Golden Entertainment SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden Entertainment Bundle

Golden Entertainment, a key player in the gaming and hospitality sector, demonstrates robust strengths in its diverse portfolio and strategic market presence. However, understanding its vulnerabilities and the external threats it faces is crucial for informed decision-making.

Want the full story behind Golden Entertainment’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Golden Entertainment boasts a diversified portfolio, encompassing casinos, taverns, and distributed gaming operations, with a significant presence in Nevada and Montana. This strategic mix of business segments allows the company to tap into various consumer preferences and revenue streams, mitigating reliance on any single market or product. For instance, as of the first quarter of 2024, the company reported revenue growth driven by its tavern segment, highlighting the benefit of this varied operational structure.

Golden Entertainment's strategic focus on the locals market provides a significant advantage, fostering more stable demand than the unpredictable tourist sector, especially during economic downturns. This approach cultivates deep community relationships and strong customer loyalty.

By prioritizing residents, the company benefits from the inherent appeal of proximity and convenience, which are crucial drivers for securing repeat business. This localized strategy proved particularly resilient, as evidenced by Golden Entertainment's 2024 performance, where its Nevada locals casinos, like the Strat, saw consistent revenue streams.

Golden Entertainment has demonstrated impressive financial stewardship by slashing its net debt by over $669 million since 2019. This strategic move has successfully lowered its net leverage to a robust 2.6x EBITDA as of June 30, 2025, nearing its goal of 3.0x or below.

This commitment to financial health, alongside a consistent strategy of returning value to shareholders via dividends and buybacks, significantly bolsters the company's financial maneuverability and cultivates greater investor trust.

Looking ahead, Golden Entertainment plans to maintain its capital return initiatives while simultaneously reinvesting in its operational assets.

Operational Efficiencies and Cost Management

Golden Entertainment has shown a strong ability to manage its costs effectively. For instance, operating expenses have been on a downward trend. This focus on cost control is evident in its casino EBITDA margins in Nevada, which climbed to 46% by late 2024, even when some revenue streams saw a dip.

The company has actively worked to make its operations leaner. A key move was selling off parts of its business that weren't central to its core strategy, such as its distributed gaming operations in Nevada. This streamlining helps boost overall profitability.

Management's dedication to operational excellence is a significant strength. This commitment has allowed the company to sustain robust profit margins, a testament to their efficiency in managing day-to-day business activities.

- Effective Cost Management: Demonstrated by decreasing operating expenses.

- Improved Nevada Margins: Casino EBITDA margins in Nevada reached 46% in late 2024.

- Strategic Divestitures: Sale of non-core assets like distributed gaming operations enhances profitability.

- Focus on Operational Effectiveness: Maintaining strong profit margins through streamlined operations.

Growth Initiatives at Flagship Properties and Taverns

Golden Entertainment is actively investing in its flagship properties and taverns to drive future growth. For instance, renovations and new attractions at The STRAT and the recently opened Atomic Golf facility are anticipated to significantly increase revenue and EBITDA. These strategic capital expenditures are designed to enhance the guest experience and attract a broader customer base.

The tavern segment represents another key area for expansion. The company is focusing on revamping operations in its newly acquired tavern locations, bringing them in line with the high-performing standards of its existing portfolio. This operational alignment is crucial for unlocking the full revenue potential of these businesses.

- The STRAT renovations and Atomic Golf are projected to boost revenue and EBITDA.

- Tavern segment growth is being driven by operational improvements in newly acquired locations.

- These initiatives are focused on enhancing customer experience and achieving organic growth.

Golden Entertainment’s diversified portfolio, including casinos and taverns, provides stability, as seen in its Q1 2024 revenue growth driven by the tavern segment. The company’s focus on the locals market fosters strong customer loyalty and consistent demand, as evidenced by the steady revenue streams at its Nevada locals casinos in 2024.

Financial strength is a key asset, with net debt reduced by over $669 million since 2019, bringing net leverage to 2.6x EBITDA as of June 30, 2025. This, coupled with shareholder returns, enhances financial flexibility. Furthermore, effective cost management, reflected in declining operating expenses and a 46% casino EBITDA margin in Nevada by late 2024, showcases operational efficiency. Strategic divestitures of non-core assets, like its distributed gaming operations, also contribute to improved profitability.

