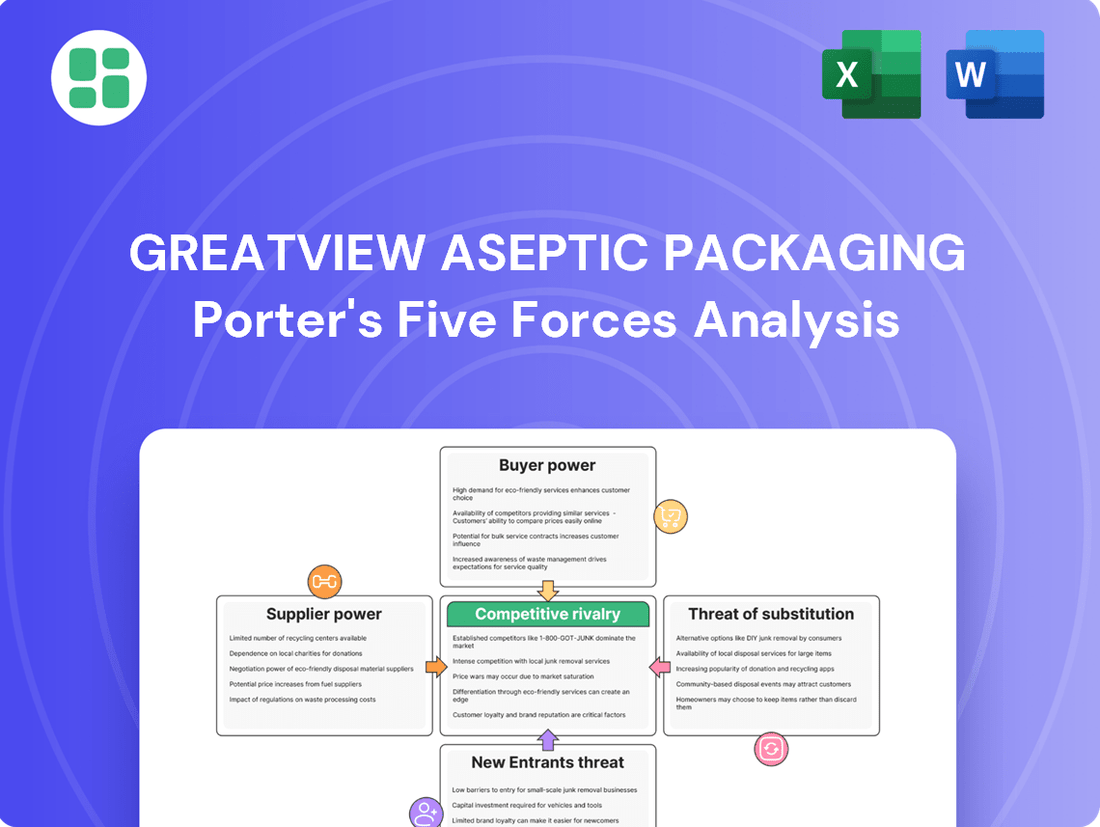

Greatview Aseptic Packaging Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greatview Aseptic Packaging Bundle

Greatview Aseptic Packaging navigates a competitive landscape shaped by moderate buyer power and intense rivalry among existing players. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for strategic advantage.

The complete report reveals the real forces shaping Greatview Aseptic Packaging’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Greatview Aseptic Packaging's reliance on specialized raw materials like paperboard, polymers, and aluminum foil means supplier concentration can significantly impact its costs. If only a few major players supply these critical components, they gain substantial bargaining power, potentially driving up prices for Greatview. For instance, the global paperboard market, a key input, saw significant price fluctuations in 2023 due to supply chain disruptions and increased demand, affecting packaging companies.

Greatview Aseptic Packaging likely faces significant switching costs for its raw material suppliers. The highly specialized nature of aseptic packaging materials, demanding precise technical specifications and stringent quality control, means changing suppliers isn't a simple task. This complexity extends to ensuring seamless integration with Greatview's advanced manufacturing and filling machinery.

These substantial switching costs empower existing suppliers, as the expense and effort involved in transitioning to a new source can be prohibitive for Greatview. For instance, the qualification process for new materials in the food and beverage packaging industry can take months and involve rigorous testing, impacting production timelines and potentially incurring substantial R&D expenses.

