Green Dot Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Dot Bundle

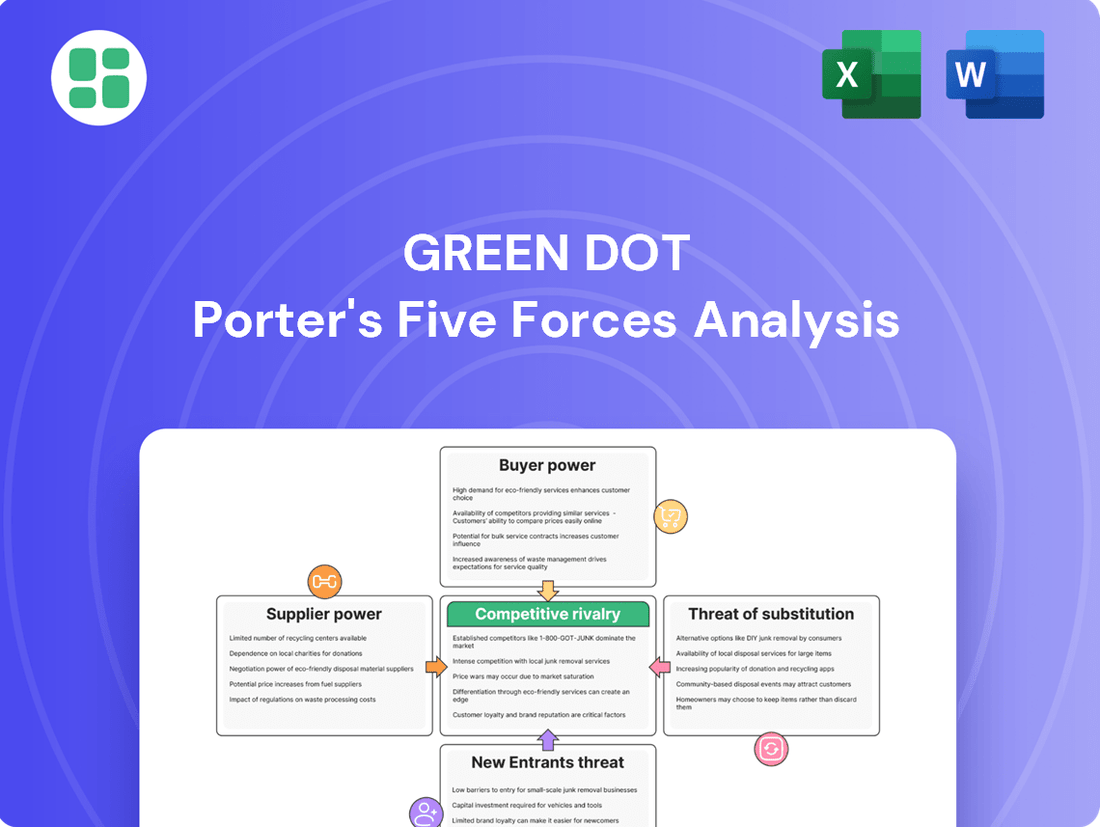

Green Dot's position in the prepaid financial services market is shaped by intense competition, moderate buyer power, and the growing threat of substitutes. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Green Dot’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Payment network providers like Visa and Mastercard wield significant bargaining power over Green Dot. Their extensive global acceptance and robust infrastructure are essential for Green Dot's prepaid and debit card services, making their cooperation indispensable. In 2024, Visa and Mastercard continued to dominate the payment processing landscape, processing trillions of dollars in transactions annually, reinforcing their leverage.

Green Dot relies heavily on technology and software providers for its core operations, including its payment processing platform, data analytics, and cybersecurity. The bargaining power of these suppliers is a key consideration. For highly specialized or proprietary software solutions, such as advanced fraud detection systems, these vendors often hold significant leverage due to limited alternatives. Conversely, for more commoditized software, like standard cloud storage or office productivity suites, Green Dot likely has more negotiating power given the abundance of comparable service providers. For instance, in 2024, the market for cloud computing services, a critical component for many fintechs, saw continued consolidation, potentially increasing the power of major providers like Amazon Web Services, Microsoft Azure, and Google Cloud, though competition remains intense.

Green Dot's reliance on a broad retail distribution network, featuring giants like Walmart, significantly influences supplier bargaining power. These retailers are crucial for reaching Green Dot's core customer base, making their partnerships vital for product visibility and sales.

