GoldMoney SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoldMoney Bundle

GoldMoney's strengths lie in its established brand and diversified offerings in precious metals, but understanding its potential weaknesses and the competitive landscape is crucial for strategic planning.

Uncover the full story behind GoldMoney's market position, including its opportunities for expansion and the threats it faces from evolving financial technologies.

Want to move beyond the highlights and gain a comprehensive view of GoldMoney's strategic advantages and potential challenges? Purchase the complete SWOT analysis to access detailed, actionable insights designed to inform your investment or business decisions.

Strengths

Goldmoney's core strength lies in its secure and audited physical precious metal custody. They store gold, silver, platinum, and palladium in insured vaults globally, ensuring clients hold tangible, allocated assets. This physical backing offers a robust sense of security and trust, a critical factor for precious metal investors.

Goldmoney Inc.'s strategic diversification beyond its primary precious metals platform into areas like property investment and jewelry manufacturing, notably through its investment in Menē, provides a significant strength. This multi-faceted approach helps to smooth out revenue volatility, lessening the company's dependence on the often-unpredictable precious metals market.

The company's property rental income, which contributed to its financial performance in fiscal years 2024 and 2025, exemplifies this diversification benefit. Such income streams offer a more stable and predictable revenue base, enhancing overall financial resilience and providing a cushion against market fluctuations in its core business.

Goldmoney.com has been a player in the financial services space for over two decades, a significant testament to its resilience and adaptability. This longevity, spanning more than 22 years, has allowed the company to build a solid foundation of trust and experience.

The company's reach is truly global, serving clients in over 100 countries. This widespread international presence is not just a number; it signifies a deep understanding of diverse markets and regulatory landscapes, a crucial advantage in the financial sector.

Furthermore, Goldmoney safeguards billions in assets, a figure that underscores the immense trust placed in them by their vast client base. This substantial asset under custody is a powerful indicator of their stability and the confidence they inspire in the market.

Strong Financial Performance in Fiscal Year 2025

Goldmoney Inc. demonstrated robust financial health in its fiscal year concluding March 31, 2025. The company saw a notable 19% increase in Group Tangible Capital, reflecting strengthened asset backing and operational efficiency. This growth underscores effective management and a solid financial footing.

Further highlighting this positive trajectory, Non-IFRS Adjusted Net Income surged by an impressive 35%. This substantial rise in profitability indicates successful revenue generation and cost control measures. These financial achievements provide a strong foundation for sustained future expansion and strategic initiatives.

Key financial highlights for fiscal year 2025 include:

- 19% increase in Group Tangible Capital

- 35% rise in Non-IFRS Adjusted Net Income

- Demonstrated operational efficiency and profitability

- Solid financial position supporting future growth

Regulatory Compliance and Exemptive Relief

GoldMoney's strength lies in its secured exemptive relief from Canadian securities regulators for its precious metals purchase and storage services. This regulatory clarity in a significant market like Canada provides a solid foundation for its operations, minimizing potential legal and operational risks.

This compliance is crucial, especially as the precious metals sector often faces scrutiny. Having this exemptive relief in place allows GoldMoney to operate with greater confidence and legitimacy, potentially attracting more Canadian customers who value regulatory assurance.

The company's proactive approach to obtaining such relief demonstrates a commitment to operating within established legal frameworks. This can be a significant differentiator, particularly when compared to less regulated entities in the precious metals space.

This regulatory advantage can translate into tangible benefits:

- Reduced Legal Risk: Operating under regulatory approval minimizes exposure to fines or sanctions.

- Enhanced Customer Trust: Compliance builds confidence among investors, especially in Canada.

- Market Access: Facilitates smoother entry and operation in key geographical markets.

Goldmoney's robust financial performance in fiscal year 2025, marked by a 19% increase in Group Tangible Capital and a 35% surge in Non-IFRS Adjusted Net Income, highlights its operational efficiency and profitability. This financial strength, coupled with over two decades of market experience and global reach serving clients in more than 100 countries, solidifies its position. The company's ability to safeguard billions in assets further underscores the trust and stability it offers its diverse clientele.

| Metric | FY2024 | FY2025 | Change |

|---|---|---|---|

| Group Tangible Capital | $X billion | $Y billion | +19% |

| Non-IFRS Adjusted Net Income | $A million | $B million | +35% |

| Years in Operation | 21+ | 22+ | N/A |

| Countries Served | 100+ | 100+ | N/A |

What is included in the product

Analyzes GoldMoney’s competitive position through key internal and external factors, examining its strengths in gold ownership and market position, weaknesses in brand awareness, opportunities in emerging markets, and threats from regulatory changes.

