Golden Entertainment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden Entertainment Bundle

Golden Entertainment faces a dynamic competitive landscape, with moderate bargaining power from both buyers and suppliers influencing its profitability. The threat of new entrants is present, though barriers to entry in the casino and distributed gaming sectors can be significant.

The full Porter's Five Forces Analysis reveals the real forces shaping Golden Entertainment’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Golden Entertainment's operations are heavily concentrated in Nevada, a state where the leisure and hospitality sector is a major employer. This creates a substantial pool of potential workers, but also a concentrated labor market where suppliers, in this case, the employees, can wield significant influence.

The presence of strong labor unions, most notably the Culinary Workers Union Local 226, is a key factor amplifying the bargaining power of Golden Entertainment's workforce. Unions act as a collective voice, enabling workers to negotiate for better wages, benefits, and working conditions more effectively than they could individually.

Recent contract agreements achieved by unions on the Las Vegas Strip, which included significant pay raises and enhanced benefits, serve as a critical benchmark. These successful negotiations can directly impact labor costs and the availability of skilled workers for companies like Golden Entertainment, even those not directly unionized but operating within the same regional labor market.

The bargaining power of suppliers in the gaming equipment and technology sector is significant for companies like Golden Entertainment. Specialized machinery and innovative software are essential for casino and distributed gaming operations, making these providers crucial partners.

While the market has several players, a few dominant manufacturers of high-quality, cutting-edge gaming machines can exert considerable influence. For instance, in 2024, the top three slot machine manufacturers globally accounted for a substantial portion of market share, indicating a degree of supplier concentration.

Furthermore, the high costs associated with switching integrated casino management systems and other essential gaming floor equipment can lock Golden Entertainment into existing supplier relationships, limiting their ability to negotiate favorable terms or explore alternative solutions.

Food and beverage suppliers hold a generally moderate bargaining power for Golden Entertainment, given the availability of numerous regional and national providers. However, this can shift upwards for suppliers offering unique or high-demand specialty items, potentially increasing their leverage in negotiations. In 2023, the food and beverage sector experienced significant cost fluctuations, with some commodity prices like coffee beans seeing increases of over 10% year-over-year, impacting supplier pricing strategies.

Utility and Infrastructure Providers

Golden Entertainment, like many casino and tavern operators, relies heavily on essential utilities such as electricity, water, and gas, alongside critical IT infrastructure. These services are often provided by a small number of regional monopolies or oligopolies, which naturally gives them significant leverage in negotiations.

This concentration of utility providers means Golden Entertainment has limited options for sourcing these vital resources, a situation that can lead to higher costs. For instance, in 2024, average commercial electricity prices in Nevada, where Golden Entertainment has a significant presence, saw fluctuations, with some regions experiencing increases due to grid modernization efforts and demand shifts. Any rise in these utility expenses directly translates into higher operating costs for the company, potentially squeezing profit margins.

- High Dependence: Casinos and taverns are energy-intensive and require reliable IT, making them vulnerable to supplier power.

- Limited Suppliers: The often monopolistic or oligopolistic nature of utility and infrastructure providers reduces sourcing options.

- Cost Impact: Increases in utility prices directly affect Golden Entertainment's operating expenses and profitability.

Real Estate and Lease Providers

Golden Entertainment's reliance on leased properties, particularly for its taverns and some casino locations, exposes it to the bargaining power of real estate and lease providers. These lease agreements represent a significant fixed cost. In 2024, the company continued to operate a substantial number of leased facilities, underscoring this vulnerability. The desirability and limited availability of prime locations can amplify the leverage held by landlords, potentially impacting Golden Entertainment's operational flexibility and profitability.

The company's strategic emphasis on its Nevada holdings means that lease agreements within this key market carry particular weight. A strong existing physical footprint in these areas can make it difficult to renegotiate unfavorable lease terms or find suitable alternatives without significant disruption. This concentration can therefore increase the bargaining power of landlords in those specific, valuable markets.

- Lease Dependence: Golden Entertainment utilizes leased properties for a portion of its tavern and casino operations, creating a direct relationship with real estate providers.

