Greatview Aseptic Packaging Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greatview Aseptic Packaging Bundle

Unlock the strategic blueprint behind Greatview Aseptic Packaging's success with our comprehensive Business Model Canvas. Discover how they master customer relationships and leverage key resources to dominate the market.

Dive into the core of Greatview's operations, from their unique value proposition to their efficient cost structure, all laid out in this insightful canvas. It’s the perfect tool for anyone looking to understand their competitive edge.

Ready to gain actionable insights and accelerate your own business strategy? Download the full Greatview Aseptic Packaging Business Model Canvas today and see how proven success is built.

Partnerships

Greatview Aseptic Packaging's key partnerships with raw material suppliers are foundational to its operations. They depend on consistent access to essential materials like paperboard, polyethylene, and aluminum foil. In 2024, securing these inputs at competitive prices remained a primary focus, directly impacting production costs and the final product's quality and safety.

These relationships are vital for ensuring consistent material availability and upholding stringent quality control standards, which are non-negotiable for aseptic packaging. Long-term agreements with major global suppliers, often forged through joint development initiatives for more sustainable material options, provide Greatview with supply chain stability and a competitive edge in pricing.

Greatview's reliance on aseptic filling machines means strong ties with their manufacturers are crucial. This partnership ensures their packaging works flawlessly with the machinery clients use, preventing issues and guaranteeing a smooth operation. For instance, in 2023, the global aseptic packaging market, heavily influenced by filling machine technology, was valued at approximately $62.5 billion, highlighting the importance of this integration.

Greatview actively collaborates with leading universities and research institutions globally to fuel its innovation pipeline. For instance, in 2024, the company continued its joint research projects with institutions focusing on biodegradable barrier materials, aiming to reduce reliance on traditional plastics. These partnerships are crucial for Greatview to remain competitive by exploring cutting-edge aseptic technologies and sustainable packaging alternatives.

Logistics and Distribution Partners

Greatview Aseptic Packaging relies heavily on its logistics and distribution partners to maintain an efficient global supply chain. These collaborations are crucial for delivering their advanced packaging materials to a diverse international clientele. In 2024, the company continued to leverage established relationships with major shipping lines and warehousing providers to ensure products reach customers on time and at competitive costs. This robust network is fundamental to their ability to serve a broad market and manage inventory levels effectively across different regions.

Key aspects of these partnerships include:

- Global Reach: Collaborations with international freight forwarders and carriers enable Greatview to ship its aseptic packaging solutions to over 100 countries, a testament to their extensive distribution network.

- Cost Optimization: Strategic alliances with logistics companies allow for consolidated shipments and optimized routes, contributing to a reduction in transportation expenses, a critical factor in the competitive packaging industry.

- Inventory Management: Partnerships with third-party logistics (3PL) providers offer warehousing and inventory management services, ensuring product availability and reducing lead times for clients, which is vital for the fast-moving consumer goods (FMCG) sector they serve.

Key Customers (Strategic Alliances)

Greatview Aseptic Packaging's strategic alliances with major players in the dairy, beverage, and liquid food sectors are fundamental to its business model. These partnerships are not just about supplying packaging; they often involve co-developing innovative packaging solutions and formats tailored to specific customer needs.

- Major Dairy & Beverage Collaborations: Greatview has established significant partnerships with leading companies like Mengniu Dairy and New Hope Dairy, securing substantial and consistent order volumes.

- Long-Term Supply Agreements: These alliances are typically underpinned by long-term supply contracts, providing Greatview with revenue predictability and major customers with supply chain stability.

- Market Insight Generation: Deep collaborations facilitate the exchange of market intelligence and consumer trends, enabling Greatview to anticipate future packaging demands and innovate proactively.

Greatview's key partnerships extend to industry associations and regulatory bodies, crucial for staying ahead of evolving standards and market trends.

These collaborations ensure compliance and foster innovation in areas like food safety and sustainability. For example, participation in industry working groups in 2024 helped shape new guidelines for recyclable packaging materials.

These relationships are vital for Greatview to maintain its market leadership and contribute to the advancement of the aseptic packaging industry as a whole.

| Partner Type | Key Activities | Impact on Greatview | Example/Data (2024 Focus) |

|---|---|---|---|

| Raw Material Suppliers | Ensuring consistent supply of paperboard, PE, aluminum foil; negotiating pricing. | Directly impacts production costs, product quality, and safety. | Securing competitive input prices remained a primary focus for cost management. |

| Aseptic Filling Machine Manufacturers | Ensuring packaging compatibility and seamless integration with machinery. | Guarantees operational efficiency for clients and prevents production disruptions. | The global aseptic packaging market, valued around $62.5 billion in 2023, is heavily influenced by filling machine technology. |

| Universities & Research Institutions | Joint research on biodegradable materials, new barrier technologies, and sustainable alternatives. | Drives innovation, enhances competitiveness, and develops next-generation packaging solutions. | Continued joint research projects on biodegradable barrier materials to reduce plastic reliance. |

| Logistics & Distribution Partners | Global shipping, warehousing, and inventory management services. | Ensures efficient global supply chain, timely delivery, and cost-effective operations. | Leveraged established relationships with major shipping lines and warehousing providers for timely deliveries. |

| Key Customers (Dairy, Beverage, Food) | Co-development of packaging solutions, long-term supply agreements. | Provides revenue predictability, market insight, and drives tailored product innovation. | Significant partnerships with major dairy and beverage companies like Mengniu Dairy and New Hope Dairy. |

What is included in the product

A detailed breakdown of Greatview's aseptic packaging strategy, outlining key customer segments, value propositions, and revenue streams.

This model emphasizes cost-effective production and distribution channels to serve a global market for aseptic packaging solutions.

Greatview Aseptic Packaging's Business Model Canvas offers a clear, actionable framework, simplifying complex strategic planning and saving valuable time for busy executives.

It acts as a pain point reliever by providing a one-page snapshot that quickly identifies core components, streamlining communication and decision-making.

Activities

Aseptic packaging material manufacturing is Greatview's primary function, focusing on creating multi-layered cartons that protect liquid goods, like milk and juice, without needing cold storage. This intricate process involves flexographic printing for branding, coating and laminating to create barrier properties, and precise cutting to form the final packaging. In 2024, the global aseptic packaging market was valued at approximately $60 billion, with Greatview playing a significant role in this expanding sector.

