain Visibility: Real-time tracking and analysis improve logistics and responsiveness.

Recycling Technologies and Infrastructure

Innovations in recycling technologies are significantly impacting the packaging industry. Advanced mechanical and chemical recycling methods are increasingly capable of handling diverse and complex packaging materials, which were previously difficult to process. This technological progress is crucial for creating a more circular economy.

The development of improved collection and sorting infrastructure is equally vital. Without efficient systems to gather and separate recyclable materials, even the most advanced technologies cannot be fully utilized. This infrastructure forms the backbone of successful recycling programs.

Greif's commitment to sustainability is evident in its operations. The company's Life Cycle Services actively work to divert waste from landfills and facilitate the collection of used containers. For instance, in 2023, Greif reported that its industrial packaging solutions achieved an average recycled content of 45% across its global operations, demonstrating a tangible contribution to resource recovery.

- Innovations: Advanced mechanical and chemical recycling enhance material processing capabilities.

- Infrastructure: Improved collection and sorting systems are essential for circularity.

- Greif's Contribution: Life Cycle Services focus on waste diversion and container collection.

- Recycled Content: Greif achieved 45% recycled content in its industrial packaging globally in 2023.

Technological advancements are rapidly transforming the packaging sector, driving both efficiency and sustainability. Innovations in automation, IoT, AI, and materials science are key drivers for companies like Greif. These technologies enable smarter operations, better product tracking, and the development of more eco-friendly packaging solutions.

The adoption of AI and data analytics is crucial for optimizing operations and improving decision-making. For instance, in 2024, many manufacturers saw significant cost savings by implementing AI-driven forecasting. Greif can leverage these tools for better resource allocation and enhanced customer service, improving its overall supply chain visibility and responsiveness.

Innovations in recycling technologies, coupled with improved collection and sorting infrastructure, are vital for a circular economy. Greif's commitment to sustainability is reflected in its use of recycled content, which reached 45% globally in its industrial packaging in 2023, demonstrating a strong focus on resource recovery.

| Technology Area | Key Impact | Greif's Opportunity/Action | 2023/2024 Data Point |

|---|---|---|---|

| Automation & Robotics | Increased efficiency, reduced labor costs, enhanced precision | Integrate robots for filling, sealing, labeling | Global industrial robotics market valued ~$50 billion in 2023 |

| IoT & AI | Real-time tracking, predictive maintenance, supply chain optimization | Offer smart packaging for traceability and inventory management | Increasing use of IoT for pharmaceutical shipment monitoring |

| Materials Science | Development of sustainable, high-performance materials | Increase use of PCR content and explore new fiber-based alternatives | Greif reported significant rise in PCR content in FY2023 |

| Digital Transformation | Improved decision-making, demand forecasting, operational efficiency | Implement advanced data analytics and AI-powered systems | Industrial manufacturers reported cost savings via AI forecasting in 2024 |

| Recycling Technologies | Enhanced processing of diverse packaging materials for circularity | Focus on waste diversion and container collection through Life Cycle Services | Greif achieved 45% recycled content in industrial packaging globally in 2023 |

Legal factors

The new EU Packaging and Packaging Waste Regulation (PPWR), set to take effect in February 2025, introduces rigorous mandates for packaging design, recyclability, recycled content, and reuse. This legislation will directly influence Greif's product development and manufacturing activities within its European markets.

Compliance necessitates meeting specific targets for recycled material inclusion in plastic packaging and adhering to limitations on the empty space within packaging. For instance, the PPWR mandates a minimum of 30% recycled content in plastic packaging by 2030.

Extended Producer Responsibility (EPR) laws are increasingly becoming a significant legal factor for companies like Greif. These regulations, adopted in numerous countries and several US states, place the onus of managing post-consumer packaging waste squarely on the producers. This means Greif is now responsible for the end-of-life management of its packaging products.

To comply, Greif must register with Producer Responsibility Organizations (PROs) and contribute financially to established recycling and waste management systems. For instance, in the European Union, where EPR is well-established, producers often pay fees based on the volume and type of packaging placed on the market, funding collection and recycling infrastructure. As of early 2024, many US states are also enacting or considering EPR legislation for packaging, with New York's Extended Producer Responsibility Act being a notable example.

These EPR schemes serve as a powerful incentive for Greif to innovate its packaging designs. The regulations encourage the development of packaging that is not only functional but also easily recyclable or reusable, thereby reducing the financial burden associated with waste management. This legal framework is driving a shift towards more sustainable packaging solutions across the industry.

