Grainger PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grainger Bundle

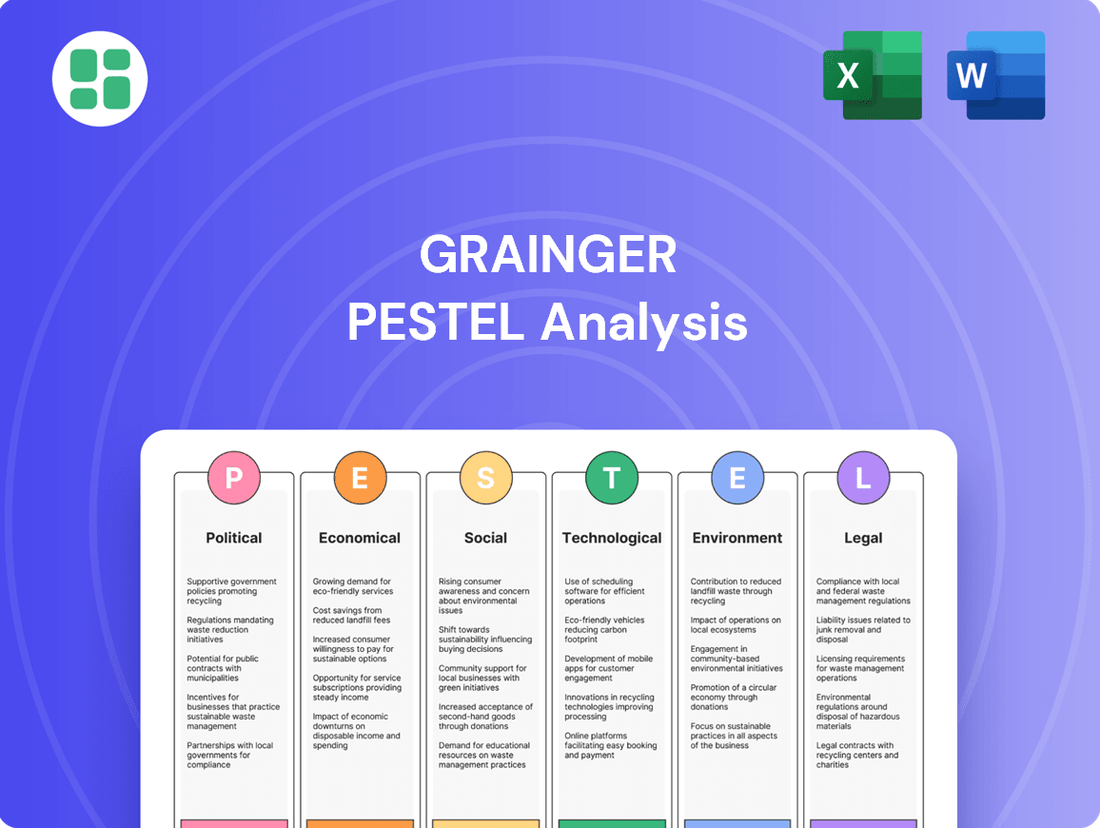

Grainger operates in a dynamic market, influenced by a complex web of external factors. Our PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental forces shaping their landscape. Gain a critical understanding of these influences to refine your own strategic approach and identify potential opportunities or threats.

Ready to unlock actionable intelligence on Grainger? Our comprehensive PESTLE analysis provides the expert insights you need to navigate the competitive terrain. Equip yourself with the knowledge to make informed decisions and stay ahead of the curve. Download the full version now and gain a significant market advantage.

Political factors

Government spending on infrastructure and public services directly impacts Grainger's sales, as these areas are significant buyers of maintenance, repair, and operating (MRO) supplies. For instance, the United States enacted the Infrastructure Investment and Jobs Act in late 2021, allocating over $1 trillion to improve roads, bridges, public transit, water pipes, broadband, and the electric grid. This substantial investment, with significant outlays expected through 2025 and beyond, creates a robust demand for the types of products Grainger offers.

Changes in international trade policies and the imposition of tariffs directly impact Grainger's supply chain and product costs. For instance, the U.S. imposed tariffs on goods from China, affecting various industrial products. These tariffs on imported raw materials or finished MRO products can increase procurement expenses, forcing strategic sourcing adjustments.

These increased costs necessitate careful consideration of pricing strategies. Grainger might absorb some of these costs, impacting profit margins, or pass them on to customers, potentially affecting sales volume. For example, in 2023, the U.S. continued to review and adjust tariffs on a wide range of goods, creating ongoing uncertainty for businesses relying on international supply chains.

