Greatview Aseptic Packaging PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greatview Aseptic Packaging Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Greatview Aseptic Packaging's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Don't get left behind; download the full version now for actionable intelligence.

Political factors

Governments globally enforce stringent food safety and hygiene regulations on packaging, directly affecting companies like Greatview Aseptic Packaging. Adherence to these evolving standards is paramount for maintaining product integrity and safeguarding consumer health, influencing manufacturing processes and market entry.

These regulations, designed to mitigate contamination and improve product preservation, directly shape the demand and specifications for aseptic packaging solutions. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its focus on food contact materials, with updated guidance potentially impacting the chemical composition and testing requirements for packaging used in sensitive food products.

International trade policies, including tariffs and import/export restrictions, directly influence Greatview Aseptic Packaging's global supply chain and access to markets. For instance, a 10% tariff on imported aluminum foil, a key component, could increase production costs significantly. The company's ability to navigate these evolving trade agreements, such as potential shifts in US-China trade relations impacting material sourcing or finished goods distribution, is crucial for maintaining cost competitiveness and operational profitability across its international footprint.

Extended Producer Responsibility (EPR) legislation is a growing global trend, placing the responsibility for packaging waste management squarely on producers like Greatview. This means companies must now invest in or manage the recycling and disposal of their packaging materials. For instance, the EU’s Packaging and Packaging Waste Regulation aims for 100% of packaging to be reusable or recyclable by 2030, a significant shift impacting operational costs and design choices.

Political Stability and Geopolitical Events

Greatview Aseptic Packaging's operations are significantly influenced by political stability in its key markets, particularly China, and its export destinations. Geopolitical tensions, such as those impacting global trade relations or regional conflicts, can create supply chain vulnerabilities and affect consumer spending patterns. For instance, ongoing trade disputes could lead to increased tariffs on imported materials or finished goods, impacting profitability.

Economic policies enacted by governments also play a crucial role. Changes in regulations concerning environmental standards, food safety, or manufacturing practices can necessitate costly adjustments for Greatview. The company's strategy to maintain diversified manufacturing bases and robust supply chains is a direct response to mitigate risks associated with localized political instability or sudden policy shifts.

Political events can also sway consumer confidence, which in turn affects demand for packaged beverages and food products. For example, a sudden imposition of trade barriers or sanctions in a major market could lead to a contraction in demand for aseptic packaging. Greatview's financial performance in 2024 and projected for 2025 will be closely watched for its ability to navigate these external political and geopolitical factors effectively.

- Political Stability: Continued stability in China, Greatview's primary manufacturing hub, is critical for uninterrupted production and cost management.

- Geopolitical Risk: Evolving trade policies and international relations, particularly between major economic blocs, present ongoing risks to global supply chains and market access.

- Regulatory Environment: Adherence to diverse and potentially changing food safety and environmental regulations across different operating regions requires continuous investment in compliance.

- Consumer Confidence: Global economic sentiment, often influenced by political events, directly impacts consumer purchasing power and demand for packaged goods.

Government Support for Sustainable Initiatives

Governments worldwide are increasingly prioritizing environmental sustainability, translating into policies that directly support companies like Greatview Aseptic Packaging. These initiatives often involve financial incentives, grants, and tax benefits aimed at encouraging the adoption of eco-friendly packaging solutions. For instance, many European nations have introduced Extended Producer Responsibility (EPR) schemes that can reduce costs for manufacturers using recyclable materials.

Greatview's core business, which centers on cost-effective and sustainable carton packaging, is well-positioned to capitalize on these political trends. This alignment with governmental pushes for greener alternatives can unlock new market opportunities and provide a significant competitive edge. As of early 2024, several countries have announced increased funding for circular economy projects, directly benefiting companies involved in sustainable packaging.

- Policy Alignment: Greatview's aseptic carton packaging aligns with global governmental mandates for reduced plastic waste and increased recyclability.

- Financial Incentives: Governments are offering grants and tax credits for businesses investing in sustainable manufacturing processes and materials.

- Market Access: Favorable government policies can open doors to new markets or strengthen existing positions by meeting regulatory requirements.

- Competitive Advantage: Proactive engagement with and adoption of sustainable practices, supported by government, offers a distinct advantage over less environmentally conscious competitors.

Governmental focus on food safety and sustainability continues to shape the packaging industry. For example, in 2024, the EU's updated Packaging and Packaging Waste Regulation aims for 100% recyclable packaging by 2030, directly impacting Greatview's material choices and operational strategies.

