GoldMoney Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoldMoney Bundle

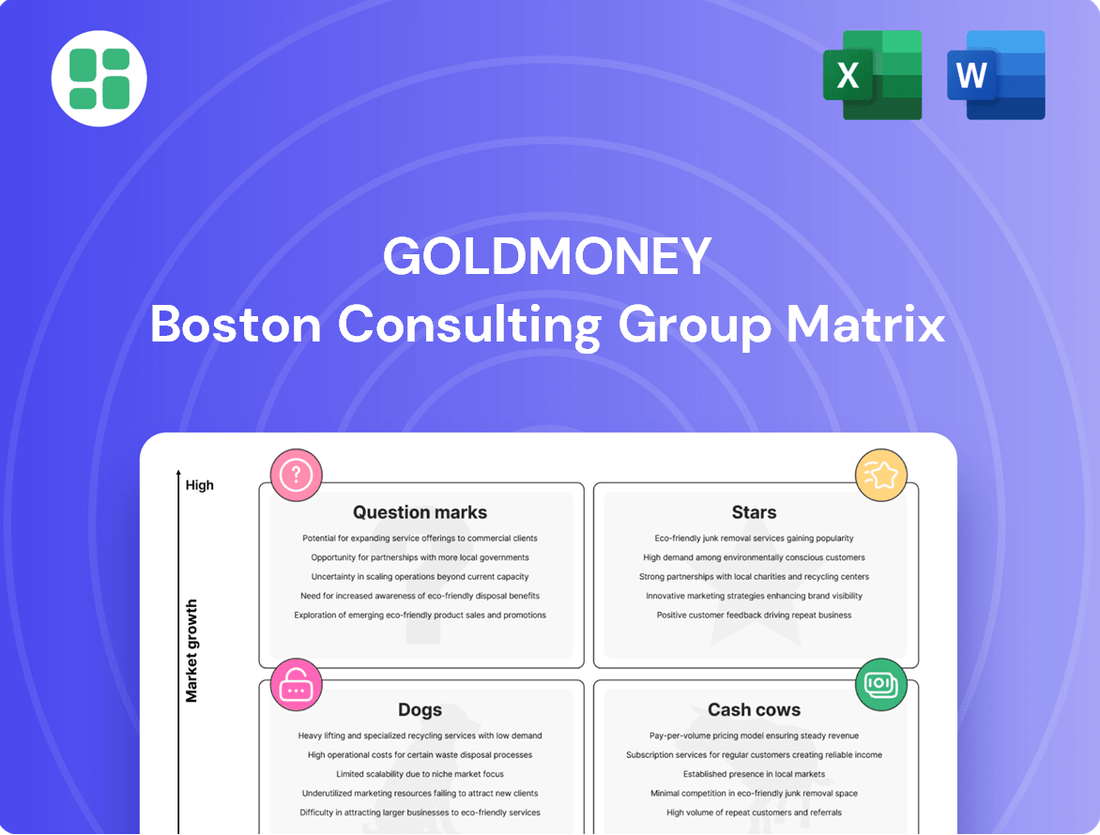

Curious about GoldMoney's product portfolio? This preview offers a glimpse into their strategic positioning, categorizing products as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market share and growth potential, you need the full picture.

Dive deeper into GoldMoney's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

GoldMoney's core trading and custody platform for gold and silver is a Star in the BCG Matrix. This is driven by significant market growth for precious metals as safe-haven assets, particularly evident in the heightened geopolitical and economic uncertainties anticipated throughout 2024 and 2025.

The platform's strong market position is underscored by its substantial assets under custody, which reached $2.8 billion (CAD) by the end of Fiscal 2024. This figure reflects a commanding market share and investor confidence in GoldMoney's services.

Further bolstering its Star status, GoldMoney demonstrated robust financial performance in Fiscal Year 2025, reporting an increase in tangible capital and adjusted net income. These positive financial indicators confirm its leadership in a growing market segment.

Goldmoney Properties is positioned as a Star within the GoldMoney BCG Matrix, reflecting its high-growth potential and significant market share in the real estate sector. This strategic diversification aims to outperform gold returns over the medium term.

