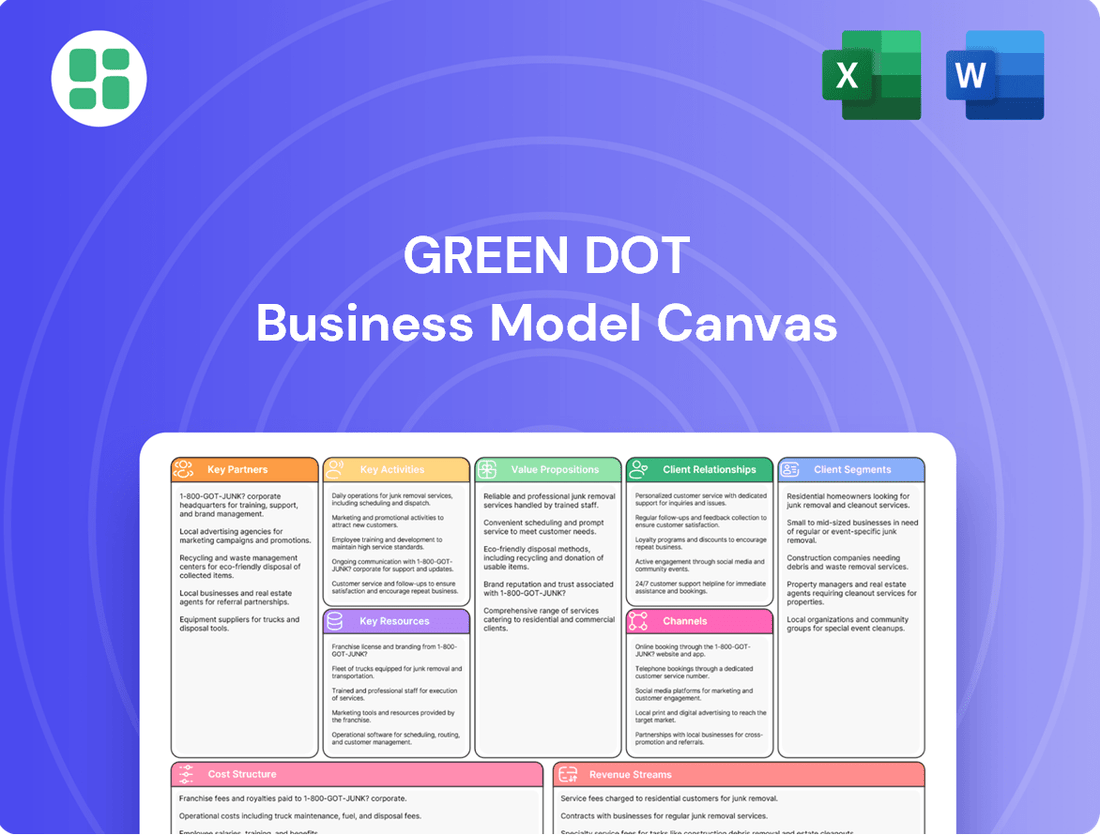

Green Dot Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Dot Bundle

Curious about how Green Dot built its disruptive business? Our full Business Model Canvas unpacks their customer relationships, revenue streams, and cost structure with actionable detail. Download the complete, professionally designed canvas to understand their strategic advantage and apply similar principles to your own ventures.

Partnerships

Green Dot's relationships with major retailers, notably Walmart, are absolutely crucial. Their extended agreement with Walmart through 2033 for products like the Walmart MoneyCard highlights the depth and longevity of these collaborations. These partnerships are the backbone for getting Green Dot's financial products into the hands of consumers and ensuring people can easily access cash nationwide.

Green Dot strategically partners with major consumer and technology brands via its Banking as a Service (BaaS) model, integrating financial products directly into their existing platforms. This approach allows these partners to offer seamless financial experiences to their customer base. For instance, recent collaborations include Samsung for its Wallet functionalities and Crypto.com, enhancing their banking and payment capabilities.

These partnerships are crucial for Green Dot's expansion into the burgeoning embedded finance market, utilizing its proprietary Arc platform. This strategy allows Green Dot to reach a wider audience by leveraging the established customer networks of its partners, effectively acting as the financial backbone for innovative consumer-facing applications.

Green Dot's strategy includes key partnerships with fintechs and digital platforms, extending its reach beyond major tech players. These collaborations are vital for growing its Green Dot Network and Banking-as-a-Service (BaaS) offerings.

For instance, partnerships with companies like Dayforce enable on-demand pay solutions through the Dayforce Wallet. Other collaborations with entities such as REPAY, FACEBANK, and Pana leverage Green Dot's extensive retail footprint to facilitate cash transactions and financial services for their customers.

Payment Networks (Visa, Mastercard)

Green Dot's relationship with payment networks like Visa and Mastercard is fundamental to its business. These partnerships are not just about branding; they are the engine that allows Green Dot's prepaid and secured credit cards to function. Without these agreements, their cards simply couldn't be used at point-of-sale terminals or online, limiting their reach to a tiny fraction of the financial world.

These collaborations are crucial for enabling Green Dot to offer its products to a wide customer base. By leveraging the extensive networks of Visa and Mastercard, Green Dot cards gain global acceptance, allowing users to make purchases wherever these major brands are recognized. This integration is key to making prepaid and secured credit cards accessible and practical for everyday use.

- Global Reach: Visa and Mastercard's vast acceptance networks ensure Green Dot cards can be used by millions of consumers worldwide.

- Transaction Processing: These partnerships provide the essential infrastructure for processing all card transactions, including authorization, clearing, and settlement.

- Ecosystem Integration: By working with these payment giants, Green Dot seamlessly integrates its offerings into the broader financial ecosystem, enhancing user convenience and trust.

