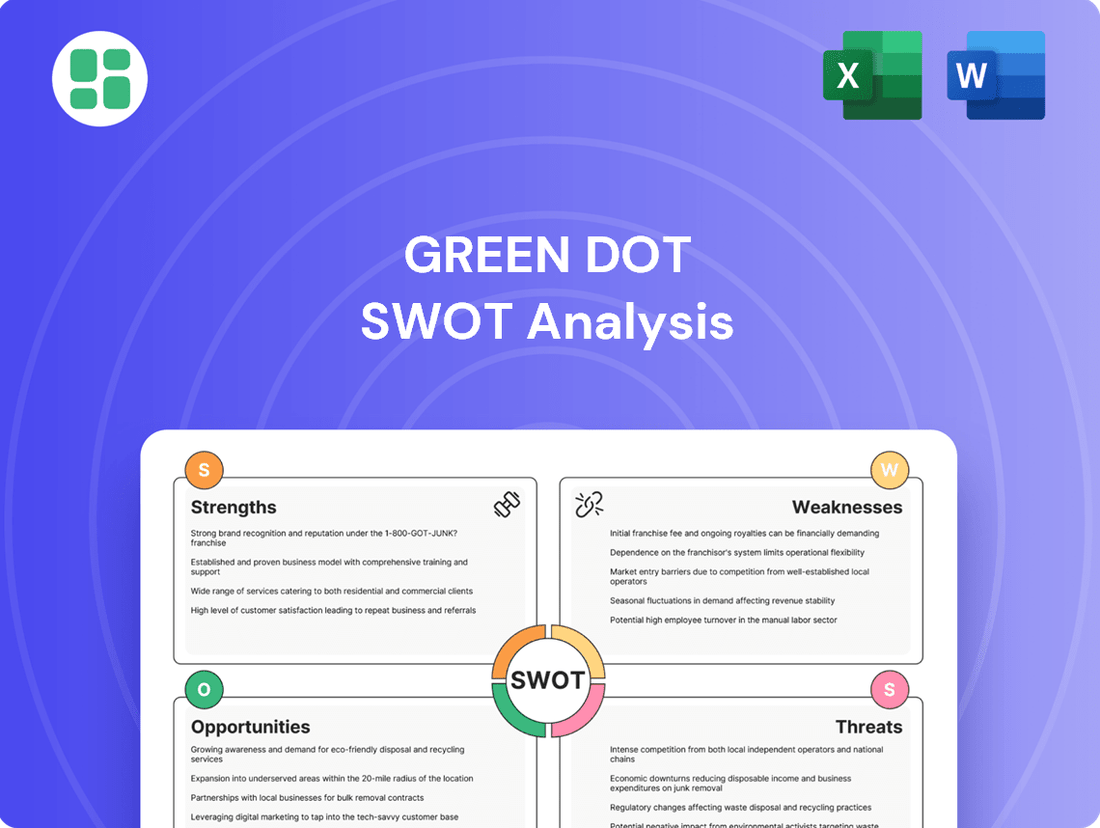

Green Dot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Dot Bundle

Green Dot's strengths lie in its established brand and large customer base, but its reliance on fee income presents a significant weakness. Opportunities exist in expanding digital services, yet competitive pressures and regulatory changes pose considerable threats.

Want the full story behind Green Dot's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Green Dot's leadership in Banking-as-a-Service (BaaS) is a major strength, powering embedded finance for giants like Apple, Amazon, and Samsung. This segment experienced impressive growth, with revenue jumping over 40% year-over-year in the first quarter of 2025. The proprietary Arc by Green Dot platform further solidifies this position, simplifying the integration of financial services for partners.

Green Dot's proprietary bank charter is a significant strength, setting it apart in the competitive fintech space. Operating its own FDIC-insured bank, Green Dot Bank, allows the company to offer a comprehensive range of regulated financial products directly, a capability many fintechs lack as they typically rely on partner banks. This direct control over banking operations provides a substantial competitive edge.

