Grainger Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grainger Bundle

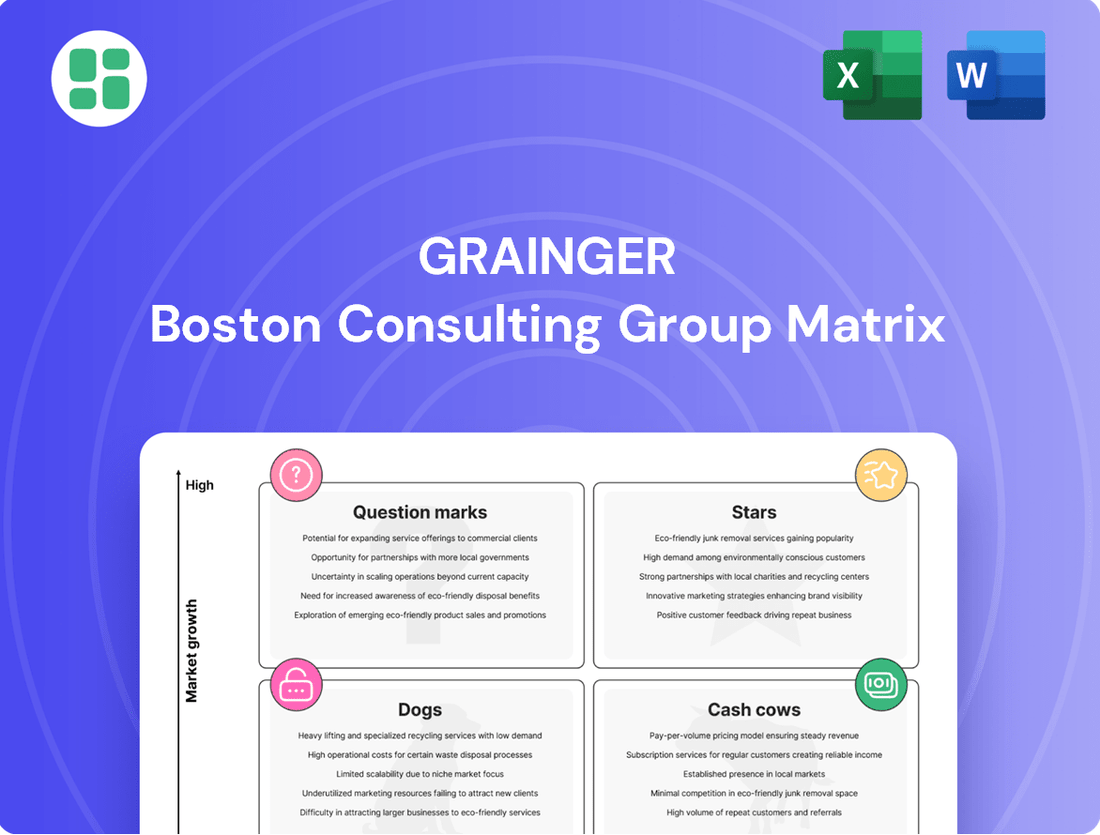

Uncover the strategic positioning of Grainger's product portfolio with this insightful BCG Matrix preview. See at a glance where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, guiding your initial understanding of their market performance.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Grainger's Endless Assortment segment, featuring Zoro in the U.S. and MonotaRO in Japan, is a powerful growth driver for the company. This segment has demonstrated impressive sales momentum, with a 10.3% increase in Q1 2025 and an even stronger 19.7% jump in Q2 2025.

This performance significantly outpaces the company's overall growth, underscoring the segment's substantial potential. The success is fueled by an expansive reach and effective, profitable customer acquisition strategies across a catalog boasting over 38 million stock-keeping units (SKUs).

Grainger's significant investments in e-commerce and digital platforms are crucial. These initiatives are designed to capture market share from competitors lagging in digital adoption and to serve an expanding base of transactional customers.