The regulatory landscape for safety and industrial products significantly shapes Grainger's MRO (Maintenance, Repair, and Operations) offerings. Evolving standards, particularly concerning workplace safety and hazardous materials, directly influence the types of products Grainger stocks and the services it provides. For instance, the Occupational Safety and Health Administration (OSHA) continues to update its guidelines, impacting everything from personal protective equipment (PPE) to chemical handling protocols.

Grainger's commitment to compliance is paramount. This includes ensuring that its extensive product catalog, which features millions of items, meets the latest certifications and legal requirements across various industries and jurisdictions. In 2024, for example, increased scrutiny on supply chain transparency for certain industrial chemicals means Grainger must meticulously verify the origins and compliance of its inventory to support customer safety and regulatory adherence.

Geopolitical Stability and Global Supply Chain Resilience

Geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, significantly impact global supply chains, directly affecting the availability and cost of Maintenance, Repair, and Operations (MRO) products. Grainger, as a major distributor, experiences these disruptions firsthand. For instance, disruptions in shipping routes, like those seen in the Red Sea in early 2024, led to increased transit times and freight costs for many goods, including those sourced by Grainger. The company's ability to navigate these challenges hinges on its supply chain resilience.

Grainger's strategy to maintain supply chain resilience is crucial for serving its broad customer base. This involves diversifying sourcing locations to reduce reliance on any single region and implementing robust inventory management strategies. For example, by holding higher levels of critical inventory or identifying alternative suppliers in less volatile regions, Grainger can better buffer against unforeseen international conflicts or trade disputes that might otherwise halt product flow.

- Geopolitical Instability: Events like the 2022-2024 conflicts in Eastern Europe have demonstrably increased shipping costs and lead times for manufactured goods globally.

- Supply Chain Disruptions: The Red Sea shipping crisis in early 2024 caused an estimated 10-15% increase in shipping costs for many affected routes, impacting inventory for distributors like Grainger.

- Resilience Strategies: Grainger's focus on diversified sourcing and inventory management aims to mitigate the financial and operational impacts of these geopolitical risks.

Government Procurement Policies

Government procurement policies and contracting processes represent a key political variable for Grainger, particularly as it serves public sector entities. Favorable policies, such as those prioritizing domestic suppliers or mandating supplier diversity, can open doors for new business. Grainger's success in navigating these intricate procurement systems and winning contracts is vital for its expansion within the government market.

In 2023, U.S. federal government spending on goods and services reached trillions of dollars, with a significant portion allocated through competitive bidding processes. Grainger's ability to align its offerings with government needs and compliance standards directly impacts its market share in this sector. For instance, changes in defense spending or infrastructure investment initiatives can reshape demand for Grainger's industrial supplies.

- Federal Contract Spending: The U.S. federal government awarded over $700 billion in prime contracts in fiscal year 2023, presenting substantial opportunities for suppliers like Grainger.

- Small Business Set-Asides: Policies encouraging contracts with small businesses can influence the competitive landscape, requiring larger firms to partner or adapt their strategies.

- Buy American Act: Compliance with regulations like the Buy American Act, which favors domestically produced goods, is critical for securing government contracts.

Government spending on infrastructure and public services directly impacts Grainger's sales, as these areas are significant buyers of maintenance, repair, and operating (MRO) supplies. For instance, the United States enacted the Infrastructure Investment and Jobs Act in late 2021, allocating over $1 trillion to improve infrastructure, with significant outlays expected through 2025 and beyond, creating robust demand for Grainger's products.

Changes in international trade policies and the imposition of tariffs directly impact Grainger's supply chain and product costs, as seen with U.S. tariffs on goods from China, which increase procurement expenses and necessitate strategic sourcing adjustments. In 2023, ongoing tariff reviews by the U.S. continued to create uncertainty for businesses reliant on international supply chains.

The regulatory landscape for safety and industrial products shapes Grainger's MRO offerings, with evolving standards from agencies like OSHA directly influencing product types and services. For example, increased scrutiny on supply chain transparency for industrial chemicals in 2024 requires Grainger to meticulously verify its inventory to ensure customer safety and regulatory adherence.

Geopolitical events, such as the conflicts in Eastern Europe and the Middle East, significantly impact global supply chains, affecting product availability and cost. Disruptions in shipping routes, like the Red Sea crisis in early 2024, led to increased transit times and freight costs, underscoring the need for Grainger's supply chain resilience strategies, including diversified sourcing.

| Political Factor | Impact on Grainger | Example/Data (2023-2025) |

|---|---|---|

| Government Spending (Infrastructure) | Increased demand for MRO supplies | US Infrastructure Investment and Jobs Act (>$1T, ongoing outlays through 2025) |

| Trade Policies & Tariffs | Higher procurement costs, supply chain adjustments | Continued U.S. tariff reviews on imported goods (2023-2024) |

| Regulatory Standards (Safety) | Influence on product offerings and compliance needs | OSHA guideline updates, supply chain transparency scrutiny (2024) |

| Geopolitical Instability | Supply chain disruptions, increased shipping costs | Red Sea shipping crisis (early 2024) leading to higher freight costs |

| Government Procurement | Opportunities via contracts, impact of policies like 'Buy American' | US Federal prime contracts awarded over $700B (FY2023) |

What is included in the product

Grainger's PESTLE Analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic decisions.