This unique charter grants Green Dot advantages in product development, funding, and scalability. By owning its bank, Green Dot can more effectively navigate the stringent regulatory environment of the financial sector, offering a wider array of services and building deeper customer relationships. For instance, in the first quarter of 2024, Green Dot reported a 3% increase in total customer accounts to 3.9 million, demonstrating its ability to grow its user base through its integrated banking platform.

Green Dot's strength lies in its vast retail distribution network, encompassing over 90,000 locations across the United States. This impressive footprint includes partnerships with major retailers such as Walmart, Walgreens, 7-Eleven, and CVS, offering unparalleled convenience.

This extensive physical presence is particularly vital for reaching unbanked and underbanked consumers who often depend on cash for daily transactions. It provides them with accessible points for financial services where traditional banking options might be limited.

Diversified Product Portfolio

Green Dot's strength lies in its diversified product portfolio, extending well beyond its foundational prepaid cards. The company offers checking accounts through GO2bank, secured credit cards, and payroll cards, alongside tax refund processing via Santa Barbara TPG. This broad offering caters to a wide array of consumer and business financial needs.

This diversification is a significant advantage, as it reduces the company's dependence on any single product line. By providing multiple financial solutions, Green Dot taps into various revenue streams, enhancing its overall financial stability and market reach. For instance, GO2bank has shown growth, with the company reporting a significant increase in its customer base for its digital banking offerings.

Key aspects of Green Dot's diversified offerings include:

- GO2bank: A digital banking platform offering checking accounts with features like early direct deposit and a secured credit card.

- Secured Credit Cards: Helping individuals build or rebuild credit history.

- Payroll Cards: Providing an alternative to traditional paychecks for employees.

- Santa Barbara TPG: Specializing in tax refund processing, serving a large customer base during tax season.

Strong Financial Performance and Outlook

Green Dot showcased impressive financial strength in the first quarter of 2025. Revenue saw a significant increase of 24% compared to the same period in the prior year, reaching $438.7 million. This growth underscores the company's expanding market presence and the effectiveness of its business strategies.

The company's profitability also saw a substantial boost. Adjusted EBITDA grew by a remarkable 53% year-over-year, climbing to $106.7 million. This surge in profitability highlights Green Dot's operational efficiency and its ability to translate revenue growth into stronger earnings.

Building on this strong performance, Green Dot has revised its full-year 2025 financial outlook upwards. The company now anticipates higher revenue and adjusted EBITDA for the full year, reflecting increased confidence in its strategic initiatives, especially within the burgeoning embedded finance sector. This optimistic guidance signals continued positive momentum for the company.

Key financial highlights from Q1 2025 include:

- Revenue Growth: 24% year-over-year increase to $438.7 million.

- Adjusted EBITDA Growth: 53% year-over-year increase to $106.7 million.

- Raised Full-Year Guidance: Indicating strong confidence in future performance, particularly in embedded finance.

Green Dot's leadership in Banking-as-a-Service (BaaS) is a major strength, powering embedded finance for giants like Apple, Amazon, and Samsung. This segment experienced impressive growth, with revenue jumping over 40% year-over-year in the first quarter of 2025. The proprietary Arc by Green Dot platform further solidifies this position, simplifying the integration of financial services for partners.

Green Dot's proprietary bank charter is a significant strength, setting it apart in the competitive fintech space. Operating its own FDIC-insured bank, Green Dot Bank, allows the company to offer a comprehensive range of regulated financial products directly, a capability many fintechs lack as they typically rely on partner banks. This direct control over banking operations provides a substantial competitive edge.

This unique charter grants Green Dot advantages in product development, funding, and scalability. By owning its bank, Green Dot can more effectively navigate the stringent regulatory environment of the financial sector, offering a wider array of services and building deeper customer relationships. For instance, in the first quarter of 2024, Green Dot reported a 3% increase in total customer accounts to 3.9 million, demonstrating its ability to grow its user base through its integrated banking platform.

Green Dot's strength lies in its vast retail distribution network, encompassing over 90,000 locations across the United States. This impressive footprint includes partnerships with major retailers such as Walmart, Walgreens, 7-Eleven, and CVS, offering unparalleled convenience.