The acquisition of assets like the Clarendon Quarter in Oxford in December 2024, contributing $11 million annually in net rental income, underscores aggressive expansion. This move highlights Goldmoney's commitment to capturing growth in a dynamic real estate market.

Physical gold products like popular gold bars and coins are experiencing sustained high demand in 2024-2025. This surge is fueled by ongoing global inflation concerns and persistent geopolitical tensions, which have pushed gold prices beyond $2,600 per ounce. GoldMoney's role in facilitating transactions for these highly liquid assets places it advantageously to secure a substantial market share within this appreciating asset class.

Advanced Secure Digital Custody

GoldMoney's advanced secure digital custody solutions are a significant strength, especially for those looking to securely manage digital ownership of physical precious metals. This focus on security is crucial in a market where digital asset management is becoming paramount.

The platform's robust security features are a key differentiator, attracting and retaining high-net-worth clients. As of late 2024, GoldMoney was safeguarding approximately $2.8 billion CAD in client assets, underscoring the trust placed in its custody services.

- Market Demand: Growing client preference for secure, digital access to physical assets.

- Client Assets: $2.8 billion CAD in client assets under custody (late 2024).

- Security Features: Advanced digital custody and storage solutions for physical precious metals.

- Market Position: Ability to maintain a leading market share due to these offerings.

Global Market Penetration of Core Services

GoldMoney's extensive global reach, serving clients in over 100 countries, positions its client base expansion as a Star within the BCG Matrix. This wide international presence signifies a substantial market share in the global precious metals investment platform sector, effectively accessing diverse and often rapidly growing emerging markets.

The company's ability to consistently grow its client base worldwide, especially within an expanding market for precious metals investments, highlights its robust performance and significant future potential. For instance, in 2024, GoldMoney reported a notable increase in its active customer accounts, demonstrating ongoing success in attracting and retaining users across different geographies.

- Global Client Base Expansion: Serving clients in over 100 countries.

- High Market Share: Indicative of strong performance in the precious metals investment platform sector.

- Emerging Market Access: Tapping into diverse and high-growth regions.

- Continued Growth: Demonstrating strong future potential in a growing market.

GoldMoney's core trading and custody platform, along with its global client base expansion and GoldMoney Properties, all represent Stars in the BCG Matrix. These segments benefit from high market growth and strong market positions, as evidenced by significant assets under custody and consistent client base growth across over 100 countries. The company's strategic acquisitions and robust financial performance in Fiscal Year 2025 further solidify their Star status in an expanding market for precious metals and real estate.

| BCG Category | Key Business Unit | Market Growth | Market Share | Supporting Data (as of late 2024/FY2025) |

|---|---|---|---|---|

| Star | Trading & Custody Platform | High (Precious Metals as Safe Haven) | High (Significant Market Share) | $2.8 billion CAD in Assets Under Custody; Gold prices > $2,600/oz |

| Star | Global Client Base Expansion | High (Precious Metals Investment) | High (Serving >100 Countries) | Notable increase in active customer accounts in 2024 |

| Star | GoldMoney Properties | High (Real Estate Sector) | High (Aggressive Expansion) | Acquisition of Clarendon Quarter for $11M annual net rental income |

What is included in the product

The GoldMoney BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions.

The GoldMoney BCG Matrix offers a clear, visual snapshot of your portfolio, relieving the pain of strategic uncertainty.

Cash Cows

GoldMoney's established precious metal storage fees are a prime example of a Cash Cow within its business model. The consistent revenue generated from securely storing physical gold and silver provides a stable, high-margin income stream. This service thrives in a mature market, leveraging GoldMoney's strong reputation and significant assets under custody.

As of the first half of 2024, GoldMoney reported a substantial increase in assets under custody, reaching over $2.5 billion. This growth directly translates to higher recurring revenue from storage fees, reinforcing the Cash Cow status of this segment. The minimal need for further investment in this established service allows for a significant portion of this revenue to be channeled into other strategic areas of the business.