The extended agreement with Walmart through 2033 underscores the strategic importance of such retail relationships. Retailers' established brand presence and high customer traffic grant them considerable leverage, as they act as the primary gateway for Green Dot's prepaid card offerings to consumers.

Data and Analytics Service Providers

In the financial sector, where data is king, providers of sophisticated data analytics and fraud detection services wield considerable influence. Green Dot relies heavily on these suppliers for precise and prompt data to effectively manage risks, gain insights into customer habits, and improve its product suite. For instance, in 2023, the global big data and business analytics market was valued at over $270 billion, highlighting the critical nature of these services.

The specialized and often proprietary nature of these analytics solutions can lead to high switching costs for companies like Green Dot. This means that changing providers might involve significant investment in new infrastructure, data integration, and retraining, thereby strengthening the bargaining power of existing suppliers. Some providers offer unique algorithms or access to exclusive datasets that are difficult to replicate, further enhancing their leverage.

- High Demand for Specialized Data: The increasing reliance on data analytics for competitive advantage in financial services elevates the importance of specialized data providers.

- Switching Costs: The integration of complex data analytics systems into core business operations creates significant barriers to switching, empowering incumbent suppliers.

- Proprietary Technology and Data: Unique algorithms and exclusive data access offered by certain analytics firms give them a distinct advantage and bargaining power.

- Market Growth: The projected compound annual growth rate (CAGR) of the analytics market, estimated to be around 10-15% in the coming years, underscores the increasing dependence on these service providers.

Human Capital and Specialized Talent

The fintech industry, including companies like Green Dot, heavily depends on individuals with expertise in financial technology, cybersecurity, regulatory compliance, and software engineering. The demand for these specialized skills often outstrips the supply.

This scarcity empowers employees, allowing them to command higher salaries and better benefits, directly impacting Green Dot's operational costs and talent acquisition strategies. For instance, in 2024, the average salary for a cybersecurity analyst in the US was reported to be around $100,000, a figure that can be significantly higher for specialized fintech roles.

- High Demand for Fintech Skills: Expertise in areas like AI in finance, blockchain, and data analytics is particularly sought after.

- Talent Scarcity Drives Costs: The limited pool of qualified candidates increases recruitment expenses and retention challenges for companies like Green Dot.

- Impact on Innovation: Access to top-tier talent is critical for developing new products and maintaining a competitive technological edge in the fast-evolving fintech landscape.

Green Dot faces significant supplier bargaining power from payment network providers like Visa and Mastercard, whose infrastructure is critical for its operations. The continued dominance of these networks in 2024, processing trillions in transactions, solidifies their leverage. Similarly, specialized technology and data analytics providers, offering proprietary solutions for fraud detection and insights, hold considerable sway due to high switching costs and the specialized nature of their offerings. The substantial valuation of the big data market, exceeding $270 billion in 2023, underscores the dependence on these crucial services.

| Supplier Type | Impact on Green Dot | Key Factors | 2024 Data/Context |

| Payment Networks (Visa, Mastercard) | High Bargaining Power | Global Acceptance, Robust Infrastructure | Processed trillions in transactions globally |

| Specialized Tech/Data Providers | High Bargaining Power | Proprietary Solutions, High Switching Costs | Global Big Data Market > $270B (2023) |

| Retail Distribution Partners (Walmart) | Moderate to High Bargaining Power | Customer Reach, Brand Presence | Extended agreement through 2033 |

| Talent (Fintech Specialists) | Moderate Bargaining Power | High Demand, Talent Scarcity | Cybersecurity Analyst Avg. Salary ~ $100K (2024) |

What is included in the product

This analysis dissects the competitive forces impacting Green Dot, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the prepaid financial services market.

Instantly identify and mitigate competitive threats with a visual, easy-to-understand breakdown of Porter's Five Forces.

Customers Bargaining Power

For its direct-to-consumer offerings like GO2bank and prepaid cards, Green Dot primarily targets underbanked and unbanked individuals. While these consumers historically had fewer banking alternatives, the surge in digital-first financial services and neobanks is expanding their options. This heightened competition subtly amplifies their bargaining power, compelling Green Dot to maintain competitive features and pricing to secure and retain this customer base.

