GoldMoney PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoldMoney Bundle

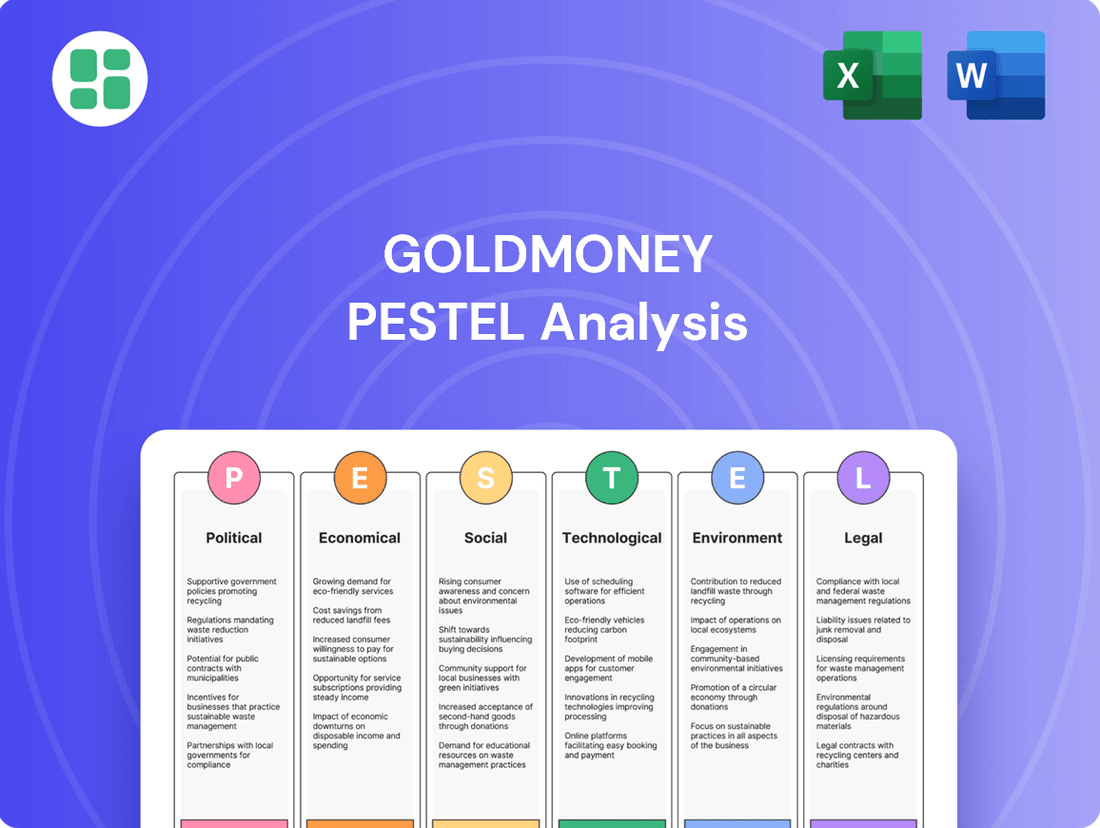

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping GoldMoney's trajectory. Our expertly crafted PESTLE analysis offers a comprehensive overview of these external forces, providing you with the strategic intelligence needed to anticipate market shifts and capitalize on opportunities. Download the full version now to gain a decisive advantage.

Political factors

Global political tensions and ongoing conflicts are significantly bolstering investor demand for precious metals like gold and silver, which directly benefits GoldMoney's business model. The persistent uncertainties stemming from events such as the prolonged conflict in Ukraine and the volatile situation in the Middle East are prompting a 'flight to safety' among investors, driving increased purchases of these traditional safe-haven assets.

Government policies on precious metals, including reserve management and trade regulations, directly influence GoldMoney's operational landscape. Shifts in these policies can create both opportunities and challenges.

Central banks globally are anticipated to maintain their gold purchasing trend, a key driver for the precious metals market. While the World Gold Council reported central bank net purchases of 1,037 tonnes in 2023, a slight decrease from 2022's record 1,136 tonnes, this sustained demand underpins market stability.

Political will to maintain stable regulations for digital precious metals platforms is vital for GoldMoney's global reach and compliance. This stability directly impacts GoldMoney's ability to operate across different markets and attract international clients.

GoldMoney's operations in Canada benefit from exemptive relief granted by securities regulators, ensuring continued service provision under defined conditions. This regulatory clarity in a key market like Canada underpins investor confidence and operational continuity.

