InterGlobe Aviation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterGlobe Aviation Bundle

InterGlobe Aviation, the parent company of IndiGo, boasts impressive strengths like its dominant market share and cost-efficient operations, but also faces significant threats from intense competition and fluctuating fuel prices. Understanding these dynamics is crucial for anyone looking to invest or strategize within the Indian aviation sector.

Want the full story behind InterGlobe Aviation's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

InterGlobe Aviation, through its IndiGo brand, stands as India's undisputed largest passenger airline, consistently holding a domestic market share north of 60% as of early 2025. This commanding position grants substantial competitive advantages, including significant economies of scale in operations and procurement, alongside deeply ingrained brand recognition across the Indian subcontinent.

This robust market dominance is not merely a static figure; IndiGo's capacity to expand and robustly defend its share against a crowded field of competitors highlights its superior operational efficiency and astute strategic planning. Such strength translates into a powerful negotiating position with suppliers and a consistent ability to attract and retain a large customer base, reinforcing its market leadership.

IndiGo's operational efficiency is a cornerstone of its success, enabling it to maintain a competitive edge. The airline consistently boasts high on-time performance (OTP), a critical metric for customer satisfaction and cost control. For instance, in the fiscal year 2023-24, IndiGo reported an average OTP of over 85%, significantly outperforming many industry peers.

This dedication to punctuality translates into optimized aircraft utilization and reduced turnaround times, directly supporting its low-cost carrier model. By minimizing ground time, IndiGo maximizes flying hours, which is crucial for managing its cost structure and offering competitive fares to its passengers.

IndiGo’s strength lies in its extensive domestic network, serving over 90 destinations across India. This robust internal connectivity acts as a powerful feeder for its international expansion. For instance, in the fiscal year 2024, IndiGo reported carrying over 100 million passengers domestically, showcasing its market dominance.

The airline is actively broadening its international presence, strategically adding new routes. By the end of 2024, IndiGo launched services to new European destinations like London and Istanbul, and expanded its reach in Central Asia and Southeast Asia, aiming to diversify revenue and capture a larger share of the global travel market.

Modern and Expanding Fleet

IndiGo boasts one of the most modern and expansive fleets in the aviation industry, predominantly featuring fuel-efficient Airbus A320 family aircraft. This commitment to a contemporary fleet underpins its operational efficiency and cost management strategies.

The airline has secured substantial future capacity through significant aircraft orders. These include a firm order for 500 Airbus A320neo family aircraft and a notable doubling of its order for 60 Airbus A350-900 wide-body jets. These strategic fleet acquisitions are designed to fuel ambitious expansion plans, both domestically and internationally.

This continuous fleet modernization directly enhances IndiGo’s operational capabilities. It allows for greater route flexibility, improved passenger comfort, and a stronger competitive position by ensuring access to newer, more efficient aircraft that can support capacity growth well into the future.

- Fleet Composition: Primarily Airbus A320 family aircraft, known for fuel efficiency.

- A320neo Orders: 500 firm orders placed for the A320neo family.

- A350-900 Orders: Doubled order to 60 Airbus A350-900 wide-body jets.

- Strategic Impact: Enhances operational capabilities and supports ambitious expansion plans.

Strong Cost Discipline and Low-Cost Model

InterGlobe Aviation, operating as IndiGo, leverages a robust cost discipline and a lean operational model as a significant strength. This focus allows the airline to consistently offer competitive fares, a crucial factor in the price-sensitive Indian aviation market. For instance, IndiGo's consistent emphasis on cost control contributed to its strong financial performance, with a reported profit after tax of ₹3,170 crore for the fiscal year ending March 31, 2024.

The airline's commitment to a simplified service offering and operational efficiency underpins its low-cost carrier (LCC) strategy. This approach, characterized by high aircraft utilization and quick turnarounds, has historically enabled IndiGo to achieve high load factors, often exceeding 85% in recent periods, thereby maximizing revenue per available seat kilometer (RASK).

- Cost Discipline: IndiGo's operational framework prioritizes cost efficiency across all facets of its business.

