Golden Entertainment Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden Entertainment Bundle

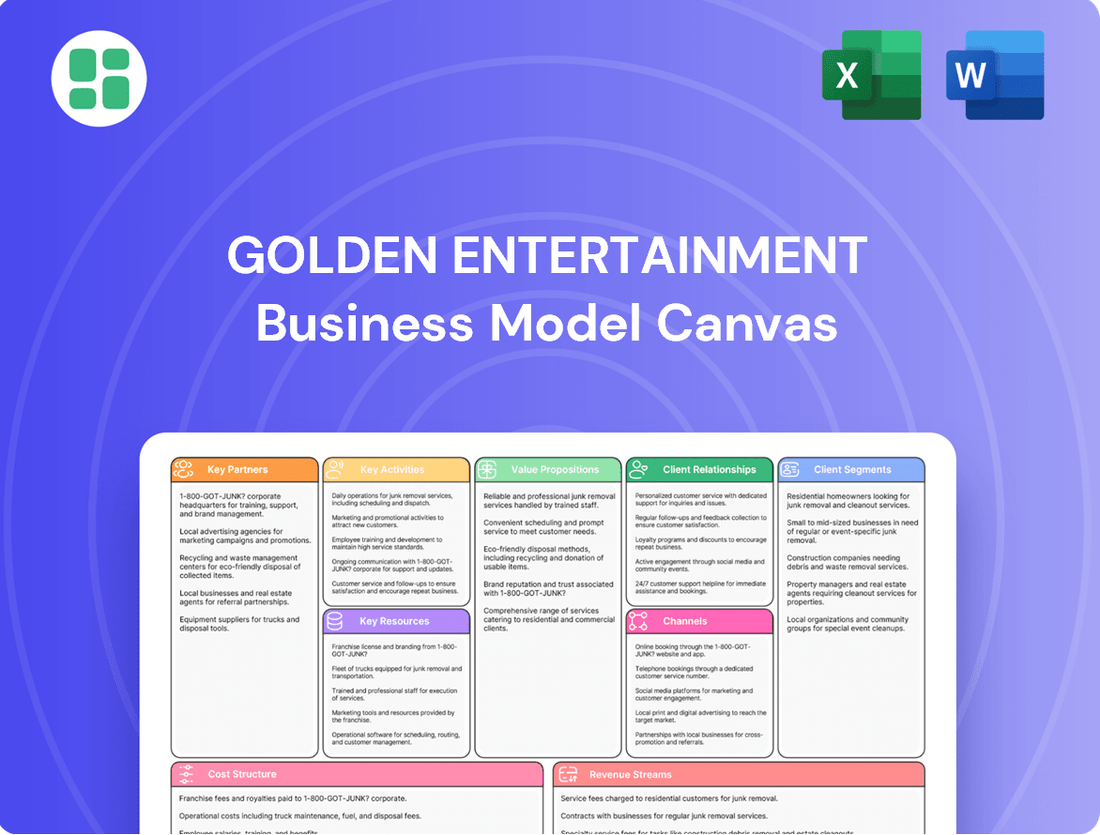

Unlock the strategic core of Golden Entertainment's success with our comprehensive Business Model Canvas. Discover their key partners, customer segments, and revenue streams that fuel their operations in the competitive entertainment and gaming industry. This in-depth analysis is your key to understanding their proven approach.

Ready to gain a competitive edge? Our full Business Model Canvas for Golden Entertainment provides a detailed breakdown of their value propositions, cost structure, and key resources. Download it now to benchmark your own strategies and identify growth opportunities.

Partnerships

Golden Entertainment's strategic real estate collaborations are crucial for expanding its entertainment ecosystem. A prime example is its relationship with Atomic Golf, an $80 million facility located next to The Strat. This proximity fosters significant cross-traffic, creating opportunities for integrated package deals that enhance the overall guest experience.

These collaborations are designed to attract a wider demographic to Golden Entertainment's flagship properties. By aligning with complementary entertainment venues, the company can offer more comprehensive and appealing leisure options, thereby increasing customer engagement and potential revenue streams.

Golden Entertainment heavily relies on gaming technology providers, including manufacturers of slot machines and table games, to keep its casino floors and taverns current. These partnerships are essential for offering a diverse and appealing gaming product to customers, ensuring they have access to the latest and most engaging entertainment options. For instance, in 2023, the company continued to upgrade its slot machine inventory, a significant portion of which involves agreements with leading hardware and software developers in the gaming industry.

Golden Entertainment relies on a diverse network of food and beverage suppliers to ensure its casinos and taverns offer a compelling culinary experience. These partnerships are crucial for stocking a wide variety of menu items, from quick bites to full-service dining, directly impacting customer satisfaction and repeat business.

Marketing and Promotion Agencies

Golden Entertainment likely partners with marketing and promotion agencies to craft compelling campaigns. These collaborations are crucial for showcasing their broad range of entertainment options, from casinos to taverns, and for attracting specific demographics. In 2024, the advertising and marketing industry saw significant investment, with companies allocating substantial budgets to reach consumers effectively.

These agencies are instrumental in developing strategies that drive foot traffic and engagement across Golden Entertainment's diverse portfolio. For instance, a well-executed digital marketing campaign in 2024 could target specific geographic areas or customer interests, leading to increased property visits. The effectiveness of such partnerships is often measured by return on ad spend and customer acquisition cost.

- Customer Acquisition: Agencies help design campaigns to attract new patrons to Golden Entertainment's casinos and taverns.

- Brand Visibility: Partnerships enhance brand recognition through targeted advertising across various media channels.

- Promotional Execution: Agencies manage the rollout of special offers and events to boost visitation and spending.

