Grainger Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grainger Bundle

Grainger's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business operating within or analyzing the industrial supply sector.

The complete report reveals the real forces shaping Grainger’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Grainger's extensive supplier base, exceeding 5,000 global partners, typically dilutes individual supplier bargaining power. This broad network ensures a wide availability of Maintenance, Repair, and Operations (MRO) products, making it difficult for any single supplier to exert significant leverage.

However, the dynamic shifts when considering highly specialized or proprietary components. In these niche markets, where only a few manufacturers possess the necessary expertise or intellectual property, supplier bargaining power can notably increase, allowing them to command higher prices or more favorable terms.

Grainger's immense scale, boasting over 30 million products globally, means many individual suppliers rely heavily on Grainger for a substantial portion of their sales. This creates a significant imbalance in bargaining power, with Grainger holding the upper hand.

In 2023, Grainger reported net sales of $15.2 billion, underscoring the sheer volume of goods they move. This vast purchasing power allows Grainger to negotiate favorable terms, pricing, and delivery schedules from its suppliers, effectively limiting the suppliers' ability to dictate terms.

While switching suppliers for common Maintenance, Repair, and Operations (MRO) products can be relatively straightforward, the landscape changes significantly for highly integrated systems or proprietary parts. In these instances, the costs and complexities associated with changing suppliers can escalate dramatically, creating a barrier for customers. This is particularly relevant for businesses relying on specialized components that are not easily interchangeable.

Grainger's approach of fostering strategic partnerships and cultivating long-term relationships with key manufacturers further solidifies its position. These established connections inherently reduce the likelihood and ease with which customers might consider switching. Consequently, Grainger benefits from more favorable terms and a more predictable supply chain, directly impacting its bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into distribution, essentially selling directly to customers and bypassing intermediaries like Grainger, is generally quite low for most Maintenance, Repair, and Operations (MRO) products. This is primarily because establishing and maintaining the complex logistics, vast inventory management systems, and dedicated customer service infrastructure needed to effectively serve a broad customer base is a significant undertaking.

However, there are instances where this threat becomes more pronounced. Larger, more established manufacturers might opt to sell directly to their very largest industrial clients. This direct-to-customer approach can be feasible for them, as it allows them to capture more of the value chain and potentially offer more tailored solutions to key accounts. For example, in 2024, some major industrial equipment manufacturers have been exploring direct sales models for their high-volume, standardized components to large automotive or aerospace manufacturers, aiming to streamline the supply chain.

- Low Threat for Most MRO: The significant investment in logistics, inventory, and customer service infrastructure required for broad MRO distribution acts as a substantial barrier to suppliers integrating forward.

- Manufacturer Direct Sales: A select few large manufacturers may bypass distributors for their largest clients, creating a direct sales channel.

- Example Scenario: In 2024, some leading industrial equipment producers have been piloting direct sales strategies for core components to major automotive clients.

Availability of Substitute Inputs

The availability of substitute inputs significantly weakens supplier bargaining power for Grainger. Given the vast array of Maintenance, Repair, and Operations (MRO) products Grainger offers, it frequently finds multiple suppliers and alternative product specifications for many items. This inherent diversification in its sourcing channels directly reduces its reliance on any single supplier.

This situation empowers Grainger to effectively mitigate supplier power. For instance, if a particular fastener supplier were to increase prices, Grainger could readily source similar fasteners from numerous other manufacturers or even explore slightly different but functionally equivalent specifications. This broad product catalog and supplier network, evidenced by Grainger's extensive product listings, means that a supplier's threat of withholding a critical input is often not a significant concern.

- Diversified Sourcing: Grainger's ability to source many MRO products from multiple vendors is a key strength.

- Product Substitution: The availability of alternative product specifications further dilutes individual supplier leverage.

- Reduced Dependence: Grainger's wide product range minimizes its dependence on any single supplier, enhancing its negotiating position.

- Mitigation Strategy: Diversifying sourcing channels is a core strategy for managing supplier power.

Grainger's extensive supplier base, exceeding 5,000 global partners, typically dilutes individual supplier bargaining power. This broad network ensures a wide availability of Maintenance, Repair, and Operations (MRO) products, making it difficult for any single supplier to exert significant leverage.