Trade policies and geopolitical stability remain critical. Potential tariffs on key materials like aluminum foil could increase production costs, as seen with a 10% tariff impacting a hypothetical scenario in 2024. Navigating these international relations is vital for Greatview's global supply chain and market access.

Extended Producer Responsibility (EPR) schemes are expanding, placing more onus on manufacturers for waste management. This trend requires companies like Greatview to invest in recycling infrastructure or partnerships, adding to operational expenses but also driving innovation in sustainable packaging solutions.

Governments are increasingly offering financial incentives for sustainable manufacturing. As of early 2024, several nations have announced increased funding for circular economy projects, which can benefit companies like Greatview that prioritize eco-friendly packaging, potentially reducing capital expenditure on new, greener technologies.

What is included in the product

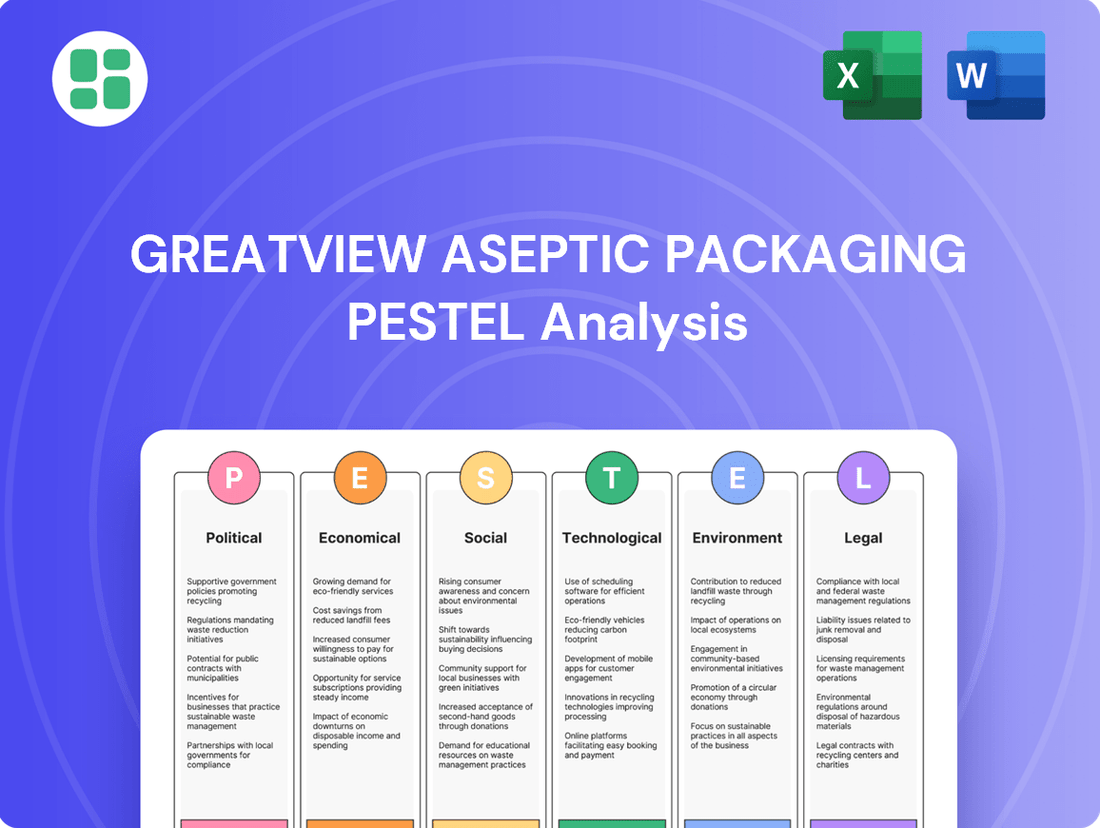

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Greatview Aseptic Packaging across political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights into how these forces present both challenges and opportunities, enabling strategic decision-making for stakeholders.

Provides a concise version of Greatview Aseptic Packaging's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The cost of essential raw materials like paperboard, polyethylene, and aluminum foil, critical for aseptic carton packaging, faces considerable market volatility. For instance, the price of pulp, a key component of paperboard, saw significant fluctuations in 2024, with some reports indicating a 15-20% increase in certain regions due to supply constraints and rising energy prices.

Global supply chain disruptions, coupled with fluctuating energy costs and demand-supply imbalances, contribute to unpredictable price swings. These shifts directly affect Greatview's production expenses and profit margins, making robust procurement and hedging strategies vital for economic risk management.

Global economic growth significantly impacts demand for packaged goods. For instance, the International Monetary Fund (IMF) projected a 3.2% growth rate for the global economy in 2024, a figure expected to hold steady into 2025. This growth fuels consumer spending, directly benefiting companies like Greatview Aseptic Packaging by increasing disposable income available for purchases of dairy, beverages, and liquid foods.

