GoldMoney Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoldMoney Bundle

GoldMoney navigates a complex landscape shaped by buyer bargaining power, the threat of substitutes, and the intensity of rivalry. Understanding these forces is crucial for any investor or strategist looking to capitalize on opportunities within the precious metals sector.

The complete report reveals the real forces shaping GoldMoney’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for physical precious metals, particularly gold and silver, is characterized by a relatively concentrated group of major refiners, mints, and wholesale dealers. GoldMoney's ability to source the physical metals it safeguards for its clients is directly dependent on these entities. Their pricing power can significantly impact GoldMoney's cost of goods, especially when dealing with substantial volumes or specific forms of bullion.

GoldMoney's operations are intrinsically linked to the availability and cost of secure, specialized vault and storage providers. These facilities are crucial for safeguarding the physical gold held on behalf of customers.

The market for high-security, insured precious metals storage is not vast. This limited pool of qualified providers means GoldMoney has fewer options, potentially increasing the bargaining power of these suppliers. For instance, in 2024, the global gold storage market is characterized by a concentration of key players offering specialized services, which can influence pricing structures.

Suppliers of core technology infrastructure, cybersecurity solutions, and payment gateway services are critical for GoldMoney's smooth operations and client satisfaction. These specialized providers, while numerous, often possess unique expertise, making it challenging and costly to switch, which can amplify their leverage.

For instance, a significant disruption in a key payment processing partner’s service could directly impact GoldMoney's ability to facilitate transactions, highlighting the dependency. In 2023, the global cybersecurity market was valued at approximately $214 billion, indicating the substantial investment and specialized nature of these critical services, further underscoring the potential bargaining power of these technology suppliers.

Regulatory and compliance service providers

For GoldMoney, navigating the complex landscape of international financial regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) is non-negotiable. This necessity makes specialized legal, audit, and compliance service providers indispensable partners. The deep expertise and established reputations of these firms are crucial for GoldMoney's operational integrity and market trust.

The highly specialized nature of regulatory and compliance services grants these suppliers considerable bargaining power. Their ability to interpret and implement intricate global financial laws, coupled with the high cost and time involved in switching providers, strengthens their position. In 2024, the global regulatory compliance market was valued at over $50 billion, highlighting the significant investment businesses make in these essential services.

- High Demand for Expertise: The increasing complexity of financial regulations worldwide drives demand for specialized compliance services.

- Switching Costs: The effort and expense associated with changing compliance providers limit GoldMoney's ability to easily switch, increasing supplier power.

- Reputation and Trust: The reliance on established, reputable firms for critical compliance functions further solidifies supplier influence.

- Market Size: The substantial global market for compliance services underscores the financial significance of these suppliers.

Switching costs for GoldMoney

Switching core suppliers for GoldMoney, like primary vault providers or essential technology platforms, presents significant hurdles. These transitions involve substantial costs and potential operational disruptions, which can embolden existing suppliers.

The complexity extends to potential security vulnerabilities during the migration process and the necessity of renegotiating crucial contracts. This intricate process can elevate the bargaining leverage of incumbent suppliers, making it challenging for GoldMoney to secure more favorable terms or switch providers easily.

For instance, in 2024, the financial services sector saw increased scrutiny on data security and operational continuity, meaning any supplier change for a platform like GoldMoney would likely involve rigorous due diligence and potentially higher transition costs to ensure compliance and uninterrupted service. This environment amplifies the power of established, trusted providers.

- High Costs: Significant financial outlay for migration, integration, and potential downtime.

- Operational Risk: Potential for service interruptions and security breaches during the transition period.

- Contractual Obligations: Existing agreements may include penalties or lengthy notice periods for termination.

- Technology Integration: Ensuring seamless compatibility with new systems can be a complex and time-consuming process.