Employer Solutions Providers

Green Dot's rapid! wage and disbursements solutions are built on a foundation of strong partnerships with over 6,000 businesses. These collaborations are crucial for delivering their pay card and earned wage access services directly to employees, effectively embedding Green Dot within the employer payroll ecosystem.

This extensive network of business partners allows Green Dot to tap into the significant payroll and employer solutions market. The company is actively pursuing further growth by extending its earned wage access offerings to businesses that may not currently utilize their pay card services, broadening their customer base.

- 6,000+ Business Partnerships: Green Dot's rapid! solution serves a vast network of employers.

- Payroll Integration: These partnerships facilitate the seamless delivery of pay and earned wage access to employees.

- Market Expansion: The focus is on growing the employer solutions segment by reaching new businesses.

- Earned Wage Access Growth: A key strategy involves selling earned wage access to non-pay card clients.

Green Dot's key partnerships are vital for its multi-channel distribution and Banking-as-a-Service (BaaS) strategy. These relationships enable the company to embed financial services into various consumer platforms, significantly expanding its reach and customer base.

The company's collaboration with major retailers, particularly Walmart through its MoneyCard program until 2033, is a cornerstone of its distribution. Furthermore, partnerships with tech giants like Samsung and crypto platforms such as Crypto.com demonstrate Green Dot's expansion into embedded finance via its Arc platform.

Crucial alliances with payment networks like Visa and Mastercard are fundamental, powering Green Dot's prepaid and secured credit card products and ensuring global transaction processing and acceptance.

Green Dot's rapid! wage and disbursements solutions are supported by over 6,000 business partnerships, facilitating pay card and earned wage access services directly to employees.

| Partner Type | Key Examples | Impact |

|---|---|---|

| Retailers | Walmart (MoneyCard through 2033) | Extensive physical distribution and customer access |

| Technology/Fintech Brands | Samsung Wallet, Crypto.com, Dayforce, REPAY, Pana | Embedded finance, BaaS, seamless user experiences |

| Payment Networks | Visa, Mastercard | Card functionality, global transaction processing, ecosystem integration |

| Businesses (Payroll) | 6,000+ employers (rapid! wage) | Delivery of pay cards and earned wage access |

What is included in the product

A pre-built, adaptable framework that outlines a company's strategic approach to generating revenue and delivering value, organized into nine essential business model components.

The Green Dot Business Model Canvas helps alleviate the pain of unclear strategy by providing a structured, visual framework to map out key business elements.

It simplifies complex business ideas into a single, actionable page, reducing the frustration of scattered information and overwhelming detail.

Activities

Green Dot is all about keeping its financial products fresh and useful. This means they're constantly working on their prepaid debit cards, checking accounts like GO2bank, and secured credit cards. They aim to offer better features and stay ahead of the competition.

A big part of this is investing in their tech. In 2024, Green Dot continued to modernize its processing systems and enhance its fraud and risk management tools. These upgrades are crucial for delivering top-notch product capabilities and ensuring a secure experience for their customers.

A crucial activity involves the ongoing management and enhancement of the Arc by Green Dot platform, serving as Green Dot's core embedded finance solution. This includes streamlining partner onboarding, maintaining stringent compliance standards, and delivering comprehensive banking and payment processing services to major consumer-facing and technology firms.

The strategic imperative to grow the Banking as a Service (BaaS) segment is a primary focus. This growth is supported by the platform's ability to offer end-to-end financial capabilities, attracting a significant number of partners and driving revenue in this expanding market.

Green Dot's core activity involves the robust operation and strategic expansion of its extensive retail network. This network, boasting over 95,000 locations as of recent reports, is fundamental to providing essential cash-in and cash-out services.

This vast physical footprint is particularly critical for serving underbanked populations who rely on accessible, brick-and-mortar points for financial transactions, often where traditional banking infrastructure is limited.

Maintaining and growing this physical presence directly supports customer accessibility and the company's mission to provide financial services to a broad demographic.

Regulatory Compliance and Risk Management

Green Dot's operations as a financial technology company and a bank holding company, including Green Dot Bank (Member FDIC), necessitate a strong emphasis on regulatory compliance and risk management. This commitment is crucial for maintaining trust and ensuring the stability of its financial services. For instance, in 2024, financial institutions like Green Dot continue to navigate complex regulatory landscapes, investing heavily in systems that monitor and report transactions to prevent illicit activities, a key focus for regulators like the OCC and CFPB.

Key activities in this area include:

- Ongoing Investment in Compliance: Continuously updating and enhancing compliance programs to meet evolving financial regulations, such as those related to anti-money laundering (AML) and know your customer (KYC) requirements.

- Fraud and Risk Management Tools: Developing and implementing advanced technological solutions to detect and prevent fraud, manage credit risk, and ensure the security of customer data and transactions.

- Adherence to Financial Regulations: Strictly following all applicable federal and state financial laws and guidelines to maintain operational integrity and protect consumers.

- Cybersecurity Measures: Prioritizing robust cybersecurity protocols to safeguard sensitive financial information against cyber threats, a critical component of risk management in the digital age.

Customer Acquisition and Relationship Management

Green Dot's key activities in customer acquisition and relationship management are multifaceted, aiming to attract and retain both individual consumers and business clients. For its consumer brands, such as GO2bank, this involves robust marketing campaigns and digital outreach to build brand awareness and drive account openings. The company also focuses on fostering loyalty through personalized offers and responsive customer service.

On the business-to-business (BaaS) side, Green Dot employs dedicated business development teams to forge partnerships with companies seeking payment processing and banking solutions. These efforts are crucial for securing large-scale client relationships and ensuring their ongoing satisfaction and engagement with Green Dot's platform. This dual approach allows Green Dot to cater to a broad market.

As of the first quarter of 2024, Green Dot reported a significant increase in its customer base. The company highlighted that GO2bank had over 11 million accounts opened by the end of 2023, with active customer growth continuing into 2024. This growth underscores the effectiveness of their acquisition strategies.