A structured Grainger PESTLE analysis provides a clear framework to identify and mitigate external threats, reducing the anxiety associated with unforeseen market shifts and competitive pressures.

Economic factors

The global economy's trajectory significantly influences Grainger's performance, as robust economic growth typically fuels demand for Maintenance, Repair, and Operations (MRO) products. For instance, in early 2024, many developed economies showed resilience, with the IMF projecting global growth at 3.2% for the year, which bodes well for industrial activity and subsequent MRO spending.

Industrial production is a key indicator; a strong manufacturing and construction sector directly translates to increased need for the supplies Grainger provides. In the US, industrial production saw a modest uptick in the first half of 2024, reflecting continued, albeit uneven, demand from key sectors that rely heavily on MRO solutions.

Conversely, any slowdown in global industrial output or regional economic contractions can dampen demand for MRO goods. Should economic headwinds intensify, leading to reduced manufacturing output or delayed construction projects, Grainger would likely experience a corresponding dip in sales as businesses scale back operational expenditures.

Inflationary pressures in the UK, as of early 2024, have seen the Consumer Price Index (CPI) fluctuate, impacting Grainger's procurement costs for everything from industrial supplies to logistics. For instance, if raw material costs increase by 5% due to inflation, this directly squeezes gross profit margins if Grainger cannot pass on these increases to customers through pricing adjustments.

Rising interest rates, such as the Bank of England's base rate which has been maintained at 5.25% through early 2024, can dampen demand for large capital expenditure projects by Grainger's B2B customers. Simultaneously, higher rates increase Grainger's own cost of borrowing for inventory financing and potential expansion, potentially impacting its ability to invest in new product lines or technological upgrades.

The MRO (Maintenance, Repair, and Operations) sector, including Grainger, is particularly sensitive to supply chain health. Fluctuations in raw material prices, shipping and logistics expenses, and any unexpected interruptions significantly impact profitability and customer service. For Grainger, effectively navigating these challenges through robust supplier relationships and an efficient distribution system is key to offering competitive prices and ensuring product availability.

Looking ahead, the MRO industry anticipates substantial headwinds from material and labor shortages, coupled with escalating costs. These factors are identified as primary disruptors for the sector in the coming years. For instance, the U.S. Producer Price Index for industrial supplies and equipment saw a notable increase, reflecting these inflationary pressures throughout 2023 and into early 2024.

Labor Market Conditions and Wage Inflation

Labor availability and wage inflation directly influence Grainger's operational costs, especially given its large workforce in distribution, sales, and customer service. For instance, the U.S. unemployment rate remained low, hovering around 3.7% in early 2024, indicating a tight labor market. This scarcity can drive up wages, impacting Grainger's profitability.

Furthermore, shortages of skilled labor within industrial sectors can indirectly affect Grainger's business. When Grainger's customers struggle to find qualified workers for maintenance, repair, and operations (MRO), their demand for Grainger's products might shift or decrease.

Grainger, similar to many in the distribution industry, confronts the ongoing challenge of attracting and retaining talent at competitive wage levels. In 2024, average hourly earnings for nonfarm payroll employees in the U.S. saw an increase, reflecting this inflationary pressure on wages.

- Tight Labor Market: U.S. unemployment rates remained near historic lows in early 2024, making labor acquisition more challenging and costly for Grainger.

- Wage Inflation: Rising average hourly earnings across the U.S. economy directly increase Grainger's labor expenses for its distribution and customer-facing roles.

- Customer Impact: Skilled labor shortages among Grainger's industrial customer base can potentially dampen their MRO spending.

Customer Industry Specific Economic Health

Grainger's performance is closely tied to the economic vitality of the diverse industries it serves, such as manufacturing, government, and healthcare. A slowdown in any of these key sectors, like a dip in manufacturing output or reduced government spending, can directly affect demand for Grainger's products and services, particularly within its High-Touch Solutions segment.

For example, the U.S. manufacturing sector, a significant customer base for Grainger, experienced a Purchasing Managers' Index (PMI) reading of 50.2 in April 2024, indicating slight expansion but with notable sub-sector variations. Similarly, government budgets and healthcare spending levels directly influence procurement patterns, making Grainger's ability to anticipate and adjust to these industry-specific economic cycles crucial for its ongoing growth and profitability.