The suppliers of physical precious metals, such as refiners and wholesale dealers, hold significant bargaining power due to the concentrated nature of the market. Similarly, specialized vault and storage providers are critical, and their limited number in 2024 amplifies their leverage over GoldMoney. Technology and compliance service providers also wield considerable influence, as their unique expertise and the high costs associated with switching suppliers create dependencies.

| Supplier Type | Key Dependencies for GoldMoney | Factors Influencing Bargaining Power (2024) | Market Data/Context |

|---|---|---|---|

| Precious Metal Suppliers | Sourcing physical gold and silver | Concentrated market of major refiners/dealers | Pricing power impacts cost of goods |

| Vault & Storage Providers | Secure physical metal storage | Limited pool of qualified, high-security facilities | Global gold storage market concentration |

| Technology Providers | Core infrastructure, cybersecurity, payment gateways | Unique expertise, high switching costs | Global cybersecurity market ~$214 billion (2023) |

| Compliance Services | Legal, audit, and regulatory adherence (AML/KYC) | Specialized expertise, high switching costs, reputation | Global regulatory compliance market >$50 billion (2024) |

What is included in the product

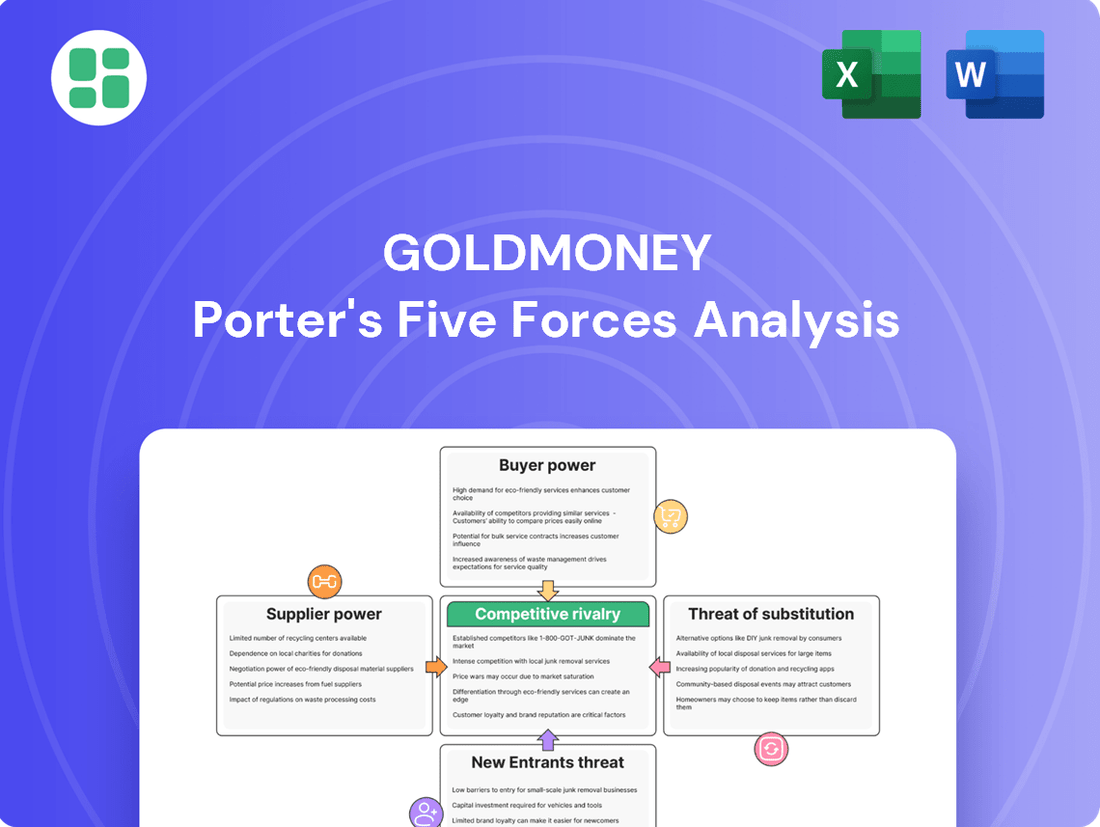

This analysis dissects the competitive forces impacting GoldMoney, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Easily visualize competitive intensity across all five forces, identifying your biggest strategic threats and opportunities in seconds.

Customers Bargaining Power

Customers can readily shift between various digital precious metal platforms or other investment avenues if they discover more favorable pricing, enhanced features, or superior service. This ease of transition significantly amplifies their bargaining power.

The digital infrastructure of services like GoldMoney inherently reduces the practical hurdles involved in relocating assets when contrasted with traditional financial entities, thereby strengthening the customer's position.