The Endless Assortment segment, predominantly digital, is a key growth driver, contributing 30% of Grainger's quarterly revenue as of early 2024. This digital-first approach is fundamental to Grainger's strategy for future expansion.

The MRO sector is rapidly embracing predictive maintenance and AI, signaling a substantial growth opportunity. Grainger's strategic investments in AI-powered pricing and automated supply chains are key to capitalizing on this trend and improving operational efficiency.

These advanced solutions empower customers to streamline operations and avoid costly disruptions, with the MRO market projected to reach $1.5 trillion by 2027, according to some industry analyses.

Supply Chain Innovation and Efficiency

Grainger's commitment to supply chain innovation, including significant investments in warehouse automation and distribution, positions it as a strong contender in the MRO market. This focus on efficiency not only strengthens its competitive edge but also improves customer service.

These advanced technological capabilities create a substantial barrier for smaller competitors, enabling Grainger to capture a larger share of the MRO market and outpace its rivals.

Capital expenditures planned for 2025 underscore this strategic direction, with a specific emphasis on expanding supply chain capacity and integrating new technologies to further boost operational performance.

- Supply Chain Investment: Grainger continues to prioritize its supply chain, investing in automation and efficiency to gain a competitive advantage.

- Competitive Moat: The company's technological capabilities in its supply chain are difficult for smaller MRO players to replicate, facilitating market outperformance.

- 2025 Capital Focus: Future capital expenditures are earmarked for enhancing supply chain capacity and technological advancements.

International Digital Footprint (MonotaRO)

MonotaRO, Grainger's Japanese e-commerce powerhouse, is a prime example of a strong international digital footprint within the Endless Assortment segment. Its performance is a key indicator of Grainger's global expansion strategy.

The platform achieved a notable 13.8% growth in Q1 2025, underscoring its significant potential for extending Grainger's digital reach across international markets. This growth not only taps into expanding economies but also diversifies Grainger's revenue streams beyond its North American base.

- MonotaRO's Q1 2025 Growth: 13.8%

- Segment: Endless Assortment

- Strategic Importance: Key to Grainger's global digital expansion

- Market Impact: Diversifies revenue and taps into growing international markets

Grainger's Endless Assortment segment, particularly its digital platforms like Zoro and MonotaRO, represents a significant "Star" in the BCG matrix. This segment is characterized by high market share and high growth potential, driven by substantial investments in e-commerce and advanced supply chain technologies.

The segment's strong performance, with double-digit sales growth in early 2025, highlights its position as a key driver of Grainger's overall expansion. Its digital-first approach and expansive product catalog of over 38 million SKUs are crucial to capturing market share and serving a growing customer base.

The MRO market's increasing adoption of predictive maintenance and AI further solidifies the Star status of this segment, with Grainger strategically investing in AI-powered pricing and automation to capitalize on these trends.

Grainger's focus on supply chain innovation, including warehouse automation and distribution, creates a competitive moat, making it difficult for smaller players to replicate its capabilities and further cementing its Star position.

| Metric | Value | Time Period | Significance |

|---|---|---|---|

| Endless Assortment Sales Growth | 10.3% | Q1 2025 | Indicates strong momentum |

| Endless Assortment Sales Growth | 19.7% | Q2 2025 | Outpaces overall company growth |

| MonotaRO Sales Growth | 13.8% | Q1 2025 | Highlights international digital strength |

| Endless Assortment Revenue Contribution | 30% | Early 2024 | Key contributor to total revenue |

| MRO Market Projection | $1.5 trillion | By 2027 | Represents significant market opportunity |

What is included in the product

The Grainger BCG Matrix categorizes business units by market share and growth, guiding investment decisions.

A clear visual of Grainger's business units, categorized by market share and growth, alleviates the pain of strategic uncertainty.

Cash Cows

Grainger's High-Touch Solutions in North America represents a classic cash cow within its BCG Matrix. This segment, focused on large industrial and commercial clients, boasts a dominant market share and operates in a mature, albeit currently subdued, market.