The uniqueness of supplier inputs for aseptic packaging significantly influences bargaining power. Greatview Aseptic Packaging relies on specialized materials that adhere to strict food safety and preservation regulations. If these critical components or manufacturing technologies are proprietary or patented by a limited number of suppliers, Greatview would face considerable pressure from those suppliers.

However, Greatview's strategy of producing materials to the same high-quality standards as original machine manufacturers suggests a degree of input standardization. This approach potentially mitigates the absolute uniqueness of every single input, allowing for some flexibility and reducing the leverage of any single supplier if alternative sources can meet these established quality benchmarks.

Threat of Forward Integration by Suppliers

The threat of forward integration by Greatview's suppliers is a key factor in their bargaining power. If suppliers, particularly those providing specialized materials like specific polymer coatings or barrier films, were to enter the aseptic packaging manufacturing market themselves, it would dramatically shift the power dynamic. This scenario would allow them to capture more of the value chain, directly competing with Greatview.

However, the substantial capital investment required to establish aseptic packaging production facilities presents a significant barrier to entry for most suppliers. For instance, building a new aseptic packaging line can cost tens of millions of dollars. This high initial cost makes it economically challenging for many raw material providers to undertake such a move, thereby limiting their ability to integrate forward.

- High Capital Expenditure: The cost of setting up aseptic packaging manufacturing plants, often exceeding $50 million for a new line, deters most suppliers from forward integration.

- Specialized Materials: Suppliers of highly specialized polymers or barrier films may lack the core competencies and existing infrastructure for complex packaging production.

- Market Entry Barriers: Entering the established aseptic packaging market requires not only capital but also technological expertise, distribution networks, and customer relationships, which are difficult for raw material suppliers to replicate quickly.

Supplier's Importance to Greatview

The bargaining power of suppliers for Greatview Aseptic Packaging is influenced by how crucial Greatview's business is to each individual supplier. If Greatview accounts for a significant percentage of a supplier's overall sales, that supplier's leverage may be reduced.

Greatview's emphasis on obtaining paper fiber from certified, responsible sources also highlights its dedication to building robust and sustainable supply chains, which can impact supplier relationships and their negotiating power.

- Supplier Dependence: If a supplier relies heavily on Greatview for a substantial portion of its revenue, its ability to dictate terms or raise prices is diminished.

- Concentration of Suppliers: The number and concentration of suppliers for key raw materials like paperboard and aluminum foil play a role; a more fragmented supplier base generally weakens supplier power.

- Switching Costs: The ease or difficulty Greatview faces in switching to alternative suppliers for its packaging materials directly affects supplier bargaining power.

Greatview Aseptic Packaging's suppliers wield considerable power due to the specialized nature of their products and the high switching costs involved for Greatview. The concentration of suppliers for critical inputs like high-barrier polymers and specific paperboard grades means these providers can exert significant pricing influence.

For instance, the global market for aseptic paperboard, a key component, experienced price increases in 2023, impacting packaging manufacturers. The rigorous qualification process for new material suppliers in this sector can take several months, creating a strong incentive for Greatview to maintain relationships with existing, approved vendors, thereby bolstering supplier leverage.

The threat of forward integration by suppliers is somewhat mitigated by the substantial capital investment required for aseptic packaging production, estimated to be upwards of $50 million for a new line, which acts as a significant barrier.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | High | Limited number of suppliers for specialized polymers and paperboard. |

| Switching Costs | High | Lengthy qualification processes for new materials (months) and integration with machinery. |

| Input Uniqueness/Proprietary Nature | Potentially High | Proprietary barrier technologies or patented manufacturing processes. |

| Threat of Forward Integration | Low to Moderate | High capital expenditure ($50M+ per new line) deters most suppliers. |

| Customer Importance to Supplier | Variable | Depends on Greatview's revenue share for individual suppliers. |

What is included in the product

This analysis dissects the competitive forces impacting Greatview Aseptic Packaging, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the aseptic packaging market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a single, intuitive dashboard.

Customers Bargaining Power

Customer concentration is a key factor in understanding bargaining power. Greatview Aseptic Packaging serves a global market, with annual sales surpassing 10 billion packs and clients in over 40 countries, including major dairy, beverage, and liquid food producers.

