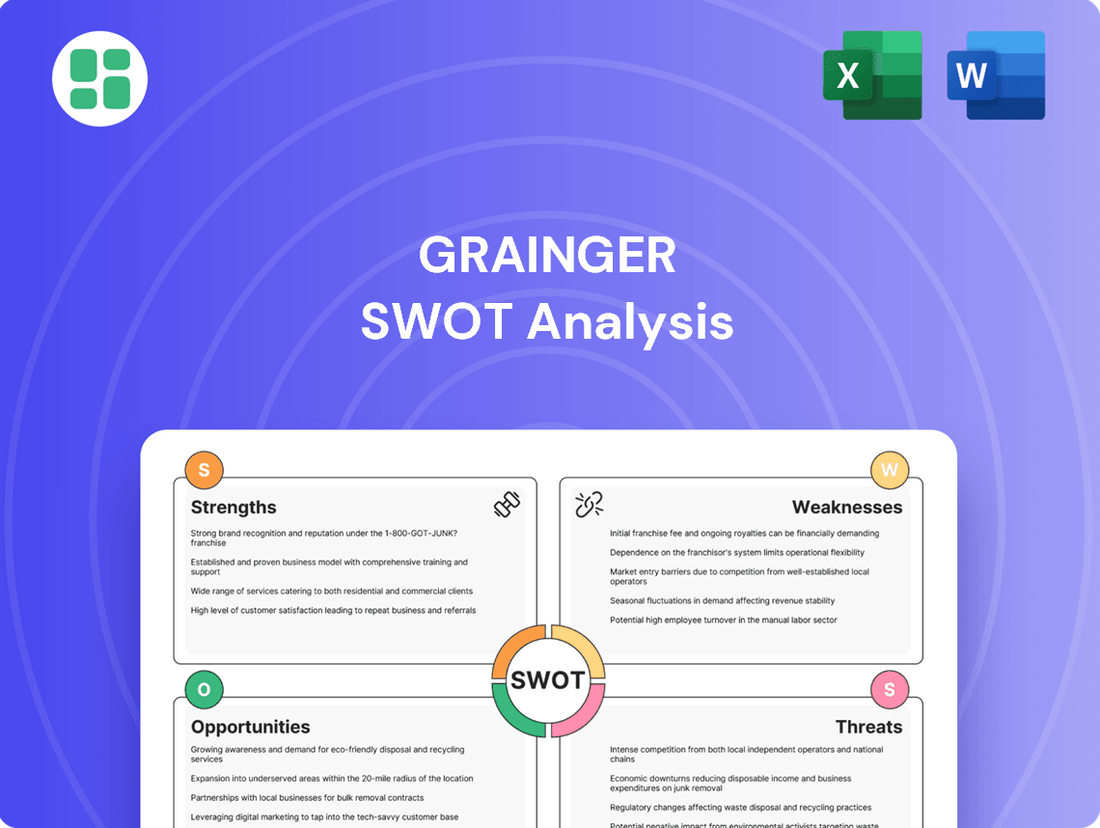

Grainger SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grainger Bundle

Grainger's robust distribution network and strong brand recognition are significant strengths, but understanding their full potential requires a deeper dive. Our comprehensive SWOT analysis reveals critical insights into their competitive landscape and potential challenges.

Want the full story behind Grainger's market position, including their opportunities for expansion and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Grainger's extensive product portfolio, encompassing everything from safety gear to motors, serves over 4.5 million customers globally. This broad offering, coupled with a diverse customer base spanning manufacturing, government, and healthcare, ensures significant market penetration and consistent revenue streams.

The company's strategic dual-channel approach, featuring High-Touch Solutions for large clients and the Endless Assortment model via Zoro.com and MonotaRO.com for smaller businesses, effectively caters to a wide spectrum of customer needs, solidifying its market position.

Grainger's robust supply chain and distribution network is a significant competitive moat, particularly in the demanding MRO sector. This infrastructure is purpose-built to handle the complexities of delivering a vast array of products efficiently to businesses.

The company operates over 34 distribution centers worldwide and maintains relationships with more than 5,000 primary suppliers. This extensive reach ensures high product availability and facilitates timely deliveries, a crucial factor for customers relying on uninterrupted operations.

Recent investments, such as the new large distribution facility in Hockley, Texas, underscore Grainger's commitment to enhancing its logistical capabilities. These strategic expansions bolster its ability to offer next-day delivery and sophisticated inventory management services, solidifying its market leadership.