Greif's operations are significantly impacted by product safety and hazardous substances regulations, particularly concerning packaging materials. For instance, upcoming regulations like the EU's Packaging and Packaging Waste Regulation (PPWR) will prohibit certain per- and polyfluoroalkyl substances (PFAS) in food packaging starting August 2026. This directly influences Greif's material sourcing and product development, requiring adherence to evolving safety standards to mitigate legal risks and ensure consumer protection.

Furthermore, existing restrictions on heavy metals in packaging remain a critical compliance area. Greif must continuously monitor and adapt its manufacturing processes and material choices to align with these stringent safety mandates, ensuring all products meet or exceed regulatory requirements across its global markets.

International Trade Laws and Customs Regulations

Greif's global operations necessitate strict adherence to a complex web of international trade laws and customs regulations. Beyond just tariffs, understanding and complying with these rules is paramount for the seamless movement of its packaging products across borders, preventing costly delays and penalties. For example, as of early 2024, the USMCA continues to facilitate trade among North American partners, offering reduced tariffs for qualifying goods, which directly impacts Greif's supply chain efficiency in the region.

Navigating these legal frameworks involves staying abreast of evolving import/export restrictions, product standards, and documentation requirements in each market. Failure to comply can lead to significant financial penalties and reputational damage. Greif's commitment to compliance ensures that its supply chain remains robust and its products reach customers without interruption. The World Trade Organization (WTO) agreements, for instance, set the foundational rules for global trade, influencing many national customs procedures that Greif must follow.

- Compliance with International Trade Laws: Greif must navigate diverse legal frameworks governing cross-border transactions for its packaging solutions.

- Customs Regulations and Import/Export Restrictions: Adherence to specific customs procedures and restrictions in each operating country is crucial to avoid penalties and ensure smooth logistics.

- Impact of Trade Agreements: Agreements like the USMCA (United States-Mexico-Canada Agreement) can offer preferential tariff treatment, impacting Greif's cost structure and market access.

- Global Supply Chain Integrity: Effective management of legal factors ensures the integrity and efficiency of Greif's international supply chain, supporting its worldwide customer base.

Competition and Anti-Trust Laws

Greif operates within a highly competitive global packaging industry, necessitating strict adherence to anti-trust and competition laws. These regulations are crucial to prevent monopolistic behaviors and ensure fair market practices, especially concerning acquisitions and market strategies. Failure to comply can result in significant fines and operational restrictions.

To navigate this complex legal landscape, Greif engages in regular legal reviews and robust compliance programs. These measures ensure that all business activities, from pricing strategies to potential mergers, align with global and regional competition frameworks. For instance, in 2024, regulatory bodies worldwide continued to scrutinize large-scale mergers in manufacturing sectors, highlighting the ongoing importance of proactive legal counsel.

- Regulatory Scrutiny: Greif must continuously monitor and adapt to evolving competition laws in every market it serves.

- Compliance Programs: Robust internal compliance programs are essential for training employees and ensuring adherence to anti-trust regulations.

- Merger & Acquisition Due Diligence: Rigorous legal review of any potential acquisitions is critical to ensure they do not violate competition laws.

- Market Practices: Greif's sales, distribution, and pricing strategies are subject to review to prevent anti-competitive conduct.

The evolving regulatory landscape significantly shapes Greif's operational and strategic decisions. New legislation like the EU's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, imposes strict requirements on packaging design, recyclability, and recycled content, directly impacting Greif's European market activities. Furthermore, the expansion of Extended Producer Responsibility (EPR) laws across numerous countries and US states, such as New York's EPR Act, mandates that producers manage post-consumer packaging waste, requiring Greif to engage with Producer Responsibility Organizations and contribute to waste management systems.

Product safety and hazardous substance regulations, including the EU's PPWR prohibition of certain PFAS in food packaging from August 2026, necessitate careful material sourcing and product development. Greif must also adhere to ongoing restrictions on heavy metals in packaging globally. International trade laws and customs regulations, influenced by agreements like the USMCA, are critical for efficient cross-border transactions, with WTO agreements providing foundational rules for global trade.

Compliance with anti-trust and competition laws is paramount in the highly competitive packaging industry. Greif must maintain robust compliance programs and conduct thorough legal due diligence for any mergers or acquisitions to prevent anti-competitive behavior and avoid significant penalties. These legal factors collectively drive Greif's commitment to innovation, sustainability, and operational integrity across its global supply chain.

Environmental factors

The global movement toward a circular economy, focused on waste reduction, material reuse, and recycling, directly influences companies like Greif. Greif's strategic expansion of its reconditioning services and increased use of recovered fiber and post-consumer resin demonstrate a commitment to this trend.

In 2023, Greif reported a significant portion of its fiber products utilized post-consumer recycled content, underscoring its role in resource efficiency. Diverting materials from landfills is a critical benchmark for these initiatives, reflecting tangible environmental progress.