Investments in flagship properties, such as The STRAT renovations and the new Atomic Golf facility, are poised to drive future revenue and EBITDA growth. Similarly, operational enhancements in newly acquired taverns are unlocking their full revenue potential, underscoring the company’s commitment to organic expansion and improved customer experience.

What is included in the product

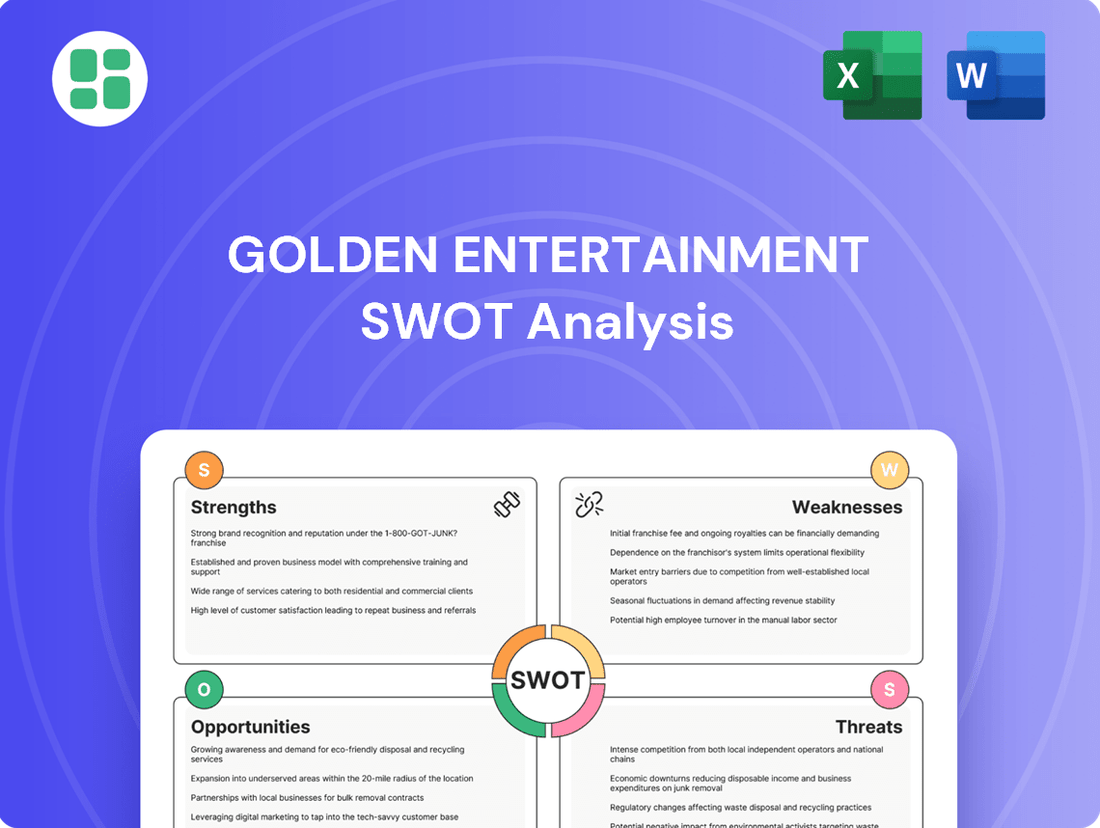

This SWOT analysis provides a comprehensive overview of Golden Entertainment's internal strengths and weaknesses, alongside external opportunities and threats, to inform its strategic decision-making.

Offers a clear, actionable framework for identifying and leveraging Golden Entertainment's competitive advantages and mitigating potential risks.

Weaknesses

Golden Entertainment's primary operations are heavily concentrated in Nevada and Montana. This geographic focus exposes the company to significant risk from regional economic downturns, adverse regulatory shifts, or intensified competition within these specific states. For instance, the Las Vegas locals market experienced softer same-store revenue trends and increased operational costs in early 2025, directly impacting Golden Entertainment's performance due to this concentration.