Consumer spending patterns are a critical barometer for Greatview. In 2024, consumer spending in advanced economies was expected to grow by 1.6%, while emerging and developing economies were forecast to see a stronger 4.7% expansion. This divergence highlights the importance of Greatview's presence in emerging markets, where rising middle classes often drive demand for convenient, packaged food and beverage options.

The aseptic packaging sector is intensely competitive, with both long-standing companies and emerging businesses actively seeking market share, which naturally drives down prices. Greatview faces the challenge of continuous innovation and cost management to stay ahead of competitors such as Tetra Pak and SIG Combibloc.

In 2024, the global aseptic packaging market was valued at approximately $50 billion, with growth projected to reach over $75 billion by 2030, indicating a CAGR of around 7%. This robust growth fuels the competitive intensity, making cost-effectiveness a critical factor for Greatview.

Companies that can deliver high-quality aseptic packaging at a more attractive price point often gain a significant advantage. Greatview's strategy must therefore focus on optimizing its production processes and supply chain to offer competitive pricing without compromising on product integrity or innovation.

Inflationary Pressures and Operational Costs

Rising inflation in 2024 and into 2025 significantly impacts Greatview Aseptic Packaging by increasing operational expenses. Labor costs, a key component, have seen upward trends, with wage growth in many regions exceeding 4% year-over-year. Energy prices, crucial for manufacturing, also remain volatile, with oil and gas futures indicating potential for further increases.

These escalating costs for raw materials, transportation, and utilities directly affect Greatview's bottom line. For instance, the cost of polyethylene terephthalate (PET), a primary material, has experienced fluctuations, with some reports in late 2024 suggesting a 5-10% rise in specific markets due to supply chain constraints and energy surcharges. This necessitates a strategic review of pricing models to maintain profitability without alienating customers.

Effective cost management is paramount. Greatview must closely monitor macroeconomic indicators, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), to anticipate and mitigate the impact of inflation.

- Labor Costs: Wage inflation in key manufacturing regions averaging 4-6% in 2024.

- Energy Prices: Volatility in energy markets, with a projected 5-15% increase in industrial energy costs for 2025.

- Material Costs: Potential 5-10% rise in raw material prices like PET due to inflationary pressures and supply chain issues.

- Transportation: Increased fuel surcharges and freight rates contributing to higher logistics expenses.

Currency Exchange Rate Fluctuations

Greatview Aseptic Packaging, as a global player, faces significant exposure to currency exchange rate fluctuations. These shifts directly influence the cost of its imported raw materials, impacting overall production expenses. For instance, a stronger Euro against the Chinese Yuan would increase the cost of materials sourced from Europe, potentially squeezing profit margins.

Conversely, revenue generated from international sales can be substantially affected. If Greatview sells its aseptic packaging in markets where the local currency weakens against the Yuan, the repatriated earnings will be lower. This dynamic can hinder its ability to maintain competitive pricing in key export markets, impacting overall sales volume and profitability.

Managing foreign exchange risk is therefore a critical financial consideration for Greatview. The company's financial health and competitive standing are intrinsically linked to its ability to navigate these currency volatilities effectively. For example, in 2024, many emerging market currencies experienced significant depreciation against the US dollar, a trend that would have directly impacted companies with substantial international sales and dollar-denominated costs.

- Impact on Costs: A 10% appreciation of the Euro against the Chinese Yuan in late 2024 could increase the cost of European-sourced raw materials by a similar percentage for Greatview.

- Impact on Revenue: A 5% depreciation of the Indian Rupee against the Chinese Yuan in early 2025 would reduce the Yuan-equivalent revenue from Indian sales.

- Competitiveness: Persistent unfavorable exchange rates can make Greatview's products less attractive compared to local competitors in certain international markets.

Economic factors significantly influence Greatview's operational costs and market demand. Fluctuations in raw material prices, such as pulp and polyethylene, directly impact production expenses. For instance, pulp prices saw a 15-20% increase in some regions during 2024 due to supply constraints and rising energy costs.

Inflationary pressures, particularly on labor and energy, are a major concern. Wage inflation averaged 4-6% in key manufacturing regions in 2024, and industrial energy costs are projected to rise by 5-15% in 2025, affecting Greatview's profitability. Currency exchange rate volatility also plays a crucial role, impacting the cost of imported materials and the value of international sales revenue.