Potential M&A Targets and Investment Partners

Golden Entertainment is strategically seeking mergers and acquisitions (M&A) that significantly impact their business, signaling a focus on growth-driving partnerships. They are specifically targeting multi-property deals that reinforce their Nevada operations, rather than smaller ventures requiring substantial deferred capital. For instance, in 2024, the company continued to evaluate opportunities that could enhance their market position and operational scale within their key geographic areas.

Their M&A strategy prioritizes deals that offer substantial returns and align with their established Nevada footprint. This approach suggests potential partnerships with entities possessing multiple, well-performing properties that can be integrated efficiently. The company's financial reports for 2024 indicated a continued emphasis on strengthening their core business through strategic acquisitions.

- Strategic M&A Focus: Golden Entertainment targets acquisitions that demonstrably improve their financial performance and market presence.

- Nevada-Centric Growth: The company prioritizes multi-property deals that align with and expand their core operations in Nevada.

- Capital Allocation Discipline: They avoid smaller, capital-intensive projects, preferring opportunities with clearer and more immediate returns.

- Partnership Criteria: Potential partners are evaluated based on their scale, performance, and strategic fit within Golden Entertainment's existing business model.

Golden Entertainment's key partnerships extend to essential suppliers for its diverse operations. Crucially, they depend on gaming equipment manufacturers and distributors to maintain a competitive edge in their casinos and taverns. In 2023, the company continued its slot machine upgrades, a process heavily reliant on these technology providers.

Furthermore, strong relationships with food and beverage vendors are vital for delivering a quality guest experience across all Golden Entertainment properties. These partnerships ensure a consistent supply of diverse offerings, directly impacting customer satisfaction and repeat visits.

| Partnership Type | Key Role | Example/Impact |

|---|---|---|

| Gaming Technology Providers | Supplying modern slot machines and table games | Essential for offering diverse and engaging gaming options; ongoing inventory upgrades in 2023. |

| Food & Beverage Suppliers | Ensuring a wide variety of menu items | Crucial for customer satisfaction and repeat business in casinos and taverns. |

| Real Estate Collaborations (e.g., Atomic Golf) | Expanding entertainment ecosystem and driving cross-traffic | Atomic Golf, an $80 million facility, enhances guest experience through integrated offerings. |

| Marketing & Promotion Agencies | Crafting campaigns to drive traffic and engagement | Crucial for increasing property visits and brand visibility; significant industry investment in 2024. |

| Mergers & Acquisitions Targets | Strategic growth and market position enhancement | Focus on multi-property deals in Nevada for operational scale, as evaluated in 2024. |

What is included in the product

A detailed framework outlining Golden Entertainment's strategy, focusing on its casino and distributed gaming operations, and how it leverages its customer segments, channels, and value propositions.

This model provides a clear understanding of Golden Entertainment's revenue streams, cost structure, and key resources, offering insights for strategic decision-making.

The Golden Entertainment Business Model Canvas acts as a pain point reliever by offering a clear, actionable framework to diagnose and address operational inefficiencies.

It simplifies complex business strategies, enabling rapid identification of areas needing improvement and facilitating targeted solutions.

Activities

Golden Entertainment's core activity is the day-to-day management of its extensive portfolio of gaming and hospitality properties. This includes eight casinos and 72 gaming taverns, predominantly located in Nevada.

This operational focus involves meticulously overseeing gaming floors, hotel services, and diverse entertainment offerings. The goal is to ensure seamless and high-quality guest experiences across all venues.

For instance, in the first quarter of 2024, Golden Entertainment reported total revenue of $245.6 million, with its distributed gaming segment, which includes taverns, contributing significantly to this performance.

Golden Entertainment's core activity revolves around the continuous enhancement of its gaming and entertainment offerings. This includes strategic investments aimed at improving slot play and boosting property occupancy rates, as seen at properties like The Strat. The company actively develops new attractions and upgrades existing ones to align with changing customer tastes and stay ahead in a competitive market.

Golden Entertainment's key activities heavily involve astute financial management. This includes a strong emphasis on reducing debt, which is crucial for enhancing financial flexibility and lowering risk. The company also actively engages in share repurchases, a strategy that can boost earnings per share and signal confidence in the company's valuation.

Furthermore, the consistent payment of dividends to shareholders is a cornerstone of their capital allocation strategy. This demonstrates a commitment to returning value directly to investors and can attract income-focused shareholders. For instance, in 2024, Golden Entertainment continued its dividend payouts, underscoring its focus on shareholder returns.

Strategic Asset Portfolio Optimization

Strategic asset portfolio optimization for Golden Entertainment involves actively managing its property and business holdings to enhance profitability and shareholder value. This includes making calculated decisions about which assets to retain, develop, or divest.

A key recent activity was the divestiture of its distributed gaming operations in Nevada and Montana. This strategic move, completed in early 2024, allowed the company to exit certain markets and focus resources on its more profitable core assets.

- Focus on Core Nevada Assets: The divestitures allow Golden Entertainment to concentrate capital and management attention on its key Nevada casino properties, such as The STRAT and Aquarius Casino Resort, which are expected to drive future growth.

- Streamlining Operations: By shedding distributed gaming, the company simplifies its operational structure, potentially leading to improved efficiency and reduced overhead costs.

- Financial Flexibility: The proceeds from asset sales provide financial flexibility, enabling debt reduction, reinvestment in existing properties, or pursuing new strategic opportunities.

- Enhanced Shareholder Value: This targeted approach aims to optimize the overall portfolio, ultimately enhancing long-term value for shareholders by concentrating on higher-return opportunities.

Customer Experience Enhancement

Golden Entertainment is deeply committed to elevating the customer experience. This focus is evident in their efforts to streamline operations, particularly at newly acquired taverns, aiming for seamless guest interactions. The company also emphasizes improving direct booking channels to offer guests more control and convenience.

