Green Dot PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Dot Bundle

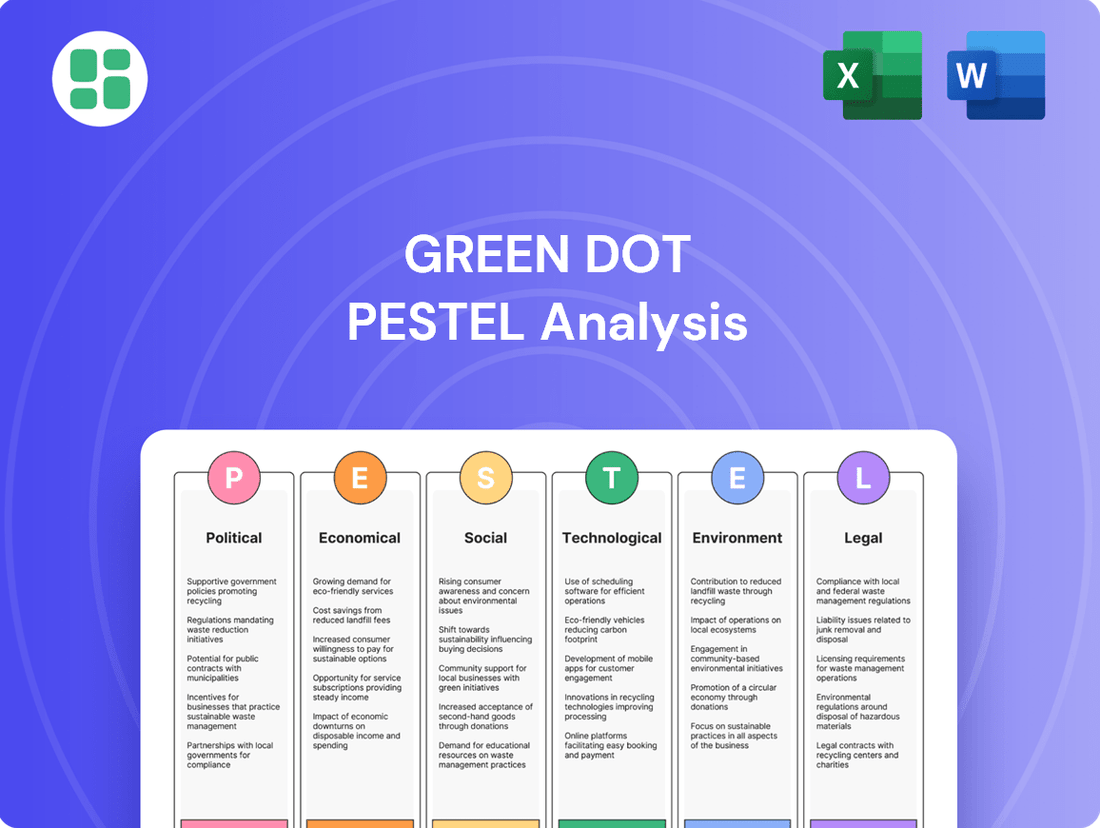

Navigate the complex external forces shaping Green Dot's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic decisions. Arm yourself with actionable intelligence to refine your own market strategies and identify potential opportunities and threats. Download the full PESTLE analysis now to gain a critical competitive edge.

Political factors

The regulatory environment for fintech and banking is dynamic, with agencies like the CFPB and FDIC increasing oversight. These evolving rules, particularly those affecting large non-bank entities and collaborations between banks and fintech firms, directly influence Green Dot's operational adherence and strategic choices.

For instance, the CFPB's recent final rule concerning digital wallets and payment applications necessitates ongoing adjustments and dedicated spending on compliance systems. This trend suggests that staying ahead of regulatory changes is a critical operational challenge for Green Dot, requiring significant resources to ensure continued compliance and market access.

Governments worldwide are prioritizing financial inclusion, aiming to connect millions of unbanked individuals to formal financial services. This global push, often supported by international organizations, creates a favorable environment for companies like Green Dot that specialize in serving these populations.

Policies promoting access to affordable financial products, especially through digital channels, directly benefit Green Dot's business model. For instance, the World Bank reported in 2023 that over 70% of adults globally now have a bank account, a significant increase driven by such initiatives.

These government-backed efforts frequently encourage partnerships between fintech companies and traditional financial institutions, as well as investments in digital infrastructure. Such collaborations and technological advancements are crucial for Green Dot's strategy to expand its reach and service offerings.