However, the dynamic shifts when considering highly specialized or proprietary components. In these niche markets, where only a few manufacturers possess the necessary expertise or intellectual property, supplier bargaining power can notably increase, allowing them to command higher prices or more favorable terms.

Grainger's immense scale, boasting over 30 million products globally, means many individual suppliers rely heavily on Grainger for a substantial portion of their sales. This creates a significant imbalance in bargaining power, with Grainger holding the upper hand.

In 2023, Grainger reported net sales of $15.2 billion, underscoring the sheer volume of goods they move. This vast purchasing power allows Grainger to negotiate favorable terms, pricing, and delivery schedules from its suppliers, effectively limiting the suppliers' ability to dictate terms.

| Factor | Grainger's Position | Impact on Supplier Bargaining Power |

| Supplier Concentration | High (5,000+ partners) | Low |

| Product Differentiation | Low for common MRO, High for specialized | Low for common, High for specialized |

| Customer Dependence on Supplier | Low for Grainger (due to scale) | Low |

| Switching Costs | Low for common MRO, High for integrated systems | Low for common, High for integrated |

| Threat of Forward Integration | Low for most MRO distributors | Low |

What is included in the product

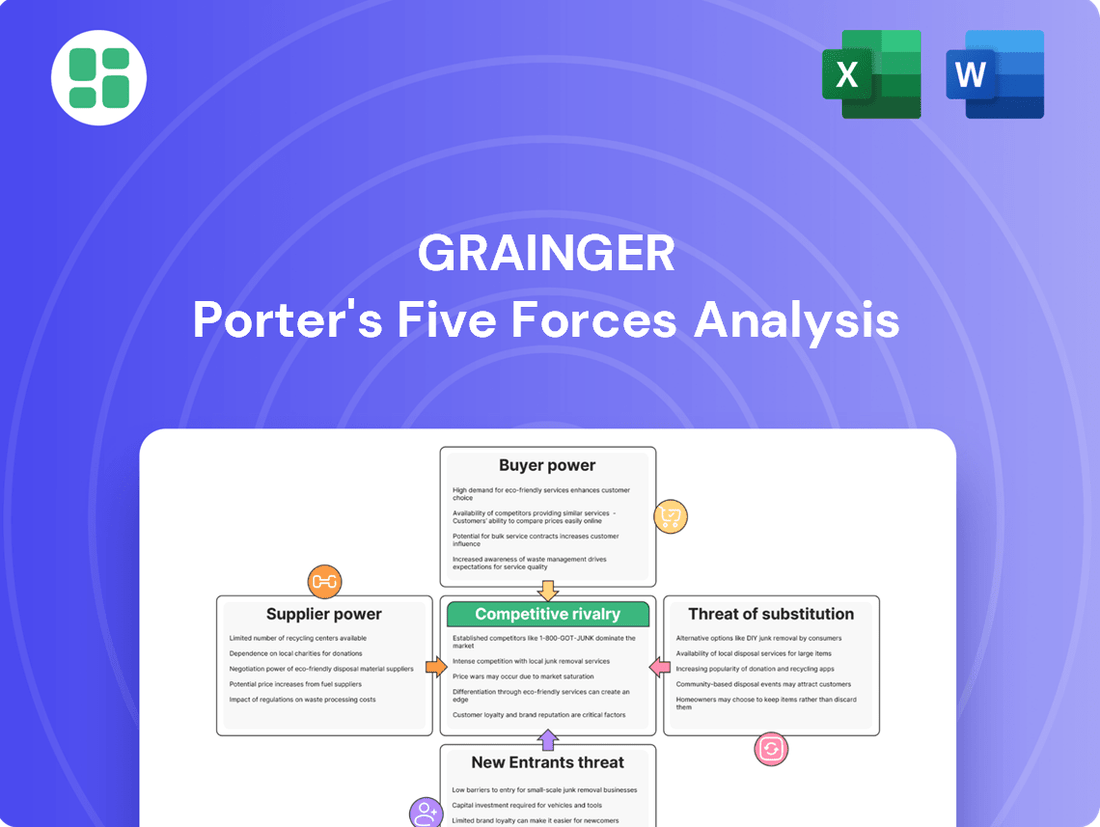

Grainger's Porter's Five Forces analysis dissects the competitive intensity within the industrial supply sector, evaluating threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and existing rivalry.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Grainger's vast customer base, exceeding 4.5 million globally, significantly dilutes individual customer bargaining power. This extensive reach across sectors like manufacturing, government, and healthcare means no single client represents a substantial portion of the company's overall revenue.