- Manufacturing Sector Health: The ISM Manufacturing PMI provides a key indicator; a reading above 50 signals expansion. For instance, the PMI stood at 50.2 in April 2024, suggesting modest growth in the sector.

- Government Spending Cycles: Changes in federal, state, and local government budgets directly impact demand for maintenance, repair, and operating supplies (MRO) from public sector clients.

- Healthcare Industry Investment: The economic health of the healthcare sector, influenced by factors like patient volumes and reimbursement rates, affects capital expenditure and operational supply needs.

- Adaptability to Vertical Cycles: Grainger's success hinges on its capacity to align its inventory and service offerings with the unique economic rhythms and investment priorities of each major customer vertical.

Global economic conditions directly impact Grainger's sales, with growth in industrial production and manufacturing sectors typically driving demand for MRO supplies. For example, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, indicating a generally supportive economic environment for industrial activity.

Inflationary pressures and interest rate policies also play a significant role, affecting both Grainger's operational costs and its customers' capital expenditure decisions. The Bank of England's base rate, for instance, remained at 5.25% through early 2024, influencing borrowing costs and investment appetite.

The labor market, characterized by low unemployment rates in early 2024 (around 3.7% in the U.S.), contributes to wage inflation, increasing Grainger's labor expenses and potentially impacting its pricing strategies.

| Economic Indicator | Value/Trend (Early 2024) | Impact on Grainger |

|---|---|---|

| Global GDP Growth Projection | 3.2% (IMF) | Supports demand for MRO products |

| U.S. Unemployment Rate | ~3.7% | Tight labor market, driving wage inflation |

| Bank of England Base Rate | 5.25% | Increases borrowing costs, potentially curbs customer investment |

What You See Is What You Get

Grainger PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Grainger PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed breakdown of each PESTLE element, offering valuable insights into Grainger's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment. You can trust that this analysis is a complete and ready-to-deploy resource for your strategic planning.

Sociological factors

The industrial sector faces a significant challenge with shifting workforce demographics, particularly the retirement of experienced skilled tradespeople. This trend, evident across many developed economies, leads to persistent skill shortages. For instance, in the US, the Bureau of Labor Statistics projected that by 2031, there will be a need for 1.1 million skilled tradespeople to meet demand. This demographic shift directly impacts Grainger's customer base, potentially increasing the demand for MRO products that are easier to use or offer enhanced safety features for a less experienced workforce.

As a result of these skill gaps, there's a growing need for solutions that can bridge the experience divide. This could translate into higher demand for automated MRO solutions, advanced diagnostic tools, or comprehensive service contracts that provide expert support. Grainger's strategic response could involve expanding its portfolio of user-friendly products and investing in digital tools that simplify maintenance and repair processes, thereby empowering a less experienced workforce and mitigating productivity losses.

Societal expectations and government regulations are increasingly emphasizing worker safety, health, and overall well-being across diverse industries. This heightened focus directly fuels demand for essential safety equipment, personal protective gear (PPE), and comprehensive workplace safety solutions, all of which are central to Grainger's product portfolio.

Businesses are actively investing in creating safer working conditions, which translates into a consistent and robust demand for Grainger's safety products and associated services. For instance, in 2023, the global industrial safety market was valued at approximately $50 billion and is projected to grow, reflecting this ongoing commitment to worker protection.

Customers increasingly demand convenience and sustainability, mirroring broader e-commerce growth and heightened environmental awareness. Grainger needs to evolve its service to provide quicker deliveries, tailored experiences, and clear data on product eco-friendliness. For instance, in 2024, e-commerce sales for industrial supplies are projected to continue their upward trajectory, with many buyers prioritizing speed and ease of transaction.

Demand for Specialized MRO Solutions

The increasing specialization across industries fuels a demand for niche Maintenance, Repair, and Operations (MRO) solutions, moving away from one-size-fits-all offerings. This shift necessitates that Grainger broaden its product catalog and cultivate specialized knowledge within specific industry sectors to meet unique customer needs. For instance, the advanced manufacturing sector, projected to grow significantly, requires highly specialized tooling and consumables not found in general MRO assortments.

Grainger's ability to provide these specialized products and services is crucial for maintaining its competitive advantage and securing market share in targeted areas. By understanding the evolving demands of sectors like renewable energy or advanced electronics, Grainger can proactively adjust its inventory and support services. In 2024, reports indicated that companies prioritizing tailored MRO solutions saw an average reduction of 15% in operational downtime.

- Industry Specialization: Growing demand for niche MRO solutions tailored to specific industry needs.

- Product Expansion: Requirement for Grainger to expand its product assortment and develop specialized expertise.

- Competitive Edge: Offering specialized products and services enhances market position and captures targeted segments.