While Golden Entertainment focuses on the locals market, its revenue is still tied to how much disposable income residents have. Factors like inflation, job security, and the general economic climate directly influence this, potentially dampening spending at their properties.

For instance, the company's Q1 2025 performance highlighted this vulnerability. They reported lower-than-expected earnings per share and revenue, partly attributed to the lack of a major event like the Super Bowl, which boosted results in the prior year, and a general slowdown in visitor numbers.

Golden Entertainment faces significant competitive pressures, especially within the regional and locals gaming markets. The recent opening of Durango Casino & Resort in Las Vegas, for instance, has demonstrably affected same-store gaming revenue for established players like Golden Entertainment, highlighting the impact of new market entrants.

Furthermore, the Nevada taverns segment, a core area for the company, is experiencing intensified competition not just from larger entities but also from numerous smaller, private operators who can be more agile in their market approach.

Declining Revenues in Certain Segments

Golden Entertainment has faced headwinds with declining revenues in specific areas. For instance, Q1 2025 saw an 8% year-over-year drop in overall revenue, and Q2 2025 also reported a slight decrease compared to the previous year.

While some of this decline in 2024 was a result of strategic divestitures, other segments have also underperformed. Notably, Nevada Casino Resorts and Laughlin operations experienced reduced visitation and lower customer spending, impacting their financial performance.

- Revenue Decline: Q1 2025 revenues were down 8% year-over-year.

- Segment Performance: Nevada Casino Resorts and Laughlin operations saw lower visitation and spending.

- Impact of Divestments: Strategic sales contributed to revenue shifts in 2024.

Impact of Non-Recurring Gains on Financial Performance

Golden Entertainment's financial results are heavily skewed by non-recurring gains, making it difficult to assess true operational strength. For example, Q1 2024 reported a substantial $69.7 million gain from asset sales. This trend continued into Q2 2024, where sale proceeds also boosted net income, obscuring the underlying profitability of core business segments.

The reliance on these one-time events means that without them, net income figures can appear considerably weaker on a year-over-year basis, potentially misrepresenting the company's ongoing performance. This volatility can create uncertainty for investors trying to gauge the sustainability of earnings.

- Q1 2024 Net Income Impacted by $69.7 Million Gain

- Q2 2024 Net Income Skewed by Asset Sale Proceeds

- Underlying Operational Performance Masked by Non-Recurring Gains

- Potential for Misleading Year-over-Year Net Income Comparisons

Golden Entertainment's concentrated geographic footprint in Nevada and Montana presents a significant vulnerability. Economic downturns or regulatory changes within these specific states directly impact the company's performance. For example, the Las Vegas locals market experienced softer revenue trends and increased operational costs in early 2025, a direct hit to Golden Entertainment due to this regional reliance.

The company's revenue is also closely tied to consumer discretionary spending, making it susceptible to broader economic shifts like inflation or job market fluctuations. This was evident in their Q1 2025 results, which showed lower earnings per share and revenue, partly due to fewer major events compared to the prior year and a general slowdown in visitor numbers.

Intensified competition, particularly from new market entrants like the Durango Casino & Resort in Las Vegas, has demonstrably affected Golden Entertainment's same-store gaming revenue. Even the Nevada taverns segment faces pressure from numerous smaller, agile operators, compounding competitive challenges.

Financial performance has been marked by revenue declines, with Q1 2025 revenues down 8% year-over-year and Q2 2025 also reporting a slight decrease. While some 2024 revenue shifts were due to strategic divestitures, segments like Nevada Casino Resorts and Laughlin operations experienced reduced visitation and spending, further impacting results.

| Metric | Q1 2025 vs. Q1 2024 | Q2 2025 vs. Q2 2024 |

|---|---|---|

| Overall Revenue | Down 8% | Slight Decrease |

| Nevada Casino Resorts Visitation | Lower | N/A |

| Laughlin Operations Spending | Lower | N/A |

What You See Is What You Get

Golden Entertainment SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the complete, unedited report for Golden Entertainment, ready for your strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Golden Entertainment's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Golden Entertainment SWOT analysis, empowering you with actionable insights.