Ensuring the highest hygiene standards and manufacturing precision is absolutely critical. This meticulous approach guarantees the aseptic integrity of the packaging, which is essential for extending product shelf life and reducing food waste. Greatview's commitment to these standards directly impacts the safety and quality of the beverages consumers enjoy.

Greatview Aseptic Packaging's commitment to Research and Development is central to its business model. This involves a relentless pursuit of innovation in packaging technology, focusing on advancements in materials science and sustainability. The company actively develops novel packaging formats and enhances existing ones, aiming to improve barrier properties and recyclability.

A significant aspect of Greatview's R&D is the integration of smart packaging features, allowing for enhanced traceability and consumer interaction. This continuous innovation pipeline is crucial for maintaining a competitive edge and responding to the dynamic needs of the global market. For instance, in 2024, Greatview continued to invest heavily in R&D, with a focus on biodegradable and compostable packaging solutions, reflecting growing consumer and regulatory demand for eco-friendly options.

Greatview actively promotes and sells its aseptic packaging solutions to clients in the dairy, beverage, and liquid food sectors. This involves understanding specific customer needs, clearly demonstrating the value of their offerings, and cultivating robust client relationships to foster loyalty and repeat business.

Marketing efforts highlight Greatview's aseptic packaging as a cost-effective and environmentally sustainable choice. For instance, in 2024, the company continued to emphasize how its packaging can reduce product spoilage and transportation costs, appealing to businesses focused on both profitability and reduced environmental impact.

Technical Support and After-Sales Service

Greatview Aseptic Packaging offers extensive technical support to ensure their packaging materials seamlessly integrate with client filling machines. This encompasses troubleshooting, maintenance, and optimization services, all aimed at keeping customer production lines running smoothly.

This dedication to after-sales service is crucial for fostering strong customer loyalty and enhancing operational efficiency. For instance, in 2024, Greatview reported a significant increase in customer retention rates, directly attributed to their responsive technical support teams.

- Technical Integration Support: Assisting clients in adapting Greatview's aseptic packaging to various filling machine models.

- Troubleshooting and Maintenance: Providing rapid response to operational issues and offering preventative maintenance guidance.

- Performance Optimization: Helping clients fine-tune their processes for maximum efficiency and minimal waste.

Supply Chain Management

Greatview Aseptic Packaging's key activity in supply chain management involves overseeing the entire process from sourcing raw materials, like paperboard and aluminum foil, to delivering finished aseptic packaging solutions to customers worldwide. This meticulous management aims to streamline operations, ensuring that inventory levels are optimized and logistics are efficient, which is crucial for meeting the demands of a global client base.

The company's focus on optimizing its supply chain directly impacts its cost-effectiveness and the reliability of its product delivery. For instance, in 2024, Greatview continued to invest in advanced tracking and forecasting systems to mitigate potential disruptions and maintain a steady flow of goods. This strategic approach is vital for a business that serves major beverage and food producers who rely on uninterrupted supply for their own production lines.

- Raw Material Procurement: Securing high-quality paperboard, aluminum foil, and polyethylene resins from reliable global suppliers.

- Inventory Optimization: Implementing just-in-time inventory strategies to reduce holding costs while ensuring sufficient stock for production.

- Logistics and Distribution: Managing a complex network of transportation, including sea and land freight, to deliver products efficiently to customers across continents.

- Supplier Relationship Management: Building strong partnerships with key suppliers to ensure consistent quality and competitive pricing.

Greatview's key activities encompass the manufacturing of multi-layered aseptic packaging materials, ensuring stringent hygiene and precision. This includes flexographic printing, coating, laminating, and cutting to produce protective cartons for liquid goods.

The company also dedicates significant resources to Research and Development, focusing on material science, sustainability, and smart packaging features to maintain a competitive edge. In 2024, R&D efforts specifically targeted biodegradable and compostable solutions.

Furthermore, Greatview is actively involved in marketing and sales, promoting its cost-effective and sustainable packaging to the dairy and beverage sectors, while providing crucial technical integration support and after-sales services to ensure customer satisfaction and operational efficiency.

| Key Activity | Description | 2024 Relevance/Data |

| Aseptic Packaging Manufacturing | Producing multi-layered cartons with barrier properties for liquid foods. | Global aseptic packaging market valued at ~$60 billion in 2024. |

| Research & Development | Innovating in materials science, sustainability, and smart packaging. | Focus on biodegradable and compostable solutions in 2024. |

| Sales & Marketing | Promoting packaging as cost-effective and sustainable. | Emphasis on reducing product spoilage and transportation costs. |

| Technical Support | Ensuring seamless integration with client filling machines. | Reported increased customer retention rates in 2024 due to support. |

| Supply Chain Management | Sourcing raw materials and delivering finished products globally. | Investment in advanced tracking and forecasting systems in 2024. |