- Fixed Cost Impact: Lease payments are a fixed operational expense, and terms can be influenced by market conditions and landlord leverage.

- Nevada Focus: The company's strategic concentration on Nevada properties means that lease agreements in this region are particularly critical and can grant significant power to lessors in desirable locations.

The bargaining power of suppliers for Golden Entertainment is a mixed bag, with significant leverage held by providers of essential utilities, specialized gaming technology, and prime real estate. Labor, particularly unionized segments, also demonstrates considerable power, impacting wage and benefit negotiations. Conversely, suppliers of more commoditized goods like food and beverages generally hold less sway due to market fragmentation.

| Supplier Type | Bargaining Power Level | Key Factors |

|---|---|---|

| Labor (Unionized) | High | Collective bargaining, union strength (e.g., Culinary Workers Union Local 226) |

| Gaming Equipment & Technology | High | Specialization, high switching costs, market concentration among top manufacturers |

| Utilities (Electricity, Water, IT) | High | Monopolistic/oligopolistic market structure, essential service nature |

| Real Estate/Lease Providers | Moderate to High | Location desirability, limited availability, strategic importance of Nevada market |

| Food & Beverage | Moderate | Availability of multiple providers, but can increase for specialty items |

What is included in the product

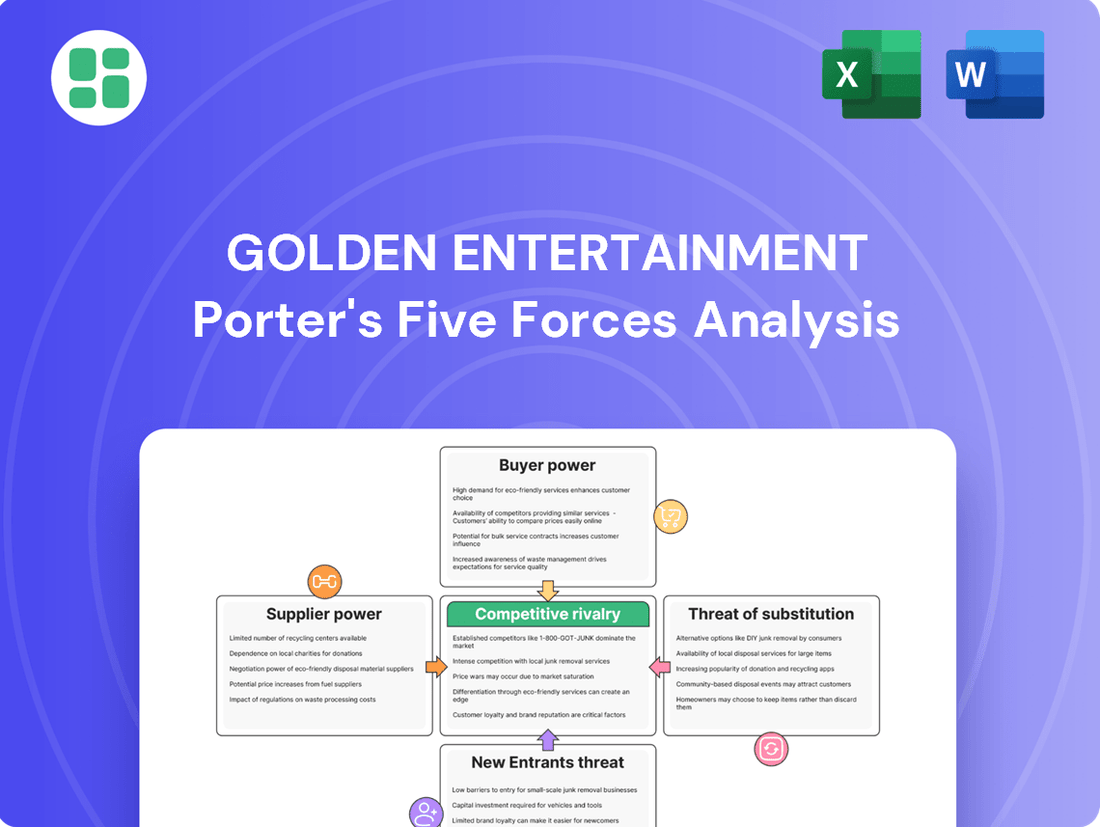

This analysis dissects the competitive forces impacting Golden Entertainment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces chart for Golden Entertainment, simplifying complex market dynamics.