The company's retention efforts are also a critical component of its business model. For instance, Green Dot aims to increase the lifetime value of its customers by offering a suite of financial products and services that encourage continued use and deeper engagement. This strategy is vital for sustainable revenue growth.

- Consumer Acquisition: Marketing and digital strategies for brands like GO2bank to attract new users, evidenced by over 11 million GO2bank accounts opened by year-end 2023.

- BaaS Business Development: Dedicated teams focused on acquiring and nurturing partnerships with corporate clients for Banking-as-a-Service solutions.

- Relationship Management: Implementing personalized engagement strategies and customer service to enhance retention and loyalty across all customer segments.

- Customer Lifetime Value: Efforts to increase revenue per customer through cross-selling and upselling a range of financial products and services.

Green Dot's key activities revolve around developing and enhancing its financial product suite, including prepaid cards and accounts like GO2bank. They are committed to modernizing their technology, with significant investments in 2024 to upgrade processing systems and bolster fraud detection. Managing and expanding the Arc by Green Dot platform is central, enabling embedded finance solutions for various businesses.

The company also prioritizes growing its Banking as a Service (BaaS) offerings, leveraging its platform's capabilities to attract partners and drive revenue. A critical ongoing activity is the maintenance and expansion of its extensive retail network, comprising over 95,000 locations, which is vital for providing accessible cash-in and cash-out services, particularly for underbanked communities.

Furthermore, Green Dot places a strong emphasis on regulatory compliance and risk management, essential for its operations as a financial technology company and bank holding company. This includes continuous investment in compliance programs, advanced fraud prevention tools, and robust cybersecurity measures to protect customer data and ensure operational integrity.

Customer acquisition and retention are also core activities, utilizing marketing campaigns for consumer brands like GO2bank and dedicated business development for BaaS clients. The company aims to increase customer lifetime value through cross-selling and upselling a diverse range of financial products and services.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Development & Enhancement | Innovating and improving prepaid debit cards, checking accounts (GO2bank), and secured credit cards. | Continued modernization of processing systems and fraud management tools. |

| Platform Management (Arc by Green Dot) | Streamlining onboarding, ensuring compliance, and providing banking/payment processing for partners. | Enhancing end-to-end financial capabilities for embedded finance solutions. |

| Banking as a Service (BaaS) Growth | Expanding BaaS segment by offering comprehensive financial capabilities to businesses. | Attracting a significant number of partners to drive revenue in this growing market. |

| Retail Network Operations | Maintaining and growing a vast physical network for cash-in/cash-out services. | Over 95,000 retail locations supporting accessibility for underbanked populations. |

| Compliance & Risk Management | Adhering to financial regulations, preventing illicit activities, and safeguarding customer data. | Heavy investment in systems for transaction monitoring and reporting, adhering to OCC and CFPB guidelines. |

| Customer Acquisition & Retention | Attracting new users and fostering loyalty through marketing, personalized offers, and customer service. | GO2bank exceeded 11 million accounts opened by end of 2023, with continued active customer growth in 2024. |

Preview Before You Purchase

Business Model Canvas

The Green Dot Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring there are no surprises. Once your order is confirmed, you'll gain full access to this ready-to-use business tool, allowing you to immediately start planning and strategizing.

Resources

Green Dot Bank, a wholly-owned subsidiary and a key resource, provides the essential banking charter that differentiates Green Dot from many other fintech companies. This charter allows Green Dot to directly offer regulated financial services, underpinning its diverse product ecosystem and serving as the core infrastructure for its Banking-as-a-Service (BaaS) collaborations.

As of the first quarter of 2024, Green Dot reported total deposits of $26.5 billion, showcasing the scale and trust placed in its chartered banking operations. This substantial deposit base is a direct result of the stability and regulatory compliance afforded by its own bank charter.

The bank charter is instrumental in Green Dot's ability to innovate and expand its offerings, from prepaid debit cards to checking accounts, all while adhering to stringent financial regulations. This direct control over its banking infrastructure is a significant competitive advantage in the rapidly evolving financial landscape.

The Arc by Green Dot is a proprietary technology platform that acts as the core of Green Dot's embedded finance strategy. This cloud-based system integrates secure banking and money processing, functioning as a single-source engine for their Banking-as-a-Service (BaaS) offerings.

Arc's scalability and robust architecture are fundamental to Green Dot's ability to efficiently deliver a wide array of financial products to its partners and customers. In 2023, Green Dot reported that its technology and processing segment, which includes Arc, generated $1.1 billion in revenue, highlighting the platform's significant contribution to the company's financial performance.

Green Dot's extensive retail distribution network is a cornerstone of its business model, boasting over 95,000 locations across the United States. This physical footprint significantly surpasses the combined total of all remaining traditional bank branches, offering unparalleled accessibility.

This vast network is crucial for Green Dot's mission to serve populations often overlooked by conventional banking systems. It facilitates convenient cash access and product distribution, making financial services readily available to a broad customer base.

Intellectual Property and Data Analytics

Green Dot's intellectual property portfolio is a cornerstone of its business model, encompassing patents and proprietary technologies in areas like payment processing, prepaid card management, and Banking-as-a-Service (BaaS) platforms. This IP allows for efficient and secure transaction handling, a critical component for their financial products.

Advanced data analytics is integral to Green Dot's operations, providing deep insights into customer behavior and transaction patterns. This capability is crucial for enhancing fraud detection systems and personalizing financial product offerings to meet diverse customer needs.

- Intellectual Property: Patents in payment processing, prepaid card technology, and BaaS solutions.

- Data Analytics: Customer behavior analysis, fraud detection, and product optimization.

- Impact: Enhanced security, improved customer experience, and data-driven product development.

- 2024 Focus: Continued investment in AI-driven analytics for proactive fraud prevention and personalized financial services.