- Operational Efficiency: Companies focusing on specialized MRO solutions reported an average of 15% less operational downtime in 2024.

Evolution of Remote Work and Facility Maintenance

The widespread adoption of remote and hybrid work models, accelerated by events in recent years, is fundamentally reshaping how commercial and industrial facilities are utilized. This shift directly impacts the demand for maintenance, repair, and operations (MRO) supplies and services, a core area for Grainger.

While traditional office spaces might experience reduced foot traffic and thus potentially less frequent maintenance needs, other critical facilities are seeing sustained or even increased operational demands. For instance, data centers, essential for supporting remote work infrastructure, and manufacturing plants, vital for producing goods, often require continuous or enhanced MRO support. This divergence necessitates a nuanced approach from suppliers like Grainger.

Grainger must closely monitor these evolving facility usage patterns to strategically adjust its inventory management and service portfolios. For example, a decline in demand for general office cleaning supplies might be offset by an increase in specialized equipment maintenance or cybersecurity-related facility needs. By understanding which sectors are growing or contracting in their MRO requirements, Grainger can better align its offerings to meet the dynamic needs of its customer base.

Data from 2024 and projections into 2025 indicate this trend continues. For example, a significant percentage of businesses are maintaining hybrid work policies, meaning office spaces will likely see a mix of occupancy. Simultaneously, investments in automation and resilient supply chains are driving activity in manufacturing and logistics facilities. Grainger's ability to adapt its MRO solutions to these varying demands will be key to its continued success.

- Remote Work Impact: Approximately 60% of US companies were expected to offer hybrid work options in 2024, impacting traditional office maintenance cycles.

- Facility Diversification: Demand for MRO in sectors like data centers and advanced manufacturing saw growth, with increased spending on specialized equipment and upkeep in 2024.

- Inventory Adjustment: Grainger's strategic planning in 2024-2025 includes adapting inventory to support both reduced office maintenance and increased industrial/tech facility needs.

Societal emphasis on diversity and inclusion is reshaping the workforce, influencing hiring practices and workplace culture. This shift can affect demand for specific types of safety equipment or training materials that cater to a broader range of employees. For instance, companies are increasingly investing in inclusive safety gear and accessible training programs to meet evolving workforce needs.

Consumer preferences are also leaning towards brands that demonstrate social responsibility and ethical practices. Grainger's commitment to sustainability and community engagement can therefore enhance its brand reputation and customer loyalty. In 2024, a significant portion of consumers indicated a preference for purchasing from companies with strong ESG (Environmental, Social, and Governance) credentials.

The growing awareness of mental health and well-being in the workplace is also a key sociological factor. This translates into a demand for products and services that support a healthier work environment, potentially including ergonomic equipment or air quality monitoring systems. Businesses are recognizing that employee well-being directly impacts productivity and retention.

Grainger's ability to adapt its product offerings and marketing strategies to these evolving societal expectations will be crucial for maintaining its competitive edge. By understanding and responding to these trends, the company can better serve its diverse customer base and reinforce its position as a responsible corporate citizen.

Technological factors

The MRO distribution landscape is being reshaped by the swift advance of e-commerce and digital transformation. Grainger has proactively embraced this trend, pouring significant resources into its online platforms like Zoro.com and MonotaRO.com. These digital investments are designed to offer customers an extensive product selection and a smooth, user-friendly online buying process.

This digital evolution is not just about convenience; it's a strategic imperative. By enhancing operational efficiency and expanding its market reach, Grainger's digital channels are becoming a key competitive advantage. For instance, in the first quarter of 2024, Grainger reported a 10% increase in sales, with a substantial portion attributed to its digital channels, underscoring the growing importance of online engagement.

Grainger is heavily investing in automation and AI to modernize its operations, aiming to boost efficiency across its supply chain and MRO distribution. This strategic focus is designed to accelerate digital transformation initiatives, enrich product data, and streamline how the company functions.

The company's commitment to AI is evident in its efforts to optimize inventory management, making sure the right products are available when customers need them. By leveraging AI, Grainger can better predict demand, leading to more efficient stocking and reduced waste.

AI-powered systems are being implemented to enhance warehouse operations and logistics, promising to speed up order fulfillment and minimize errors. These advancements also extend to predictive maintenance, where AI can forecast equipment failures, thereby cutting down on costly downtime.

Predictive maintenance, fueled by the growing adoption of sensors and IoT devices, is transforming equipment management from reactive fixes to proactive care. This shift allows customers to closely monitor performance and foresee maintenance requirements, thereby increasing demand for sophisticated MRO products and services designed for these intelligent systems.