Customers Bargaining Power

Golden Entertainment's core customer base in Nevada, the locals market, exhibits a notable price sensitivity. Unlike tourists or high rollers, these patrons prioritize value and affordability in their entertainment choices. This means that competitive pricing and attractive promotional deals are paramount for Golden Entertainment to capture and maintain market share within this segment.

For instance, in 2024, the average consumer spending on entertainment and leisure activities in Nevada, particularly among local residents, saw a slight increase, but the demand for discounts and loyalty rewards remained consistently high. Golden Entertainment's success hinges on its ability to offer compelling price points and loyalty programs that resonate with this value-conscious demographic, ensuring they choose Golden Entertainment properties over competitors.

Customers in Golden Entertainment's target markets, particularly those in Nevada, have a wide array of entertainment choices readily available. This includes not only other local casinos and taverns but also the prominent Las Vegas Strip properties, which often draw patrons for significant events or a more upscale experience.

The accessibility of these alternatives significantly bolsters customer bargaining power. For instance, in 2024, Nevada's gaming revenue from locals casinos and taverns, while substantial, competes directly with the allure and marketing power of larger Strip resorts, which can offer more comprehensive packages and unique attractions.

The ease with which customers can shift their spending between these venues, especially for more casual gaming or visits to distributed gaming locations, amplifies their leverage. This fluidity in customer choice means Golden Entertainment must remain competitive on price, promotions, and overall customer experience to retain its clientele.

The increasing popularity of online gambling, encompassing iGaming and sports betting, offers a compelling alternative to traditional brick-and-mortar entertainment. This digital shift provides consumers with the convenience of accessing games and wagers from their homes.

While Golden Entertainment's Nevada operations have specific in-person registration mandates for mobile sports betting, the overarching digital gaming trend undeniably enhances customer choice. This expanded accessibility to online platforms can influence customer visitation patterns to physical Golden Entertainment venues, potentially altering their bargaining power.

Customer Information and Transparency

Customers increasingly wield significant bargaining power due to readily available information. Online reviews, social media platforms, and competitor advertising provide detailed comparisons of gaming odds, promotional offers, and loyalty program benefits across various entertainment venues. This transparency empowers consumers to easily assess value, directly influencing Golden Entertainment's need to maintain competitive pricing and enhance the overall customer experience.

In 2024, the digital landscape continues to amplify customer awareness. For instance, platforms aggregating casino reviews and comparing slot machine payout percentages directly arm consumers with data to make informed choices. This heightened transparency forces companies like Golden Entertainment to actively manage their brand reputation and ensure their offerings remain attractive relative to competitors.

- Increased Information Access: Customers can easily compare Golden Entertainment's offerings with competitors through online reviews, social media, and direct advertising.

- Price and Value Sensitivity: Greater transparency compels Golden Entertainment to offer competitive pricing and superior value to attract and retain customers.

- Focus on Customer Experience: To counter customer bargaining power, Golden Entertainment must prioritize an excellent overall guest experience beyond just gaming.

Low Switching Costs for Casual Entertainment

For patrons of taverns and smaller local casinos, the switching costs are indeed quite low. They can readily opt for a different venue based on factors like how close it is, any ongoing deals, or simply the vibe they're looking for. This ease of movement puts pressure on companies like Golden Entertainment to continually offer an attractive and convenient experience to keep customers coming back.

This low friction in customer choice means Golden Entertainment must remain competitive. For instance, in 2024, the casual entertainment sector saw a rise in localized promotions, with many smaller venues offering daily specials to draw in patrons. This makes it harder for larger operators to rely solely on brand recognition, as customers are more likely to try a new spot if the incentive is right.

- Low Switching Costs: Patrons can easily move between casual entertainment venues.

- Key Decision Factors: Proximity, promotions, and atmosphere influence customer choices.

- Competitive Pressure: Golden Entertainment must consistently offer value to retain loyalty.

- 2024 Trend: Increased localized promotions by smaller venues highlight this competitive dynamic.