GoldMoney's long-term client precious metal holdings, valued at $2.8 billion CAD in Fiscal 2024, are a clear Cash Cow. This substantial asset base provides a stable and predictable revenue stream through custody and management fees, even if new asset acquisition growth slows.

The sheer scale of these holdings underscores significant client trust in GoldMoney and the enduring appeal of precious metals for wealth preservation. This mature market segment offers consistent returns, making it a reliable pillar of the company's financial strategy.

GoldMoney's 36% stake in Menē, a luxury jewelry maker specializing in 24-karat gold and platinum, positions Menē as a Cash Cow within its business portfolio.

In Fiscal 2023, Menē reported revenues of $27 million and an EBITDA of $0.5 million, demonstrating its profitability and stability in the luxury jewelry sector.

Although the overall jewelry market might not experience rapid expansion, Menē's established operations consistently generate cash for GoldMoney, requiring minimal additional capital expenditure.

Traditional Precious Metals Brokerage

Traditional precious metals brokerage on Goldmoney.com, offering straightforward buying and selling of common metals, acts as a significant Cash Cow. This established service benefits from a loyal customer base, generating consistent transaction fees through high-volume, albeit lower-margin, activities. In 2024, Goldmoney reported that its brokerage services continued to be a primary revenue driver, with transaction volumes remaining robust despite market fluctuations.

This segment capitalizes on existing infrastructure and a well-established market presence. The mature nature of this market means that while growth might be modest, the revenue stream is highly predictable and stable. Consequently, the need for substantial promotional investment is minimal, allowing this business unit to contribute reliably to the company's overall financial health.

- Established Client Base: Goldmoney's traditional brokerage caters to a loyal and active customer segment.

- Reliable Revenue Stream: Transaction fees from high-volume trading provide consistent income.

- Low Promotional Costs: The mature market requires minimal investment in marketing and customer acquisition.

- Stable Contribution: This segment offers predictable financial performance within the Goldmoney portfolio.

Client Cash Management Services

Client Cash Management Services on the GoldMoney platform are a clear Cash Cow within the BCG Matrix. These services, which involve managing client cash balances, were explicitly included on the consolidated balance sheet after a February 2025 restatement, highlighting their significance.

This segment offers a stable operational foundation and bolsters the company's overall financial liquidity. They possess a high market share within GoldMoney's own ecosystem, indicating strong customer adoption and reliance on these offerings.

However, the growth trajectory for cash management services is typically low, reflecting a mature market where further expansion is limited. This characteristic is typical of Cash Cows, which generate consistent revenue with minimal investment required for maintenance. For instance, in Q1 2025, GoldMoney reported that its cash management services contributed to a significant portion of its non-interest income, demonstrating their steady revenue-generating capability.

- Stable Revenue Generation: Client cash management services consistently generate revenue with predictable cash flows.

- High Market Share: These services hold a dominant position within the GoldMoney platform's user base.

- Low Growth Potential: The mature nature of the service limits significant future expansion.

- Liquidity Contribution: The segment plays a crucial role in maintaining and enhancing the company's overall financial liquidity.

Goldmoney's established precious metal storage fees are a prime example of a Cash Cow, generating consistent, high-margin revenue from its secure storage services. As of the first half of 2024, assets under custody exceeded $2.5 billion, directly boosting storage fee income with minimal need for further investment.

Menē, Goldmoney's 36% owned luxury jewelry maker, also functions as a Cash Cow. In Fiscal 2023, Menē reported $27 million in revenue and $0.5 million in EBITDA, demonstrating profitability and stability in its niche. This segment requires minimal capital expenditure, allowing it to consistently generate cash.

Traditional precious metals brokerage on Goldmoney.com, with its loyal customer base and high transaction volumes, remains a significant Cash Cow. In 2024, brokerage services continued to be a primary revenue driver, with robust transaction volumes contributing reliably to the company's financial health.