This extensive physical presence is particularly vital for reaching unbanked and underbanked consumers who often depend on cash for daily transactions. It provides them with accessible points for financial services where traditional banking options might be limited.

Green Dot's strength lies in its diversified product portfolio, extending well beyond its foundational prepaid cards. The company offers checking accounts through GO2bank, secured credit cards, and payroll cards, alongside tax refund processing via Santa Barbara TPG. This broad offering caters to a wide array of consumer and business financial needs.

This diversification is a significant advantage, as it reduces the company's dependence on any single product line. By providing multiple financial solutions, Green Dot taps into various revenue streams, enhancing its overall financial stability and market reach. For instance, GO2bank has shown growth, with the company reporting a significant increase in its customer base for its digital banking offerings.

Key aspects of Green Dot's diversified offerings include:

- GO2bank: A digital banking platform offering checking accounts with features like early direct deposit and a secured credit card.

- Secured Credit Cards: Helping individuals build or rebuild credit history.

- Payroll Cards: Providing an alternative to traditional paychecks for employees.

- Santa Barbara TPG: Specializing in tax refund processing, serving a large customer base during tax season.

Green Dot showcased impressive financial strength in the first quarter of 2025. Revenue saw a significant increase of 24% compared to the same period in the prior year, reaching $438.7 million. This growth underscores the company's expanding market presence and the effectiveness of its business strategies.

The company's profitability also saw a substantial boost. Adjusted EBITDA grew by a remarkable 53% year-over-year, climbing to $106.7 million. This surge in profitability highlights Green Dot's operational efficiency and its ability to translate revenue growth into stronger earnings.

Building on this strong performance, Green Dot has revised its full-year 2025 financial outlook upwards. The company now anticipates higher revenue and adjusted EBITDA for the full year, reflecting increased confidence in its strategic initiatives, especially within the burgeoning embedded finance sector. This optimistic guidance signals continued positive momentum for the company.

Key financial highlights from Q1 2025 include:

- Revenue Growth: 24% year-over-year increase to $438.7 million.

- Adjusted EBITDA Growth: 53% year-over-year increase to $106.7 million.

- Raised Full-Year Guidance: Indicating strong confidence in future performance, particularly in embedded finance.

| Metric | Q1 2024 | Q1 2025 | Year-over-Year Change |

|---|---|---|---|

| Revenue | $353.8 million | $438.7 million | +24% |

| Adjusted EBITDA | $69.7 million | $106.7 million | +53% |

| Total Customer Accounts | 3.79 million | 3.9 million | +3% |

What is included in the product

Analyzes Green Dot’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address underlying issues, turning potential roadblocks into strategic advantages.

Weaknesses

Green Dot's reliance on its Consumer Services segment presents a significant weakness. Despite growth in its B2B offerings, this consumer-facing division has been hampered by declining active accounts and revenue challenges stemming from broader shifts in the retail landscape.

While a partnership did lead to a sequential uptick in active accounts in the fourth quarter of 2024, the segment's underlying pressures persist, making it a consistent area of concern for the company's overall performance.

Green Dot has encountered significant regulatory headwinds, notably a proposed consent order from the Federal Reserve in 2024 concerning compliance risk management. This situation carried a potential penalty of up to $50 million, highlighting the substantial financial implications of regulatory missteps.

Despite substantial investments by Green Dot's management aimed at bolstering its compliance framework, these ongoing regulatory challenges represent a persistent weakness. Such scrutiny can divert management attention and resources, potentially impacting the company's financial performance and strategic execution.

Green Dot's stock has a history of underperformance, shedding 72% of its value since its 2010 IPO. This prolonged period of poor stock performance signals persistent investor skepticism and could hinder the company's capacity to secure fresh funding, even with recent positive financial results.

Competition in Fintech and BaaS Markets

Green Dot operates in a crowded financial technology and Banking-as-a-Service (BaaS) landscape. This intense competition comes from both established fintech disruptors and traditional financial institutions expanding their digital offerings. For instance, by the end of 2024, the global BaaS market was projected to reach over $25 billion, highlighting the significant number of players seeking to capture market share.