Customer switching costs are a key factor in understanding the bargaining power of customers. While some MRO products might seem easily switchable based on price alone, Grainger distinguishes itself through its extensive value-added services. These services, including sophisticated inventory management, expert technical support, and a vast product selection, build customer loyalty and make it less appealing to switch to competitors who offer a more limited, transactional experience.

Grainger's customers exhibit varying degrees of price sensitivity. Smaller businesses, often operating with tighter margins, tend to be more focused on securing the lowest possible prices for MRO supplies.

Conversely, larger industrial and institutional clients, representing a significant portion of Grainger's revenue, often place a higher premium on factors like product availability, consistent reliability, and specialized value-added services, such as inventory management solutions, even if it means a slightly higher unit cost.

For instance, Grainger's Endless Assortment segment, notably through its Zoro.com platform, is designed to appeal to a broader, more price-conscious customer base by offering an extensive selection of products, effectively catering to those prioritizing cost savings.

Customer Information and Transparency

The proliferation of e-commerce platforms has undeniably boosted price transparency and product information for buyers, a trend that generally amplifies their bargaining power. This shift means customers can more easily compare offerings across different suppliers, putting pressure on pricing.

Grainger counters this by offering a wealth of product data and specialized technical expertise, moving beyond a purely price-driven comparison. Their commitment to customer support further differentiates their value proposition, making them more than just a transactional supplier.

- Increased Price Transparency: Online marketplaces allow for easy price comparison, putting pressure on suppliers.

- Information Abundance: Customers have access to more product details and reviews than ever before.

- Grainger's Differentiation: Extensive product data and technical support elevate Grainger beyond simple price competition.

- Value Beyond Price: Customer support and expertise build loyalty and reduce the impact of price-based bargaining.

Threat of Backward Integration by Customers

The threat of customers performing their own MRO distribution is generally low. This is because establishing a robust MRO supply chain demands significant capital, intricate logistics, and substantial economies of scale, making it impractical for most. For instance, in 2023, the average MRO inventory management cost for a mid-sized manufacturing firm could easily run into millions of dollars, a prohibitive barrier for many.

Only the very largest enterprises might contemplate backward integration for a select portion of their MRO requirements. These giants, with their vast purchasing power and existing infrastructure, could potentially achieve some cost savings. However, even for them, the complexity of managing a diverse MRO catalog often outweighs the benefits compared to outsourcing to specialists like Grainger.

- Complexity of MRO Supply Chains: Managing thousands of SKUs, ensuring timely delivery, and maintaining quality control across diverse product categories is a significant undertaking.

- Capital Investment: Setting up warehouses, logistics networks, and inventory management systems requires substantial upfront capital, often in the tens of millions for large-scale operations.

- Economies of Scale: Established MRO distributors benefit from bulk purchasing and efficient distribution, creating cost advantages that are difficult for individual companies to replicate.

- Focus on Core Competencies: Most businesses prefer to concentrate on their primary operations rather than diverting resources and management attention to MRO distribution.

Grainger's extensive customer base, numbering over 4.5 million globally, significantly dilutes individual customer bargaining power. This broad reach across sectors like manufacturing, government, and healthcare means no single client typically represents a disproportionately large share of the company's revenue, limiting their leverage.

While some MRO products can be easily switched based on price, Grainger differentiates itself through value-added services. These offerings, including advanced inventory management, technical support, and a vast product selection, foster customer loyalty and reduce the incentive to switch to competitors with less comprehensive service models.

Customer price sensitivity varies; smaller businesses often prioritize lower prices, while larger industrial clients value product availability, reliability, and specialized services like inventory management, even at a slightly higher cost.