Opportunities

Golden Entertainment has a clear opportunity to enhance its flagship property, The STRAT, by investing in renovations and introducing new attractions. The recent addition of Atomic Golf, for example, aims to boost customer experience and draw more visitors, particularly during traditionally slower periods. This strategic focus on improving existing assets is key to driving increased visitation and revenue.

Optimizing midweek occupancy rates and increasing direct bookings represent another significant opportunity for Golden Entertainment. By implementing targeted marketing campaigns and loyalty programs, the company can encourage more frequent visits and reduce reliance on third-party booking channels, thereby improving profitability. For instance, in Q1 2024, The STRAT saw a 3.5% increase in revenue per available room (RevPAR) compared to the prior year, indicating positive momentum from such initiatives.

Furthermore, Golden Entertainment controls substantial undeveloped land surrounding The STRAT. This presents a long-term opportunity for phased development of new entertainment venues, hotels, or retail spaces, capitalizing on the existing infrastructure and brand recognition. This strategic land bank allows for flexible expansion plans to meet future market demand and further diversify revenue streams.

Golden Entertainment's stronger financial footing, evidenced by a reduced debt-to-equity ratio, positions it advantageously for strategic acquisitions within its core Nevada casino and tavern segments. This focus allows for targeted expansion to bolster market share and operational synergies.

Management has publicly stated an intent to explore potential acquisitions, aiming to enhance its competitive standing. For instance, in late 2023, the company completed the sale of its Maryland casino, freeing up capital for such strategic moves.

Golden Entertainment can significantly boost customer satisfaction by adopting advanced technologies. For instance, AI-driven marketing and predictive analytics, as seen in the broader hospitality sector, can help tailor promotions and personalize guest interactions. This approach is crucial in the competitive landscape, where a personalized touch drives loyalty.

Further strengthening its online gaming presence is a key opportunity. As the digital gaming market continues its upward trajectory, with global online gambling revenue projected to reach over $150 billion by 2029, investing in these offerings will enhance Golden Entertainment's competitive edge and reach a wider audience.

Growth in the Locals Gaming Market

The Las Vegas locals gaming market presents a significant opportunity for Golden Entertainment, demonstrating strong post-pandemic recovery. Gaming revenue in this segment has seen impressive growth, achieving a 5.1% compound annual growth rate since 2019.

While there might be minor fluctuations, the broader economic health and ongoing population increases in Clark County create a consistently favorable backdrop for Golden Entertainment's strategy of focusing on local patrons. This demographic remains a critical engine for the company's performance.

- Robust Post-Pandemic Growth: The Las Vegas locals gaming market has experienced a notable upswing since 2019.

- Sustained Revenue Increase: Gaming revenue in this sector has grown at a compound annual rate of 5.1% since 2019.

- Favorable Economic Environment: Nevada's economic stability and Clark County's population expansion support Golden Entertainment's local market focus.

- Key Revenue Driver: This market segment continues to be a primary contributor to the company's overall revenue.

Increased Shareholder Returns

Golden Entertainment's robust financial health and consistent free cash flow generation provide ample room to enhance shareholder value through share repurchases and dividends. This financial flexibility allows the company to actively manage its capital structure and reward its investors.

The company's commitment to returning capital is evident in its ongoing share repurchase program. As of June 30, 2025, Golden Entertainment still had $77.2 million available under its existing authorization, demonstrating a clear strategy to buy back its own stock.

This focus on shareholder returns can lead to increased earnings per share and a higher stock valuation over time. By reducing the number of outstanding shares, each remaining share represents a larger portion of the company's earnings and assets.

The continuation of these capital return initiatives is a key opportunity for Golden Entertainment to solidify investor confidence and potentially attract new investment. It signals a well-managed company that prioritizes profitability and shareholder benefit.

Golden Entertainment has a prime opportunity to leverage its undeveloped land surrounding The STRAT for future expansion, potentially adding new entertainment venues or retail spaces. This strategic land bank offers flexibility for growth, allowing the company to capitalize on existing infrastructure and brand recognition as market demand evolves.

The company can also enhance its digital presence by investing further in online gaming, a sector projected for significant global growth. By strengthening its online offerings, Golden Entertainment can broaden its customer reach and maintain a competitive edge in the evolving entertainment landscape.