International Trade Relations and Tariffs

Trade disputes and the imposition of tariffs can significantly disrupt the global movement of precious metals, directly influencing their market prices. These disruptions can indirectly affect GoldMoney's trading volumes and overall market dynamics as supply chains adjust. For instance, ongoing trade tensions between major economies in 2024 and early 2025 could lead to increased volatility in gold and silver prices.

Controversial trade policies, particularly those leading to widespread protectionism, can contribute to inflationary pressures. This economic environment often drives increased demand for precious metals as investors seek a hedge against currency devaluation and rising prices. In 2024, several countries implemented new tariffs, with the IMF noting a potential 0.5% drag on global GDP growth due to escalating trade barriers, which could bolster safe-haven asset demand.

- Tariff Impact: Increased tariffs on goods traded between major economic blocs in 2024 have led to higher shipping costs for precious metals, impacting their landed price.

- Inflationary Hedge: As inflation concerns persist into 2025, with some projections showing CPI remaining above 3% in key developed economies, gold and silver are likely to see continued investor interest.

- Trade Volatility: Geopolitical events and trade disagreements in 2024 have already caused short-term price spikes in precious metals, demonstrating their sensitivity to international trade relations.

Political Influence on Monetary Policy

Political pressures can significantly sway central bank decisions on interest rates and quantitative easing. These decisions directly influence currency values and, consequently, the appeal of non-yielding assets like gold. For instance, anticipation of interest rate cuts by major central banks, such as the US Federal Reserve or the European Central Bank, often makes investments in assets that don't generate income, like gold, more attractive as the opportunity cost of holding them decreases.

Central banks operate with a degree of independence, but political considerations can still exert influence. Government fiscal policies, public debt levels, and employment targets can all create an environment where central banks feel pressure to align monetary policy with broader political objectives. This can lead to adjustments in policy that might not solely be driven by inflation or economic growth considerations.

Looking ahead to 2024 and 2025, expectations for interest rate movements are a key factor. Many analysts anticipate potential rate cuts in major economies as inflation moderates. For example, the US Federal Reserve signaled a pivot towards potential easing in late 2024, with further cuts possible in 2025, depending on economic data. This environment typically boosts demand for gold.

- Interest Rate Expectations: Anticipated rate cuts by central banks like the Federal Reserve and ECB in 2024-2025 reduce the opportunity cost of holding gold.

- Inflation Concerns: While inflation has cooled, persistent geopolitical risks or unexpected economic shocks could reignite inflation fears, making gold a traditional hedge.

- Geopolitical Stability: Political instability in key regions can drive demand for safe-haven assets like gold, impacting its price independently of monetary policy.

- Currency Fluctuations: Monetary policy decisions directly impact currency strength; a weaker US dollar, for instance, often correlates with higher gold prices.

Global political instability, including ongoing conflicts and trade disputes, continues to drive demand for precious metals as safe-haven assets, benefiting GoldMoney. Government policies on precious metals, such as reserve management and trade regulations, directly shape GoldMoney's operational environment, creating both opportunities and challenges. Central banks' sustained gold purchasing, with 2023 net purchases at 1,037 tonnes, provides a stable market underpinning. Political will for stable digital precious metals regulations is crucial for GoldMoney's global operations and client trust.

| Factor | 2024/2025 Outlook | Impact on GoldMoney |

|---|---|---|

| Geopolitical Tensions | Elevated due to ongoing conflicts (e.g., Ukraine, Middle East) | Increased investor demand for gold and silver, boosting trading volumes. |

| Central Bank Policies | Continued gold purchases, potential interest rate adjustments | Market stability, potential for increased gold attractiveness if rates fall. |

| Trade Policies & Tariffs | Persistent trade disputes and protectionist measures | Supply chain disruptions, price volatility, potential inflationary hedge demand. |

| Regulatory Environment | Need for stable regulations for digital precious metals platforms | Impacts global reach, compliance, and investor confidence. |

What is included in the product

This GoldMoney PESTLE analysis examines the impact of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the company's operations and strategy.

It provides a comprehensive overview of how these forces create both challenges and opportunities, aiding in strategic decision-making and market positioning.

Provides a concise version of the GoldMoney PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain point of time-consuming synthesis.

Economic factors

Persistent inflation, a significant concern throughout 2024 and projected into 2025, directly fuels investor interest in tangible assets like gold and silver as a hedge against declining purchasing power. This trend benefits GoldMoney as individuals and institutions actively seek to preserve wealth by acquiring precious metals.