However, a past reliance on a single large customer, which accounted for 47% of sales in 2018, highlights the potential for significant customer leverage. This concentration means that even with a broad geographical reach, a few dominant clients could exert considerable influence over pricing and terms.

Greatview Aseptic Packaging's product design significantly lowers switching costs for its customers. By ensuring compatibility with prevalent filling machines, such as those used by Tetra Pak and SIG Combibloc, Greatview enables clients to transition between suppliers with minimal disruption and investment. This ease of switching is a critical factor in the bargaining power of customers.

This compatibility translates directly into increased negotiating power for purchasers. Customers can leverage the ability to source from multiple suppliers, maintaining dual supply chains and engaging in competitive tendering. This practice effectively drives down prices and enhances the leverage customers hold over Greatview.

Customers in the dairy and beverage sectors often display significant price sensitivity. This is largely because these industries themselves operate in highly competitive landscapes, forcing them to closely manage their own costs. For instance, the global dairy market, a key segment for aseptic packaging, faced fluctuating raw material prices throughout 2024, amplifying the need for cost-efficient packaging solutions.

Greatview Aseptic Packaging positions itself as a cost-effective and sustainable alternative to incumbent packaging suppliers. This strategic messaging directly addresses the price-conscious nature of its customer base. The company's ability to offer competitive pricing is therefore a crucial lever in attracting and retaining business within these sensitive markets.

This heightened price sensitivity empowers customers to exert considerable pressure on Greatview's pricing strategies. When customers can easily switch to competitors offering similar quality at a lower price point, Greatview must remain vigilant about its cost structure and pricing to maintain its market share.

Availability of Alternative Packaging Suppliers

The availability of alternative packaging suppliers significantly bolsters customer bargaining power. Greatview Aseptic Packaging operates in a market with established competitors such as Tetra Pak, SIG Combibloc, and Elopak. This competitive landscape allows customers to easily explore and switch between suppliers, seeking more favorable pricing or contract terms.

For instance, the global aseptic packaging market was valued at approximately USD 49.6 billion in 2023 and is projected to grow, indicating a dynamic environment where customer choice is paramount.

- Multiple Suppliers: Customers can choose from several key aseptic packaging providers, reducing reliance on any single supplier.

- Switching Costs: While some switching costs exist, the competitive pressure generally keeps them manageable for customers.

- Price Sensitivity: The presence of alternatives makes customers more sensitive to price increases from any one supplier.

- Negotiating Leverage: Customers can leverage offers from one supplier to negotiate better deals with another, including Greatview.

Threat of Backward Integration by Customers

Large food and beverage manufacturers, particularly those with substantial production volumes, possess the capability to integrate backward and produce their own packaging materials. This presents a significant latent threat, directly enhancing customer bargaining power.

While the capital investment and expertise required for backward integration are considerable, the potential to control a critical input like packaging materials is a powerful lever for major customers. This strategic option can be exercised if they perceive current packaging suppliers as too costly or unreliable.

- Threat of Backward Integration: Large customers can bring packaging production in-house.

- Capital & Expertise: This requires significant investment and specialized knowledge.

- Customer Leverage: The potential for integration increases customer bargaining power.

- Past Precedent: Inner Mongolia Yili Industrial has previously shifted orders to its own packaging facilities, demonstrating this threat.

Greatview Aseptic Packaging faces considerable bargaining power from its customers, largely due to the availability of multiple suppliers and low switching costs. The global aseptic packaging market, valued at approximately USD 49.6 billion in 2023, offers customers numerous alternatives like Tetra Pak and SIG Combibloc, allowing them to easily compare prices and terms.