- Low-Cost Model: The airline's strategy is centered on providing affordable air travel through a simplified service.

- High Load Factors: Efficient operations and competitive pricing consistently drive high passenger occupancy rates.

- Profitability: Strong cost management has allowed IndiGo to maintain profitability even in challenging market conditions.

InterGlobe Aviation's primary strength lies in its dominant market share within India, consistently exceeding 60% as of early 2025. This leadership position translates into significant economies of scale and strong brand recognition.

The airline's operational efficiency, evidenced by an average on-time performance of over 85% in FY23-24, directly supports its low-cost model and customer satisfaction.

IndiGo's extensive domestic network, serving over 90 destinations and carrying over 100 million passengers in FY24, provides a solid foundation for its growing international operations.

Its modern, fuel-efficient fleet, anchored by a substantial order for 500 A320neo family aircraft and 60 A350-900s, positions it for future growth and cost management.

| Metric | Value (as of early 2025) | Significance |

|---|---|---|

| Domestic Market Share | > 60% | Market leadership, economies of scale |

| On-Time Performance (FY23-24) | > 85% | Operational efficiency, customer satisfaction |

| Domestic Destinations Served | > 90 | Extensive network, feeder for international routes |

| A320neo Family Orders | 500 | Future capacity, fuel efficiency |

What is included in the product

Delivers a strategic overview of InterGlobe Aviation’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Uncovers critical vulnerabilities and competitive advantages, enabling proactive risk mitigation and opportunity capitalization for InterGlobe Aviation.

Weaknesses

Aviation Turbine Fuel (ATF) is a major operating expense for airlines, often accounting for as much as 40% of total costs. This makes InterGlobe Aviation, operating as IndiGo, particularly vulnerable to swings in global crude oil prices and the rupee-dollar exchange rate, both of which directly influence ATF expenses.

The financial strain from recent ATF price increases observed in late 2024 and continuing into mid-2025 is significant. These hikes can force airlines to raise ticket prices, which in turn may dampen passenger demand for air travel.

InterGlobe Aviation, operating as IndiGo, has grappled with significant operational disruptions stemming from recurring issues with Pratt & Whitney engines. This has led to a substantial number of aircraft being grounded, directly impacting the airline's ability to serve its routes.

These groundings translate into considerable financial burdens. IndiGo faces elevated expenses, including lease rentals for aircraft that cannot fly and ongoing maintenance costs. These costs eat into profitability and represent a direct drain on resources.

The grounding of aircraft also severely constrains the airline's available capacity. This limitation hinders IndiGo's ability to fully capitalize on the robust demand observed in the aviation sector, particularly in the 2024-2025 period. For instance, by early 2024, a notable percentage of their A320neo family fleet was affected, impacting flight schedules and passenger availability.

The Indian aviation market is incredibly competitive, with IndiGo facing a strong duopoly alongside Tata Group's airlines. This intense rivalry puts pressure on ticket prices and overall profitability as carriers fight to keep planes full.

For example, in the fiscal year ending March 2024, IndiGo reported a net profit of ₹8,178 crore, a significant turnaround from the previous year, but this was achieved amidst a challenging pricing environment. New airlines entering the fray or existing ones employing aggressive expansion tactics constantly threaten market share and the ability to command better fares.

Significant Debt Levels

InterGlobe Aviation grapples with significant debt levels, a factor that can constrain its financial maneuverability and amplify interest expenses. For instance, as of the end of the fiscal year 2023, the company's total debt stood at approximately ₹40,000 crore. This substantial borrowing, while enabling aggressive fleet expansion, necessitates careful debt management, especially given Moody's recent stable rating for the airline.

The inherent high fixed costs within the aviation sector, such as aircraft leasing, maintenance, and employee salaries, exacerbate the impact of debt. During downturns or periods of reduced cash flow, these fixed obligations become a greater burden, potentially straining the company's ability to service its debt effectively.

- Substantial Debt Burden: InterGlobe Aviation's total debt was around ₹40,000 crore at the close of FY23.

- Financial Flexibility: High debt levels can limit the company's capacity for further investment or weathering economic shocks.