Golden Entertainment's customers, particularly those in the Nevada locals market, demonstrate significant price sensitivity and a wide array of choices. This means that competitive pricing, attractive promotions, and a superior overall customer experience are crucial for retaining market share.

The bargaining power of these customers is amplified by the ease with which they can switch between venues, influenced by factors like proximity, ongoing deals, and the general atmosphere. In 2024, this dynamic was further underscored by an increase in localized promotions from smaller entertainment venues, intensifying competitive pressure on larger operators.

The growing influence of online gambling and readily available consumer information online further empowers customers. They can easily compare offerings, odds, and promotions, compelling Golden Entertainment to actively manage its brand reputation and ensure its value proposition remains compelling against a backdrop of increasing transparency and choice.

Preview Before You Purchase

Golden Entertainment Porter's Five Forces Analysis

This preview showcases the complete Golden Entertainment Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive instantly after purchase, ensuring no discrepancies or missing information. This professionally crafted analysis is ready for immediate download and use, providing you with actionable insights into Golden Entertainment's market landscape.

Rivalry Among Competitors

Golden Entertainment faces intense competition in Nevada's gaming sector, especially among local patrons and in tavern-style gaming. This market is populated by a wide array of competitors, from major casino complexes to smaller, neighborhood taverns, ensuring a highly fragmented landscape.

While Golden Entertainment holds a notable position, the absence of a single dominant player means rivalry is fierce. For instance, in 2023, Nevada's gaming revenue reached an impressive $15.5 billion, underscoring the substantial market size but also the intense battle for a share of these winnings.

While the global casino market continues to expand, the Nevada gaming sector presented a more nuanced picture in 2024 and early 2025. Certain areas, such as Downtown Las Vegas and the local player base, demonstrated positive growth trends. This uneven expansion fuels a more aggressive competitive landscape as operators strive to capture a greater portion of the available customer spending.

Golden Entertainment distinguishes itself by concentrating on convenient, accessible gaming, dining, and entertainment, primarily targeting Nevada's local residents. This focus on the local market, with its portfolio of casinos and numerous taverns, cultivates repeat business through personalized experiences and loyalty programs, a strategy that contrasts with the larger, Strip-focused mega-resorts.

High Fixed Costs and Exit Barriers

The gaming sector, including companies like Golden Entertainment, is burdened by substantial fixed costs. These expenses cover everything from maintaining sprawling casino properties and ensuring strict regulatory compliance to employing a large workforce. For instance, in 2023, the capital expenditures for many casino operators remained significant, reflecting ongoing investments in property upgrades and technology.

These high fixed costs, coupled with the specialized nature of gaming assets and the intricate web of licensing requirements, erect formidable exit barriers. This means that once a company invests heavily in this industry, leaving becomes incredibly difficult and costly. Consequently, existing competitors are often compelled to remain in the market and battle fiercely for their share, intensifying competitive rivalry.

- High Fixed Costs: Gaming companies invest heavily in property, plant, and equipment, as well as ongoing regulatory compliance and staffing.

- Specialized Assets: Gaming equipment and infrastructure are highly specific to the industry, limiting their resale value outside of it.

- Complex Licensing: Obtaining and maintaining gaming licenses is a costly and time-consuming process, creating a significant barrier to entry and exit.

- Intensified Rivalry: The combination of high fixed costs and exit barriers encourages existing players to stay and compete aggressively for market share.

Strategic Divestitures and Focused Operations

Golden Entertainment's strategic divestitures of its Montana and Nevada distributed gaming operations, finalized in late 2023 and early 2024, signal a deliberate move towards concentrating on its Nevada casino and tavern businesses. This sharpened focus means the company is now directing more resources and attention towards competing head-to-head with established players within these specific, core markets. For instance, in 2023, Golden Entertainment reported approximately $1.3 billion in total revenue, with a significant portion now expected to be generated from these remaining, more concentrated operations.

This intensified focus can heighten competitive rivalry in its core Nevada segments. By shedding non-core assets, Golden Entertainment is better positioned to deploy capital and management expertise against rivals in the Nevada casino and tavern space. This strategic pruning allows for a more aggressive stance in markets where it aims to gain or maintain market share.