Green Dot's Banking as a Service (BaaS) partners, often large consumer and technology companies like Samsung and Crypto.com, wield significant bargaining power. This is primarily due to the immense transaction volumes they can generate, making them highly attractive clients for BaaS providers. In 2024, these large clients can easily switch between numerous BaaS providers, demanding competitive pricing and tailored solutions.

Retail partners, particularly large chains like Walmart, represent a significant customer segment for Green Dot, acting as crucial distributors for its prepaid products. Their extensive reach provides essential channel access, and their sheer volume of sales grants them considerable bargaining power.

This power allows retailers to influence terms, dictate product placement on shelves, and negotiate promotional activities, directly impacting Green Dot's market presence and profitability. The recent renewal of Green Dot's multi-year agreement with Walmart in 2024, which began in 2022, highlights the strategic importance of maintaining strong, mutually beneficial relationships with these key distribution partners.

Small and Medium-sized Businesses (SMBs)

Small and Medium-sized Businesses (SMBs) hold considerable bargaining power with Green Dot, particularly given the competitive landscape of payroll and disbursement solutions. These businesses can readily compare offerings from traditional banks, specialized fintech companies, and other payroll service providers. This ease of switching means Green Dot must offer compelling pricing and robust features to retain SMB clients.

The ability of SMBs to negotiate terms is amplified by the availability of numerous alternatives. For instance, a significant portion of SMBs utilize third-party payroll providers, with estimates suggesting that over 40% of US businesses outsource their payroll functions. This widespread adoption of outsourcing underscores the competitive pressure on any single provider like Green Dot to deliver superior value and service.

Green Dot's success with SMBs hinges on its capacity to provide cost-effective solutions and adaptable services that meet diverse operational needs. The bargaining power of these customers is a direct result of the market's saturation with payment and payroll options, forcing providers to remain competitive and customer-centric.

- High Switching Potential: SMBs can easily move to competitors offering better rates or enhanced functionalities for payroll and disbursement services.

- Price Sensitivity: As businesses often operate on tighter margins, SMBs are highly attuned to pricing structures and seek the most economical solutions.

- Demand for Tailored Solutions: SMBs require payment and payroll services that are flexible enough to accommodate their unique operational requirements, increasing their leverage.

Tax Refund Customers

Green Dot, through its Santa Barbara TPG division, is a significant player in processing tax refunds. This positions them with a customer base that often has multiple options for receiving their refunds, such as direct deposit into traditional bank accounts or utilizing other tax preparation services. This availability of alternatives means customers can exert some influence over the fees and the quality of service they receive.

The bargaining power of tax refund customers is amplified by the presence of readily available substitutes. For instance, the IRS reported that in the 2023 tax season (for returns filed in 2024), over 90% of refunds were issued via direct deposit, indicating a strong preference and infrastructure for direct deposit to traditional accounts, which bypasses specialized refund processors.

- Customer Choice: Taxpayers can opt for direct deposit to their existing bank accounts, often avoiding processing fees.

- Competitive Landscape: Numerous tax preparation services and financial institutions offer refund disbursement options.

- Price Sensitivity: Customers are likely to compare fees associated with different refund processing methods.

- Service Expectations: The convenience offered by Green Dot must be weighed against potential savings from alternative refund methods.

Green Dot faces considerable customer bargaining power across its diverse product lines. For its direct-to-consumer offerings, the rise of neobanks and digital financial services provides underbanked individuals with more choices, forcing Green Dot to remain competitive on pricing and features. Similarly, its large Banking as a Service partners, like Samsung and Crypto.com, leverage their substantial transaction volumes to negotiate favorable terms, with the flexibility to switch providers easily in 2024. Retail giants such as Walmart, acting as key distributors for prepaid cards, also wield significant influence, impacting product placement and promotional terms, as evidenced by their ongoing multi-year agreement renewed in 2024.