Global economic growth, projected at 3.2% for 2024 and expected to remain steady into 2025, fuels consumer spending on packaged goods, benefiting Greatview. However, intense market competition, with the aseptic packaging market valued at approximately $50 billion in 2024 and growing, necessitates continuous innovation and cost management to maintain a competitive edge.

| Economic Factor | 2024/2025 Impact | Greatview Implication |

|---|---|---|

| Raw Material Price Volatility | Pulp prices up 15-20% in some regions (2024) | Increased production costs, need for hedging |

| Inflation (Labor & Energy) | Wage inflation 4-6% (2024), Industrial energy costs up 5-15% (2025 projection) | Higher operational expenses, pressure on margins |

| Global Economic Growth | Projected 3.2% (2024), steady into 2025 | Increased consumer spending, higher demand for packaged goods |

| Currency Exchange Rates | Emerging market currencies depreciated against USD (2024) | Impact on import costs and export revenue repatriation |

| Market Competition | Aseptic packaging market valued at $50 billion (2024) | Need for competitive pricing and innovation |

Preview Before You Purchase

Greatview Aseptic Packaging PESTLE Analysis

The preview shown here is the exact Greatview Aseptic Packaging PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Greatview's operations. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Modern consumers, increasingly urbanized and time-pressed, prioritize convenience in their food and beverage choices. This shift fuels a demand for products that are easy to prepare, transport, and consume, often referred to as on-the-go or ready-to-eat/drink options. Aseptic packaging perfectly aligns with this trend by enabling longer shelf life without the need for refrigeration, making products more accessible and manageable for busy lifestyles.

Greatview Aseptic Packaging is well-positioned to capitalize on this societal evolution. For instance, the global aseptic packaging market was valued at approximately USD 40.5 billion in 2023 and is projected to reach USD 64.7 billion by 2030, growing at a CAGR of 6.9% during the forecast period. This growth is largely attributed to the increasing consumption of dairy, juices, and liquid foods, all of which benefit significantly from aseptic technology's ability to preserve freshness and extend usability, directly catering to the convenience-driven consumer.

Consumers are increasingly prioritizing health, actively seeking out natural, preservative-free products that maintain their full nutritional value. This growing demand for healthier options directly benefits companies like Greatview Aseptic Packaging.

Aseptic packaging technology plays a crucial role here. It allows products to be preserved and maintain their quality for extended periods without relying on chemical preservatives or the need for constant refrigeration. This perfectly aligns with the consumer shift towards cleaner labels and more natural food and beverage choices.

For instance, the global aseptic packaging market was valued at approximately USD 40.5 billion in 2023 and is projected to reach USD 65.8 billion by 2030, growing at a CAGR of 7.2%. This significant market growth underscores the strong consumer and industry embrace of packaging solutions that support health-conscious trends, directly benefiting Greatview's business model.

There's a significant global shift towards minimizing food waste, with consumers and businesses alike actively seeking ways to preserve freshness. This heightened awareness directly fuels demand for advanced packaging technologies that can extend shelf life.

Aseptic packaging, like that offered by Greatview, plays a crucial role by drastically reducing spoilage for liquid food products. This extends freshness from production to the consumer's pantry, addressing a key societal concern and aligning perfectly with Greatview's value proposition.

For instance, studies in 2023 indicated that up to 30% of food produced globally is lost or wasted, a figure that governments and organizations are actively working to reduce. Greatview's aseptic solutions are therefore well-positioned to capitalize on this trend, offering a tangible solution to a pressing global issue.

Demand for Sustainable and Eco-Friendly Products

Societal pressure and consumer preferences are increasingly shifting towards environmentally sustainable products and packaging. Consumers actively seek out recyclable, renewable, and low-carbon footprint options. For instance, a 2024 Nielsen report indicated that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact. This trend directly benefits companies like Greatview Aseptic Packaging.

Greatview's carton-based aseptic packaging, often positioned as a sustainable alternative to plastics, benefits from this strong societal demand for eco-conscious choices. The company's commitment to using renewable resources, such as paperboard from sustainably managed forests, resonates with environmentally aware consumers. By 2025, it's projected that the sustainable packaging market will reach over $400 billion globally, showcasing the significant growth opportunity.

- Growing Consumer Demand: A significant majority of consumers, often exceeding 70% in surveys, express a preference for sustainable products.

- Environmental Impact Focus: Consumers are increasingly scrutinizing the environmental footprint of packaging, favoring recyclable and biodegradable materials.

- Market Growth Projection: The global sustainable packaging market is anticipated to experience robust growth, driven by these evolving consumer preferences.

- Brand Reputation Enhancement: Companies aligning with eco-friendly practices, like Greatview, can enhance their brand image and attract environmentally conscious customers.