Furthermore, optimizing midweek occupancy at properties like The STRAT presents a clear avenue for increased profitability. Targeted marketing and loyalty programs aimed at boosting direct bookings can reduce reliance on third-party channels and improve overall financial performance, as suggested by the 3.5% RevPAR increase in Q1 2024.

The strong performance of the Las Vegas locals gaming market, with a 5.1% CAGR in gaming revenue since 2019, offers a consistent opportunity for Golden Entertainment. This demographic remains a critical driver of revenue, supported by favorable economic conditions and population growth in Clark County.

Threats

A significant economic downturn or persistent high inflation could severely dampen consumer discretionary spending, directly impacting Golden Entertainment's revenue streams from gaming and entertainment. Many regional casino operators are already experiencing a gradual decline in gross gaming revenue, with ongoing macroeconomic challenges putting pressure on certain locations.

Golden Entertainment operates in a highly competitive regional gaming market, particularly in Nevada, where new casino openings and aggressive promotional tactics by smaller operators are common. This intensified competition directly impacts same-store revenue and puts pressure on profit margins for established companies like Golden Entertainment.

The recent opening of the Durango Casino & Resort has already demonstrated this effect, drawing customers and impacting the performance of other local gaming establishments. This trend highlights the constant need for adaptation and strategic differentiation to maintain market share in the face of evolving competitive pressures.

The casino landscape is rapidly evolving, with consumers increasingly favoring online and mobile gaming experiences. Golden Entertainment must adapt its strategies to incorporate these digital shifts and the burgeoning sports betting market. Failure to do so could lead to a significant loss of market share to more agile, digitally-focused competitors.

Regulatory and Legislative Changes

Regulatory and legislative shifts pose a significant threat to Golden Entertainment. Changes in gaming taxes, fees, or licensing structures within its core markets of Nevada and Montana could directly impact operational costs and profitability. For instance, any increase in gaming taxes in Nevada, a state that accounted for over 80% of Golden Entertainment's revenue in 2023, would disproportionately affect the company.

The evolving landscape of legalized online gambling presents additional regulatory hurdles. As more jurisdictions embrace online betting, Golden Entertainment must navigate varying compliance requirements, potentially increasing complexity and investment in new operational frameworks. This expansion also introduces new competitors and necessitates adaptation to different market dynamics and consumer behaviors.

- Increased Operational Costs: Potential hikes in gaming taxes or licensing fees in Nevada and Montana.

- Limited Business Opportunities: Stricter regulations could restrict expansion or new market entry.

- Navigating Online Gambling Regulations: Compliance challenges and investment needs for expanding online betting operations across various regions.

Labor Costs and Workforce Challenges

Rising labor costs present a significant threat to Golden Entertainment. The casino industry, like many others, is grappling with increased wages and benefits necessary to attract and keep qualified staff. This upward pressure on compensation directly impacts operational expenses.

Furthermore, Golden Entertainment faces challenges in recruiting and retaining skilled employees, particularly in specialized roles within the gaming and hospitality sectors. The competitive labor market means companies must invest more in their workforce, potentially affecting profit margins if these costs aren't offset by revenue growth or efficiency gains. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for leisure and hospitality workers rose by approximately 5.5% year-over-year through April 2024, highlighting this trend.

- Increased Wage Demands: Competition for talent drives up hourly pay and benefits packages.

- Retention Difficulties: High turnover rates necessitate continuous, costly recruitment and training efforts.

- Operational Cost Inflation: Rising labor expenses can squeeze profitability if not managed through productivity improvements or strategic pricing.

- Impact on Service Quality: Difficulty in filling positions with experienced staff could potentially affect customer service levels.

Golden Entertainment faces significant threats from a highly competitive regional gaming market, with new entrants like the Durango Casino & Resort directly impacting established operators. The increasing shift towards online and mobile gaming requires substantial adaptation to avoid losing market share to more digitally agile competitors.

SWOT Analysis Data Sources

This Golden Entertainment SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and insights from reputable industry analysts. These sources provide a holistic view of the company's performance and its operating environment.