For instance, in the broader digital asset space in 2024, reports indicated that the average customer acquisition cost for fintech platforms can be as low as $50, suggesting that retaining customers through competitive offerings is paramount, as acquiring new ones is relatively inexpensive and switching is often a matter of a few clicks.

Many precious metal investors exhibit high price sensitivity, diligently comparing premiums, storage fees, and transaction costs across different platforms. This means providers like GoldMoney face direct pressure on their profitability, as customers naturally gravitate towards the most economical options for buying and holding precious metals.

For instance, in early 2024, the average premium for gold bullion bars from major online dealers fluctuated between 1.5% and 3% over the spot price, with storage fees ranging from 0.1% to 0.5% annually. Customers actively seeking the lowest overall cost can significantly influence market share, forcing companies to maintain competitive pricing structures.

The bargaining power of customers is significantly amplified by the sheer availability of diverse investment alternatives to GoldMoney. Investors can readily access physical bullion from numerous reputable dealers, invest in precious metal Exchange Traded Funds (ETFs) that trade on major stock exchanges, or utilize other emerging digital platforms offering similar services. This broad spectrum of choices means customers are not locked into GoldMoney and can easily switch if they find better pricing or service elsewhere, thereby increasing their leverage.

Customer knowledge and access to information

GoldMoney's customers are typically well-informed, with easy access to market data and competitor analyses via online resources. This financial literacy means they can swiftly compare offerings and switch to rivals providing better terms or novel services, thereby increasing pressure on GoldMoney to maintain competitive pricing and service innovation.

The ease with which customers can access information on pricing, fees, and service quality significantly amplifies their bargaining power. For instance, in 2024, the proliferation of fintech comparison websites and financial news outlets means a customer looking to store or transact in precious metals can readily see GoldMoney's fee structure against that of its competitors within minutes.

- Informed Customer Base: Financially literate individuals readily utilize online platforms to compare GoldMoney's fees and services against competitors.

- Price Sensitivity: Customers can easily identify and switch to providers offering more favorable terms, directly impacting GoldMoney's pricing strategy.

- Demand for Innovation: Access to market trends allows customers to pressure GoldMoney to adopt new technologies and service enhancements to remain competitive.

Lack of significant lock-in or proprietary features

The bargaining power of customers for GoldMoney is influenced by the lack of significant lock-in or proprietary features. Many of GoldMoney's fundamental services, such as purchasing, selling, and storing precious metals, are readily available from numerous competitors in the market. This ease of switching means customers can readily move to alternative providers if they perceive better pricing or service elsewhere.

For instance, in 2024, the precious metals investment market saw continued growth, with platforms offering similar functionalities to GoldMoney. The competitive landscape means that unless GoldMoney can differentiate itself with unique, hard-to-replicate offerings that genuinely bind customers to its platform, the inherent bargaining power of these customers remains substantial. This pressure can limit GoldMoney's ability to raise prices or dictate terms without risking customer attrition.

- Limited Customer Lock-in: GoldMoney's core services are easily replicated by competitors, allowing customers to switch providers with minimal friction.

- Competitive Landscape: The precious metals market in 2024 featured many platforms offering comparable buying, selling, and storage solutions.

- Price Sensitivity: Without unique proprietary features, customers are more likely to base decisions on price, increasing their bargaining power.

- Potential for Churn: High customer bargaining power can lead to increased churn if competitors offer more attractive terms or features.

Customers possess significant leverage due to the ease of switching between precious metal platforms and the availability of numerous alternative investment vehicles. This accessibility, coupled with a high degree of price sensitivity, forces providers like GoldMoney to remain highly competitive on fees and premiums. The digital nature of these services further reduces switching costs, allowing customers to readily move assets if better terms are found elsewhere.

| Factor | Impact on GoldMoney | 2024 Data/Observation |

|---|---|---|

| Ease of Switching | High customer bargaining power | Customer acquisition costs for fintech platforms averaged around $50 in 2024, indicating low switching barriers. |

| Price Sensitivity | Pressure on pricing and profitability | Gold premiums in early 2024 ranged from 1.5% to 3% over spot, with storage fees at 0.1%-0.5% annually. |

| Availability of Alternatives | Limits provider's pricing power | Numerous digital platforms, ETFs, and physical bullion dealers offered comparable services in 2024. |

Same Document Delivered

GoldMoney Porter's Five Forces Analysis

This preview showcases the comprehensive GoldMoney Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, fully formatted report you will receive immediately upon purchase, ensuring no discrepancies or missing information. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this precise file, ready for your immediate review and utilization.