Grainger can capitalize on this trend by expanding its portfolio to include IoT-enabled products and accompanying diagnostic tools. For instance, the industrial IoT market, projected to reach $150 billion by 2025, presents a significant opportunity for MRO suppliers to integrate smart capabilities into their offerings.

Data Analytics for Inventory and Customer Insights

Advanced data analytics is a significant technological factor for Grainger, offering profound insights into customer buying habits, inventory management, and emerging market trends. By harnessing its extensive proprietary data, Grainger can refine its product selection, optimize pricing, and streamline its supply chain operations, leading to greater efficiency and responsiveness.

This data-driven strategy directly translates into improved customer experiences and solidifies Grainger's competitive edge in the Maintenance, Repair, and Operations (MRO) sector. For instance, in 2023, Grainger reported a 5% increase in on-time delivery rates, largely attributed to enhanced inventory forecasting powered by data analytics.

- Customer Behavior Analysis: Grainger utilizes data analytics to understand customer purchasing frequency, product preferences, and buying triggers, enabling personalized offers and improved sales outreach.

- Inventory Optimization: Predictive analytics help forecast demand, reducing stockouts and overstock situations, thereby lowering carrying costs and improving cash flow.

- Supply Chain Efficiency: Data insights inform logistics and distribution strategies, leading to faster delivery times and reduced operational expenses.

- Market Trend Identification: Analyzing market data allows Grainger to anticipate shifts in demand and adapt its product assortment proactively.

Emergence of New MRO Product Technologies

The MRO sector is seeing rapid advancements, with technologies like smart tools and advanced robotics reshaping product offerings. Grainger's ability to integrate these innovations, such as IoT-enabled sensors for predictive maintenance or automated inventory management systems, directly impacts its competitive edge. For instance, the global industrial automation market was projected to reach over $200 billion in 2024, highlighting the demand for such technologies.

Incorporating sustainable materials and energy-efficient solutions is also a key technological driver. Customers increasingly seek MRO products that reduce environmental impact and operational costs. Grainger's catalog expansion to include items like LED lighting retrofits or low-emission lubricants reflects this trend, aligning with growing corporate sustainability initiatives. The market for green building materials, a related area, is expected to see significant growth through 2025.

- Smart Tools: Integration of sensors and connectivity for real-time performance monitoring and diagnostics.

- Sustainable Materials: Development and adoption of eco-friendly alternatives in MRO supplies.

- Advanced Robotics: Use of automated systems for tasks like warehousing, delivery, and on-site maintenance.

- Energy Efficiency: Products designed to reduce energy consumption in industrial operations.

Technological advancements are fundamentally altering the MRO distribution landscape, pushing companies like Grainger to innovate rapidly. The increasing adoption of e-commerce and digital platforms, such as Grainger's Zoro.com, is a prime example, driving sales growth and enhancing customer experience. For instance, Grainger's digital channels saw significant contributions to its sales in early 2024, reflecting a broader industry shift.

Grainger's investment in automation and AI is crucial for optimizing its supply chain and operations. These technologies improve inventory management, predict demand more accurately, and streamline warehouse processes, as seen in their reported 5% increase in on-time delivery rates in 2023, largely due to better forecasting.

The integration of IoT devices and sensors is enabling predictive maintenance, transforming how equipment is managed and increasing demand for smart MRO products. The industrial IoT market's projected $150 billion valuation by 2025 highlights this significant opportunity for suppliers to offer connected solutions.

Advanced data analytics provides Grainger with critical insights into customer behavior and market trends, allowing for more efficient operations and a refined product assortment. This data-driven approach is key to maintaining a competitive edge in the dynamic MRO sector.

Legal factors

Grainger navigates a complex landscape of product liability and safety standards, especially critical given its focus on industrial and safety equipment. Non-compliance can lead to significant legal repercussions and damage to its reputation. For instance, in 2023, product liability claims across various sectors saw an uptick, underscoring the importance of rigorous safety adherence.

Ensuring every product distributed meets stringent industry and governmental safety certifications, such as OSHA regulations or ANSI standards, is not just a legal obligation but a cornerstone of customer trust. Failing to do so exposes Grainger to potential lawsuits and costly recalls. The company's commitment to safety directly impacts its operational continuity and market standing.

Grainger, as a major employer, navigates a complex web of labor laws and employment regulations. These statutes govern everything from minimum wage requirements and overtime pay to workplace safety standards and anti-discrimination policies. For instance, in 2024, the U.S. Department of Labor continued to enforce federal wage and hour laws, impacting Grainger's compensation practices across its numerous distribution centers and retail locations.

Compliance is not merely a legal obligation but a strategic imperative for Grainger. Adhering to these regulations helps prevent costly litigation and maintains the company's reputation as a responsible employer. Failure to comply can result in significant fines and damage to employee morale, directly affecting operational efficiency.