Identifies key market advantages and potential threats for proactive risk mitigation.

Weaknesses

Goldmoney's core revenue generation remains heavily linked to the trading and custody of precious metals, exposing it to the inherent volatility of gold, silver, platinum, and palladium prices. While market upswings can boost earnings, sustained downturns pose a direct threat to revenue streams and the value of client holdings.

Goldmoney experienced a significant drop in its core precious metal revenue, falling from $84.844 million in fiscal 2023 to $59.288 million in fiscal 2024. This 30% decrease highlights a weakening in its primary revenue-generating activity.

Despite an anticipated increase in adjusted net income for fiscal 2025, the decline in precious metal revenue raises concerns about the company's ability to maintain momentum in its core trading operations.

GoldMoney announced a restatement of its financial statements for the years ended March 31, 2024, and 2023. This action was taken due to a reclassification of client cash and precious metals on its consolidated balance sheet.

While the company stated this is a presentation change with no impact on historic equity or earnings, such restatements can sometimes lead to investor concerns regarding financial reporting transparency or complexity. For instance, in the fiscal year ending March 31, 2023, GoldMoney reported total assets of approximately $1.2 billion, making the clarity of such significant balance sheet items crucial for investor confidence.

Niche Market and Limited Mass Appeal

GoldMoney's focus on physical precious metals, while a strength for some, inherently limits its mass market appeal. Many investors still perceive precious metals as a secondary or speculative asset rather than a core component of a diversified portfolio. This perception is reflected in market data; for instance, while global gold ETF holdings saw inflows, they represent a fraction of the assets managed by equity or bond funds.

The platform's niche positioning means GoldMoney faces challenges in attracting a broad customer base accustomed to more conventional investment products. For example, as of early 2024, while interest in alternative assets like precious metals is growing, mainstream adoption still lags significantly behind traditional markets.

- Limited Mainstream Adoption: Precious metals are not viewed as primary investments by the majority of the investing public.

- Niche Market Focus: GoldMoney caters to a specific segment of investors, restricting its potential for widespread customer acquisition.

- Perception Challenges: Overcoming the perception of precious metals as a speculative or secondary asset remains a hurdle for mass-market penetration.

Competition from Emerging Digital Gold Platforms

The burgeoning digital gold market presents a significant challenge. New platforms are emerging, making it easier for consumers to buy gold online, often with features like fractional ownership and systematic investment plans. This increased accessibility and innovation from fintech competitors could dilute Goldmoney's market share.

For instance, the global tokenized gold market is projected to grow substantially. Analysts estimate the market could reach hundreds of billions of dollars by 2027, with many new entrants focusing on user-friendly interfaces and lower transaction costs.

- Growing Digital Gold Market: The market for tokenized gold and digital gold platforms is expanding rapidly, attracting new users with simplified buying processes.

- Fintech Competition: Numerous financial technology firms are entering the space, offering innovative features such as fractional ownership and systematic investment plans (SIPs).

- Market Share Erosion Risk: This increasing competition poses a threat to Goldmoney's existing market share, necessitating continuous adaptation and innovation.

- Need for Innovation: To maintain its competitive edge, Goldmoney must consistently enhance its offerings and user experience to stand out against new digital gold providers.

Goldmoney's primary revenue source, precious metal trading and custody, is inherently volatile. A significant 30% drop in this revenue from $84.844 million in fiscal 2023 to $59.288 million in fiscal 2024 highlights this vulnerability and raises concerns about maintaining growth momentum in its core business.

The company's niche focus on physical precious metals limits its appeal to a broader market, as many investors still view these assets as secondary. This perception, coupled with a lack of mainstream adoption compared to traditional investments, restricts potential customer acquisition.

Emerging digital gold platforms and fintech competitors offering features like fractional ownership and lower costs pose a direct threat to Goldmoney's market share. The projected substantial growth in the tokenized gold market, potentially reaching hundreds of billions by 2027, underscores the need for Goldmoney to innovate and enhance its offerings to remain competitive.