The correlation between rising inflation and precious metal prices is well-established. For instance, in the US, the Consumer Price Index (CPI) saw a notable increase in 2024, prompting many to view gold and silver as safe havens. This increased demand for hedging against eroding currency value translates into higher transaction volumes for platforms like GoldMoney.

Lower interest rates significantly reduce the opportunity cost of holding non-yielding assets such as gold and silver. This makes GoldMoney's services, which facilitate investment in these precious metals, more attractive to a broader investor base. For instance, if benchmark rates fall, the yield forgone by not investing in interest-bearing accounts decreases, thereby increasing the relative appeal of gold.

The Federal Reserve's monetary policy trajectory is a key driver. Projections indicate a continued trend of interest rate reductions through 2024 and into 2025. This dovish stance is expected to bolster the prices of gold and silver, as lower rates typically weaken the U.S. dollar and increase demand for safe-haven assets.

Currency fluctuations, particularly concerning the U.S. dollar, significantly impact GoldMoney's operational landscape. A weakening dollar generally makes dollar-denominated precious metals, like gold and silver, more affordable for international purchasers. This price advantage can attract a broader global clientele, potentially boosting GoldMoney's customer acquisition and transaction volumes.

Historically, a weaker U.S. dollar has often correlated with rising gold prices. For instance, during periods of dollar depreciation, gold's appeal as a safe-haven asset intensifies, as it becomes relatively cheaper for holders of other currencies. This dynamic can lead to increased demand for gold stored and managed by GoldMoney, enhancing the value of its offerings.

Global Economic Growth and Recession Risks

Global economic growth is showing signs of moderation, raising concerns about potential recession risks. For instance, the International Monetary Fund (IMF) projected global growth to slow from 3.2% in 2023 to 2.9% in 2024, with a potential further slowdown in 2025. This economic uncertainty often drives investors towards safe-haven assets like gold, which can positively impact GoldMoney's business model by increasing demand for its precious metal services.

The increasing possibility of a global recession, partly fueled by geopolitical tensions and trade disputes, further amplifies the appeal of safe-haven assets. As of mid-2024, persistent inflation in major economies and the ongoing impact of supply chain disruptions continue to create an environment where capital preservation is a priority for many investors. This environment is conducive to increased interest in physical gold and silver, core offerings for GoldMoney.

- Economic Slowdown: Projections indicate a deceleration in global economic expansion for 2024-2025, potentially increasing demand for gold.

- Recession Fears: Heightened recession risks, driven by factors like geopolitical instability, often lead investors to seek refuge in precious metals.

- Safe-Haven Demand: Historically, periods of economic uncertainty see a rise in the price of gold, directly benefiting businesses like GoldMoney that facilitate gold ownership.

- Inflationary Pressures: Persistent inflation can erode the purchasing power of fiat currencies, making tangible assets like gold more attractive as a store of value.

Central Bank and Institutional Demand

Central banks, including major players like China and India, have been significant net buyers of gold. In 2023, central bank gold purchases reached 1,037 tonnes, marking the second-highest annual total on record, according to the World Gold Council. This sustained institutional demand acts as a crucial price support mechanism for gold, benefiting businesses like GoldMoney by fostering a more predictable market environment.

The outlook for 2024 and 2025 suggests this trend will continue. Institutions are diversifying reserves and seeking safe-haven assets amidst geopolitical and economic uncertainties. This ongoing institutional buying is expected to underpin gold prices, providing a stable foundation for GoldMoney's operations and client confidence.

- Record Central Bank Purchases: Central banks acquired 1,037 tonnes of gold in 2023, the second-highest annual total ever.

- Continued Demand Expected: Projections indicate central banks will remain net buyers of gold through 2024 and 2025.

- Price Stability: Institutional demand creates a strong floor for gold prices, enhancing market stability.

Persistent inflation throughout 2024 and into 2025 drives demand for gold as a hedge against declining purchasing power. This trend benefits GoldMoney by increasing interest in precious metals for wealth preservation.

Lower interest rates reduce the opportunity cost of holding gold, making GoldMoney's services more attractive. For example, if benchmark rates fall, the forgone yield on interest-bearing accounts decreases, enhancing gold's relative appeal.

A weakening U.S. dollar, anticipated through 2024-2025 due to dovish monetary policy, makes dollar-denominated precious metals more affordable globally, potentially boosting GoldMoney's international clientele.

