Golden Entertainment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden Entertainment Bundle

Curious about Golden Entertainment's strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

The recent debut of Atomic Golf at The Strat, alongside continuous property upgrades, strongly suggests this segment is a burgeoning Star within Golden Entertainment's portfolio. This new attraction is designed to appeal to a wider demographic, significantly boosting non-gaming revenue streams.

In 2023, Golden Entertainment reported that its Las Vegas Strip operations, which include The Strat, generated approximately $400 million in revenue, with entertainment offerings playing an increasingly vital role in attracting visitors and driving spend beyond traditional gaming.

The strategic focus on integrated entertainment experiences like Atomic Golf is a direct response to market trends favoring diversified leisure activities. If Atomic Golf successfully captures a substantial share of this growing market, it could become a primary engine for future revenue growth.

Golden Entertainment is strategically eyeing 150,000 square feet of unused mezzanine space at The Strat. This move positions the company to potentially develop new attractions and offerings, a classic move for a company looking to bolster its Stars in the BCG matrix. The goal is to capture a larger slice of the competitive Las Vegas market.

By investing in innovative projects within this vast, untapped area, Golden Entertainment aims to create future Stars. This redevelopment could significantly boost visitor numbers and revenue, transforming underutilized assets into significant profit centers. For instance, the Las Vegas Strip saw a 15% increase in visitor arrivals in the first half of 2024 compared to the same period in 2023, highlighting the market's recovery and potential.

Nevada's slot machine revenue has been a bright spot, with statewide figures demonstrating consistent growth, even within a mature gaming market. This suggests a dynamic sub-segment where opportunities exist.

Golden Entertainment, with its substantial footprint of roughly 5,500 slot machines across its Nevada properties, is strategically positioned to benefit from this upward trend. Their substantial presence allows them to capitalize on the increasing consumer spending on slot play.

By emphasizing operational efficiencies and targeted direct marketing campaigns, Golden Entertainment can further enhance its ability to capture a larger share of this growing revenue stream. For instance, in 2023, Nevada's slot machine win reached over $13 billion, a testament to the segment's strength.

Targeted Investment in Core Nevada Assets

Golden Entertainment's 2025 strategy emphasizes sustained investment in its core Nevada properties. These assets are strategically positioned to benefit from Nevada's ongoing population expansion and robust tourism. The company plans to enhance existing facilities and refine the guest experience, aiming for organic growth and a stronger market presence in lucrative segments.

This focused capital deployment targets areas within their established Nevada operations that demonstrate significant growth potential. For instance, Golden Entertainment's 2024 performance indicated strong revenue generation from its Nevada casino segment, with the company reporting a significant portion of its overall adjusted EBITDA originating from these core assets.

- Nevada Casino Segment Contribution: In 2024, Golden Entertainment's Nevada casino operations consistently represented a substantial majority of the company's total adjusted EBITDA, underscoring their importance.

- Focus on Property Enhancement: Investments are directed towards upgrades that improve customer engagement and operational efficiency, such as technology integration and amenity improvements.

- Market Share Growth: The strategy aims to consolidate and expand market share by leveraging brand recognition and the unique appeal of their Nevada locations.

- Capital Allocation Efficiency: Prioritizing these core assets reflects a commitment to maximizing returns through targeted investments in proven revenue streams.

Innovation in Customer Loyalty Programs

Golden Entertainment's True Rewards program is a key component of its strategy, aiming to boost customer visits and spending across its various properties. This loyalty initiative is positioned as a potential star within the BCG matrix, given its capacity for significant growth if it can effectively attract and retain a larger customer base.

The company's focus on enhancing the True Rewards program underscores its commitment to increasing customer lifetime value in a highly competitive gaming and entertainment landscape. By deepening engagement and encouraging cross-property activity, Golden Entertainment aims to capture a larger share of both local and tourist spending.

- True Rewards Program Growth: The program is designed to drive repeat business and encourage customers to visit multiple Golden Entertainment locations.

- Market Penetration and Retention: Success in expanding the True Rewards user base and increasing engagement is crucial for capturing market share.