Human Capital and Financial Expertise

Green Dot's human capital is a cornerstone of its operations, encompassing a diverse range of skilled professionals. This includes financial experts who manage the company's intricate financial operations, technology developers crucial for platform innovation, and compliance officers who navigate the complex regulatory environment of fintech. In 2024, the company's workforce, numbering approximately 2,000 employees, was instrumental in driving its strategic initiatives.

The collective expertise of these teams is directly responsible for Green Dot's ability to innovate in its product offerings, manage its extensive network of partnerships, and maintain strict adherence to financial regulations. This skilled workforce is essential for executing the company's vision in the rapidly changing fintech sector.

- Financial Expertise: Professionals managing treasury, accounting, and financial planning.

- Technology Development: Teams building and maintaining the company's digital platforms.

- Compliance Officers: Ensuring adherence to banking and financial regulations.

- Business Development: Driving strategic partnerships and market expansion.

Green Dot's proprietary technology platform, Arc, is central to its Banking-as-a-Service (BaaS) strategy. This cloud-based system handles secure banking and money processing, enabling Green Dot to efficiently deliver financial products to partners. In 2023, the technology and processing segment, including Arc, generated $1.1 billion in revenue, underscoring its financial significance.

The company's extensive retail distribution network, spanning over 95,000 locations, provides unparalleled accessibility, especially for underserved populations. This physical presence is a key differentiator, facilitating convenient cash access and product distribution across the United States.

Green Dot's intellectual property, including patents in payment processing and BaaS, enhances security and efficiency. Coupled with advanced data analytics for customer insights and fraud detection, these resources drive product innovation and personalized financial services. The company continues to invest in AI-driven analytics for proactive fraud prevention.

Human capital, comprising around 2,000 employees in 2024, is vital for managing financial operations, developing technology, and ensuring regulatory compliance. This skilled workforce underpins Green Dot's ability to innovate and expand its market reach.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Banking Charter | Wholly-owned subsidiary enabling direct regulated financial services and BaaS. | $26.5 billion in total deposits (Q1 2024), providing stability and regulatory compliance. |

| Arc Platform | Proprietary cloud-based technology for embedded finance and BaaS. | $1.1 billion revenue from technology and processing segment (2023). |

| Retail Distribution Network | Over 95,000 locations across the U.S. | Unparalleled accessibility for underserved populations; key for cash access and product distribution. |

| Intellectual Property & Data Analytics | Patents in payment processing, BaaS; AI-driven analytics for customer insights and fraud prevention. | Enhanced security, improved customer experience, data-driven product development. |

| Human Capital | Approx. 2,000 employees (2024) with expertise in finance, technology, and compliance. | Drives innovation, partnership management, and regulatory adherence. |

Value Propositions

Green Dot offers vital financial services like prepaid debit cards and checking accounts through platforms such as GO2bank, specifically targeting individuals who are underbanked or unbanked. This accessibility provides a cost-effective and user-friendly substitute for conventional banking, fostering greater financial inclusion and enabling secure money management for millions.

In 2024, Green Dot continued its mission to serve these communities, with GO2bank reporting over 2 million customers by the end of the year. This growth highlights the significant demand for affordable and accessible banking solutions among populations often excluded from traditional financial systems.

Green Dot's BaaS solutions and the Arc platform offer businesses a powerful way to embed financial services directly into their customer experiences. This means companies like large retailers or tech firms can offer branded debit cards, payment solutions, or even deposit accounts without needing a banking license themselves. In 2024, the embedded finance market is projected to reach over $7 trillion globally, highlighting the immense demand for such integrated solutions.

By leveraging Green Dot's infrastructure, businesses gain a customizable, end-to-end banking backbone. This allows them to create new revenue streams, enhance customer loyalty by offering convenient financial tools, and speed up their growth trajectory. Companies can avoid the significant capital expenditure and regulatory hurdles associated with building their own banking operations.

Green Dot's extensive network, boasting over 95,000 retail locations, provides unmatched convenience for both depositing and withdrawing cash. This vast accessibility is a core value, especially for those who primarily use cash or need straightforward ways to manage their money.

This broad reach for cash services and money transfers is a significant draw, making it easier for customers to access their funds and move money efficiently. For instance, in 2024, Green Dot reported facilitating billions in transactions, underscoring the scale of this convenient access.

Flexible Payroll and Wage Access Solutions

Green Dot's rapid! solutions offer businesses flexible pay card and earned wage access (EWA) services. This allows employees to tap into their earned wages whenever they need them, providing crucial financial flexibility.

This capability significantly boosts employee financial wellness, acting as a powerful tool for employers to attract and retain talent. For instance, in 2024, studies indicated that companies offering EWA saw a noticeable uptick in employee satisfaction and a reduction in turnover rates.

- Flexible Wage Access: Employees can receive a portion of their earned wages before the traditional payday, improving cash flow management.

- Enhanced Financial Wellness: Reduces reliance on costly short-term loans or predatory lending for employees facing unexpected expenses.

- Employer Benefits: Serves as a competitive advantage in recruitment and a key factor in improving employee engagement and loyalty.

- Operational Efficiency: Streamlines payroll processes for businesses by offering digital pay solutions.

Secure and Regulated Financial Services

Green Dot, operating as a bank holding company through Green Dot Bank, offers the inherent security and trustworthiness associated with a regulated financial institution. This regulatory framework, including FDIC membership, assures customers that their deposits are protected up to the standard insurance amount, fostering confidence in the platform's stability and reliability.

This robust regulatory standing provides significant peace of mind for both individual consumers and substantial corporate partners. Knowing their funds and transactions are safeguarded by stringent banking standards and oversight allows users to engage with Green Dot's services without undue concern about financial security or compliance issues.

As of the first quarter of 2024, Green Dot Bank reported total deposits of approximately $11.7 billion, underscoring the substantial trust placed in its secure and regulated services by a broad customer base.