Global economic slowdown fears and potential recession risks in 2024-2025 increase demand for safe-haven assets like gold, positively impacting GoldMoney's business model.

Preview Before You Purchase

GoldMoney PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive GoldMoney PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting GoldMoney.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed strategic overview for GoldMoney.

Sociological factors

Investor sentiment towards digital assets, particularly in relation to precious metals, is increasingly shaped by the demand for secure and transparent platforms. As of early 2025, surveys indicate a significant portion of retail investors express concern over the security of digital holdings, yet simultaneously show a growing interest in digital solutions that offer verifiable ownership and ease of access to assets like gold. This dichotomy underscores the importance of building robust trust mechanisms within digital platforms.

The Digital Gold Project's focus on creating a safe investment environment directly addresses this evolving investor psychology. By emphasizing security features and transparent transaction processes, the project aims to capture the segment of the market that is cautious but open to digital innovation in precious metals. This approach is critical as global digital asset adoption continues to rise, with an estimated 420 million people worldwide owning cryptocurrency by the end of 2024, signaling a broader acceptance of digital financial tools.

Younger generations, particularly Gen X and Millennials, are increasingly financially literate and tech-savvy, leading to a growing interest in digital assets and platforms. This demographic shift presents a substantial opportunity for digital precious metal providers like GoldMoney, as these investors are comfortable with online transactions and digital holdings.

Data from 2024 indicates that Millennials and Gen X collectively manage trillions in assets, with a notable portion expressing interest in diversifying their portfolios with tangible assets like gold. Their comfort with technology makes digital platforms the preferred method for accessing and managing these investments, aligning perfectly with GoldMoney's service model.

A significant societal shift is underway, moving from the tangible to the digital realm, and this trend is profoundly impacting how people interact with assets like precious metals. The desire for convenience and immediate digital accessibility is fueling the growth of platforms that simplify the process of acquiring, managing, and trading gold and other precious metals. This bypasses the traditional logistical hurdles of physical possession.

For instance, the global digital gold market experienced substantial growth, with transactions reaching billions of dollars annually. In 2024, reports indicated a continued surge in online precious metals purchases, with many platforms offering fractional ownership, making investment more approachable for a wider audience. This digital transformation makes gold an asset class that aligns with modern consumer expectations for ease of use and online engagement.

Financial Education and Awareness

Growing financial education is encouraging more people to think about protecting their wealth and spreading their investments around. This heightened awareness, especially when economic times are uncertain, often leads individuals to look at precious metals like gold as a stable option for their portfolios. For instance, a 2024 survey indicated that 45% of retail investors were considering or already holding gold for its perceived safety during economic downturns.

Retail investors can potentially improve their returns, even when considering the risks involved, by putting some money into gold when the world feels unstable. This strategy is particularly relevant as global economic forecasts for 2024-2025 suggest continued volatility in traditional markets. Data from the World Gold Council shows that gold demand from retail investors increased by 12% in the first half of 2024 compared to the same period in 2023.

- Increased Investor Sophistication: As financial literacy rises, more individuals understand the role of diversification and wealth preservation, leading to greater interest in assets like gold.

- Response to Economic Uncertainty: Periods of inflation and geopolitical tension, prevalent in 2024, often drive retail investors towards gold as a safe-haven asset.

- Accessibility of Information: Online platforms and educational resources have made it easier for the average person to learn about and access gold investments, contributing to a broader awareness.

- Portfolio Diversification Benefits: Financial education emphasizes that including gold can help mitigate risk and potentially enhance risk-adjusted returns, especially during market downturns.

Ethical and Responsible Investment Concerns

Growing investor interest in ethical sourcing and responsible investment practices is shaping the precious metals market. This trend may influence demand for metals, prompting GoldMoney to prioritize the provenance and supply chain integrity of the metals it facilitates.

ESG integration and fossil fuel exclusions are becoming standard strategies in sustainable investing. For instance, in 2024, a significant portion of new fund inflows in Europe were directed towards ESG-focused products, indicating a strong preference for ethically aligned investments.

- Ethical Sourcing Demand: Investors increasingly scrutinize the origins of precious metals, favoring those sourced responsibly.

- Supply Chain Transparency: GoldMoney must ensure its supply chain is transparent and free from unethical labor or environmental practices.

- ESG Integration: The company needs to align its offerings with Environmental, Social, and Governance criteria to attract a growing segment of sustainable investors.