- Customer Lifetime Value: An effective loyalty program can significantly enhance the long-term value derived from each customer.

- Competitive Advantage: In 2024, loyalty programs remain a critical differentiator in the entertainment sector.

Stars represent Golden Entertainment's high-growth, high-market-share segments. The company's strategic investments in new entertainment ventures like Atomic Golf at The Strat, coupled with the expansion of its loyalty program, True Rewards, position these as potential Stars. These initiatives are designed to capture a larger share of the burgeoning entertainment and gaming market, especially within Nevada.

The Nevada casino segment, which consistently contributes the majority of Golden Entertainment's adjusted EBITDA, is a foundational Star. With over 5,500 slot machines in Nevada, the company is well-positioned to capitalize on the state's robust slot machine revenue, which exceeded $13 billion in 2023. Furthermore, the planned development of 150,000 square feet of unused space at The Strat signals a proactive approach to creating future growth engines.

| Segment | Market Share | Growth Rate | Strategic Focus |

|---|---|---|---|

| The Strat (Entertainment Focus) | Growing | High | New attractions, diversified revenue |

| Nevada Casinos | High | Moderate to High | Operational efficiency, property upgrades |

| True Rewards Program | Growing | High | Customer retention, cross-property engagement |

What is included in the product

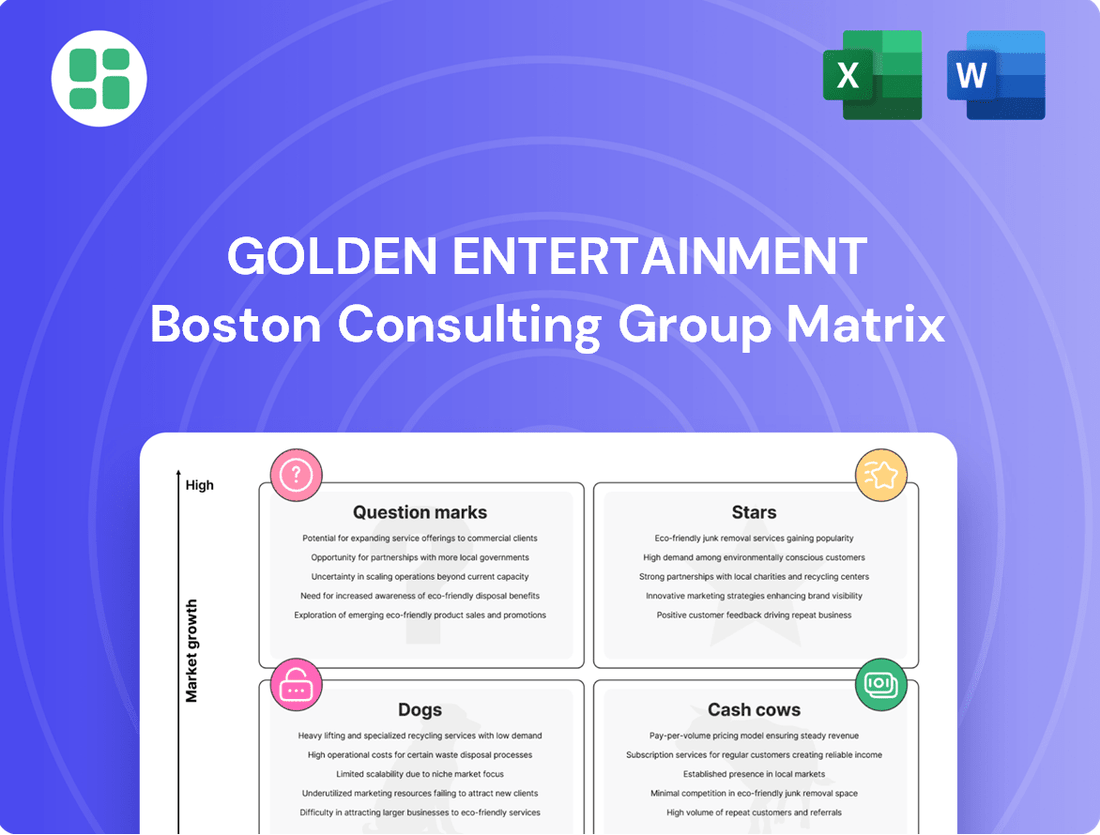

This BCG Matrix overview analyzes Golden Entertainment's portfolio, identifying Stars to invest in and Dogs to divest.