Rivalry Among Competitors

The digital precious metal sector is quite crowded, with established names like BullionVault and Kinesis Money, alongside numerous other online bullion dealers. This high level of competition means GoldMoney faces constant pressure on pricing and service offerings.

This intense rivalry forces GoldMoney to stay on its toes, continually innovating and finding new ways to stand out from the crowd to attract and retain customers in a market where alternatives are readily available.

Traditional banks and brokerage firms are stepping up their game, now offering precious metal investment options, either directly or by teaming up with custodians. This means you can often find gold and silver investments through the same channels you use for stocks and bonds.

These established financial giants bring a lot to the table. They have deep pockets, a long history of trust with customers, and a massive existing client base. For specialized platforms like GoldMoney, this presents a serious challenge because these institutions can leverage their scale and brand recognition to attract investors.

For instance, in 2024, major banks saw a significant uptick in client inquiries about alternative assets, including precious metals, as investors sought diversification amidst market volatility. This trend highlights the competitive pressure on niche providers to differentiate their offerings and customer experience.

The rise of blockchain technology has spurred the creation of gold-backed cryptocurrencies and stablecoins, offering a novel way to own and trade digital representations of gold. These digital assets are attracting a new wave of investors, particularly those comfortable with technology, and represent a burgeoning competitive force against traditional gold ownership methods.

As of early 2024, the market capitalization of stablecoins, a category that includes some gold-backed options, has seen significant growth, with some estimates placing the total market cap of all stablecoins in the hundreds of billions of dollars. This indicates a substantial shift in how some investors are engaging with assets like gold, seeking the convenience and speed of digital transactions.

Differentiation based on security, fees, and features

Competitive rivalry in the precious metals sector, particularly for platforms like GoldMoney, intensely focuses on differentiation through security, fees, and features. Companies are locked in a continuous effort to enhance their offerings in these critical areas to capture and hold market share.

Storage security is paramount, with providers emphasizing vaulting locations, insurance coverage, and audit protocols. For instance, many reputable players highlight segregated storage to ensure client assets are not commingled, a key trust factor. Fee structures also vary significantly, ranging from storage and transaction costs to assaying and delivery charges. Transparency in these fees is a major differentiator, as customers seek clear, predictable pricing. In 2024, many platforms are actively reviewing and adjusting their fee models to remain competitive, with some offering tiered discounts for larger holdings or longer-term commitments.

The range of precious metals offered, beyond gold and silver to include platinum, palladium, and even rhodium, broadens a company's appeal. Furthermore, the user-friendliness of the digital platform, including mobile accessibility and seamless transaction processing, is a significant driver of customer acquisition and retention. Additional services, such as integrated payment solutions or the ability to trade metals easily, further distinguish competitors.

- Security: Emphasis on segregated, insured, and audited vaulting facilities.

- Fees: Transparency and competitiveness in storage, transaction, and ancillary charges.

- Features: Breadth of metals offered, platform usability, and integrated payment options.

Market maturity and growth rate of digital precious metals

While the broader precious metals market is well-established, the digital precious metals sector is experiencing significant evolution. Projections through 2025 and beyond indicate a robust growth trajectory for this segment, suggesting continued expansion opportunities.

A moderate, yet steady, growth rate in digital precious metals is likely to fuel more aggressive competition among established players vying for existing market share. This dynamic might see companies focusing on capturing customers from rivals rather than solely on expanding into entirely new demographics, thereby intensifying the competitive rivalry within the digital space.

- Digital precious metals market growth is projected to remain strong through 2025.

- Existing players are likely to compete fiercely for market share due to moderate growth.

- The evolving nature of digital platforms can lead to innovation-driven competition.

Competitive rivalry within the digital precious metals sector is fierce, with GoldMoney facing established players like BullionVault and Kinesis Money, alongside a growing number of online bullion dealers. This intense competition necessitates continuous innovation in pricing and service offerings to attract and retain customers. Traditional financial institutions are also increasingly offering precious metals, leveraging their brand recognition and existing client bases, thereby intensifying the pressure on specialized platforms.