Changes in political administrations, such as the upcoming 2024 US presidential election, can significantly alter regulatory landscapes for fintech companies like Green Dot. A shift in power could lead to revised priorities concerning consumer protection, data privacy, and financial inclusion, directly impacting Green Dot's compliance strategies and operational costs.

While federal regulatory momentum may ebb and flow with political cycles, state-level oversight is likely to intensify. For instance, states are increasingly focusing on digital asset regulation and consumer lending practices, forcing Green Dot to navigate a complex patchwork of rules. This fragmentation demands robust compliance infrastructure to ensure adherence across all operating jurisdictions, a challenge amplified as more states adopt stricter digital payment regulations.

Consumer Protection Laws and Enforcement

The Consumer Financial Protection Bureau (CFPB) remains a significant force in shaping the financial landscape, actively issuing new regulations and enforcing existing ones. In 2024, the CFPB continued its focus on areas like 'buy now, pay later' services, aiming to bring them under closer scrutiny, and has been particularly diligent in examining fee structures and disclosure clarity across financial products.

For Green Dot, this means a constant need to adapt its offerings, from prepaid cards to its expanding digital banking services, to meet these evolving consumer protection mandates. Non-compliance can lead to substantial fines and damage to brand reputation, impacting customer acquisition and retention. For instance, the CFPB's ongoing efforts to ensure fair lending practices and transparent fee disclosures directly affect how Green Dot markets and operates its reloadable prepaid cards and associated services.

- CFPB's 2024 focus: 'Buy Now, Pay Later' (BNPL) regulation and scrutiny of fees/disclosures.

- Green Dot's imperative: Ensure full compliance with consumer protection laws for prepaid cards and digital accounts.

- Consequences of non-compliance: Potential for significant penalties and erosion of consumer trust.

- Impact on operations: Direct influence on product design, marketing, and fee structures.

Anti-Money Laundering (AML) and Sanctions Enforcement

Government agencies, including the Department of Justice and the Treasury, are intensifying their enforcement of anti-money laundering (AML) and sanctions regulations. This heightened scrutiny is particularly focused on companies operating within the digital asset and financial technology sectors.

As a regulated bank holding company and a key player in money movement services, Green Dot is obligated to uphold stringent AML compliance programs. These programs are crucial for mitigating the risks associated with financial crime and avoiding substantial penalties. For instance, in 2023, the Financial Crimes Enforcement Network (FinCEN) collected over $1.7 billion in civil penalties related to BSA/AML violations.

- Increased Regulatory Scrutiny: Agencies are actively pursuing enforcement actions against financial institutions for AML and sanctions violations.

- Financial Penalties: Non-compliance can result in significant fines, impacting profitability and operational stability.

- Reputational Risk: AML failures can damage a company's reputation, affecting customer trust and business partnerships.

Political stability and government policies significantly shape the financial services landscape. Changes in administration, such as potential shifts following the 2024 US elections, can directly alter regulatory priorities, impacting areas like consumer protection and data privacy for companies like Green Dot.

Heightened government focus on financial inclusion, particularly through digital channels, creates opportunities for Green Dot's business model. For instance, initiatives aimed at expanding access to affordable financial products benefit companies serving unbanked and underbanked populations, a core demographic for Green Dot.

Increased enforcement of anti-money laundering (AML) and sanctions regulations by agencies like FinCEN presents a compliance challenge. In 2023, FinCEN collected over $1.7 billion in civil penalties for BSA/AML violations, underscoring the financial and reputational risks of non-compliance for financial institutions.

| Political Factor | Impact on Green Dot | Supporting Data/Trend |

| Regulatory Environment Shifts | Increased compliance costs and operational adjustments | CFPB's ongoing focus on BNPL and fee disclosures in 2024 |

| Financial Inclusion Initiatives | Expanded market opportunities and favorable operating conditions | World Bank data showing over 70% global adult bank account ownership in 2023 |

| AML/Sanctions Enforcement | Heightened risk of penalties and need for robust compliance programs | FinCEN collected over $1.7 billion in AML penalties in 2023 |

| Election Cycles | Potential for changes in consumer protection and data privacy regulations | Anticipated impact of 2024 US presidential election outcomes on fintech policy |

What is included in the product

This Green Dot PESTLE analysis examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions impact the company's operations and strategy.