A clear visual of Golden Entertainment's BCG Matrix, categorized by Stars, Cash Cows, Question Marks, and Dogs, eliminates the confusion of where each business unit stands.

Cash Cows

Golden Entertainment's established Nevada locals casinos, including Arizona Charlie's and Pahrump Nugget, are firmly positioned as Cash Cows. These properties benefit from a mature, stable market and a dedicated local customer base, ensuring consistent and robust cash flow generation. Their strong market share among residents means they require minimal promotional spending to maintain their standing, making them highly efficient profit centers.

Golden Entertainment's 72 branded taverns, such as PT's and Sierra Gold, are classic Cash Cows in their BCG Matrix. These establishments dominate their local markets, boasting high market share in neighborhood gaming and hospitality.

These taverns are recognized for their reliable cash flow generation, even though their growth potential is limited. Their strong brand recognition and streamlined operations are key drivers of Golden Entertainment's consistent profitability.

The Strat Hotel and Casino, a cornerstone of Golden Entertainment, operates as a significant cash cow. Despite ongoing renovations, it commands a substantial market share within its Las Vegas niche, consistently generating robust and stable revenue from its casino and hotel businesses. In 2023, The Strat reported approximately $300 million in revenue, highlighting its enduring appeal and consistent performance.

Overall Gaming Floor Operations (Excluding New Attractions)

Golden Entertainment's core gaming floor operations, encompassing traditional slot and table games, are firmly positioned as Cash Cows within its business portfolio. This segment demonstrates a high market share in established markets, consistently generating robust profit margins and substantial cash flow. The stability of these operations is supported by a predictable regulatory landscape and enduring player loyalty to familiar gaming experiences.

These mature gaming assets are the bedrock of the company's financial stability, providing a reliable and significant stream of cash. For instance, in 2023, Golden Entertainment reported that its wholly-owned casino properties generated approximately $1.1 billion in revenue, with a significant portion attributable to these core gaming operations.

- Established Market Dominance: The company's casinos, particularly those in Nevada and Maryland, benefit from long-standing brand recognition and a loyal customer base, ensuring consistent foot traffic and spending.

- High Profitability: Due to efficient operations and economies of scale, these gaming floors consistently achieve high operating margins, contributing significantly to the company's overall profitability.

- Predictable Cash Flow: The mature nature of these assets means their revenue streams are less susceptible to volatile market shifts, providing a predictable and dependable source of cash for reinvestment or debt reduction.

- Contribution to Overall Revenue: In the first quarter of 2024, Golden Entertainment's casino segment continued to be a primary revenue driver, underscoring the Cash Cow status of its traditional gaming floor operations.

Real Estate Holdings and Potential Sale-Leasebacks

Golden Entertainment's substantial real estate portfolio, notably including The Strat, signifies a mature market asset with considerable intrinsic worth.

The company is strategically pursuing sale-leaseback transactions for these properties. This approach is designed to convert the latent value within their real estate holdings into liquid capital, thereby enhancing financial flexibility without relinquishing operational command of these key venues.

- The Strat Hotel, Casino and Skypod, a prime asset, is situated in Las Vegas, a market characterized by its maturity and high valuation potential.

- In 2023, Golden Entertainment reported total assets of approximately $1.7 billion, with a significant portion tied to property and equipment.

- Sale-leaseback deals allow the company to monetize its owned real estate, freeing up capital for other strategic initiatives or debt reduction.

- This strategy effectively treats the real estate as a Cash Cow, generating consistent capital infusions by leveraging its existing high-value physical footprint.