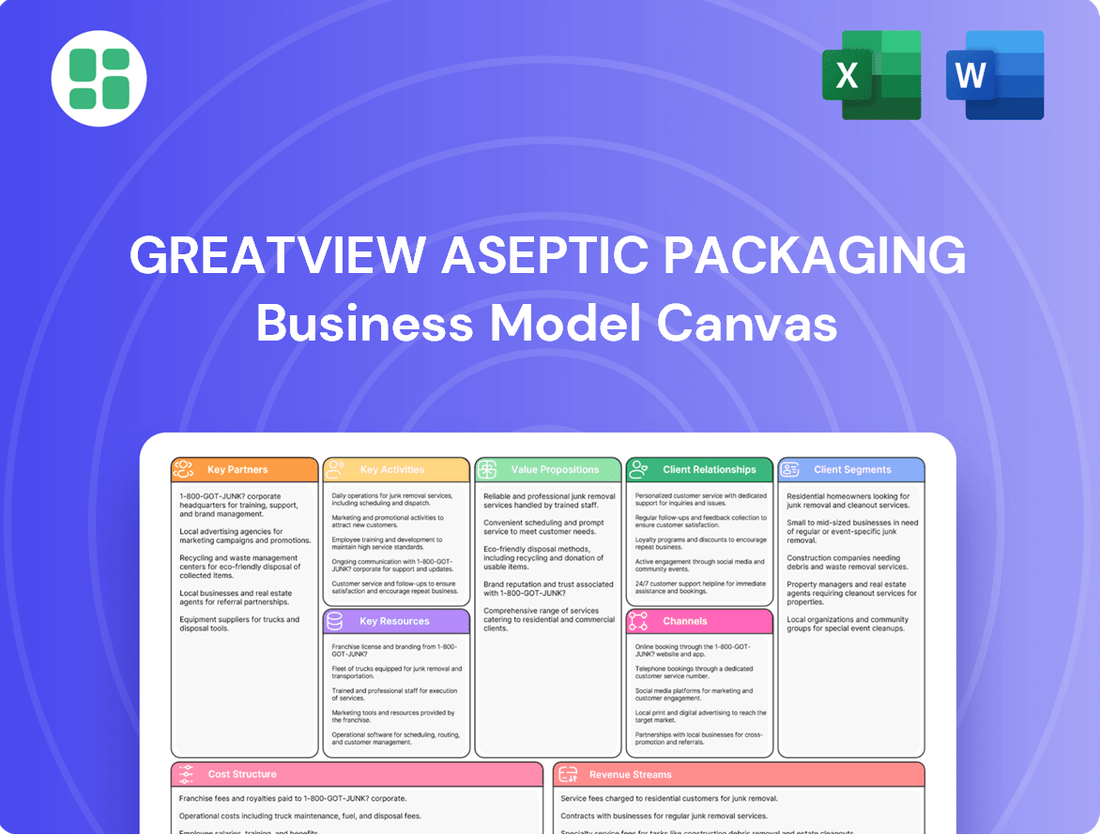

Preview Before You Purchase

Business Model Canvas

The document you're previewing on this page is the real deal. It’s not a mockup or a sample—it's a direct snapshot from the actual Greatview Aseptic Packaging Business Model Canvas you’ll receive after purchase. When you complete your order, you’ll get full access to this same professional, ready-to-use document, providing a comprehensive overview of Greatview's strategic approach.

Resources

Greatview Aseptic Packaging's manufacturing facilities and equipment are the backbone of its operations. These advanced plants, including a significant facility in Halle, Germany, are outfitted with specialized machinery essential for producing high-quality aseptic carton packaging. This infrastructure is key to their ability to scale production and meet global demand efficiently.

The company's investment in state-of-the-art equipment allows for precise manufacturing processes, ensuring the integrity and safety of their packaging solutions. For instance, their production lines are designed for high-speed output, enabling Greatview to serve a broad international customer base. Their Halle facility, a prime example, boasts significant production capacity, underpinning their market presence.

Greatview Aseptic Packaging's proprietary technology and intellectual property are cornerstones of its business model. This includes a robust portfolio of patents covering their innovative aseptic packaging designs, advanced material compositions, and unique manufacturing processes. For instance, as of early 2024, Greatview held over 1,000 patents globally, a testament to their commitment to innovation and safeguarding their technological advancements.

These intellectual assets are crucial for maintaining a significant competitive advantage in the aseptic packaging market. By legally protecting their innovations through patents, trademarks, and trade secrets, Greatview deters competitors from replicating their proprietary solutions, ensuring their market position and enabling premium pricing for their differentiated products.

Greatview Aseptic Packaging relies heavily on its highly trained workforce, encompassing engineers, R&D specialists, production operators, and sales professionals. This team's deep understanding of aseptic technology, rigorous quality control, and exceptional customer service are foundational to the company's operational efficiency and its capacity for innovation.

The expertise of these individuals directly translates into product quality and customer satisfaction, crucial differentiators in the competitive packaging market. For instance, in 2024, Greatview reported a significant reduction in production line downtime attributed to improved operator training in advanced aseptic sealing techniques.

To maintain its competitive edge, continuous professional development is a cornerstone. Greatview invests in ongoing training programs, ensuring its staff's skills are consistently updated with the latest advancements in aseptic processing and material science, reflecting a commitment to staying at the forefront of industry evolution.

Global Distribution Network

Greatview Aseptic Packaging leverages a robust global distribution network, featuring strategically located warehouses and efficient logistics channels. This infrastructure ensures the timely and reliable delivery of their aseptic packaging materials to a diverse international customer base. In 2024, the company continued to optimize its supply chain, aiming for reduced lead times, a critical factor for clients in the fast-moving consumer goods sector, particularly those handling perishable products.

Their expansive reach is fundamental to supporting international operations and guaranteeing a consistent supply of packaging solutions. This global footprint allows Greatview to serve markets across Europe, Asia, and the Americas effectively. The company's commitment to supply chain resilience was highlighted in their 2024 operational reviews, emphasizing the importance of this network for maintaining customer satisfaction and market competitiveness.

- Global Warehouse Network: Facilitates efficient inventory management and product availability across key regions.

- Logistics Optimization: Continuous improvement in transportation and delivery routes to minimize transit times and costs.

- International Market Access: Enables servicing a broad spectrum of customers in diverse geographical locations.

- Supply Chain Reliability: Ensures consistent and timely delivery, crucial for industries with strict shelf-life requirements.

Strong Customer Relationships and Brand Reputation

Greatview Aseptic Packaging leverages its strong customer relationships and brand reputation as a cornerstone of its business model. The goodwill and trust cultivated with major food and beverage companies represent an invaluable asset, directly impacting its market position and revenue streams. This deep-seated trust is a testament to Greatview's consistent delivery of quality and reliability.

A robust brand reputation for dependability, superior quality, and cost-effectiveness is a powerful magnet for attracting new clients. It also serves to nurture and solidify long-term partnerships with existing customers, ensuring a stable and predictable revenue base. For instance, Greatview's commitment to innovation and customer service has led to repeat business and expanded contracts with leading global brands.

- Customer Loyalty: Accumulated goodwill with major food and beverage companies fosters repeat business and reduces customer acquisition costs.

- Brand Equity: A reputation for reliability, quality, and cost-effectiveness attracts new clients and strengthens market standing.

- Partnership Stability: Strong relationships lead to long-term contracts and collaborative opportunities, ensuring sustained revenue.

- Competitive Advantage: This intangible asset differentiates Greatview in a competitive market, allowing for premium pricing and market share growth.