Leveraging the synergy between their various entertainment venues is a key strategy. By encouraging cross-traffic between adjacent facilities, Golden Entertainment aims to create a more integrated and satisfying entertainment journey for their patrons. This approach is designed to boost overall guest satisfaction and loyalty.

- Operational Efficiencies: Revamping processes at acquired taverns to ensure smoother service delivery.

- Guest Satisfaction Focus: Prioritizing initiatives that directly contribute to positive guest experiences.

- Direct Booking Improvements: Enhancing online and direct booking platforms for greater user-friendliness.

- Cross-Traffic Opportunities: Strategically promoting visits between adjacent Golden Entertainment properties.

Golden Entertainment's key activities center on the strategic management and enhancement of its casino and distributed gaming operations. This includes optimizing the performance of its Nevada-based casinos, such as The STRAT, and its 72 gaming taverns. The company actively pursues operational efficiencies and guest experience improvements across its portfolio.

Financial management is paramount, with a focus on debt reduction and shareholder returns through dividends and share repurchases. For instance, as of the first quarter of 2024, the company continued its commitment to returning capital to shareholders. The strategic divestiture of its distributed gaming operations in Nevada and Montana in early 2024 also represents a significant key activity, allowing for a sharpened focus on core assets.

Enhancing the customer experience through streamlined operations and improved direct booking channels is a continuous effort. Furthermore, Golden Entertainment leverages synergies between its properties to drive cross-traffic and boost overall guest satisfaction and loyalty.

| Key Activity | Description | Financial Impact/Data (Q1 2024) |

|---|---|---|

| Casino & Tavern Operations | Day-to-day management and enhancement of gaming and hospitality venues. | Total Revenue: $245.6 million |

| Financial Management | Debt reduction, dividend payments, share repurchases. | Continued dividend payouts in 2024. |

| Portfolio Optimization | Divestiture of distributed gaming operations (Nevada & Montana). | Completed early 2024, allowing focus on core Nevada assets. |

| Customer Experience Enhancement | Streamlining operations, improving direct booking, cross-property synergy. | Focus on seamless guest interactions and loyalty. |

Full Document Unlocks After Purchase

Business Model Canvas

The Golden Entertainment Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact document, allowing you to immediately begin strategizing and refining your business plan.

Resources

Golden Entertainment’s core physical assets are its extensive network of gaming and hospitality properties. This includes eight casinos, notably The Strat Hotel, Casino & Tower in Las Vegas, and a significant footprint of 72 gaming taverns, primarily concentrated in Nevada.

These venues are the lifeblood of their operations, providing the physical spaces where customers engage with the company’s diverse offerings, from traditional casino gaming and sports betting to dining, lodging, and various entertainment experiences.

In 2024, Golden Entertainment’s gaming and hospitality segment is a critical revenue driver, with the company’s strategic focus on optimizing these locations for maximum customer engagement and profitability.

Golden Entertainment's real estate is a significant asset beyond its gaming and hospitality operations. The company holds approximately 63 acres of excess land, offering considerable room for future expansion or sale.

Furthermore, an additional 5.5 to 6 acres are situated directly across from The Strat on the iconic Las Vegas Boulevard. This prime location presents substantial development potential, allowing for new ventures or strategic partnerships.

Golden Entertainment's gaming licenses in Nevada and Montana, along with its Illinois video gaming terminal license, are fundamental intangible assets. These licenses are not just permits but the very foundation upon which their gaming operations are built, allowing them to legally conduct business in these key markets.

Maintaining rigorous adherence to regulatory compliance is paramount. In 2023, the gaming industry faced increased scrutiny, and companies like Golden Entertainment must consistently invest in compliance measures to avoid penalties and ensure uninterrupted operations. This commitment to regulatory standards is a critical safeguard against significant legal and financial repercussions in a heavily regulated sector.

Financial Capital and Liquidity

Golden Entertainment's financial capital and liquidity are foundational to its operations and strategic growth. A robust financial position, demonstrated through substantial cash on hand and access to credit, allows for agile decision-making and investment.

This financial strength is crucial for reinvesting in their existing casino and distributed gaming assets, as well as for exploring opportunistic acquisitions. For instance, as of the first quarter of 2024, Golden Entertainment reported cash and cash equivalents of $178.5 million, underscoring their commitment to maintaining liquidity.

- Cash Reserves: Maintaining significant cash balances provides operational stability and the capacity for immediate investment or debt reduction.

- Credit Facilities: Access to undrawn revolving credit lines offers flexibility to fund growth initiatives or manage short-term liquidity needs.

- Debt Management: A disciplined approach to leverage ensures financial health and supports long-term value creation for shareholders.

- Capital Allocation: Financial flexibility enables strategic capital deployment, whether through asset upgrades, acquisitions, or shareholder returns.

Skilled Workforce and Management Team

Golden Entertainment's skilled workforce, encompassing everything from the frontline staff at its casinos and taverns to its seasoned management team, represents a critical asset. These individuals are fundamental to delivering positive guest experiences and driving the company's operational excellence.

The dedication of its employees is paramount. For instance, in 2024, the company continued to invest in training and development programs aimed at enhancing customer service skills across its diverse properties. This focus on human capital directly supports their strategy of creating memorable guest interactions.

Furthermore, the strategic leadership provided by the management team is indispensable for navigating the dynamic gaming and hospitality landscape. Their expertise in identifying market trends, managing operational costs, and pursuing strategic growth initiatives, such as potential property expansions or acquisitions, is key to the company's sustained success and ability to adapt to evolving consumer preferences.

- Dedicated Operational Staff: Employees directly interacting with guests in casinos and taverns are crucial for service quality.