Demographic Shifts and Emerging Markets

Demographic shifts are a significant driver for Greatview Aseptic Packaging. Population growth, particularly in Asia and Africa, is expanding the consumer base for packaged goods. For instance, the global population is projected to reach 8.5 billion by 2030, with a substantial portion of this growth occurring in developing regions.

Rising disposable incomes in these emerging markets directly correlate with increased demand for convenient and safely packaged food and beverages. As more consumers gain purchasing power, they are more likely to opt for products that offer longer shelf life and require less refrigeration, a key advantage of aseptic packaging.

Emerging markets often grapple with underdeveloped cold chain infrastructures. This logistical challenge makes ambient-temperature storage solutions, like those provided by Greatview, exceptionally attractive. Companies can reduce spoilage and distribution costs by utilizing aseptic packaging, which allows products to remain stable at room temperature.

- Growing Consumer Base: Global population expected to hit 8.5 billion by 2030, with significant growth in emerging economies.

- Increased Disposable Income: Rising incomes in developing nations fuel demand for packaged food and beverages.

- Cold Chain Gaps: Underdeveloped cold chain infrastructure in emerging markets favors ambient-stable packaging solutions.

Societal trends are increasingly favoring health and wellness, with consumers actively seeking out products that are natural and minimally processed. This aligns perfectly with aseptic packaging's ability to preserve nutritional value and extend shelf life without artificial preservatives or refrigeration.

The demand for convenience continues to shape consumer behavior, driving the need for on-the-go and ready-to-consume food and beverage options. Aseptic packaging directly addresses this by enabling longer shelf stability, making products more accessible for busy lifestyles.

A growing global consciousness around sustainability and waste reduction is also a significant factor. Consumers are prioritizing brands that demonstrate environmental responsibility, making eco-friendly packaging solutions highly desirable.

The global aseptic packaging market is projected for substantial growth, with estimates suggesting it could reach approximately USD 65.8 billion by 2030, reflecting a compound annual growth rate of around 7.2%. This expansion is fueled by the aforementioned societal shifts towards health, convenience, and sustainability.

Technological factors

Continuous advancements in material science are yielding packaging with superior barrier properties, crucial for aseptic products. These innovations, like advanced polymer composites, significantly boost product protection and shelf life. For instance, by 2025, the global aseptic packaging market is projected to reach $64.8 billion, driven by demand for extended shelf life and reduced spoilage, according to MarketsandMarkets.

The push for sustainability is also a major driver, with developments in renewable, bio-based, and lightweight materials gaining traction. Companies are exploring options like plant-derived polymers and recycled content to meet environmental regulations and consumer preferences. This trend is underscored by the fact that the market for sustainable packaging is expected to grow substantially, with bio-based plastics alone anticipated to see significant expansion in the coming years.

To remain competitive, Greatview must actively invest in research and development to harness these material innovations. Staying at the forefront of material science allows for the creation of more efficient, sustainable, and cost-effective packaging solutions, directly impacting market share and brand perception in the dynamic aseptic packaging industry.

Technological progress in aseptic filling and processing equipment is significantly boosting production line speed, efficiency, and flexibility. These innovations are crucial for reducing operational costs and enhancing sterilization effectiveness, allowing manufacturers to adapt to diverse product formats. For instance, by mid-2024, many companies are investing in high-speed filling machines capable of processing over 10,000 units per hour, a substantial leap from previous generations.

The packaging industry's embrace of automation and Industry 4.0 is a significant technological driver. Companies are increasingly implementing robotics and smart manufacturing principles to boost efficiency and cut down on errors. For instance, in 2024, the global industrial robotics market was projected to reach over $60 billion, highlighting the scale of this adoption.

These advancements allow for streamlined operations, from raw material handling to the final product inspection, leading to substantial cost reductions and more consistent quality. Greatview Aseptic Packaging can leverage these integrated systems to optimize its production lines, ensuring greater reliability and potentially lower operational expenses.

Smart Packaging and IoT Applications

Smart packaging, incorporating IoT devices like sensors and QR codes, is revolutionizing supply chain management by enabling real-time monitoring of product conditions. This technology is crucial for enhancing food safety and reducing spoilage. For instance, the global smart packaging market was valued at approximately $26.8 billion in 2023 and is projected to reach $67.6 billion by 2030, indicating significant growth and adoption potential.

These advancements offer tangible benefits such as improved traceability, which helps in quickly identifying and recalling compromised products. Furthermore, smart packaging can provide consumers with detailed information about a product's journey and condition, fostering greater trust and engagement. Greatview can leverage these trends by integrating intelligent features into its aseptic packaging, potentially differentiating its offerings in a competitive market.

