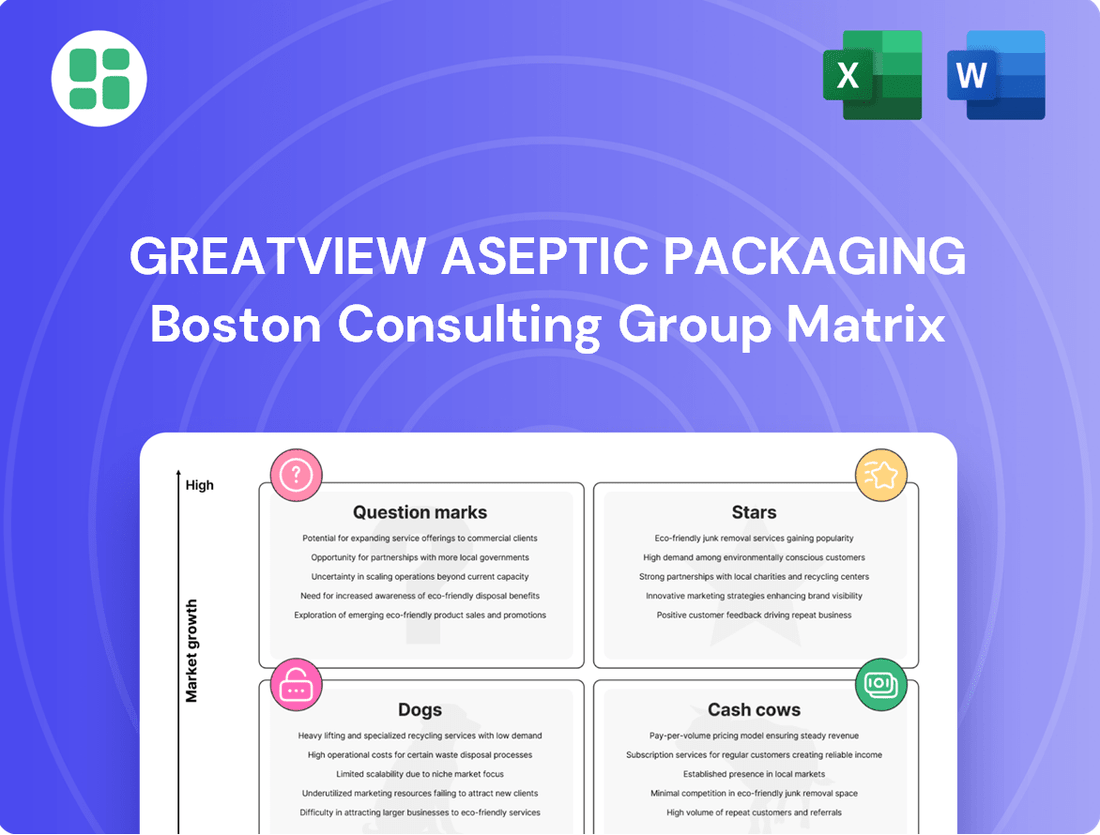

Greatview Aseptic Packaging Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greatview Aseptic Packaging Bundle

Greatview Aseptic Packaging's BCG Matrix offers a powerful lens to understand its product portfolio's market share and growth potential. This preview hints at strategic positioning, but the full report unlocks the complete picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Greatview's dedication to sustainability shines through with products like 'Greatview Planet' and their innovative bio-based aseptic cartons. These offerings are strategically positioned as Stars within the BCG matrix due to their strong alignment with the booming global sustainable packaging market. This market is projected to reach an estimated USD 485.8 billion by 2029, growing at a CAGR of 6.8% from 2022.

Driven by increasing environmental awareness and a strong consumer preference for eco-friendly choices, Greatview's focus on recyclable and conscious materials directly taps into this high-growth trend. Their proactive approach allows them to secure a significant share in this rapidly evolving and increasingly important market segment.