- Experienced Management: Strategic leadership guides market navigation and growth opportunities.

- Investment in Training: Focus on enhancing employee skills, particularly in customer service, is a priority.

Golden Entertainment's key resources are its extensive network of gaming and hospitality properties, including eight casinos and 72 gaming taverns, primarily in Nevada. Its substantial real estate holdings, approximately 63 acres of excess land, offer significant future development potential, particularly the 5.5 to 6 acres across from The Strat on Las Vegas Boulevard. Crucial intangible assets include its gaming licenses in Nevada, Montana, and Illinois, underpinning legal operations. The company also possesses strong financial capital, with $178.5 million in cash and cash equivalents as of Q1 2024, enabling strategic investments and operational stability. Finally, its skilled workforce, from frontline staff to experienced management, is vital for delivering excellent guest experiences and driving operational excellence.

| Resource Type | Description | Key Data/Facts (as of Q1 2024 or latest available) |

|---|---|---|

| Physical Assets | Gaming and Hospitality Properties | 8 Casinos, 72 Gaming Taverns |

| Real Estate | Excess Land | Approx. 63 acres total; 5.5-6 acres prime Las Vegas Blvd location |

| Intangible Assets | Gaming Licenses | Nevada, Montana, Illinois |

| Financial Capital | Liquidity and Access to Funds | $178.5 million in cash and cash equivalents |

| Human Capital | Workforce and Management | Skilled operational staff and experienced leadership team |

Value Propositions

Golden Entertainment makes it easy for people to enjoy themselves by having gaming, dining, and entertainment readily available at their many local casinos and taverns, mainly in Nevada. This accessibility means you don't have to go far for a good time, offering a convenient escape for daily enjoyment.

Golden Entertainment offers a rich, integrated entertainment experience through its diverse portfolio, combining casinos, taverns, and dining establishments. This allows customers to seamlessly transition between gaming, enjoying a meal, or socializing, catering to a broad spectrum of entertainment needs and preferences.

In 2024, Golden Entertainment's strategic diversification proved beneficial. The company reported strong performance across its gaming and hospitality segments, with its Nevada operations, including the popular The STRAT, contributing significantly to overall revenue. This integrated approach allows for cross-promotional opportunities, enhancing customer engagement and loyalty.

Golden Entertainment focuses on delivering exceptional value, offering authentic entertainment experiences tailored for everyday individuals. Their commitment to 'real entertainment for real people' translates into genuine food, generous drink portions, and an overall enjoyable atmosphere.

This value proposition resonates strongly with customers who prioritize quality and fun without the hefty price tag, a strategy particularly effective in capturing the loyalty of the local market. For instance, in 2024, Golden Entertainment's strategic pricing and focus on the customer experience contributed to a significant portion of their revenue from these core markets.

Integrated Loyalty Program Benefits

Golden Entertainment's True Rewards program offers a unified loyalty experience, allowing members to earn and spend points across all its casinos and taverns using a single card. This integration significantly boosts customer value by providing consistent, tangible incentives for repeat business throughout their portfolio.

This integrated approach fosters deeper customer engagement and encourages cross-property visits. For instance, a patron might earn points at a Las Vegas casino and redeem them at a local tavern, creating a seamless and rewarding customer journey.

- Unified Point Accumulation: Members earn points on all purchases, from gaming to dining, across the entire Golden Entertainment network.

- Cross-Property Redemption: Points can be redeemed for a variety of rewards, including free play, hotel stays, dining credits, and merchandise, at any Golden Entertainment venue.

- Enhanced Customer Value Proposition: The program incentivizes loyalty by offering a broader range of earning and redemption opportunities than siloed programs.

- Data-Driven Insights: The integrated system provides Golden Entertainment with valuable data on customer behavior across different property types, enabling more targeted marketing and personalized offers.

Strategic Investment in Property Enhancements

Golden Entertainment prioritizes enhancing its existing properties to boost customer satisfaction and operational efficiency. This strategic approach involves ongoing investments in areas like room renovations at The Strat and upgrades to tavern operations.

These property enhancements are crucial for maintaining modern facilities and creating a more appealing environment for guests. For instance, in 2023, the company reported capital expenditures of $128.5 million, with a significant portion allocated to property improvements and development.

- Property Enhancement Focus: Continuous investment in existing assets like The Strat's room renovations and tavern operational improvements.

- Customer Experience Goal: To ensure modern facilities and an improved environment that elevates the guest experience.

- Financial Commitment: Significant capital expenditures, such as $128.5 million in 2023, underscore the dedication to property development.

Golden Entertainment offers accessible, integrated entertainment by combining gaming, dining, and taverns, primarily in Nevada, providing a convenient local escape. Their value proposition centers on delivering authentic, enjoyable experiences with quality food and drinks at fair prices, fostering loyalty among everyday customers.

The True Rewards program enhances customer value by unifying point accumulation and redemption across all venues, encouraging repeat business and providing valuable data for personalized marketing. Investments in property enhancements, like room renovations at The Strat, further elevate the guest experience and ensure modern, appealing facilities.

| Value Proposition | Description | Supporting Data/Fact |

| Accessible Entertainment Hub | Conveniently located casinos and taverns offering gaming, dining, and entertainment. | Primarily focused on Nevada locations, making entertainment readily available locally. |

| Authentic & Value-Driven Experience | Genuine food, generous drinks, and an enjoyable atmosphere at accessible price points. | Strategy effectively captures loyalty in local markets by prioritizing quality and fun without excessive cost. |

| Integrated Loyalty Program (True Rewards) | Unified earning and spending of points across all Golden Entertainment properties. | Boosts customer value and encourages cross-property visits through consistent, tangible incentives. |

| Enhanced Property Offerings | Ongoing investment in existing assets to improve customer satisfaction and operational efficiency. | Capital expenditures, such as $128.5 million in 2023, highlight commitment to property development and guest experience. |

Customer Relationships

Golden Entertainment's 'True Rewards' program is a cornerstone of their customer relationship strategy, designed to cultivate lasting loyalty. This program allows guests to accumulate and utilize points across their entire portfolio of casinos and taverns, creating a unified and rewarding experience.