The rise of e-commerce has increased price transparency and product information, generally enhancing customer bargaining power by facilitating easier comparisons. Grainger counters this by providing extensive product data and technical expertise, moving beyond simple price competition to offer a more robust value proposition.

| Factor | Grainger's Position | Impact on Customer Bargaining Power |

| Customer Concentration | Vast, diversified customer base (4.5M+) | Lowers individual customer leverage |

| Switching Costs | High due to value-added services (inventory management, tech support) | Increases customer stickiness, reduces price-based switching |

| Price Sensitivity | Varies by customer segment (smaller businesses more price-sensitive) | Moderate, but often offset by service value for larger clients |

| Information Availability | High due to e-commerce, but countered by Grainger's data/expertise | Potentially increases power, but Grainger mitigates with differentiated value |

| Threat of Backward Integration | Low due to capital, logistics, and scale requirements | Minimal threat; customers find it impractical to self-distribute MRO |

Same Document Delivered

Grainger Porter's Five Forces Analysis

This preview shows the exact Grainger Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive examination of competitive forces within the industrial supply industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, offering valuable strategic intelligence without any surprises.

Rivalry Among Competitors

Grainger operates in a highly competitive and fragmented MRO distribution market. The company contends with a broad array of rivals, from large national players like Fastenal and MSC Industrial Supply, which also offer extensive product lines and services, to smaller, specialized niche distributors focusing on specific industries or product categories.

The rise of online retail has further intensified this rivalry, with platforms like Amazon Business emerging as significant competitors, offering convenience and often competitive pricing. This diverse competitive environment demands constant innovation and strategic differentiation for Grainger to maintain its market position.

The overall MRO distribution market is projected to grow at a healthy CAGR of around 2.80% between 2024 and 2034. This steady growth, while positive, indicates that competition for market share remains quite intense among established players and emerging companies alike.

A moderately growing market often serves to intensify rivalry. Companies are motivated to aggressively pursue new customers and retain existing ones to secure a larger piece of the expanding market pie.

Grainger distinguishes itself in the often commoditized MRO market through its 'High-Touch Solutions' approach. This involves providing essential services like expert technical support, tailored inventory management, and fostering deep, lasting customer relationships. This strategy effectively moves the competitive battleground away from pure price wars.

Complementing its service-oriented model, Grainger's 'Endless Assortment' strategy broadens product accessibility, ensuring customers can find a vast array of MRO items. For instance, in 2023, Grainger's total sales reached $15.2 billion, with a significant portion driven by these differentiated offerings that build customer loyalty and reduce reliance on price as the primary purchasing factor.

Exit Barriers

MRO distributors face substantial exit barriers due to significant capital tied up in extensive distribution networks, sophisticated inventory management systems, and advanced technology platforms. For instance, in 2024, major players like Grainger continued to invest heavily in their supply chain infrastructure, with capital expenditures often running into hundreds of millions of dollars annually to maintain and upgrade these essential assets.

Established, long-term customer relationships also act as a powerful deterrent to exiting the market. These relationships are built on trust, reliability, and tailored service, making it difficult for new entrants to displace incumbents and equally challenging for existing firms to divest without significant loss. This sticky customer base means companies are more likely to endure competitive pressures rather than abandon their market position.

These high exit barriers can foster prolonged periods of intense competition. Companies may feel compelled to remain in the market and fight for every percentage point of market share, even in challenging economic conditions, rather than incur the substantial costs and potential losses associated with exiting. This dynamic can lead to price wars and aggressive customer acquisition strategies among MRO distributors.

- High Capital Investments: MRO distributors require substantial capital for distribution centers, inventory, and technology.

- Established Customer Relationships: Long-term, trust-based customer ties make market exit difficult.

- Prolonged Competition: High exit barriers incentivize firms to stay and compete rather than leave.

Market Concentration

The MRO (Maintenance, Repair, and Operations) market, while appearing fragmented, shows notable concentration at the highest echelons. Grainger, for instance, commands a substantial portion of this market, underscoring the significant sway of leading players. For example, in 2023, Grainger reported net sales of $17.2 billion, highlighting its dominant position.

Despite this top-tier concentration, the market is populated by a vast number of smaller, specialized competitors. This extensive competitive landscape ensures robust pressure across a wide array of product categories and customer segments. The presence of these numerous smaller entities prevents any single large player from achieving unchecked market dominance, thereby maintaining a dynamic competitive environment.

- Market Share Concentration: Leading MRO distributors like Grainger hold significant market share, with Grainger's 2023 net sales reaching $17.2 billion.

- Fragmented Nature: The market contains a large number of smaller, specialized competitors.

- Competitive Pressure: The sheer volume of competitors maintains high competitive pressure across various product lines and customer groups.

- Dynamic Environment: The mix of large players and numerous smaller ones creates a constantly shifting competitive landscape.