The Green Dot PESTLE Analysis offers a streamlined, actionable framework that simplifies complex external factors, alleviating the pain of information overload and enabling faster, more confident strategic decision-making.

Economic factors

Economic conditions, particularly inflation and interest rates, significantly shape consumer spending and the profitability of financial services like those offered by Green Dot. High inflation, which saw the US CPI average 4.1% in 2023 and projected to be around 2.3% for 2024, can erode the purchasing power of Green Dot's core customer base, potentially impacting transaction volumes and account balances.

Changes in interest rates directly affect Green Dot Bank's cost of funds and the competitiveness of its product offerings. For instance, the Federal Reserve's benchmark interest rate remained elevated throughout 2023 and into 2024, impacting borrowing costs and the yield on interest-bearing accounts, which could influence customer acquisition and retention strategies.

The unbanked and underbanked populations represent a significant and growing market for Green Dot. Despite global increases in account ownership, a substantial number of adults, especially those with lower incomes, still lack access to traditional banking services. This persistent gap, estimated by the World Bank in their 2023 Global Findex report to affect around 1.4 billion adults worldwide, directly translates to a continued demand for the financial solutions Green Dot provides.

The Banking as a Service (BaaS) market is surging, projected to reach $37.4 billion by 2027, a substantial increase from $22.1 billion in 2022, according to Statista. This expansion is fueled by a growing appetite for integrated financial solutions within non-financial businesses and the ongoing digital overhaul of the financial sector.

For Green Dot, this economic trend translates into a significant opportunity. Its proprietary Arc platform, coupled with its own bank charter, positions it advantageously to offer BaaS solutions. This allows Green Dot to partner with major consumer and technology firms, effectively broadening its revenue streams beyond traditional banking services.

Consumer Spending and Digital Payment Adoption

Consumer spending habits are a significant driver for Green Dot, particularly as the economy navigates inflation and potential shifts in disposable income. The ongoing trend towards digital payments and e-commerce directly benefits Green Dot's core offerings, as consumers increasingly seek convenient and secure ways to manage their money online and in-app.

The increasing adoption of digital payment methods is a strong tailwind for Green Dot. For instance, in 2024, it's estimated that digital payment transactions in the US will continue their upward trajectory, with projections suggesting a significant percentage of retail sales will be conducted digitally. This surge in online activity directly translates to a greater need for the types of prepaid debit cards and digital wallet solutions that Green Dot specializes in, offering a pathway for consumers to participate in the digital economy.

- Digital Payment Growth: The global digital payments market is projected to reach trillions of dollars by 2025, indicating substantial room for growth in services like Green Dot's.

- E-commerce Influence: As e-commerce continues to expand, the demand for accessible and user-friendly payment instruments, such as prepaid cards, remains robust.

- Consumer Preference: A growing segment of consumers, particularly the unbanked or underbanked, rely on prepaid solutions for everyday transactions and online purchases.

Competition in the Fintech Sector

The fintech landscape is intensely competitive, with established banks, emerging fintech startups, and major tech giants all aggressively pursuing market share. This creates significant economic pressure on companies like Green Dot to constantly innovate and offer unique value propositions. For instance, the digital payments market alone is projected to reach $2.4 trillion by 2027, highlighting the vast opportunities but also the intense rivalry.

Green Dot must differentiate its services and maintain attractive pricing strategies to win and keep both individual customers and business partners. The economic imperative to stand out in this crowded space means that investment in research and development, as well as agile marketing, is crucial for survival and growth.

- Intense Rivalry: Traditional banks are investing heavily in digital transformation, while neobanks and payment processors compete on fees and user experience.

- Innovation Pressure: The need to develop new features, such as embedded finance solutions or advanced fraud detection, is constant.

- Pricing Sensitivity: Customers and partners often switch providers based on cost, forcing companies to optimize their economic models.

- Market Saturation: With numerous players offering similar services, carving out a distinct niche is a significant economic challenge.

Economic factors like inflation and interest rates significantly influence Green Dot's customer base and operational costs. With US CPI projected around 2.3% for 2024, and the Federal Reserve maintaining elevated interest rates, Green Dot must adapt its strategies to manage funding costs and maintain competitive product offerings.