By centralizing the loyalty system, Golden Entertainment effectively incentivizes repeat business and strengthens the bond with its patrons. For instance, in 2023, the company reported a significant portion of its revenue coming from repeat customers, underscoring the program's success in driving engagement and retention.

Golden Entertainment prioritizes personalized guest services, aiming to create exceptional experiences across its casinos and taverns. This focus on individual customer needs fosters strong rapport and a sense of belonging, particularly with their local customer base.

Golden Entertainment prioritizes direct booking channels, which in 2024 continued to be a cornerstone of their customer relationship strategy. This approach allows for immediate interaction and data capture.

By actively encouraging feedback through multiple touchpoints, such as post-stay surveys and in-person interactions at their properties, Golden Entertainment gathers valuable insights. This direct communication is crucial for understanding evolving customer preferences and promptly addressing any issues.

In 2024, this focus on direct engagement helped Golden Entertainment refine its service offerings, leading to improved customer satisfaction scores. For instance, feedback from their Las Vegas properties directly influenced updates to their loyalty program, enhancing its appeal to frequent visitors.

Community-Centric Approach

Golden Entertainment prioritizes a community-centric approach by focusing on the locals market. This means understanding and catering to the unique preferences of residents, making them feel valued and integrated into the company's operations.

- Deep Community Ties: By primarily serving the locals market, Golden Entertainment cultivates relationships deeply embedded within the community.

- Understanding Local Tastes: This involves understanding local preferences, ensuring their offerings resonate with the resident population.

- Active Community Participation: Golden Entertainment actively participates in community events, becoming a regular part of residents' leisure activities.

- Fostering Loyalty: This engagement fosters a sense of local ownership and loyalty, strengthening their connection with the community.

Operational Efficiency for Customer Satisfaction

Golden Entertainment’s commitment to operational efficiency directly enhances its customer relationships by ensuring seamless service delivery across its properties. This focus on streamlining processes, from gaming floor management to hospitality services, aims to provide a consistently high-quality and enjoyable experience for every guest. By minimizing friction points and maximizing convenience, the company cultivates a sense of reliability that encourages repeat business and fosters stronger customer loyalty.

In 2023, Golden Entertainment reported a significant increase in revenue, with its casino segment contributing substantially. This growth is partly attributable to improved operational workflows that enhance the guest experience, leading to higher customer satisfaction and retention rates. For instance, investments in technology to speed up check-ins and improve gaming machine uptime directly translate into more positive interactions.

- Streamlined Processes: Operational efficiencies ensure smooth service delivery, from gaming to dining, enhancing the overall customer experience.

- Consistent Quality: By optimizing operations, Golden Entertainment delivers reliable and enjoyable experiences, building trust.

- Customer Retention: Reliable and positive experiences fostered by operational excellence directly contribute to increased customer loyalty and repeat visits.

- 2023 Performance: The company’s strong revenue growth in 2023 reflects the positive impact of operational improvements on customer satisfaction and engagement.

Golden Entertainment's customer relationships are built on a foundation of loyalty programs, personalized service, and community engagement. The 'True Rewards' program, a key driver of repeat business, allows point accumulation across their diverse portfolio. In 2023, a substantial portion of revenue was attributed to returning patrons, highlighting the program's effectiveness in fostering loyalty.

Direct booking channels are also prioritized, facilitating immediate customer interaction and data capture, which in 2024 continued to refine service offerings. This direct engagement, coupled with active feedback collection, allows for continuous improvement and enhanced customer satisfaction.

Their community-centric approach, particularly in the locals market, deepens ties by understanding and catering to resident preferences. This focus on local integration and participation fosters a strong sense of belonging and loyalty among their core customer base.

Operational efficiency further bolsters customer relationships by ensuring seamless service delivery, directly impacting guest satisfaction and encouraging repeat visits. For instance, investments in technology to improve check-in times and machine uptime in 2023 contributed to enhanced guest experiences and overall revenue growth.

| Customer Relationship Strategy | Key Initiatives | Impact/Data (2023-2024) |

|---|---|---|

| Loyalty Program | 'True Rewards' program | Significant portion of 2023 revenue from repeat customers. |

| Direct Engagement | Direct booking channels, feedback collection | Refined service offerings in 2024 based on feedback. |

| Community Focus | Targeting locals market, community participation | Fosters strong local loyalty and integration. |

| Operational Excellence | Streamlined processes, technology investments | Improved guest experience, contributing to 2023 revenue growth. |

Channels

Golden Entertainment's physical casino locations are its bedrock, encompassing eight distinct properties across Nevada, including prominent venues like The Strat and Arizona Charlie's. These casinos act as direct customer touchpoints, offering a full spectrum of entertainment, from gaming floors to diverse dining options, hotel accommodations, and live shows.

Golden Entertainment operates 72 branded gaming taverns, including well-known names like PT's, Sierra Gold, and Lucky's. These establishments serve as highly localized and accessible entertainment hubs, deeply integrated into their communities.

These smaller venues are designed for convenience, offering both gaming and dining experiences that cater to the everyday leisure needs of local residents. Their accessible nature makes them a go-to option for casual entertainment.

In 2023, Golden Entertainment reported that its tavern segment generated approximately $500 million in revenue, highlighting the significant contribution of these branded gaming taverns to the company's overall financial performance.