Customers' price sensitivity, particularly in the competitive dairy and beverage sectors, amplifies their negotiating leverage. For instance, fluctuating raw material prices in the dairy market during 2024 heightened the demand for cost-effective packaging. Furthermore, the potential for large customers to engage in backward integration, bringing packaging production in-house, serves as a significant latent threat, increasing their power over suppliers like Greatview.

| Factor | Impact on Greatview | Customer Leverage |

|---|---|---|

| Supplier Availability | High competition from established players | Customers can switch easily for better terms |

| Switching Costs | Low due to product compatibility | Customers can change suppliers with minimal disruption |

| Price Sensitivity | High in key customer industries | Customers exert pressure for lower pricing |

| Backward Integration Threat | Potential for large customers to produce own packaging | Customers can leverage this option to negotiate |

Preview the Actual Deliverable

Greatview Aseptic Packaging Porter's Five Forces Analysis

This preview showcases the identical, comprehensive Greatview Aseptic Packaging Porter's Five Forces Analysis you will receive immediately after purchase. You are viewing the final, professionally formatted document, ensuring no discrepancies or missing information. This detailed analysis is ready for your immediate use, providing valuable insights into the competitive landscape of aseptic packaging.

Rivalry Among Competitors

The aseptic packaging landscape is a competitive arena, largely shaped by a handful of dominant global entities. Tetra Pak International S.A., SIG Combibloc Group, and Elopak are the primary forces, with Greatview Aseptic Packaging emerging as a substantial competitor, ranking as the world's third-largest supplier by sales volume. This oligopolistic structure inherently fuels a high degree of rivalry.

The aseptic packaging market is set for impressive expansion, with forecasts indicating a compound annual growth rate (CAGR) of 10.47% between 2025 and 2030. This upward trend is particularly pronounced in the paper and paperboard segments, suggesting a dynamic and growing industry.

This strong industry growth is fueled by a rising consumer preference for shelf-stable food products, convenient ready-to-drink beverages, and increasingly, environmentally friendly packaging solutions. Such significant market potential naturally draws in numerous players, eager to capture a piece of the expanding pie.

While rapid growth can sometimes temper intense competition by making it easier for all players to expand, the substantial market opportunity in aseptic packaging continues to foster a highly competitive environment. Companies are actively vying for market share, indicating that rivalry remains a significant force.

While aseptic carton packaging fundamentally serves to preserve quality and extend shelf life, companies actively differentiate themselves through diverse packaging formats, enhanced sustainability features, integrated smart packaging solutions, and robust technical services. Greatview, for instance, emphasizes a broad spectrum of formats and a strong focus on cost-effectiveness and sustainability.

This competitive landscape sees rivals also heavily investing in innovation and eco-friendly solutions, creating a dynamic environment where product differentiation is key. For example, in 2024, the global aseptic packaging market was valued at approximately $55 billion, with companies continuously innovating to capture market share through unique product offerings and sustainability commitments.

Exit Barriers

High capital investment in specialized aseptic packaging manufacturing facilities acts as a significant exit barrier for companies like Greatview. The substantial sunk costs associated with advanced machinery and production lines mean that exiting the market is not a simple or low-cost decision. This can trap companies in the industry, forcing them to continue operating and competing even when returns are unfavorable, thereby intensifying competitive rivalry.

For instance, the aseptic packaging industry requires specialized equipment that can cost tens of millions of dollars. Companies that have made these substantial investments find it difficult to recoup their capital if they decide to exit. This financial commitment often leads to continued, aggressive competition among existing players, as they strive to utilize their capacity and generate some return on their fixed assets, even in challenging market conditions.

- High Capital Investment: Specialized aseptic packaging machinery and facilities represent a significant upfront cost, creating a substantial barrier to exit.

- Sunk Costs: Once invested, these capital expenditures are irrecoverable, compelling firms to remain operational and compete.

- Intensified Rivalry: The presence of high exit barriers forces companies to compete aggressively, even during periods of low profitability, to maximize asset utilization.

Diversity of Competitors

The competitive landscape for aseptic packaging is marked by the presence of deeply entrenched, diversified players. Competitors such as Tetra Pak and SIG Combibloc operate as system suppliers, providing not only packaging materials but also the crucial filling machinery and integrated solutions. This broad offering creates a significant barrier to entry and influences competitive dynamics by locking customers into their ecosystems.

Greatview Aseptic Packaging has strategically differentiated itself by historically concentrating on packaging materials designed for compatibility with existing filling machines, aiming to disrupt established market monopolies. While Greatview is expanding its portfolio to include filling machines and spare parts, its core strategy has been to offer an alternative that challenges the dominance of the system suppliers.