- Interest Obligations: Servicing this debt adds a significant fixed cost, impacting profitability.

- Fleet Expansion Impact: The aggressive fleet expansion strategy, while growth-oriented, is financed by this debt, making its management critical.

Dependence on Specific Aircraft Manufacturers

InterGlobe Aviation's significant reliance on Airbus for its fleet, particularly the A320 family, presents a notable weakness. As of early 2025, IndiGo operates over 320 Airbus A320neo family aircraft, representing a substantial majority of its fleet. This concentration makes the airline vulnerable to production delays or supply chain disruptions originating from Airbus. For instance, ongoing global aerospace supply chain challenges in 2024 have impacted aircraft delivery schedules across the industry, potentially affecting IndiGo's expansion plans.

This dependence extends to future growth, with IndiGo having a substantial order book of A320neo family aircraft. Any issues with Airbus's production capacity, engine suppliers like Pratt & Whitney, or unforeseen technical problems with the A320neo could directly hinder IndiGo's ability to scale its operations and meet market demand. The airline's strategy is deeply intertwined with Airbus's delivery commitments, creating a single point of failure for its fleet expansion.

- Fleet Concentration: Over 320 Airbus A320neo family aircraft in operation as of early 2025.

- Delivery Dependence: Future expansion heavily relies on Airbus's delivery schedules.

- Supply Chain Risk: Vulnerability to disruptions affecting Airbus or its component suppliers.

- Operational Impact: Production delays or technical issues could impede growth and capacity.

The airline's substantial debt, standing at approximately ₹40,000 crore by the end of FY23, limits financial flexibility and increases interest expenses. This debt, while supporting fleet expansion, requires careful management, especially considering the inherent high fixed costs of the aviation industry.

IndiGo's heavy reliance on Airbus for its fleet, with over 320 A320neo family aircraft in operation by early 2025, creates a significant vulnerability. This concentration exposes the airline to risks from Airbus's production delays, supply chain disruptions, or technical issues with the A320neo family, potentially hindering growth and capacity plans.

The intense competition within the Indian aviation market, particularly the duopoly with Tata Group airlines, pressures ticket prices and overall profitability. Aggressive expansion by competitors or new market entrants constantly threatens IndiGo's market share and its ability to maintain favorable pricing.

Recurring issues with Pratt & Whitney engines have led to a considerable number of IndiGo's aircraft being grounded, impacting flight schedules and capacity. These groundings result in substantial financial burdens, including lease rentals and maintenance costs, directly affecting profitability and the ability to capitalize on market demand.