In 2024, a key battleground for differentiation lies in security, fees, and platform features. Providers are emphasizing segregated storage, insurance, and transparent fee structures, with many adjusting their models to remain competitive. The breadth of metals offered and the user-friendliness of digital platforms, including mobile accessibility, are also crucial differentiators.

The market capitalization of stablecoins, some of which are gold-backed, has seen substantial growth as of early 2024, indicating a shift towards digital asset engagement. This evolving landscape presents both challenges and opportunities for platforms like GoldMoney, as they navigate competition from both traditional finance and emerging digital solutions.

| Competitive Factor | Key Differentiators | 2024 Trend Impact |

|---|---|---|

| Security | Segregated storage, insurance, audits | Heightened customer demand for robust security measures. |

| Fees | Transparency, competitive rates, tiered discounts | Price sensitivity among investors, leading to fee model adjustments. |

| Platform Features | Metal variety, user experience, mobile access, payment integration | Focus on seamless digital experience and expanded product offerings. |

SSubstitutes Threaten

The most direct substitute for GoldMoney's offering is the physical ownership of gold and silver bullion, such as coins and bars, acquired from traditional dealers. This method appeals to investors who prioritize direct control over their assets and wish to bypass the perceived risks associated with digital platforms. For instance, in 2023, the World Gold Council reported that central banks purchased a record 1,080 tonnes of gold, indicating a strong preference for tangible assets among major institutional players.

Precious metal Exchange Traded Funds (ETFs) and Exchange Traded Commodities (ETCs) present a significant threat of substitution for direct ownership of physical precious metals. These financial instruments offer investors a convenient and often more cost-effective way to gain exposure to gold, silver, and other precious metals. For instance, as of early 2024, the global ETF market held trillions of dollars in assets, with precious metals ETFs representing a substantial portion, indicating their widespread adoption and accessibility.

The ease of trading these ETFs/ETCs through standard brokerage accounts, coupled with lower minimum investment requirements compared to acquiring physical bullion, makes them a compelling alternative. This accessibility can divert investment capital that might otherwise flow into direct precious metal holdings, thereby reducing the demand for physical assets and impacting their market dynamics.

For investors prioritizing wealth preservation and diversification, traditional assets like government bonds, real estate, and established blue-chip stocks present viable alternatives to precious metals. These asset classes offer distinct risk-reward profiles and varying levels of liquidity, which can divert investment capital away from gold and other precious metals.

In 2024, for instance, the yield on U.S. Treasury bonds fluctuated, providing income-generating opportunities that compete with the non-yielding nature of gold. Similarly, real estate markets continued to show resilience in many regions, offering tangible asset appreciation and rental income, further presenting a substitute for precious metal holdings.

Cryptocurrencies and digital assets

Cryptocurrencies, often dubbed 'digital gold,' present a significant threat of substitution for traditional assets like gold. Investors are increasingly viewing Bitcoin and other digital assets as alternative stores of value, especially those attracted to decentralization and potential for high returns.

This burgeoning digital asset class directly competes with precious metals for investment capital. For instance, in early 2024, Bitcoin's market capitalization fluctuated significantly, at times exceeding the total market value of gold, demonstrating its growing influence as a perceived safe haven or growth asset.

- Digital Gold Narrative: Bitcoin and other cryptocurrencies are marketed and perceived by some investors as a modern-day equivalent to gold, offering a hedge against inflation and a store of wealth outside traditional financial systems.

- Decentralization Appeal: The decentralized nature of many cryptocurrencies appeals to investors wary of centralized control and potential government intervention in traditional financial markets.

- Investment Class Competition: As a distinct investment class, digital assets directly vie for investor allocations that might otherwise be directed towards precious metals, impacting demand for gold.

- Market Volatility and Growth: While highly volatile, the significant price appreciation seen in certain cryptocurrencies in 2023 and early 2024 has attracted considerable investment, further positioning them as an alternative to gold for growth-oriented investors.

Alternative digital payment systems

The threat of substitutes for GoldMoney's payment services is significant, primarily from a wide array of alternative digital payment systems. Platforms like PayPal, Wise (formerly TransferWise), and even traditional bank transfers offer robust and widely accepted methods for everyday transactions, often without the complexities or specific use cases associated with gold-backed payments. These established players benefit from network effects and broad consumer familiarity.