- FDIC Insured Deposits: Green Dot Bank is a Member FDIC, ensuring customer deposits are insured up to $250,000 per depositor, per insured bank, for each account ownership category.

- Regulatory Compliance: Adherence to banking regulations provides a secure environment for all financial transactions and customer data.

- Trust and Reliability: The regulated status builds confidence among individual users and corporate clients regarding the safety of their financial assets.

- Financial Stability: Operating under banking regulations contributes to Green Dot's overall financial stability and operational integrity.

Green Dot provides accessible, affordable banking alternatives for the underbanked and unbanked through GO2bank, fostering financial inclusion. In 2024, GO2bank served over 2 million customers, demonstrating the strong demand for these services.

Its BaaS and Arc platforms enable businesses to embed financial services, tapping into the over $7 trillion global embedded finance market projected for 2024. This offers new revenue streams and enhanced customer loyalty for partners.

Green Dot's extensive retail network of over 95,000 locations offers unparalleled convenience for cash transactions, supporting billions in transactions facilitated in 2024.

The rapid! solutions offer earned wage access, improving employee financial wellness and aiding employer talent acquisition. Companies using EWA in 2024 saw improved employee satisfaction.

| Value Proposition | Description | Target Audience | 2024 Impact/Data |

|---|---|---|---|

| Financial Inclusion | Accessible banking for underbanked/unbanked | Individuals lacking traditional banking access | GO2bank: >2 million customers |

| Embedded Finance | BaaS for businesses to offer financial services | Retailers, tech firms, fintechs | Market projected >$7T globally |

| Cash Access Network | Extensive retail locations for cash services | Cash-reliant individuals, unbanked | >95,000 locations; Billions in transactions |

| Earned Wage Access | Flexible pay for employees | Employees, Employers | Improved employee satisfaction/retention |

| Banking Security | FDIC-insured deposits via Green Dot Bank | All customers, corporate partners | $11.7B deposits (Q1 2024) |

Customer Relationships

Green Dot prioritizes automated and self-service channels for its consumer products, such as prepaid debit cards and GO2bank accounts. This digital-first approach empowers customers to manage their finances conveniently through online portals and robust mobile applications. In 2024, Green Dot reported a significant portion of its customer interactions occurring via digital self-service, reflecting a growing preference for immediate, on-demand support.

Green Dot fosters dedicated partnerships with its Banking as a Service (BaaS) clients, recognizing that success hinges on a collaborative approach. This isn't a hands-off arrangement; it's about building a strong, managed relationship.

Dedicated account management teams are central to this strategy. These teams work closely with BaaS partners, offering tailored financial solutions and ensuring seamless integration of Green Dot's capabilities into their offerings. This proactive support helps partners navigate technical complexities and adapt to changing market demands.

Ongoing collaboration is key to supporting partner growth. By understanding their evolving needs, Green Dot can continuously refine its BaaS solutions, ensuring they remain competitive and effective. This commitment to partnership is a cornerstone of Green Dot's BaaS value proposition.

Green Dot maintains robust relationships with its vast network of retail partners, including giants like Walmart, Walgreens, and 7-Eleven. This is vital for their business model, ensuring widespread accessibility for their financial products. In 2023, Green Dot reported that over 70,000 retail locations carried their products, highlighting the depth of these partnerships.

To foster these connections, Green Dot provides continuous operational support for the Green Dot Network, ensuring a smooth experience for both retailers and customers. They also engage in collaborative marketing for co-branded items, driving mutual sales growth. Strategic discussions with retailers focus on optimizing product placement and enhancing the overall customer journey within the store environment.

Problem-Solving and Compliance Support

Green Dot offers robust problem-solving across all customer segments, assisting with transaction errors, account inquiries, and platform navigation. This comprehensive support ensures a smooth experience for users interacting with Green Dot's financial services.

For its Banking-as-a-Service (BaaS) partners, Green Dot extends this support to encompass critical compliance and regulatory guidance. This specialized assistance is vital as Green Dot Bank, a regulated entity, helps partners navigate complex financial laws and maintain adherence.

- Transaction and Account Troubleshooting: Green Dot addresses issues for all users, ensuring seamless financial operations.

- Platform Usage Support: Assistance is provided for navigating and utilizing Green Dot's digital platforms.

- BaaS Partner Compliance Expertise: Specialized guidance on regulatory adherence is offered to BaaS collaborators.

- Leveraging Bank Status for Partner Adherence: Green Dot Bank's regulated nature underpins support for partners' legal compliance.

Community Engagement and Financial Education

Green Dot goes beyond basic transactions by actively engaging with its customer base, especially the underbanked, through financial education initiatives. This commitment to empowering individuals with knowledge and accessible tools fosters deeper trust and encourages lasting loyalty.

- Financial Literacy Programs: Green Dot offers resources designed to improve financial decision-making among its users.

- Accessible Tools: Providing easy-to-use platforms and services helps customers manage their money more effectively.

- Building Trust: These educational efforts demonstrate a genuine interest in the financial well-being of their customers, strengthening relationships.

- Long-Term Loyalty: By investing in customer financial health, Green Dot aims to cultivate a loyal customer base that sees value beyond mere transactional services.

Green Dot cultivates diverse customer relationships, from broad consumer accessibility via retail partnerships to deep, managed collaborations with Banking as a Service (BaaS) clients. Their approach emphasizes self-service digital channels for consumers, complemented by dedicated support for their business partners. This dual strategy aims to ensure convenience and foster growth across all segments.

| Relationship Type | Key Engagement Strategy | 2024/2023 Data Point |

|---|---|---|

| Retail Consumers | Widespread product availability, digital self-service | Over 70,000 retail locations carried Green Dot products in 2023. |

| BaaS Partners | Dedicated account management, tailored solutions, compliance support | Focus on seamless integration and proactive support for partner growth. |

| All Customers | Problem-solving, platform assistance, financial education | Significant portion of customer interactions handled via digital self-service in 2024. |

Channels

Green Dot's retail store network is a cornerstone of its business, acting as the primary physical touchpoint for millions of customers. This network, boasting over 95,000 locations, includes major retailers such as Walmart, Walgreens, and 7-Eleven, providing unparalleled accessibility.