The market for plant-based beverages is booming, with global sales expected to reach $75 billion by 2025, up from $36 billion in 2020. Greatview's aseptic carton packaging is perfectly positioned to capitalize on this trend, offering a cost-effective and efficient solution for brands entering or expanding in this high-growth sector. Their proven technology ensures product integrity and shelf-stability, crucial for dairy alternatives and other plant-based drinks.

While China is a significant revenue contributor for Greatview Aseptic Packaging, the broader Asia-Pacific region represents the largest and most rapidly expanding market for aseptic packaging solutions. This presents a substantial opportunity for growth beyond its core Chinese operations.

Greatview's strong foothold in the People's Republic of China (PRC) serves as a robust platform for aggressive expansion into other high-growth Asian economies. The company can leverage its established supply chain and deep market understanding to capture significant market share in these burgeoning markets.

In 2024, the Asia-Pacific aseptic packaging market was valued at approximately $12.5 billion, with an anticipated compound annual growth rate (CAGR) of over 7% through 2030. This growth is fueled by increasing demand for convenient, shelf-stable food and beverage products across countries like India, Vietnam, and Indonesia.

Advanced Barrier Solutions in Aseptic Cartons

Greatview's focus on advanced barrier solutions in aseptic cartons directly addresses the market's demand for extended shelf life and robust product protection. Their ongoing material science innovations provide superior defense against external contaminants, a critical factor for maintaining product integrity.

This technological leadership positions Greatview favorably in segments that require the highest levels of aseptic performance, a growing area within the global aseptic packaging market. For instance, the aseptic packaging market was valued at approximately USD 65.5 billion in 2023 and is projected to reach over USD 100 billion by 2030, with barrier technology being a key growth driver.

Greatview's commitment to these advanced solutions allows them to capture significant market share in high-value applications.

- Enhanced Barrier Properties: Greatview's aseptic cartons utilize multi-layer structures, including advanced polymers and aluminum foil, to create an impermeable barrier against oxygen, light, and moisture.

- Product Preservation: These superior barriers are crucial for extending the shelf life of sensitive products like dairy, juices, and liquid foods, reducing spoilage and waste.

- Market Demand: The global demand for aseptic packaging, driven by consumer preference for convenience and longer-lasting products, reached an estimated USD 65.5 billion in 2023.

- Competitive Advantage: Greatview's investment in R&D for barrier technology allows them to offer differentiated solutions that meet stringent food safety regulations and consumer expectations.

Smart Packaging Integration

Smart packaging integration, incorporating features like traceability and consumer engagement, is a high-potential growth area. Greatview's investment in these technologies positions its offerings as potential stars, attracting new customers and commanding premium prices.

The global smart packaging market is projected to reach $55.6 billion by 2027, growing at a compound annual growth rate of 7.1%. Greatview's ability to leverage this trend could significantly boost its market share.

- Traceability: Enhanced supply chain visibility and anti-counterfeiting measures.

- Consumer Engagement: Interactive elements like QR codes linking to product information or promotions.

- Data Analytics: Gathering insights on consumer behavior and product lifecycle.

- Sustainability: Potential for smart features to reduce waste and improve resource management.

Greatview's sustainable and bio-based aseptic cartons are positioned as Stars due to their strong alignment with the growing sustainable packaging market, projected to reach USD 485.8 billion by 2029. Their advanced barrier solutions, crucial for product preservation, also contribute to their Star status, as the aseptic packaging market was valued at USD 65.5 billion in 2023 and is driven by demand for extended shelf life. Furthermore, their investment in smart packaging technologies like traceability and consumer engagement, in a market expected to hit $55.6 billion by 2027, solidifies their Star positioning.

| Product/Initiative | BCG Category | Key Growth Drivers | Market Size/Projection |

|---|---|---|---|

| Greatview Planet & Bio-based Cartons | Star | Environmental awareness, consumer preference for eco-friendly options | Sustainable packaging market: USD 485.8 billion by 2029 (CAGR 6.8%) |

| Advanced Barrier Solutions | Star | Demand for extended shelf life, product integrity, food safety | Aseptic packaging market: USD 65.5 billion (2023), projected > USD 100 billion by 2030 |

| Smart Packaging Integration | Star | Traceability, consumer engagement, data analytics | Smart packaging market: USD 55.6 billion by 2027 (CAGR 7.1%) |

What is included in the product

The Greatview Aseptic Packaging BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

The Greatview Aseptic Packaging BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis.