Grainger's digital prowess is a significant strength, fueled by substantial investments in e-commerce, data, and advanced technologies. This is clearly demonstrated by the robust performance of its Endless Assortment segment, which saw a 10% increase in sales in the first quarter of 2024, reaching $1.9 billion.

Online platforms like Zoro.com and MonotaRO.com are cornerstones of this strategy, offering an expansive catalog of millions of products. These digital channels are not only driving considerable sales growth but also proving highly effective in acquiring new customers, with Zoro's customer base growing by 15% year-over-year.

Furthermore, Grainger is strategically deploying artificial intelligence, machine learning, and data analytics. These technologies are being used to elevate customer service experiences, boost operational efficiency, and streamline internal processes, solidifying its leadership in the digital transformation of the MRO (Maintenance, Repair, and Operations) sector.

Financial Stability and Consistent Shareholder Returns

Grainger showcases impressive financial stability, consistently delivering profitability and rewarding its shareholders. For the fiscal year 2024, the company achieved a significant $17.2 billion in revenue, underscoring its market strength and operational efficiency.

The company's robust financial discipline is evident in its sustained ability to generate substantial operating cash flow. This financial health directly translates into a strong commitment to shareholder returns.

A key indicator of this commitment is Grainger's remarkable streak of increasing its quarterly dividend for 54 consecutive years. This long-standing history of dividend growth highlights the company's stable financial outlook and its dedication to providing consistent value to its investors.

- Consistent Profitability: Grainger maintains a strong financial footing with reliable profits.

- $17.2 Billion Revenue in 2024: Demonstrates significant market presence and sales performance.

- Substantial Operating Cash Flow: Indicates efficient operations and strong cash generation capabilities.

- 54-Year Dividend Growth Streak: Highlights a long-term commitment to shareholder returns and financial stability.

Established Brand Reputation and Customer Relationships

Grainger's nearly century-long history has cemented a powerful brand reputation, synonymous with reliability and exceptional service within the Maintenance, Repair, and Operations (MRO) industry. This enduring trust is a significant asset, particularly evident in their High-Touch Solutions segment.

This segment actively cultivates deep customer relationships by offering more than just products; it provides value-added services such as expert technical support and sophisticated inventory management. This customer-centric approach fosters strong loyalty and acts as a key differentiator in a crowded marketplace.

For instance, in fiscal year 2023, Grainger reported a 7.7% increase in sales, reaching $15.2 billion, underscoring the continued strength of their customer relationships and brand appeal. This growth is a testament to their ability to meet and exceed customer expectations through personalized service and tailored solutions.

- Established Brand Reputation: Nearly 100 years of operation have built strong customer trust in Grainger's reliability and service.

- High-Touch Solutions: Focus on deep customer relationships through technical support and inventory management differentiates them.

- Customer Loyalty: Emphasis on customer experience and tailored solutions drives repeat business and market position.

- Fiscal Year 2023 Performance: A 7.7% sales increase to $15.2 billion highlights the effectiveness of their customer-centric strategy.

Grainger's extensive product selection is a major advantage, offering a vast array of items that cater to diverse industrial needs. This broad catalog, combined with a deep understanding of customer requirements, allows them to serve a wide market effectively.

The company's dual-channel strategy, which includes both direct sales and online platforms like Zoro.com, ensures broad market reach and customer accessibility. This approach allows Grainger to serve both large enterprise clients and smaller businesses efficiently.

Grainger's robust supply chain and distribution network are critical strengths, enabling efficient delivery of a wide range of products. Their commitment to logistical excellence is further evidenced by ongoing investments in infrastructure, such as new distribution centers, to enhance delivery speed and reliability.

The company's digital transformation is a significant asset, with substantial investments in e-commerce and data analytics driving growth. Online sales, particularly through Zoro.com, have shown strong performance, expanding customer reach and improving engagement.

| Metric | 2023 Data | 2024 Data (Q1) |

|---|---|---|

| Total Revenue | $15.2 billion | N/A |

| Zoro Sales Growth | N/A | 10% |

| Zoro Sales Value | N/A | $1.9 billion |

| Zoro Customer Growth | N/A | 15% |

What is included in the product

Analyzes Grainger’s competitive position through key internal and external factors, highlighting its strengths in distribution and market leadership alongside potential threats from e-commerce competition.

Offers a clear, actionable SWOT framework to pinpoint and address strategic challenges efficiently.

Weaknesses

Grainger's reliance on industrial customers means its performance is closely tied to their production and investment activity. When the economy slows, these customers tend to cut back on spending, directly affecting Grainger's sales. For instance, early 2025 saw a noticeable slowdown in the High-Touch Solutions segment, a clear indicator of how sensitive Grainger's business is to a muted demand environment.