- Fossil Fuel Exclusions: While not directly related to metals, this broader trend reflects a desire to divest from industries perceived as harmful, indirectly impacting investor sentiment towards all asset classes.

Societal trends highlight a growing preference for digital convenience and transparency in financial dealings. This shift is driving demand for platforms that offer seamless access to assets like gold, bypassing traditional complexities. By early 2025, a substantial percentage of retail investors expressed a desire for digital solutions that provide verifiable ownership and ease of use, even while maintaining concerns about digital security.

Younger demographics, particularly Millennials and Gen X, are increasingly financially savvy and comfortable with digital technologies. This group, representing trillions in assets by 2024, shows a marked interest in diversifying portfolios with tangible assets like gold, preferring online platforms for their investment activities. This aligns directly with GoldMoney's model, catering to a tech-native investor base.

The increasing emphasis on ethical consumption and responsible investing is also influencing the precious metals market. Investors are scrutinizing the provenance and supply chain integrity of gold, favoring providers who demonstrate commitment to ESG principles. This trend, evident in the significant inflows into ESG-focused products in 2024, necessitates that companies like GoldMoney prioritize transparency and ethical sourcing to attract this growing investor segment.

| Sociological Factor | Description | 2024-2025 Data/Trend |

|---|---|---|

| Digital Adoption & Convenience | Growing preference for online platforms for financial transactions and asset management. | 420 million global cryptocurrency owners by end of 2024; billions in digital gold market transactions annually. |

| Demographic Shifts | Increasing financial literacy and tech-savviness among younger generations (Millennials, Gen X). | Millennials and Gen X manage trillions in assets; express strong interest in digital gold investment. |

| Ethical & Sustainable Investing | Demand for transparency in supply chains and adherence to ESG principles. | Significant portion of new fund inflows in Europe directed towards ESG products in 2024. |

| Investor Sentiment & Economic Outlook | Seeking safe-haven assets like gold during periods of economic uncertainty. | 45% of retail investors considered gold for safety during economic downturns in 2024; retail gold demand up 12% H1 2024 (World Gold Council). |

Technological factors

Blockchain and distributed ledger technology offer significant potential for GoldMoney by enhancing the transparency and security of digital gold ownership. This technology’s inherent immutability builds greater trust and efficiency, crucial for GoldMoney's operations. For instance, by mid-2024, the global blockchain market was valued at over $12 billion, with significant growth projected, indicating increasing industry confidence in these foundational technologies.

Cybersecurity is a critical technological factor for GoldMoney, a digital platform managing substantial financial assets and sensitive user data. The increasing sophistication of cyber threats necessitates continuous investment in advanced security protocols to safeguard against breaches and maintain user trust. For instance, the global cybersecurity market was projected to reach $233.4 billion in 2024, highlighting the significant resources dedicated to this area.

GoldMoney's digital infrastructure must incorporate robust measures like multi-factor authentication, encryption, and regular security audits. These protocols are essential for protecting against evolving threats such as ransomware and phishing attacks. The company's commitment to data protection directly impacts its reputation and regulatory compliance, especially as data privacy regulations like GDPR and CCPA continue to shape digital operations.

GoldMoney's commitment to intuitive online and mobile platforms is crucial for user engagement. In 2024, the digital asset management sector saw a significant surge, with platforms offering seamless transactions and secure storage becoming paramount. This user-centric approach directly impacts GoldMoney's ability to attract and retain a diverse clientele seeking convenient access to precious metals.

The 24/7 accessibility of online platforms empowers investors to buy, sell, and store gold from anywhere. By Q3 2024, over 70% of GoldMoney's new account openings were initiated through their mobile application, highlighting the importance of a robust and user-friendly digital interface for market penetration and customer satisfaction.

Integration with Payment Systems

GoldMoney's integration with payment systems is a key technological driver. Seamlessly connecting with modern digital payment methods, including Unified Payments Interface (UPI) in markets like India, significantly boosts transaction speed and user convenience. This integration allows users to effortlessly fund their accounts and make payments, broadening the platform's accessibility.

The expansion of digital payment ecosystems directly benefits platforms like GoldMoney. For instance, the global digital payments market was valued at approximately $2.5 trillion in 2023 and is projected to grow substantially in the coming years. This growth signifies a larger user base accustomed to and expecting digital transaction capabilities, making GoldMoney's focus on integration even more critical for market penetration and customer retention.

- UPI Adoption: India's UPI processed over 120 billion transactions in 2023, indicating widespread consumer comfort with digital payment interfaces.