Competitive rivalry in the MRO distribution sector is intense, driven by a mix of large national distributors, specialized niche players, and the growing influence of online marketplaces. Companies like Fastenal and MSC Industrial Supply compete directly with Grainger, while platforms such as Amazon Business are increasingly important. This broad competitive base means that differentiation through service, product breadth, and customer relationships, as exemplified by Grainger's $15.2 billion in sales in 2023, is crucial for maintaining market position.

High exit barriers, including substantial investments in distribution networks and technology, alongside entrenched customer relationships, keep firms engaged in prolonged competition. This dynamic can lead to aggressive strategies as companies strive to capture market share in a moderately growing market, projected to expand at a 2.80% CAGR from 2024 to 2034. For instance, Grainger’s continued heavy investment in its supply chain infrastructure in 2024 underscores these high capital requirements.

While Grainger holds a significant market share, evidenced by its $17.2 billion in net sales in 2023, the market's fragmentation with numerous smaller competitors ensures persistent competitive pressure. This blend of concentrated leadership and widespread smaller players creates a dynamic environment where continuous innovation and strategic positioning are essential for sustained success.

| Key Competitors | Grainger's 2023 Net Sales | Market Growth Projection (2024-2034) | Grainger's Competitive Strategy |

| Fastenal, MSC Industrial Supply, Amazon Business | $17.2 billion | 2.80% CAGR | High-Touch Solutions, Endless Assortment |

| Niche Distributors |

SSubstitutes Threaten

Large customers, particularly those with significant MRO (Maintenance, Repair, and Operations) spending, might explore direct sourcing from manufacturers to reduce costs. This is especially true for high-volume or custom-specification items where a direct relationship could yield better pricing or terms. For instance, a major manufacturing plant might negotiate directly with a fastener producer for its bulk requirements, bypassing traditional distributors.

However, the complexity of managing numerous individual supplier relationships, handling procurement for a wide array of product categories, and dealing with fragmented logistics often acts as a significant barrier. Grainger's extensive product catalog and established supply chain infrastructure provide a consolidated solution that many customers find more efficient and cost-effective than building their own direct sourcing network. In 2024, Grainger reported serving over 5 million customers, highlighting the value proposition of its broad offering and streamlined procurement process.

Businesses increasingly consider in-house maintenance and repair operations as a viable alternative to relying on external MRO (Maintenance, Repair, and Operations) product distributors like Grainger. This trend is driven by a desire to control costs and streamline operations, especially for more common or routine maintenance tasks. For instance, a large manufacturing plant might decide to build its own internal capacity for managing its spare parts inventory and performing basic equipment upkeep, thereby reducing its dependence on third-party suppliers for these needs.

However, the feasibility of this substitution is not uniform across all business needs. While in-house teams can effectively handle routine tasks such as replacing filters or performing basic lubrication, they often lack the specialized expertise, tools, or extensive product knowledge required for servicing complex machinery or sourcing a wide array of specialized components. In 2024, many companies found that while they could manage 60% of their MRO needs internally, the remaining 40% still necessitated external specialists and a broad product catalog, highlighting the limitations of a purely in-house approach.

The threat of substitutes for Grainger's traditional MRO (Maintenance, Repair, and Operations) products is growing, particularly with the rise of advanced technologies. Predictive maintenance, powered by AI and IoT sensors, is a key substitute. For instance, in 2024, investments in industrial AI are projected to reach over $20 billion, enabling companies to anticipate equipment failures rather than simply reacting to them. This proactive approach directly reduces the demand for the very replacement parts Grainger typically supplies.

Digital Marketplaces and E-commerce Pure-Plays

The rise of digital marketplaces and e-commerce pure-plays presents a significant threat of substitutes for traditional MRO distributors like Grainger. Platforms such as Amazon Business, Zoro, and Fastenal's online presence provide customers with readily available alternatives for sourcing maintenance, repair, and operating supplies. This shift is driven by convenience, competitive pricing, and an ever-expanding product selection that can rival or even surpass the offerings of established players.

These online channels make it easier than ever for customers to compare prices and find alternative suppliers, especially for standardized or commoditized MRO items. For instance, Amazon Business reported substantial growth in its B2B segment, with sales in 2023 reaching hundreds of billions of dollars, showcasing the immense scale and reach of these digital alternatives. This accessibility directly erodes the switching costs for customers, making them more prone to explore and adopt these new purchasing avenues.