Small and medium-sized businesses (SMBs) represent another segment where customer bargaining power is high. The widespread outsourcing of payroll, with over 40% of US businesses using third-party providers, means SMBs can readily compare Green Dot's services against numerous competitors, demanding competitive pricing and tailored solutions. Even customers receiving tax refunds through Green Dot's Santa Barbara TPG division have alternatives, such as direct deposit to traditional bank accounts, which saw over 90% of refunds issued this way in the 2023 tax season (filed in 2024), pushing Green Dot to offer attractive fee structures and service quality.

| Customer Segment | Source of Bargaining Power | Key Demands/Impact | 2024 Context/Data |

|---|---|---|---|

| Underbanked Individuals (GO2bank, Prepaid Cards) | Increased digital banking options, neobanks | Competitive pricing, feature parity | Growing digital-first financial service adoption |

| BaaS Partners (e.g., Samsung, Crypto.com) | High transaction volumes, ability to switch providers | Competitive pricing, tailored solutions | Numerous BaaS providers available |

| Retail Distributors (e.g., Walmart) | Extensive reach, sales volume | Favorable terms, product placement, promotions | Multi-year agreement with Walmart renewed in 2024 |

| Small & Medium Businesses (SMBs) | Availability of alternative payroll/disbursement solutions | Cost-effectiveness, flexible services, competitive pricing | Over 40% of US businesses outsource payroll |

| Tax Refund Recipients (Santa Barbara TPG) | Direct deposit to traditional banks, other tax services | Competitive fees, quality of service | Over 90% of refunds issued via direct deposit (2023 tax season) |

Preview the Actual Deliverable

Green Dot Porter's Five Forces Analysis

This preview showcases the comprehensive Green Dot Porter's Five Forces Analysis, detailing the competitive landscape for the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase. It provides an in-depth examination of industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, offering valuable strategic insights.

Rivalry Among Competitors

Traditional banks are intensifying their efforts to serve the underbanked, posing an indirect competitive threat to Green Dot. Many large financial institutions are expanding their basic checking accounts and digital banking options, aiming to capture a broader customer base. For instance, in 2024, several major banks announced initiatives focused on financial inclusion, offering low-fee accounts and simplified onboarding processes that could attract customers who might otherwise turn to Green Dot.

The competitive rivalry from neobanks and digital-first challengers is intense for Green Dot. Companies like Chime and Varo are aggressively capturing market share by offering attractive low-fee or no-fee checking accounts, coupled with user-friendly mobile apps and quicker transaction speeds. This directly challenges Green Dot's GO2bank and its broader consumer base, particularly those seeking digital convenience and cost savings.

The prepaid card market is intensely competitive, featuring numerous established financial institutions and agile fintech companies all vying for consumer and business spending. Major players such as BlackHawk Network, MoneyGram, and American Express offer comparable prepaid solutions, intensifying price-based competition and driving a need for unique features and broader distribution networks. This dynamic landscape sees constant innovation, with new offerings frequently emerging to capture market share.

Banking as a Service (BaaS) Competitors

Green Dot's Banking as a Service (BaaS) offerings contend with a dynamic field of competitors, each vying to provide embedded finance solutions. Companies such as Plaid, SBS Banking Platform, and Checkout.com are prominent players, offering comparable API-driven financial infrastructure that facilitates seamless integration for businesses.

The BaaS market is defined by its accelerated pace of innovation, demanding significant investment in cutting-edge technology. Success hinges on the ability to forge and maintain strong partnerships with large enterprises, a critical factor for scaling and market penetration.

- Key BaaS Competitors: Plaid, SBS Banking Platform, Checkout.com

- Market Characteristics: Rapid innovation, robust technology requirements, importance of enterprise partnerships

- Competitive Landscape: Intense rivalry for enabling embedded finance through API-driven solutions

Payment Processors and Money Transfer Services

Green Dot's money movement services, encompassing cash reload and transaction processing, face stiff competition from established players like Western Union and PayPal, as well as numerous other payment processors and money transfer entities. This competitive landscape intensifies due to the commoditized nature of many of these services.

The rivalry is characterized by a strong emphasis on price, convenience, speed, and the breadth of their network reach. For instance, in 2024, the global digital payment market was projected to reach over $2.5 trillion, highlighting the sheer volume and competitive intensity within this sector.

- Intense Price Competition: Companies frequently engage in price wars to attract and retain customers, especially for basic money transfer and payment processing.

- Focus on Convenience and Speed: Offering seamless, fast, and easily accessible transaction methods is crucial for differentiation.

- Network Reach: The ability to facilitate transactions across a wide geographic area and diverse payment methods is a significant competitive advantage.

- Technological Innovation: Continuous investment in new technologies, such as blockchain or improved mobile payment solutions, is vital to stay ahead.