- Digital Wallet Growth: The global digital wallet market is expected to exceed $10 trillion by 2027, highlighting a strong trend towards cashless transactions.

- Cross-border Payments: Enhanced integration capabilities can facilitate smoother cross-border gold transactions, a significant area for growth.

- Fintech Partnerships: Collaborations with fintech providers are crucial for staying ahead in payment system integration.

Data Analytics and AI for Market Insights

GoldMoney can leverage sophisticated data analytics and artificial intelligence to gain a more nuanced understanding of market trends and client behavior. This allows for enhanced risk management by identifying potential vulnerabilities more effectively. Furthermore, AI-driven insights can enable GoldMoney to tailor its services, offering personalized investment strategies and product recommendations, thereby improving client retention and satisfaction.

The accelerating pace of AI development is a significant factor in the technology sector. For instance, the global AI market was valued at approximately $136.6 billion in 2022 and is projected to grow substantially, with some estimates suggesting a CAGR of over 37% through 2030. Identifying and integrating with companies at the forefront of AI innovation will be crucial for GoldMoney’s long-term competitive advantage and investment strategy.

The application of AI in finance is expanding rapidly, impacting areas like fraud detection, algorithmic trading, and customer service. For GoldMoney, this translates to opportunities in:

- Enhanced Predictive Analytics: Utilizing AI to forecast market movements and identify investment opportunities with greater accuracy.

- Personalized Client Experiences: Deploying AI-powered chatbots and recommendation engines to offer bespoke advice and support.

- Streamlined Operations: Automating back-office processes and improving compliance through AI-driven solutions.

- Advanced Risk Assessment: Employing machine learning algorithms to better gauge and mitigate investment and operational risks.

Technological advancements, particularly in blockchain and AI, are reshaping how GoldMoney operates and interacts with its clients. The increasing adoption of digital payment systems globally, like India's UPI which processed over 120 billion transactions in 2023, directly supports GoldMoney's strategy of seamless integration and broad accessibility.

Cybersecurity remains paramount, with the global cybersecurity market expected to reach $233.4 billion in 2024, underscoring the continuous need for robust protection of digital assets and sensitive data against evolving threats.

GoldMoney's focus on user-friendly digital platforms, evident in over 70% of new accounts opened via mobile by Q3 2024, aligns with the growing demand for convenient, 24/7 access to financial services.

Leveraging AI for predictive analytics and personalized client experiences, as the global AI market was valued at approximately $136.6 billion in 2022, offers significant opportunities for enhanced service delivery and competitive advantage.

Legal factors

GoldMoney operates within a stringent regulatory landscape, necessitating compliance with financial services regulations and licensing requirements across the diverse jurisdictions where it offers precious metal trading and storage. This includes adhering to anti-money laundering (AML) and know-your-customer (KYC) protocols, which are continually updated by global financial watchdogs.

A key aspect of GoldMoney's legal navigation is its successful acquisition of exemptive relief from Canadian securities regulators. This specific relief, granted in 2023, allows GoldMoney to offer its unique precious metals-backed accounts and trading services to Canadian residents, demonstrating a proactive approach to legal compliance in a significant market.

GoldMoney's operations are critically dependent on robust Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance. Failure to adhere to these global regulations, such as those enforced by FATF recommendations, exposes the company to significant legal penalties and reputational damage. These measures are paramount for preventing illicit financial activities and ensuring GoldMoney is perceived as a trustworthy platform for digital gold transactions.

The digital gold sector, in particular, faces intense scrutiny regarding its compliance with regulatory frameworks. For instance, in 2024, regulatory bodies worldwide continued to enhance their oversight of digital asset providers, with fines for non-compliance reaching millions of dollars for some entities. GoldMoney must therefore maintain stringent KYC protocols to verify customer identities and monitor transactions for suspicious patterns, thereby safeguarding its integrity and market position.

Consumer protection laws are critical for GoldMoney, especially concerning the secure storage and redemption of precious metals. Regulations like the Securities Investor Protection Act (SIPA) in the US, while not directly governing physical metal storage, set a precedent for investor safeguards that influence customer expectations and operational transparency. In 2023, regulatory bodies globally continued to emphasize consumer disclosures and fair practices within financial services, impacting how companies like GoldMoney communicate their security measures.

GoldMoney's Digital Gold Project is designed with robust compliance and user investment protection at its core. This focus is essential as regulators worldwide, including those overseeing digital assets and financial institutions, increasingly scrutinize platforms that hold customer assets. For instance, the ongoing development of frameworks for digital assets by entities like the Financial Stability Board aims to enhance investor confidence through clearer rules, which GoldMoney must navigate to ensure its operations remain compliant and trustworthy.