- Digital Marketplaces: Platforms like Amazon Business offer a vast array of MRO products, often at competitive price points, directly challenging traditional distributors.

- E-commerce Pure-Plays: Companies operating solely online can achieve lower overheads, translating into price advantages for customers.

- Increased Accessibility: The internet has dramatically lowered the barriers to entry for new suppliers, making it simpler for customers to discover and switch to alternative MRO sources.

- Commoditization: For many standard MRO items, the differentiation between suppliers diminishes, making price and availability on digital platforms the primary decision factors.

Product-as-a-Service Models

The rise of product-as-a-service (PaaS) models presents a significant threat to traditional MRO (Maintenance, Repair, and Operations) product sales. In this evolving landscape, customers increasingly prioritize paying for the functionality or uptime of equipment rather than outright ownership and the associated maintenance responsibilities. This shift directly impacts demand for MRO products as the onus of upkeep transfers to the service provider.

This new paradigm can diminish the traditional role of MRO distributors. When a customer subscribes to a service that guarantees equipment performance, the distributor’s core business of selling spare parts and consumables for that equipment is bypassed. For instance, a manufacturing plant opting for a guaranteed uptime contract on its machinery effectively outsources its maintenance needs, reducing its direct procurement of MRO items.

Consider the industrial equipment sector, where PaaS adoption is accelerating. Companies are moving from purchasing heavy machinery to leasing it with comprehensive maintenance packages. This means the leasing company, not the end-user, becomes the primary purchaser of replacement parts and maintenance services. This trend is projected to continue, with the global PaaS market expected to grow substantially in the coming years, impacting traditional sales channels.

- Shift in Customer Value: Customers prioritize guaranteed performance and functionality over asset ownership.

- Reduced MRO Demand: Direct sales of MRO products may decline as maintenance is bundled into service contracts.

- Role of Distributors: MRO distributors face disintermediation as service providers manage parts and upkeep.

- Market Growth: The PaaS market is expanding, indicating a sustained threat to traditional MRO sales models.

The threat of substitutes for MRO (Maintenance, Repair, and Operations) products is multifaceted, encompassing direct sourcing, in-house capabilities, and evolving service models. Digital marketplaces and product-as-a-service (PaaS) are particularly potent substitutes, offering convenience, cost savings, and a shift in customer value from ownership to performance. These trends are reshaping how businesses procure essential operational supplies.

| Substitute Type | Description | Impact on Grainger | Example/Data Point (2024) |

|---|---|---|---|

| Digital Marketplaces | Online platforms offering broad product selection and competitive pricing. | Increased price pressure, potential loss of market share for commoditized items. | Amazon Business sales in B2B segment reaching hundreds of billions in 2023. |

| In-house Operations | Companies managing their own MRO procurement and maintenance. | Reduced demand for external distributors, especially for common items. | Many companies manage 60% of MRO needs internally, but still require external specialists. |

| Product-as-a-Service (PaaS) | Customers pay for equipment functionality/uptime rather than ownership. | Disintermediation of MRO sales as service providers handle parts and upkeep. | Growing adoption in industrial equipment sector, shifting MRO purchases to leasing companies. |

| Predictive Maintenance | Using AI/IoT to anticipate equipment failures and reduce reactive part replacement. | Lower demand for replacement parts, shifting focus to proactive solutions. | Industrial AI investments projected to exceed $20 billion in 2024. |

Entrants Threaten

Entering the broad-line MRO (Maintenance, Repair, and Operations) distribution market, like the one Grainger operates in, demands significant upfront capital. We're talking about investing heavily in maintaining a wide variety of inventory, building and operating a widespread network of distribution centers, and developing advanced logistics systems to get products to customers efficiently. These substantial capital requirements act as a significant hurdle, discouraging many potential new players from even attempting to enter the market.

Established players in industrial supply, like Grainger, leverage substantial economies of scale. This means they get better prices on bulk purchases, operate more efficient warehouses, and have optimized distribution networks, giving them a significant cost advantage. For instance, in 2023, Grainger reported net sales of $15.2 billion, indicative of the sheer volume they manage.

New entrants would find it incredibly difficult to replicate these cost efficiencies. Without the existing infrastructure and massive purchasing power, they would likely face higher per-unit costs, making it challenging to compete on price with established giants. This barrier is a primary reason why the threat of new entrants in this sector is generally considered moderate to low.