Golden Entertainment's established Nevada locals casinos, including Arizona Charlie's and Pahrump Nugget, are firmly positioned as Cash Cows. These properties benefit from a mature, stable market and a dedicated local customer base, ensuring consistent and robust cash flow generation. In the first quarter of 2024, Golden Entertainment's casino segment continued to be a primary revenue driver, underscoring the Cash Cow status of its traditional gaming floor operations.

Golden Entertainment's 72 branded taverns, such as PT's and Sierra Gold, are classic Cash Cows in their BCG Matrix. These establishments dominate their local markets, boasting high market share in neighborhood gaming and hospitality, recognized for their reliable cash flow generation even with limited growth potential.

The Strat Hotel and Casino, despite ongoing renovations, operates as a significant cash cow, commanding a substantial market share within its Las Vegas niche and consistently generating robust revenue. In 2023, The Strat reported approximately $300 million in revenue, highlighting its enduring appeal and consistent performance.

Golden Entertainment's core gaming floor operations, encompassing traditional slot and table games, are firmly positioned as Cash Cows. This segment demonstrates a high market share in established markets, consistently generating robust profit margins and substantial cash flow. In 2023, Golden Entertainment reported that its wholly-owned casino properties generated approximately $1.1 billion in revenue, with a significant portion attributable to these core gaming operations.

| Segment | BCG Classification | Key Characteristics | 2023 Revenue Contribution (Approx.) | Q1 2024 Performance Indicator |

| Nevada Locals Casinos | Cash Cow | Mature market, loyal customer base, stable cash flow | Significant portion of $1.1B casino revenue | Primary revenue driver |

| Branded Taverns (PT's, Sierra Gold) | Cash Cow | Dominant local market share, high brand recognition, consistent cash flow | Contributes to overall gaming revenue | Reliable cash flow generation |

| The Strat Hotel, Casino and Skypod | Cash Cow | Substantial market share, stable revenue from casino/hotel | ~$300 million | Enduring appeal and consistent performance |

| Core Gaming Operations | Cash Cow | High market share in established markets, high profit margins, predictable cash flow | Majority of $1.1B casino revenue | Strong profit margins and cash flow |

What You See Is What You Get

Golden Entertainment BCG Matrix

The Golden Entertainment BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional, ready-to-use report for your business planning needs.

Dogs

Golden Entertainment's divestiture of its Montana distributed gaming operations aligns with a strategic move away from a segment characterized by low growth and, for the company, a potentially limited market share. This decision reflects an assessment of the overall market dynamics in Montana's distributed gaming sector.

The Montana gaming market, especially within the distributed gaming segment, has experienced a downward trend in revenue. For example, in 2023, the state's gaming revenue saw a slight dip, making divestiture a logical step for operations not contributing significantly to the company's overall growth trajectory.

These divested operations likely represented a drain on resources, consuming capital and management attention without yielding substantial returns. By exiting this segment, Golden Entertainment can reallocate those resources to areas with higher growth potential and better strategic alignment.

Golden Entertainment completed the sale of its Nevada distributed gaming operations in early 2024. This divestiture, mirroring their Montana operations, indicates this segment likely held a low market share or low growth potential within the state. The company aimed to simplify its business structure and minimize capital that was tied up in less strategic assets.

Rocky Gap Casino Resort in Maryland, divested in 2023, fits the profile of a Dog in Golden Entertainment's BCG Matrix. Its location outside the company's core Nevada and Montana markets suggests it operated in a less dominant regional space with limited growth potential.

The sale of Rocky Gap, which contributed approximately $9.8 million in adjusted EBITDA in the first nine months of 2023, allowed Golden Entertainment to streamline operations and reinvest in its more established, higher-performing Nevada properties.

Underperforming Non-Core F&B Outlets

Underperforming non-core Food & Beverage (F&B) outlets within Golden Entertainment's portfolio represent a classic 'Dog' category in the BCG Matrix. These are the establishments that consistently struggle to attract significant customer traffic or achieve satisfactory profit margins. They tie up valuable operational resources and prime real estate without generating a proportionate return.