The growing digital payment and e-commerce sectors, with the US digital payment market expected to see continued growth in 2024, present a substantial opportunity for Green Dot's core services. Furthermore, the expanding Banking as a Service (BaaS) market, projected to reach $37.4 billion by 2027, offers a significant avenue for revenue diversification through its proprietary platforms.

| Economic Factor | 2023/2024 Data/Projection | Impact on Green Dot |

|---|---|---|

| US CPI Inflation | 4.1% (2023 Avg), ~2.3% (2024 Proj.) | Erodes purchasing power of core customers; impacts transaction volumes. |

| Federal Reserve Interest Rate | Elevated throughout 2023-2024 | Affects cost of funds and product competitiveness; influences customer acquisition. |

| Digital Payments Market (US) | Continued upward trajectory in 2024 | Increases demand for Green Dot's digital wallet and prepaid solutions. |

| Banking as a Service (BaaS) Market | Projected to reach $37.4 billion by 2027 | Creates opportunity for Green Dot's BaaS solutions via proprietary platforms. |

Full Version Awaits

Green Dot PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Green Dot PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations and strategy.

Sociological factors

Societal focus on financial inclusion continues to grow, emphasizing the need for accessible and affordable financial services for underserved communities. In 2024, the World Bank reported that approximately 73% of adults globally had a bank account, a significant increase from earlier years, yet substantial gaps remain, particularly in developing economies.

Green Dot's mission aligns with this trend, as it provides essential banking tools to populations often overlooked by traditional banks. For instance, Green Dot's prepaid debit cards and mobile banking app offer a gateway to financial services for millions of Americans who may not meet the requirements of mainstream financial institutions.

Efforts to improve financial literacy can also increase the adoption of digital banking solutions. Studies from 2024 indicate that individuals with higher financial literacy are more likely to utilize digital financial services, suggesting that targeted educational programs could further boost Green Dot's customer base and engagement.

Consumers are increasingly opting for digital and mobile banking, driven by a desire for convenience and constant accessibility. This shift is a major sociological trend shaping the financial services industry.

Green Dot's GO2bank directly addresses this by offering a mobile-first platform. This caters to users who expect seamless, on-demand financial management and payment solutions, reflecting a growing preference for digital interactions over traditional branch banking.

The integration of GO2bank with popular digital wallets further enhances this user experience, making financial transactions quicker and more integrated into daily digital life. This is crucial as a significant portion of consumers, particularly younger demographics, rely heavily on these digital tools for everyday spending and management.

Consumer trust in digital finance, especially concerning data security and privacy, remains a critical sociological hurdle. Many users, particularly those less familiar with fintech, harbor reservations about entrusting their sensitive financial information to new platforms. For Green Dot, maintaining this trust is paramount, requiring ongoing investment in advanced cybersecurity protocols and clear, transparent communication about data handling practices.

Demographic Shifts and Underbanked Needs

Demographic shifts are significantly shaping the financial landscape. The increasing prevalence of younger, digitally savvy consumers, who are more comfortable with mobile banking and digital payment solutions, directly impacts the demand for Green Dot's services. For instance, in 2023, approximately 85% of US adults used a smartphone, indicating a strong preference for digital channels.

Furthermore, ongoing migration patterns, both domestically and internationally, create diverse customer bases with varying financial needs. This includes a growing segment of individuals who may not have traditional banking relationships. The underbanked population remains a critical demographic, with an estimated 4.5% of U.S. households, or about 5.9 million adults, being unbanked in 2022, according to the FDIC. These individuals often rely on alternative financial services, highlighting the sustained relevance of Green Dot's offerings.

- Digital Natives: Younger generations, comfortable with mobile-first solutions, are a key growth area.

- Migration Trends: Shifting populations create new markets with diverse financial requirements.

- Unbanked Population: Millions still lack access to traditional banking, driving demand for alternative services.

- Income Disparities: Lower income levels and historical barriers continue to necessitate accessible financial tools.

Social Attitudes Towards Alternative Financial Services

Societal acceptance of prepaid cards and digital banking is crucial for Green Dot's expansion. As of early 2024, a significant portion of consumers, particularly younger demographics and the unbanked, are increasingly viewing these services as viable alternatives to traditional banks, driven by their accessibility and lower fees. This growing comfort level directly influences adoption rates.

Positive social attitudes, fueled by the convenience and perceived value of services like Green Dot's, are a strong growth driver. For instance, the demand for flexible payment solutions and digital-first financial management tools continues to rise. This trend is supported by data showing a steady increase in the usage of non-traditional financial services for everyday transactions.

Conversely, any lingering negative perceptions or stigma associated with prepaid cards or digital accounts could impede Green Dot's progress. While trust in these services is building, overcoming historical skepticism remains a factor. For example, concerns about security or the perceived lack of comprehensive features compared to traditional banking can still deter some potential users.