This divergence in business models and strategic aims leads to a multifaceted competitive environment. For instance, while Tetra Pak reported revenues of approximately €15.3 billion in 2023, Greatview's strategy focuses on capturing market share by offering flexibility and choice to customers who may not be tied to a single machine supplier.

- System Suppliers: Tetra Pak and SIG Combibloc offer integrated packaging and filling machine solutions.

- Greatview's Strategy: Focus on compatible packaging materials to break existing supplier monopolies.

- Market Diversification: Competitors offer a wider range of services beyond just packaging materials.

- Competitive Tactics: Varied approaches stem from different business models and market entry strategies.

Competitive rivalry in the aseptic packaging sector is intense, driven by a few dominant global players like Tetra Pak and SIG Combibloc, alongside significant competitors such as Greatview Aseptic Packaging, which holds the position of the world's third-largest supplier by sales volume. This oligopolistic structure naturally intensifies competition as companies vie for market share in a rapidly growing industry.

The market is projected to grow at a CAGR of 10.47% from 2025 to 2030, a trend boosted by consumer demand for shelf-stable products and sustainable packaging. This expansion attracts numerous participants, further fueling rivalry, especially as companies differentiate through innovative formats, sustainability, and cost-effectiveness. For instance, the global aseptic packaging market was valued around $55 billion in 2024.

High capital investments in specialized manufacturing facilities, often costing tens of millions of dollars, create substantial exit barriers. These sunk costs compel companies to remain competitive, even during periods of lower profitability, to maximize asset utilization and derive some return on their fixed assets, thereby intensifying ongoing rivalry.

The competitive dynamic is further shaped by system suppliers like Tetra Pak and SIG, who offer integrated packaging and filling machinery solutions. Greatview, conversely, has historically focused on packaging materials compatible with existing machines, aiming to disrupt established customer ecosystems, although it is expanding into filling machines. This strategic divergence contributes to a multifaceted competitive environment.

| Competitor | 2023 Revenue (Approx.) | Key Differentiator |

| Tetra Pak | €15.3 billion | Integrated system supplier (packaging & machinery) |

| SIG Combibloc | Not publicly specified separately | Integrated system supplier (packaging & machinery) |

| Greatview Aseptic Packaging | Not publicly specified separately | Focus on compatible packaging materials; expanding into machinery |

SSubstitutes Threaten

Traditional packaging like PET bottles, glass, and metal cans, alongside fresh, refrigerated products, represent key substitutes for aseptic cartons. While aseptic packaging excels in shelf-stability and distribution costs, these alternatives can be more appealing where cold chains are robust or the initial investment in aseptic technology is a barrier. For instance, the global aseptic packaging market was valued at approximately USD 42.5 billion in 2023, showcasing significant adoption, but the cost-effectiveness of alternatives in specific contexts remains a relevant consideration.

Customer propensity to substitute Greatview's aseptic packaging is influenced by convenience, sustainability, and existing infrastructure. In areas with robust chilled distribution, the demand for UHT milk, and by extension aseptic packaging, might be less pronounced.

However, the increasing global demand for ready-to-eat meals, longer shelf lives, and a move away from artificial preservatives are all factors that boost the attractiveness of aseptic packaging solutions. For example, the global market for aseptic packaging was valued at approximately USD 44.5 billion in 2023 and is projected to grow significantly, indicating a strong customer preference for these attributes.

The relative price of alternative packaging solutions significantly influences the threat of substitutes for Greatview Aseptic Packaging. While aseptic packaging offers cost savings through reduced refrigeration needs, shifts in the cost of key raw materials like polymers and paperboard can affect its price competitiveness.

For instance, if the price of polymers used in aseptic cartons increases substantially due to global supply chain issues or rising crude oil prices, the cost advantage of aseptic packaging might diminish. This could make cheaper alternatives, such as traditional glass bottles or metal cans, more attractive to beverage and food producers, even if they lack the same shelf-life or preservation benefits.

Quality and Performance of Substitutes

While substitutes like retort pouches offer extended shelf-life, aseptic packaging often maintains a competitive edge. This advantage stems from its superior barrier properties, sterility, and cost-effectiveness for many liquid food and beverage applications, a factor that has driven its market growth. In 2024, the global aseptic packaging market was valued at approximately USD 45 billion, demonstrating its significant presence.