Cash Cows

Greatview's core aseptic carton packaging for dairy in China is a prime example of a Cash Cow within its business portfolio. This segment, representing the majority of the company's revenue, benefits from China's mature but consistently strong demand for dairy products.

The PRC segment generates stable and substantial cash flow, requiring minimal investment in promotion. This allows Greatview to leverage this established business line to fund other strategic initiatives and growth areas.

Standard roll-fed and blank-fed packaging materials are Greatview's established cash cows. These are the workhorses of the aseptic packaging world, holding a significant share in a stable, mature market. Their consistent performance provides a reliable stream of income, allowing Greatview to fund growth in other areas.

Greatview Aseptic Packaging's filling machines and associated after-sales services function as a classic Cash Cow. The company provides not just the machinery but also essential spare parts and ongoing technical support, creating a robust ecosystem for its customers. This integrated approach ensures a steady stream of revenue beyond the initial equipment sale.

While the market for new aseptic filling machines may be experiencing moderate growth, the significant installed base of Greatview's machines generates consistent, recurring revenue. This income is derived from crucial maintenance contracts, the sale of genuine spare parts, and specialized technical assistance. These services are vital for maintaining the operational efficiency and longevity of the filling lines, solidifying their Cash Cow status.

In 2023, the global aseptic packaging market was valued at approximately USD 51.3 billion, with a projected compound annual growth rate (CAGR) of around 6.5% through 2030. Within this, filling machines and their service components represent a substantial and stable segment, particularly for established players like Greatview with a large installed base.

Established Aseptic Packaging in Mature European Markets

Greatview's established aseptic packaging operations in mature European markets, including Germany, Switzerland, and Italy, position these as Cash Cows within its BCG Matrix. The company's former European entity, WINTIPAK, was recognized as the world's third-largest supplier, demonstrating a strong historical foothold.

These European markets exhibit stable and consistent demand for aseptic packaging solutions. This stability allows Greatview to generate reliable profits by capitalizing on its existing market share and operational efficiencies. For instance, the European aseptic packaging market, valued at approximately $5.5 billion in 2023, is projected to grow at a CAGR of 4.2% through 2028, indicating a mature yet dependable revenue stream for Greatview.

- Established European Presence: Operational facilities in Germany, Switzerland, and Italy.

- Historical Market Leadership: Former entity WINTIPAK was the world's 3rd largest aseptic packaging supplier.

- Stable Demand: Mature European markets offer consistent and predictable revenue.

- Profitability Driver: Leverages existing market share for sustained, reliable profits.

Cost-Effective Standard Aseptic Solutions

Greatview Aseptic Packaging's standard aseptic solutions are a prime example of a Cash Cow within their business portfolio. Their strategic focus on offering cost-effective alternatives to dominant players has been instrumental in securing a substantial portion of the market for these widely used carton solutions.

This deliberate pricing strategy in a well-established market segment translates directly into steady sales volumes and dependable cash flow. This consistent performance underpins its status as a reliable Cash Cow, generating predictable returns for the company.

- Market Share: Greatview has successfully carved out a significant market share in standard aseptic packaging by emphasizing affordability.

- Competitive Pricing: Their cost-effective approach is a key differentiator in a mature market.

- Sales Volume: This strategy ensures consistent and predictable sales volumes for their standard aseptic solutions.

- Cash Generation: The reliability of these sales makes them a strong contributor to the company's cash flow.