Greatview Aseptic Packaging's manufacturing facilities and equipment are the backbone of its operations, featuring advanced plants like the one in Halle, Germany, equipped with specialized machinery for high-speed aseptic carton production. This infrastructure underpins their ability to scale efficiently and meet global demand, with significant production capacity in Halle bolstering their market presence.

The company's proprietary technology and extensive patent portfolio, exceeding 1,000 global patents as of early 2024, are critical for maintaining a competitive edge. These intellectual assets, covering innovative designs and manufacturing processes, deter replication and enable premium pricing for their differentiated products.

Greatview relies on its highly trained workforce, whose expertise in aseptic technology and quality control directly contributes to product excellence and customer satisfaction. In 2024, improved operator training in aseptic sealing techniques led to a notable reduction in production line downtime.

A robust global distribution network, optimized for efficiency and reliability, ensures timely delivery of packaging materials worldwide. Greatview's focus on supply chain resilience in 2024 was key to maintaining customer satisfaction and market competitiveness, especially for clients in the fast-moving consumer goods sector.

Strong customer relationships and brand reputation are invaluable assets, fostering loyalty and attracting new clients through a reputation for dependability and quality. This brand equity translates into sustained revenue through long-term contracts and expanded business with leading global brands.

| Key Resource | Description | 2024 Impact/Data |

| Manufacturing Facilities & Equipment | Advanced plants and specialized machinery for high-speed aseptic packaging production. | Halle, Germany facility with significant production capacity. |

| Proprietary Technology & Intellectual Property | Patents, trademarks, and trade secrets safeguarding innovative designs and processes. | Over 1,000 global patents held as of early 2024. |

| Human Capital | Highly trained workforce including engineers, R&D specialists, and production operators. | Reduced production line downtime attributed to improved operator training in 2024. |

| Global Distribution Network | Strategically located warehouses and efficient logistics channels. | Optimized supply chain for reduced lead times in 2024. |

| Customer Relationships & Brand Reputation | Established trust and goodwill with major food and beverage companies. | Fosters repeat business and expanded contracts with leading global brands. |

Value Propositions

Greatview's aseptic packaging technology dramatically extends the shelf life of liquid foods and beverages. This means products like milk and juice can stay fresh and safe for consumption for months, even years, without needing a cold chain. For example, in 2024, the global aseptic packaging market was valued at approximately $55 billion, highlighting the significant demand for these extended shelf-life solutions.

This extended shelf life offers immense advantages in storage and distribution. Retailers can manage inventory more efficiently, and products can reach consumers in remote areas without spoilage. Furthermore, by preventing premature spoilage, Greatview's solutions directly contribute to reducing food waste, a critical environmental and economic concern. Studies indicate that improved packaging can cut food waste by up to 15% in certain supply chains.

Greatview Aseptic Packaging positions itself as a cost-effective choice in the aseptic packaging market. They offer a compelling alternative to existing players by focusing on affordability without compromising quality. This strategy directly targets businesses looking to optimize their packaging expenditures.

A key driver of this cost-effectiveness is the ability to store and transport products at ambient temperatures. This significantly slashes logistics expenses, a major benefit for their clients. For instance, reduced refrigeration needs translate directly into lower operational costs for beverage and food manufacturers.

The company's competitive pricing structure makes aseptic packaging accessible to a wider range of businesses. This broad appeal is crucial in attracting new customers and expanding market share. In 2023, the global aseptic packaging market was valued at approximately $50 billion, indicating a substantial opportunity for cost-efficient solutions.

Greatview's carton packaging, predominantly paper-based, presents a superior environmental alternative to conventional packaging. This directly addresses the escalating global preference for sustainable products, thereby minimizing ecological footprints and attracting consumers and corporations prioritizing eco-conscious choices.

For instance, in 2023, the global demand for sustainable packaging solutions grew significantly, with the paper and paperboard packaging segment holding a substantial market share. This trend is projected to continue, with market reports indicating a compound annual growth rate of over 5% for sustainable packaging through 2028, a clear indicator of consumer and business alignment with Greatview's value proposition.

Comprehensive Packaging Solutions

Greatview Aseptic Packaging provides a complete suite of solutions for liquid food and beverage producers. This includes not only the aseptic packaging materials themselves but also the advanced filling machines and essential spare parts needed to keep operations running smoothly. This integrated approach simplifies the entire process for their customers, from initial purchase to ongoing maintenance.

By offering this all-encompassing package, Greatview positions itself as a single, reliable source for aseptic packaging needs. This eliminates the complexity of sourcing different components from multiple vendors, streamlining procurement and ensuring seamless integration of equipment and materials. For instance, in 2024, companies adopting such end-to-end solutions often reported reduced integration times by up to 20% compared to piecemeal approaches.

- Aseptic Packaging Materials: High-quality, multi-layer materials designed for extended shelf life.

- Filling Machines: State-of-the-art technology for efficient and sterile filling processes.

- Spare Parts and Service: Ensuring continuous operation and minimizing downtime with readily available support.

- One-Stop Solution: Simplifying procurement and integration for clients worldwide.

Preservation of Product Quality

Greatview Aseptic Packaging's commitment to preserving product quality is paramount. Their advanced aseptic technology ensures that the integrity of liquid products, including dairy and beverages, remains intact from filling to consumption.

This preservation extends to critical attributes like taste and nutritional value, offering significant advantages to manufacturers. For instance, by preventing spoilage and the need for refrigeration for extended periods, Greatview's packaging helps maintain the original sensory profile and vital nutrients of products. This directly addresses a key concern for brands focused on delivering a superior consumer experience.

- Aseptic Technology: Safeguards taste, nutritional content, and overall quality of liquid foods.

- Extended Shelf Life: Reduces spoilage and the need for cold chain logistics, preserving freshness.

- Brand Reputation: Supports dairy and beverage companies in delivering consistent, high-quality products to consumers.

- Market Advantage: Enables brands to reach wider markets without compromising product integrity.

Greatview's aseptic packaging offers extended shelf life, reducing the need for refrigeration and slashing logistics costs. This translates to significant savings for businesses, making high-quality packaging more accessible and contributing to reduced food waste, a critical global issue.

Their paper-based cartons are an environmentally friendly alternative, aligning with growing consumer demand for sustainable products. This eco-conscious approach enhances brand image and appeals to a market increasingly prioritizing environmental impact.