Golden Entertainment leverages its official websites as a primary channel for direct hotel bookings, offering a streamlined experience for customers seeking accommodations. These platforms also serve as vital hubs for disseminating company information and engaging directly with their audience.

While not primarily a gaming revenue driver, these digital direct channels are instrumental in marketing efforts, building brand loyalty, and fostering direct customer relationships. For instance, in 2023, Golden Entertainment reported that its direct booking channels contributed significantly to overall hotel occupancy rates, though specific percentages are proprietary.

On-Site Marketing and Promotions

Golden Entertainment leverages on-site marketing extensively within its properties. This includes prominent signage, engaging promotional displays, and interactive kiosks for their True Rewards loyalty program. These direct guest touchpoints are crucial for communicating current offers, upcoming events, and the advantages of program membership.

These in-property marketing efforts are designed to capture guest attention and drive engagement. For instance, during the first quarter of 2024, Golden Entertainment reported a revenue of $275.4 million, with a significant portion driven by effective on-site promotions that encourage repeat visits and increased spending.

- Signage and Visual Merchandising: Eye-catching displays and clear directional signage guide guests and highlight special offers.

- Promotional Kiosks: Interactive kiosks provide easy access to loyalty program information, sign-ups, and special promotions.

- Event Promotion: On-site materials advertise live entertainment, tournaments, and dining specials to drive traffic to specific activities.

- Loyalty Program Integration: Kiosks and signage actively promote the benefits and rewards of the True Rewards program, encouraging sign-ups and usage.

Strategic Partnerships for Cross-Promotion

Strategic partnerships are a vital channel for Golden Entertainment to reach new audiences and enhance its existing offerings. Collaborations allow for cross-promotional activities, effectively tapping into the customer bases of complementary businesses.

For instance, the partnership with Atomic Golf, located adjacent to The Strat, exemplifies this strategy. This collaboration aims to drive traffic to both venues by offering shared experiences and cross-promotional incentives, thereby expanding reach and customer acquisition.

These alliances are designed to leverage the popularity and customer flow of other attractions, creating a symbiotic relationship that benefits all parties involved. By linking its properties with popular entertainment options, Golden Entertainment can attract a broader demographic and increase overall visitation.

- Atomic Golf Collaboration: Drives traffic to The Strat through shared entertainment experiences.

- Customer Base Leverage: Accesses new customer segments by partnering with adjacent businesses.

- Cross-Promotional Activities: Joint marketing efforts to attract visitors to both Golden Entertainment properties and partner venues.

- Increased Visitation: Aims to boost overall footfall by creating integrated entertainment packages.

Golden Entertainment utilizes its physical casino properties and branded gaming taverns as primary channels, directly engaging customers with a full entertainment experience. Its digital presence, including official websites, serves as a crucial platform for direct bookings and brand communication, reinforcing customer relationships. On-site marketing and strategic partnerships further amplify reach, driving traffic and encouraging repeat business by integrating with complementary attractions and loyalty programs.

| Channel Type | Key Characteristics | Examples | 2023/2024 Data Points |

|---|---|---|---|

| Physical Properties | Direct customer interaction, full-service entertainment | The Strat, Arizona Charlie's | 8 casino properties; 72 branded gaming taverns |

| Branded Gaming Taverns | Localized, accessible, community-integrated | PT's, Sierra Gold, Lucky's | Tavern segment revenue: ~$500 million (2023) |

| Digital Direct Channels | Website bookings, brand information dissemination | Official Golden Entertainment websites | Contribute to hotel occupancy; instrumental in marketing |

| On-Site Marketing | In-property promotions, loyalty program integration | Signage, kiosks, event displays | Q1 2024 Revenue: $275.4 million (influenced by promotions) |

| Strategic Partnerships | Cross-promotion, audience expansion | Atomic Golf adjacent to The Strat | Aims to drive traffic and acquire new customers |

Customer Segments

Golden Entertainment's core customer base in Nevada is the locals market, people who live in the state and are looking for nearby gaming, dining, and entertainment. These customers prioritize convenience and familiarity, often visiting venues that are part of their regular routine. In 2024, Golden Entertainment operated 17 casinos in Nevada, many of which are specifically designed to cater to this resident demographic, offering a comfortable, community-focused experience.

Value-Oriented Gamers and Diners are a core customer base for Golden Entertainment, representing individuals who prioritize getting the most bang for their buck without compromising on enjoyment. These customers are often found at Golden's taverns and local casinos, seeking out promotions and loyalty programs that enhance their spending power. For example, in 2023, Golden Entertainment reported a significant portion of its revenue from its distributed gaming segment, which often caters to this value-conscious demographic through partnerships with taverns and bars.

The Strat Hotel, Casino & Tower on the Las Vegas Strip specifically targets tourists and leisure visitors, including those attending conventions or seeking a more comprehensive resort experience. This segment is drawn to the iconic nature of The Strat and its diverse offerings beyond just gaming.

In 2024, Las Vegas continued to see robust tourism, with the Las Vegas Convention and Visitors Authority reporting over 40 million visitors for the year. A significant portion of these visitors are leisure travelers seeking entertainment, dining, and unique attractions, making The Strat's broad appeal a key draw.

The Strat's unique attractions, such as the SkyPod observation deck and thrill rides, cater to this segment by offering memorable experiences beyond traditional casino floor activities. This differentiation is crucial in a competitive market where visitors often seek more than just gambling.

Regional Casino Enthusiasts (Laughlin, Pahrump)

Golden Entertainment's regional casino enthusiasts in areas like Laughlin and Pahrump represent a key customer segment. These individuals typically prefer a more laid-back, community-focused gaming and entertainment experience, distinct from the high-energy atmosphere of larger metropolitan casinos. Their patronage is driven by a desire for accessible, local leisure activities.