- Growing Comfort: Over 50% of U.S. adults have used a prepaid card or digital banking service, with adoption rates highest among Gen Z and Millennials as of late 2023.

- Value Perception: Consumers increasingly cite lower fees and greater control as key reasons for choosing alternative financial services.

- Trust Factor: While improving, a segment of the population still expresses reservations about the security and breadth of services offered by non-traditional financial providers.

Societal trends highlight a growing demand for accessible financial services, particularly among younger demographics and the unbanked. In 2024, global financial inclusion efforts continued, with digital banking adoption rising significantly. Green Dot's focus on providing mobile-first banking and payment solutions directly addresses these evolving consumer preferences and the persistent need for services catering to underserved populations.

The increasing comfort level with digital financial tools, coupled with a desire for convenience, fuels the adoption of services like those offered by Green Dot. As of late 2023, over 50% of U.S. adults had used prepaid cards or digital banking, with younger generations leading this shift. This indicates a strong societal acceptance of non-traditional financial platforms, driven by perceived value and accessibility.

Demographic shifts, including migration and the growing digitally native population, create diverse financial needs that Green Dot is positioned to meet. With approximately 5.9 million unbanked adults in the U.S. as of 2022, the demand for alternative financial services remains substantial, underscoring the societal relevance of Green Dot's mission.

| Sociological Factor | Description | Relevance to Green Dot | Supporting Data (2023-2024) |

|---|---|---|---|

| Financial Inclusion Focus | Societal emphasis on providing banking access to underserved groups. | Green Dot's core mission aligns with this, offering services to the unbanked and underbanked. | ~73% of adults globally had a bank account (World Bank, 2024); 4.5% of U.S. households remained unbanked (FDIC, 2022). |

| Digitalization of Finance | Increasing consumer preference for mobile and online banking solutions. | Green Dot's GO2bank platform caters to this trend with a mobile-first approach. | ~85% of U.S. adults used a smartphone (2023); growing adoption of digital wallets. |

| Demographic Shifts | Influence of younger, tech-savvy generations and migration patterns. | Younger consumers are key targets; migration creates diverse customer needs. | High smartphone penetration among Gen Z and Millennials; diverse financial needs from migrant populations. |

| Trust and Perception | Consumer confidence in digital security and the value of alternative financial services. | Building trust through robust security and transparent communication is vital. | Growing comfort with digital services, though some lingering security concerns persist. |

Technological factors

Green Dot's 'Arc by Green Dot' platform exemplifies its Banking as a Service (BaaS) strategy, utilizing APIs to integrate financial products into non-financial companies' ecosystems. This approach is key to their growth, enabling them to offer services like card issuing and payment processing to a wider array of businesses.

The BaaS market is rapidly evolving, with ongoing advancements in platform scalability, modularity, and seamless integration capabilities. For Green Dot, staying ahead in these technological areas is vital to securing and maintaining partnerships with large enterprise clients who demand robust and adaptable solutions.

The widespread use of smartphones, with global mobile penetration reaching over 6.8 billion users in early 2024, directly fuels the growth of mobile banking. Green Dot's GO2bank platform leverages this trend by providing a comprehensive mobile banking solution.

Furthermore, the increasing adoption of digital wallets, such as Samsung Wallet, presents a significant opportunity. Green Dot's integration capabilities here allow for easier transactions and broader customer engagement, a crucial factor for expanding their market presence in the evolving digital finance landscape.

Data analytics and AI are transforming fintech, enabling Green Dot to bolster fraud detection and personalize customer experiences. For instance, by mid-2024, financial institutions are increasingly adopting AI-powered fraud detection systems, which, according to Juniper Research, are projected to save businesses over $300 billion annually by 2027. Green Dot can leverage these advanced analytics to refine its risk management, offering more relevant products and services to its diverse customer base.

Cybersecurity and Data Protection Technologies

As a financial technology and bank holding company, Green Dot's operations are intrinsically linked to advanced cybersecurity and data protection. Protecting sensitive customer financial information and preventing fraudulent activities are paramount. In 2024, the financial services sector, including fintechs like Green Dot, continued to see significant investment in these areas, with global cybersecurity spending projected to reach over $200 billion by the end of the year. This focus is driven by the increasing sophistication of cyber threats and stringent regulatory requirements.