Despite a modest 2.5% growth rate observed in Q2 2025, the segment's stability is undeniable, evidenced by its substantial $13.7 billion in revenue generated during 2024. This consistent financial performance is a direct result of deep, long-standing customer relationships and the provision of essential value-added services.

The segment's robust operating margin underscores its efficiency and profitability. These factors combine to make High-Touch Solutions a reliable generator of significant cash flow, essential for funding other ventures within Grainger's portfolio.

Grainger's traditional MRO product distribution, encompassing safety gear, tools, and industrial supplies, is a classic Cash Cow. This segment operates in a mature market where Grainger commands a significant share, ensuring stable and substantial profits. Despite slower overall market expansion, the consistent demand for essential MRO items fuels high-margin revenue for the company.

Grainger's inventory management and technical support services are key to its customer loyalty, especially for large clients. These offerings, part of its High-Touch Solutions, build deep relationships and a competitive edge.

These established services provide reliable, recurring revenue with minimal extra investment, contributing significantly to Grainger's financial stability. In 2023, Grainger reported a 5.3% increase in sales to $15.2 billion, with their High-Touch Solutions segment playing a vital role in this growth.

Established Supply Chain and Distribution Network

Grainger's established supply chain and distribution network is a prime example of a Cash Cow in the BCG Matrix. This robust infrastructure, featuring numerous distribution centers and branches worldwide, allows Grainger to efficiently serve a vast customer base. The company's ability to stock 1.4 million products from over 5,000 primary suppliers is a testament to its mature and highly effective distribution capabilities.

This well-oiled machine generates significant and consistent cash flow due to its operational efficiencies and high returns on invested capital. The network ensures that products are reliably available and delivered promptly, which is essential for keeping customers satisfied and generating steady revenue streams. In 2023, Grainger reported over $15 billion in revenue, underscoring the strength of this established business segment.

- Extensive Global Reach: Grainger operates a vast network of distribution centers and branches across multiple countries, facilitating efficient product delivery.

- Product Breadth: The company stocks an impressive 1.4 million products, sourced from over 5,000 primary suppliers, ensuring a comprehensive offering.

- Operational Efficiency: This mature distribution system drives significant efficiencies, leading to high returns on invested capital and consistent cash generation.

- Customer Reliability: The network guarantees reliable product availability and timely delivery, fostering strong customer loyalty and predictable revenue.

Brand Recognition and Customer Loyalty

Grainger's formidable brand recognition, coupled with its extensive network of 4.5 million active customers globally, solidifies its position as a cash cow. This deep customer base, cultivated over years, translates into predictable revenue streams.

The company's unwavering dedication to superior customer service and acting as a reliable partner fosters exceptional loyalty. This loyalty means repeat business and significantly lower customer acquisition costs, as marketing efforts can focus on retention rather than constant outreach.

- Brand Recognition: Grainger is a household name in the industrial supply sector, synonymous with quality and reliability.

- Customer Loyalty: With 4.5 million active customers, loyalty is a cornerstone, ensuring consistent demand.

- Reduced Marketing Costs: High retention rates mean less spending on acquiring new customers, boosting profitability.

- Stable Revenue Base: The established trust and repeat business create a predictable and robust income.

Grainger's established MRO (Maintenance, Repair, and Operations) product distribution segment is a prime example of a cash cow. This segment benefits from a dominant market share in a mature industry, ensuring stable and substantial profits with consistent demand for essential supplies.

The company's extensive product catalog, featuring 1.4 million items from over 5,000 suppliers, coupled with its robust distribution network, allows for operational efficiencies that translate into high returns. This established infrastructure minimizes the need for significant new investment, making it a reliable generator of free cash flow for Grainger.