Green Dot faces substantial competitive rivalry across its core business segments. Traditional banks are increasingly targeting the underbanked, with initiatives in 2024 focusing on low-fee accounts and simplified onboarding, directly challenging Green Dot's customer base. Neobanks and digital challengers like Chime and Varo are aggressively gaining market share through user-friendly apps and cost-effective services, intensifying competition for Green Dot's GO2bank. The prepaid card market is crowded with established players and fintechs, leading to price-based competition and a constant need for unique features.

| Competitor Type | Key Players | Competitive Tactics |

| Traditional Banks | Major Financial Institutions | Expanding low-fee accounts, financial inclusion initiatives |

| Neobanks/Digital Challengers | Chime, Varo | User-friendly apps, low/no-fee accounts, faster transactions |

| Prepaid Card Providers | BlackHawk Network, MoneyGram, American Express | Comparable solutions, price competition, unique features, broad distribution |

SSubstitutes Threaten

Despite the increasing adoption of digital payment methods, cash continues to be a significant substitute for Green Dot’s services, especially among the unbanked and underbanked. In 2024, a substantial portion of the U.S. population, estimated to be around 4.5% or 11.5 million households, remained unbanked, relying heavily on cash for their financial needs. This persistent reliance on physical currency for everyday transactions presents a direct alternative to prepaid cards and digital accounts, as many individuals prefer or require cash for their daily spending.

Green Dot acknowledges this threat and actively works to mitigate it by leveraging its extensive Green Dot Network, which offers numerous physical locations for cash access. This strategy allows customers to deposit and withdraw cash, thereby bridging the gap between cash-based economies and the digital financial services Green Dot provides. The availability of these cash access points is crucial for retaining customers who may otherwise opt for traditional cash-based financial behaviors.

Traditional bank accounts pose a threat to Green Dot by offering services that can appeal to its target demographic. As mainstream banks work to improve financial inclusion, they can attract customers seeking basic checking accounts with fewer hurdles. For instance, in 2024, several major banks continued to expand their low-fee or no-fee checking account options, making them more accessible to individuals previously underserved.

The rise of peer-to-peer (P2P) payment apps like Venmo and Cash App, along with digital wallets such as Apple Pay and Google Pay, presents a significant threat of substitution for Green Dot. These platforms offer user-friendly ways to transfer funds and make purchases, often bypassing traditional payment rails that Green Dot utilizes.

In 2024, the adoption of these digital payment solutions continues to surge. For instance, Venmo reported over 90 million users by the end of 2023, demonstrating the widespread appeal of P2P payments. This broad accessibility means consumers increasingly have convenient alternatives for everyday transactions, potentially diminishing the need for Green Dot's prepaid cards and related services.

Money Orders and Check Cashing Services

For individuals lacking traditional banking, money orders and check cashing services are direct substitutes for financial management and payment needs, similar to Green Dot's prepaid cards and money transfer services. These alternatives, while potentially carrying higher fees or offering less convenience, effectively address the core requirements of secure transactions and bill settlement for the unbanked and underbanked population.

The market for check cashing services, for instance, remains substantial. In 2023, an estimated 10 million Americans were unbanked, and many more were underbanked, relying on services outside traditional financial institutions. These consumers often turn to check cashing outlets, which can charge fees upwards of 2% to 5% of the check's value, highlighting a significant cost differential compared to more modern digital solutions.

- Cost Comparison: Check cashing services can charge fees ranging from 2% to 5% of the check amount, whereas Green Dot's reloadable prepaid cards may have lower per-transaction fees or monthly service charges, depending on usage.

- Accessibility for Unbanked: Approximately 10 million Americans remained unbanked in 2023, a demographic that heavily relies on alternatives like money orders and check cashing for essential financial activities.

- Transaction Security: Both money orders and check cashing services provide a tangible, albeit sometimes less efficient, method for secure payment, serving as a direct substitute for the secure transaction capabilities offered by Green Dot.

Emerging Fintech Solutions (e.g., Earned Wage Access, Crypto-linked Cards)

The fintech sector is a hotbed of innovation, constantly churning out new ways for consumers to manage their money. Earned Wage Access (EWA) platforms, for instance, allow workers to tap into their paychecks before payday, directly competing with traditional payroll and potentially reducing reliance on services like Green Dot's prepaid cards for immediate cash needs. The market for EWA is growing rapidly, with projections indicating significant expansion in the coming years.