However, ongoing innovations in alternative packaging materials present a growing threat. For instance, advancements in plastic bottles, such as improved oxygen barrier layers, and new treatments for glass containers could enhance their performance and shelf-life capabilities. These developments might chip away at aseptic packaging's market share in specific segments.

- Superior Barrier Properties: Aseptic packaging excels in preventing oxygen and light ingress, crucial for product longevity.

- Cost-Effectiveness: For high-volume liquid packaging, aseptic cartons often prove more economical than some alternatives.

- Innovation in Alternatives: Emerging technologies in plastic and glass packaging are closing the performance gap.

Availability of New Technologies for Substitutes

The threat of substitutes for aseptic packaging is influenced by ongoing technological advancements in alternative packaging sectors. Innovations in areas like enhanced barrier plastics, biodegradable films, and smart packaging features for non-aseptic formats could make these substitutes more appealing to consumers and manufacturers alike. For instance, the development of advanced polymer blends offering comparable shelf-life extension to aseptic methods could divert market share.

Despite these advancements in substitutes, the aseptic packaging industry itself is not static. Innovations such as the development of aluminum-free barrier technologies and the integration of bio-based materials are actively being pursued. These advancements aim to improve the sustainability profile and performance of aseptic packaging, thereby reinforcing its competitive position against emerging substitutes. The global aseptic packaging market was valued at approximately USD 55 billion in 2023 and is projected to grow, indicating continued demand despite substitute pressures.

- Technological advancements in barrier plastics and biodegradable films increase the appeal of non-aseptic substitutes.

- Smart packaging features in conventional packaging can offer comparable benefits to some aseptic applications.

- Innovations in aseptic packaging, such as aluminum-free barriers and bio-based materials, counter the threat of substitutes.

- The aseptic packaging market's growth trajectory suggests its resilience against substitute threats, with a projected CAGR of over 6% through 2030.

While aseptic packaging boasts significant advantages, substitutes like PET bottles, glass, and metal cans remain a considerable threat. These alternatives are often favored when cold chain infrastructure is robust or when initial investment in aseptic technology is prohibitive. For example, the global aseptic packaging market reached approximately USD 45 billion in 2024, but the cost-effectiveness of traditional packaging in certain scenarios continues to be a factor.

Customer preference for substitutes is also shaped by convenience and sustainability perceptions. In regions with well-established refrigerated supply chains, the demand for UHT milk, and thus aseptic cartons, may be less intense. However, the growing global demand for longer shelf life and convenience foods generally favors aseptic solutions.

Innovations in alternative packaging materials, such as improved barrier properties in plastic bottles and enhanced treatments for glass, are actively narrowing the performance gap. This means substitutes are becoming more competitive, potentially capturing market share from aseptic packaging in specific applications.

| Packaging Type | Key Substitutes | Pros of Substitutes | Cons of Substitutes | Market Relevance |

|---|---|---|---|---|

| Aseptic Packaging | PET Bottles, Glass, Metal Cans | Lower initial investment, established infrastructure, consumer familiarity | Shorter shelf-life without refrigeration, higher distribution costs | Global market valued at approx. USD 45 billion in 2024 |

| Refrigerated Products | Perceived freshness, direct consumer appeal | Requires continuous cold chain, higher spoilage risk | Significant portion of dairy and beverage market |

Entrants Threaten

Entering the aseptic packaging sector demands significant upfront investment. For instance, setting up a single high-speed aseptic filling line can easily cost upwards of USD 18 million, reflecting the advanced technology and precision engineering involved. This substantial capital requirement acts as a formidable barrier, deterring many potential new competitors from entering the market.

Established players like Greatview Aseptic Packaging already enjoy significant cost advantages due to their large-scale operations. This translates into lower per-unit costs for production, securing raw materials, and efficient distribution networks, enabling them to price their products very competitively. For instance, in 2024, Greatview's substantial production capacity allowed them to negotiate bulk discounts on paperboard and polymer films, key components in aseptic packaging.

Newcomers would find it incredibly challenging to match these cost efficiencies without first achieving a comparable production volume. The upfront investment required to build facilities and establish supply chains at a scale that rivals Greatview is immense, creating a substantial barrier to entry. Without achieving similar economies of scale, new entrants would be forced to operate at higher cost points, making it difficult to compete effectively on price against a well-entrenched competitor.