Greatview's standard roll-fed and blank-fed aseptic packaging materials are definitive Cash Cows. These products dominate a stable, mature market, providing a consistent and substantial income stream. This reliable performance allows Greatview to allocate resources to other strategic growth areas.

The company's filling machines and associated after-sales services, including spare parts and technical support, also function as Cash Cows. Despite moderate growth in new machine sales, the large installed base ensures recurring revenue from maintenance contracts and essential services, vital for operational continuity.

Greatview's established presence in mature European markets like Germany, Switzerland, and Italy, formerly under WINTIPAK, represents Cash Cows. These regions offer stable demand, allowing Greatview to generate predictable profits through its existing market share and operational efficiencies.

| Business Segment | BCG Category | Key Characteristics | 2023 Market Context |

| Standard Aseptic Cartons (China) | Cash Cow | Mature market, strong dairy demand, minimal investment needed. | Global aseptic packaging market valued at ~$51.3 billion in 2023. |

| Filling Machines & Services | Cash Cow | Large installed base, recurring revenue from maintenance and parts. | Services are critical for operational efficiency and longevity. |

| Established European Operations | Cash Cow | Stable demand in mature markets (Germany, Switzerland, Italy). | European aseptic packaging market ~$5.5 billion in 2023, CAGR 4.2% (2023-2028). |

What You’re Viewing Is Included

Greatview Aseptic Packaging BCG Matrix

The Greatview Aseptic Packaging BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you're seeing the exact analysis, formatting, and strategic insights that will be yours to utilize immediately. Rest assured, there are no watermarks, demo content, or missing sections; what you see is precisely what you get, ready for your business planning needs.

Dogs

Within Greatview Aseptic Packaging's BCG Matrix, legacy packaging formats represent the Dogs. These are older designs or material compositions that no longer resonate with today's market, particularly concerning sustainability and advanced functionalities. Greatview's market share in these segments is small and, in many cases, declining.

These products are characterized by minimal profit generation and consume valuable resources without offering significant future growth potential. For instance, older carton structures that lack advanced barrier properties or are not easily recyclable would fall into this category. The focus for Greatview is to manage these assets efficiently, potentially phasing them out as newer, more competitive solutions gain traction.

Greatview Aseptic Packaging might operate in niche regional markets characterized by low demand and minimal growth potential. These segments, often geographically isolated, could represent a significant challenge for the company’s expansion efforts.

In 2024, for instance, certain sub-Saharan African countries or specific regions within Southeast Asia might exhibit stagnant demand for aseptic packaging due to limited industrialization or a preference for traditional packaging methods. Greatview's investment in these areas, without significant market share gains, could be a drain on resources.

In the aseptic packaging sector, Greatview Aseptic Packaging may identify product lines operating within intensely competitive niches. These segments are characterized by the presence of established, dominant competitors, making it challenging for Greatview to carve out a significant market share. For instance, in 2023, the global aseptic packaging market saw growth, but certain specialized segments, like those for niche beverage types, experienced slower adoption rates due to entrenched players.

These struggling product lines, often exhibiting both low market share and low market growth, are essentially the Dogs in the BCG matrix. They demand substantial investment to maintain their position or attempt to gain traction, yet the potential for substantial returns remains minimal. This scenario could lead to a drain on resources that could be better allocated to more promising areas of the business.

Packaging Materials with High Environmental Footprint

Packaging materials with a high environmental footprint, if still a significant part of Greatview's portfolio and not quickly replaced by sustainable options, could be categorized as Dogs in the BCG Matrix. This is particularly true as market demand and regulations increasingly favor eco-friendly solutions. For instance, by 2024, the global demand for sustainable packaging is projected to reach $413.9 billion, indicating a strong market shift away from traditional, less environmentally conscious materials.

Greatview's continued reliance on such materials would mean they face low market share in a declining or stagnant industry segment. This scenario is exacerbated by growing consumer awareness and corporate sustainability goals. Companies are actively seeking alternatives, potentially leading to reduced demand and profitability for legacy packaging types. For example, the European Union's Packaging and Packaging Waste Directive continues to push for higher recycling rates and the reduction of single-use plastics, directly impacting materials with a high footprint.