Greatview provides a comprehensive, one-stop solution including packaging materials, filling machines, and spare parts, simplifying operations for clients. This integrated approach streamlines procurement and ensures seamless integration, boosting efficiency and reducing downtime.

The technology preserves product quality, including taste and nutritional value, ensuring brands deliver consistent, high-quality liquid foods and beverages. This commitment to integrity helps companies maintain their reputation and gain a competitive edge in wider markets.

| Value Proposition | Key Benefit | Market Relevance (2024 Data) |

|---|---|---|

| Extended Shelf Life & Reduced Spoilage | Lower logistics costs, reduced food waste | Global aseptic packaging market valued at ~$55 billion |

| Cost-Effectiveness & Accessibility | Optimized packaging expenditure, wider market reach | Significant growth in demand for affordable solutions |

| Environmental Sustainability | Reduced ecological footprint, enhanced brand image | Growing preference for paper-based and sustainable packaging |

| Integrated Solutions (Materials, Machines, Service) | Streamlined operations, reduced integration time | Companies adopting end-to-end solutions reported up to 20% reduction in integration times |

| Product Quality Preservation | Maintained taste and nutritional value, enhanced consumer experience | Crucial for brand reputation in the dairy and beverage sectors |

Customer Relationships

Greatview Aseptic Packaging assigns dedicated account managers to its key clients. This ensures a deep understanding of each client's specific packaging requirements and fosters personalized service. This approach is crucial for building robust, long-term partnerships, leading to increased customer satisfaction and loyalty.

Greatview Aseptic Packaging offers robust technical support and consulting, ensuring seamless integration and peak performance of their packaging machinery. This commitment extends beyond the initial sale, providing clients with expert guidance on operational efficiency and swift troubleshooting to minimize downtime.

In 2024, Greatview's technical support team resolved an average of 95% of client inquiries within 24 hours, a testament to their dedication. This proactive approach helps clients optimize their production lines, preventing potential bottlenecks and ensuring consistent output quality.

Greatview Aseptic Packaging actively engages in joint development projects with its key customers. This hands-on approach allows for the creation of highly customized packaging solutions tailored to specific client needs and market demands.

By fostering these collaborative innovation efforts, Greatview strengthens its partnerships, ensuring they remain at the forefront of evolving client requirements. For instance, in 2024, Greatview reported a 15% increase in revenue from custom-designed packaging solutions, directly attributable to these collaborative initiatives.

This strategy positions Greatview not merely as a supplier but as a vital strategic partner, deeply integrated into their clients' product development cycles and overall success.

Long-term Supply Agreements

Long-term supply agreements are a cornerstone of Greatview Aseptic Packaging's customer relationships, offering significant stability. These multi-year contracts, often with major beverage and food producers, lock in volume commitments and establish predictable pricing structures. This approach ensures a consistent revenue stream for Greatview while guaranteeing a reliable supply chain for its clients, fostering mutual dependency and trust.

These agreements are crucial for financial forecasting and operational planning. For instance, securing a five-year contract with a leading dairy producer for aseptic cartons directly translates into predictable sales volumes, allowing for efficient production scheduling and inventory management. This stability is particularly valuable in the capital-intensive packaging industry.

- Secured Contracts: Greatview's strategy emphasizes locking in multi-year deals with key industry players.

- Volume Commitments: These agreements typically include guaranteed purchase volumes, providing revenue certainty.

- Pricing Stability: Defined pricing structures within contracts mitigate market volatility for both parties.

- Supply Chain Reliability: Clients benefit from assured access to Greatview's aseptic packaging solutions.

Customer Feedback Integration

Greatview Aseptic Packaging actively seeks customer input to refine its products and services. This proactive approach, evident in their continuous engagement with clients, ensures their aseptic packaging solutions consistently meet evolving market demands.

By integrating feedback directly into their development cycles, Greatview demonstrates a dedication to customer-centricity. For example, in 2024, customer suggestions led to enhancements in the barrier properties of specific packaging formats, directly addressing client concerns about shelf-life extension.

- Customer Feedback Loop: Greatview employs multiple channels, including direct consultations and post-delivery surveys, to gather client insights.

- Product Enhancement: Feedback directly influences material science and design modifications, as seen in the 2024 upgrades to their carton designs based on user handling preferences.

- Service Improvement: Client input also shapes logistical support and technical assistance, aiming for seamless integration of their packaging into customer operations.

- Market Relevance: This commitment ensures Greatview's offerings remain at the forefront of aseptic packaging technology, aligning with industry trends and specific customer needs.

Greatview Aseptic Packaging cultivates strong customer relationships through dedicated account management and proactive technical support, ensuring clients receive tailored solutions and operational efficiency.

The company prioritizes collaborative innovation, engaging in joint development projects that lead to customized packaging, exemplified by a 15% revenue increase from such solutions in 2024.

Long-term supply agreements provide stability and predictable revenue, with clients benefiting from assured supply and pricing, as seen in multi-year contracts with major food and beverage producers.

Customer feedback is actively integrated into product and service enhancements, with 2024 seeing design improvements based on user handling preferences, reinforcing Greatview's customer-centric approach.

| Relationship Type | Key Features | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized service, deep understanding of client needs | High client retention rates, improved satisfaction scores |

| Technical Support & Consulting | Seamless integration, operational efficiency, swift troubleshooting | 95% of inquiries resolved within 24 hours |

| Joint Development Projects | Customized solutions, collaborative innovation | 15% revenue increase from custom packaging |

| Long-Term Supply Agreements | Volume commitments, pricing stability, supply chain reliability | Secured multi-year contracts with leading beverage/food producers |

| Customer Feedback Integration | Product and service refinement, market relevance | Design enhancements based on user handling preferences |

Channels

Greatview Aseptic Packaging leverages a direct sales force to engage major players in the dairy, beverage, and liquid food industries. This approach facilitates direct negotiation, allowing for tailored solutions and fostering robust relationships with critical decision-makers. In 2024, Greatview reported significant growth in their direct sales channel, driven by a focus on building these key partnerships.

Greatview Aseptic Packaging strategically establishes regional sales offices in key geographical markets, with a significant focus on China and other international territories. This network ensures localized support, enabling deeper market penetration and tailored customer engagement.