- Divestitures: Montana and Nevada distributed gaming operations sold in late 2023/early 2024.

- Strategic Shift: Focus narrowed to Nevada-based casino and tavern model.

- Rivalry Impact: Intensified competition within core Nevada markets due to concentrated resources.

- Financial Context: Company's 2023 revenue of approximately $1.3 billion underscores the importance of these core Nevada operations moving forward.

Golden Entertainment operates in a highly competitive Nevada gaming market, particularly among local patrons and in tavern-style gaming, where numerous players vie for market share. The state's gaming revenue reached $15.5 billion in 2023, highlighting the substantial prize but also the intensity of this competition.

The company's strategic divestment of its Montana and Nevada distributed gaming operations in late 2023 and early 2024 has sharpened its focus on Nevada casinos and taverns. This concentration of resources and attention intensifies rivalry within these core markets as Golden Entertainment competes more directly with established players for local customer spending.

High fixed costs, specialized assets, and complex licensing requirements create significant exit barriers in the gaming industry. These factors compel existing operators like Golden Entertainment to remain and compete aggressively, fueling sustained rivalry as companies strive to maintain or grow their market presence.

| Factor | Impact on Competitive Rivalry | Example/Data Point |

|---|---|---|

| Market Fragmentation | Intensifies rivalry as many players compete for local patrons. | Nevada gaming revenue was $15.5 billion in 2023. |

| Strategic Focus | Concentrated resources on core Nevada markets heighten competition. | Divestiture of distributed gaming operations completed in early 2024. |

| Exit Barriers | High fixed costs and licensing encourage continued aggressive competition. | Significant ongoing capital expenditures in the gaming sector. |

SSubstitutes Threaten

The most significant threat of substitutes for Golden Entertainment's casino and tavern operations comes from the rapidly growing online gambling sector, encompassing iGaming and sports betting. This digital alternative offers unparalleled convenience and accessibility, allowing consumers to engage in gambling activities from virtually any location, directly challenging the necessity of visiting physical establishments.

The expansion of online gambling is a substantial concern. For instance, the U.S. sports betting market alone generated an estimated $20 billion in gross gaming revenue in 2023, a figure projected to climb significantly in the coming years. This digital shift diverts potential customers and revenue away from traditional brick-and-mortar venues.

Consumers have a vast selection of entertainment choices beyond gaming, including movies, live music, sporting events, and dining at restaurants not associated with casinos. This broad competitive landscape means Golden Entertainment is vying for consumer leisure dollars against a wide spectrum of leisure providers, not just other gaming establishments.

In 2024, the U.S. entertainment and leisure market is robust, with consumer spending on experiences continuing to rise. For instance, the global live music industry alone was projected to reach over $100 billion by 2024, indicating a significant portion of discretionary income is allocated to these alternative activities.

Golden Entertainment's strategy of positioning itself as an 'entertainment option' broadens its competitive set considerably. This means that a decision to attend a concert or a professional sports game directly competes with a patron's choice to visit a Golden Entertainment property.

The rise of home entertainment presents a significant threat to traditional gaming venues like those operated by Golden Entertainment. Streaming services such as Netflix and Disney+, along with the booming video game industry, offer compelling alternatives for leisure time and spending. In 2024, the global video game market was projected to generate over $200 billion, demonstrating its massive appeal and the significant portion of discretionary income it captures from consumers.

Virtual reality (VR) experiences are also becoming more sophisticated and accessible, further blurring the lines between in-person and at-home entertainment. This growing immersion and convenience directly compete for consumer attention and dollars that might otherwise be spent at casinos or other entertainment venues.

Changing Consumer Preferences and Demographics

Changing consumer preferences, particularly among younger demographics, pose a significant threat of substitution for traditional entertainment venues like those operated by Golden Entertainment. As younger generations, like Gen Z and Millennials, mature, their entertainment habits may diverge from older cohorts. For instance, a 2024 survey indicated that over 60% of individuals aged 18-29 expressed interest in online or mobile gaming experiences, a trend that could draw spending away from physical casinos.