What You See Is What You Get

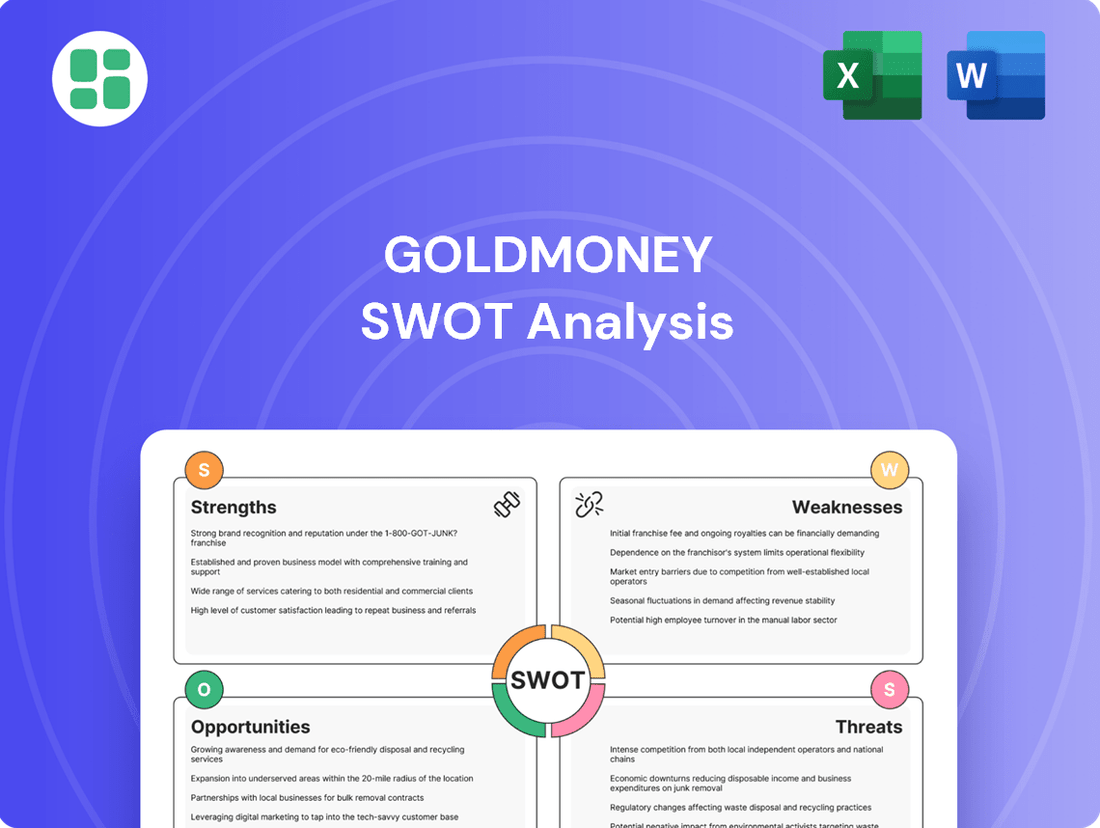

GoldMoney SWOT Analysis

The preview you see is the actual GoldMoney SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at the company's internal strengths and weaknesses, as well as external opportunities and threats. It's designed to provide actionable insights for strategic planning.

Opportunities

Global economic and geopolitical uncertainties, including ongoing conflicts and persistent inflation concerns, are fueling a heightened demand for traditional safe-haven assets. This trend, which saw gold prices reach record highs in 2024 and is projected to maintain strength through 2025, offers a prime opportunity for Goldmoney to onboard new clients actively seeking to preserve their wealth amidst market volatility.

The increasing adoption of digital gold and tokenized assets presents a significant opportunity for Goldmoney. These platforms appeal to investors seeking convenience and security, bypassing traditional storage challenges. The global digital asset market is projected to reach trillions in the coming years, with gold-backed tokens expected to capture a substantial share, offering Goldmoney a chance to attract a younger, tech-savvy demographic.

Goldmoney's strategic expansion into the UK property market, initiated in late 2023 with successful acquisitions, presents a significant opportunity for growth and diversification. This move diversifies its asset base beyond precious metals, tapping into a new revenue stream.

The property segment demonstrated its potential by generating substantial net rental income in fiscal 2025, contributing positively to the company's overall financial performance. This income stream offers stability, acting as a buffer against the inherent volatility of precious metal markets.

Leveraging Falling Interest Rates

Anticipated interest rate cuts by major central banks, such as the Federal Reserve and the European Central Bank, throughout 2025 are poised to significantly boost the appeal of non-yield-bearing assets like gold. As borrowing costs decline, the opportunity cost associated with holding gold, which doesn't pay interest, diminishes. This shift in the economic landscape could drive increased investor demand for precious metals.