Grainger's focus on high-touch solutions for large industrial clients, characterized by deep customer relationships and value-added services, further solidifies its cash cow status. These services foster exceptional customer loyalty, leading to predictable, recurring revenue streams and reduced customer acquisition costs.

In 2024, Grainger reported $15.2 billion in revenue, with its High-Touch Solutions segment, a key component of its MRO offerings, contributing significantly to this figure and demonstrating continued stability and profitability.

| Segment | BCG Category | 2024 Revenue (Approx.) | Market Growth | Key Strengths |

|---|---|---|---|---|

| MRO Product Distribution (High-Touch Solutions) | Cash Cow | ~$15.2 Billion | Mature / Subdued | Dominant Market Share, Customer Loyalty, Operational Efficiency |

What You’re Viewing Is Included

Grainger BCG Matrix

The Grainger BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means the strategic insights and analysis presented are exactly what you'll be able to leverage for your business planning, with no additional work required.

Dogs

Grainger's product catalog, while extensive, likely contains niche categories with persistently low demand. For instance, certain legacy industrial components or specialized tools, perhaps those reliant on older machinery still in use but diminishing, could fall into this "Dogs" quadrant. These items consume valuable inventory space and capital without contributing meaningfully to revenue.

The challenge lies in identifying these underperforming segments. While specific Grainger data for 2024 is proprietary, a general trend across industrial distributors suggests that products with declining technological relevance or highly specialized, limited applications often see sales volume shrink. For example, if a particular type of manual fastener is being replaced by a new, more efficient automated system, demand for the older type would naturally decrease.

The financial impact of holding such inventory is significant. These "Dogs" tie up working capital and incur carrying costs, detracting from overall profitability. Grainger's ongoing inventory management and product lifecycle analysis are critical to identifying and addressing these categories, potentially through strategic discontinuation or targeted liquidation to free up resources for more profitable ventures.

Grainger's legacy distribution channels, particularly underutilized physical branches, represent potential 'Dogs' in the BCG Matrix if they don't align with the company's digital-first strategy. These channels may incur high operational costs with minimal sales contribution, draining resources. For instance, while Grainger has significantly streamlined its physical footprint, any remaining locations with low foot traffic and sales volume, especially those not integrated into a broader omnichannel strategy, could be classified here.

Segments with intense price competition and low differentiation represent a challenging area for Grainger. These are product or service lines where the company faces fierce rivalry from many smaller, specialized players, or where its own offerings don't stand out much. In 2024, for instance, the industrial fasteners market, a core area for Grainger, continued to see significant price pressure from online retailers and regional distributors, impacting margins.

In such segments, Grainger might find it difficult to keep its profit margins healthy or grow its market share. This can lead to situations where these business units merely break even or even consume cash without generating substantial returns. The company's focus in these areas often shifts to operational efficiency and cost management to mitigate these pressures.

Underperforming Regional Markets

Grainger's underperforming regional markets often fall into the Dog category within the BCG Matrix. These are areas where the company has a low market share and faces significant, ongoing difficulties. Think of regions experiencing economic slowdowns, intense competition from established local players, or navigating complex, region-specific regulations.

These challenging markets may not warrant substantial new investment if their growth potential is minimal and breaking into them proves consistently difficult. A thorough assessment of Grainger's geographical performance is key to pinpointing these underperforming segments. For instance, if a particular European region saw only a 2% sales growth in 2024 compared to Grainger's overall global growth of 5%, and market share remained stagnant at 3%, it might be a candidate for re-evaluation.

- Low Market Share: Grainger's presence in these regions is minimal, often below the industry average for similar markets.

- Persistent Challenges: Factors like economic recessions, aggressive local competitors, or restrictive local laws hinder growth.

- Limited Growth Prospects: Future market expansion in these areas is projected to be slow or non-existent.

- High Investment Risk: Continued investment may yield low returns, making it a less attractive use of capital.