Green Dot's commitment to robust data encryption, real-time threat detection, and secure transaction processing is essential for maintaining customer trust and ensuring compliance with regulations like the Gramm-Leach-Bliley Act (GLBA). The company's ability to safeguard sensitive data directly impacts its reputation and its license to operate. For instance, the average cost of a data breach in the financial sector has been reported to be in the millions of dollars, underscoring the financial imperative for strong security.

- Cybersecurity Investment: Green Dot must continuously invest in cutting-edge cybersecurity technologies to combat evolving threats.

- Data Protection: Implementing advanced encryption and secure data storage is crucial for safeguarding customer information.

- Fraud Prevention: Utilizing sophisticated threat detection and secure transaction protocols helps mitigate financial fraud.

- Regulatory Compliance: Adherence to data protection laws is non-negotiable for maintaining operational integrity and customer trust.

Cloud Computing and API Infrastructure

The increasing reliance on cloud computing and robust API infrastructure is a key technological factor for Green Dot. This shift is crucial for scaling their Banking-as-a-Service (BaaS) offerings and maintaining agility in the fast-paced embedded finance sector. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the massive infrastructure available.

Cloud technology allows Green Dot to deploy new financial services more rapidly, significantly cutting down operational expenses. This efficiency is vital for staying ahead in a market that demands constant innovation. Companies leveraging cloud infrastructure often see improved time-to-market for new products, a critical advantage in financial technology.

Green Dot's ability to integrate seamlessly with partners through strong API infrastructure is also paramount. This enables them to embed financial services into non-financial platforms efficiently. The API management market itself is experiencing substantial growth, with forecasts suggesting continued expansion driven by the need for interconnected digital ecosystems.

- Scalability: Cloud platforms provide the elasticity needed to handle fluctuating demand for BaaS solutions.

- Cost Efficiency: Reduced infrastructure management and operational overheads are key benefits of cloud adoption.

- Innovation Speed: Faster deployment cycles and easier integration through APIs accelerate product development.

- Partner Integration: Robust APIs facilitate smooth and secure connections with a wide range of business partners.

Green Dot's technological strategy heavily relies on its Banking-as-a-Service (BaaS) platform, 'Arc by Green Dot', which uses APIs for seamless integration into partner ecosystems. This approach is critical for growth, allowing them to offer services like card issuing to a broad range of businesses.

The increasing global mobile penetration, exceeding 6.8 billion users by early 2024, directly supports Green Dot's mobile-first strategy with platforms like GO2bank. Furthermore, the rise of digital wallets presents significant opportunities for enhanced customer engagement and transaction facilitation.

Advancements in data analytics and AI are crucial for Green Dot, particularly in fraud detection and personalizing customer experiences. By mid-2024, financial institutions are increasingly adopting AI for fraud prevention, a trend expected to save businesses billions annually.

Cloud computing and robust API infrastructure are foundational for Green Dot's BaaS and embedded finance operations, enabling scalability and rapid service deployment. The global cloud market's projected growth to over $1.3 trillion by 2024 underscores the importance of this infrastructure.

Legal factors

As a financial technology and bank holding company, Green Dot operates under the watchful eyes of the FDIC, CFPB, and SEC. This means compliance with a wide array of rules is not just important, it's essential for their operations. For instance, in 2024, the CFPB continued to focus on consumer protection in digital payment apps, a key area for Green Dot's business model.

The SEC's ongoing scrutiny of financial reporting and market practices also directly impacts Green Dot, influencing how they present their financial health and operational transparency to investors. Staying ahead of these evolving regulatory landscapes, including potential changes in capital requirements or consumer data privacy laws, is a constant challenge and a critical factor in their strategic planning.

Green Dot must rigorously comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws to combat financial crime. The Department of Justice and Treasury have intensified their scrutiny of digital asset firms, underscoring the critical need for Green Dot to maintain strong internal controls and reporting systems. This ensures the identification and prevention of illicit activities facilitated through its services.

Green Dot faces increasing scrutiny under data privacy laws like the California Consumer Privacy Act (CCPA) and similar state regulations. These laws dictate how the company must handle customer data, requiring transparency in collection and usage. For instance, by the end of 2023, over 15 US states had enacted comprehensive data privacy laws, impacting how financial technology firms like Green Dot manage sensitive information.