What You See Is What You Get

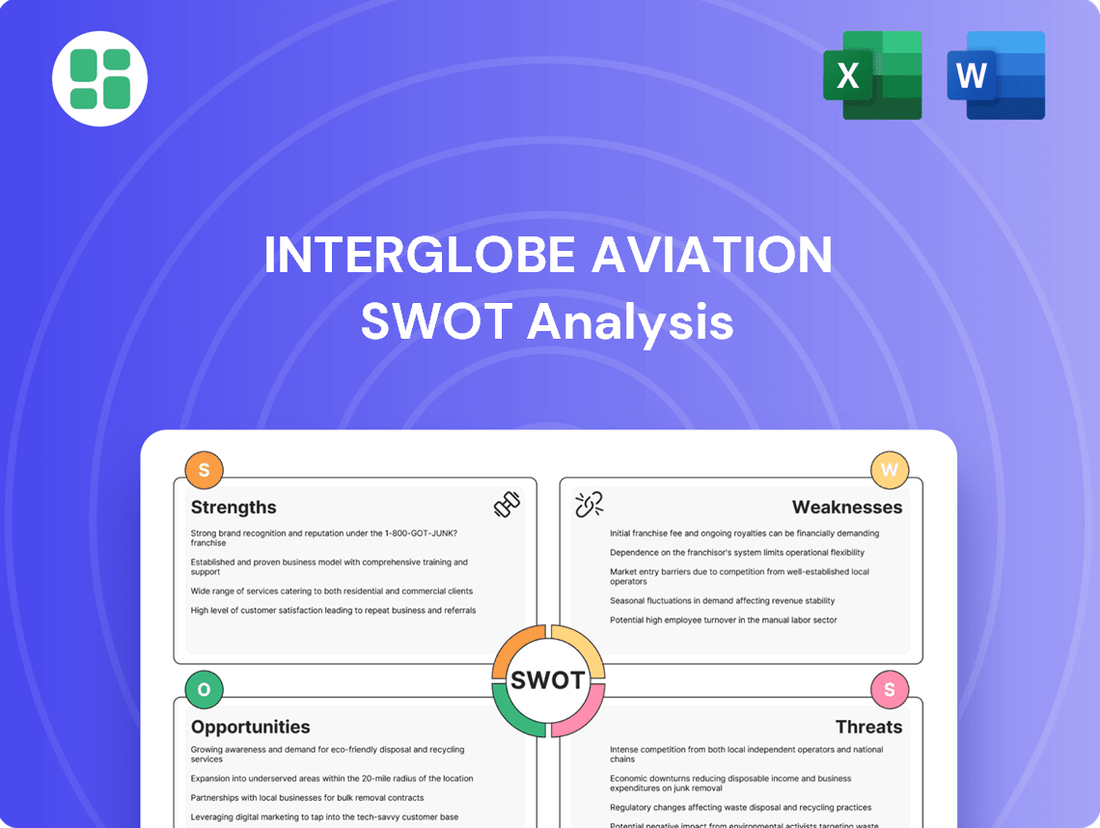

InterGlobe Aviation SWOT Analysis

This is the actual InterGlobe Aviation SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic factors influencing InterGlobe Aviation's market position and future growth.

Opportunities

India's aviation sector is on a remarkable growth trajectory, with projections indicating it will be the third-largest globally by 2025. This surge is fueled by a growing middle class, rising disposable incomes, and increasing urbanization, all contributing to a substantial rise in air travel demand.

InterGlobe Aviation, operating as IndiGo, is strategically positioned to leverage this expansion. The airline's focus on expanding its network, particularly into Tier-2 and Tier-3 cities, aligns perfectly with the market's increasing demand for accessible air travel.

InterGlobe Aviation, operating as IndiGo, is aggressively pursuing international expansion, targeting a 40% share of international capacity by fiscal year 2030. This strategic move leverages the introduction of new long-haul aircraft, including the Airbus A321XLR and A350-900, alongside leased Boeing 787 Dreamliners.

These new aircraft are key enablers for opening up new, high-demand routes to Europe, the United States, and Australia. Such diversification significantly reduces the airline's dependence on the Indian domestic market, allowing it to tap into the substantial and growing global travel market.

The Indian government's commitment to aviation infrastructure is a significant tailwind. Projects like the development of new greenfield airports and the expansion of existing ones are crucial for increasing capacity. For instance, the government aims to build 100 new airports by 2024, which will directly benefit airlines by providing more operational bases and routes.

Supportive policies such as the UDAN (Ude Desh Ka Aam Nagrik) scheme, focused on enhancing regional air connectivity, open up new markets and passenger bases for airlines. This scheme has already connected over 600 routes as of early 2024, demonstrating its impact on expanding the aviation network.

Furthermore, reforms in Maintenance, Repair, and Overhaul (MRO) services and aircraft leasing are streamlining operations and reducing costs. These policy shifts create a more conducive business environment, potentially lowering IndiGo's operational expenses and enabling more aggressive fleet expansion and route development strategies.

Growth in Ancillary Revenue Streams

InterGlobe Aviation, operating as IndiGo, has a strong history of successfully generating ancillary revenue, a key component of its financial performance. For instance, in the fiscal year 2023-24, ancillary revenue played a crucial role in bolstering the airline's profitability, contributing a significant percentage to its total income, demonstrating its importance beyond base fares.

The airline can further capitalize on this by expanding its diverse range of ancillary services. This includes enhancing in-flight sales, offering premium baggage options, and promoting its popular 'IndiGo Stretch' seating. Additionally, exploring integrated holiday packages presents a promising avenue to increase revenue per passenger.