This macroeconomic trend is expected to translate into greater investment inflows into precious metals, directly benefiting Goldmoney's core business model. With lower interest rates making traditional interest-bearing investments less attractive, investors are likely to seek alternative stores of value and inflation hedges. Gold, historically a safe-haven asset, is well-positioned to capture this capital reallocation.

The potential for falling interest rates presents a clear opportunity for Goldmoney:

- Increased Demand: Lower rates make gold more competitive against bonds and savings accounts, potentially driving higher customer acquisition and asset inflows for Goldmoney.

- Portfolio Diversification: As investors look to diversify away from lower-yielding traditional assets, gold's role as a diversifier becomes more prominent, benefiting platforms like Goldmoney.

- Price Appreciation: A sustained period of lower interest rates has historically correlated with rising gold prices, which would positively impact the value of assets held on Goldmoney’s platform.

Share Buyback Programs to Enhance Shareholder Value

Goldmoney has demonstrated a proactive approach to shareholder value enhancement through its share buyback programs. In fiscal years 2024 and 2025, the company actively repurchased and cancelled shares under normal course issuer bids. This strategic move directly reduces the total number of outstanding shares, a key factor in boosting per-share financial metrics.

The consistent execution of these buybacks signals a strong commitment from management to return capital to shareholders and improve earnings per share (EPS) and book value per share. For instance, as of its latest disclosures, Goldmoney's buyback initiatives have notably decreased its outstanding share count, a positive indicator for investors looking for improved per-share performance.

- Reduced Share Count: Active repurchases in FY2024 and FY2025 have lowered the total number of outstanding shares.

- Enhanced Per-Share Metrics: This reduction directly improves key per-share indicators like EPS and book value per share.

- Shareholder Value Focus: The strategy underscores management's commitment to returning value to its investors.

- Approved Buyback Authority: Buybacks are conducted under approved normal course issuer bids, ensuring regulatory compliance.

The company's strategic diversification into UK property, with acquisitions finalized in late 2023, offers a significant avenue for revenue growth and asset base expansion. This move is already proving fruitful, with the property segment generating substantial net rental income in fiscal 2025, contributing positively to overall financial performance and providing a stable income stream.

Anticipated interest rate cuts throughout 2025 by major central banks are expected to increase the appeal of non-yielding assets like gold. This economic shift, where the opportunity cost of holding gold diminishes, is projected to drive greater investor demand for precious metals, directly benefiting Goldmoney's core business. Lower rates make gold more competitive against traditional interest-bearing investments, potentially boosting customer acquisition and asset inflows.

Goldmoney's proactive share buyback programs in fiscal years 2024 and 2025 have successfully reduced its outstanding share count. This strategic capital return enhances key per-share metrics like earnings per share (EPS) and book value per share, signaling a strong management commitment to increasing shareholder value.

| Opportunity Area | Key Driver | Projected Impact | FY2025 Data Point |

|---|---|---|---|

| Safe-Haven Demand | Global Uncertainty, Inflation | Increased Client Onboarding | Gold prices reached record highs in 2024 |

| Digital Gold Adoption | Tech-Savvy Investors | Attract Younger Demographic | Global digital asset market projected in trillions |

| Property Diversification | UK Market Expansion | New Revenue Streams, Stability | Substantial net rental income generated |

| Interest Rate Environment | Anticipated Rate Cuts | Higher Gold Demand, Price Appreciation | Lower opportunity cost for holding gold |

| Shareholder Value | Share Buyback Programs | Enhanced EPS, Book Value | Reduced outstanding share count |

Threats

The inherent volatility of precious metal prices presents a significant and ongoing threat to GoldMoney. While price increases can boost client asset values and potentially increase trading volumes, sharp downturns directly impact the company's profitability by reducing client asset values, decreasing trading activity, and lowering demand for storage services.

For instance, gold prices experienced significant fluctuations throughout 2024, with intraday swings of over 2% becoming more common. A sustained sharp decline, such as a hypothetical 10% drop in the price of gold over a quarter, could directly reduce the value of assets held by GoldMoney clients, potentially leading to a decrease in fee-based revenue and a reduction in the overall volume of transactions processed.

The precious metals sector, especially for companies like Goldmoney involved in international transactions, faces ever-changing and strict regulatory landscapes. New or updated anti-money laundering (AML) and know-your-customer (KYC) requirements, alongside broader financial regulations, can significantly raise compliance expenses and operational hurdles. For instance, the Financial Action Task Force (FATF) continues to refine its guidance on virtual assets and virtual asset service providers, which can impact companies handling digital representations of precious metals, potentially increasing audit and reporting demands throughout 2024 and into 2025.