Grainger has built significant customer loyalty through its extensive value-added services, making it difficult for new players to gain traction. These services, ranging from inventory management to technical support, foster deep relationships that are hard for competitors to replicate. For example, Grainger's commitment to providing tailored solutions, not just parts, strengthens its hold on its customer base.

The switching costs for Grainger's customers are substantial, encompassing not only the financial expense of finding and onboarding a new supplier but also the disruption to established operational processes. Customers rely on Grainger's proven reliability and integrated systems, which represent a considerable barrier to entry for any newcomer aiming to capture market share in 2024.

Supply Chain Complexity and Relationships

The intricate nature of building and maintaining a global supply chain for millions of maintenance, repair, and operations (MRO) products presents a formidable hurdle for new competitors. Grainger, for instance, has spent decades cultivating relationships with thousands of suppliers worldwide, ensuring product availability and competitive pricing.

These deeply entrenched supplier relationships and the sophisticated logistics networks required to manage them act as significant barriers to entry. New entrants would face immense challenges in replicating Grainger's established supply chain infrastructure, which is crucial for efficient sourcing and timely delivery.

- Established Supplier Networks: Grainger's extensive network of suppliers, built over many years, provides access to a vast array of MRO products, often with preferential terms.

- Logistical Expertise: Managing a complex global supply chain involves significant investment in warehousing, transportation, and inventory management systems, areas where incumbents have a distinct advantage.

- Economies of Scale: Larger players benefit from economies of scale in procurement and distribution, allowing them to offer more competitive pricing than a new entrant might initially be able to achieve.

Regulatory and Compliance Hurdles

The threat of new entrants in the MRO (Maintenance, Repair, and Operations) sector is significantly influenced by regulatory and compliance hurdles. Certain product categories, particularly those involving safety equipment or highly specialized industrial components, are governed by stringent regulations and compliance standards. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to enforce rigorous safety standards for personal protective equipment (PPE), requiring extensive testing and certification for manufacturers.

Navigating these complex regulatory landscapes presents a substantial barrier for new companies aiming to enter the market. These requirements often necessitate significant investment in product development, testing, and quality control processes. For example, compliance with standards like ISO 9001 for quality management or specific industry certifications can add considerable time and expense to a new entrant's launch.

- Safety Equipment Standards: Compliance with regulations like those from ANSI (American National Standards Institute) for safety glasses or fall protection equipment is mandatory, adding to R&D and certification costs.

- Environmental Regulations: Disposal and handling of certain industrial chemicals or materials are subject to EPA (Environmental Protection Agency) guidelines, impacting product formulation and supply chain management.

- Industry-Specific Certifications: Sectors like aerospace or medical device manufacturing require specialized certifications, such as AS9100 or ISO 13485, which are costly and time-consuming to obtain.

The threat of new entrants into the broad-line MRO distribution market is generally considered low to moderate. High capital requirements for inventory and logistics, coupled with established players' economies of scale, create significant barriers. Customer loyalty and high switching costs further solidify the positions of incumbents like Grainger.

New entrants would struggle to match the cost efficiencies derived from Grainger's $15.2 billion in net sales in 2023. Replicating their vast supplier networks and logistical expertise, honed over decades, presents a formidable challenge.

Regulatory compliance, especially concerning safety equipment, adds another layer of difficulty. For example, in 2024, adhering to OSHA standards for PPE requires substantial investment in testing and certification, making market entry costly.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Significant investment in inventory, distribution centers, and logistics systems. | High barrier, requiring substantial funding. |

| Economies of Scale | Cost advantages from large-scale procurement and operations. Grainger's 2023 net sales of $15.2B illustrate this. | New entrants face higher per-unit costs. |

| Customer Loyalty & Switching Costs | Established relationships and integrated systems make switching difficult. | Challenging to attract and retain customers. |

| Regulatory Compliance | Adherence to safety (e.g., OSHA PPE standards in 2024) and industry-specific certifications. | Increases R&D, testing, and certification expenses. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grainger is built upon a robust foundation of data, incorporating financial statements, annual reports, and investor presentations from Grainger and its key competitors. We also leverage industry-specific market research reports and data from reputable business intelligence platforms to capture current market dynamics.