These efforts to diversify income streams are vital for insulating IndiGo against the inherent volatility of core ticket prices. Such a strategy not only boosts overall profitability but also creates a more resilient business model.

Key ancillary revenue opportunities include:

- Enhanced In-Flight Sales: Expanding product offerings and improving the purchasing experience.

- Premium Services: Growing demand for options like 'IndiGo Stretch' seats and priority baggage handling.

- Travel Packages: Developing and marketing bundled holiday deals that include flights and accommodation.

- Loyalty Programs: Leveraging loyalty programs to encourage spending on ancillary services.

Leveraging Strategic Partnerships and Alliances

InterGlobe Aviation, operating as IndiGo, is actively pursuing strategic partnerships and codeshare agreements with prominent global carriers like Delta Air Lines, Air France-KLM, and Turkish Airlines. These collaborations are crucial for expanding IndiGo's international footprint and providing passengers with smooth connections to far-flung destinations. This approach allows for network growth and increased customer value without the substantial capital outlay typically required for establishing new long-haul routes or acquiring long-range aircraft.

These alliances are particularly beneficial in the current aviation landscape, where market access and route development are key differentiators. For instance, IndiGo's partnership with Turkish Airlines offers its passengers enhanced connectivity to over 300 destinations across Europe, Africa, and the Middle East. This strategic move directly addresses the opportunity to broaden IndiGo's network breadth and bolster its appeal to a wider customer base, especially for international travel segments.

- Expanded Global Reach: Partnerships provide access to routes IndiGo does not currently serve directly.

- Seamless Connectivity: Customers benefit from integrated travel experiences and fewer layovers.

- Cost-Effective Growth: Alliances reduce the need for significant capital investment in new aircraft and route development.

- Enhanced Network Breadth: The airline's overall route map becomes more comprehensive and attractive to travelers.

InterGlobe Aviation, operating as IndiGo, is well-positioned to capitalize on the Indian aviation sector's projected growth, which is expected to become the third-largest globally by 2025. The airline's strategic focus on expanding its network, particularly into Tier-2 and Tier-3 cities, directly addresses the increasing demand for accessible air travel driven by a growing middle class and urbanization.

The airline's aggressive international expansion plans, targeting a 40% share of international capacity by FY2030, are supported by the introduction of new long-haul aircraft like the Airbus A321XLR and A350-900. This diversification into markets like Europe, the US, and Australia will reduce reliance on the domestic market and tap into global travel demand.

Government initiatives, such as the development of 100 new airports by 2024 and the UDAN scheme connecting over 600 routes by early 2024, create a favorable environment for network expansion and new market penetration.

IndiGo's proven success in generating ancillary revenue, which significantly contributed to its profitability in FY2023-24, offers a substantial opportunity. Expanding services like premium seating, in-flight sales, and integrated holiday packages can further diversify income streams and enhance profitability.

Strategic partnerships with global carriers like Delta Air Lines and Air France-KLM are crucial for expanding IndiGo's international footprint and offering seamless connectivity. These alliances provide cost-effective growth by granting access to new routes without the need for significant capital investment in new aircraft.

Threats

Persistent high aviation fuel prices remain a significant threat to InterGlobe Aviation's profitability. Despite some fluctuations, Aviation Turbine Fuel (ATF) costs in India have stayed notably higher than pre-pandemic levels. For instance, ATF prices in major metros like Delhi saw increases throughout 2023 and into early 2024, impacting operational expenses.

Fuel constitutes a substantial portion of an airline's overall expenditure, often ranging between 30-40%. Sustained elevated ATF prices directly squeeze profit margins, potentially forcing airlines like InterGlobe Aviation to increase ticket prices. This could dampen demand, especially in India's price-sensitive travel market, further challenging revenue growth.

The Indian aviation landscape is becoming a tighter race, with the Tata Group's airlines consolidating and growing, directly challenging IndiGo's dominance. This intensifying competition, particularly with the potential for a near-duopoly, could trigger aggressive price wars, impacting IndiGo's revenue per passenger (yield) and overall profitability.