Cross-Border Transaction Laws and Tax Implications

GoldMoney's international operations mean navigating a complex web of cross-border transaction laws. These regulations can significantly impact how customers buy, sell, and store precious metals across different countries. For instance, varying anti-money laundering (AML) and know your customer (KYC) requirements in jurisdictions like the UK, Switzerland, and Canada necessitate robust compliance frameworks.

Tax implications represent a substantial legal factor. Countries have diverse approaches to taxing precious metal ownership, capital gains on sales, and even storage fees. This creates jurisdictional risk, as changes in tax laws in key markets could affect profitability and customer behavior. For example, a country might introduce a wealth tax that includes precious metals, or alter capital gains tax rates on commodities.

- Regulatory Divergence: GoldMoney must adhere to differing financial regulations, such as those from the Financial Conduct Authority (FCA) in the UK and FINMA in Switzerland, impacting customer onboarding and transaction processing.

- Taxation Variability: Tax treatments for precious metals differ significantly; for example, in 2024, the UK treats gold bullion as a capital asset with potential capital gains tax, while some other nations may have different rules for VAT or other levies.

- Jurisdictional Risk: Changes in national laws concerning financial services, currency controls, or asset ownership can create operational challenges and financial liabilities for GoldMoney's global customer base.

Data Privacy and Security Regulations (e.g., GDPR, CCPA)

GoldMoney's operations are significantly shaped by data privacy and security regulations like GDPR and CCPA. Compliance is paramount given the sensitive personal and financial data entrusted by its global clientele. Failure to adhere could result in substantial fines; for instance, GDPR violations can incur penalties up to 4% of annual global turnover or €20 million, whichever is higher. GoldMoney has invested in robust data protection measures to ensure client information remains secure and private, a critical factor in maintaining trust and operational integrity.

The company's commitment to data security is not just a legal obligation but a strategic imperative. In 2024, cybersecurity incidents globally continued to rise, with the average cost of a data breach reaching an estimated $4.45 million. GoldMoney's proactive approach includes regular security audits and employee training to mitigate these risks. This focus on safeguarding data is essential for retaining customer confidence in an increasingly digital financial landscape.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- CCPA Impact: California's law grants consumers rights over their personal data, requiring clear consent and opt-out options.

- 2024 Data Breach Costs: Average cost estimated at $4.45 million globally, highlighting the financial risk of non-compliance.

- Customer Trust: Robust data protection is vital for maintaining client confidence and loyalty.

GoldMoney's legal framework is shaped by evolving global regulations, particularly concerning digital assets and financial services. The company must navigate differing compliance standards across jurisdictions, such as the UK's FCA and Switzerland's FINMA, impacting operations and customer transactions. Ongoing regulatory scrutiny of digital asset providers, with significant fines levied in 2024 for non-compliance, underscores the critical need for GoldMoney's robust KYC and AML protocols.

| Regulatory Area | Key Compliance Factor | 2024/2025 Relevance |

|---|---|---|

| AML/KYC | Preventing illicit financial activities | Continued global emphasis on transaction monitoring and customer verification; FATF recommendations are key. |

| Data Privacy | Protecting customer information (e.g., GDPR, CCPA) | GDPR fines can reach 4% of global annual turnover; CCPA grants consumers data rights. |

| Consumer Protection | Ensuring fair practices and asset security | Increased regulatory focus on transparency and investor safeguards in financial services. |

| Taxation | Varying tax treatments on precious metals | Jurisdictional tax law changes can impact profitability and customer investment decisions. |

Environmental factors

The growing emphasis on Environmental, Social, and Governance (ESG) criteria is prompting investors to scrutinize companies like GoldMoney more closely. This means the environmental footprint of precious metal extraction and procurement will likely face increased attention. For instance, as of early 2024, sustainable investing assets globally are projected to exceed $50 trillion, highlighting the significant shift in investor priorities towards environmentally conscious practices.

GoldMoney, as a facilitator of precious metal ownership, faces increasing scrutiny regarding the ethical sourcing of its metals. This involves ensuring that the gold, silver, and other precious metals traded are not linked to environmental degradation or exploitative labor conditions. The global momentum towards transparency and regulatory adherence in sustainable investing is a significant environmental factor.