These offices are crucial for fostering direct communication, allowing Greatview to be highly responsive to the unique needs of regional clients and to swiftly adapt to evolving market trends. For instance, in 2024, Greatview continued to expand its presence in Southeast Asia, a region demonstrating robust growth in the beverage and food packaging sectors.

Greatview Aseptic Packaging actively engages in key global food and beverage packaging trade shows and industry conferences. These events serve as vital platforms to display innovative products, demonstrate cutting-edge aseptic technologies, and build relationships with potential clients and partners. For instance, participation in events like FachPack in Germany or Pack Expo in the United States allows for direct interaction with decision-makers, fostering lead generation and significantly boosting brand visibility within highly competitive target markets.

Online Presence and Digital Marketing

Greatview Aseptic Packaging maintains a professional company website, acting as a central hub for product information and corporate communications. This digital storefront is crucial for reaching a wider audience beyond traditional sales channels.

Digital marketing efforts are strategically employed to enhance brand visibility and generate qualified leads. While direct sales remain paramount, a robust online presence significantly supports these efforts by establishing credibility and providing accessible information.

- Website as a Primary Information Source: Greatview's website serves as a comprehensive resource for potential clients, detailing their aseptic packaging solutions and technological advancements.

- Digital Marketing for Lead Generation: Targeted digital campaigns, including search engine optimization (SEO) and online advertising, aim to attract and capture interest from businesses seeking advanced packaging.

- Global Reach and Brand Credibility: An effective online presence allows Greatview to connect with international markets, building trust and demonstrating their capabilities to a global customer base.

- Supporting Direct Sales Efforts: The digital platform complements direct sales by pre-qualifying leads and providing essential product data, streamlining the sales cycle.

Distributor Networks (for certain markets/products)

Greatview Aseptic Packaging can leverage distributor networks to penetrate markets where establishing a direct presence is challenging or less cost-effective. This strategy is particularly useful for reaching smaller clients or specialized segments that might not justify a direct sales force.

For instance, in 2024, the global aseptic packaging market was valued at approximately $50 billion, with significant growth projected in emerging economies. Utilizing local distributors can provide the necessary market insights and logistical support to tap into these growing regions effectively.

- Market Expansion: Distributors can unlock access to new geographical areas or customer segments that Greatview might not otherwise reach efficiently.

- Local Expertise: Partners with established local networks offer invaluable understanding of regional regulations, customer preferences, and competitive landscapes.

- Cost Efficiency: Outsourcing sales and distribution can reduce overhead costs associated with building and maintaining an in-house sales infrastructure in every target market.

- Scalability: Distributor networks offer a flexible way to scale operations up or down based on market demand without significant fixed asset investment.

Greatview utilizes a multi-channel approach to reach its customers. Direct sales are paramount, supported by regional offices for localized engagement and a strong online presence via its website and digital marketing. Additionally, distributor networks are employed to expand market reach, particularly in regions where direct sales are less feasible.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Engaging major players in dairy, beverage, and liquid food industries for tailored solutions and strong relationships. | Significant growth reported, driven by building key partnerships. |

| Regional Sales Offices | Establishing localized support in key markets like China and Southeast Asia for deeper penetration and tailored engagement. | Continued expansion in Southeast Asia to capitalize on market growth. |

| Trade Shows & Conferences | Showcasing innovative products and technologies, building relationships, and generating leads globally. | Active participation in major industry events like FachPack and Pack Expo. |

| Website & Digital Marketing | Central hub for information, brand visibility, lead generation, and building global credibility. | Enhanced online presence to support direct sales and reach a wider audience. |

| Distributor Networks | Penetrating markets where direct presence is challenging, reaching smaller clients, and leveraging local expertise. | Strategic use to tap into growing emerging economies within the global aseptic packaging market. |

Customer Segments

Large-scale dairy producers are a cornerstone customer segment for aseptic packaging solutions. These major players in the dairy industry, such as Danone or Lactalis, require robust packaging for high-volume output of milk, flavored milk beverages, and various cream products. The primary driver for their adoption of aseptic technology is the critical need for extended shelf life and the ability to distribute products without constant refrigeration, significantly reducing logistical costs and expanding market reach.

These clients typically operate with substantial production capacities, meaning they have very high volume demands for packaging materials. For instance, a single large dairy producer might require hundreds of millions of aseptic cartons annually. Consequently, Greatview Aseptic Packaging must ensure a reliable, consistent, and high-quality supply chain to meet these ongoing operational needs. In 2024, the global dairy market was valued at over $900 billion, with a significant portion of this value relying on effective preservation and distribution methods like aseptic packaging.

Beverage companies, specifically those focused on fruit juices, iced teas, and other non-carbonated soft drinks, are a core customer segment. They require aseptic packaging to ensure their products remain fresh and can be stored without refrigeration, which significantly reduces logistics costs. In 2024, the global aseptic packaging market for beverages was valued at over $30 billion, with juices and teas representing a substantial portion of this. These producers prioritize packaging that effectively preserves the original taste and nutritional value of their beverages, making Greatview's technology a critical component for their product integrity.

Liquid food manufacturers, such as those specializing in soups, purees, and sauces, represent a core customer segment for aseptic packaging solutions. These companies prioritize extended shelf life and efficient distribution, both of which are significantly enhanced by aseptic technology. For instance, the global aseptic packaging market was valued at approximately USD 45.6 billion in 2023 and is projected to reach USD 76.8 billion by 2030, growing at a CAGR of 7.7%, demonstrating the strong demand in this sector.

The primary value proposition for this segment lies in the safety and convenience aseptic packaging provides. It allows for the preservation of food products without refrigeration, reducing spoilage and transportation costs. In 2024, major players in the soup and puree market reported increased reliance on advanced packaging to meet consumer demand for ready-to-eat and shelf-stable options, further solidifying the importance of aseptic solutions.

Emerging Market Food and Beverage Companies

Emerging market food and beverage companies are a key customer segment, particularly those operating in developing economies where cold chain infrastructure is often less robust. These businesses highly value aseptic packaging solutions that enable ambient storage and transportation, significantly reducing reliance on expensive refrigeration. This is crucial for reaching wider consumer bases and minimizing product spoilage.