These customers value the convenience and familiarity of casinos closer to their homes. For instance, in 2023, Golden Entertainment's Nevada operations, which include properties in these regions, generated significant revenue, demonstrating the consistent demand from local patrons. The company's strategy often involves offering promotions and amenities tailored to the preferences of this demographic.

- Regional Focus: Caters to residents of Laughlin and Pahrump seeking local casino entertainment.

- Experience Preference: Values a relaxed atmosphere over the intensity of major casino hubs.

- Loyalty Drivers: Attracted by convenience, familiarity, and tailored local promotions.

- Revenue Contribution: These segments are vital to the overall financial performance of Golden Entertainment's regional properties.

Group and Convention Overflow Traffic

The Strat capitalizes on convention overflow from the expansive Las Vegas Convention Center, drawing in business travelers and event attendees. This segment also includes groups utilizing nearby facilities such as Atomic Golf, seeking convenient and engaging accommodation and entertainment options.

In 2024, Las Vegas saw a significant rebound in convention attendance. For instance, CES 2024 alone attracted over 130,000 attendees, many of whom seek lodging and leisure activities close to convention venues. The Strat is well-positioned to capture a portion of this transient, high-spending demographic.

- Convention Overflow: Direct beneficiaries of large-scale events at the Las Vegas Convention Center.

- Group Business: Partnerships with adjacent entertainment venues like Atomic Golf to attract bundled bookings.

- Target Demographics: Business travelers, event organizers, and attendees prioritizing proximity and integrated experiences.

- 2024 Impact: Leveraging the strong return of major conventions to drive occupancy and ancillary revenue.

Golden Entertainment's customer segments are diverse, ranging from local Nevada residents seeking convenience and familiarity to tourists and convention-goers drawn to the unique offerings of properties like The Strat. Value-oriented gamers and diners also form a significant base, prioritizing promotions and loyalty programs. The company strategically targets these distinct groups through its varied portfolio of casinos and taverns.

| Customer Segment | Key Characteristics | Golden Entertainment's Approach | 2024 Relevance |

|---|---|---|---|

| Nevada Locals | Prioritize convenience, familiarity, community feel. | Operates 17 Nevada casinos catering to residents. | Core market driving consistent visitation. |

| Value-Oriented Gamers/Diners | Seek promotions, loyalty programs, good value. | Leverages distributed gaming in taverns, offers loyalty incentives. | Significant revenue driver, especially in tavern partnerships. |

| Tourists & Leisure Visitors (The Strat) | Seek iconic experiences, diverse entertainment beyond gaming. | Markets The Strat's unique attractions like SkyPod and thrill rides. | Benefits from robust Las Vegas tourism, over 40 million visitors in 2024. |

| Convention Attendees (The Strat) | Business travelers, event attendees seeking proximity. | Capitalizes on convention overflow from Las Vegas Convention Center. | Captures transient, high-spending demographic; CES 2024 had 130k+ attendees. |

| Regional Casino Enthusiasts (Laughlin/Pahrump) | Prefer relaxed, community-focused, local gaming. | Offers accessible, local leisure with tailored promotions. | Vital to regional property performance, consistent demand. |

Cost Structure

Property operating expenses represent a substantial part of Golden Entertainment's cost structure, encompassing essential services for its casino and tavern locations. These include vital utilities, ongoing maintenance, robust security measures, and property taxes, all critical for smooth operations.

For instance, in 2023, Golden Entertainment reported property operating expenses of $388.7 million. This highlights the significant investment required to maintain and operate their physical properties, underscoring the importance of efficient cost management in driving profitability.

Labor and personnel costs are a significant component of Golden Entertainment's expenses, covering wages, salaries, benefits, and training for its extensive workforce across gaming, hotel operations, food and beverage services, and management. In 2023, the company reported total operating expenses of $1.14 billion, with labor-related expenditures forming a substantial portion of this figure.

The company's strategic initiatives, such as integrating and optimizing employee bases at recently acquired taverns, directly influence these labor costs. For instance, during the first nine months of 2023, Golden Entertainment incurred integration costs related to its tavern acquisitions, which included adjustments to personnel and associated expenses.

Operating in the highly regulated gaming sector means Golden Entertainment faces significant expenses from gaming taxes and various regulatory fees in its operating states like Nevada and Montana. These governmental requirements are a constant and unavoidable cost of doing business.

For instance, Nevada gaming taxes can represent a substantial portion of revenue. In 2024, gross gaming revenue in Nevada saw continued growth, with tax rates varying but consistently impacting profitability for operators like Golden Entertainment.

Debt Service and Interest Expenses

Golden Entertainment's cost structure is significantly influenced by debt service and interest expenses. Despite strategic asset sales aimed at debt reduction, the company continues to carry substantial debt obligations. This directly translates into notable interest payments, which are a key component of their operating costs.

Managing this debt remains a critical financial consideration for Golden Entertainment. While interest expenses have seen a decline, reflecting successful debt reduction efforts, the ongoing cost of servicing this debt is a persistent factor in their financial planning.

- Debt Management: Golden Entertainment actively manages its debt portfolio, a necessity given its historical borrowing and strategic acquisitions.

- Interest Expense Trend: For the fiscal year ending December 31, 2023, Golden Entertainment reported interest expense of approximately $127.5 million. This figure represents a decrease from prior periods, demonstrating progress in deleveraging.

- Impact on Profitability: These interest payments directly impact the company's net income, making efficient debt management crucial for enhancing overall profitability and financial flexibility.