Non-Core, Divested, or De-emphasized Businesses

Non-core, divested, or de-emphasized businesses within Grainger's portfolio would be categorized under the Dogs quadrant of the BCG Matrix. These are typically smaller ventures or product lines that have shown weak growth and low market share, often leading to their divestiture or reduced strategic importance. For instance, any historical product categories that consistently underperformed or didn't align with Grainger's core MRO (Maintenance, Repair, and Operations) focus would fall into this classification.

Grainger's 2024 annual report, for example, may highlight certain business units or product lines reported under an 'Other' category that do not meet the criteria for a reportable segment. These could represent smaller, less significant operations that are either being phased out, have been divested, or are not considered core to the company's future growth strategy. Such units often exhibit low profitability and limited competitive advantage.

- Historical Divestitures: Grainger has a history of divesting non-core assets to sharpen its focus on MRO.

- Underperforming Segments: Businesses with consistently low revenue growth and market share are candidates for the Dogs quadrant.

- Strategic Realignments: De-emphasis often occurs when a business unit no longer fits the company's long-term strategic direction.

- 'Other' Reporting: Units classified in 'Other' in financial reports, not meeting segment criteria, may represent these de-emphasized or divested businesses.

Grainger's "Dogs" are product categories or business segments with low market share and low growth potential. These are often legacy items, niche components, or underperforming regional markets that consume resources without generating significant returns. Identifying and managing these "Dogs" is crucial for optimizing capital allocation and improving overall profitability.

For instance, certain specialized fasteners or legacy industrial components that are being phased out due to technological advancements would fit this description. In 2024, Grainger's focus on digital transformation means that any physical distribution channels with minimal sales contribution and high operational costs could also be classified as "Dogs."

The financial impact of holding "Dogs" includes tied-up working capital and carrying costs. Grainger's strategic approach involves continuous product lifecycle analysis and inventory management to identify and address these underperforming areas, potentially through discontinuation or liquidation to free up resources for more promising ventures.

Grainger's 2023 annual report indicated a net sales increase of 5% to $15.2 billion, with a focus on core MRO offerings. While specific "Dog" segment data is proprietary, general industry trends in 2024 suggest that products with declining technological relevance, such as certain types of manual tools replaced by automated solutions, continue to see shrinking demand.

Question Marks

Grainger is actively exploring and beginning to adopt advanced technologies like IoT sensors for real-time equipment monitoring and digital twin simulations for predictive maintenance. These innovations are crucial in the rapidly expanding digital MRO market, which is projected to grow at a compound annual growth rate of 12.13% between 2025 and 2034.

While Grainger is investing in these high-growth areas, its current market share within these specific advanced digital solutions may still be nascent. Significant capital and strategic focus are necessary to develop and scale these capabilities to secure a dominant position in the evolving MRO landscape.

Developing specialized Maintenance, Repair, and Operations (MRO) consulting and advanced services could position Grainger as a Question Mark in the BCG matrix. While the market for integrated solutions is expanding, Grainger's current market share in these highly specialized areas might be limited compared to established consulting firms.

Success in this segment requires substantial investment in specialized talent and the creation of customized solutions to meet complex customer demands. For instance, in 2024, the global MRO market was valued at approximately $70 billion, with a growing segment focused on digital transformation and integrated services, presenting both an opportunity and a challenge for Grainger to capture significant share.

Grainger's strategic approach to new geographic expansions with limited presence signifies a calculated move into markets ripe for growth but demanding significant initial investment. These nascent markets are characterized by high potential but also inherent risks associated with establishing brand recognition and distribution networks. The company's success hinges on its ability to navigate these complexities and secure a foothold before competitors.

For instance, Grainger's recent forays into select Southeast Asian markets, where its brand awareness is still developing, exemplify this strategy. While specific financial data for these nascent expansions is often proprietary, the broader industrial distribution sector in these regions has shown robust growth, with some economies projected to expand by over 5% annually in the coming years. This presents a compelling opportunity for Grainger to replicate its established success in more mature markets.