These retail partners are crucial for distributing Green Dot's core products, including prepaid debit cards and facilitating essential services like cash reloads and deposits. This widespread physical presence is particularly vital for serving the underbanked population, who often rely on cash-based transactions.

Green Dot leverages its proprietary digital platforms and mobile applications, like the GO2bank app, to directly engage consumers with its banking services. These channels are central to offering seamless account management, advanced mobile banking features, and readily accessible customer support, effectively serving a digitally-oriented clientele.

As of the first quarter of 2024, Green Dot reported that approximately 70% of its total customer transactions occurred through its digital channels, highlighting the significant reliance on these platforms. The GO2bank app, a key component, saw a 25% increase in active users year-over-year, demonstrating strong adoption and engagement with its digital offerings.

Green Dot's channels for its BaaS solutions are primarily the digital platforms and applications of its corporate and technology partners. Think of companies like Samsung Wallet or Crypto.com, where Green Dot's financial services are directly integrated.

This means customers don't have to go to a separate Green Dot app; they access banking services right within the partner's existing interface. This embedded approach offers a seamless, often white-label or co-branded, experience for the end-user.

For instance, in 2024, Green Dot continued to expand its partnerships, enabling millions of users to access banking and payment services through these integrated channels, demonstrating the scalability of this embedded finance strategy.

Online Direct-to-Consumer Sales

Green Dot actively acquires customers directly through its online platforms for offerings like GO2bank and secured credit cards. This digital-first approach leverages targeted online marketing to reach consumers specifically looking for convenient, modern banking solutions. The direct online channel facilitates a streamlined onboarding process, enhancing customer acquisition efficiency.

This direct-to-consumer (DTC) strategy is crucial for Green Dot's expansion in the digital banking space. In 2024, companies heavily investing in digital customer acquisition saw significant growth. For instance, many neobanks reported substantial increases in their customer bases driven primarily by online marketing and referral programs. This channel allows Green Dot to control the customer experience from the initial touchpoint, fostering brand loyalty and enabling personalized communication.

- Direct Online Acquisition: GO2bank and secured credit cards are marketed and acquired via Green Dot's websites and digital advertising.

- Customer Engagement: This channel allows for direct interaction with individuals seeking digital banking services.

- Convenient Onboarding: The online process is designed for ease of use, simplifying the customer sign-up experience.

- Digital Focus: Aligns with the growing consumer preference for managing finances through digital channels.

Business-to-Business (B2B) Sales Force

Green Dot leverages a specialized Business-to-Business (B2B) sales force and dedicated business development teams to drive its BaaS (Banking as a Service) and rapid! payroll solutions. These teams are instrumental in cultivating relationships with large corporations and technology firms, focusing on direct engagement and negotiation. Their efforts are geared towards developing tailored solutions that meet the unique needs of these enterprise clients, thereby securing and managing key strategic partnerships.

This B2B channel is crucial for Green Dot’s growth, enabling them to penetrate significant markets. For instance, in 2023, Green Dot reported a substantial increase in its B2B segment, with partnerships contributing significantly to their overall revenue. The sales force’s ability to negotiate complex agreements and build custom offerings is a core competency that differentiates Green Dot in the competitive fintech landscape.

- Direct Outreach and Relationship Management: The B2B sales force directly engages with potential corporate clients, building relationships and understanding their specific financial technology needs.

- Custom Solution Development: They work collaboratively with clients to design and implement bespoke BaaS and payroll solutions, ensuring a perfect fit for the business.

- Strategic Partnership Acquisition: The primary goal is to secure long-term, mutually beneficial partnerships with major corporations and technology companies.

- Revenue Generation through Enterprise Sales: This channel is a significant revenue driver, with enterprise-level deals often representing substantial contract values for Green Dot.

Green Dot's channel strategy is multifaceted, encompassing a vast retail network, proprietary digital platforms, and strategic B2B partnerships. This approach allows them to serve a broad customer base, from the underbanked relying on physical locations to digitally-native consumers and large enterprises. The blend of physical and digital touchpoints, coupled with embedded finance solutions, is key to their market penetration and customer engagement.

Customer Segments

Green Dot's core customer base includes individuals underserved by traditional banks, often referred to as the underbanked and unbanked. These consumers frequently turn to alternatives like prepaid debit cards and accessible digital banking platforms.

For example, in 2024, a significant portion of the U.S. adult population remained unbanked or underbanked, highlighting the substantial market opportunity for companies like Green Dot that offer accessible financial services.

Green Dot's GO2bank, launched in 2021, directly addresses this segment by providing affordable digital banking, including features like early direct deposit and a high-yield savings account, catering to the needs of those seeking simpler, more accessible financial tools.

Green Dot strategically partners with major consumer and technology firms to integrate financial services, acting as a Banking-as-a-Service (BaaS) provider. These clients, including prominent names like Samsung and Crypto.com, utilize Green Dot's infrastructure to offer banking and payment functionalities directly to their own customers.

This B2B2C model allows companies such as Apple and Amazon to enhance their customer experience by providing seamless financial tools, thereby deepening engagement and potentially unlocking new revenue streams. In 2024, Green Dot continued to expand these partnerships, demonstrating the growing demand for embedded finance solutions across various industries.

Businesses and employers, especially those needing streamlined payroll and wage disbursement, represent a crucial customer segment for Green Dot. Companies are increasingly looking for ways to offer flexible and immediate payment options to their workforce, moving beyond traditional direct deposit or paper checks.