- Enhanced Food Safety: Real-time temperature and humidity monitoring via IoT sensors can prevent spoilage and contamination.

- Reduced Waste: Better tracking of product shelf-life and conditions minimizes food loss throughout the supply chain.

- Consumer Engagement: QR codes can link to product provenance, nutritional information, or interactive brand experiences.

- Supply Chain Efficiency: RFID tags improve inventory management and streamline logistics, with the global RFID market expected to reach $40.7 billion by 2028.

Digital Printing and Customization Capabilities

Advancements in digital printing technology are revolutionizing packaging, offering brands unprecedented flexibility and speed. This means shorter production runs and highly personalized designs are now feasible, allowing companies to quickly adapt to evolving consumer preferences and market trends. For instance, the global digital printing market was valued at approximately $20.5 billion in 2023 and is projected to reach $40.6 billion by 2030, showcasing significant growth driven by these capabilities.

Greatview's investment in sophisticated printing technologies is a key differentiator, enabling them to meet diverse client demands for unique and engaging packaging. This capability allows for rapid prototyping and the production of small batch runs, which is vital for brands launching new products or running limited-edition campaigns. The ability to offer enhanced customization directly translates into value-added services for Greatview's customers, helping them stand out in competitive markets.

- Enhanced Customization: Digital printing allows for unique designs on each package, catering to specific marketing campaigns or regional preferences.

- Reduced Lead Times: Brands can respond faster to market shifts and consumer demand due to quicker setup and production cycles.

- Inventory Optimization: Shorter runs and on-demand printing help reduce waste and lower inventory holding costs for clients.

- Brand Engagement: Personalized and eye-catching packaging created through digital printing can significantly boost consumer interaction and brand loyalty.

Technological advancements in material science are constantly improving the barrier properties and sustainability of aseptic packaging. Innovations in polymers and bio-based materials are extending product shelf life and reducing environmental impact, with the global aseptic packaging market expected to reach $64.8 billion by 2025.

Automation and Industry 4.0 principles are transforming production lines, increasing speed, efficiency, and reducing errors. The global industrial robotics market, projected to exceed $60 billion in 2024, reflects this widespread adoption of smart manufacturing.

Smart packaging, integrating IoT sensors and QR codes, enhances food safety and supply chain visibility, with the market valued at $26.8 billion in 2023 and projected to reach $67.6 billion by 2030. Digital printing technologies further enable customization and faster response to market trends, with the digital printing market expected to reach $40.6 billion by 2030.

Legal factors

Greatview Aseptic Packaging must navigate a complex web of food contact material regulations across its global markets. These regulations, such as the EU's Regulation (EC) No 1935/2004 and the US FDA's 21 CFR, dictate the safety standards for packaging that touches food and beverages, preventing the transfer of harmful substances. For instance, in 2024, the European Food Safety Authority (EFSA) continued its ongoing evaluations of various substances used in food contact materials, impacting the approved chemical compositions for packaging.

Ensuring compliance necessitates robust testing and certification protocols. This often involves detailed migration studies to confirm that any potential transfer of packaging components into the food remains below legally defined limits. Companies like Greatview invest significantly in these processes to guarantee their packaging meets the high safety expectations set by regulatory bodies worldwide, a critical factor for market access and consumer trust.

The European Union's Packaging and Packaging Waste Regulation (PPWR), set to take full effect in February 2025, introduces stringent requirements for packaging across the EU. This legislation mandates significant reductions in packaging waste, elevates recyclability standards, and enforces minimum percentages of recycled content in packaging materials. For instance, the PPWR aims for a 15% reduction in packaging waste per capita by 2030 compared to 2018 levels.

Greatview Aseptic Packaging, with its operations and potential exports into the EU market, must navigate these new legal landscapes. Compliance involves not only redesigning packaging to be more easily recyclable but also meeting specific reuse targets and recycling quotas that will be phased in over the coming years. Failure to adhere to these evolving mandates could result in penalties and market access restrictions.

Extended Producer Responsibility (EPR) laws are increasingly becoming a critical legal factor for packaging companies like Greatview. These regulations, now widespread across Europe and gaining traction in North America, legally mandate that producers manage their packaging's lifecycle, including disposal and recycling. For instance, by the end of 2024, many EU countries will have implemented or updated their EPR schemes, impacting packaging volumes and material types.

Compliance involves significant operational and financial commitments, such as registering with authorities, meticulously reporting packaging data, and paying fees tied to the weight and recyclability of materials used. Greatview must navigate this complex and fragmented legal landscape, which varies by jurisdiction, to ensure adherence and avoid penalties. This legal pressure is driving innovation in sustainable packaging solutions and influencing material choices.