These readily available digital payment alternatives present a compelling substitute because they often provide greater convenience and universal acceptance for a vast range of daily purchases and international transfers. For instance, in 2024, global digital payment transaction volumes continued to surge, with estimates suggesting the market could reach trillions of dollars, highlighting the immense scale of these competing systems. GoldMoney's niche appeal to those seeking gold-backed transactions faces direct competition from these mainstream, user-friendly options.

- Widespread Adoption: Digital payment giants like PayPal boast hundreds of millions of active users globally, offering an immediate and convenient alternative for a vast customer base.

- Cost-Effectiveness: Many alternative services, particularly for international transfers, have aggressively lowered fees in recent years, making them more attractive than traditional methods and potentially gold-backed options.

- Technological Advancement: The continuous innovation in digital payment technology, including faster processing times and enhanced security features, further strengthens the competitive position of these substitutes.

- Regulatory Landscape: Traditional and digital payment systems often operate within well-established and understood regulatory frameworks, which can provide a sense of security and predictability for users that may be less apparent with newer or more specialized payment methods.

The threat of substitutes for GoldMoney is multifaceted, encompassing both direct physical ownership and various financial instruments. While direct ownership of gold and silver bullion offers control, it lacks the liquidity and ease of trading found in precious metal ETFs and ETCs. These financial products, which held trillions globally in early 2024, provide accessible exposure to precious metals, drawing capital that might otherwise go to physical assets.

Furthermore, traditional investments like bonds and real estate, along with newer digital assets like Bitcoin, also serve as significant substitutes. In 2024, fluctuating bond yields and resilient real estate markets offered income and tangible appreciation, respectively, competing with gold's role as a store of value. Bitcoin's market capitalization, which at times in early 2024 surpassed gold's, highlights its growing appeal as an alternative investment.

| Substitute Type | Key Characteristics | Investor Appeal | Market Data/Trends (2023-2024) |

|---|---|---|---|

| Physical Gold/Silver Bullion | Direct ownership, tangible asset | Control, perceived security | Central bank purchases reached 1,080 tonnes in 2023 |

| Precious Metal ETFs/ETCs | Convenient exposure, tradable | Liquidity, lower entry barriers | Trillions of dollars held globally in ETFs |

| Traditional Assets (Bonds, Real Estate, Stocks) | Income generation, tangible appreciation, diversification | Risk-reward profiles, established markets | Fluctuating US Treasury yields, resilient real estate markets |

| Cryptocurrencies (e.g., Bitcoin) | Digital store of value, decentralization | Potential high returns, hedge against inflation | Market capitalization sometimes exceeding gold's |

Entrants Threaten

Establishing a precious metal platform like GoldMoney necessitates substantial capital for acquiring and safeguarding physical bullion reserves, which are crucial for backing customer holdings. This significant upfront investment serves as a formidable barrier, deterring potential new entrants from entering the market.

For instance, the sheer volume of gold and silver required to establish credibility and meet customer demand can run into hundreds of millions of dollars. In 2024, the price of gold has consistently traded above $2,000 per ounce, meaning even a modest reserve of a few tons would represent a massive capital outlay, making it exceptionally difficult for smaller, less capitalized firms to compete.

The financial services sector, particularly those involved with precious metals and payment processing, faces a formidable barrier to entry due to stringent regulatory and compliance requirements. New players must navigate a complex web of rules, including those for Anti-Money Laundering (AML), Know Your Customer (KYC), consumer protection, and securing appropriate financial licenses. For instance, in 2024, the cost of obtaining and maintaining compliance in the payments industry alone can easily run into hundreds of thousands, if not millions, of dollars, making it a significant deterrent for nascent companies.

The need for trust, reputation, and robust security infrastructure presents a significant barrier to new entrants in the precious metals storage sector. Storing high-value assets like gold and silver requires an exceptionally high level of confidence in the provider’s reliability and security measures. New players must invest heavily in building a reputation for trustworthiness and establishing sophisticated vaulting and cybersecurity systems, a process that is both time-consuming and capital-intensive.