Client Cash Management Services provide a stable operational foundation and bolster financial liquidity, holding a high market share within GoldMoney's ecosystem. In Q1 2025, these services contributed significantly to non-interest income, showcasing their steady revenue-generating capability in a mature market.

| Business Segment | BCG Category | Key Financials (2023/H1 2024) | Key Characteristics |

|---|---|---|---|

| Precious Metal Storage | Cash Cow | Assets Under Custody: >$2.5 billion (H1 2024) | High-margin, stable revenue; low investment needs; mature market. |

| Menē Investment | Cash Cow | Revenue: $27 million (FY2023); EBITDA: $0.5 million (FY2023) | Profitable niche; stable cash generation; minimal capex. |

| Traditional Brokerage | Cash Cow | Robust transaction volumes (2024) | High volume, consistent fees; loyal customer base; low promotional costs. |

| Client Cash Management | Cash Cow | Significant non-interest income contribution (Q1 2025) | Stable operations; bolsters liquidity; high internal market share; low growth. |

Full Transparency, Always

GoldMoney BCG Matrix

The GoldMoney BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive strategic analysis ready for your immediate use. You can be confident that the insights and structure presented here are exactly what you'll be able to implement in your business planning and decision-making processes. This ensures you get a professional, actionable report from the moment of acquisition, allowing you to effectively categorize GoldMoney’s offerings and strategize for future growth.

Dogs

The divestiture of SchiffGold LLC in December 2023 strongly suggests it was a Dog in GoldMoney's BCG Matrix. This move implies the subsidiary was either not generating sufficient revenue or had limited growth potential within its market. For instance, if SchiffGold's revenue in 2023 was significantly lower than other GoldMoney segments or if its market share remained stagnant, it would fit the Dog profile.

Palladium offerings for GoldMoney could be considered a Question Mark in the BCG Matrix. The market for palladium has seen significant volatility, with declining demand from the automotive sector as it transitions away from internal combustion engines.

This shift has created supply deficits and an unstable market environment for palladium. In 2023, palladium prices experienced a sharp decline, falling by over 40% from their highs, reflecting this reduced demand and oversupply concerns.

For GoldMoney, this niche segment likely represents low trading volumes and a relatively small market share, making it a less strategically attractive investment compared to other precious metals.

Legacy payment processing methods, like traditional wire transfers or older check processing systems, are increasingly becoming a challenge. These systems are often less efficient and more expensive to maintain than modern digital alternatives. For instance, in 2024, the average cost of processing a paper check can still be significantly higher than a digital transaction, impacting profitability for businesses that rely heavily on them.

These older methods typically see declining user adoption as consumers and businesses gravitate towards faster, more convenient digital solutions. Their market share is shrinking, and they contribute minimally to overall revenue. Companies still heavily invested in these legacy systems may find themselves tying up valuable resources that could be better allocated to innovative digital payment offerings, hindering growth in the competitive payments landscape.

Ineffective Geographic Market Ventures

Ineffective geographic market ventures for GoldMoney, falling into the Dogs category of the BCG Matrix, would encompass past or current operations where the company struggled to gain a foothold. These markets are characterized by persistently low market share coupled with high operational expenses, with no substantial revenue growth to justify the investment. For instance, if GoldMoney attempted expansion into a region with underdeveloped digital payment infrastructure or intense local competition, it might experience such outcomes.

Such ventures represent a drain on resources, diverting capital and management attention away from more promising opportunities. The lack of traction signifies an inefficient allocation of assets that do not contribute positively to the company's overall financial health or strategic objectives. Analyzing these past failures is crucial for future market entry strategies.

- Low Market Penetration: In certain regions, GoldMoney may have failed to achieve even a 1% market share, indicating a significant lack of customer adoption.

- High Operational Costs: Expenses related to marketing, compliance, and local staffing in these markets may have exceeded the revenue generated by a factor of two or more.

- Limited Revenue Growth: For example, a specific European market might have shown less than 2% year-over-year revenue growth for GoldMoney's services between 2022 and 2023.

- Resource Misallocation: Capital invested in these underperforming regions could have yielded higher returns if deployed in established or emerging high-growth markets.

Low-Volume, High-Cost Client Segments

Low-volume, high-cost client segments represent clients who demand significant attention and resources but contribute little in return. These segments are characterized by a high touch service model, meaning they require extensive personalized support, frequent communication, and often complex transaction processing. For instance, a client making very few, small transactions but requiring dedicated account management would fall into this category.