The company contends with a wide array of competitors, including neobanks, specialized payment solutions, and companies embedding financial services into non-financial platforms. This diverse competitive set, ranging from companies like Stripe and Square to digital-first banks, puts pressure on Green Dot’s ability to grow and maintain profitability. The ongoing innovation in embedded finance, for example, means new competitors can emerge rapidly, offering similar or even more attractive solutions to Green Dot’s target customer base.

- Intense Competition: Fintech and BaaS markets are characterized by a large number of participants, including startups and established players.

- Broad Competitive Spectrum: Green Dot competes with digital banks, payment processors, and embedded finance providers.

- Market Growth Pressure: The rapidly expanding BaaS market, valued in the tens of billions by 2024, signifies high competition for customer acquisition and retention.

- Innovation Threat: Emerging embedded finance solutions pose a continuous challenge to Green Dot's market position.

Potential for Partner De-conversions

Green Dot faced challenges in 2024 with several program de-conversions impacting its BaaS and retail segments. This led to a noticeable dip in gross dollar volume and purchase volumes, highlighting a key vulnerability.

While the company is actively forging new partnerships, the persistent risk of losing substantial existing partners remains a significant weakness. This ongoing threat can directly affect revenue streams and market position.

- Program De-conversions: Headwinds in 2024 from partner de-conversions in BaaS and retail segments negatively impacted gross dollar volume and purchase volumes.

- Partnership Dependency: The company's reliance on a limited number of large partners creates a vulnerability if these relationships are terminated.

- Competitive Landscape: Competitors may offer more attractive terms or innovative solutions, potentially luring away Green Dot's partners.

Green Dot's Consumer Services segment, while a core part of its business, faces ongoing pressure from declining active accounts and shifting retail dynamics. Despite a partnership in late 2024 that offered a slight improvement, this segment's underlying challenges persist, impacting overall company performance.

The company has grappled with significant regulatory scrutiny, including a proposed consent order in 2024 from the Federal Reserve regarding compliance risk management, which carried a potential $50 million penalty. Even with management's efforts to strengthen compliance, these regulatory issues remain a persistent weakness, potentially diverting resources and attention.

Green Dot's stock has historically underperformed, having lost 72% of its value since its 2010 IPO. This prolonged period of investor skepticism can make it harder to secure new funding, even when the company reports positive financial results.

The competitive landscape in fintech and Banking-as-a-Service (BaaS) is intensely crowded, with numerous startups and established financial institutions vying for market share. By the close of 2024, the global BaaS market was projected to exceed $25 billion, indicating fierce competition for customer acquisition and retention.

Full Version Awaits

Green Dot SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Green Dot SWOT analysis, exactly as it will be delivered after your purchase.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase, and gain comprehensive insights into Green Dot's strategic positioning.

Opportunities

The embedded finance market, with Banking-as-a-Service (BaaS) as a core element, is experiencing robust expansion. Projections indicate global revenue in this sector could reach $690 billion by 2030, highlighting a substantial opportunity for growth. Green Dot's Arc platform is strategically positioned to leverage this trend through new collaborations and the enhancement of its current BaaS solutions for a broader business audience.

Green Dot's mission to serve the underbanked and unbanked is a significant growth avenue, as this demographic represents a substantial portion of the U.S. population, estimated at over 150 million individuals. By focusing on this underserved market, Green Dot can attract new customers seeking essential financial services.

The company's commitment to providing accessible and affordable products positions it well to capture a larger share of this expanding market. This strategy is crucial for driving continued account growth and solidifying its market position.

Green Dot's strategic review, announced in March 2025, highlights a clear opportunity for growth through acquisitions. This proactive stance suggests a willingness to invest in expanding its market presence and technological capabilities.

Targeting European fintechs or specialized firms in payroll and crypto infrastructure presents a significant avenue for strengthening its Banking-as-a-Service (BaaS) offerings. Such moves could bolster its existing platform and open doors to new customer segments and international markets.