Grainger's significant e-commerce presence necessitates strict adherence to data privacy laws like GDPR and CCPA. Failure to protect sensitive customer and company information from cyber threats can lead to substantial fines; for instance, companies face penalties up to 4% of global annual revenue under GDPR. Maintaining robust cybersecurity measures and transparent data handling is paramount for customer trust and avoiding legal repercussions.

Antitrust and Competition Laws

Grainger operates in a highly competitive MRO (Maintenance, Repair, and Operations) market, necessitating strict adherence to antitrust and competition laws. These regulations are designed to prevent monopolistic practices, price collusion, and other unfair competitive behaviors that could harm consumers and stifle innovation. For instance, in 2023, the U.S. Federal Trade Commission (FTC) continued its focus on challenging mergers that could reduce competition, indicating a vigilant regulatory environment for companies like Grainger.

Grainger's growth strategies, particularly any potential acquisitions or significant market share increases, must be carefully vetted to ensure compliance with these legal frameworks. Failure to do so could result in substantial fines, divestitures, or other legal actions. For example, the FTC's ongoing review of market concentration across various sectors underscores the importance of proactive legal counsel in M&A activities. Grainger's commitment to fair play is crucial for maintaining its operational integrity and market reputation.

- Regulatory Scrutiny: Antitrust laws aim to prevent market dominance that could lead to price gouging or reduced product quality.

- Compliance in Acquisitions: Grainger must ensure that any mergers or acquisitions do not create anti-competitive market conditions, as per FTC and Department of Justice guidelines.

- Fair Competition Practices: Regulations prohibit practices like predatory pricing or exclusive dealing arrangements that unfairly disadvantage rivals.

- Global Enforcement Trends: In 2024, many global competition authorities are increasing scrutiny on digital platforms and supply chain consolidation, impacting how large distributors operate.

International Trade Compliance and Customs Regulations

Grainger's extensive global footprint means navigating a complex web of international trade compliance and customs regulations. This involves meticulously managing import and export duties, adhering to trade sanctions, and ensuring accurate documentation for every transaction across numerous jurisdictions.

Failure to comply can result in severe financial penalties, operational disruptions due to shipment delays, and significant damage to Grainger's reputation. For instance, in 2023, the U.S. Department of Commerce reported record-breaking enforcement actions related to export control violations, highlighting the increasing scrutiny on global trade practices.

- Duty Management: Grainger must accurately classify products and pay appropriate tariffs, which vary widely by country and product type. For example, tariffs on industrial goods can range from 0% to over 30% depending on the origin and destination.

- Sanctions Compliance: Adherence to international sanctions regimes, such as those imposed by the UN, EU, and OFAC, is critical to avoid dealing with prohibited entities or countries.

- Documentation Accuracy: Maintaining precise and complete documentation, including commercial invoices, bills of lading, and certificates of origin, is paramount to facilitate smooth customs clearance.

- Risk Mitigation: Implementing robust internal controls and compliance programs is essential to proactively identify and mitigate risks associated with international trade.

Grainger's operational integrity hinges on its adherence to a broad spectrum of legal and regulatory frameworks. These encompass product safety, labor laws, data privacy, antitrust regulations, and international trade compliance. The company's proactive approach to these legal factors is crucial for mitigating risks, fostering customer trust, and ensuring sustained market presence.

Environmental factors

The market for sustainable and eco-friendly Maintenance, Repair, and Operations (MRO) products is experiencing significant growth. This surge is fueled by businesses increasingly prioritizing their own corporate sustainability objectives and navigating a landscape of evolving environmental regulations. For instance, a 2024 report indicated that over 70% of consumers are willing to pay more for sustainable products.

Grainger is actively addressing this trend by strategically expanding its portfolio of environmentally responsible offerings. This includes a focus on energy-efficient equipment, products manufactured with recycled content, and items engineered for extended durability and lifespan. By doing so, Grainger not only supports its customers' environmental goals but also strengthens its competitive position and market relevance in this expanding segment.

Environmental regulations on waste management and product disposal significantly impact Grainger's operations, particularly concerning hazardous materials and end-of-life product management. Compliance with evolving rules for e-waste and chemical disposal is paramount for maintaining responsible business practices and avoiding potential penalties.

Grainger's commitment to sustainability means it must ensure proper handling and disposal of products across its entire supply chain, a process that can involve substantial operational adjustments and costs. For instance, the increasing global focus on circular economy principles and extended producer responsibility (EPR) schemes, which were gaining momentum in 2024 and are expected to intensify, will likely necessitate further investment in product lifecycle management and waste reduction strategies.

Stakeholders are increasingly demanding transparency regarding the environmental and social impact of supply chains. Grainger recognizes this, actively working to ensure its operations and supplier network adhere to sustainable and ethical sourcing practices. This commitment is crucial for maintaining stakeholder trust and mitigating reputational risks.