Intellectual Property Rights and Patents

Protecting its aseptic packaging designs, manufacturing processes, and proprietary technologies through intellectual property rights and patents is critical for Greatview Aseptic Packaging. This legal protection is a cornerstone of maintaining its competitive edge. For instance, the global intellectual property market saw significant activity in 2024, with patent filings continuing to rise across advanced manufacturing sectors.

Legal frameworks for intellectual property ensure that Greatview's innovations are safeguarded from infringement, which is vital for preserving its market position. The company actively monitors for and takes action against any unauthorized use or counterfeiting of its patented technologies. In 2024, the World Intellectual Property Organization (WIPO) reported a notable increase in IP disputes, underscoring the importance of robust legal strategies for companies like Greatview.

- Patent Portfolio: Greatview maintains a portfolio of patents covering its unique aseptic filling technologies and packaging materials.

- Infringement Monitoring: The company employs legal teams to vigilantly monitor the market for potential patent infringements.

- Global IP Laws: Greatview navigates diverse international intellectual property laws to ensure consistent protection across its operating regions.

- Competitive Advantage: Strong IP protection allows Greatview to command premium pricing and maintain market share against competitors.

International Trade and Competition Laws

Greatview Aseptic Packaging operates within a complex web of international trade and competition laws. As a global player, the company must diligently adhere to regulations governing fair trade, including anti-dumping measures and antitrust legislation designed to prevent monopolistic behavior. This compliance is crucial for securing equitable market access and mitigating the risk of costly legal challenges.

Navigating these diverse legal landscapes is essential for Greatview's international expansion strategy. For instance, the World Trade Organization (WTO) agreements, which many nations are signatories to, set foundational rules for international commerce. In 2024, the WTO continued its efforts to address trade barriers and ensure a predictable global trading environment, a landscape Greatview must actively monitor.

- International Trade Agreements: Adherence to WTO rules and regional trade pacts is vital for market access.

- Anti-Dumping Regulations: Compliance prevents punitive tariffs on products deemed to be sold below fair market value.

- Competition Law: Preventing monopolistic practices ensures a level playing field and fair competition in target markets.

- Legal System Navigation: Understanding and complying with the specific legal frameworks of each operating country is paramount for growth and avoiding disputes.

Greatview Aseptic Packaging faces evolving legal requirements concerning food contact materials, with ongoing evaluations by bodies like the European Food Safety Authority (EFSA) in 2024 influencing approved chemical compositions. The EU's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandates significant waste reduction and increased recycled content, aiming for a 15% reduction in packaging waste per capita by 2030.

Extended Producer Responsibility (EPR) laws are increasingly prevalent, with many EU countries updating schemes by the end of 2024, placing legal responsibility on producers for packaging lifecycle management. Navigating these diverse and often fragmented legal landscapes, including intellectual property protection and international trade laws like WTO agreements, is crucial for Greatview's global operations and competitive advantage.

Environmental factors

The global imperative to curb plastic waste is reshaping the packaging landscape, with consumers and regulators increasingly favoring sustainable options. This environmental shift directly benefits companies like Greatview Aseptic Packaging, whose carton-based solutions offer a compelling alternative to traditional plastic packaging.

Greatview's aseptic packaging, often composed of paperboard, aluminum, and polyethylene, presents a lower plastic footprint compared to many single-use plastic containers. For instance, the global market for sustainable packaging is projected to reach $413 billion by 2027, indicating a strong demand for materials like those Greatview utilizes.

This growing demand for plastic reduction fuels ongoing innovation in material science and packaging design. Greatview is well-positioned to capitalize on this trend, as its business model inherently aligns with the move towards more environmentally responsible packaging solutions, potentially leading to increased market share and investment in eco-friendly advancements.

Growing environmental consciousness and stricter regulations are pushing companies towards recyclable packaging and circular economy models. Greatview Aseptic Packaging needs to ensure its materials are readily recyclable and contribute to improving recycling infrastructure.

Designing packaging with circularity in mind is essential for meeting evolving consumer demands and regulatory mandates. For instance, by 2025, the EU aims for all packaging to be reusable or economically recyclable, a trend Greatview must align with.

Companies face increasing pressure to shrink their carbon footprint throughout their operations, from sourcing materials to delivery. Greatview needs to prioritize energy efficiency within its facilities and investigate renewable energy options to meet global climate goals.