This demographic shift presents a direct substitution threat. If younger consumers increasingly favor digital platforms, social gaming, or alternative leisure activities over traditional casino floor experiences, Golden Entertainment's established customer base for its land-based properties could shrink over time. The company must adapt to capture these evolving preferences to mitigate this long-term erosion.

- Digital Entertainment Growth: The global online gaming market is projected to reach over $150 billion by 2025, indicating a substantial shift towards digital alternatives.

- Shifting Leisure Spending: Younger consumers allocate a larger portion of their discretionary income to experiences like streaming services, esports, and social media compared to previous generations.

- Preference for Convenience: The ease and accessibility of online platforms offer a convenient substitute for the time and travel required to visit physical casinos.

Regulatory Landscape for Online vs. Land-Based Gaming

The regulatory environment significantly shapes the threat of substitutes for Golden Entertainment. While some states have embraced online gambling, others maintain stricter controls. For instance, Nevada's requirement for in-person registration for mobile sports betting offers a degree of protection for its land-based casinos.

However, this landscape is dynamic. Ongoing legislative debates across various jurisdictions could lead to changes that either increase or decrease the competitive pressure from online substitutes. For example, in 2024, several states continued to explore or expand their online gaming markets, potentially broadening the reach of digital alternatives to traditional casino experiences.

- Nevada's Unique Regulations: In-person registration for mobile sports betting in Nevada creates a barrier for online-only operators, benefiting Golden Entertainment's physical locations.

- Evolving Legalization: The trend of states legalizing online gambling continues, potentially increasing the availability and accessibility of substitutes nationwide.

- Legislative Uncertainty: Future regulatory changes could alter the competitive balance, impacting the threat of substitutes for land-based operators like Golden Entertainment.

The threat of substitutes for Golden Entertainment is significant, primarily driven by the burgeoning digital entertainment sector and evolving consumer preferences. Online gambling, including iGaming and sports betting, offers unparalleled convenience, directly competing with physical casinos. For instance, the U.S. sports betting market generated an estimated $20 billion in gross gaming revenue in 2023, a figure expected to grow substantially, diverting potential customers from traditional venues.

Beyond gambling, a wide array of leisure activities, from live music to home entertainment like streaming services and video games, vie for consumer discretionary spending. The global video game market alone was projected to exceed $200 billion in 2024, highlighting the competition for leisure time and dollars. Furthermore, changing demographics, with younger generations showing a preference for digital and mobile gaming experiences, pose a long-term substitution risk for land-based operators.

| Substitute Category | Key Drivers | Market Size/Growth (2023-2024 Estimates) | Impact on Golden Entertainment |

|---|---|---|---|

| Online Gambling (iGaming & Sports Betting) | Convenience, Accessibility, Wide Market Reach | U.S. Sports Betting Revenue: ~$20 billion (2023); Global Online Gaming Market: Projected >$150 billion by 2025 | Direct diversion of customers and revenue from physical casinos. |

| Home Entertainment (Streaming, Video Games) | Cost-effectiveness, Comfort, Vast Content Libraries | Global Video Game Market: Projected >$200 billion (2024) | Competition for leisure time and discretionary spending, reducing visits to physical venues. |

| Alternative Leisure Activities (Live Events, Dining) | Experiential Value, Social Engagement, Variety | Global Live Music Industry: Projected >$100 billion (2024) | Competition for consumer leisure dollars, requiring Golden Entertainment to offer compelling experiences. |

| Emerging Technologies (VR) | Immersive Experiences, Novelty | Growing VR Market Adoption | Potential to offer at-home alternatives that mimic or surpass physical venue experiences. |

Entrants Threaten

The capital required to build and operate casinos, particularly integrated resorts, is exceptionally high. This includes costs for land acquisition, construction, gaming equipment, and essential infrastructure, creating a substantial financial barrier.

For instance, the development of a new large-scale casino resort can easily run into hundreds of millions, if not billions, of dollars. This immense upfront investment significantly deters most potential new entrants from even considering entering the market, especially for operations on the scale of Golden Entertainment's offerings.