These markets are experiencing rapid growth, making them attractive for expansion. For instance, the global aseptic packaging market, valued at approximately USD 35.5 billion in 2023, is projected to reach USD 55.8 billion by 2030, with emerging markets being significant drivers of this growth. The demand for convenient, shelf-stable products fuels the adoption of aseptic technologies in these regions.

- Growth Potential: Emerging markets represent substantial growth opportunities due to increasing disposable incomes and evolving consumer preferences for packaged goods.

- Infrastructure Gaps: Companies in these regions often face challenges with limited cold chain logistics, making aseptic packaging a cost-effective and practical solution.

- Market Demand: There's a rising demand for safe, long-shelf-life food and beverage products, which aseptic packaging directly addresses.

- Economic Factors: The economic development in these countries supports increased consumption of processed and packaged foods, benefiting aseptic packaging providers.

Private Label Brands

Private label brands are a key customer segment for Greatview Aseptic Packaging. These are typically retailers or other businesses that want to sell liquid products, like milk or juice, under their own brand name. Greatview provides the aseptic packaging solution that allows these companies to bring their branded products to market efficiently.

These clients often prioritize cost-effectiveness without compromising on quality or sustainability. For example, a large supermarket chain might partner with Greatview to package its store-brand juices, aiming for competitive pricing while ensuring the product's safety and shelf-life through aseptic technology. This allows them to leverage Greatview's manufacturing expertise and scale.

- Cost-Conscious Solutions: Private label brands seek packaging that offers a favorable price point to maintain healthy margins on their own products.

- Quality Assurance: Despite cost considerations, these clients demand packaging that meets stringent quality and safety standards for consumer trust.

- Sustainability Focus: Many private label brands are increasingly incorporating sustainability into their product offerings, looking for eco-friendly packaging options from their suppliers.

- Brand Differentiation: Aseptic packaging allows private label brands to present a professional and reliable image, differentiating themselves in a crowded marketplace.

Greatview Aseptic Packaging serves a diverse range of customers, from massive dairy corporations to burgeoning food and beverage companies in emerging markets. These clients prioritize extended shelf-life, reduced logistical costs, and reliable product preservation. The global aseptic packaging market's robust growth, projected to reach approximately USD 76.8 billion by 2030 from USD 45.6 billion in 2023, underscores the critical role Greatview's solutions play across these varied segments.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Large-scale Dairy Producers | Extended shelf-life, reduced refrigeration costs, high-volume supply | Global dairy market valued over $900 billion |

| Beverage Companies (Juices, Teas) | Product freshness, ambient storage, taste preservation | Aseptic packaging for beverages valued over $30 billion |

| Liquid Food Manufacturers (Soups, Sauces) | Safety, convenience, reduced spoilage, shelf-stability | Aseptic packaging market growth CAGR of 7.7% |

| Emerging Market Companies | Cost-effective cold chain alternatives, wider distribution | Aseptic packaging market growth driven by emerging economies |

| Private Label Brands | Cost-effectiveness, quality assurance, brand differentiation | Increasing demand for private label products across categories |

Cost Structure

The primary cost driver for Greatview Aseptic Packaging is the procurement of essential raw materials, notably paperboard, polyethylene, and aluminum foil. These components form the backbone of their aseptic packaging solutions.

Fluctuations in global commodity prices, particularly for pulp and polymers, directly impact Greatview's cost of goods sold. For instance, during 2023, the price of pulp experienced significant volatility, impacting the cost of paperboard, a key input for aseptic cartons.

Manufacturing and production costs are a significant component for Greatview Aseptic Packaging. These expenses encompass the energy required to run their advanced production lines, the wages paid to their skilled factory workforce, and the ongoing upkeep of sophisticated machinery to ensure optimal performance. For instance, in 2024, the global packaging industry saw energy costs fluctuate, impacting manufacturers like Greatview, with some regions experiencing a 5-10% increase in electricity prices impacting operational budgets.

Greatview's commitment to optimizing production efficiency directly translates to managing these costs effectively. By investing in automation and lean manufacturing principles, they aim to reduce waste, minimize downtime, and maximize output per unit of energy and labor. This focus is crucial, as labor costs in manufacturing can represent 20-30% of total production expenses, and efficient machinery maintenance can prevent costly breakdowns that disrupt supply chains.

Greatview Aseptic Packaging heavily invests in Research and Development to drive innovation. These investments are channeled into developing new packaging solutions, exploring advanced materials, and refining manufacturing processes. For instance, in 2024, the company continued its focus on biodegradable and recyclable packaging materials, aiming to reduce environmental impact.

This commitment to R&D is a substantial expenditure but is vital for Greatview to stay ahead in the competitive aseptic packaging market. By consistently improving product performance and sustainability, they secure a competitive edge and pave the way for long-term growth and market leadership.

Sales, Marketing, and Distribution Costs

Greatview's cost structure heavily relies on expenses associated with its sales, marketing, and distribution efforts. These include significant outlays for sales force compensation, which comprises salaries and commissions, as well as substantial investments in marketing campaigns designed to build brand awareness and drive demand. Participation in key industry trade shows is also a notable expense, providing crucial platforms for product showcasing and client engagement.

The global nature of Greatview's operations necessitates considerable spending on logistics and distribution to ensure timely and efficient delivery of aseptic packaging solutions to customers worldwide. Effective channel management is paramount in controlling these distribution costs, optimizing routes, and managing inventory across various regions. For instance, in 2024, companies in the packaging sector often allocate between 5-10% of their revenue to sales and marketing, with distribution costs varying based on the complexity of the supply chain.

- Sales Force Compensation: Salaries and commissions for the global sales team.

- Marketing and Advertising: Investments in brand campaigns, digital marketing, and promotional materials.

- Trade Shows and Events: Costs associated with exhibiting at major industry conferences and events.

- Distribution and Logistics: Expenses for warehousing, transportation, and supply chain management.

General and Administrative Costs

General and administrative (G&A) costs at Greatview Aseptic Packaging encompass essential overhead like executive and administrative staff salaries, office space rentals, and vital corporate functions such as legal and accounting services. These are largely fixed costs that support the entire organization's operations.