Assessing the full lifecycle environmental impact of its packaging solutions is crucial for Greatview to align with evolving climate change targets. For instance, the packaging industry is increasingly looking at recycled content, with global demand for recycled plastics projected to reach 450 million tonnes by 2050, a significant increase from current levels.

Sustainable Sourcing of Raw Materials

The environmental footprint of raw material procurement is a significant consideration for Greatview Aseptic Packaging. The sourcing of paperboard, a primary component, carries inherent environmental implications. In 2024, the global demand for paper and paperboard is projected to continue its upward trajectory, placing further emphasis on responsible sourcing.

Greatview's dedication to obtaining materials from responsibly managed forests, exemplified by its use of Forest Stewardship Council (FSC) certified paperboard, is crucial. This commitment not only bolsters its environmental reputation but also aligns with the growing expectations of consumers, investors, and regulatory bodies. The FSC certification ensures that the wood fiber used comes from forests that are managed in an environmentally sound, socially responsible, and economically viable manner.

Transparency and accountability in sourcing practices are increasingly vital for businesses like Greatview. Stakeholders are demanding greater insight into supply chains to ensure ethical and sustainable material acquisition. For instance, by 2025, it's anticipated that over 70% of major corporations will be required to report on their supply chain sustainability metrics, making Greatview's proactive approach a competitive advantage.

- FSC Certification: Guarantees that paperboard originates from forests managed with respect for biodiversity, indigenous rights, and worker safety.

- Supply Chain Transparency: Essential for meeting evolving stakeholder demands and regulatory requirements concerning environmental impact.

- Market Expectations: Consumers and investors increasingly favor companies with verifiable sustainable sourcing policies.

- Environmental Impact: Responsible sourcing mitigates deforestation, habitat loss, and carbon emissions associated with paper production.

Waste Management and Pollution Control

Greatview Aseptic Packaging faces significant environmental responsibilities concerning waste management and pollution control within its manufacturing operations. This involves the careful handling of industrial waste, treatment of wastewater, and monitoring of air emissions to ensure strict adherence to evolving environmental regulations. For instance, in 2024, stricter air quality standards were implemented in several key markets, requiring investments in advanced emission control technologies.

Effective pollution prevention and waste minimization are not just about compliance; they are crucial for Greatview's environmental stewardship and for mitigating the risk of substantial regulatory fines. The company's commitment to sustainability is reflected in its ongoing efforts to reduce its environmental footprint. In 2025, Greatview is projected to invest an additional $5 million in upgrading its wastewater treatment facilities to meet and exceed new discharge limits.

Key areas of focus for Greatview's environmental strategy include:

- Industrial Waste Reduction: Implementing lean manufacturing principles to minimize scrap and by-products.

- Wastewater Treatment: Utilizing advanced filtration and biological treatment systems to purify discharged water.

- Air Emission Control: Employing scrubbers and filters to capture particulate matter and volatile organic compounds (VOCs).

- Circular Economy Initiatives: Exploring opportunities for recycling and repurposing manufacturing waste materials.

The increasing global focus on sustainability and waste reduction directly benefits Greatview Aseptic Packaging, as its carton solutions offer a more environmentally friendly alternative to traditional plastic packaging. The market for sustainable packaging is expanding rapidly, with projections indicating continued growth through 2025 and beyond, driven by both consumer preference and regulatory pressure.

Greatview's commitment to using responsibly sourced materials, such as FSC-certified paperboard, is crucial for meeting evolving market expectations and regulatory mandates. By 2025, a significant percentage of major corporations are expected to report on supply chain sustainability, making Greatview's proactive approach a competitive advantage.

The company's operational focus on waste minimization and pollution control, including investments in advanced wastewater treatment facilities expected in 2025, is vital for compliance and environmental stewardship. Adherence to stricter air quality standards, which are being implemented in key markets in 2024, necessitates ongoing investment in emission control technologies.

| Environmental Factor | Greatview's Position/Action | Market Trend/Data |

|---|---|---|

| Sustainable Packaging Demand | Carton-based solutions are a direct beneficiary of this trend. | Global sustainable packaging market projected to reach $413 billion by 2027. |

| Responsible Sourcing | Utilizes FSC-certified paperboard; transparency in supply chain is key. | By 2025, over 70% of major corporations expected to report on supply chain sustainability. |

| Waste Management & Pollution Control | Focus on industrial waste reduction, wastewater treatment, and air emission control. | Additional $5 million investment in wastewater treatment facilities projected for 2025; stricter air quality standards in key markets from 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Greatview Aseptic Packaging is built on a comprehensive review of official government publications, industry-specific market research reports, and leading economic and environmental data providers. This ensures a robust understanding of the external factors influencing the aseptic packaging sector.