Furthermore, the emergence of crypto-linked debit cards presents another layer of substitution. These cards allow users to spend their cryptocurrency holdings directly, bypassing traditional banking rails and offering an alternative for everyday transactions. This trend signifies a shift in how people access and utilize their funds, potentially diverting users from established payment providers.

- Earned Wage Access (EWA) platforms provide early access to earned income, offering an alternative to traditional payroll advances or short-term loans.

- Crypto-linked debit cards enable spending of digital assets, presenting a novel payment method that bypasses conventional financial systems.

- The increasing adoption of these fintech solutions suggests a growing consumer appetite for flexible and immediate financial management tools.

- These innovations directly challenge the value proposition of traditional financial services by offering convenience and novel functionalities.

The threat of substitutes for Green Dot remains significant, encompassing both traditional and emerging financial solutions. Cash continues to be a primary substitute, especially for the unbanked population, with around 11.5 million U.S. households relying on it in 2024. Traditional banks are also increasing their appeal by offering low-fee accounts, directly competing for Green Dot's customer base.

Digital payment platforms like Venmo, with over 90 million users by late 2023, and peer-to-peer payment apps offer convenient alternatives for everyday transactions. Furthermore, services like money orders and check cashing, while often more expensive, still serve as viable substitutes for the unbanked and underbanked, with an estimated 10 million Americans remaining unbanked in 2023.

Emerging fintech innovations such as Earned Wage Access (EWA) platforms and crypto-linked debit cards further diversify the substitute landscape. These solutions provide alternative methods for accessing funds and making payments, potentially reducing the reliance on services like Green Dot's prepaid offerings.

| Substitute Type | Key Characteristics | 2023/2024 Data Point | Impact on Green Dot |

|---|---|---|---|

| Cash | Physical currency for transactions | 11.5 million U.S. households unbanked (2024) | Direct alternative for daily spending |

| Traditional Bank Accounts | Low-fee/no-fee checking options | Increasing accessibility by major banks (2024) | Attracts underserved demographic |

| P2P Payment Apps (e.g., Venmo) | Digital fund transfers, purchases | 90+ million users (end of 2023) | Convenient alternative for transactions |

| Money Orders/Check Cashing | Tangible payment methods | 10 million Americans unbanked (2023) | Addresses core needs for unbanked |

| Fintech Innovations (EWA, Crypto Cards) | Early wage access, crypto spending | Rapid market growth (ongoing) | Offers flexible, immediate financial tools |

Entrants Threaten

Operating as a bank holding company with its own bank, Green Dot Bank (Member FDIC), creates substantial hurdles for potential new entrants. The process of securing banking licenses and navigating complex regulatory frameworks, such as those set by the FDIC and the Community Reinvestment Act (CRA), is both time-consuming and capital-intensive.

The threat of new entrants for Green Dot is significantly influenced by high capital requirements. Launching a fintech and banking service demands massive investment in technology, robust security, and navigating complex regulatory landscapes. For instance, obtaining a bank charter alone can cost millions, a substantial barrier for many aspiring competitors.

New players must also fund extensive marketing campaigns to build brand recognition and trust, a critical factor in financial services. Acquiring customers in a crowded market requires significant spend, potentially exceeding $100 per customer in some digital banking segments. This financial hurdle limits the number of entities that can realistically challenge established players like Green Dot.

Green Dot's formidable retail distribution network, spanning over 90,000 locations, presents a significant hurdle for new entrants. This extensive reach, coupled with strong brand trust, especially within the underbanked demographic, makes replicating Green Dot's market penetration a daunting and costly endeavor.

Technological Complexity and Infrastructure

The technological complexity and infrastructure required to build and operate a modern financial services platform, especially one offering Banking-as-a-Service (BaaS) like Green Dot's Arc platform, present a significant barrier to entry. Developing and maintaining the sophisticated, secure, and scalable technology stack necessitates substantial upfront investment and ongoing expertise. For instance, in 2024, the global BaaS market was projected to reach over $20 billion, highlighting the immense capital and technical know-how needed to capture even a fraction of this space.