Grainger's commitment to a robust physical distribution network and extensive product inventory, while crucial for its customer service promise, contributes significantly to high operational costs. These ongoing expenses can impact profitability, particularly when facing economic downturns or intensified market competition.

For instance, Grainger's operating margin experienced a minor dip in the first quarter of 2025 when compared to the same period in the previous year, underscoring the sensitivity of its cost structure to market conditions.

Grainger operates in a crowded industrial supply market, facing stiff competition from giants like Fastenal and MSC Industrial Direct, as well as a growing number of specialized suppliers and online platforms. This crowded landscape inevitably creates significant pricing pressures.

These competitive forces can directly impact Grainger's profitability. For instance, if rivals aggressively cut prices to gain market share, Grainger might be compelled to follow suit, potentially eroding its gross profit margins, which were reported at 43.5% for the first quarter of 2024.

Reliance on Traditional Distribution Model

Grainger's continued reliance on its traditional, high-touch distribution model, while effective for certain customer segments, presents a weakness. This approach, though providing personalized service, can be less nimble and more expensive than purely digital-first competitors. For instance, in the first quarter of 2024, Grainger reported that its High-Touch Solutions segment, which embodies this model, faced headwinds from tariffs and inventory valuation, impacting its performance relative to the digitally focused Endless Assortment segment.

This reliance creates a strategic challenge as the company balances investment in its digital capabilities with the operational realities of its established physical infrastructure. The cost structure associated with maintaining this traditional model can limit Grainger's ability to compete aggressively on price with online-only retailers, potentially impacting market share in price-sensitive segments.

- Segment Performance Duality: While the Endless Assortment segment demonstrated robust growth in early 2024, the High-Touch Solutions segment experienced margin pressures.

- Cost Structure Disadvantage: The high-touch model incurs higher operational costs compared to purely digital distribution channels.

- Agility Limitations: Traditional distribution networks can be slower to adapt to rapidly changing market demands and technological shifts.

Exposure to Supply Chain Disruptions and Geopolitical Risks

Grainger, despite its strong supply chain, faces significant vulnerabilities from global events, geopolitical shifts, and evolving trade policies. These external factors can create bottlenecks, driving up operational costs and impacting product availability.

The company has explicitly noted the uncertainty surrounding tariffs and their potential to affect both future demand and profit margins. This highlights a persistent challenge in adapting to a dynamic and often unpredictable international landscape.

- Supply Chain Bottlenecks: Global trade disputes and geopolitical tensions can disrupt the flow of goods, leading to delays and increased logistics expenses.

- Tariff Impact: Uncertainties around tariffs directly influence Grainger's cost structure and pricing strategies, potentially dampening customer demand.

- Geopolitical Sensitivity: Reliance on global sourcing exposes Grainger to risks associated with political instability and international relations in key manufacturing regions.

Grainger's extensive physical distribution network, while a strength for customer service, inherently carries higher operational costs compared to digital-native competitors. This can translate into pricing disadvantages in certain market segments. For example, the High-Touch Solutions segment, which relies heavily on this model, faced margin pressures in early 2024, partly due to inventory valuation, contrasting with the more digitally focused Endless Assortment segment's performance.

The company's traditional, high-touch distribution model, though valued by some customers, can be less agile in responding to rapid market shifts or technological advancements. This can limit Grainger's ability to compete on price with leaner, online-only rivals, potentially affecting market share among price-sensitive buyers.

Grainger's significant reliance on its established physical infrastructure creates a strategic balancing act. The costs associated with maintaining this network can hinder aggressive pricing strategies against purely online competitors, potentially impacting its competitive edge in certain areas.

Preview Before You Purchase

Grainger SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Grainger SWOT Analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report.

Opportunities

Grainger's continued investment in its e-commerce channels, specifically Zoro and MonotaRO, offers a substantial avenue for expansion. These platforms are crucial for capturing a greater share of the expanding online Maintenance, Repair, and Operations (MRO) market.

By integrating advanced technologies like AI, machine learning, and data analytics, Grainger can significantly elevate customer experience, refine pricing strategies, and improve operational efficiency. This digital transformation is key to staying competitive.

The Endless Assortment segment, a core part of Grainger's digital strategy, has demonstrated impressive momentum, consistently achieving strong double-digit growth, underscoring the success of its online focus.

Grainger can strategically expand by entering new geographic regions, particularly those with developing industrial bases. For instance, its presence in Canada and Latin America, while established, still presents avenues for deeper penetration and market share growth. The company's robust supply chain and e-commerce capabilities are well-suited to support this expansion.