Greatview Aseptic Packaging has cultivated a robust global distribution network, reaching customers in over 40 nations spanning multiple continents. This extensive reach presents a significant barrier to new entrants.

New players would struggle to replicate Greatview's established relationships with major national and multinational dairy, beverage, and liquid food producers. Securing access to these crucial supply chains is a formidable hurdle, requiring substantial time and investment to overcome.

Proprietary Technology and Expertise

The aseptic packaging industry demands significant technological expertise, particularly in sterilization processes, advanced material science, and the intricate compatibility of filling machinery. This complexity inherently raises the barrier to entry.

Companies like Greatview Aseptic Packaging have cultivated proprietary knowledge and secured numerous patents, effectively creating a robust defense against newcomers. These intellectual property assets represent a substantial hurdle for potential entrants who would either need to undertake extensive and costly research and development or acquire existing, established technologies.

- Proprietary Technology: Aseptic packaging relies on specialized knowledge in sterilization, material science, and filling machine integration.

- High R&D Investment: New entrants face substantial costs to develop or acquire the necessary technological capabilities.

- Patents and Intellectual Property: Existing players, such as Greatview, benefit from patents that protect their innovations and deter competitors.

- Capital Requirements: The need for significant investment in both technology and intellectual property makes the threat of new entrants relatively low.

Regulatory and Sustainability Hurdles

The aseptic packaging industry faces significant regulatory and sustainability challenges that act as a barrier to new entrants. These include stringent food safety regulations worldwide and increasingly demanding sustainability standards concerning recyclability and environmental impact. For instance, in 2024, the European Union continued to push for higher recycled content in packaging, with targets that require substantial investment in new material technologies and processes.

Navigating these complex compliance requirements necessitates considerable upfront investment in research, development, and adherence to evolving global standards. New players must demonstrate robust capabilities in material safety, waste reduction, and circular economy principles. Failure to meet these criteria can lead to market exclusion and reputational damage, making the initial entry particularly arduous.

The cost of compliance and the need for specialized expertise in regulatory affairs and sustainable material science create a high barrier. Companies like Greatview Aseptic Packaging have already invested heavily in these areas, establishing a competitive advantage. For new entrants, the financial outlay and the learning curve associated with these evolving demands are substantial deterrents.

Key hurdles for new entrants include:

- Meeting stringent global food safety certifications, such as those from the FDA and EFSA.

- Adhering to evolving sustainability mandates, including increased use of recycled materials and recyclability targets.

- Investing in advanced material science and production technologies to comply with environmental regulations.

- Securing necessary approvals and registrations in multiple international markets, a process that can take years and significant resources.

The threat of new entrants in aseptic packaging is generally low due to substantial barriers. High capital requirements, estimated at over USD 18 million for a single filling line, deter many. Established players benefit from significant economies of scale, proprietary technology, and extensive distribution networks, making it difficult for newcomers to compete on cost and reach.

New companies must also navigate complex regulatory landscapes and sustainability mandates, requiring significant investment in R&D and compliance. For instance, in 2024, the push for higher recycled content in packaging by the EU necessitates advanced material science. Greatview Aseptic Packaging's established customer relationships and patents further solidify its position, creating a formidable challenge for any potential competitor seeking market entry.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Setting up aseptic packaging lines costs upwards of USD 18 million. | High barrier, requiring substantial funding. |

| Economies of Scale | Large-scale operations lead to lower per-unit costs. | New entrants struggle to match cost efficiencies without comparable volume. |

| Technology & IP | Proprietary technology and patents protect innovations. | Requires costly R&D or acquisition for new players. |

| Distribution & Relationships | Established global networks and strong customer ties. | Difficult for newcomers to replicate access to key supply chains. |

| Regulatory & Sustainability | Stringent food safety and evolving environmental standards. | Demands significant investment in compliance and material science. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Greatview Aseptic Packaging leverages data from company annual reports, industry-specific market research (e.g., Mintel, Euromonitor), and financial databases like Bloomberg and S&P Capital IQ. This blend ensures a comprehensive understanding of the competitive landscape, including supplier and buyer power, new entrants, substitutes, and industry rivalry.