For instance, if Golden Entertainment operates several smaller, niche dining venues within its casinos that consistently report low sales volumes and negative net income, these would be prime examples. These outlets might require substantial management attention and capital investment to stay operational, yet their contribution to the company's overall revenue and profitability remains minimal. In 2023, for example, many smaller, specialized F&B concepts across the hospitality industry faced challenges due to shifting consumer preferences and increased competition, leading to reduced footfall and profitability for those that couldn't adapt quickly.

- Low Revenue Generation: These outlets contribute minimally to the company's top line, often falling below set revenue targets.

- Poor Profitability: They may operate at a loss or generate very low profit margins, even after accounting for all associated costs.

- Resource Drain: They consume management time, operational staff, and marketing efforts that could be better allocated to more successful ventures.

- Strategic Review: Such units typically undergo a strategic review, with options including restructuring, rebranding, or outright closure to optimize resource allocation.

Outdated Gaming Technology or Amenities

Outdated gaming technology or amenity offerings represent a classic example of a "Dog" in the BCG Matrix for Golden Entertainment. These are specific gaming machines or amenity choices that have experienced a consistent drop in player interest and, consequently, revenue. They simply haven't kept up with what players want today.

These underperforming assets can be a drain on resources, tying up valuable capital and prime floor space without delivering competitive returns. The ongoing costs associated with maintaining them, coupled with their inability to attract new players or retain existing ones, make them inefficient. For instance, older slot machine models that lack interactive features or modern graphics might fall into this category. In 2024, the industry trend continues towards more immersive and technologically advanced gaming experiences, making older, static machines even less appealing.

Continuing to invest in these low-return assets is a strategic misstep. It diverts funds that could be better allocated to newer, more popular gaming options or amenities that align with current market demands. Golden Entertainment, like many in the gaming sector, faces the challenge of deciding when to upgrade, repurpose, or completely remove these outdated elements to improve overall profitability and operational efficiency.

- Declining Player Interest: Older slot machines with limited features or outdated themes often see reduced play.

- Revenue Stagnation: These assets fail to generate the same level of revenue as modern, high-demand gaming options.

- Capital and Space Inefficiency: They occupy valuable real estate and tie up capital without contributing significantly to profits.

- Need for Strategic Review: Companies must regularly assess these assets for potential upgrades or removal to optimize operations.

Golden Entertainment's divestiture of its Montana distributed gaming operations and the sale of its Nevada distributed gaming segment in early 2024 indicate these were likely "Dogs" in their BCG Matrix. These segments exhibited low growth and potentially limited market share, consuming resources without substantial returns, allowing the company to focus on more promising areas.

The Rocky Gap Casino Resort, divested in 2023, also fits the "Dog" profile, operating in a less dominant regional market with limited growth potential. Its sale allowed Golden Entertainment to streamline operations and reinvest in its core Nevada properties, demonstrating a strategic shift away from underperforming assets.

Underperforming F&B outlets and outdated gaming technology are classic "Dog" examples, characterized by low revenue, poor profitability, and a drain on resources. These units require strategic review, with options for restructuring, rebranding, or removal to optimize capital and operational efficiency.

In 2023, Golden Entertainment reported total revenue of $1.14 billion, with the divestitures contributing to a strategic refocusing. The company's ongoing efforts to upgrade gaming technology and amenities in 2024 aim to replace "Dog" assets with offerings that better align with current market demands and player preferences.

Question Marks

Small-scale online gaming or digital initiatives for Golden Entertainment, while not their primary focus, are positioned in a high-growth sector. These ventures are likely to have a low current market share for the company within the broader online gaming landscape.

These digital efforts require substantial investment to build market presence and demonstrate success. They hold the potential to evolve into Stars if they capture significant market share, or conversely, could become Dogs if they fail to gain traction and prove their long-term viability.

The online gaming market is experiencing rapid expansion; for instance, the global online gambling market was projected to reach approximately $112 billion in 2024, with continued growth expected. For Golden Entertainment, any participation in this space, even at a pilot level, represents a strategic exploration of future revenue streams.