Growing global concern over climate change is compelling businesses like Greif to actively reduce their carbon footprint and embrace renewable energy. This shift is not just about environmental responsibility but also about meeting the evolving expectations of investors and customers who increasingly prioritize sustainability.

Greif's proactive approach is evident in its engagement with Virtual Power Purchase Agreements (VPPAs), a strategy to procure renewable energy and support emissions reduction. The company has set ambitious climate action goals aimed at lowering its greenhouse gas emissions, demonstrating a tangible commitment to environmental stewardship.

Greif's reliance on fibre-based packaging means responsible sourcing of pulp and paper is paramount to combatting deforestation and preserving biodiversity. The company must actively ensure its supply chain upholds sustainable forestry practices, often validated through certifications like the Forest Stewardship Council (FSC). In 2024, global demand for certified sustainable forest products continued to rise, with FSC-certified forests covering over 200 million hectares worldwide, signaling a strong market preference for ethically sourced materials.

Plastic Pollution and Waste Management

The escalating global plastic crisis, with mounting awareness of plastic pollution, is driving demand for innovative packaging solutions. This includes a significant push towards reducing single-use plastics, enhancing product recyclability, and bolstering advanced recycling infrastructure. Greif's strategic emphasis on increasing post-consumer recycled (PCR) content in its plastic containers directly addresses these critical environmental imperatives.

For instance, in 2024, the European Union's Plastic Pact set targets to increase the average recycled content in plastic packaging to 30% by 2030. Companies like Greif are responding by investing in technologies and supply chains to incorporate more PCR into their products, aiming to meet both regulatory demands and evolving consumer preferences for sustainable packaging options.

- Growing Demand for Sustainable Packaging: Consumers and regulators are increasingly prioritizing environmentally friendly packaging, pushing companies to adopt more sustainable materials and practices.

- Investment in Recycling Infrastructure: Significant investments are being made globally in advanced recycling technologies and infrastructure to process a wider range of plastic waste effectively.

- Greif's PCR Initiative: Greif's commitment to increasing the use of post-consumer recycled (PCR) content in its plastic containers is a direct response to the plastic pollution challenge and the demand for circular economy solutions.

- Regulatory Landscape: Evolving regulations, such as extended producer responsibility (EPR) schemes and recycled content mandates, are shaping the packaging industry and encouraging greater adoption of recycled materials.

Water Scarcity and Water Stewardship

Water scarcity is a significant environmental challenge, especially for industries like packaging manufacturing that rely heavily on water for their operations. Greif, as a major player in this sector, faces direct impacts from regions experiencing water stress, potentially affecting production continuity and costs.

Companies are increasingly under pressure to demonstrate strong water stewardship. This involves actively reducing water usage, improving water-use efficiency, and ensuring that any discharged wastewater meets stringent environmental standards. Greif's commitment to sustainability necessitates a comprehensive approach to water management across all its global facilities.

For instance, as of their 2023 sustainability report, Greif highlighted efforts to reduce water intensity. While specific 2024 or 2025 data is still emerging, the trend indicates a focus on achieving measurable improvements in water efficiency. This aligns with broader industry expectations and regulatory pressures, especially in water-stressed areas where Greif operates.

- Water Intensity Reduction: Greif aims to decrease water consumption per ton of product manufactured.

- Wastewater Management: Implementing advanced treatment technologies to ensure responsible wastewater discharge.

- Regional Focus: Prioritizing water stewardship initiatives in areas identified as having high water stress.

- Stakeholder Expectations: Responding to growing demands from investors and customers for transparent water management practices.

The global push for sustainability and a circular economy significantly impacts Greif's operations, driving demand for recycled content and eco-friendly packaging solutions. Greif's strategic investments in reconditioning services and increased use of post-consumer recycled (PCR) materials directly align with these environmental trends.

Greif's commitment to reducing its carbon footprint is evident through its engagement with Virtual Power Purchase Agreements (VPPAs) and ambitious greenhouse gas emission reduction goals. The company's reliance on fiber-based products necessitates responsible sourcing, with a growing market preference for certified sustainable forest products, such as those from FSC-certified forests which covered over 200 million hectares globally in 2024.

Addressing the plastic crisis, Greif is actively increasing PCR content in its plastic containers, responding to regulatory mandates like the EU's Plastic Pact targeting 30% recycled content by 2030. Furthermore, water stewardship is a key focus, with Greif working to reduce water intensity and improve wastewater management across its facilities, particularly in water-stressed regions.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Greif is built on a robust foundation of data from leading market research firms, government economic reports, and industry-specific publications. We meticulously gather insights on political stability, economic indicators, technological advancements, and environmental regulations that impact the packaging industry.