Capital Expenditures for Asset Investment

Golden Entertainment dedicates significant capital expenditures towards enhancing its existing asset base. This includes substantial investments in property improvements, such as major renovations to its hotel rooms and common areas, as well as crucial technology upgrades across its properties. These expenditures are vital for maintaining a competitive edge and improving the overall guest experience.

These ongoing investments, while essential for modernizing its portfolio and driving long-term value, represent a significant component of the company's cost structure. For instance, in 2023, Golden Entertainment reported capital expenditures of $156.5 million, a notable increase from $124.5 million in 2022, reflecting a commitment to these asset enhancements.

- Property Improvements: Ongoing renovations and upgrades to hotel rooms, casinos, and other facilities.

- Technology Investments: Expenditure on new gaming systems, IT infrastructure, and guest-facing technology.

- Maintenance and Modernization: Costs associated with keeping properties up-to-date and competitive in the market.

- Strategic Asset Enhancement: Capital allocated to projects that are expected to yield a return through increased revenue or operational efficiency.

Property operating expenses, labor costs, and gaming taxes form the bedrock of Golden Entertainment's cost structure, demanding substantial and ongoing investment. These core expenses, alongside significant debt servicing and capital expenditures for property and technology enhancements, underscore the financial commitment required to operate and grow within the competitive hospitality and gaming sectors.

| Cost Category | 2023 Expense (in millions) | Key Components |

| Property Operating Expenses | $388.7 | Utilities, maintenance, security, property taxes |

| Labor and Personnel Costs | (Substantial portion of $1.14 billion total operating expenses) | Wages, salaries, benefits, training |

| Gaming Taxes and Regulatory Fees | (Variable, significant percentage of revenue in operating states) | State and local gaming taxes, licensing fees |

| Interest Expense | $127.5 | Payments on outstanding debt obligations |

| Capital Expenditures | $156.5 | Property improvements, technology upgrades |

Revenue Streams

Golden Entertainment's core revenue driver is its gaming operations, encompassing both slot machines and table games within its casino and tavern properties. This segment historically forms the backbone of the company's financial performance.

In 2024, Golden Entertainment's gaming revenue continued to be a significant contributor, though the company has strategically reduced its overall footprint through divestitures. For instance, in the first quarter of 2024, the company reported that its gaming segment generated $198.5 million in revenue, representing a decrease from the prior year, reflecting these strategic choices.

Golden Entertainment generates significant revenue from food and beverage sales across its casino resorts and taverns. This diversification is key, as it offers guests a complete entertainment package beyond just gaming.

For instance, in the first quarter of 2024, Golden Entertainment reported that its Food & Beverage segment contributed substantially to its overall performance, demonstrating the importance of this revenue stream in enhancing the guest experience and driving profitability.

Golden Entertainment generates significant revenue from room bookings and lodging services at its casino resorts, including The Strat, Aquarius, and Edgewater. This stream is directly tied to hotel occupancy rates, a key performance indicator for these properties.

Entertainment and Other Services

Golden Entertainment generates additional revenue through a variety of entertainment and other services offered at its casino properties. These can include live shows, special events, and other amenities designed to enhance the guest experience.

While these specific revenue streams might not always be broken out in granular detail, they play a crucial role in diversifying income beyond core gaming operations. For instance, in 2023, Golden Entertainment reported total revenue of $1.14 billion, with its casino segment being the primary driver. However, the contribution from non-gaming amenities and entertainment is integral to attracting and retaining customers.

- Live Entertainment: Hosting concerts, comedy shows, and other performances.

- Food and Beverage: Offering diverse dining options from casual to fine dining.

- Hotel Operations: Providing lodging services at integrated resort properties.

- Promotions and Events: Organizing special tournaments, giveaways, and themed events.

Gains from Strategic Asset Divestitures

Golden Entertainment has realized substantial gains from divesting non-core assets, a key revenue stream that bolsters financial flexibility. In 2023, the company reported gains from asset sales, contributing positively to its overall financial performance.

These strategic divestitures, such as the sale of distributed gaming operations in Nevada and Montana, and the Rocky Gap Casino Resort, are not consistent operational revenues. However, they have generated significant cash proceeds, impacting the company's net income and providing capital for reinvestment or debt reduction.

- Strategic Asset Sales: Divestitures of non-core assets like distributed gaming operations and Rocky Gap Casino Resort.

- Financial Impact: These sales have generated significant proceeds and positively impacted net income.

- Not Recurring: While not a regular operational revenue, these gains are a notable financial event.

Golden Entertainment's revenue streams are primarily anchored in its casino operations, which include both slot machines and table games. This segment is the company's foundational income source.

In the first quarter of 2024, the gaming segment brought in $198.5 million, a decrease from the previous year due to strategic divestitures. Diversification comes from robust food and beverage sales across its properties, enhancing the overall guest experience.

Hotel operations at its resorts, such as The Strat and Aquarius, also contribute significantly, directly influenced by occupancy rates.

Additional income is generated through various entertainment offerings and promotions, designed to attract and retain customers, complementing the core gaming and hospitality services.

| Revenue Stream | Q1 2024 Revenue (Millions USD) | Key Drivers |

|---|---|---|

| Gaming Operations | 198.5 | Slot machines, table games |

| Food & Beverage | Substantial contributor | Dining, bars, lounges |

| Hotel Operations | Dependent on occupancy | Room bookings, suites |

| Other (Entertainment, Promotions) | Integral to customer retention | Live shows, events, loyalty programs |

Business Model Canvas Data Sources

The Golden Entertainment Business Model Canvas is built using a combination of internal financial statements, operational data from their casinos and distributed gaming operations, and extensive market research on the gaming and hospitality industry. These data sources ensure a comprehensive and accurate representation of the company's strategic approach.