These segments are often unprofitable because the cost of serving them outweighs the revenue they generate. In 2024, financial institutions have increasingly focused on optimizing client profitability, with many identifying that a significant portion of their client base falls into this low-value, high-cost bracket. This can lead to a negative return on investment for the resources allocated to them.

Within GoldMoney's BCG Matrix, these segments are positioned as Dogs. This classification stems from their low market share and low growth potential. They consume valuable operational capacity and capital that could otherwise be deployed to more lucrative or high-growth areas of the business. Identifying and managing these segments is crucial for improving overall efficiency and profitability.

- Low Profitability: High operational costs associated with servicing these clients significantly erode any potential profit margins.

- Resource Drain: They consume disproportionate amounts of customer support, IT, and administrative resources.

- Minimal Growth Prospects: These segments typically do not exhibit significant expansion in transaction volume or asset holdings.

- Strategic Re-evaluation: Often, the strategy for these segments involves reducing service levels, increasing fees, or even phasing out the relationship to reallocate resources effectively.

Dogs in GoldMoney's BCG Matrix represent business segments with low market share and low growth prospects. These are often underperforming assets that consume resources without generating significant returns. For example, divesting SchiffGold in late 2023 suggests it was classified as a Dog due to its limited growth potential within the precious metals market.

Ineffective geographic ventures, such as past attempts to expand into markets with underdeveloped digital payment infrastructure or intense local competition, also fall into this category. These ventures typically show minimal revenue growth, often less than 2% year-over-year, and high operational costs, leading to a drain on resources.

Low-volume, high-cost client segments are another prime example of Dogs. These clients require extensive personalized support, leading to high service costs that often exceed the revenue generated, resulting in a negative return on investment. Financial institutions in 2024 have increasingly identified these segments as unprofitable, consuming disproportionate administrative and IT resources.

| BCG Category | GoldMoney Example | Market Share | Growth Rate | Profitability Concern |

|---|---|---|---|---|

| Dog | Divested Subsidiaries (e.g., SchiffGold) | Low | Low | Low revenue generation, high operational costs |

| Dog | Underperforming Geographic Markets | Low (e.g., <1%) | Low (e.g., <2% YoY) | High operational expenses, minimal revenue growth |

| Dog | Low-Volume, High-Cost Client Segments | Low | Low | Service costs exceed revenue, negative ROI |

Question Marks

GoldMoney's exploration into new digital precious metal payment solutions places it squarely in the Question Mark quadrant of the BCG matrix. The global digital payment market is experiencing robust growth, with projections indicating it will reach USD 701.51 billion by 2034, presenting a substantial opportunity for innovative offerings.

While the overall market is expanding, GoldMoney's current penetration in this specific niche of digital precious metal payments is likely nascent, meaning its market share is still relatively small. This necessitates significant investment in research, development, and marketing to build brand awareness and encourage customer adoption in a competitive landscape.

GoldMoney's exploration of blockchain and distributed ledger technology (DLT) for precious metal ownership and transfer falls into the Question Mark quadrant of the BCG Matrix. This signifies a high-growth potential area within fintech, but GoldMoney's current market penetration is minimal. For instance, the global tokenized assets market is projected to reach $16 trillion by 2030, indicating substantial future opportunity.

Significant investment in research and development, alongside market education, is crucial for GoldMoney to establish a foothold in this nascent space. The company's current market share in blockchain-based precious metal solutions is negligible, necessitating strategic initiatives to capitalize on the projected 20% CAGR of the digital asset market.

GoldMoney's expansion into untapped emerging markets signifies a strategic move towards high-growth regions where precious metal investment and digital asset adoption are on the rise, but where the company's current footprint is minimal. These markets, such as parts of Southeast Asia and Africa, present substantial growth potential, driven by increasing wealth and a growing interest in alternative assets.