New entrants must contend with the high cost and intricate development of core banking systems, payment processing, fraud detection, and regulatory compliance technology. Green Dot, having invested heavily over years, possesses established infrastructure. Competitors would need to either build this from scratch, a process that can take years and millions of dollars, or acquire existing technology, which is often costly and may not perfectly align with their strategic goals.

- High Capital Expenditure: Building secure, compliant, and scalable financial technology platforms requires significant upfront investment in hardware, software, and specialized personnel, often running into tens or hundreds of millions of dollars.

- Specialized Expertise: Accessing and retaining talent with deep knowledge in areas like cybersecurity, blockchain, AI for fraud prevention, and regulatory technology is crucial and can be a bottleneck for new entrants.

- Regulatory Hurdles: Navigating the complex regulatory landscape for financial services, including data privacy (like GDPR or CCPA) and anti-money laundering (AML) requirements, adds another layer of technical and operational complexity that established players have already mastered.

- Infrastructure Scalability: Ensuring the platform can handle fluctuating transaction volumes and adapt to future technological advancements without performance degradation is a continuous challenge requiring robust and flexible infrastructure design.

Customer Acquisition Costs and Network Effects

The threat of new entrants for Green Dot, particularly in the Banking-as-a-Service (BaaS) space, is significantly mitigated by high customer acquisition costs and powerful network effects. Acquiring customers, especially within the underbanked demographic that Green Dot serves, requires substantial investment in marketing and building trust, which can be a considerable barrier. For instance, in 2024, digital banks and fintechs continued to spend heavily on user acquisition, with average customer acquisition costs (CAC) often ranging from $50 to $150 for basic accounts, and significantly higher for more engaged users. This makes it challenging for newcomers to compete on cost alone.

Furthermore, securing large enterprise partners for BaaS solutions involves protracted sales cycles and complex integration processes. These relationships are built on trust and proven reliability, which new entrants struggle to establish quickly. Green Dot's established network of existing customers and strategic partnerships creates a significant network effect. This existing ecosystem makes it more attractive for new users and partners to join Green Dot, as they benefit from the established community and services, thereby increasing the difficulty for new entrants to achieve critical mass and gain meaningful traction in the market.

- High Customer Acquisition Costs: Marketing and trust-building expenses are substantial, especially for the underbanked segment, with CAC for similar financial services often exceeding $50 in 2024.

- Lengthy Enterprise Sales Cycles: Onboarding new BaaS partners requires significant time and effort in sales and integration, a hurdle for less established players.

- Network Effects: Green Dot's existing customer base and partnerships create a strong competitive advantage, making it harder for new entrants to attract users and partners.

The threat of new entrants for Green Dot is considerably low due to the immense capital and regulatory barriers inherent in the banking and fintech sectors. Securing banking licenses, complying with stringent regulations like those from the FDIC, and the substantial investment in technology and security, often running into millions, deter most new players. For instance, the global Banking-as-a-Service (BaaS) market, where Green Dot operates, was projected to exceed $20 billion in 2024, indicating the significant financial commitment required to compete effectively.

Furthermore, Green Dot's extensive retail distribution network, reaching over 90,000 locations, and its established brand trust, especially among the underbanked, create a formidable competitive moat. New entrants face high customer acquisition costs, often exceeding $50 to $150 per customer in 2024 for digital banking services, and lengthy sales cycles for enterprise BaaS partnerships, making it difficult to achieve critical mass and replicate Green Dot's market penetration.

| Barrier Type | Description | Estimated Cost/Challenge |

| Regulatory Compliance | Obtaining banking licenses, adhering to FDIC and CRA regulations. | Millions of dollars, extensive legal and compliance teams. |

| Capital Investment | Building secure, scalable technology infrastructure, marketing. | Tens to hundreds of millions for a robust platform. |

| Distribution Network | Replicating Green Dot's 90,000+ retail locations. | Extremely high logistical and partnership costs. |

| Customer Acquisition | Marketing and building trust, especially for the underbanked. | CAC often $50-$150+ in 2024 for digital financial services. |

| BaaS Partnerships | Securing enterprise clients via long sales cycles and integration. | Requires proven track record and significant sales effort. |

Porter's Five Forces Analysis Data Sources

Our Green Dot Porter's Five Forces analysis is built upon a foundation of verified data, including financial statements from Green Dot and its competitors, industry-specific market research reports, and regulatory filings from relevant financial authorities.