Furthermore, Grainger has an opportunity to target specialized industrial segments that are currently underserved by its broad-line approach. This could involve focusing on high-growth sectors like renewable energy infrastructure maintenance or advanced manufacturing, where specific tooling and MRO (Maintenance, Repair, and Operations) solutions are in high demand. For example, the global industrial automation market was valued at over $150 billion in 2023 and is projected to grow significantly, offering a prime target for specialized offerings.

Grainger can strategically acquire smaller, specialized distributors or technology firms to rapidly broaden its product catalog, integrate new functionalities, or penetrate untapped markets. For instance, acquiring a company with advanced e-commerce analytics could significantly bolster Grainger's digital presence.

Forming strategic alliances can also be instrumental in refining its technological capabilities or fortifying its supply chain infrastructure. Partnerships with logistics innovators could streamline delivery networks, a crucial element in the MRO sector.

While Grainger's most recent significant acquisitions weren't in the 2024-2025 timeframe, this avenue for growth remains a potent and actively considered strategy. The company's robust financial position, evidenced by its strong free cash flow generation, provides ample capacity for such strategic moves.

Leveraging Data Analytics and AI for Operational Efficiency

Grainger's significant investment in its data and technology infrastructure, including its proprietary systems, creates a prime opportunity to enhance operational efficiency through advanced data analytics and artificial intelligence. This technological foundation allows for sophisticated analysis of vast datasets, paving the way for smarter business decisions.

By applying AI and data analytics, Grainger can achieve tangible improvements across its operations. This includes optimizing inventory levels to reduce carrying costs and stockouts, streamlining logistics for faster and more cost-effective delivery, and developing predictive maintenance tools for customers, thereby adding value beyond just product supply.

- Enhanced Inventory Management: Utilizing AI to forecast demand more accurately, potentially reducing excess inventory by an estimated 10-15% based on industry trends in supply chain optimization.

- Logistics Optimization: Implementing AI-powered route planning and load balancing to improve delivery efficiency, aiming for a 5-10% reduction in transportation costs.

- Predictive Maintenance Solutions: Offering AI-driven insights to customers on equipment upkeep, potentially increasing customer retention and creating new service revenue streams.

- Personalized Customer Experiences: Leveraging data analytics to provide tailored product recommendations and marketing, which can boost sales conversion rates by an estimated 5-20%.

Growth in Sustainability and ESG Solutions

Grainger is well-positioned to capitalize on the burgeoning demand for sustainability and Environmental, Social, and Governance (ESG) solutions. As businesses worldwide increasingly prioritize ESG metrics, Grainger can expand its product and service portfolio to align with customer sustainability objectives.

The company's 2024 ESG report underscores its commitment to reducing its own environmental footprint and developing solutions that enable customers to do the same. This strategic focus taps into a rapidly expanding market where sustainable procurement is becoming a key differentiator.

- Expanding Sustainable Product Lines: Offering a wider range of eco-friendly tools, energy-efficient equipment, and waste reduction supplies directly addresses customer ESG goals.

- Developing ESG-Focused Services: Providing consulting or assessment services to help customers identify and implement sustainability initiatives can create new revenue streams.

- Leveraging ESG Reporting: Highlighting Grainger's own ESG progress, as seen in its 2024 report, builds trust and demonstrates expertise in the sustainability space.

- Meeting Regulatory Demands: As more regulations mandate sustainable practices, Grainger's offerings become essential for compliance.

Grainger's robust investments in its e-commerce platforms, particularly Zoro and MonotaRO, position it to capture significant growth in the expanding online MRO market. The company's strategic focus on digital transformation, leveraging AI and data analytics, is enhancing customer experience and operational efficiency, as evidenced by the strong double-digit growth in its Endless Assortment segment.

Expanding into new geographic markets and targeting specialized industrial segments, such as renewable energy and advanced manufacturing, presents further growth opportunities. Grainger can also accelerate its expansion through strategic acquisitions and partnerships to broaden its product catalog and integrate new technological capabilities.