Grainger's dedication to sustainability includes rigorous vetting of its suppliers to ensure they meet defined environmental standards. By cultivating a diverse and responsible supplier base, the company aims to build a more resilient and environmentally conscious supply chain, a key factor in today's market. For instance, in 2023, Grainger reported progress on its supplier diversity goals, with women- and minority-owned businesses representing a significant portion of its spend.

Carbon Footprint Reduction Initiatives

Grainger is responding to increasing pressure to lower its carbon footprint. The company has set targets to reduce its Scope 1 and Scope 2 emissions, aiming for a significant decrease by 2025. This commitment involves substantial investments in renewable energy, such as solar power installations at its facilities, and the adoption of energy-efficient technologies in its building operations.

These efforts not only showcase environmental responsibility but also offer tangible operational benefits. For instance, by improving energy efficiency, Grainger can expect to see a reduction in its utility expenses. The company's 2023 sustainability report highlighted a 5% reduction in energy intensity across its distribution centers compared to the previous year, demonstrating progress towards its climate goals.

- Scope 1 & 2 Emissions Reduction: Grainger aims to achieve a 25% reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2025 from a 2020 baseline.

- Renewable Energy Investment: The company is increasing its use of renewable energy, with solar installations planned for 10 major distribution centers by the end of 2024.

- Energy Efficiency Measures: Implementation of advanced building management systems and LED lighting retrofits across its portfolio contributed to a 3% decrease in overall energy consumption in 2023.

- Operational Cost Savings: Successful emissions reduction and energy efficiency initiatives are projected to yield annual operational cost savings of approximately $1.5 million by 2025.

Climate Change Impacts on Logistics and Operations

The physical effects of climate change, like more frequent and intense extreme weather, directly impact logistics and supply chains. This means delivery schedules can be thrown off, and costs can increase as Grainger navigates these disruptions. For instance, severe flooding in 2024 impacted key transportation routes across North America, leading to delays for many businesses relying on timely deliveries.

Grainger must proactively assess its distribution network and inventory strategies to build resilience. This involves understanding which regions are most vulnerable and ensuring backup plans are in place. By doing so, the company can better maintain service continuity, even when faced with challenging environmental conditions. Adapting to these realities is crucial for sustained operational efficiency.

- Increased Frequency of Extreme Weather: Reports indicate a significant rise in severe weather events globally, affecting transportation infrastructure.

- Supply Chain Vulnerability: Studies from 2024 highlighted that over 70% of businesses experienced supply chain disruptions due to climate-related events.

- Adaptation Investment: Companies are increasingly investing in supply chain resilience, with projections showing a 15% annual growth in this sector through 2025.

Growing consumer and business demand for sustainable MRO products is a key environmental driver, with over 70% of consumers in 2024 willing to pay more for eco-friendly options. Grainger is responding by expanding its range of energy-efficient and recycled-content items to meet these evolving preferences and regulatory landscapes.

Environmental regulations, particularly concerning waste and product disposal, necessitate careful management of hazardous materials and end-of-life products. Grainger's commitment to circular economy principles and extended producer responsibility schemes, which gained traction in 2024, requires ongoing investment in lifecycle management and waste reduction.

The company is actively working to reduce its carbon footprint, targeting a 25% reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2025 from a 2020 baseline. This includes significant investments in renewable energy, such as solar installations at 10 major distribution centers by the end of 2024, aiming for projected annual operational cost savings of $1.5 million by 2025.

Physical climate impacts, like increased extreme weather events, pose risks to logistics and supply chains, with over 70% of businesses experiencing disruptions in 2024 due to such events. Grainger is investing in supply chain resilience, with this sector projected for 15% annual growth through 2025, to mitigate these operational challenges.

| Environmental Factor | Grainger's Response/Impact | Key Data/Trend |

| Sustainable Product Demand | Expanding portfolio of eco-friendly MRO products. | 70% of consumers willing to pay more for sustainable products (2024). |

| Regulatory Compliance | Managing waste, chemical disposal, and e-waste. | Increasing focus on circular economy and Extended Producer Responsibility (EPR). |

| Carbon Footprint Reduction | Targeting 25% Scope 1 & 2 emissions reduction by 2025 (vs. 2020). | Investing in solar power for 10 distribution centers by end of 2024; projected $1.5M annual savings by 2025. |

| Climate Change Impacts | Building supply chain resilience against extreme weather. | 70%+ businesses faced climate-related supply chain disruptions (2024); 15% annual growth in resilience investment projected through 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grainger is built on a robust foundation of data from official government publications, reputable market research firms, and leading economic and industry trend reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Grainger's operations.