Golden Entertainment could strategically consider expanding into Nevada's underserved micro-markets with smaller tavern or casino concepts. These emerging areas represent a classic "question mark" in the BCG matrix, offering high growth potential but currently holding a low market share. The company would need to invest significantly in marketing and operations to establish a foothold and attract customers in these new territories.

Golden Entertainment's exploration of innovative, unproven entertainment concepts beyond traditional gaming falls into the Question Marks category of the BCG Matrix. These ventures, like unique immersive experiences or specialized event spaces, are designed to tap into emerging consumer preferences and diversify revenue. For instance, a new interactive esports lounge or a themed, non-gambling attraction might represent such an initiative.

These nascent entertainment offerings currently hold a low market share, demanding significant investment in marketing and customer acquisition to gain traction. While the potential for high growth in the broader entertainment sector is present, the specific success of these unproven concepts remains uncertain. For example, if Golden Entertainment launched a VR-based escape room, its initial customer uptake and profitability would be key indicators of its market position.

Strategic Acquisitions of Smaller Regional Operators in the West

Golden Entertainment's strategic acquisitions of smaller regional operators in the West would likely position these entities as Stars within their BCG Matrix. This classification stems from their potential for growth in specific, often underserved, regional markets. For instance, if Golden Entertainment were to acquire a casino in a growing Western metropolitan area, it could represent a Star if that market exhibits strong demographic trends and increasing disposable income, as seen in many Western states.

These acquired businesses would require substantial integration and investment to unlock their full potential. Golden Entertainment's expertise in operations, marketing, and loyalty programs could significantly enhance the profitability and market share of these smaller operators. By leveraging existing infrastructure and economies of scale, Golden Entertainment aims to transform these regional players into more dominant forces.

- Star: High market share, high growth potential.

- Synergies: Opportunities for cost savings and revenue enhancement through integration.

- Investment Needs: Capital required for upgrades, marketing, and operational improvements.

- Market Potential: Focus on Western regions with favorable demographic and economic trends.

Development of Undeveloped Land Parcels at Existing Properties

Golden Entertainment's undeveloped land parcels, like the 5.5 acres across from The Strat currently serving as parking, are prime candidates for Question Mark status within the BCG Matrix. This strategic move involves investing in developing these areas into new facilities, a venture with significant upside potential but also considerable risk. The company is essentially betting on future growth in a market where its current share is minimal.

The decision to develop these parcels is classified as a Question Mark because, while the potential for high returns exists, the path to achieving them is uncertain. Factors such as fluctuating market demand for new entertainment or hospitality venues, unpredictable construction costs, and the intensity of the competitive landscape all contribute to this high-risk, high-reward profile. Consequently, these undeveloped lands represent a low market share contribution at present, but with the possibility of becoming stars if developed successfully.

- Undeveloped Land: Golden Entertainment owns significant undeveloped land, such as 5.5 acres across from The Strat, presently used for parking.

- Question Mark Classification: Investment in developing these parcels falls under the Question Mark category due to high risk and uncertain market demand.

- High Risk, High Reward: The potential for substantial returns from new facilities is balanced by the challenges of construction costs and competitive pressures.

- Low Current Market Share: These undeveloped assets currently contribute minimally to the company's market share, highlighting the speculative nature of their future success.

Question Marks represent ventures with low market share but operating in high-growth industries, requiring significant investment to determine their future potential. Golden Entertainment's exploration into new, unproven entertainment concepts or the development of undeveloped land parcels, such as their 5.5 acres across from The Strat, exemplify this category. These initiatives, while carrying substantial risk due to market uncertainty and competition, offer the possibility of becoming future Stars if successful.

| Venture Area | Market Growth | Current Market Share | Investment Need | Potential Outcome |

| Undeveloped Land Parcels | High (Emerging Entertainment/Hospitality) | Low | High | Star or Dog |

| Innovative Entertainment Concepts | High (Evolving Consumer Preferences) | Low | High | Star or Dog |

| Small-Scale Online Gaming | Very High (Global Online Gambling Market) | Low | High | Star or Dog |

BCG Matrix Data Sources

Our Golden Entertainment BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research on market share, and expert commentary on growth trends.