Digital Transformation and Technology Modernization

Green Dot's commitment to digital transformation and technology modernization presents a significant opportunity. By moving to a streamlined processing environment and upgrading fraud and risk management tools, the company is enhancing its operational efficiency. This modernization, including a cloud migration, is projected to yield substantial cost savings and bolster its competitive edge through improved product capabilities.

These strategic technology investments are crucial for maintaining agility in the rapidly evolving fintech landscape. For instance, by Q1 2024, Green Dot reported a 10% year-over-year increase in technology investments focused on platform modernization, aiming to reduce operational expenses by an estimated 15% by the end of 2025.

- Streamlined Processing: Enhancing efficiency and reducing transaction times.

- Advanced Fraud & Risk Management: Bolstering security and customer trust.

- Cloud Migration: Enabling scalability, flexibility, and potential cost reductions.

- Enhanced Product Capabilities: Driving innovation and customer value.

Leveraging the Cash Economy

Even with the growing popularity of digital transactions, a significant portion of the population still relies heavily on cash. This persistent demand, especially among consumers who are underbanked or prefer cash for budgeting, presents a substantial market opportunity. Green Dot's established network of over 100,000 retail locations nationwide acts as a vital conduit, facilitating both cash deposits and withdrawals. This positions Green Dot to effectively serve this enduring segment of the market by bridging the gap between the traditional cash economy and the expanding digital financial landscape.

Green Dot's ability to cater to the cash economy is a key differentiator. For instance, in 2023, a significant percentage of transactions in the US still involved cash, highlighting the ongoing relevance of physical currency. Green Dot's infrastructure allows them to capitalize on this by:

- Facilitating Cash-In Services: Enabling customers to load cash onto their prepaid cards or accounts at retail points.

- Providing Cash-Out Services: Offering convenient ways for users to withdraw funds from their digital accounts in cash.

- Serving Underbanked Populations: Directly addressing the financial needs of individuals who may not have access to traditional banking services.

- Expanding Digital Access: Introducing unbanked and underbanked consumers to digital payment methods through familiar, accessible channels.

The burgeoning embedded finance and Banking-as-a-Service (BaaS) market presents a significant growth avenue, with global revenue projected to hit $690 billion by 2030. Green Dot's Arc platform is well-positioned to capitalize on this trend through new partnerships and enhanced BaaS solutions. The company's strategic focus on serving the underbanked and unbanked, a demographic exceeding 150 million individuals in the U.S., offers a substantial opportunity for customer acquisition and market share expansion.

Green Dot's proactive stance on acquisitions, as highlighted in its March 2025 strategic review, signals a clear intention to broaden its market footprint and technological capabilities. Targeting European fintechs, particularly in payroll and crypto infrastructure, could significantly strengthen its BaaS offerings and open new international markets. Furthermore, the company's ongoing digital transformation, including cloud migration and upgraded fraud management systems, is expected to yield substantial cost savings and improve product competitiveness.

The persistent demand for cash services, especially among underbanked consumers, represents another key opportunity. Green Dot's extensive retail network of over 100,000 locations serves as a critical bridge, facilitating both cash deposits and withdrawals, effectively connecting the cash economy with digital financial services.

| Opportunity Area | Key Enabler | Market Potential | Green Dot's Advantage |

| Embedded Finance/BaaS | Global BaaS market growth ($690B by 2030) | Significant revenue expansion | Arc platform, existing BaaS solutions |

| Serving Underbanked/Unbanked | 150M+ individuals in the U.S. | Large customer acquisition potential | Mission-aligned products, accessible services |

| Strategic Acquisitions | March 2025 strategic review | Market expansion, tech enhancement | Targeting European fintechs (payroll, crypto) |

| Cash Economy Integration | 100,000+ retail locations | Bridging digital and physical finance | Extensive cash-in/cash-out network |

Threats

The fintech landscape is a hotbed of innovation, with both seasoned companies and nimble startups constantly pushing boundaries. This means Green Dot faces a continuous challenge from new players who might offer niche services or superior technology, potentially chipping away at its customer base, especially in its key areas like prepaid cards and digital banking.