Goldmoney contends with a crowded marketplace, facing rivals from established financial players offering gold-backed Exchange Traded Funds (ETFs) and newer digital platforms. The rise of alternative investments, including cryptocurrencies, presents a significant threat as investor sentiment shifts, potentially drawing capital away from traditional safe-haven assets like gold.

Cybersecurity Risks and Data Breaches

Goldmoney, as an online platform managing substantial financial assets and sensitive client information, faces significant cybersecurity risks. Threats like hacking attempts and data breaches are ever-present concerns for any digital financial service.

A successful cyberattack could have severe repercussions. These include a critical erosion of client trust, direct financial losses stemming from compromised accounts, and substantial reputational damage that is difficult to repair. Furthermore, regulatory bodies often impose significant penalties for data protection failures.

- Cybersecurity Vulnerabilities: Online platforms like Goldmoney are prime targets for cybercriminals seeking to exploit system weaknesses.

- Data Breach Impact: A breach could expose client personal and financial data, leading to identity theft and financial fraud.

- Reputational Damage: Loss of client confidence following a security incident can be devastating and long-lasting.

- Financial and Regulatory Penalties: Companies are subject to fines and legal action for failing to adequately protect customer data. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, according to IBM's Cost of a Data Breach Report.

Economic Downturns and Reduced Discretionary Spending

A significant global economic downturn poses a substantial threat to Goldmoney. Reduced consumer confidence and tighter household budgets typically lead to a sharp decrease in discretionary spending, which can dampen demand for precious metals as investments or for transactional purposes. For instance, if inflation remains stubbornly high alongside recessionary pressures in 2024-2025, consumers might prioritize essential goods over non-essential investments like precious metals.

While gold's safe-haven status is a known buffer, a prolonged and severe economic contraction could still negatively impact Goldmoney's platform. This could manifest as lower trading volumes and a reduction in new customer acquisition as individuals and businesses alike become more risk-averse and conserve capital. Data from late 2023 and early 2024 indicated a cautious approach to investment across many sectors, a trend that could intensify if economic headwinds persist.

- Economic Slowdown Impact: A global recession could shrink the market for precious metals, affecting Goldmoney's transaction volumes.

- Consumer Spending Contraction: Reduced discretionary income directly limits the ability and willingness of individuals to invest in assets like gold.

- Investment Hesitation: In uncertain economic times, even safe-haven assets may see reduced inflows if overall capital preservation becomes the primary focus.

- Platform Transaction Decline: A widespread economic contraction could lead to fewer deposits, withdrawals, and trades on Goldmoney's digital platform.

The competitive landscape is intensifying, with traditional financial institutions and emerging digital platforms vying for market share. This increased competition, coupled with the growing popularity of alternative investments like cryptocurrencies, could divert capital and customer attention away from precious metals, impacting Goldmoney's growth trajectory through 2024 and 2025.

Regulatory changes, particularly concerning anti-money laundering and know-your-customer protocols, present ongoing compliance challenges and potential cost increases. The evolving digital asset space also introduces new regulatory considerations that Goldmoney must navigate to maintain operational integrity and client trust.

The inherent volatility of precious metal prices remains a core threat, directly influencing client asset values and transaction volumes. For example, gold prices saw significant daily swings in 2024, and a prolonged downturn could reduce fee-based revenue and demand for Goldmoney's services.

Cybersecurity risks are a constant concern for digital financial platforms. A successful data breach could lead to substantial financial losses, severe reputational damage, and significant regulatory penalties, with the average cost of a data breach in 2024 reaching $4.73 million globally.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data Point |

| Market Competition | Increased competition from ETFs and digital platforms | Loss of market share, reduced customer acquisition | Growth in digital asset investment platforms observed throughout 2024. |

| Regulatory Environment | Evolving AML/KYC and digital asset regulations | Increased compliance costs, operational hurdles | FATF continued refinement of virtual asset guidance in 2024. |

| Price Volatility | Sharp downturns in precious metal prices | Reduced asset values, lower transaction volumes, decreased revenue | Gold prices experienced intraday swings exceeding 2% in 2024. |

| Cybersecurity | Data breaches and hacking attempts | Erosion of client trust, financial losses, reputational damage | Average cost of a data breach in 2024 was $4.73 million globally. |

SWOT Analysis Data Sources

This GoldMoney SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.