Growing consumer and investor demand for ethically sourced products is a key driver. For instance, the Responsible Jewellery Council (RJC) has seen increased membership and adherence to its Code of Practices, which covers ethical labor and environmental management. This trend suggests that companies like GoldMoney will need to demonstrate robust due diligence in their supply chains to maintain trust and market access.

Physical risks from climate change, like severe storms or prolonged droughts, pose a significant threat to mining operations and the transportation of precious metals. These disruptions can directly impact supply chains, potentially leading to price volatility that indirectly affects GoldMoney's business model. For instance, extreme weather events in 2024 have already caused temporary shutdowns at several South American mining sites, highlighting the vulnerability of these essential links.

Energy Consumption of Digital Infrastructure

The energy consumption of digital infrastructure supporting GoldMoney's secure platforms and data centers presents a growing environmental consideration. As global awareness of climate change intensifies, the carbon footprint associated with maintaining these digital assets will likely face increased scrutiny. By 2025, the technology sector is heavily focused on efficiency and sustainability, pushing for greener data center solutions and energy-saving protocols.

The demand for digital services continues to surge, directly correlating with increased energy needs for data processing and storage. For instance, global data center energy consumption was estimated to be around 1.5% of total global electricity use in 2023, a figure projected to rise. This trend highlights the importance of GoldMoney adopting energy-efficient technologies and renewable energy sources to mitigate its environmental impact.

- Data Center Efficiency: Advancements in cooling technologies and server virtualization are key to reducing energy consumption.

- Renewable Energy Adoption: Companies are increasingly sourcing power from solar and wind farms to offset their digital footprint.

- E-waste Management: The lifecycle of digital hardware also contributes to environmental concerns, necessitating responsible disposal and recycling practices.

Waste Management and Recycling of Metals

The precious metals industry, while not directly involved in large-scale manufacturing for GoldMoney, faces increasing scrutiny regarding its environmental footprint, particularly concerning waste management and the recycling of metals. As the global push for clean energy transitions and carbon reduction intensifies, investors and consumers are more aware of the sustainability practices throughout the value chain. This can indirectly affect GoldMoney's public perception and its long-term viability as stakeholders increasingly favor environmentally responsible businesses.

Efforts to improve metal recycling rates are crucial. For instance, the global recycling rate for copper, a metal often associated with industrial processes that can intersect with precious metal refining, was estimated to be around 30% in recent years, though this varies significantly by region and application. Similarly, advancements in efficient precious metal recovery from electronic waste (e-waste) are gaining traction. The World Health Organization has highlighted the growing problem of e-waste, which contains valuable precious metals, and the need for better collection and processing systems. These industry-wide trends in sustainability and resource efficiency are becoming key considerations for businesses like GoldMoney, even in its role as a facilitator of ownership and storage.

The emphasis on a circular economy is driving innovation in how metals are recovered and reused. Companies are investing in technologies that can extract precious metals with higher purity and lower environmental impact.

- Growing E-waste: The global generation of e-waste is projected to reach 74 million metric tons by 2030, presenting both a challenge and an opportunity for precious metal recovery.

- Recycling Efficiency: Investments in advanced refining techniques aim to increase the recovery rates of precious metals from secondary sources, reducing reliance on primary mining.

- Investor Demand: There's a discernible trend of investors favoring companies with strong environmental, social, and governance (ESG) credentials, which includes responsible waste management and recycling practices.

- Regulatory Landscape: Evolving environmental regulations globally are pushing industries, including precious metals, towards more sustainable waste handling and recycling protocols.

The increasing focus on Environmental, Social, and Governance (ESG) factors means GoldMoney must demonstrate a commitment to sustainability. This includes addressing the environmental impact of precious metal mining and refining, as evidenced by the projected over $50 trillion in global sustainable investing assets by early 2024.

GoldMoney's operations, particularly its digital infrastructure, also face environmental scrutiny regarding energy consumption. By 2025, the technology sector is prioritizing greener data center solutions, with global data center energy consumption estimated at 1.5% of total global electricity use in 2023, a figure expected to rise.

The precious metals industry's waste management and recycling practices are under increased attention. The growing global generation of e-waste, projected to reach 74 million metric tons by 2030, highlights the opportunity for improved precious metal recovery and the investor preference for companies with strong ESG credentials.

PESTLE Analysis Data Sources

Our GoldMoney PESTLE Analysis is meticulously constructed using a blend of official government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. This ensures a comprehensive and data-driven understanding of the macro-environmental landscape.