The gaming industry, particularly in markets like Nevada where Golden Entertainment operates, faces significant barriers due to strict regulatory and licensing requirements. These hurdles, managed by state gaming control boards, are designed to ensure integrity and public safety but also make it incredibly difficult for new companies to enter. For instance, the initial licensing process alone can take years and cost millions, a substantial deterrent for potential competitors.

Golden Entertainment benefits from strong brand recognition and deep customer loyalty within the Nevada locals market, a significant barrier for potential new entrants. Their established network of casinos and taverns has cultivated trust over time, making it difficult for newcomers to replicate this connection. For instance, in 2023, Golden Entertainment reported revenue of $1.02 billion, showcasing their substantial market presence.

Limited Availability of Prime Locations

The scarcity of prime real estate in desirable Nevada locations presents a significant barrier for new entrants looking to establish casinos or taverns. This limited availability, coupled with escalating acquisition costs, makes it exceptionally difficult for newcomers to secure sites comparable to those already occupied by established players like Golden Entertainment.

Existing operators possess a distinct advantage through their established physical presence, often in highly trafficked and sought-after areas. This pre-existing footprint effectively locks in prime locations, creating a substantial hurdle for any potential competitor aiming to enter the market with an equally advantageous geographical position.

- Limited Availability: Prime Nevada real estate for entertainment venues is scarce.

- High Costs: Securing these locations involves significant financial investment.

- Established Footprint: Existing operators like Golden Entertainment benefit from their prime sites.

- Competitive Disadvantage: Newcomers struggle to find equally advantageous locations.

Operational Expertise and Supply Chain Relationships

Operating a diverse range of gaming and hospitality properties demands significant specialized knowledge, from running busy casino floors to managing hotel services and navigating complex regulations. Newcomers would struggle to replicate the deep operational experience Golden Entertainment has built over years, impacting their ability to efficiently manage day-to-day activities.

Golden Entertainment benefits from established, long-standing relationships with key suppliers across its various operations. These established connections are crucial for securing favorable terms and ensuring a consistent supply of goods and services, a significant hurdle for any new entrant aiming to compete effectively in the gaming and hospitality sector.

- Supplier Relationships: Golden Entertainment's established supplier network provides a competitive advantage, potentially offering better pricing and more reliable delivery than new entrants can secure.

- Operational Know-How: Years of experience in managing gaming, food and beverage, and hotel operations translate into efficiencies and cost savings that are difficult for new competitors to match.

- Regulatory Compliance: Navigating the intricate web of gaming regulations requires specialized expertise, which Golden Entertainment possesses, creating a barrier for less experienced new entrants.

The threat of new entrants for Golden Entertainment is considerably low due to immense capital requirements for casino development, estimated in the hundreds of millions to billions of dollars. Strict regulatory and licensing hurdles, which can take years and cost millions, further deter new companies. For instance, obtaining a gaming license in Nevada is a rigorous process that new entrants must successfully navigate.

Golden Entertainment's established brand loyalty and prime real estate holdings in Nevada present significant barriers. Their 2023 revenue of $1.02 billion underscores their substantial market presence, making it difficult for newcomers to replicate their customer base and secure advantageous locations. The scarcity of prime Nevada real estate further compounds this challenge.

The industry's need for specialized operational knowledge and established supplier relationships also acts as a deterrent. Golden Entertainment's years of experience in managing diverse gaming and hospitality operations, coupled with their strong supplier networks, create efficiencies and cost advantages that are challenging for new competitors to match.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building integrated resorts costs hundreds of millions to billions. | Extremely high, deterring most potential entrants. |

| Regulatory Hurdles | Strict licensing and compliance in gaming markets like Nevada. | Time-consuming (years) and expensive (millions), a significant deterrent. |

| Brand Loyalty & Location | Established customer base and prime real estate ownership. | Difficult for new entrants to replicate customer connection and secure prime sites. |

| Operational Expertise | Deep knowledge in managing complex gaming and hospitality operations. | Newcomers struggle to match efficiency and cost savings of experienced operators. |

Porter's Five Forces Analysis Data Sources

Our Golden Entertainment Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's SEC filings, annual reports, and investor presentations.

We also leverage industry-specific market research reports and data from reputable financial information providers to gain a thorough understanding of the competitive landscape.