Bank-Fintech Partnership Scrutiny and Licensing Requirements

Regulatory bodies such as the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) are intensifying their oversight of collaborations between traditional banks and financial technology (fintech) firms. This heightened scrutiny translates into more rigorous demands for risk management frameworks and compliance audits, particularly for Banking-as-a-Service (BaaS) providers like Green Dot. For instance, the OCC's Project Regulator initiative, ongoing through 2024 and into 2025, aims to clarify and strengthen supervisory expectations for third-party relationships, directly impacting BaaS models.

Green Dot's reliance on its BaaS infrastructure, which underpins many of its partnerships, necessitates a proactive approach to adapting to these evolving regulatory landscapes. Maintaining all requisite state and federal licenses is paramount, as any lapse could significantly disrupt operations and customer trust. The company must demonstrate robust compliance programs that meet or exceed the heightened standards being set, especially concerning data security and consumer protection in its partner integrations.

- Increased OCC and FDIC Scrutiny: Regulators are demanding more robust risk management and compliance for bank-fintech partnerships, impacting BaaS models.

- Evolving Regulatory Expectations: Green Dot must navigate changing rules, with initiatives like the OCC's Project Regulator shaping supervisory approaches through 2025.

- Licensing Imperative: Maintaining all necessary state and federal licenses is critical for Green Dot's BaaS operations and partner integrations.

Consumer Lending and Credit Card Regulations

Green Dot's consumer lending and credit card offerings, including secured credit cards, fall under stringent regulatory frameworks such as the Truth in Lending Act (TILA) and Regulation Z. These laws govern disclosures, interest rates, and fees, ensuring consumer protection. For instance, TILA mandates clear communication of the Annual Percentage Rate (APR) and finance charges.

The Consumer Financial Protection Bureau's (CFPB) recent interpretive rules extending credit card-like regulations to 'buy now, pay later' (BNPL) services signal an evolving regulatory landscape. This trend suggests Green Dot must remain agile in adapting its product disclosures and dispute resolution mechanisms to comply with potentially broader interpretations of credit regulations. As of Q1 2024, the total outstanding credit card debt in the U.S. exceeded $1.1 trillion, highlighting the significant market and regulatory attention on this sector.

- TILA Compliance: Ensures accurate and transparent disclosure of credit terms, including APR and fees, for all credit products.

- Regulation Z: Governs various aspects of credit card transactions, including billing, disputes, and advertising.

- CFPB BNPL Interpretations: Indicates a potential for expanded regulatory oversight on all forms of revolving credit, requiring proactive adaptation by Green Dot.

- Market Context: The substantial U.S. credit card debt market underscores the critical importance of regulatory adherence for companies like Green Dot.

Green Dot's operations are heavily influenced by evolving legal frameworks, particularly concerning data privacy and financial crime prevention. The proliferation of state-level data privacy laws, with over 15 states enacting comprehensive legislation by the end of 2023, necessitates strict adherence to how customer information is handled. Furthermore, intensified scrutiny from the Department of Justice and Treasury on digital asset firms highlights the critical need for robust Anti-Money Laundering (AML) and Know Your Customer (KYC) controls to prevent illicit activities.

Environmental factors

Green Dot, as a financial services provider, is experiencing heightened scrutiny regarding its Environmental, Social, and Governance (ESG) performance. Investors and regulatory bodies are pushing for more transparent ESG reporting, influencing how financial institutions manage their operations and investment portfolios. This trend is particularly evident as many jurisdictions move towards mandatory ESG disclosures for publicly traded companies.

The financial services sector, in general, saw significant growth in sustainable investing in 2024, with assets in ESG-focused funds reaching record highs. For instance, global sustainable fund assets were projected to exceed $50 trillion by the end of 2025, underscoring the market's demand for companies to demonstrate strong ESG integration. This directly impacts Green Dot's ability to attract capital and maintain its corporate reputation.

The financial sector is experiencing a significant surge in consumer and institutional interest for sustainable finance products. This includes a growing market for green bonds and sustainability-linked loans, with the global green bond market projected to reach over $3.4 trillion by 2026, according to Bloomberg Intelligence data. While Green Dot's core business may not directly offer these specialized 'green' financial instruments, its established banking infrastructure and payment processing capabilities position it to potentially partner with entities that are developing and distributing such solutions.

Green Dot, like other tech-focused entities, faces scrutiny over its operational carbon footprint, stemming from data centers, office spaces, and its digital infrastructure. While not a heavy industrial polluter, there's a growing pressure for transparency and reduction in energy use.