- Low Market Share: Products with a high environmental footprint may struggle to maintain significant market share as preferences shift.

- Declining Industry Growth: The segment of packaging with a high environmental footprint is likely experiencing slow or negative growth.

- Risk of Obsolescence: Without innovation or a pivot to greener alternatives, these materials face the risk of becoming obsolete.

- Regulatory Pressure: Increasing environmental regulations worldwide put pressure on companies to phase out less sustainable packaging options.

Any Non-Core Business with Consistent Losses

Any non-core business segments within Greatview Aseptic Packaging that consistently generate losses or operate at a break-even point, without offering strategic value to the primary aseptic packaging operations, would fall into the Dogs category of the BCG matrix. These could include historical examples like scrap metal sales, which, if they no longer contribute significantly to revenue or market share, represent underperforming assets.

While specific financial data for such ancillary segments is not always granularly reported in recent Greatview filings, the principle remains. Businesses in the Dogs quadrant typically have low market share and low growth prospects. For instance, if a past non-core venture, such as a small distribution arm for unrelated products, saw its revenue decline by 15% year-over-year in 2023 and its contribution to overall profit was negative, it would exemplify a Dog.

- Underperforming Assets: Non-core businesses with sustained losses drain resources and management attention.

- Strategic Review: These segments should be candidates for divestiture or restructuring to focus on core strengths.

- Resource Allocation: Divesting Dogs frees up capital and human resources for more promising ventures.

- Historical Context: Older reports might mention specific examples like scrap metal sales, which if no longer profitable, fit this classification.

Greatview Aseptic Packaging's "Dogs" represent legacy products or niche segments with low market share and minimal growth. These are often older packaging formats that don't meet current sustainability demands or operate in highly competitive, stagnant markets. For example, by 2024, certain older, less recyclable carton designs would be classified as Dogs, as the global sustainable packaging market is projected to reach $413.9 billion, highlighting a strong shift away from such materials.

These underperforming assets, like older packaging materials with a high environmental footprint, require careful management. They might be phased out or restructured to prevent them from draining resources needed for more promising areas of the business. For instance, the EU's Packaging and Packaging Waste Directive continues to push for reduced single-use plastics, directly impacting materials with a high footprint.

The company may also have non-core business segments that consistently generate losses. If a historical ancillary venture, like a small distribution arm for unrelated products, saw its revenue decline by 15% year-over-year in 2023 and contributed negatively to overall profit, it would exemplify a Dog. Such segments are candidates for divestiture to free up capital for core strengths.

| BCG Category | Greatview Aseptic Packaging Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Legacy carton designs with low recyclability | Low | Low/Declining | Divest or phase out; manage for cash if possible |

| Dogs | Niche regional markets with stagnant demand | Low | Low | Consider exit or minimal investment |

| Dogs | Packaging materials with high environmental footprint | Low | Low/Declining | Replace with sustainable alternatives; regulatory risk |

| Dogs | Non-core, loss-generating business segments | Low | Low | Divestiture or restructuring |

Question Marks

Greatview's expansion into emerging markets like South America positions them squarely in the Question Marks quadrant of the BCG Matrix. The aseptic packaging market in South America is expected to experience substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 14.21% through 2030. This rapid expansion presents a significant opportunity, but Greatview's current market share in these regions is relatively low.

These new ventures demand considerable investment to capture market share and transform into future Stars. The high growth potential of the South American aseptic packaging sector, estimated to reach $1.7 billion by 2027, makes these strategic expansions crucial for Greatview's long-term growth trajectory, despite the initial uncertainty and required capital outlay.

Advanced smart packaging features, such as real-time temperature monitoring or sophisticated anti-counterfeiting measures, are likely in their early stages for Greatview Aseptic Packaging. These innovations represent potential future growth areas but currently have limited market penetration.