Economies of scale and established supply chains

Existing players in the precious metals sector, such as GoldMoney, leverage significant economies of scale. This translates to lower per-unit costs in purchasing, secure storage, and streamlined operational processes. For instance, in 2024, major bullion dealers reported handling volumes that allowed for preferential pricing from refiners, a benefit not readily available to smaller, emerging competitors.

Furthermore, established firms possess robust and reliable supply chains. GoldMoney, for example, has cultivated long-standing relationships with key entities like refiners, mints, and secure vaulting service providers. These entrenched partnerships are crucial, as they ensure consistent access to high-quality precious metals and secure storage solutions, creating a substantial barrier for newcomers attempting to match these operational advantages and cost efficiencies.

- Economies of Scale: GoldMoney and similar established firms benefit from reduced per-unit costs in purchasing, storage, and operations due to high transaction volumes.

- Established Supply Chains: Long-term relationships with refiners, mints, and vault providers create a competitive advantage in securing reliable and cost-effective metal supply.

- Cost Competitiveness: New entrants face challenges in matching the cost efficiencies derived from the scale and established supplier networks of incumbent players.

- Access to Resources: Securing consistent access to refined precious metals and secure, insured storage solutions is a significant hurdle for nascent competitors.

Brand recognition and customer acquisition costs

The financial services sector, particularly in digital gold and precious metals, faces significant hurdles for newcomers due to established brand recognition. New entrants must invest heavily in marketing and customer education to even begin to compete with the trust and awareness built by incumbents. For instance, in 2023, the global digital payments market, a related sector, saw marketing and advertising spend reach hundreds of billions of dollars, illustrating the scale of investment required.

Consequently, customer acquisition costs (CAC) are a major deterrent. New platforms need to spend considerably to attract and onboard users, often through incentives and extensive advertising campaigns. This cost is amplified by the need to educate consumers about the security and benefits of alternative financial platforms, a process that requires sustained effort and budget. By Q1 2024, average CAC in the fintech sector was reported to be upwards of $100 for some customer segments, a figure that can be prohibitive for startups.

- High Marketing Spend: New entrants face substantial costs in building brand awareness in a crowded financial market.

- Customer Education Burden: Significant investment is needed to educate potential customers about new platforms and their offerings.

- Customer Acquisition Costs (CAC): High CAC in the fintech sector, often exceeding $100 per customer in early 2024, acts as a barrier to entry.

- Overcoming Inertia: New companies must work harder to persuade customers to switch from established, trusted financial service providers.

The threat of new entrants into the precious metals platform market, like GoldMoney, is significantly mitigated by the immense capital required for operations. This includes securing substantial physical bullion reserves, which are essential to back customer holdings and build trust. For instance, with gold prices consistently above $2,000 per ounce in 2024, even modest reserves represent a massive financial commitment, effectively pricing out smaller competitors.

Furthermore, the stringent regulatory landscape in financial services, particularly for payments and precious metals, imposes high compliance costs. New entrants must navigate complex Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, alongside consumer protection rules and licensing requirements. In 2024, the combined cost of obtaining and maintaining these necessary licenses and compliance frameworks can easily reach millions of dollars, acting as a substantial deterrent.

The need for established trust, a strong reputation, and robust security infrastructure also presents a formidable barrier. New platforms must invest heavily in building credibility and sophisticated vaulting and cybersecurity systems. This process is both time-consuming and capital-intensive, making it difficult for newcomers to compete with the established security and reliability of incumbents.

Economies of scale enjoyed by established players like GoldMoney, stemming from high transaction volumes, lead to lower per-unit costs in purchasing, storage, and operations. In 2024, major bullion dealers' ability to secure preferential pricing from refiners due to their scale is a significant advantage that emerging competitors struggle to match, impacting their cost competitiveness.

Established supply chains, built on long-term relationships with refiners, mints, and secure vaulting providers, are crucial for ensuring consistent access to high-quality precious metals and reliable storage. These entrenched partnerships create a substantial barrier for newcomers attempting to replicate the operational advantages and cost efficiencies enjoyed by incumbent firms.

Porter's Five Forces Analysis Data Sources

Our GoldMoney Porter's Five Forces analysis is built upon a foundation of diverse data, including GoldMoney's annual reports, investor presentations, and regulatory filings. This is supplemented by industry-specific market research reports and financial news outlets to capture the competitive landscape.