For instance, IndiGo's market share, while strong, faces pressure as Air India, under Tata's ownership, aggressively expands its fleet and international routes. This consolidation trend has already seen IndiGo report a net profit of ₹3,070 crore for the fiscal year ending March 31, 2024, a significant turnaround from the previous year, but the competitive pressures are expected to intensify.

Furthermore, a market dominated by just two major players, IndiGo and the Tata Group's airlines, is likely to attract greater attention from regulators. This increased scrutiny could lead to interventions aimed at ensuring fair competition and preventing monopolistic practices, potentially impacting strategic decisions and pricing strategies for all involved.

Global supply chain issues continue to be a significant hurdle, particularly impacting the availability of Pratt & Whitney engines crucial for IndiGo's fleet. These ongoing disruptions have led to a notable number of aircraft being grounded, directly affecting operational efficiency.

The grounding of aircraft due to engine reliability problems translates into substantial increased costs for IndiGo, encompassing higher lease rentals for idle planes and escalating maintenance expenditures. For instance, by the end of the first quarter of 2024, IndiGo had a significant number of aircraft grounded due to these engine issues, impacting its planned capacity.

These operational constraints directly hinder IndiGo's capacity deployment, making it challenging to capitalize on the robust recovery in passenger demand observed throughout 2024. This situation could potentially limit the airline's ability to expand services and capture market share in a recovering aviation sector.

Economic Slowdown and Impact on Discretionary Travel

An economic slowdown in India or globally presents a significant threat to InterGlobe Aviation. Rising inflation and the increasing cost of living can directly curb consumer discretionary spending, making air travel a less attractive option for many. This reduction in demand could lead to lower passenger traffic, forcing airlines like IndiGo to implement fare reductions to fill seats, which would inevitably squeeze profit margins.

For instance, if India's GDP growth, which was projected around 6.5% for FY24, were to falter due to global economic headwinds, the impact on disposable incomes would be substantial. This directly translates to a weaker propensity for non-essential travel.

- Reduced Consumer Spending: Higher inflation erodes purchasing power, making air travel a luxury rather than a necessity for many households.

- Lower Passenger Traffic: A slowdown typically leads to fewer people opting for flights, impacting load factors for airlines.

- Pressure on Fares: To maintain occupancy, airlines may be compelled to lower ticket prices, directly affecting revenue per passenger.

- Profitability Squeeze: The combination of lower demand and reduced fares can significantly impact an airline's bottom line.

Regulatory and Geopolitical Risks

The aviation industry navigates a complex web of regulations. Changes in government policies, such as increased airport taxes or revised international aviation agreements, can directly affect InterGlobe Aviation's operational costs and revenue streams. For instance, the Indian government's imposition of excise duty and VAT on aviation turbine fuel (ATF) in various states has historically added to operating expenses.

Geopolitical instability presents another significant threat. Events like the Russia-Ukraine conflict in 2022 led to airspace closures, forcing airlines, including InterGlobe Aviation, to reroute flights. This resulted in longer flight times, increased fuel consumption, and higher operational costs, impacting profitability.

- Regulatory Impact: Changes in aviation policies, taxes, and bilateral air service agreements can alter operating costs and market access.

- Geopolitical Disruptions: Airspace restrictions and political tensions can lead to flight diversions, increased fuel burn, and schedule disruptions, as observed during recent global conflicts.

- Compliance Costs: Adhering to evolving safety, environmental, and operational regulations necessitates ongoing investment, potentially straining financial resources.

Intensifying competition, particularly from the consolidated Tata Group airlines, poses a significant threat, potentially leading to price wars that could erode IndiGo's yields. Furthermore, ongoing global supply chain disruptions, specifically impacting Pratt & Whitney engines, have resulted in a substantial number of aircraft being grounded, directly hindering operational capacity and increasing costs for InterGlobe Aviation.

These engine issues forced IndiGo to ground a significant portion of its fleet in early 2024, impacting its ability to meet demand. An economic slowdown, coupled with persistent high aviation fuel prices, further exacerbates these challenges by reducing consumer spending on air travel and increasing operational expenses.

SWOT Analysis Data Sources

This InterGlobe Aviation SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and accurate assessment.