Greatview's commitment to developing these cutting-edge technologies requires substantial investment in research and development, alongside efforts to build market demand. This strategic focus on nascent, high-potential features places them in a position that necessitates significant ongoing support and market cultivation.

The pharmaceutical sector represents a significant growth opportunity for aseptic packaging, demanding exceptionally high standards for sterility and product integrity. If Greatview is actively pursuing this market, characterized by its rapid expansion and Greatview's current limited penetration, it would indeed be classified as a Question Mark in the BCG matrix. The global aseptic packaging market for pharmaceuticals was valued at approximately $7.5 billion in 2023 and is projected to reach over $12 billion by 2028, indicating a robust compound annual growth rate of around 9.5%.

Development of Next-Generation Sustainable Materials

The development of next-generation sustainable materials represents a significant investment for Greatview Aseptic Packaging, pushing beyond current bio-based options into truly revolutionary territory like fully compostable or advanced renewable barriers. These cutting-edge materials are largely in the research and development or pilot stages, indicating a high-risk, high-reward profile.

While these initiatives hold the promise of massive future growth and could redefine the market, they currently possess minimal market share. The substantial capital required for their development and scaling places them firmly in the question mark category of the BCG matrix, demanding careful strategic consideration.

- Investment Focus: R&D for fully compostable and advanced renewable barrier materials.

- Market Position: Currently low market share, primarily in pilot or R&D phases.

- Growth Potential: High, with the capacity to disrupt existing markets and create new ones.

- Capital Needs: Significant capital investment required for development and commercialization.

Strategic Acquisitions of Niche Packaging Technologies

Greatview Aseptic Packaging's strategic direction, particularly following its acquisition by NEWJF, indicates a strong focus on acquiring specialized packaging technologies. This move is designed to foster business synergy and drive global expansion. Any niche technologies brought into the fold through these acquisitions, characterized by high growth potential but currently holding a small market share, would typically be classified as Question Marks within the BCG Matrix.

These newly integrated technologies necessitate significant, targeted investment to nurture their development and capitalize on their promising growth trajectories. For instance, if Greatview acquired a company specializing in biodegradable barrier films for aseptic packaging, this innovation, while potentially disruptive, might initially have a limited market penetration. The company's investment in such a segment in 2024 could be crucial for its future market leadership.

- Niche Technology Acquisition: Greatview's integration strategy aims to absorb specialized packaging innovations.

- Question Mark Classification: Newly acquired, high-growth, low-market-share technologies fit the Question Mark profile.

- Investment Imperative: Focused capital allocation is vital to cultivate these technologies into market leaders.

- 2024 Context: Strategic investments in 2024 are key to unlocking the potential of these niche assets.

Greatview's ventures into emerging markets, such as South America, and their pursuit of advanced features like smart packaging and novel sustainable materials, place them in the Question Marks category. These areas offer substantial growth potential, with the South American aseptic packaging market projected to grow at a CAGR of 14.21% through 2030. However, Greatview's current market share in these segments is relatively low, requiring significant investment to build presence and potentially transition them into future Stars.

| Category | Market Growth | Market Share | Investment Need | Strategic Outlook |

| Emerging Markets (e.g., South America) | High (14.21% CAGR projected through 2030) | Low | High | Capture market share, potential future Star |

| Advanced Smart Packaging | High | Low | High (R&D, market cultivation) | Develop and scale nascent technologies |

| Next-Gen Sustainable Materials | Very High (disruptive potential) | Minimal (R&D/pilot stages) | Very High | Long-term, high-risk/high-reward investment |

| Niche Acquired Technologies | High (potential) | Low (initially) | High | Integrate and grow acquired specialized assets |

BCG Matrix Data Sources

Our Greatview Aseptic Packaging BCG Matrix leverages comprehensive market intelligence, drawing from financial reports, industry analysis, and competitor data to provide strategic insights.