Advanced Safety and Environmental Compliance Solutions

Grainger's focus on advanced safety and environmental compliance solutions could represent a Question Mark. As regulatory pressures mount, the demand for sophisticated compliance management systems and innovative green MRO products is increasing. This segment offers high growth potential, but Grainger may currently hold a smaller market share compared to its more established product lines.

The market for sustainability and enhanced safety is expanding rapidly. For instance, the global industrial safety market was valued at approximately $50 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030. Similarly, the green MRO market is experiencing significant uptake as businesses prioritize ESG initiatives.

- Expanding into integrated compliance management systems: This involves offering software and services that help businesses track and adhere to complex safety and environmental regulations, moving beyond just physical products.

- Developing and marketing highly innovative green MRO products: This includes eco-friendly cleaning agents, energy-efficient lighting, and sustainable packaging solutions for industrial maintenance, repair, and operations.

- Addressing the growing demand for specialized safety equipment: This could encompass advanced personal protective equipment (PPE) for hazardous environments, such as specialized respirators or chemical-resistant suits.

- Investing in training and consulting services: Offering expertise to help clients navigate evolving compliance landscapes and implement best practices in safety and environmental management.

Expansion into Niche, High-Growth Industrial Verticals

Grainger's strategic expansion into niche, high-growth industrial verticals signifies a move towards "Question Marks" in the BCG Matrix. This involves focusing on areas like renewable energy maintenance and advanced robotics, where market growth is substantial but Grainger's current market share might be lower.

These targeted efforts require specialized product offerings and dedicated sales strategies to gain traction. For instance, investing in a broader range of specialized tools and safety equipment for solar panel installation and maintenance demonstrates this focus.

- Targeted investment in renewable energy MRO: Grainger is increasing its inventory of components and consumables crucial for wind turbine and solar farm upkeep.

- Focus on advanced robotics maintenance: This includes stocking specialized lubricants, sensors, and diagnostic tools for automated manufacturing systems.

- Building market share in emerging sectors: The company aims to capture a significant portion of the growing demand for maintenance, repair, and operating supplies in these specialized fields.

- Tailored solutions and expertise: Grainger is developing specialized support and training for these high-growth verticals to address unique customer needs.

Question Marks represent business units or product lines with low market share in high-growth industries. Grainger's expansion into advanced digital MRO solutions, such as IoT sensors and digital twins, positions it as a Question Mark. While the digital MRO market is projected for robust growth, Grainger's current market penetration in these specific advanced areas is likely limited, necessitating significant investment to capture market share.

Similarly, Grainger's strategic focus on developing specialized MRO consulting and advanced services, alongside its ventures into nascent geographic markets, also aligns with the Question Mark category. These areas offer high growth potential but require substantial initial investment and strategic effort to build brand recognition and secure a competitive position.

The company's exploration of advanced safety and environmental compliance solutions, along with targeted investments in niche, high-growth industrial verticals like renewable energy maintenance and advanced robotics, further solidifies its Question Mark portfolio. These segments are characterized by strong market growth but demand specialized offerings and tailored strategies for Grainger to establish a significant market presence.

Grainger's strategic moves into these areas highlight a deliberate effort to tap into future growth opportunities, even if current market share is modest. The success of these Question Marks will depend on continued investment and effective execution to convert potential into market leadership.

| Business Area | Market Growth | Grainger Market Share | Strategic Focus |

|---|---|---|---|

| Digital MRO Solutions (IoT, Digital Twins) | High | Low to Moderate | Investment in technology development and adoption |

| Specialized MRO Consulting & Services | High | Low | Talent acquisition and customized solution development |

| Nascent Geographic Markets | High | Low | Brand building and distribution network establishment |

| Advanced Safety & Environmental Compliance | High | Low to Moderate | Product innovation and service expansion |

| Niche High-Growth Verticals (Renewables, Robotics) | High | Low | Specialized product offerings and tailored sales strategies |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.