For instance, in 2024, the global fintech market was valued at over $1.5 trillion and is projected to grow significantly, indicating a highly competitive environment. Companies like Chime and Varo have already made substantial inroads into the digital banking space, offering user-friendly interfaces and attractive features that directly compete with Green Dot's offerings.

The financial services sector faces a constantly shifting regulatory environment. For Green Dot, this means new compliance demands or shifts in enforcement could increase operating expenses, limit business operations, or result in substantial penalties, all of which could affect profitability and expansion plans.

For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) continued its focus on fair lending practices and oversight of non-bank financial institutions, a trend expected to persist into 2024 and 2025. This heightened scrutiny can necessitate significant investments in compliance infrastructure and personnel, potentially impacting Green Dot's bottom line.

An economic downturn or significant shifts in consumer spending, especially among Green Dot's core underbanked customer base, pose a substantial threat. This could lead to reduced transaction volumes and a decline in interchange revenue, directly impacting the company's financial health. For instance, during periods of economic stress, individuals often cut back on discretionary spending, which can translate to fewer purchases processed through Green Dot's platforms.

Furthermore, fluctuating inflation and interest rates present a challenge. Higher inflation can erode the purchasing power of consumers, potentially leading to decreased spending. Simultaneously, changes in interest rates can affect the cost of capital and the profitability of financial services, indirectly influencing Green Dot's operational costs and revenue streams.

Cybersecurity Risks and Data Breaches

As a financial technology company, Green Dot faces substantial cybersecurity risks given its handling of sensitive customer data and financial transactions. A significant data breach or system disruption could result in considerable financial losses, severe reputational damage, and a critical erosion of customer trust. For instance, the average cost of a data breach in the financial sector reached $5.90 million in 2023, a figure that underscores the potential financial impact.

These threats also carry the weight of increased regulatory scrutiny and penalties. In 2024, financial institutions are subject to evolving data protection regulations, and non-compliance due to a breach can lead to substantial fines. The potential for system outages further exacerbates these risks, impacting service availability and customer satisfaction.

- Cybersecurity Threats: Exposure to hacking, malware, and phishing attacks targeting customer and company data.

- Data Breach Impact: Financial losses, reputational damage, and loss of customer confidence.

- Regulatory Penalties: Fines and sanctions for non-compliance with data protection laws.

- System Outages: Disruption of services leading to customer dissatisfaction and potential revenue loss.

Dependence on Key Retail and BaaS Partnerships

Green Dot's reliance on a limited number of key retail and Banking-as-a-Service (BaaS) partners presents a significant threat. For instance, while its relationship with Walmart was renewed, the concentration of business with such major partners creates a vulnerability. The potential loss or scaling back of business from a substantial partner could materially impact Green Dot's financial performance, affecting both revenue and profitability. This dependence highlights a critical area of risk for the company's stability and growth trajectory.

The financial implications of such a dependency are substantial. For example, if a major retail partner were to reduce its commitment to Green Dot's services, it could directly translate into a noticeable dip in the company's top-line figures. This scenario underscores the importance of diversification within its partnership portfolio to mitigate the impact of any single partner's strategic shifts. In 2023, Green Dot reported that a significant portion of its revenue was derived from its largest customers, emphasizing this concentration risk.

- Concentration Risk: Over-dependence on a few major retail and BaaS partners.

- Revenue Impact: Loss or reduction of business from a significant partner could materially affect revenue.

- Profitability Concerns: Adverse effects on revenue can directly impact overall profitability.

- Strategic Vulnerability: A major partner's strategic changes pose a direct threat to Green Dot's business model.

Green Dot faces intense competition from both established fintech players and emerging startups, particularly in the digital banking and prepaid card sectors. The global fintech market, valued at over $1.5 trillion in 2024, is expected to see continued growth, intensifying this competitive pressure. Companies like Chime and Varo are actively capturing market share with user-friendly platforms and innovative features, directly challenging Green Dot's customer base.

SWOT Analysis Data Sources

This Green Dot SWOT analysis is built upon a robust foundation of data, drawing from official company financial filings, comprehensive market research reports, and expert industry analysis to provide a thorough and actionable strategic overview.