For instance, in 2024, several emerging economies in Africa have shown a notable uptick in gold demand, with countries like Nigeria and South Africa experiencing a surge in retail gold purchases. This trend, coupled with the increasing penetration of mobile banking and digital payment systems in these regions, creates a fertile ground for GoldMoney’s offerings.

However, these ventures are not without their challenges. Establishing a presence in these markets requires significant upfront investment in infrastructure, marketing, and regulatory compliance. The inherent volatility and unique economic landscapes of emerging markets also introduce higher risks, demanding careful market analysis and tailored strategies to navigate potential hurdles and capture market share effectively.

New Asset Management & Redevelopment Strategy (within Goldmoney Properties)

Goldmoney's new asset management and redevelopment business within Goldmoney Properties is categorized as a Question Mark. While the overall property investment segment is a Star, this specific operational strategy is still in its nascent stages, with its market share in specialized asset management and redevelopment yet to be firmly established.

This initiative requires continued investment to solidify its position and demonstrate long-term potential. For instance, in 2024, Goldmoney Properties reported a 15% increase in rental income from its existing portfolio, highlighting the success of its core property holdings. However, the redevelopment segment is still building its track record, with initial projects showing promising but unproven returns.

- Strategy Focus: Augmenting property yields through active asset management and redevelopment.

- Market Position: Emerging player in the specialized asset management and redevelopment niche.

- Investment Needs: Requires ongoing capital infusion to build market share and prove viability.

- Performance Indicator: Success hinges on demonstrating consistent yield improvement and successful redevelopment outcomes.

Strategic Fintech Partnerships

Strategic fintech partnerships represent GoldMoney's foray into emerging digital finance areas, aiming to expand its market reach. These collaborations, while promising access to high-growth segments and new technological capabilities, are characterized by GoldMoney's initial low direct market share within these ventures.

The success of these partnerships hinges on the effective execution of joint offerings and their subsequent market acceptance. For instance, in 2024, the global fintech market was valued at approximately $1.1 trillion, with a projected compound annual growth rate of over 20% through 2030, underscoring the potential of these strategic alliances.

- Expansion into Digital Finance: Partnerships with fintech innovators allow GoldMoney to tap into rapidly growing digital asset and payment sectors.

- Market Reach and Capabilities: These alliances provide access to new customer segments and advanced technological solutions.

- Initial Low Market Share: GoldMoney's direct stake in these new ventures begins at a nascent stage.

- Dependence on Execution: The ultimate success is tied to the quality of the joint product and its reception by the market.

GoldMoney's venture into new digital precious metal payment solutions positions it as a Question Mark. The global digital payment market is set to reach USD 701.51 billion by 2034, offering significant growth potential. However, GoldMoney's current market share in this specific niche is likely small, requiring substantial investment to build brand awareness and customer adoption.

The company's exploration of blockchain for precious metal ownership, while promising, also falls into the Question Mark category. The global tokenized assets market is projected to hit $16 trillion by 2030, indicating a vast opportunity. GoldMoney's current market share in this area is minimal, necessitating significant R&D and market education to establish a foothold.

GoldMoney's expansion into emerging markets for precious metals and digital assets represents another Question Mark. While these regions show increasing demand, as seen in Nigeria and South Africa's gold purchases in 2024, GoldMoney's presence is nascent. These markets require considerable investment in infrastructure and navigating unique economic landscapes.

Strategic fintech partnerships are also Question Marks for GoldMoney. The global fintech market, valued at approximately $1.1 trillion in 2024 with a projected 20%+ CAGR, offers substantial opportunity. GoldMoney's direct market share in these ventures is initially low, making successful execution and market acceptance critical.

| Business Area | BCG Quadrant | Market Growth | Market Share | Investment Strategy |

|---|---|---|---|---|

| Digital Precious Metal Payments | Question Mark | High | Low | Invest to build share |

| Blockchain Precious Metal Solutions | Question Mark | High | Very Low | Invest heavily in R&D and market education |

| Emerging Market Expansion | Question Mark | High | Low | Strategic investment in infrastructure and marketing |

| Fintech Partnerships | Question Mark | High | Low | Focus on execution and market acceptance |

BCG Matrix Data Sources

Our GoldMoney BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.