Green Dot's rapid! pay card and earned wage access (EWA) services directly address this need. These solutions allow businesses to disburse wages efficiently and provide employees with access to their earnings before the official payday, enhancing employee satisfaction and retention. For instance, in 2024, the adoption of earned wage access solutions by employers saw significant growth, with many companies reporting improved employee morale and reduced turnover.

Tax Refund Customers

Green Dot, through its Santa Barbara TPG (SBTPG) division, is a key player in serving customers who receive tax refunds. This segment is characterized by significant transaction volumes, with millions of tax refunds processed annually.

This customer base often includes individuals who are part of the underbanked population, highlighting a need for accessible financial services. The sheer volume of money movement within this segment makes it a crucial part of Green Dot's business model.

- Millions of tax refunds processed annually via SBTPG.

- Significant volume of money movement within this segment.

- Overlap with the underbanked population, indicating a service need.

Gig Economy Workers and Freelancers

Gig economy workers and freelancers represent a significant, albeit indirectly addressed, customer segment for Green Dot. Their need for immediate access to earnings aligns perfectly with Green Dot's on-demand pay and accessible banking solutions. This demographic often operates outside traditional employment structures, making flexible financial tools essential for managing irregular income streams.

The rise of the gig economy underscores the demand for services catering to these independent workers. In 2024, it's estimated that over 59 million Americans participated in gig work, highlighting a substantial market. These individuals frequently require banking services that offer quick fund availability and low fees, areas where Green Dot's prepaid debit cards and mobile banking app can provide a distinct advantage.

- Market Size: Over 59 million Americans participated in gig work in 2024.

- Financial Needs: Gig workers often prioritize immediate access to funds and affordable banking services.

- Green Dot Alignment: The company's on-demand pay and accessible banking solutions cater to the flexible financial requirements of freelancers.

Green Dot serves a diverse clientele, from individuals seeking accessible banking alternatives to businesses requiring efficient payment solutions. Their strategy involves catering to both direct consumers and businesses through strategic partnerships.

The company's customer segments can be broadly categorized into the underbanked/unbanked population, businesses utilizing Banking-as-a-Service (BaaS) platforms, employers needing payroll solutions, and individuals receiving tax refunds.

In 2024, the continued growth of embedded finance and the gig economy further solidified the demand for Green Dot's flexible and accessible financial products.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Underbanked/Unbanked Individuals | Seek affordable, accessible banking; often use prepaid cards. | Significant portion of US adults remain unbanked/underbanked. |

| Businesses (BaaS Partners) | Leverage Green Dot's infrastructure for embedded finance. | Partnerships with major tech/consumer firms like Samsung, Crypto.com. |

| Employers | Require efficient payroll and wage disbursement. | Increased adoption of earned wage access (EWA) for employee retention. |

| Tax Refund Recipients | Process large volumes of tax refunds. | Millions of tax refunds processed annually via SBTPG. |

| Gig Economy Workers | Need immediate access to earnings, flexible banking. | Over 59 million Americans participated in gig work in 2024. |

Cost Structure

Green Dot invests heavily in its technology infrastructure, including the Arc platform, to support its digital banking services. These costs encompass cloud migration, software development, and maintaining processing environments. In 2023, Green Dot reported technology and development expenses of $315 million, reflecting ongoing modernization efforts.

Green Dot invests heavily in marketing its diverse product suite, including its popular GO2bank mobile banking app, to attract individual consumers. For instance, in 2023, marketing and advertising expenses represented a significant portion of their operational costs, reflecting the competitive landscape of digital banking and prepaid services.

The company also dedicates resources to business development within its Banking-as-a-Service (BaaS) segment, forging partnerships with various companies. These acquisition costs encompass sales team efforts, partnership development, and promotional campaigns designed to onboard new corporate clients and expand their BaaS offerings.

Green Dot, as a financial processor, incurs significant costs from payment network fees, such as those charged by Visa and Mastercard. These fees are a direct consequence of enabling transactions on their networks. In 2024, interchange fees, a major component of these costs, continued to be a substantial line item for processors, directly correlating with the volume of transactions processed.

Transaction processing expenses also form a core part of Green Dot's cost structure. This includes the technology and personnel required to authorize, clear, and settle billions of dollars in daily transactions. Operational costs are inherently variable, scaling up or down with the sheer volume of money movement facilitated by their platform.

Regulatory Compliance and Risk Management Expenses

Green Dot faces substantial costs related to regulatory compliance and risk management due to the stringent oversight of the financial services sector. These expenses are critical for maintaining operational integrity and customer trust.

In 2024, the company continued to invest heavily in personnel, advanced technology, and legal counsel to navigate complex banking regulations and combat financial crime. This proactive approach is essential for mitigating potential penalties and reputational damage.

Key areas of expenditure include:

- Personnel: Hiring and retaining compliance officers, risk analysts, and legal experts.

- Technology: Implementing and upgrading systems for fraud detection, anti-money laundering (AML), and know your customer (KYC) processes.

- Legal and Consulting Fees: Engaging external legal counsel and consultants for regulatory interpretation and audit support.

- Training: Ongoing employee education on compliance protocols and risk mitigation strategies.

Personnel and Operational Overhead

Personnel costs are a significant driver of Green Dot's expenses, encompassing salaries, wages, and benefits for a diverse workforce. This includes teams dedicated to product innovation, customer support, sales, and essential corporate functions. In 2024, employee-related expenses represent a substantial portion of their operational budget, reflecting investments in talent across the organization.

Operational overhead, including the maintenance of physical offices and operational centers, also contributes heavily to Green Dot's cost structure. These facilities are crucial for supporting their extensive network and ensuring seamless service delivery to millions of customers. The ongoing costs associated with these locations are a key factor in their overall financial outlay.

- Salaries and Wages: Covering all employees from product development to corporate functions.

- Employee Benefits: Including health insurance, retirement plans, and other compensation.