The company's energy consumption, though indirect, contributes to its environmental impact. Stakeholders increasingly expect companies to report on and mitigate these aspects, especially as sustainability becomes a key performance indicator for many investors and consumers.

For instance, in 2023, the tech sector's energy consumption for data centers alone was estimated to be around 1% of global electricity usage, a figure that continues to rise with digital expansion. Green Dot is therefore positioned within this broader trend of needing to address its energy-related environmental responsibilities.

Climate Risk Assessments in Financial Services

Financial institutions are increasingly integrating climate risk assessments into their core risk management processes. This involves a thorough evaluation of potential impacts from both physical climate events, like extreme weather, and transition risks, such as policy changes and shifts in consumer preferences towards greener alternatives. For instance, by the end of 2024, many major banks are expected to have conducted scenario analyses to understand their exposure to climate-related financial risks, as mandated by regulatory bodies.

As a bank holding company, Green Dot might experience indirect pressure to address these climate-related financial risks within its overall risk management strategies. This could stem from investor expectations, regulatory guidance, or the need to maintain strong relationships with partners and customers who are increasingly focused on sustainability. For example, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, widely adopted by financial firms, encourage comprehensive reporting on climate risks.

- Regulatory Scrutiny: Global regulators, including those in the US and Europe, are enhancing oversight of climate-related financial risks, pushing institutions to embed these considerations into capital planning and stress testing by 2025.

- Investor Demand: A growing number of investors, managing trillions in assets by early 2025, are demanding greater transparency and action on climate risk from financial services companies.

- Physical Risk Exposure: Financial institutions are assessing their portfolios for exposure to physical climate risks, such as increased insurance claims or loan defaults in regions prone to natural disasters.

- Transition Risk Management: Evaluating how shifts to a low-carbon economy might impact asset values and creditworthiness within lending portfolios is becoming a key focus.

Green and Sustainable Practices in Payment Solutions

The payment solutions sector is witnessing a significant shift towards eco-friendly operations, influenced by growing consumer demand for sustainability. This trend is particularly relevant for prepaid card providers like Green Dot, as customers increasingly favor companies demonstrating environmental stewardship.

While digital payment solutions inherently have a lower physical footprint compared to traditional banking, the emphasis on environmental responsibility can still manifest in customer choices. This could involve opting for providers who minimize energy consumption in their data centers or offer digital-first features that reduce paper waste.

For instance, a growing number of consumers are actively seeking out financial services that align with their values. By 2024, reports indicated that over 60% of consumers considered a company's environmental policies when making purchasing decisions, a figure expected to climb further into 2025.

Green Dot can capitalize on this by highlighting its own sustainability initiatives, such as:

- Reducing paper statements: Encouraging digital-only account updates.

- Optimizing data center energy efficiency: Investing in greener technology for their digital infrastructure.

- Partnering with eco-conscious organizations: Aligning brand image with environmental causes.

Environmental factors are increasingly shaping the financial services landscape, with a significant focus on ESG performance and sustainable investing. By early 2025, global sustainable fund assets are anticipated to surpass $50 trillion, reflecting strong investor demand for environmentally conscious companies.

Green Dot, like other tech-centric firms, faces scrutiny over its operational carbon footprint, particularly concerning data center energy consumption, which represented about 1% of global electricity usage in 2023. Furthermore, financial institutions are integrating climate risk assessments into their core strategies, with many major banks expected to complete scenario analyses for climate-related financial risks by the end of 2024.

Consumer preference for eco-friendly operations is also a growing influence, with over 60% of consumers in 2024 considering environmental policies in their purchasing decisions. This trend highlights an opportunity for Green Dot to emphasize its sustainability initiatives, such as promoting digital statements and optimizing data center energy efficiency.

| Environmental Factor | Impact on Green Dot | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Sustainable Investing Growth | Attracts capital, enhances reputation | Global sustainable fund assets projected to exceed $50 trillion by end of 2025. |

| Operational Carbon Footprint | Pressure for transparency and reduction | Tech sector data centers consumed ~1% of global electricity in 2023. |

| Climate Risk Management | Integration into risk strategies | Major banks expected to conduct climate risk scenario analyses by end of 2024. |

| Consumer Environmental Awareness | Influences customer choice | Over 60% of consumers considered environmental policies in 2024 purchasing decisions. |

PESTLE Analysis Data Sources

Our Green Dot PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable market research reports, and academic studies. We synthesize data on environmental regulations, economic incentives, technological advancements, and social consumer trends to provide actionable insights.