In 2024, effective management of these G&A expenses is crucial for profitability. For instance, companies in the packaging sector often see G&A as a percentage of revenue. While specific Greatview figures aren't publicly detailed for 2024, industry benchmarks suggest G&A can range from 5% to 15% of total revenue, depending on the scale and complexity of operations.

- Management Salaries: Compensation for the executive team and senior leadership.

- Administrative Staff: Salaries for HR, finance, IT, and other support personnel.

- Office Rent & Utilities: Costs associated with corporate office facilities.

- Professional Fees: Expenses for legal counsel, auditors, and consultants.

Greatview's cost structure is heavily influenced by its investment in research and development, focusing on material innovation and process refinement. These R&D expenditures are critical for maintaining a competitive edge in the evolving aseptic packaging market. For example, in 2024, the company continued to allocate significant resources towards developing sustainable and high-performance packaging solutions.

The company also incurs substantial costs related to its sales, marketing, and distribution networks. This includes compensation for its global sales force, marketing campaigns to build brand awareness, and the logistics of delivering products worldwide. In 2024, industry-wide distribution costs for packaging companies often ranged from 5% to 10% of revenue, reflecting the complexities of global supply chains.

General and administrative expenses, encompassing executive salaries, office overhead, and professional services, form another key cost category. While specific figures for Greatview are not detailed, industry averages for 2024 suggest these costs can represent 5% to 15% of revenue, depending on operational scale.

| Cost Category | Key Components | 2024 Industry Insight (Packaging Sector) |

|---|---|---|

| Raw Materials | Paperboard, polyethylene, aluminum foil | Subject to commodity price volatility; pulp prices saw significant fluctuations in 2023. |

| Manufacturing & Production | Energy, labor, machinery maintenance | Energy costs can impact operational budgets, with some regions seeing 5-10% increases in electricity prices in 2024. |

| Research & Development | New material exploration, process refinement | Essential for innovation and market competitiveness. |

| Sales, Marketing & Distribution | Sales force, advertising, logistics | Distribution costs can represent 5-10% of revenue; sales and marketing often 5-10% of revenue. |

| General & Administrative | Executive salaries, office overhead, professional fees | Can range from 5-15% of revenue. |

Revenue Streams

Greatview Aseptic Packaging's main income source is the sale of aseptic carton packaging. These materials are crucial for dairy, beverage, and liquid food companies to keep their products fresh without refrigeration. This includes both roll-fed and blank-fed packaging, offering flexibility to manufacturers.

In 2024, the global aseptic packaging market continued its robust growth, driven by increasing consumer demand for convenient and shelf-stable food and beverage options. Greatview, as a key player, benefits directly from this trend, with its sales volume reflecting the market's expansion.

Greatview Aseptic Packaging generates revenue by selling and leasing its specialized aseptic filling machines. These machines are crucial for clients to effectively use Greatview's packaging materials, creating a bundled offering that drives sales. This revenue stream is often tied to the ongoing purchase of the company's packaging solutions.

Greatview Aseptic Packaging generates ongoing revenue by selling essential spare parts for its filling machines, ensuring operational continuity for its customers. This stream is crucial for maintaining the longevity and efficiency of the installed base.

Beyond parts, the company offers a suite of technical services, including expert maintenance, repair, and specialized consulting. These services not only provide a recurring revenue stream but also foster deeper, more loyal customer relationships by ensuring optimal performance of their packaging solutions.

Customized Packaging Solutions

Greatview Aseptic Packaging generates revenue by offering customized packaging solutions, catering to clients with specific product needs or distinct branding requirements. This segment often yields higher profit margins due to the specialized innovation and development involved.

These bespoke solutions are crucial for brands looking to differentiate themselves in competitive markets. For instance, a beverage company might require a unique carton shape or a special barrier coating to protect a sensitive ingredient. Greatview's ability to engineer these specific attributes directly translates into revenue.

- Tailored Innovation: Revenue is directly tied to the development and supply of specialized aseptic packaging designs that meet unique client specifications.

- Premium Margins: Customization often allows for higher pricing and consequently, enhanced profit margins compared to standard offerings.

- Client Differentiation: These solutions empower clients to stand out in their respective markets through unique packaging formats and branding integration.

International Market Expansion

Greatview Aseptic Packaging is actively growing its revenue by expanding its presence in international markets. This strategy involves increasing market penetration and boosting sales in regions outside of its primary base in China. Such geographical diversification is key to enhancing overall revenue growth and fostering greater financial stability for the company.

The company's international sales efforts are showing positive traction. For instance, in 2024, Greatview reported a significant uptick in demand from emerging markets in Southeast Asia and Eastern Europe, contributing to a notable portion of its total revenue. This expansion not only diversifies income but also reduces reliance on any single market.

- International Market Penetration: Greatview is focused on deepening its sales and distribution networks in key overseas markets, aiming to capture a larger share of the global aseptic packaging industry.

- Revenue Diversification: By establishing a stronger foothold in countries beyond China, the company mitigates risks associated with regional economic downturns and currency fluctuations.

- Growth Drivers: Increased adoption of aseptic packaging solutions for beverages and liquid food products in developing economies is a primary driver of Greatview's international revenue growth.

Greatview Aseptic Packaging's revenue streams are primarily driven by the sale of aseptic carton packaging materials, which are essential for preserving dairy, beverage, and liquid food products. The company also generates income from leasing and selling its specialized aseptic filling machines, often bundled with packaging material sales. Furthermore, revenue is bolstered by the sale of spare parts for these machines and ongoing technical services, including maintenance and repair.

| Revenue Stream | Description | 2024 Market Context/Data |

|---|---|---|

| Aseptic Carton Packaging Sales | Sale of roll-fed and blank-fed aseptic packaging materials. | Global aseptic packaging market projected to reach $68.5 billion by 2027, with strong growth in Asia-Pacific. |

| Filling Machine Sales & Leasing | Revenue from specialized aseptic filling machines, often linked to packaging sales. | Demand for efficient and automated packaging solutions continues to rise across the food and beverage industry. |

| Spare Parts & Technical Services | Sales of machine spare parts and provision of maintenance, repair, and consulting services. | Ensuring operational uptime for clients is critical, driving recurring revenue from service contracts and parts. |

Business Model Canvas Data Sources

The Greatview Aseptic Packaging Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic analysis of industry trends. This ensures each component accurately reflects the company's operational realities and market positioning.