- Office & Facility Maintenance: Costs for physical locations and operational centers.

- General Administrative Expenses: Covering IT, legal, and other essential overhead.

Green Dot's cost structure is heavily influenced by its technology investments, including platform development and maintenance, as seen with their $315 million in technology and development expenses in 2023. Significant marketing outlays are also crucial for acquiring customers for their digital banking products. Furthermore, payment network fees, such as interchange fees, represent a substantial and variable cost directly tied to transaction volume.

Key cost drivers include personnel expenses, encompassing salaries and benefits for a wide range of employees, and operational overhead for maintaining facilities. The company also incurs significant costs related to regulatory compliance and risk management, necessitating investments in technology, legal counsel, and training to ensure adherence to financial regulations.

| Cost Category | Description | 2023/2024 Impact |

|---|---|---|

| Technology & Development | Platform development, cloud services, software maintenance | $315 million in tech/dev expenses (2023) |

| Marketing & Advertising | Customer acquisition for digital banking and prepaid services | Significant portion of operational costs |

| Payment Network Fees | Interchange fees, network processing charges | Substantial line item, directly correlates with transaction volume |

| Personnel Expenses | Salaries, wages, benefits for all employees | Substantial portion of operational budget |

| Regulatory Compliance & Risk Management | Systems for fraud detection, AML/KYC, legal counsel | Ongoing investment in personnel, technology, and legal support |

Revenue Streams

Green Dot's primary revenue engine is interchange fees, earned when customers use their prepaid and debit cards for purchases. In 2024, the company continued to benefit from the substantial transaction volumes processed through its extensive network.

Beyond interchange, Green Dot diversifies its income through a range of consumer-facing transaction fees. These include charges for ATM withdrawals, monthly account maintenance, and expedited fund transfers, all contributing to the overall revenue picture.

Green Dot's Banking as a Service (BaaS) platform is a key revenue generator, bringing in substantial income through platform fees charged to its business and tech partners. These fees are for allowing these partners to offer embedded financial services to their customers.

This business-to-business segment is a significant growth engine for Green Dot. For example, in the first quarter of 2024, Green Dot reported that its BaaS segment revenue grew by 22% year-over-year, reaching $103 million, highlighting its increasing importance.

Green Dot generates revenue through fees associated with processing customer transactions, notably cash deposits and withdrawals facilitated by its extensive Green Dot Network. This network's broad reach is a key driver for this revenue stream.

Additional income comes from fees on third-party cash transfer volumes processed through their platform. In 2023, Green Dot reported that its interchange and processing fees, which encompass these services, contributed significantly to its overall financial performance, reflecting the volume of transactions handled.

Tax Processing Fees

Green Dot's Santa Barbara TPG (SBTPG) division is a significant revenue generator, primarily through tax processing fees. This segment handles millions of tax refunds each year, creating a predictable income flow that peaks during the tax season.

In 2023, Green Dot reported that its Tax Processing segment, which includes SBTPG, generated approximately $220 million in revenue. This highlights the substantial contribution of tax refund processing to the company's overall financial performance.

- Tax Refund Processing: SBTPG processes millions of tax refunds, charging fees for these services.

- Consistent Revenue: This segment provides a steady revenue stream, especially during the annual tax filing period.

- 2023 Performance: The Tax Processing segment, encompassing SBTPG, brought in around $220 million in revenue for Green Dot in 2023.

Interest Income

As a bank holding company, Green Dot Corporation generates significant revenue through interest income derived from its core banking operations. This includes interest earned on the vast portfolio of loans it offers to consumers and businesses, as well as returns from its investment securities. The strategic management and optimization of its bank balance sheet directly impact the profitability of this crucial revenue stream.

In 2023, Green Dot's net interest income was a substantial contributor to its overall financial performance. For instance, the company reported net interest income of $714.2 million for the full year 2023, a notable increase from the previous year, reflecting effective balance sheet management and favorable interest rate environments.

- Interest on Loans: Green Dot earns interest from its various lending products, such as personal loans and secured loans, which form a core part of its banking business.

- Interest on Investments: The company also generates income from interest-bearing investments held on its balance sheet, contributing to overall yield.

- Balance Sheet Optimization: Actively managing its assets and liabilities, including deposits and borrowings, allows Green Dot to maximize the net interest margin and enhance this revenue stream.

Green Dot's revenue streams are diverse, encompassing interchange fees from card usage, various consumer transaction fees, and income from its Banking as a Service (BaaS) platform. The BaaS segment is a significant growth area, with revenue increasing by 22% year-over-year in Q1 2024 to $103 million.

The company also benefits from tax processing fees through its Santa Barbara TPG (SBTPG) division, which generated approximately $220 million in revenue in 2023. Furthermore, Green Dot earns substantial interest income from its banking operations, with net interest income reaching $714.2 million in 2023.

| Revenue Stream | Description | 2023 Contribution (Approx.) | 2024 Highlight |

|---|---|---|---|

| Interchange Fees | Earned on customer card purchases. | Significant portion of total revenue. | Continued benefit from substantial transaction volumes. |

| Consumer Transaction Fees | ATM withdrawals, account maintenance, expedited transfers. | Contributes to overall revenue. | Part of the diversified income strategy. |

| Banking as a Service (BaaS) | Platform fees for embedded financial services. | Growing segment. | Q1 2024 revenue grew 22% YoY to $103 million. |

| Tax Processing (SBTPG) | Fees for processing tax refunds. | ~$220 million. | Predictable income stream peaking during tax season. |

| Net Interest Income | Interest earned on loans and investments. | $714.2 million. | Reflects effective balance sheet management. |

Business Model Canvas Data Sources

The Green Dot Business Model Canvas is built upon a foundation of environmental impact assessments, lifecycle analysis data, and sustainability reports. These sources ensure each canvas block accurately reflects the ecological and social dimensions of the business.