The company's commitment to sustainability and ESG solutions offers a significant avenue for growth, with an expanding range of eco-friendly products and services designed to meet increasing customer demand for sustainable procurement. Grainger's proactive approach to ESG, as highlighted in its 2024 report, strengthens its market position and customer trust.

| Opportunity Area | Key Actions | Potential Impact |

|---|---|---|

| E-commerce Expansion | Continued investment in Zoro and MonotaRO | Increased market share in online MRO |

| Digital Transformation | AI/ML integration for customer experience and operations | Improved efficiency, personalized offerings |

| Geographic Expansion | Penetration in Canada, Latin America, and emerging markets | Diversified revenue streams, increased global presence |

| Specialized Market Focus | Targeting high-growth sectors like renewable energy | New revenue streams, competitive differentiation |

| Strategic Acquisitions/Alliances | Acquiring tech firms or partnering with logistics innovators | Accelerated growth, enhanced capabilities |

| Sustainability & ESG | Expanding eco-friendly product lines and services | Meeting customer demand, regulatory compliance, new revenue |

Threats

Grainger faces increasing pressure from online-only retailers and specialized distributors. These competitors often leverage leaner operating models to offer competitive pricing, particularly in Maintenance, Repair, and Operations (MRO) categories where price sensitivity is high. This trend was evident in 2023, where the e-commerce segment of the industrial supply market continued its robust growth, capturing market share from traditional players.

An economic slowdown, particularly a dip in industrial production, poses a significant threat to Grainger. Reduced manufacturing output and decreased business investment directly translate to lower demand for Maintenance, Repair, and Operations (MRO) supplies. For instance, if industrial production in the US, a key market for Grainger, experiences a contraction, companies are likely to postpone non-essential purchases, impacting Grainger's sales volume.

Grainger faces ongoing threats from global supply chain disruptions, exacerbated by geopolitical instability. Events like trade wars, natural disasters, or pandemics can create significant vulnerabilities, leading to product shortages and increased freight costs. For instance, the lingering effects of global shipping container shortages in 2023 continued to impact delivery times and costs for many industrial suppliers.

These disruptions directly affect Grainger's ability to meet customer demand efficiently and maintain healthy profit margins. The company has already experienced the impact of tariffs, which directly squeeze margins. In 2024, continued geopolitical tensions in regions crucial for manufacturing and shipping could further escalate these cost pressures and delivery uncertainties.

Technological Disruption and Evolving Customer Preferences

Rapid technological advancements, including additive manufacturing and novel procurement platforms, pose a significant threat by potentially bypassing traditional distribution networks. For instance, the global 3D printing market is projected to reach $62.5 billion by 2030, indicating substantial growth in alternative production and sourcing methods.

Evolving customer expectations for hyper-personalized experiences and direct-to-manufacturer sourcing present another challenge. Companies that can offer more tailored solutions or streamlined, direct access may gain an advantage over established distributors. In 2024, B2B e-commerce sales are expected to continue their upward trajectory, with a growing emphasis on digital-first customer journeys.

- Technological Disruption: Emerging technologies like advanced robotics in warehousing and AI-driven supply chain optimization could alter operational efficiencies and competitive landscapes.

- Shifting Procurement Models: The rise of digital marketplaces and platform-based sourcing offers alternative channels that may reduce reliance on traditional distributors.

- Customer Personalization Demands: A growing expectation for customized product offerings and tailored service levels requires agile adaptation from distributors.

- Direct-to-Manufacturer Trends: Some industrial buyers may seek to bypass intermediaries, opting for direct relationships with manufacturers for specific components or services.

Inflationary Pressures and Cost Increases

Inflationary pressures are a significant threat to Grainger. The rising costs of essential inputs like raw materials, labor, and transportation directly impact the company's operational expenses. For example, the Producer Price Index for manufactured goods saw a notable increase throughout 2023 and into early 2024, indicating broader cost pressures across industries that supply Grainger.

These escalating costs can put considerable pressure on Grainger's profit margins. While the company actively works to mitigate these effects through strategic price adjustments and robust supplier negotiations, persistent inflation can challenge its ability to maintain profitability. If price increases are too steep, it risks alienating customers or losing market share to competitors who may absorb costs differently.

- Rising Input Costs: Increased prices for raw materials, components, and energy directly affect Grainger's cost of goods sold.

- Labor Cost Inflation: A tight labor market and wage growth contribute to higher operating expenses for Grainger's workforce.

- Transportation & Logistics: Elevated fuel prices and shipping rates increase the cost of moving inventory and delivering products to customers.

- Margin Squeeze: The need to pass on some costs to customers while remaining competitive can lead to reduced profit margins if not managed effectively.

Intensifying competition from online-only retailers and specialized distributors presents a formidable threat, especially in price-sensitive MRO segments. An economic downturn, marked by reduced industrial production, directly curtails demand for Grainger's core offerings. Furthermore, persistent global supply chain disruptions and geopolitical instability continue to inflate freight costs and create product availability challenges, impacting both delivery efficiency and profit margins.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of credible data, including Grainger's official financial reports, comprehensive market research, and expert industry analysis to ensure a robust and insightful assessment.